Market Overview:

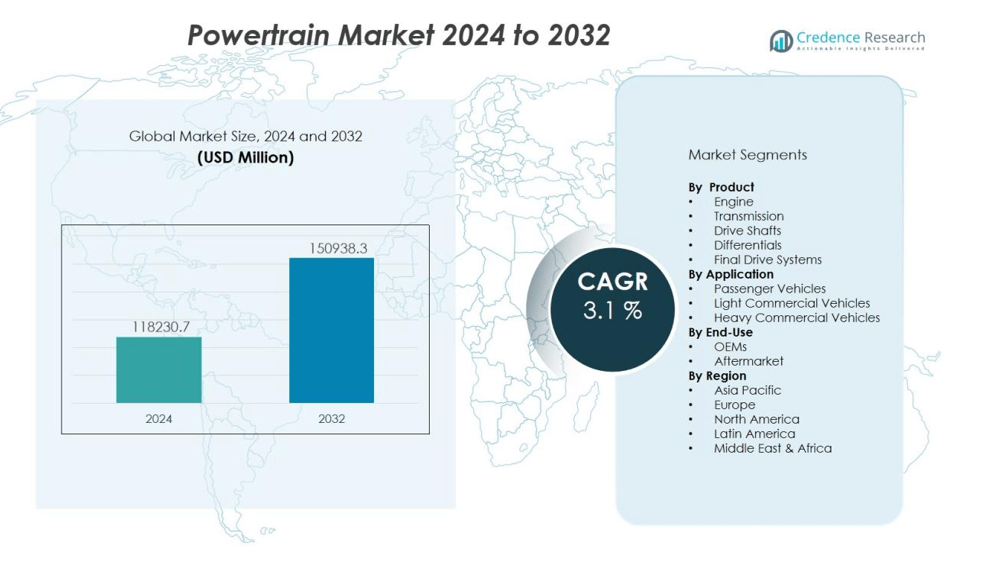

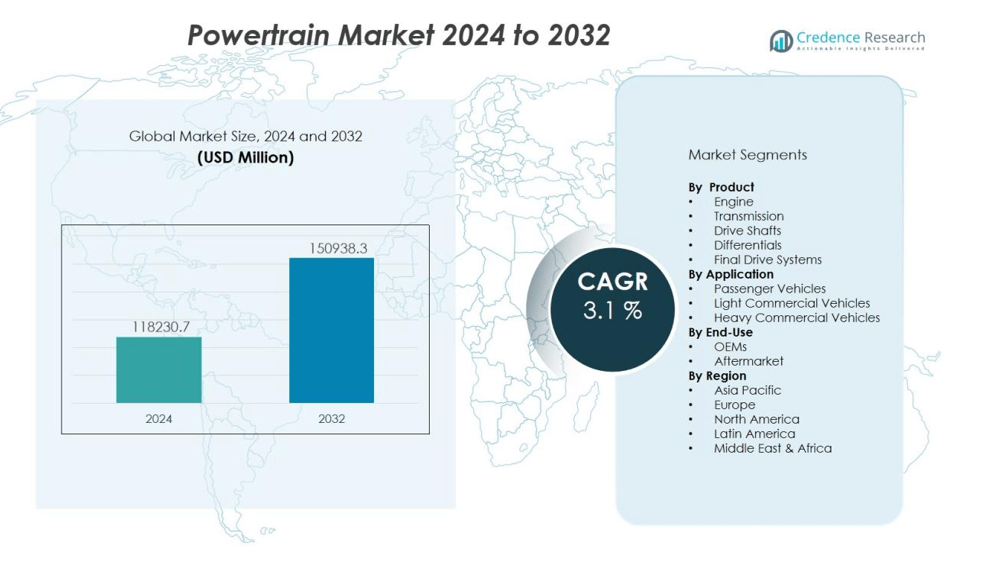

The powertrain market size was valued at USD 118230.7 million in 2024 and is anticipated to reach USD 150938.3 million by 2032, at a CAGR of 3.1 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Powertrain Market Size 2024 |

USD 118230.7 million |

| Powertrain Market, CAGR |

3.1% |

| Powertrain Market Size 2032 |

USD 150938.3 million |

Key market drivers include stringent emission norms worldwide, the rapid adoption of electric mobility, and consumer demand for high-performance and fuel-efficient vehicles. Automakers are increasingly focusing on lightweight materials, advanced transmission systems, and electrification technologies to meet environmental and efficiency targets. Integration of digital control systems and enhanced thermal management solutions further boosts efficiency, while government incentives for electric vehicles accelerate the shift toward sustainable powertrain solutions.

Regionally, Asia-Pacific dominates the global powertrain market, supported by high vehicle production in China, Japan, and India, coupled with strong EV adoption policies. Europe remains a key market due to strict environmental regulations and rapid electrification initiatives, while North America benefits from robust technological innovation and growing demand for hybrid and electric vehicles.

Market Insights:

- The powertrain market was valued at USD 118,230.7 million in 2024 and is expected to reach USD 150,938.3 million by 2032, growing at a CAGR of 3.1%.

- Stringent global emission norms such as Euro 7, CAFE, and China VI are driving investment in hybrid and electric powertrain systems.

- Rising adoption of electric and hybrid vehicles is boosting demand for advanced battery technologies, efficient motors, and flexible vehicle platforms.

- Automakers are focusing on lightweight materials, optimized transmissions, and improved aerodynamics to balance efficiency with performance.

- Integration of AI, machine learning, and connected systems is enabling predictive maintenance, real-time optimization, and enhanced compatibility with autonomous vehicles.

- Asia-Pacific leads with 52% market share, supported by strong EV policies, high vehicle production, and a robust supply chain ecosystem.

- Europe and North America are expanding through strict emission regulations, advanced R&D capabilities, and rising consumer demand for low-emission mobility solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Stringent Emission Regulations Driving Technological Advancements:

The powertrain market is experiencing significant transformation due to tightening global emission regulations. Governments are enforcing stricter standards such as Euro 7, CAFE, and China VI, compelling manufacturers to adopt cleaner and more efficient technologies. It is prompting increased investment in hybrid and electric powertrain systems to reduce greenhouse gas emissions. Automakers are integrating advanced combustion techniques, turbocharging, and aftertreatment systems to meet compliance targets without compromising performance. This regulatory pressure is accelerating innovation and reshaping product development strategies.

- For instance, Bosch’s latest diesel powertrain technology has enabled vehicles to achieve average real driving nitrogen oxide (NOx) emissions as low as 13mg/km—just one-tenth of the Euro 6 limit—thanks to innovations in injection systems and exhaust-gas treatment.

Rising Demand for Electric and Hybrid Vehicles:

Global interest in electric and hybrid vehicles is a major catalyst for growth in the powertrain market. It is driving rapid advancements in battery technology, electric motors, and power electronics to deliver improved efficiency and extended driving ranges. Consumer awareness of environmental concerns, coupled with government incentives, is influencing purchasing decisions toward low-emission mobility solutions. Automakers are developing flexible platforms capable of supporting multiple powertrain configurations to meet diverse market demands. This shift is fostering a competitive landscape where technological differentiation is essential.

- For instance, Tesla Model S Plaid’s tri-motor 760 kW powertrain achieves 0–60 mph in just 1.98 seconds.

Focus on Fuel Efficiency and Performance Optimization:

Fuel efficiency remains a core priority, with the powertrain market leveraging lightweight materials, advanced transmission designs, and optimized engine calibration. It is enabling manufacturers to balance stringent efficiency requirements with customer expectations for high performance. Variable valve timing, cylinder deactivation, and improved aerodynamics are increasingly common in modern powertrain systems. Manufacturers are also enhancing driveline integration to reduce energy losses and maximize output. These innovations are strengthening product competitiveness across global markets.

Integration of Digital and Intelligent Control Systems:

The adoption of digital technologies is redefining operational capabilities within the powertrain market. It is enabling predictive maintenance, real-time performance monitoring, and adaptive control strategies through advanced software. Connected systems are facilitating over-the-air updates and enhancing compatibility with autonomous driving technologies. Integration of artificial intelligence and machine learning is improving system responsiveness and efficiency. This digital evolution is positioning powertrain solutions for the next phase of intelligent mobility.

Market Trends:

Electrification and Hybridization Reshaping Product Portfolios:

The powertrain market is undergoing a fundamental shift toward electrification and hybridization, with manufacturers expanding offerings to include battery electric, plug-in hybrid, and fuel cell systems. It is influencing supply chains, component design, and manufacturing processes to align with sustainable mobility goals. The focus is on developing scalable architectures that can accommodate multiple propulsion types without significant redesign. Battery technology improvements, such as higher energy density and faster charging, are supporting wider adoption. Automakers are also prioritizing cost reduction to make electric powertrains more competitive with internal combustion options. Partnerships between OEMs and technology firms are accelerating innovation in this segment. The transition is positioning manufacturers to capture emerging demand in both mature and developing markets.

- For instance, Tesla achieved production of over 1.77 million electric vehicles globally in 2024, with their 4680 battery cells reaching over 50 million units produced at Gigafactory Texas by June 2024.

Advanced Materials and Intelligent Systems Enhancing Efficiency:

The integration of advanced materials and intelligent systems is becoming a defining trend in the powertrain market. It is driving weight reduction, thermal efficiency, and improved durability across various propulsion technologies. Lightweight composites, high-strength alloys, and innovative lubrication solutions are enabling better performance while meeting environmental standards. Intelligent control systems are optimizing torque distribution, energy recovery, and power delivery based on driving conditions. Over-the-air software updates are extending product lifecycles and maintaining regulatory compliance. The combination of material science and digital intelligence is delivering higher efficiency and reliability. This convergence is establishing a new benchmark for competitiveness in global automotive manufacturing.

- For instance, Volkswagen’s ID.4 utilizes hot-formed boron steel in its body-in-white, boosting torsional stiffness by 25 percent, while an over-the-air calibration tweak to its drive inverter reduced energy losses by 1.8 percent.

Market Challenges Analysis:

High Development Costs and Complex Regulatory Compliance:

The powertrain market faces significant challenges due to the high costs associated with research, development, and compliance. It is becoming increasingly expensive to design systems that meet stringent global emission and efficiency standards. Manufacturers must invest heavily in advanced materials, precision engineering, and new manufacturing capabilities to remain competitive. Diverse regulatory requirements across regions add complexity, requiring multiple adaptations of the same platform. The financial burden is particularly high for smaller players with limited capital. This dynamic is driving consolidation and strategic alliances within the industry.

Technological Transition and Supply Chain Disruptions:

The rapid shift toward electrification is creating technological and operational hurdles in the powertrain market. It demands a complete transformation of supply chains, with increased dependence on rare earth elements, advanced electronics, and battery components. Shortages of critical materials and geopolitical uncertainties are disrupting production schedules. The pace of technological change also increases the risk of product obsolescence, pressuring manufacturers to accelerate development cycles. Skilled labor shortages in software, electronics, and advanced manufacturing are intensifying competition for talent. These factors are challenging the ability of companies to scale efficiently while maintaining profitability.

Market Opportunities:

Expansion in Electric and Hybrid Vehicle Segments:

The powertrain market holds significant opportunities in the expanding electric and hybrid vehicle segments. It benefits from increasing government incentives, rising fuel costs, and growing environmental awareness among consumers. Demand for high-efficiency, low-emission mobility solutions is encouraging investment in advanced battery systems, electric motors, and integrated power electronics. Automakers can leverage modular and flexible platforms to cater to both developed and emerging markets. Collaboration with technology providers enables faster deployment of next-generation powertrains. This segment offers long-term growth potential as electrification becomes mainstream across global markets.

Advancements in Connected and Intelligent Powertrain Systems:

Integration of connectivity and intelligent control systems is creating new avenues for value creation in the powertrain market. It enables predictive maintenance, remote diagnostics, and real-time optimization of performance, enhancing customer satisfaction and operational efficiency. The adoption of AI and machine learning supports adaptive energy management and seamless integration with autonomous driving technologies. Lightweight materials combined with advanced analytics can deliver both performance gains and sustainability benefits. Expanding adoption in commercial fleets presents opportunities for efficiency-driven solutions. This trend is positioning manufacturers to lead in the era of intelligent and sustainable mobility.

Market Segmentation Analysis:

By Product:

The powertrain market is segmented into engine, transmission, drive shafts, differentials, and final drive systems. It covers both internal combustion engine (ICE) and electrified powertrains, including hybrid and fully electric systems. Demand for advanced engines with turbocharging, direct injection, and variable valve timing remains strong, while electric powertrains are gaining market share through improved battery and motor technologies. Transmissions are evolving toward multi-speed and continuously variable systems to enhance fuel efficiency. Drive shafts and differentials are being optimized for lightweight performance and durability.

- For instance, ZF Friedrichshafen’s elecTrac front e-axle delivers 160 kW of peak power and 300 Nm of torque in a 28 kg unit, achieving a 97% efficiency rating and reducing system weight by 15%.

By Application:

Applications span passenger vehicles, light commercial vehicles, and heavy commercial vehicles. The passenger vehicle segment leads due to high production volumes and strong consumer demand for fuel-efficient and high-performance vehicles. It benefits from the rapid integration of hybrid and electric technologies. Light commercial vehicles are focusing on durability, load capacity, and cost efficiency, while heavy commercial vehicles emphasize torque delivery and fuel optimization.

- For instance, toyota’s prius models have delivered more than a 10% fuel efficiency improvement with each generation, and the brand surpassed 10 million global hybrid vehicle sales by 2021, demonstrating large-scale technological advancement.

By End-Use:

End-use segments include OEMs and aftermarket. OEMs dominate due to large-scale production and integration of advanced technologies at the manufacturing stage. It is driving innovation through collaborations with technology providers and material suppliers. The aftermarket segment is expanding, driven by maintenance, repair, and replacement needs, especially for aging ICE fleets. Growth in electric and hybrid models is creating opportunities for specialized aftermarket services and components.

Segmentations:

By Product:

- Engine

- Transmission

- Drive Shafts

- Differentials

- Final Drive Systems

By Application:

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By End-Use:

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia-Pacific :

Asia-Pacific holds 52% market share in the global powertrain market, supported by its position as the largest automotive manufacturing hub. China, Japan, and India drive the region’s dominance through high production volumes and rapid electric vehicle adoption. It benefits from strong government incentives, expanding charging infrastructure, and competitive manufacturing costs. Local suppliers are enhancing capabilities in both internal combustion and electric powertrains to meet diverse demand. The presence of major automakers and battery manufacturers strengthens the supply chain ecosystem. Regional growth is further supported by rising consumer demand for fuel-efficient and low-emission vehicles.

Europe :

Europe accounts for 26% market share, driven by stringent environmental regulations and aggressive electrification strategies. The European Union’s emission standards are accelerating adoption of hybrid and fully electric powertrain technologies. It is fostering significant R&D investment in lightweight materials, advanced transmissions, and battery efficiency. Leading automotive nations such as Germany, France, and the UK are focusing on premium, high-performance, and sustainable mobility solutions. Collaborative initiatives between governments, research institutions, and automakers are promoting innovation. The region’s mature automotive industry and strong engineering expertise provide a competitive advantage.

North America :

North America holds 18% market share, supported by robust technological innovation and growing interest in hybrid and electric vehicles. The United States leads regional development with strong investments in advanced propulsion technologies. It is witnessing rapid integration of intelligent control systems, AI-driven performance optimization, and connected vehicle solutions. Consumer demand for high-performance, fuel-efficient vehicles is influencing product strategies. The presence of major OEMs and a well-developed aftermarket supports continued growth. Government policies promoting clean energy and sustainable transportation are strengthening the market outlook.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Bosch Limited

- Mitsubishi Electric Corp.

- BorgWarner

- Schaeffler AG

- ZF Friedrichshafen AG

- Magna International Inc.

- Nidec Corporation

- Continental AG

- Valeo

- Magneti Marelli Ck Holdings

Competitive Analysis:

The powertrain market is highly competitive, with established global players leveraging technological expertise, extensive product portfolios, and strong supply chain networks to maintain market leadership. Key companies include Bosch Limited, Mitsubishi Electric Corp., BorgWarner, Schaeffler AG, ZF Friedrichshafen AG, Magna International Inc., and Nidec Corporation. It is characterized by rapid innovation in electrification, hybrid systems, and intelligent control technologies to meet evolving regulatory and consumer demands. Leading manufacturers are investing in R&D to enhance efficiency, performance, and sustainability, while expanding capabilities in electric and hybrid powertrains. Strategic partnerships, mergers, and acquisitions are common to strengthen market position and access advanced technologies. Companies are also focusing on cost optimization, modular platform development, and regional production hubs to improve competitiveness. The market’s dynamic nature requires continuous adaptation to technological shifts and changing mobility trends.

Recent Developments:

- In February 2025, Mitsubishi Electric signed an agreement to form a joint venture and acquire a minority stake in HD Renewable Energy, a Taipei-based developer, aiming to aggregate distributed energy resources in Japan.

- In April 2025, BorgWarner introduced the iM-575 integrated inverter-motor drive module engineered for commercial electric vehicles at the ACT Expo 2025 in Anaheim.

- In August 2025, Bosch Limited finalized the acquisition of the global residential and light commercial HVAC business from Johnson Controls and its stake in the Johnson Controls-Hitachi joint venture, a transaction valued at $8billion aimed at expanding Bosch’s Home Comfort division.

Market Concentration & Characteristics:

The powertrain market demonstrates a moderately high level of concentration, with leading global OEMs and Tier-1 suppliers holding significant influence over technology development, production, and supply chains. It is characterized by strong competition driven by rapid innovation, regulatory compliance, and the transition toward electrified mobility. Key players focus on strategic alliances, vertical integration, and R&D investment to secure market position. The industry features a mix of established combustion powertrain providers and emerging electric mobility specialists, creating a dynamic competitive landscape. Continuous advancements in efficiency, performance, and sustainability define product differentiation. Regional manufacturing hubs and localized supply networks enhance responsiveness to market-specific demands.

Report Coverage:

The research report offers an in-depth analysis based on Segment 1, Segment 2, Segment 3, and Segment 3. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Electrification will remain the primary growth driver, with increasing adoption of battery electric, plug-in hybrid, and fuel cell powertrains across global markets.

- It will see significant advancements in battery technology, improving energy density, charging speed, and lifecycle performance.

- Integration of intelligent control systems and AI-driven energy management will enhance efficiency and adaptability.

- Lightweight materials and advanced manufacturing processes will reduce vehicle weight and improve power-to-weight ratios.

- Hybrid powertrains will continue to evolve as a transitional solution, balancing performance, range, and emissions compliance.

- Demand for modular and flexible platforms capable of supporting multiple propulsion types will rise among automakers.

- Growth in connected and autonomous vehicles will drive innovation in integrated powertrain and vehicle control systems.

- It will benefit from expanding government incentives and infrastructure investment for electric mobility.

- Supply chain localization and diversification will become critical to mitigate risks related to critical materials and geopolitical factors.

- Collaboration between automotive OEMs, technology firms, and energy providers will accelerate innovation and commercialization of next-generation powertrain solutions.