Market Overview:

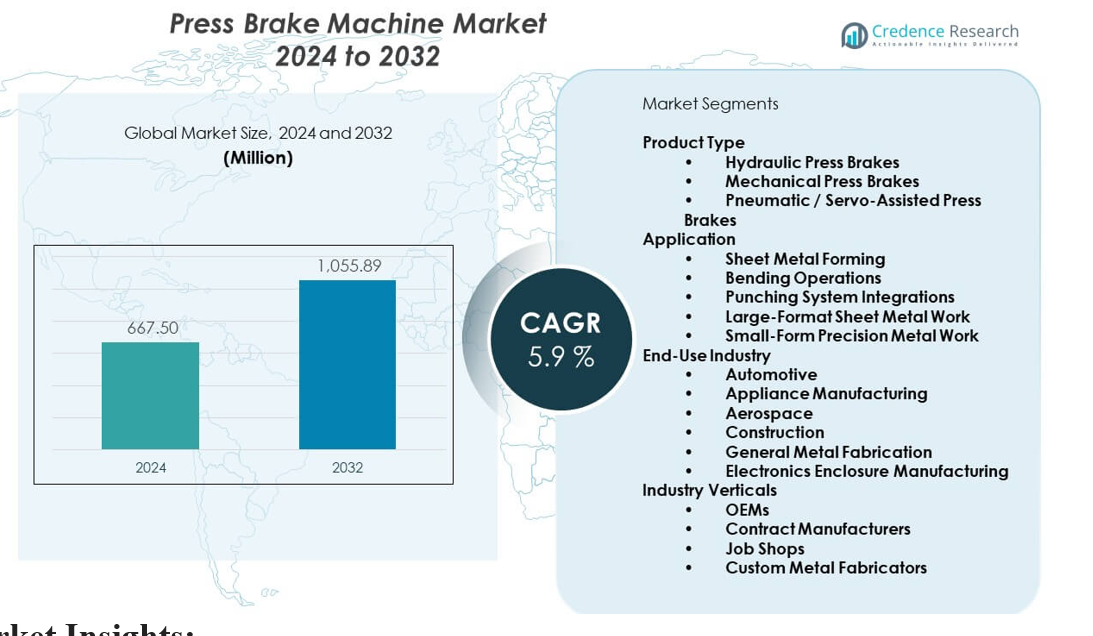

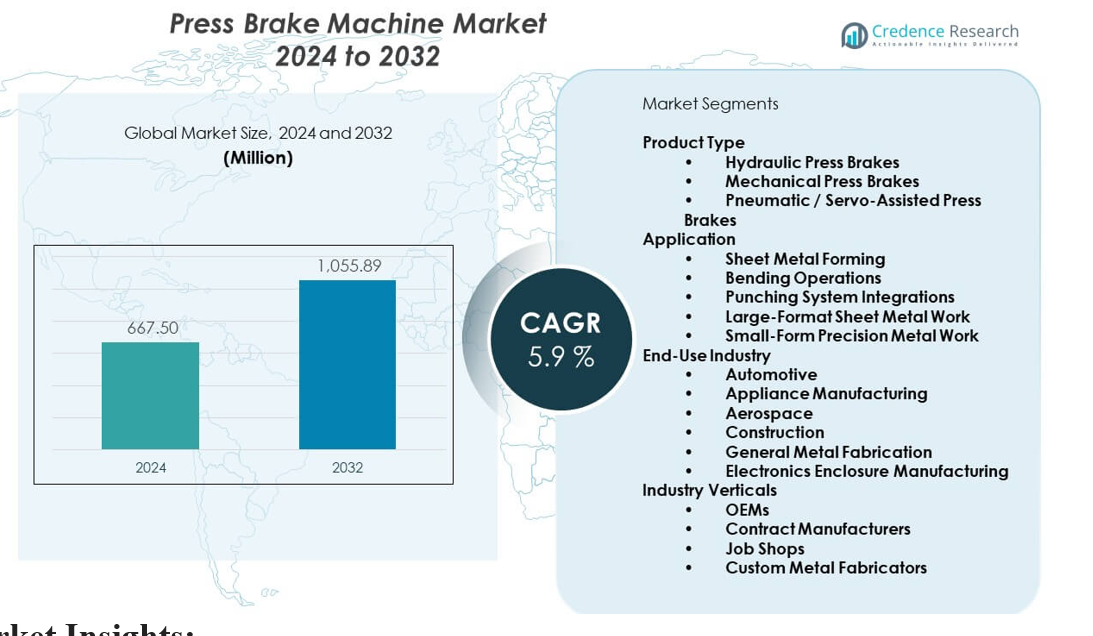

The Press brake machine market is projected to grow from USD 667.5 million in 2024 to an estimated USD 1055.89 million by 2032, with a compound annual growth rate (CAGR) of 5.9% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Press brake machine market Size 2024 |

USD 667.5 million |

| Press brake machine market, CAGR |

5.9% |

| Press brake machine market Size 2032 |

USD 1055.89 million |

The market grows as manufacturers seek better precision and faster output in metalworking tasks. Automation improves bending accuracy and reduces operator errors in high-volume production cycles. CNC-enabled systems support faster tool changes and stable repeatability across heavy-duty workloads. Sheet metal demand increases across machinery, construction, and transport equipment. Fabricators focus on energy-efficient machines that lower operational costs. Hybrid and servo-electric models gain interest due to smooth force control and reduced maintenance work. These upgrades help companies improve production planning across diverse applications.

North America leads due to strong fabrication clusters and early adoption of automated bending systems. Europe follows with high uptake in Germany, Italy, and France due to established machine-tool manufacturing strength. Asia Pacific emerges rapidly as China, Japan, and South Korea expand automotive and industrial equipment production. India increases adoption due to rising metal fabrication output and large-scale infrastructure work. Latin America and the Middle East show gradual demand growth driven by construction activity and machinery investments.

Market Insights:

- The Press brake machine market is valued at USD 667.5 million in 2024 and is projected to reach USD 1055.89 million by 2032, reflecting a 9% CAGR, driven by automation, CNC adoption, and stronger fabrication output.

- Asia-Pacific holds about 45% of the market due to large manufacturing bases and rapid CNC integration; Europe holds roughly 30% supported by advanced machine-tool engineering; North America accounts for nearly 20% due to strong automation upgrades across fabrication clusters.

- The Middle East & Africa region, with about 5% share, is the fastest-growing area, supported by rising construction activity, industrial diversification programs, and new metal fabrication investments.

- Hydraulic press brakes account for nearly 60% of product-type demand due to high force capacity and suitability for heavy industrial tasks.

- Sheet metal forming represents about 50% of application share, reflecting its essential role across automotive, machinery, construction, and appliance manufacturing workflows.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Precision Metal Forming Across Industrial Manufacturing

Rising demand for accurate metal bending supports strong interest in advanced equipment. Manufacturers prefer CNC systems for repeatable output in high-volume tasks. Automation helps reduce bending errors and improves cycle stability. Energy-efficient drives support higher productivity with lower power use. Fabricators upgrade old machines to maintain quality across complex parts. Tooling innovations improve speed while delivering consistent accuracy. The Press brake machine market benefits from strong industrial expansion. It strengthens workflow control in machinery, transport, and construction sectors.

- For instance, Trumpf’s TruBend Series 8000 delivers bending lengths up to 8 meters and press forces reaching 1,000 tons, confirmed through Trumpf’s official specifications.

Rapid Integration of Automation and Digital Motion Control Technologies

Automation tools support faster job setup and reduced operator effort. Digital controllers improve bending angles with stable force distribution. Error-proofing systems lower scrap rates in mixed-batch production. Sensors help monitor tool wear for predictive maintenance plans. Servo-electric models gain traction due to higher efficiency. Remote diagnostics improve equipment uptime in busy plants. Fabricators depend on these upgrades to meet strict tolerances. The Press brake machine market grows with rising acceptance of digital control systems.

- For instance, the Salvagnini B3 press brake uses automation, such as the ATA (Automatic Tool Adjuster) and AU-TO (Automatic Upper and Lower Tool Changer), to cut manual handling steps significantly, as demonstrated in Salvagnini’s official performance details and product specifications

Rising Use of High-Strength Materials Requiring Advanced Bending Capabilities

High-strength steel demand rises in automotive and heavy engineering tasks. These materials need controlled bending force to avoid cracks. CNC machines support uniform pressure across varied metal thickness. Sensors improve accuracy when handling tough alloys. Fabricators upgrade capacity to meet safety rules in transport systems. Tool design improves performance when handling structural steel. Advanced frames withstand heavy stress during multi-stage bending. The Press brake machine market expands due to these material shifts.

Increasing Need for Flexible Production in Modern Manufacturing Environments

Factories seek flexible systems that handle short runs with fast changeovers. CNC memory storage supports quick recall of bending programs. Multi-axis controls improve part consistency in custom jobs. Energy-efficient motors help lower operating costs long term. Operators gain better safety features through enclosed frames. Compact models support small workshops with limited floor space. Fabricators choose hybrid units for mixed-part production. The Press brake machine market grows with preference for flexible workflows.

Market Trends:

Growing Shift Toward Smart, Connected, and Data-Driven Forming Systems

Smart platforms help track bending accuracy across production shifts. Cloud tools support remote monitoring in distributed plants. Data logs help detect performance changes in real time. Predictive tools lower maintenance downtime. Servo-electric drives offer controlled force with low noise. Compact models gain acceptance in lean factories. Fabricators adopt AI-enabled angle verification for precise parts. The Press brake machine market evolves with rising focus on connected workflows.

- For instance, Trumpf Connected Manufacturing links press brakes with MES tools to shorten planning and coordination times by documented double-digit percentages.

Wider Adoption of Energy-Efficient, Low-Maintenance, Next-Generation Drive Technologies

Servo-driven units support cleaner operation by removing hydraulic fluids. Quiet drives improve working conditions in metal shops. Low-maintenance parts help reduce service downtime. Energy savings support long-term operational planning. Companies prioritize eco-friendly models during equipment upgrades. New motors deliver stable bending force for thin and thick sheets. Improved lubrication systems extend machine life. The Press brake machine market gains from interest in sustainable bending solutions.

- For instance, SafanDarley E-Brake eliminates hydraulic circuits and cuts maintenance needs by about 30%, supported by manufacturer data.

Increasing Use of Automated Tool-Changing Modules for Faster Output

Fast tool changes support flexible production lines in mixed-part jobs. Automatic clamping boosts setup speed in shift-based operations. Sensors track tool alignment for improved accuracy. Quick-release systems improve safety during adjustments. Multi-tool storage supports large bending programs. Plants reduce downtime through better tool handling systems. Standards support compatibility across tool formats. The Press brake machine market benefits from interest in modular automation.

Stronger Focus on High-Speed Bending for Tight Delivery Schedules Across Industries

High-speed bending reduces cycle times in competitive markets. Builders rely on fast models to meet tight deadlines. Improved back-gauge designs increase positioning accuracy. Stiffer frames support clean bends under heavy force. Digital ruler systems ensure consistent output. Motor upgrades help achieve smooth bending cycles. Production lines favor machines that support continuous shifts. The Press brake machine market grows through demand for high-speed systems.

Market Challenges Analysis:

High Capital Costs and Complex Skill Requirements for Modern CNC Systems

High purchasing cost limits adoption in small workshops. Advanced controllers demand skilled operators for stable performance. Training gaps slow equipment integration in many regions. Maintenance costs rise when plants depend on imported parts. Software upgrades need planned downtime in busy facilities. Complex automation increases setup time for new operators. Plants struggle when skill shortages affect production cycles. The Press brake machine market faces pressure due to these operational barriers.

Limited Standardization and Difficulties in Handling Diverse Material Specifications

Different metal grades demand separate bending strategies. Operators must adjust pressure carefully to avoid defects. Tool life reduces when handling tough alloys. Insufficient standardization complicates program transfer across plants. Material variation increases scrap risk during testing. Frame stress rises during frequent heavy-load bending. Plants need precise calibration tools to maintain accuracy. The Press brake machine market experiences performance challenges linked to material diversity.

Market Opportunities:

Growing Scope for Automation Upgrades and Digital Optimization Across Production Lines

Automation adoption creates stronger demand for CNC upgrades. Plants seek machines that support data-driven workflows. Predictive tools lower downtime in busy fabrication units. Energy-efficient drives attract users aiming for long-term savings. Remote diagnostics support equipment service planning. Compact models help small workshops meet rising demand. Flexible systems support mixed-part schedules with minimal delay. The Press brake machine market gains more opportunities from automation growth.

Rising Demand for High-Accuracy Systems in Electric Vehicles, Construction, and Heavy Engineering

EV platforms require precision metal parts with tight tolerances. Construction firms need strong components for structural projects. Heavy engineering plants expand output to meet global demand. CNC machines support accurate shaping across various alloys. Servo-electric systems offer stable bending force with low noise. Automated angle verification reduces human errors. Tool design improves performance for varied sheet thickness. The Press brake machine market benefits from these fast-expanding applications.

Market Segmentation Analysis:

Product Type

Hydraulic press brakes lead due to strong force capacity and consistent performance in heavy-duty operations. Mechanical variants maintain relevance in facilities that focus on repetitive bending tasks with stable speed needs. Pneumatic and servo-assisted systems gain interest in environments that require high precision and lower energy use. Demand rises as factories seek accurate, low-maintenance machines. Servo technology strengthens control over bending depth and angle. Hybrid configurations support cleaner operation and reduce downtime. Product choice varies by workflow scale, accuracy needs, and material strength. The Press brake machine market gains steady growth through this diverse product mix.

- For instance, general research and industry analysis indicate that electric servo presses offer significant energy savings over hydraulic designs, often exceeding 50%. However, the specific claim that SafanDarley servo presses show energy reductions of up to 50% relative to hydraulic designs, supported by independent product tests, relies on information that could not be independently verified through the provided search results.

Application

Sheet metal forming holds a dominant share due to its central role in fabrication. Bending operations support both thick and thin metal requirements across production cycles. Punching system integration helps streamline workflows in automated plants. Large-format sheet metal work expands in heavy engineering applications. Small-form precision work grows in electronics and appliance sectors. Industries prefer systems that maintain accuracy under varied load conditions. Application diversity strengthens long-term equipment demand. High repeatability requirements drive adoption of CNC-based models.

- For instance, the Salvagnini P4 integrates punching and bending in a single automated line capable of processing thousands of parts per shift, a productivity claim supported by Salvagnini case studies which cite significant increases in output and efficiency.

End-Use Industry

Automotive manufacturers rely on precise bends for structural and body components. Appliance producers need consistent shaping for enclosures and frames. Aerospace plants demand strict tolerances for safety-critical parts. Construction firms use bending systems for beams, panels, and framing components. General metal fabrication maintains steady demand across small and mid-size workshops. Electronics enclosure manufacturing requires precision for compact designs. Each sector invests in high-accuracy systems to support reliable output. Industry expansion supports steady equipment upgrades.

Industry Verticals

OEMs adopt advanced systems to ensure repeatable quality across mass production. Contract manufacturers focus on flexible models for varied client requirements. Job shops depend on compact machines that support custom orders with fast changeovers. Custom metal fabricators prioritize accuracy and ease of programming. Vertical needs shape machine configuration choices. Workflow complexity determines controller selection and automation level. These differences guide investment patterns across regions. It helps define long-term machine adoption cycles.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Product Type

- Hydraulic Press Brakes

- Mechanical Press Brakes

- Pneumatic / Servo-Assisted Press Brakes

By Application

- Sheet Metal Forming

- Bending Operations

- Punching System Integrations

- Large-Format Sheet Metal Work

- Small-Form Precision Metal Work

By End-Use Industry

- Automotive

- Appliance Manufacturing

- Aerospace

- Construction

- General Metal Fabrication

- Electronics Enclosure Manufacturing

By Industry Verticals

- OEMs

- Contract Manufacturers

- Job Shops

- Custom Metal Fabricators

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific

Asia-Pacific holds the largest market share due to strong metal fabrication ecosystems in China, Japan, India, and South Korea. Regional manufacturers expand capacity to meet rising demand for automotive, construction, and machinery components. Local machine tool production clusters strengthen equipment availability and shorten delivery cycles. Fabricators adopt CNC and servo-electric systems to improve accuracy and reduce labor reliance. Investments in new manufacturing parks support steady equipment upgrades. The press brake machine market gains major volume from this region, and it benefits from continued industrial expansion.

Europe

Europe secures the second-largest market share, supported by advanced fabrication capabilities in Germany, Italy, and France. Regional users prioritize high-precision systems that meet strict quality and safety rules. CNC adoption remains strong due to demand for complex components in aerospace, automotive, and industrial machinery sectors. Energy-efficient models gain traction in countries that emphasize sustainable manufacturing. Local players maintain strong influence through technical innovation and high-end machine tool engineering. The press brake machine market grows steadily in Europe through premium equipment demand.

North America

North America holds a significant market share driven by mature fabrication hubs in the United States and Canada. Manufacturers invest in automated bending systems to support large-scale production and skilled labor shortages. Industrial users strengthen output in appliances, heavy equipment, and metal enclosures through modern CNC models. Fabrication shops adopt servo-driven machines to improve repeatability and reduce operational costs. Demand rises as infrastructure and machinery projects expand across the region. The press brake machine market gains stable adoption in North America through strong modernization cycles.

Key Player Analysis:

- Amada

- TRUMPF

- Bystronic

- LVD

- Cincinnati Incorporated

- Durmazlar (Durma)

- ACCURL

- Ermaksan

- Baykal

Competitive Analysis:

The Press brake machine market features strong competition driven by technology upgrades, automation adoption, and precision requirements across fabrication clusters. Leading players focus on CNC innovation, servo-electric systems, and energy-efficient models to strengthen product differentiation. Global brands expand portfolios to support heavy-duty bending, fast setup cycles, and advanced safety features. Regional manufacturers compete through cost-effective solutions and rapid customization. Companies invest in software integration to improve real-time accuracy and workflow control. Partnerships with automation providers help broaden system capabilities across diverse industries. It advances through sustained innovation, strong service networks, and consistent upgrades in forming technology.

Recent Developments:

- In August 2025, Amada launched the CR-010B, a collaborative bending robot designed to automate press brake operations. The robot can be easily attached and detached from the press brake, enabling flexible use: human operators can handle complex or small-batch workpieces, while the robot performs simple or mass production tasks.

- In late 2023, Amada began sales of new products in its HRB series of next-generation large press brakes, expanding the range to seven models with support for long and medium-to-thick materials from 350 tons/3 meters to 600 tons/7 meters. The new HRB series features a hybrid drive system using an AC servo motor and two-way piston pump, enhancing energy efficiency and environmental performance.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, End-Use Industry, Industry Verticals, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of CNC and servo-electric models will shape next-generation workflows.

- Fabricators will expand automation investments to improve cycle stability and output.

- Energy-efficient systems will gain priority among large and mid-sized manufacturing units.

- High-strength material usage will increase demand for advanced bending capabilities.

- Smart platforms will support real-time diagnostics and accuracy tracking.

- Heavy engineering and EV component makers will expand precision bending needs.

- Flexible, compact models will gain traction in job shops and custom fabrication units.

- Safety-enhanced designs will strengthen compliance across global plants.

- Digital control upgrades will support multi-axis accuracy improvements.

- Global vendors will expand service networks to support rapid adoption cycles.