Market Overview:

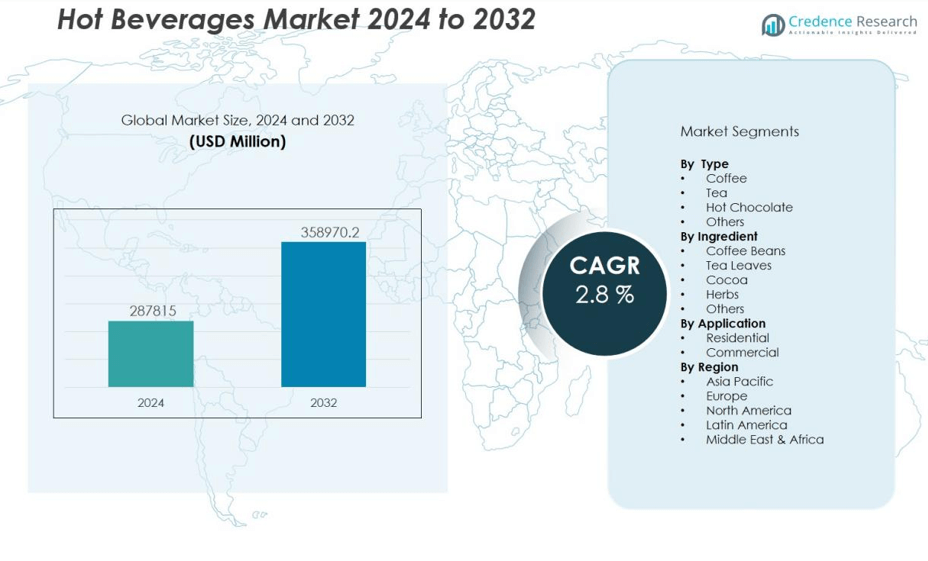

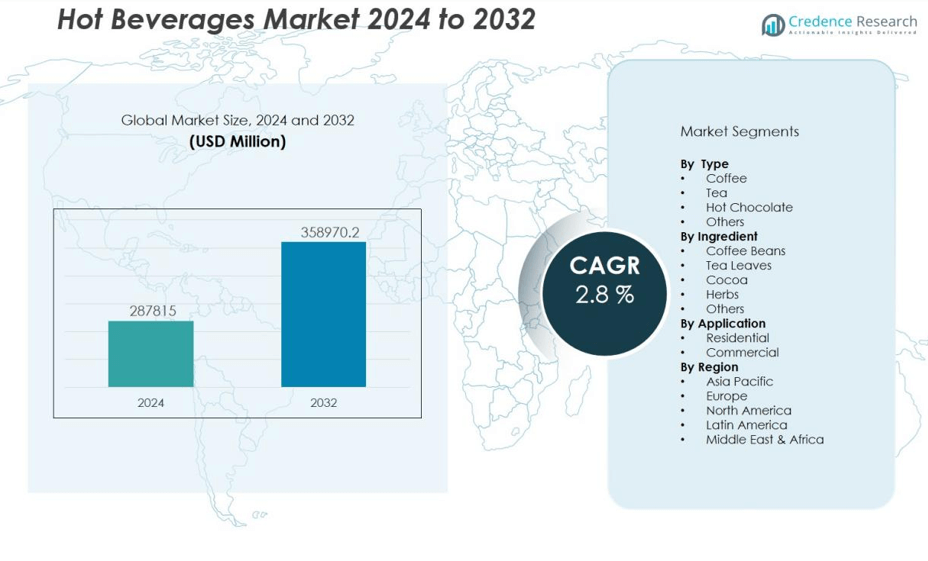

The hot beverages market size was valued at USD 287815 million in 2024 and is anticipated to reach USD 358970.2 million by 2032, at a CAGR of 2.8 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hot Beverages Market Size 2024 |

USD 287815 million |

| Hot Beverages Market, CAGR |

2.8% |

| Hot Beverages Market Size 2032 |

USD 358970.2 million |

Market growth is driven by rising health and wellness awareness, which has boosted demand for herbal and functional hot beverages with added nutritional benefits. The increasing popularity of specialty coffee, artisanal tea blends, and ready-to-drink hot beverage formats is reshaping consumption trends. Technological advancements in brewing equipment, coupled with expanding café culture and home-brewing convenience, are further driving adoption. Sustainability initiatives, including eco-friendly packaging and fair-trade sourcing, are also influencing purchase decisions.

Regionally, Asia-Pacific dominates the hot beverages market, supported by strong tea consumption in China, India, and Japan, alongside rising coffee adoption among younger consumers. Europe remains a key market, driven by a long-standing café culture and premiumization trends, while North America is witnessing strong growth in specialty coffee and health-focused beverage segments.

Market Insights:

- The hot beverages market was valued at USD 287,815 million in 2024 and is projected to reach USD 358,970.2 million by 2032, growing at a CAGR of 2.8%.

- Rising health and wellness awareness is boosting demand for herbal teas, green tea, and functional beverages enriched with antioxidants, vitamins, and adaptogens.

- Specialty coffee and artisanal tea culture are expanding, supported by café proliferation, single-origin offerings, and ethically sourced products.

- Technological advancements in brewing equipment, e-commerce platforms, and subscription models are enhancing accessibility and consumer convenience.

- Sustainability commitments, including eco-friendly packaging, recyclable materials, and fair-trade sourcing, are shaping purchase decisions.

- Asia-Pacific leads with 42% market share, followed by Europe at 28% and North America at 20%, each driven by unique cultural and consumption trends.

- Market challenges include fluctuating raw material prices, intense competition, and shifting preferences toward low-sugar, plant-based, and ready-to-drink alternatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Consumer Preference for Health and Wellness-Oriented Beverages:

The growing awareness of health and wellness is significantly influencing consumer choices in the hot beverages market. Demand for herbal teas, green tea, and functional beverages enriched with antioxidants, vitamins, and adaptogens is accelerating. Consumers are increasingly opting for low-sugar, natural, and organic options that align with preventive health trends. This shift is prompting manufacturers to expand portfolios with products that offer both flavor and functional benefits, strengthening their market position.

- For instance, Matcha green tea from brands such as Tradition Matcha is scientifically proven to contain up to 1,968.8mg/L of flavonoids and 1,765.1mg/L of polyphenols per liter, making it one of the highest antioxidant beverages available in the category.

Expansion of Specialty Coffee and Premium Tea Culture:

The surge in specialty coffee and artisanal tea consumption is a major growth driver. Urban consumers are seeking unique flavors, single-origin varieties, and ethically sourced products. The proliferation of coffeehouses, tea lounges, and specialty cafés has elevated beverage experiences, encouraging premium purchases. The hot beverages market benefits from this trend through higher value sales and increased customer loyalty toward quality-focused brands.

- For instance, Nespresso’s VertuoLine machines spin coffee capsules at up to 7,000 RPM to achieve uniform infusion and a velvety crema on every cup.

Technological Advancements in Brewing and Distribution Channels:

Advancements in brewing equipment, from single-serve machines to smart coffee makers, are enhancing convenience for both households and commercial establishments. E-commerce platforms and subscription models are expanding product accessibility, allowing brands to reach a broader audience. It leverages these innovations to improve distribution efficiency and strengthen brand presence. This integration of technology is reshaping consumer engagement and purchasing habits.

Sustainability and Ethical Sourcing Driving Brand Differentiation:

Sustainability has become a core purchasing criterion, influencing packaging choices and sourcing strategies. Consumers are favoring brands committed to fair trade, eco-friendly packaging, and traceable supply chains. The hot beverages market is responding by adopting recyclable materials and supporting ethical farming practices. These initiatives not only meet regulatory requirements but also enhance brand credibility in competitive markets.

Market Trends:

Premiumization and Diversification of Product Portfolios:

The shift toward premium and diverse beverage options is reshaping the competitive landscape of the hot beverages market. Consumers are increasingly drawn to specialty coffee, artisanal tea blends, and limited-edition seasonal flavors that deliver unique taste experiences. Brands are introducing single-origin and micro-lot varieties to cater to discerning buyers who value authenticity and provenance. Functional ingredients, such as adaptogens, probiotics, and plant-based alternatives, are being incorporated to enhance nutritional value. It is also expanding into fusion beverages that combine traditional flavors with contemporary twists to capture younger demographics. The trend is driving higher price points and strengthening customer loyalty in both retail and foodservice channels.

- For instance, Keurig Dr Pepper’s K-Brew + Chill brewer, introduced in fall 2024, employs QuickChill™ Technology to deliver coffee three times colder than its prior Brew-Over-Ice method in under 3 minutes.

Integration of Technology and Sustainable Practices in Operations:

Technological innovation is influencing how consumers purchase and prepare hot beverages. Smart brewing devices, mobile ordering, and subscription-based delivery models are becoming mainstream, offering convenience and personalization. E-commerce platforms are enabling direct-to-consumer engagement, supported by targeted digital marketing campaigns. The hot beverages market is adopting sustainable practices, such as compostable packaging, carbon-neutral production, and ethical sourcing, to meet evolving consumer expectations. It is also witnessing collaborations between beverage brands and technology companies to create interactive customer experiences. This combination of digital transformation and sustainability is shaping long-term competitive strategies across the industry.

- For instance, Keurig Dr Pepper shipped 9.7 million single-serve coffee brewers in the 12 months ending December 31, 2023.

Market Challenges Analysis:

Fluctuating Raw Material Prices and Supply Chain Vulnerabilities:

Volatility in the prices of key raw materials such as coffee beans, tea leaves, cocoa, and dairy products poses a significant challenge for the hot beverages market. Unpredictable weather patterns, geopolitical tensions, and trade restrictions disrupt supply stability and increase production costs. Small and medium-sized brands face higher pressure in maintaining profit margins amid fluctuating input expenses. It also contends with logistical bottlenecks, including port delays and transportation shortages, which can hinder timely distribution. These challenges demand agile sourcing strategies and strong supplier relationships to sustain market competitiveness.

Intense Competition and Shifting Consumer Preferences:

The market faces strong competition from both global brands and local players offering niche, innovative products. Rapidly changing consumer preferences toward healthier, low-sugar, and plant-based options require continuous product adaptation. Failure to meet these evolving demands risks losing market share to agile competitors. The hot beverages market must also address the growing popularity of ready-to-drink cold beverages, which can divert consumer spending. It requires sustained investment in research, product development, and marketing to retain relevance and customer loyalty in a crowded landscape.

Market Opportunities:

Expansion into Functional and Health-Focused Beverage Segments:

The growing demand for beverages that offer health benefits presents a strong opportunity for the hot beverages market. Functional teas, fortified coffees, and herbal infusions with immunity-boosting or stress-relieving properties are gaining popularity among health-conscious consumers. Brands can leverage this trend by innovating with superfoods, adaptogens, and plant-based ingredients. It can also expand product lines to include options catering to specific dietary needs, such as vegan, keto-friendly, or gluten-free. Strategic collaborations with nutrition experts and wellness influencers can further strengthen market positioning. This focus on functional offerings aligns with global wellness trends and supports premium pricing potential.

Leveraging Digital Channels and Emerging Markets for Growth:

The rapid expansion of e-commerce and subscription-based delivery models creates new avenues for brand reach and customer engagement. The hot beverages market can capitalize on direct-to-consumer platforms to personalize product recommendations and build loyalty. Growing middle-class populations in emerging markets, coupled with rising disposable incomes, provide fertile ground for market expansion. Urbanization and café culture adoption in Asia, Africa, and Latin America offer untapped sales potential. It can also benefit from targeted marketing strategies and localized product innovations to appeal to regional tastes. These opportunities can significantly enhance market penetration and revenue streams in the coming years.

Market Segmentation Analysis:

By Type:

The hot beverages market is segmented into coffee, tea, hot chocolate, and others. Coffee holds the largest share, driven by the rising popularity of specialty brews, single-origin varieties, and café culture. Tea remains a strong segment, supported by deep-rooted consumption habits in Asia and growing demand for herbal and green tea in global markets. Hot chocolate appeals to both younger consumers and indulgence-seeking adults, with premium and artisanal variants gaining traction.

- For instance, Twinings reached over 4.84 million consumers for its herbal and green tea varieties in the UK in 2023, showing robust demand for premium blends.

By Ingredient:

Key ingredients include coffee beans, tea leaves, cocoa, herbs, and others. Coffee beans lead the segment due to strong consumption in both retail and foodservice channels. Tea leaves see consistent demand, with specialty and organic variants attracting health-conscious buyers. Cocoa remains integral to the hot chocolate segment, while herbs such as chamomile, ginger, and peppermint are increasingly used in functional blends. It benefits from the rising interest in natural and ethically sourced raw materials.

- For instance, Nestlé’s Abuelita Mexican Style Hot Chocolate Mix uses cocoa sourced under the Nestlé Cocoa Plan, offering an 18-month shelf life and is produced in 2lb bulk pouches for commercial and retail use.

By Application:

Applications span residential and commercial use. Residential consumption is supported by convenient brewing devices and expanding e-commerce availability. Commercial applications, including cafés, restaurants, hotels, and corporate spaces, drive significant sales through premium beverage offerings. Seasonal menus, on-site brewing technology, and experiential service formats further enhance growth in this segment.

Segmentations:

By Type:

- Coffee

- Tea

- Hot Chocolate

- Others

By Ingredient:

- Coffee Beans

- Tea Leaves

- Cocoa

- Herbs

- Others

By Application:

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia-Pacific :

Asia-Pacific holds 42% market share in the global hot beverages market, driven by its deep-rooted tea culture and expanding coffee consumption. China, India, and Japan remain dominant tea markets, while Southeast Asian countries are experiencing rapid growth in specialty coffee demand. Rising disposable incomes and urban lifestyles are fueling café culture and premium product adoption. It benefits from strong retail networks, growing e-commerce penetration, and a young consumer base eager to try new flavors. Health-focused products, such as green tea and herbal infusions, are gaining traction among middle-class households. Government initiatives supporting agricultural development further strengthen the supply base.

Europe :

Europe commands 28% market share, supported by a long-established coffeehouse and tea tradition. The region exhibits strong demand for specialty and organic hot beverages, particularly in countries like the UK, Germany, France, and Italy. Premiumization trends are evident in the popularity of single-origin coffee and artisanal tea blends. The hot beverages market benefits from well-developed distribution infrastructure and a high preference for ethically sourced products. Sustainability commitments, such as recyclable packaging and fair-trade certifications, are key purchase drivers. Seasonal and festive product launches remain popular across retail and hospitality channels.

North America :

North America holds 20% market share, fueled by the popularity of premium coffee, health-oriented beverages, and on-the-go formats. The United States leads consumption, with a strong presence of global café chains and innovative local roasters. Consumer interest in plant-based creamers, low-sugar hot chocolate, and fortified teas is expanding the product mix. It benefits from advanced brewing technology adoption and high per-capita beverage spending. Direct-to-consumer models and subscription services are gaining traction, enhancing brand loyalty. Seasonal flavors and limited-edition offerings continue to boost sales in both retail and foodservice channels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Celestial Seasonings,

- Harney & Sons

- Costa Limited

- Dilmah

- Nestlé S.A.

- JAB Holding Company

- Smucker Company

- JDB (China) Beverages Ltd.

- Jacobs Douwe Egberts

- Kraft Heinz Company

- McCafé

- Luigi Lavazza S.p.A.

- Twini

Competitive Analysis:

The hot beverages market is highly competitive, with global brands and regional specialists competing for market share through product innovation, brand positioning, and distribution strength. Leading players such as Celestial Seasonings, Inc., Harney & Sons, Costa Limited, Dilmah, Nestlé S.A., McCafé, Luigi Lavazza S.p.A., and R. Twining & Company maintain strong portfolios spanning coffee, tea, and specialty beverages. It is characterized by high brand loyalty, where consumer preferences are shaped by flavor variety, ethical sourcing, and quality consistency. Companies invest heavily in sustainable practices, premium product lines, and health-focused formulations to align with evolving market trends. Strategic partnerships, acquisitions, and expansion into e-commerce are key tactics to enhance reach and engagement. Innovation in brewing technology, seasonal offerings, and functional beverage formulations continues to be a core differentiator in strengthening competitive advantage.

Recent Developments:

- In April 2025, Nestlé S.A. initiated its largest-ever agroforestry partnership with OFI (Olam Food Ingredients), aiming to train 25,000 cocoa farmers and plant 2.8 million trees in Nigeria, Côte d’Ivoire, and Brazil.

- In May 2025, Dilmah and Emirates celebrated 33 years of partnership, highlighting over 33 million cups of Dilmah tea served annually on Emirates flights.

Market Concentration & Characteristics:

The hot beverages market exhibits moderate concentration, with a mix of global corporations and strong regional players competing across product categories. Leading brands such as Nestlé, Starbucks, Unilever, JDE Peet’s, and Tata Consumer Products dominate through extensive distribution networks, diversified portfolios, and strong brand equity. It is characterized by high product differentiation, frequent innovation in flavors and formats, and increasing emphasis on premium and functional offerings. Consumer loyalty plays a critical role, driven by consistent quality and brand reputation. Market dynamics are influenced by seasonal demand shifts, evolving health trends, and sustainability initiatives. E-commerce expansion and café culture growth continue to reshape competitive positioning.

Report Coverage:

The research report offers an in-depth analysis based on Type, Ingredient, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand for functional hot beverages with added health benefits will continue to grow, driven by consumer focus on wellness and preventive nutrition.

- Specialty coffee and premium tea segments will expand further, supported by rising urban café culture and evolving taste preferences.

- Brands will increasingly invest in sustainable sourcing, recyclable packaging, and carbon-neutral production to meet environmental expectations.

- Digital sales channels, including e-commerce platforms and subscription-based models, will strengthen market accessibility and customer retention.

- Emerging markets in Asia, Africa, and Latin America will witness faster adoption due to growing middle-class populations and urbanization.

- Product innovation will focus on unique flavor combinations, fusion beverages, and plant-based alternatives to cater to diverse dietary needs.

- Smart brewing devices and personalized beverage technology will enhance consumer convenience and engagement.

- Seasonal, limited-edition, and culturally inspired product launches will play a vital role in driving short-term sales spikes.

- Strategic collaborations between beverage brands, cafés, and technology companies will boost experiential marketing and brand visibility.

- Health-focused and ethically positioned brands will gain a competitive edge as conscious consumption shapes purchasing decisions.