Market Overview

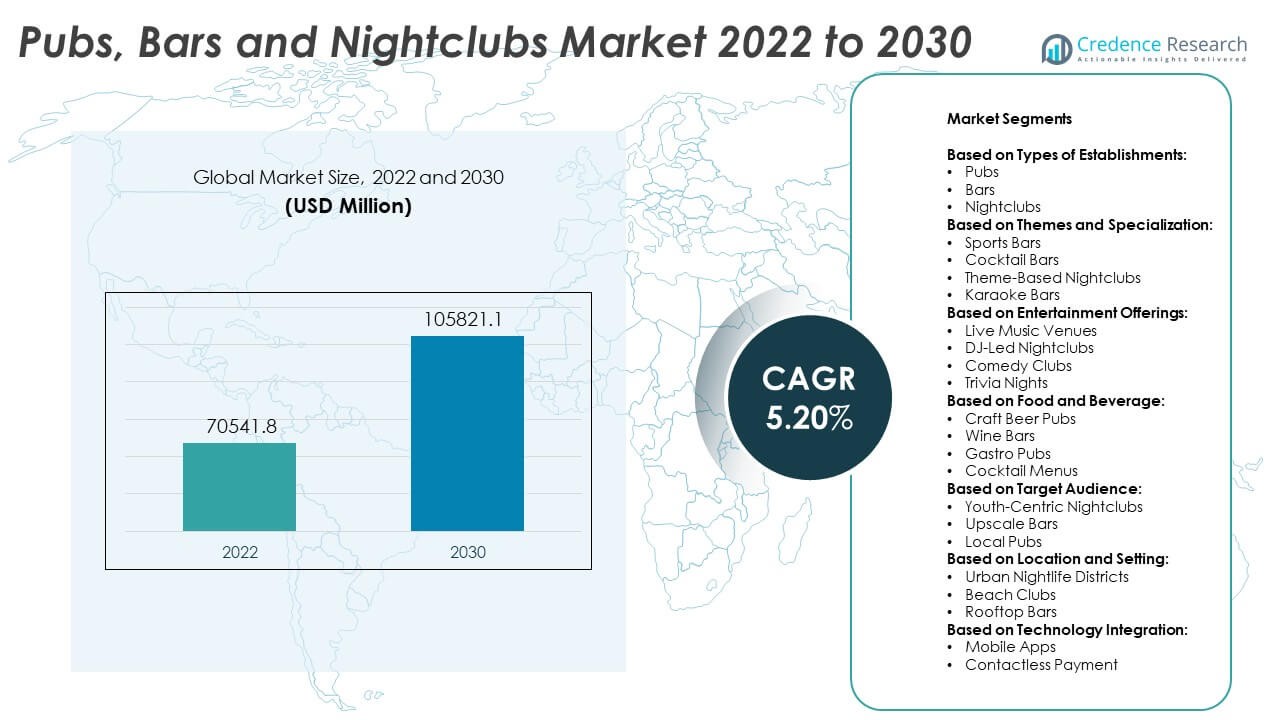

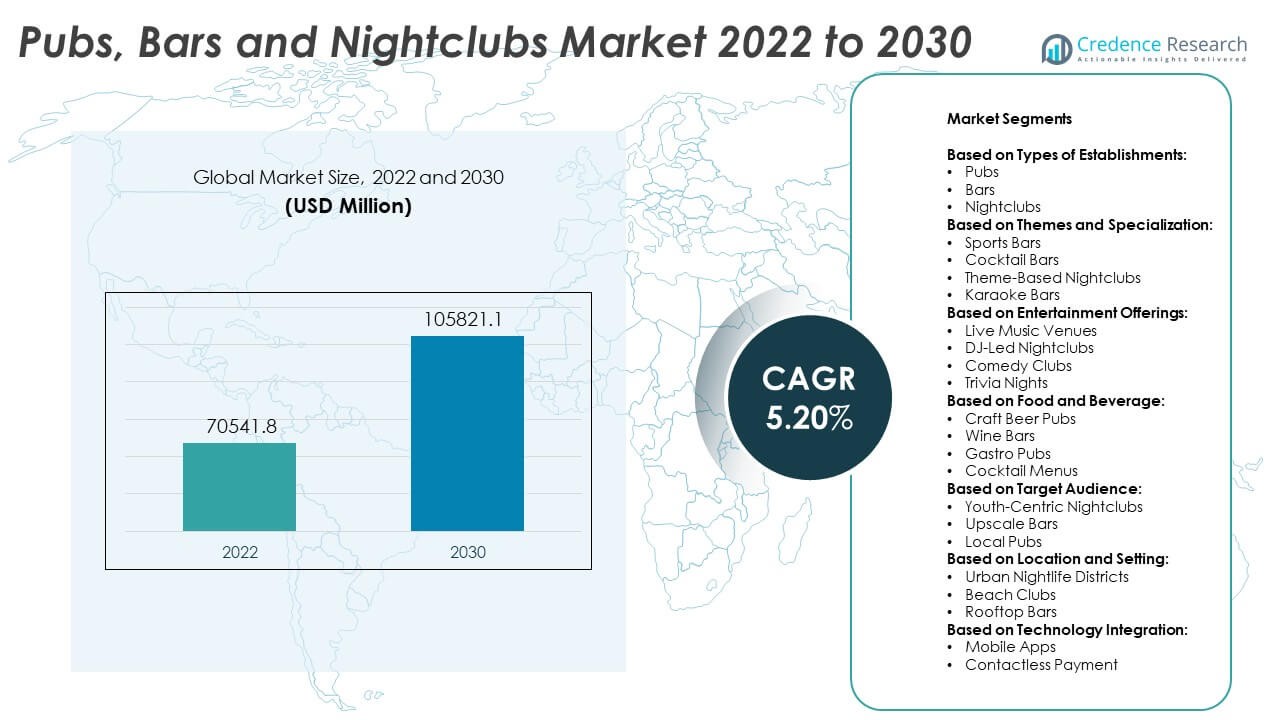

Pubs, Bars and Nightclubs Market size was valued at USD 70.54 Billion in 2024 and is anticipated to reach USD 105.82 Billion by 2032, at a CAGR of 5.20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pubs, Bars and Nightclubs Market Size 2024 |

USD 70.54 Billion |

| Pubs, Bars and Nightclubs Market, CAGR |

5.20% |

| Pubs, Bars and Nightclubs Market Size 2032 |

USD 105.82 Billion |

The Pubs, Bars and Nightclubs market grows on the strength of rising urbanization, increasing disposable income, and evolving consumer preferences for social and experiential entertainment. Demand for premium offerings, live music, and themed venues supports expansion across urban centers and travel destinations. Operators adopt digital tools to streamline service, personalize engagement, and improve operational efficiency. Trends such as health-conscious drink options, sustainability practices, and hybrid venue formats further shape market evolution. It benefits from collaborations with beverage brands, tech integration, and event-driven models that enhance customer loyalty and revenue potential across diverse demographic segments.

The Pubs, Bars and Nightclubs market shows strong presence in North America and Europe, supported by established nightlife infrastructure, high consumer spending, and cultural affinity for on-premise socializing. Asia Pacific emerges as a high-growth region driven by urban expansion, tourism, and evolving lifestyle trends in countries like China, India, and Japan. Latin America and the Middle East & Africa present niche opportunities in urban hubs and hospitality zones. Key players shaping the market include Accor SA, J D Wetherspoon plc.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Pubs, Bars and Nightclubs market was valued at USD 70.54 Billion in 2022 and is expected to reach USD 105.82 Billion by 2032, growing at a CAGR of 5.20%.

- Rising urbanization, disposable income growth, and changing social behavior support increased spending on nightlife and on-premise entertainment venues.

- Premiumization, health-conscious beverage options, digital service tools, and hybrid venue formats drive evolving consumer expectations and new revenue streams.

- Competition remains fragmented, with a mix of hotel-affiliated luxury venues, national pub chains, and independent operators offering localized experiences.

- High regulatory compliance costs, licensing barriers, and staff shortages challenge operational agility and long-term profitability for venue owners.

- North America and Europe dominate the market due to established social drinking culture and tourism infrastructure, while Asia Pacific shows rapid growth from urban expansion and lifestyle shifts.

- Key players such as Accor SA, J D Wetherspoon plc, Four Seasons Hotels Ltd., and Hakkasan Group shape market development through strategic expansions, digital adoption, and curated guest experiences.

Market Drivers

Rising Urbanization and Shifting Social Preferences Fuel On-Premise Leisure Demand

The Pubs, Bars and Nightclubs market benefits from rapid urban population growth and changing lifestyle patterns. Urban dwellers increasingly seek out social venues for after-work relaxation, weekend gatherings, and nightlife experiences. Younger demographics prioritize experiential entertainment over material consumption, reinforcing demand for casual yet vibrant social environments. The growth of dual-income households increases disposable income and supports higher expenditure on recreational activities. It aligns with the rising popularity of themed bars, rooftop lounges, and music-driven venues that attract a wide clientele. This cultural shift sustains steady footfall and broadens the market’s consumer base.

- For instance, J D Wetherspoon plc operated over 814 pubs across the UK and Ireland in 2024, offering event-driven evenings and location-specific promotions, which led to an increase of 7.7 million drinks served compared to the previous year.

Expansion of Alcoholic Beverage Offerings and Brand Collaborations Drive Footfall

The market gains momentum from a diverse and evolving alcoholic beverage portfolio that appeals to varied taste preferences. Craft beer, premium spirits, and mixology-based cocktails enhance the appeal of pubs and nightclubs seeking to differentiate themselves. Beverage companies actively collaborate with venue operators to launch signature drinks, seasonal menus, and promotional events. It supports repeat visits and customer engagement while creating an exclusive experience. Limited-edition releases and tasting sessions attract both connoisseurs and casual consumers. This synergy between beverage producers and venue owners sharpens the market’s competitive edge.

- For instance, Hakkasan Group launched a global series of premium cocktail experiences in partnership with Rémy Cointreau, hosting over 150 events across its nightlife venues.

Digital Integration Enhances Operational Efficiency and Customer Retention

The Pubs, Bars and Nightclubs market adopts digital platforms to streamline reservations, manage inventory, and personalize customer engagement. Mobile apps, loyalty programs, and targeted digital marketing help venues attract and retain customers. It enables data-driven decisions that improve service efficiency, menu optimization, and crowd management. Operators deploy customer feedback systems and performance analytics to refine offerings and address evolving preferences. Smart payment systems and contactless transactions also improve convenience and safety. These digital advancements increase operational control and elevate the overall guest experience.

Tourism Recovery and Event-Based Revenue Models Stimulate Market Expansion

The global rebound in tourism and large-scale events generates new opportunities for the Pubs, Bars and Nightclubs market. Tourists seek immersive nightlife experiences that reflect local culture and entertainment. Venue operators capitalize on festivals, concerts, and sports events to drive high traffic volumes and premium spending. It promotes collaboration with event organizers, DJs, and influencers to amplify exposure. Temporary pop-up bars and themed nights add variety and seasonal interest to existing operations. This focus on event-led programming expands revenue streams beyond regular business hours.

Market Trends

Premiumization of Experiences Elevates Consumer Willingness to Spend More Per Visit

The Pubs, Bars and Nightclubs market sees a growing trend toward premium offerings and curated experiences. Consumers show a preference for high-quality beverages, luxury interiors, and personalized service. Venues introduce exclusive tasting menus, VIP lounges, and mixologist-led bar counters to justify higher price points. It reflects a shift in customer expectations from simple service to experiential value. Upscale venues gain popularity among urban professionals and affluent travelers seeking social sophistication. This premiumization trend influences design, pricing, and promotional strategies across the market.

- For instance, Diageo launched over 45 new low- and no-alcohol products, achieving sales of 282 million across this category, reflecting surging demand in premium pubs and clubs.

Health-Conscious Choices Drive Demand for Low and No-Alcohol Alternatives

A shift toward wellness influences drinking behavior, prompting venues to expand non-alcoholic and low-ABV product lines. Health-aware consumers seek alternatives that balance social enjoyment with moderation. The Pubs, Bars and Nightclubs market responds by offering botanical mocktails, fermented teas, and alcohol-free spirits. It allows operators to attract a broader demographic, including designated drivers and sober-curious patrons. Beverage innovation in this category receives strong interest from both global brands and local distilleries. These offerings strengthen inclusivity and reduce dependence on traditional alcohol sales.

- For instance, Mitchells and Butlers plc implemented digital ordering systems in over 1,600 sites, processing more than 11.4 million app-based transactions within the first six months of rollout.

Technology Integration Enhances Guest Experience and Operational Control

Smart technologies increasingly shape the guest journey in nightlife venues. Contactless ordering, app-based reservations, and digital menus become standard in modern pubs and clubs. The Pubs, Bars and Nightclubs market uses these tools to optimize labor, minimize wait times, and capture consumer data. It enables venues to deliver faster service and personalized promotions. Advanced sound and lighting systems also transform the ambiance and support immersive entertainment formats. This digital shift improves both efficiency and guest satisfaction across operating models.

Sustainability Initiatives Influence Design, Procurement, and Consumer Loyalty

Sustainable practices gain traction across hospitality venues seeking long-term brand trust. Many operators adopt eco-friendly materials, minimize single-use plastics, and prioritize local sourcing for food and beverages. The Pubs, Bars and Nightclubs market aligns with consumer interest in ethical and environmentally responsible experiences. It helps differentiate brands in competitive urban landscapes where green values matter. Certifications, waste reduction goals, and transparency in operations appeal to socially conscious audiences. This trend reinforces environmental stewardship without compromising service quality.

Market Challenges Analysis

Rising Regulatory Pressures and Compliance Costs Strain Operational Agility

The Pubs, Bars and Nightclubs market faces persistent regulatory scrutiny related to alcohol licensing, public safety, and zoning laws. Venue owners must navigate complex approval processes and frequent inspections, which delay expansion or renovation plans. It increases the cost burden through mandatory security installations, staff certifications, and insurance premiums. Regulatory frameworks often differ across municipalities, making scalability difficult for multi-location operators. Compliance failures carry penalties that threaten both revenue and reputation. These pressures reduce flexibility in business decisions and require continuous legal and procedural alignment.

Labor Shortages and High Attrition Rates Disrupt Service Consistency

Securing and retaining skilled staff remains a major concern for nightlife venue operators. The Pubs, Bars and Nightclubs market relies heavily on bartenders, servers, and security personnel to maintain service quality and customer satisfaction. It struggles with high turnover rates driven by irregular hours, intense workloads, and limited career advancement. Training new employees adds to operational delays and increases onboarding costs. Poor staff availability during peak periods directly impacts guest experience and revenue flow. This labor instability limits capacity and impairs consistency in hospitality standards.

Market Opportunities

Expansion into Tier-2 Cities and Emerging Travel Hubs Broadens Revenue Potential

The Pubs, Bars and Nightclubs market holds significant opportunity in expanding beyond saturated metropolitan centers. Rising disposable income, improved infrastructure, and growing youth populations in tier-2 cities create favorable conditions for nightlife development. It enables operators to access untapped demographics with evolving social preferences. Tourist destinations and emerging travel hubs also offer seasonal spikes in demand for on-premise entertainment. Brands that localize their offerings and adapt to regional tastes gain faster acceptance. Strategic entry into these high-growth zones supports long-term scalability and brand visibility.

Diversification Through Day-Part Concepts and Multi-Use Spaces Increases Utilization

Operators can unlock value by extending business hours through new service models. The Pubs, Bars and Nightclubs market benefits from venues that serve as cafés or co-working lounges during the day and transform into nightlife spaces by evening. It maximizes real estate use while appealing to different consumer segments throughout the day. Hosting brunches, live acoustic sessions, and private events adds new revenue streams. Adaptive layouts and modular furniture help manage this transition without major capital investment. These concepts improve profitability through higher asset productivity and broader customer engagement.

Market Segmentation Analysis:

By Types of Establishments:

The Pubs, Bars and Nightclubs market divides into pubs, bars, and nightclubs, each catering to distinct customer expectations. Pubs maintain strong appeal through their casual ambiance, community-centric atmosphere, and broad food menus. Bars offer a wide spectrum of experiences, ranging from high-end cocktail lounges to casual neighborhood setups focused on drinks and light snacks. Nightclubs attract younger audiences with a high-energy environment, dance floors, and extended operating hours. It reflects dynamic demand patterns based on time of day, consumer lifestyle, and spending capacity. These core categories serve as foundational anchors for market revenue across urban and tourist locations.

- For instance, Accor SA eliminated more than 290 million single-use plastic items across its hotels and bars by the end, while sourcing 74% of its food and beverage supplies locally to meet sustainability targets.

By Themes and Specialization:

Specialized formats continue to gain traction by creating differentiated customer experiences. Sports bars thrive on live event broadcasts, integrating screens, merchandise, and dedicated fan zones that boost repeat visits. Cocktail bars focus on mixology and curated menus, drawing in premium clientele with crafted beverages and upscale service. Theme-based nightclubs center their appeal around immersive décor and music, often aligned with cultural, seasonal, or retro inspirations. Karaoke bars maintain popularity in urban centers and travel corridors, encouraging group visits and longer dwell times. The Pubs, Bars and Nightclubs market leverages these formats to appeal to diverse demographics and drive brand positioning.

- For instance, Licorería Limantour in Mexico City launched over 120 new signature cocktails and reported sales of 460,000 cocktails during the year, making it one of the most awarded bars in Latin America.

By Entertainment Offerings:

Entertainment remains a critical lever for footfall generation and customer retention. Live music venues offer acoustic sets, indie performances, and regional talent showcases that build local loyalty. DJ-led nightclubs dominate in metropolitan centers, hosting touring acts and genre-based events to attract large crowds. Comedy clubs appeal to a wide audience segment seeking light entertainment in a relaxed setting, often combined with food and drink packages. Trivia nights support engagement in pubs and bars by fostering interactive, mid-week traffic and encouraging group participation. It allows venues to maintain consistent visitation and increase revenue per customer across varying operating days.

Segments:

Based on Types of Establishments:

Based on Themes and Specialization:

- Sports Bars

- Cocktail Bars

- Theme-Based Nightclubs

- Karaoke Bars

Based on Entertainment Offerings:

- Live Music Venues

- DJ-Led Nightclubs

- Comedy Clubs

- Trivia Nights

Based on Food and Beverage:

- Craft Beer Pubs

- Wine Bars

- Gastro Pubs

- Cocktail Menus

Based on Target Audience:

- Youth-Centric Nightclubs

- Upscale Bars

- Local Pubs

Based on Location and Setting:

- Urban Nightlife Districts

- Beach Clubs

- Rooftop Bars

Based on Technology Integration:

- Mobile Apps

- Contactless Payment

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share in the Pubs, Bars and Nightclubs market, accounting for 36.4% of global revenue. The region benefits from a deeply rooted pub and bar culture supported by a well-developed foodservice infrastructure and high consumer spending on entertainment. Major cities like New York, Los Angeles, Toronto, and Chicago serve as nightlife hubs with diverse venue formats, from upscale rooftop bars to DJ-led clubs. It witnesses strong patronage for theme-based concepts, such as speakeasy bars and sports pubs, often supported by real-time sporting event schedules. The U.S. leads regional growth due to its large urban population and steady tourism inflows. Operators across the region invest in venue upgrades, digital platforms, and experiential enhancements to retain younger audiences seeking high-value social interactions.

Europe

Europe represents the second-largest share, contributing 29.7% of the global Pubs, Bars and Nightclubs market. Countries such as the United Kingdom, Germany, France, and Spain show consistent consumer interest driven by strong cultural ties to pub-centric leisure. The UK’s historic pub network remains a vital part of its social fabric, with sports screenings, trivia nights, and cask ale offerings sustaining footfall. In Southern Europe, late-night culture supports nightclub attendance, particularly in tourist destinations like Ibiza, Mykonos, and Barcelona. It sees a rise in cocktail and lounge bar formats across urban centers appealing to professionals and high-income groups. Regulatory stability, combined with a diverse entertainment offering, sustains long-term revenue strength across the region.

Asia Pacific

Asia Pacific accounts for 21.3% of the global market, with strong growth expected from emerging middle-class spending and urban expansion. Major markets include China, Japan, India, South Korea, and Australia, each with unique nightlife patterns. In metropolitan centers like Tokyo, Seoul, and Mumbai, the rise of karaoke bars, live music venues, and upscale lounges reflects the influence of evolving consumer preferences and rising disposable income. It benefits from growing tourism, particularly in Southeast Asia, where beach towns and resort cities support seasonal nightlife peaks. International chains and local operators explore localized themes and menu curation to resonate with diverse tastes. The shift toward premium offerings and digital booking platforms further improves market accessibility and brand loyalty.

Latin America

Latin America holds a smaller but notable share of 7.5% in the Pubs, Bars and Nightclubs market. Brazil, Mexico, Argentina, and Colombia lead regional demand through a vibrant social culture and music-driven nightlife. It draws strength from traditional formats like open-air bars, dance-centric clubs, and hybrid café-bars that operate across meal and nightlife hours. Urban centers such as São Paulo and Mexico City exhibit growing interest in themed venues and craft beverage concepts. Challenges such as informal operations and regulatory inconsistencies hinder rapid scalability, but tourism growth supports seasonal spikes. Operators in this region focus on cost optimization and localized experiences to maintain profitability in price-sensitive segments.

Middle East & Africa

The Middle East & Africa contribute the remaining 5.1% of the global market, driven by tourism-focused cities and expatriate communities. Countries like the UAE, South Africa, Morocco, and Israel show increasing adoption of upscale bars and nightclubs, particularly in hospitality zones. Dubai and Cape Town feature premium venues offering curated menus, international DJs, and rooftop lounges that cater to global standards. It faces limitations due to religious and cultural restrictions in some territories, which restrict alcohol licensing and operational hours. Despite these barriers, tourism growth, economic diversification, and international hotel investments expand opportunities for licensed nightlife venues. Local adaptation and compliance remain critical to long-term viability in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mitchells and Butlers plc

- The Clumsies

- Attaboy

- McKs Tavern

- Four Seasons Hotels Ltd.

- PCO

- Hakkasan Group

- Kings Head Pub

- The Atlas

- The Cats Eye Pub

- Accor SA

- The Dove

- Floreria Atlantico

- Trailer Happiness

- Maybourne Hotel Group.

- Oetker Hotel Management Company GmbH

- J D Wetherspoon plc

- Boadas

- Licoreria Limantour

- Oberoi Group

Competitive Analysis

The Pubs, Bars and Nightclubs market features a diverse competitive landscape with leading players such as Accor SA, Attaboy, Boadas, Floreria Atlantico, Four Seasons Hotels Ltd., Hakkasan Group, J D Wetherspoon plc, Kings Head Pub, Licoreria Limantour, Maybourne Hotel Group, McKs Tavern, Mitchells and Butlers plc, Oberoi Group, Oetker Hotel Management Company GmbH, PCO, The Atlas, The Cats Eye Pub, The Clumsies, The Dove, and Trailer Happiness.These players compete on brand reputation, location, service quality, and themed experiences. Hotel-affiliated venues focus on upscale clientele through curated menus and luxury ambiance, while pub chains and independent bars emphasize affordability, community engagement, and entertainment diversity. Many operators invest in mixology innovation, live entertainment, and digital reservation platforms to improve customer retention. Regional adaptability and thematic differentiation remain essential in maintaining footfall across varied demographic segments. Operators that integrate loyalty programs and immersive entertainment formats enhance long-term brand equity. Competitive intensity remains high in urban centers, where proximity, service speed, and experiential novelty drive consumer choice. Strategic partnerships with alcohol brands, music labels, and tourism boards support market reach and revenue diversification.

Recent Developments

- In July 2025, J D Wetherspoon plc company achieved a 5.1% year-on-year increase in like‑for‑like sales over a 12‑week period ending July 20, driven by summer demand for drinks such as Guinness and sparkling wines. It revealed plans to open approximately 30 new pubs next year (divided equally between managed and franchised locations), alongside continued investment in staff amenities and glassware upgrades, aiming to meet full‑year profit expectations despite rising tax and wage pressures

- In April 2025, Accor SA Launched the Orient Express La Dolce Vita luxury train service, initiating its inaugural journey in Italy.

Market Concentration & Characteristics

The Pubs, Bars and Nightclubs market remains moderately fragmented, with a mix of large hospitality groups, regional chains, and independent establishments competing across urban and tourist-driven geographies. It features diverse venue formats, including high-end cocktail bars, traditional pubs, live music spaces, and theme-based nightclubs, each targeting specific audience segments. Market concentration is higher in developed regions, where branded operators maintain strong brand recall, operational scale, and loyalty programs. Independent venues dominate in emerging markets and smaller cities, offering localized experiences and flexible pricing. The market operates with low entry barriers, but long-term success requires regulatory compliance, staff retention, and experiential differentiation. It shows strong correlation with urbanization, tourism, and consumer leisure spending patterns. Players that invest in technology, premium offerings, and adaptive space utilization position themselves for sustained performance across changing demand cycles.

Report Coverage

The research report offers an in-depth analysis based on Types of Establishments, Themes and Specialization, Entertainment Offerings, Food and Beverage, Target Audience, Location and Settings, Technology Integration and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand further in tier-2 cities driven by urban growth and rising disposable income.

- Operators will focus on wellness-oriented offerings, including low and no-alcohol drinks.

- Technology adoption will increase across reservations, payments, and personalized marketing.

- Premium venues will gain market share through curated experiences and exclusive menus.

- Sustainability initiatives will influence material sourcing, waste reduction, and operational design.

- Demand for hybrid venues that serve different purposes throughout the day will grow.

- Strategic collaborations with alcohol brands and entertainment partners will become more common.

- Tourism recovery will support growth in resort-based and city-center nightlife venues.

- Investments in safety, compliance, and staff training will remain critical for risk mitigation.

- Themed entertainment formats will attract diverse age groups and increase venue differentiation.