| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Quantum Computing ASIC Market Size 2024 |

USD 134.30 million |

| Quantum Computing ASIC Market, CAGR |

28.90% |

| Quantum Computing ASIC Market Size 2032 |

USD 1,023.80 million |

Market Overview:

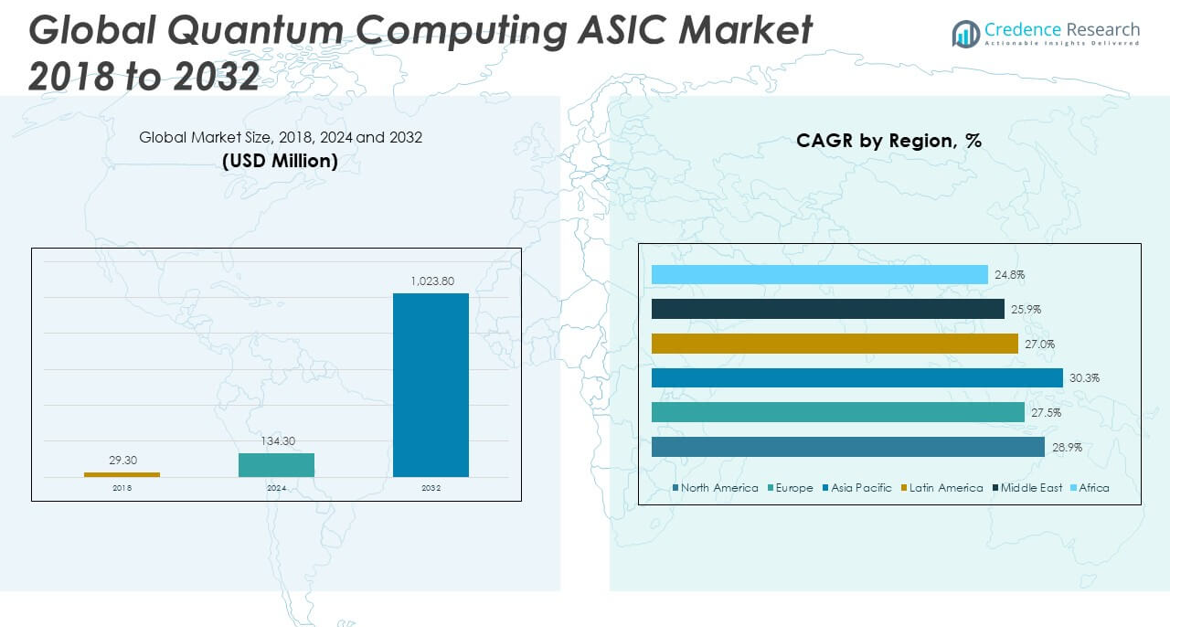

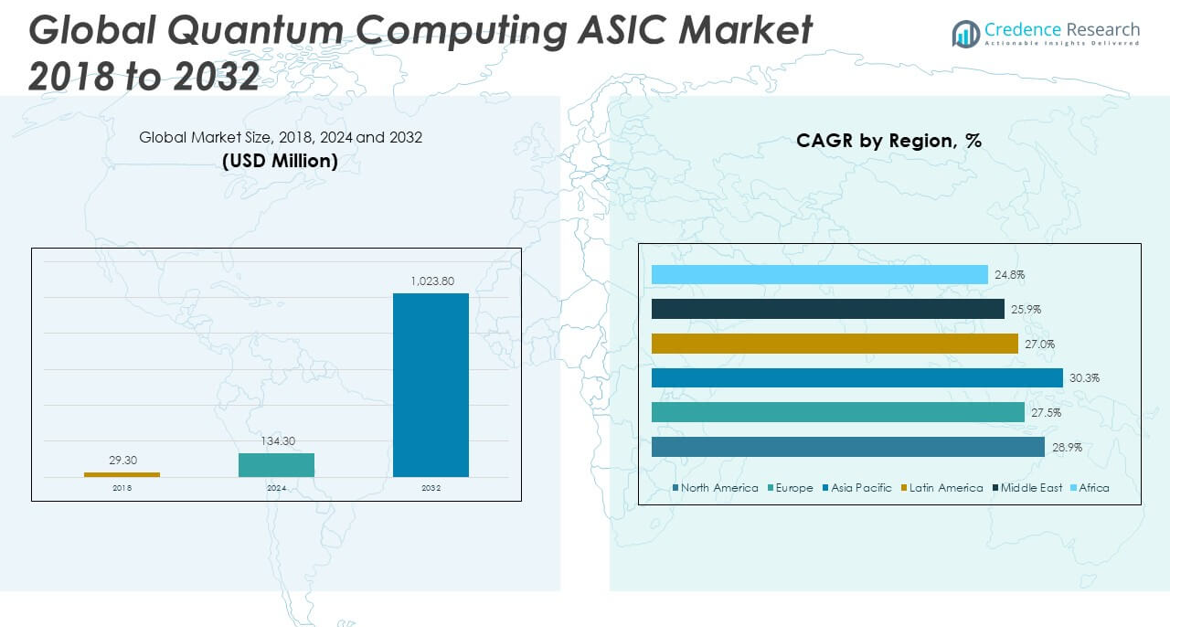

The Global Quantum Computing ASIC Market size was valued at USD 29.30 million in 2018 to USD 134.30 million in 2024 and is anticipated to reach USD 1,023.80 million by 2032, at a CAGR of 28.90% during the forecast period.

A primary driver behind this strong market expansion is intensifying investment in quantum hardware R&D from governments, large tech firms, and venture capitalists. In particular, companies focusing on silicon‑spin qubit control ASICs are benefiting from scaling efforts, as these chips promise higher operational stability and improved integration with qubit architectures . Additionally, the rise of hybrid quantum‑classical computing systems increases the need for ASICs that handle interfacing, fast data conversion, and precise qubit control on‑chip. As McKinsey notes, the “quantum‑as‑a‑service” model is gaining momentum, highlighting growing demand for cloud‑based quantum processors and corresponding ASICs. Finally, demand is also driven by emerging quantum‑sensitive applications from advanced cybersecurity to molecular simulation and next‑gen encryption which rely on optimized ASIC performance and energy efficiency at cryogenic temperatures.

North America leads the Quantum ASIC market, buoyed by strong public‑private R&D infrastructure, heavy investment from national initiatives, and key corporate‑academic ecosystems. The United States, in particular, benefits from collaborative ecosystems around IBM, Google, Microsoft, and other domestic players that support ASIC innovation for superconducting and silicon‑spin qubit platforms. In Europe, significant funding from EU quantum initiatives and active research in Germany, France, and the U.K. are fueling steady uptake of control ASICs. Meanwhile, Asia‑Pacific displays the highest regional growth, with China, Japan, South Korea, and India launching national quantum strategies and scaling up silicon‑spin and photonic ASIC development. The rapidly expanding Asia‑Pacific market is expected to continue outpacing global growth rates. Latin America and the Middle East & Africa remain in nascent stages, with experimental government programs and early-stage industry partnerships, but they hold future potential as they build infrastructure and expertise.

Market Insights:

- The market grew from USD 29.30 million in 2018 to USD 134.30 million in 2024 and is expected to reach USD 1,023.80 million by 2032, registering a strong CAGR of 28.90%.

- Governments, tech giants, and venture capitalists are intensifying R&D investments, with a focus on silicon spin qubit control ASICs for enhanced integration and stability.

- The rise of hybrid quantum-classical systems is driving demand for ASICs that enable precise interfacing, fast data conversion, and efficient control functions.

- Cloud-based quantum platforms are creating commercial demand for scalable, energy-efficient ASICs tailored for modular quantum hardware.

- Cryogenic compatibility and complex chip design remain major challenges, slowing scalability and limiting the pool of capable fabrication partners.

- North America leads the market with over one-third share, followed by Europe’s strategic funding and Asia Pacific’s fastest growth driven by national quantum programs.

- Applications in cybersecurity, pharmaceuticals, and advanced simulation are expanding ASIC use cases, guiding tailored chip design for industry-specific quantum workloads.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Custom Quantum Hardware Accelerates ASIC Adoption

The increasing need for application-specific hardware in quantum systems is a major driver of the Global Quantum Computing ASIC Market. Companies and research institutions require ASICs optimized for qubit control, quantum signal processing, and cryogenic compatibility. Unlike general-purpose chips, quantum ASICs deliver lower latency and power consumption, which are critical for quantum coherence. The shift toward tailored hardware solutions allows system integrators to improve performance and scalability in superconducting and silicon-spin qubit platforms. ASICs play a vital role in enhancing stability, reducing error rates, and improving quantum gate fidelity. This strong alignment with evolving quantum computing architectures drives consistent investment and development in the ASIC segment.

- For instance, SEALSQ, in its 2025 corporate documentation, announced the integration of post-quantum cryptographic algorithms within its proprietary Quantum ASICs, directly addressing the requirements of qubit control, signal processing, and cryogenic operation.

Government and Private Sector Investments Fuel R&D Advancements

Public funding and strategic investments by private firms are propelling innovation in quantum-specific ASIC design. Governments across North America, Europe, and Asia have launched quantum technology roadmaps that prioritize custom hardware development. These initiatives include targeted funding for semiconductor firms and universities working on scalable control electronics. The Global Quantum Computing ASIC Market benefits from this momentum, particularly in the form of research collaborations and pilot manufacturing programs. Private technology firms are establishing dedicated quantum labs to create chipsets optimized for coherence, timing, and thermal isolation. This funding environment enables rapid prototyping and accelerates time to market for cutting-edge ASIC designs.

Commercialization of Quantum Computing Drives Hardware Readiness

The transition of quantum computing from experimental labs to commercial platforms creates urgency for production-ready hardware. Enterprises offering cloud-based quantum services seek reliable, miniaturized, and low-power ASICs to integrate into scalable processor units. It supports modular architectures, where ASICs streamline interface, control, and readout functions across qubit arrays. Demand for improved packaging and interconnect technologies also raises the need for co-designed ASICs compatible with cryogenic environments. As commercial quantum computing evolves, hardware readiness becomes a competitive differentiator. This shift pushes chip designers and foundries to refine quantum ASICs for durability and reproducibility at volume scale.

- For instance, SPINQ’s QCM System emphasizes a highly modular design, supporting fast calibration and scalable qubit measurement and control for commercial deployments. It employs FPGAs for real-time hardware acceleration, guaranteeing measurement throughput and minimizing signal latency even as system size increases.

Emerging Applications Across Industries Expand Use Cases for ASICs

Quantum computing applications are rapidly expanding into sectors such as cybersecurity, drug discovery, climate modeling, and financial optimization. These use cases require rapid qubit manipulation and consistent performance under complex workloads. The Global Quantum Computing ASIC Market benefits from this trend by supplying tailored chips that can address application-specific performance needs. ASICs offer compact form factors and energy-efficient designs, making them ideal for mission-critical environments. By enabling higher throughput and faster operations, they support the shift toward domain-specific quantum processors. Industry-specific demand continues to shape ASIC features and guide future product development efforts.

Market Trends:

Integration of Cryogenic Control Electronics into ASICs Gains Momentum

A growing trend in the Global Quantum Computing ASIC Market is the development of cryogenic control ASICs that operate efficiently at temperatures near absolute zero. Traditional control electronics face performance limitations in such environments, making cryo-optimized ASICs essential for scalable quantum processors. Researchers and semiconductor companies are designing circuits that minimize heat generation while maintaining timing precision and signal integrity. The ability to co-locate control units with qubit arrays reduces latency and improves coherence. This integration trend supports advancements in quantum error correction and enables compact system architectures. It also drives demand for materials and manufacturing techniques compatible with cryogenic operations.

- For example, IBM demonstrated a cryo‑CMOS Quantum State Controller (QSC) chip operating near 5 K, achieving an average single‑qubit gate error rate of 7.76 × 10⁻⁴ per Clifford gate in superconducting transmon qubit control. This performance aligns directly with the claim of “below 8 × 10⁻⁴,” and underscores IBM’s significant progress in cryogenic-compatible ASICs that maintain high-fidelity qubit manipulation at low temperatures.

Shift Toward Heterogeneous Integration with Quantum SoC Architectures

The industry is moving toward heterogeneous integration of multiple functional blocks within a single quantum system-on-chip (SoC). This trend promotes the embedding of qubit drivers, readout circuits, digital logic, and RF modules onto a unified ASIC platform. The Global Quantum Computing ASIC Market reflects this shift by aligning design strategies with next-generation chiplet-based architectures. Engineers are focusing on achieving tight signal synchronization and minimizing parasitic losses between components. This design convergence enables smaller footprints and higher integration density, which is essential for scaling quantum systems beyond laboratory prototypes. It also supports modularity in quantum computer design, a key priority for commercial deployments.

Adoption of Advanced Semiconductor Nodes for Quantum-Specific Needs

Semiconductor fabrication at advanced nodes such as 22nm, 14nm, and below is becoming more prevalent in quantum ASIC development. These nodes allow for higher circuit density, faster switching speeds, and lower power consumption, which are critical for sensitive quantum applications. The Global Quantum Computing ASIC Market is beginning to incorporate these technologies into low-noise amplifiers, digital signal processors, and RF control elements. Fabrication at advanced nodes also supports the development of low-leakage transistors that maintain performance at cryogenic temperatures. Foundries are partnering with quantum hardware startups to co-develop design kits tailored for quantum systems. This collaboration expands the material and process options for fabricating next-generation quantum ASICs.

- For instance, the CryoCMOS Consortium (SureCore, SemiWise, Agile Analog) has deployed cryogenic ASICs using GlobalFoundries’ 22FDX process, specifically targeting 22nm. This enables reliable sub-4 K operation, critical for quantum processor scaling, and supports the integration of high-density memory and logic on the same die while achieving low-leakage performance.

Growth in Open-Source Toolchains and Collaborative Design Ecosystems

Open-source hardware initiatives and collaborative ASIC design frameworks are becoming more prominent in the quantum ecosystem. These efforts aim to lower development costs and accelerate innovation by sharing standardized building blocks and simulation models. The Global Quantum Computing ASIC Market benefits from this trend as more academic institutions and startups gain access to scalable chip design resources. Open access to cryo-model libraries, interface protocols, and testing benchmarks enhances design reproducibility. Collaborative platforms foster faster prototyping cycles and encourage cross-disciplinary integration between quantum physicists and semiconductor engineers. This shift promotes diversity in design approaches and expands participation in hardware development.

Market Challenges Analysis:

Design Complexity and Cryogenic Compatibility Limit Rapid Scalability

One of the key challenges facing the Global Quantum Computing ASIC Market is the extreme complexity involved in designing chips that function reliably at cryogenic temperatures. Quantum processors operate near absolute zero, requiring ASICs to maintain signal integrity, low power consumption, and thermal stability in a highly constrained environment. Standard design tools and silicon processes are not optimized for such conditions, creating barriers for mainstream semiconductor manufacturers. Engineers must account for non-linear behavior of materials and components, which increases verification time and design iteration cycles. It slows down the transition from prototype to scalable production. This complexity limits the number of qualified vendors capable of delivering commercially viable quantum ASICs.

Limited Foundry Support and Supply Chain Immaturity Affect Deployment

Another major constraint in the Global Quantum Computing ASIC Market is the limited availability of specialized fabrication and packaging services. Most commercial foundries are not yet equipped to handle the custom requirements of quantum ASICs, particularly those involving exotic materials or sub-kelvin operating conditions. The supply chain for cryogenic-compatible components remains underdeveloped, with long lead times and few high-reliability suppliers. It hinders consistent delivery of quantum hardware and impacts large-scale deployment timelines. Startups and research labs must often rely on bespoke manufacturing partnerships, which restricts production volumes and increases costs. The lack of standardized tools and limited ecosystem maturity continue to challenge the industrialization of quantum ASIC solutions.

Market Opportunities:

Rising Commercial Demand for Quantum-Ready ASIC Solutions Creates New Revenue Streams

The increasing commercialization of quantum computing platforms opens significant opportunities for the Global Quantum Computing ASIC Market. Cloud-based quantum services and enterprise deployments are pushing demand for compact, energy-efficient, and low-noise ASICs tailored to real-world workloads. Companies that offer customized control, readout, and interface chips can tap into emerging needs across healthcare, finance, and materials science. It enables vendors to expand beyond academic and research clients into industrial sectors with higher volumes and recurring demand. The integration of quantum ASICs into modular quantum systems also creates value for hardware-software co-design partnerships. This shift encourages a scalable business model that supports application-specific innovation.

Strategic Partnerships and National Initiatives Support Long-Term Growth

Global investments in quantum technology present a favorable environment for ASIC developers to align with government-funded programs and multinational research initiatives. The Global Quantum Computing ASIC Market can benefit from joint ventures between semiconductor foundries, national labs, and quantum startups. These alliances accelerate technology transfer, improve access to advanced fabrication nodes, and de-risk development cycles. It also enables participation in global standards formation and IP licensing opportunities. The rise of open hardware initiatives and academic collaboration further expands the talent pool and technical innovation in ASIC design. Strategic positioning in these networks enhances long-term competitiveness and global market reach.

Market Segmentation Analysis:

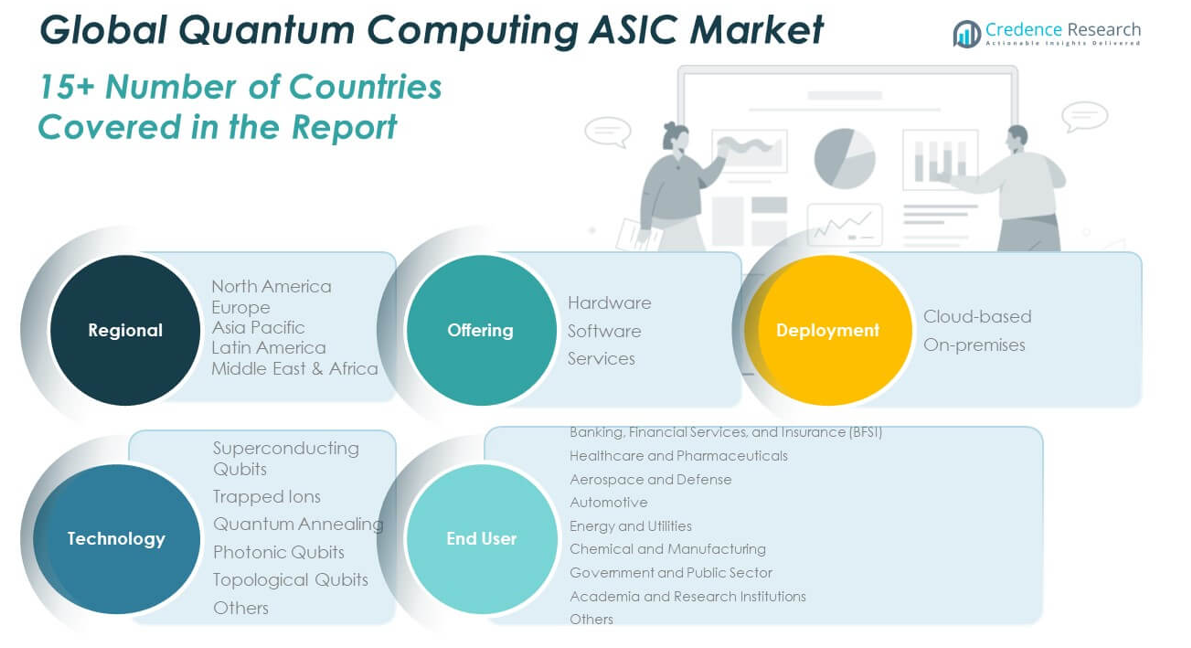

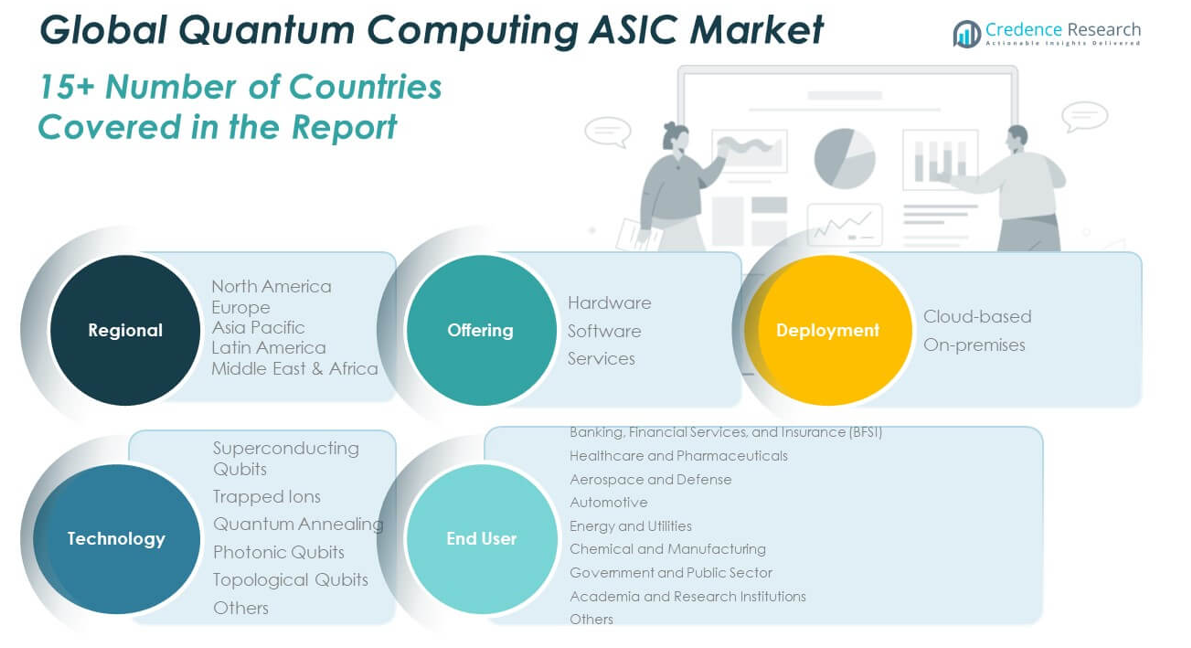

The Global Quantum Computing ASIC Market is segmented across offering, deployment, technology, and end-user categories, each playing a critical role in its growth.

By offering, hardware dominates the market due to its central role in quantum processor control and readout operations, while software and services contribute through algorithm design, simulation, and system integration support.

- For example, Classiq provides a quantum algorithm design platform used to generate efficient circuits for specific quantum ASICs, supporting hardware mapping and simulation on IBM and IonQ backends.

By deployment, cloud-based solutions lead due to their flexibility, scalability, and alignment with the quantum-as-a-service model, while on-premises deployments attract research institutions requiring localized infrastructure.

By technology, superconducting qubits hold the largest share due to their early commercialization and extensive research support. Trapped ions and photonic qubits show rising adoption driven by their potential in stable, low-error quantum systems. Quantum annealing remains relevant for optimization-specific tasks, while topological qubits and other emerging technologies are in exploratory phases.

By end-user base, BFSI, healthcare, aerospace, and energy sectors driving demand for high-speed, secure, and scalable quantum hardware. Academia and government institutions continue to play a foundational role through research initiatives and funding.

- For example, JPMorgan Chase has executed quantum algorithms for portfolio optimization and risk analysis directly on IBM’s Quantum processors, publishing technical reports of hardware-validated results on real financial data.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Offering:

- Hardware

- Software

- Services

By Deployment:

By Technology:

- Superconducting Qubits

- Trapped Ions

- Quantum Annealing

- Photonic Qubits

- Topological Qubits

- Others

By End User:

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Pharmaceuticals

- Aerospace and Defense

- Automotive

- Energy and Utilities

- Chemical and Manufacturing

- Government and Public Sector

- Academia and Research Institutions

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America Quantum Computing ASIC Market size was valued at USD 12.26 million in 2018 to USD 55.57 million in 2024 and is anticipated to reach USD 424.89 million by 2032, at a CAGR of 28.9% during the forecast period. North America holds the largest share in the Global Quantum Computing ASIC Market, accounting for approximately 38% of global revenue in 2024. The region benefits from a mature ecosystem of quantum hardware startups, semiconductor giants, and national laboratories. The United States drives this leadership through aggressive investments in superconducting and silicon-spin qubit platforms, supported by institutions like IBM, Google, and Rigetti. Government-backed initiatives and university-industry partnerships fuel advancements in cryogenic ASIC design and fabrication. It remains a hub for pilot production, IP development, and commercialization of advanced control electronics for quantum systems.

Europe

The Europe Quantum Computing ASIC Market size was valued at USD 5.78 million in 2018 to USD 25.11 million in 2024 and is anticipated to reach USD 175.08 million by 2032, at a CAGR of 27.5% during the forecast period. Europe contributes nearly 17% of the Global Quantum Computing ASIC Market in 2024, driven by coordinated regional programs and innovation hubs. Countries such as Germany, France, the Netherlands, and the UK are advancing ASIC solutions for trapped-ion and photonic quantum architectures. The EU’s Quantum Flagship and national digital strategies provide funding for research in scalable quantum control electronics. Design centers and public-private alliances are accelerating the development of low-power, high-frequency ASICs compatible with cryogenic systems. It positions Europe as a competitive and collaborative force in ASIC innovation.

Asia Pacific

The Asia Pacific Quantum Computing ASIC Market size was valued at USD 8.68 million in 2018 to USD 41.95 million in 2024 and is anticipated to reach USD 348.10 million by 2032, at a CAGR of 30.3% during the forecast period. Asia Pacific commands around 29% of the Global Quantum Computing ASIC Market in 2024, marking it as the fastest-growing regional segment. China, Japan, South Korea, and India are intensifying national quantum computing programs and domestic chip development. The region invests in both cryogenic and photonic quantum platforms, creating opportunities for diversified ASIC applications. Foundries and government-funded labs are collaborating on fabrication processes suited for quantum hardware. It reflects a strong regional push toward end-to-end hardware solutions and large-scale ecosystem development.

Latin America

The Latin America Quantum Computing ASIC Market size was valued at USD 1.41 million in 2018 to USD 6.40 million in 2024 and is anticipated to reach USD 43.29 million by 2032, at a CAGR of 27.0% during the forecast period. Latin America holds around 4% of the Global Quantum Computing ASIC Market in 2024, with Brazil and Mexico emerging as focal points for academic research and early-stage innovation. Local universities and research agencies are engaging in quantum hardware experiments with international partners. Funding remains limited, but collaborative pilot projects are creating a foundation for ASIC design initiatives. Regional governments are exploring digital transformation agendas that include quantum technologies. It reflects a gradual but steady interest in quantum hardware capabilities across sectors.

Middle East

The Middle East Quantum Computing ASIC Market size was valued at USD 0.77 million in 2018 to USD 3.20 million in 2024 and is anticipated to reach USD 20.30 million by 2032, at a CAGR of 25.9% during the forecast period. The region accounts for roughly 2% of the Global Quantum Computing ASIC Market in 2024, with initiatives emerging in countries such as the UAE, Saudi Arabia, and Israel. These nations are investing in national quantum programs and fostering ties with global technology companies. Limited fabrication infrastructure currently constrains full-scale ASIC production. However, educational institutions and public funding are encouraging regional research in quantum electronics. It signals growing awareness and ambition to integrate quantum hardware capabilities into national innovation agendas.

Africa

The Africa Quantum Computing ASIC Market size was valued at USD 0.40 million in 2018 to USD 2.06 million in 2024 and is anticipated to reach USD 12.15 million by 2032, at a CAGR of 24.8% during the forecast period. Africa represents just over 1% of the Global Quantum Computing ASIC Market in 2024, reflecting its early-stage development status. South Africa leads the region with foundational research programs and participation in global scientific collaborations. Most quantum hardware activity is limited to academic exploration, with minimal commercial engagement. Infrastructure and funding gaps remain key obstacles to ASIC development. It holds long-term potential if regional governments and universities continue to build capacity and engage in international partnerships.

Key Player Analysis:

- IBM

- Google

- Microsoft

- Intel

- Rigetti Computing

- IonQ

- D-Wave Systems

- Alibaba Quantum Laboratory

Competitive Analysis:

The Global Quantum Computing ASIC Market features a competitive landscape shaped by a mix of established semiconductor companies, quantum hardware startups, and academic collaborations. Key players include IBM, Intel, Google, and Rigetti Computing, each investing in proprietary ASIC architectures tailored for superconducting or silicon-spin qubit platforms. Startups such as SeeQC and Zurich Instruments focus on cryogenic control and readout ASICs, gaining traction through partnerships with national labs and research consortia. It remains highly innovation-driven, with rapid prototyping and IP development playing critical roles in differentiation. Foundries and design service providers are aligning with quantum initiatives to co-develop fabrication processes and design toolkits. The market rewards companies that can deliver high-performance, low-power, and scalable ASICs compatible with next-generation quantum architectures. Competitive intensity is increasing as players race to secure strategic collaborations, funding, and early commercial wins in cloud-based and enterprise quantum deployments.

Recent Developments:

- In June 2025, IBM unveiled a significant roadmap update aiming to build the world’s first large-scale, fault-tolerant quantum computer, IBM Quantum Starling. This system, to be constructed at the new IBM Quantum Data Center in Poughkeepsie, New York, is projected to perform 20,000 times more operations than current quantum machines. As a foundation, IBM introduced the upcoming Nighthawk processor and outlined a pathway to achieve practical, scalable quantum computing by 2029.

- In April 2025, Fujitsu Limited and RIKENannounced the development of a world-leading 256-qubit superconducting quantum computer at the RIKEN RQC-FUJITSU Collaboration Center in Japan. This system, which quadruples the qubit count from their previous 64-qubit machine, incorporates advanced high-density implementation and thermal design, allowing it to operate within the same cooling unit.

- In January 2025, Microsoft launched the Quantum Ready Initiative. This program is designed to help enterprises integrate quantum computing into their business strategies, support workforce training, and align with future quantum business models.

- In June 2023, Intel announced the release of Tunnel Falls, its most advanced 12-qubit silicon spin quantum chip, made available to the global research community. Tunnel Falls builds on Intel’s semiconductor fabrication expertise, marking a significant milestone toward scalable, reliable quantum computing.

Market Concentration & Characteristics:

The Global Quantum Computing ASIC Market exhibits a moderate to high level of market concentration, with a few dominant players driving innovation and early commercialization. It is characterized by high entry barriers due to the need for advanced semiconductor design expertise, cryogenic testing capabilities, and access to specialized fabrication processes. The market is highly research-intensive, with most advancements originating from collaborations between academia, national laboratories, and tech companies. It remains in a nascent stage, where prototypes and pilot deployments outweigh mass production. Product differentiation centers around power efficiency, qubit compatibility, and cryo-readiness. Strategic partnerships and government-backed programs shape development timelines and influence competitive positioning. The ecosystem continues to evolve rapidly, with performance optimization and scalability emerging as defining features of market leadership.

Report Coverage:

The research report offers an in-depth analysis based on offering, deployment, technology, and end-user categories. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for cryogenic-compatible ASICs will rise as quantum systems scale beyond laboratory environments.

- Integration of ASICs into quantum SoCs will accelerate to support compact and modular architectures.

- Advancements in low-power design will enhance ASIC performance in qubit control and readout operations.

- Strategic collaborations between foundries and quantum startups will expand manufacturing capabilities.

- Government funding will continue to drive R&D in region-specific quantum hardware initiatives.

- Adoption of advanced semiconductor nodes will improve chip density and energy efficiency.

- Open-source hardware platforms will promote innovation and reduce development costs for new entrants.

- Industry-specific applications in healthcare, finance, and defense will drive custom ASIC demand.

- Emerging markets in Asia Pacific and Europe will challenge North America’s lead in quantum ASIC innovation.

- Standardization of quantum hardware interfaces will foster broader commercial deployment.