| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Radiation-Hardened ASIC Market Size 2024 |

USD 1,886.51 Million |

| Radiation-Hardened ASIC Market, CAGR |

4.51% |

| Radiation-Hardened ASIC Market Size 2032 |

USD 2,753.47 Million |

Market Overview:

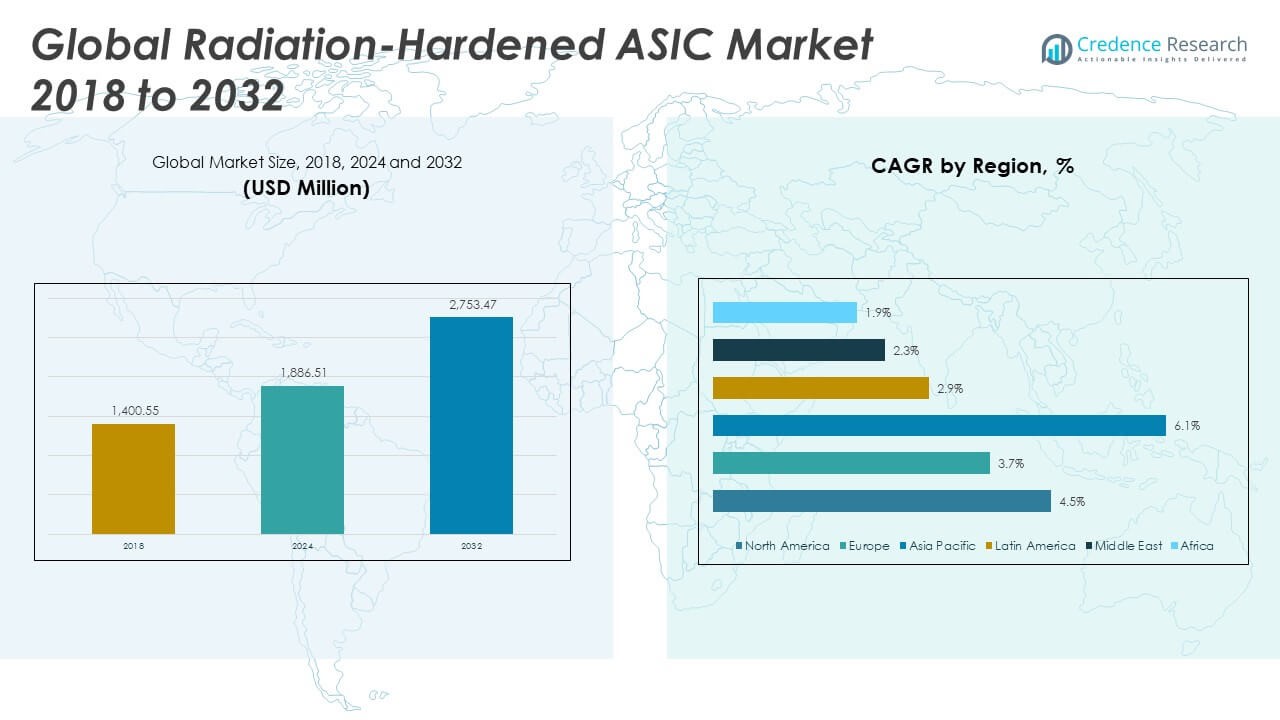

The Global Radiation-Hardened ASIC Market size was valued at USD 1,400.55 million in 2018 to USD 1,886.51 million in 2024 and is anticipated to reach USD 2,753.47 million by 2032, at a CAGR of 4.51% during the forecast period.

The Global Radiation-Hardened ASIC Market is primarily driven by the increasing demand for high-reliability electronics in space exploration, military, and nuclear energy applications. The rapid expansion of satellite constellations, deep-space missions, and interplanetary probes has intensified the need for custom ASICs capable of withstanding radiation in extreme environments. Governments and space agencies such as NASA, ESA, and ISRO are investing heavily in rad-hard electronics to support next-generation communications and navigation systems. Additionally, defense modernization programs across the U.S., China, India, and NATO allies are fueling demand for radiation-hardened components used in missile systems, radar, avionics, and UAVs. The growing adoption of nuclear power and particle accelerators, where radiation poses a threat to standard electronics, further boosts market growth. Technological advancements in RHBD (Radiation-Hardening-By-Design), SOI (Silicon on Insulator) processes, and FinFET structures are also enabling improved performance, energy efficiency, and cost-effective production of radiation-hardened ASICs.

North America leads the Global Radiation-Hardened ASIC Market, accounting for the largest share due to robust government spending on defense and space exploration. The U.S. dominates the regional landscape, with strong support from NASA, the Department of Defense, and private aerospace firms like SpaceX and Lockheed Martin. The presence of major players such as Honeywell, BAE Systems, and Microchip Technology strengthens the regional ecosystem. In contrast, the Asia-Pacific region is witnessing the fastest growth, driven by rising satellite launches, defense initiatives, and nuclear infrastructure developments in China, India, and Japan. India’s growing ISRO missions and China’s aggressive space programs are expanding the regional demand for rad-hard ASICs. Meanwhile, Europe maintains a stable share, backed by ESA projects and national defense modernization in France, Germany, and the UK. Countries in the Middle East, Latin America, and Africa are gradually adopting rad-hard solutions, primarily for communications satellites and strategic defense systems, showing long-term market potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Radiation-Hardened ASIC Market was valued at USD 1,886.51 million in 2024 and is projected to reach USD 2,753.47 million by 2032, growing at a CAGR of 4.51%.

- Strong demand from space agencies and commercial satellite operators continues to fuel adoption of radiation-hardened ASICs for LEO and deep-space missions.

- Military modernization efforts across the U.S., China, and India are increasing the need for ASICs in missiles, UAVs, radar, and secure communications.

- Growth in nuclear power facilities and high-energy labs is creating steady demand for radiation-tolerant ASICs in control systems and diagnostics.

- Technological advances in RHBD, FinFET, and SOI are improving chip efficiency while enabling broader commercial deployment.

- High development costs and limited access to radiation-hardened foundries remain key barriers, especially for small and mid-sized players.

- North America leads the market with the highest share, while Asia Pacific is the fastest-growing region due to rising satellite activity and defense investments.

Market Drivers:

Expansion of Satellite Deployments and Deep-Space Missions

The growing demand for space-based technologies is a significant driver of the Global Radiation-Hardened ASIC Market. Government and commercial space programs are increasing satellite deployments for navigation, communication, and earth observation. Missions in low-earth orbit (LEO) and beyond require electronics that can operate reliably in radiation-intensive environments. Custom-designed ASICs offer superior performance and reduced power consumption, making them ideal for space systems where resilience is critical. Space agencies such as NASA, ESA, and ISRO are investing in rad-hard ASICs to ensure mission longevity and data integrity. The rise of private sector players like SpaceX and Blue Origin supports the demand for cost-effective, high-reliability ASICs tailored for repeated space applications.

- For example, NASA’s Mars Perseverance Roveruses 130 nm rad-hard ASICs from BAE Systems that operate flawlessly at TID levels of up to 1 Mrad(Si), ensuring long mission life in high-radiation environments.

Rising Military and Defense Investments in Radiation-Hardened Electronics

The defense sector remains a major consumer of radiation-hardened electronics, propelling demand for specialized ASICs. Advanced military systems, including guided missiles, satellites, radar platforms, and avionics, require ASICs that function under extreme conditions. Governments are allocating substantial budgets for defense modernization, particularly in the United States, China, and India. The Global Radiation-Hardened ASIC Market benefits from the strategic push to enhance electronic warfare capabilities and ensure uninterrupted communications in combat zones. It supports national security initiatives by delivering robust, fault-tolerant circuitry for mission-critical defense applications. ASIC-based solutions improve performance in defense systems, helping them withstand nuclear environments and electromagnetic interference.

- For example, Cobham’s UT699E LEON3FT SPARC microprocessor exemplifies radiation-hardened ASIC deployment in military satellites and critical defense infrastructure. It is a fault-tolerant SPARC V8 processor designed for aerospace, high-altitude avionics, and nuclear plant controllers, supporting applications that require robust resilience to SEU (Single Event Upset) and is qualified for demanding military use-cases.

Growth of Nuclear Energy Sector and Critical Infrastructure

The expanding nuclear energy industry is also fueling the need for radiation-hardened components. ASICs used in nuclear reactors, control systems, and diagnostic equipment must perform accurately despite exposure to high radiation levels. With many countries advancing clean energy goals, the construction of new nuclear power facilities is increasing. It creates a stable and growing requirement for radiation-tolerant integrated circuits across reactor monitoring and safety operations. The Global Radiation-Hardened ASIC Market serves these applications by offering reliable, application-specific solutions that meet stringent regulatory and safety standards. This demand extends to particle accelerators and high-energy physics labs, where radiation exposure is an inherent operational challenge.

Advancements in Technology and Adoption of Radiation-Hardening Techniques

Continuous innovation in semiconductor design is transforming the radiation-hardened ASIC landscape. The integration of radiation-hardening-by-design (RHBD) methodologies and use of technologies such as Silicon on Insulator (SOI) and FinFET architectures are improving ASIC resilience and efficiency. It allows manufacturers to develop smaller, faster, and more energy-efficient chips while reducing susceptibility to single-event upsets. The availability of commercial off-the-shelf (COTS) solutions adapted for radiation environments is expanding market accessibility. These advancements lower production costs and lead times, enabling broader adoption in both established space agencies and emerging space-tech startups. The Global Radiation-Hardened ASIC Market continues to evolve alongside these innovations, creating opportunities for competitive differentiation and long-term growth.

Market Trends:

Shift Toward Miniaturization and High-Density ASIC Architectures

Manufacturers are increasingly focusing on developing compact, high-density ASICs to meet the size and weight constraints of next-generation platforms. The need for smaller electronics in satellites, unmanned aerial systems, and portable defense equipment has driven innovation in chip design and layout optimization. Designers are integrating more functionality into smaller footprints, reducing the need for multiple components while maintaining radiation resistance. The Global Radiation-Hardened ASIC Market is aligning with this trend by offering ASICs with higher gate density and lower power consumption. It supports applications where space and energy efficiency are mission-critical, without compromising durability. This miniaturization trend also allows systems to maintain performance while reducing payload weight in aerospace applications.

- For example, NASA’s Jet Propulsion Laboratory (JPL)has demonstrated methods for radiation-aware, miniaturized ASIC design using GlobalFoundries’ 22nm technology. Their recent ASIC layouts, derived from flight-qualified FPGA designs, achieved substantial area reduction while maintaining space-grade TID resistance and SEE mitigation validating high-density ASIC methodologies for future Mars projects.

Growing Interest in AI-Enabled Radiation-Hardened ASICs

The incorporation of artificial intelligence (AI) into radiation-hardened ASICs is gaining attention across aerospace and defense sectors. Engineers are exploring ways to embed machine learning algorithms directly into ASICs for enhanced autonomy and real-time decision-making in space and battlefield environments. AI-enabled rad-hard ASICs are becoming essential for applications such as onboard data processing, autonomous navigation, and intelligent threat detection. The Global Radiation-Hardened ASIC Market is evolving to support such complex requirements by integrating compute acceleration functions alongside traditional control logic. It enables advanced functionalities in satellites, drones, and robotic systems operating in high-radiation zones. This trend is reshaping the expectations for ASIC performance in future mission-critical systems.

Emphasis on Extended Lifecycle and Long-Term Supply Assurance

A growing number of end users are prioritizing ASICs with extended product lifecycles and secure long-term supply. Space and defense programs often span decades, requiring electronic components that remain supported and available well beyond standard commercial timelines. Manufacturers are responding by committing to long-term fabrication processes, archival packaging solutions, and strategic stockpiling to ensure continuity. The Global Radiation-Hardened ASIC Market is adapting by formalizing lifetime guarantees, obsolescence management strategies, and partnerships with foundries to preserve legacy node capabilities. It enhances trust and dependability across long-duration missions where component replacement is not feasible. This trend reflects a growing preference for lifecycle-stable electronics over purely performance-based alternatives.

- For example, Honeywell Aerospace has received U.S. government contracts to sustain and extend the production and support of strategic radiation-hardened microelectronics for space and defense. the Department of Defense awarded them a $25.8 million contract to expand domestic production and increase supply chain resilience for these critical components.

Collaboration Across Public and Private Sectors for ASIC Innovation

Public-private partnerships are becoming instrumental in accelerating innovation and deployment of radiation-hardened ASICs. Governments are increasingly funding collaborative research with private semiconductor companies to develop next-generation solutions tailored for national programs. These alliances foster shared R&D, access to testing infrastructure, and reduced development risks. The Global Radiation-Hardened ASIC Market benefits from this model by gaining access to both commercial speed and government-grade requirements. It creates a feedback loop where technological advancements meet practical field applications more rapidly. This collaborative trend supports faster time-to-market and ensures alignment with evolving defense and aerospace priorities.

Market Challenges Analysis:

High Development Costs and Long Design Cycles Hinder Adoption

Radiation-hardened ASICs demand specialized design methodologies, extensive testing, and radiation validation protocols, which significantly increase development time and cost. The complexity of RHBD (Radiation-Hardening-by-Design) techniques, combined with low-volume production runs, creates financial pressure on manufacturers. For emerging players and commercial space ventures, these upfront investments can be prohibitive, especially when timelines are tight and return on investment is uncertain. The Global Radiation-Hardened ASIC Market faces a persistent challenge in balancing reliability with affordability, particularly in missions requiring unique customizations. It must address the need for scalable solutions that can meet strict performance requirements without imposing unsustainable costs. Without breakthroughs in cost-efficient design and manufacturing, the market may remain limited to large defense and space agencies with ample funding.

Limited Access to Radiation-Hardened Foundry Capabilities and IP Ecosystems

The availability of trusted foundries equipped to manufacture radiation-hardened ASICs remains restricted, impacting supply chain resilience and scalability. Only a few global fabrication facilities offer radiation-hardening processes and legacy nodes suited for these applications. This concentration increases lead times and dependency risks, especially during geopolitical or trade disruptions. The Global Radiation-Hardened ASIC Market also struggles with a limited pool of proven IP cores and design libraries tailored for radiation environments. It restricts innovation and slows time-to-market for new designs. To sustain long-term growth, the industry must expand its foundry partnerships and develop a more open, radiation-aware IP ecosystem that supports faster and more flexible ASIC development.

Market Opportunities:

Expansion of Commercial Space Industry and LEO Satellite Networks

The rise of commercial satellite operators and space-tech startups presents a major growth avenue for the Global Radiation-Hardened ASIC Market. Companies launching large-scale low-earth orbit (LEO) constellations for broadband, earth observation, and IoT services are seeking compact, power-efficient, and durable ASICs. These missions demand electronics that can endure radiation exposure while maintaining performance in constrained form factors. It creates opportunities for ASIC vendors to deliver custom or semi-custom rad-hard solutions that meet cost and scalability targets. The commercial sector’s drive for affordability and faster launch timelines supports the adoption of rad-hard ASICs with shorter development cycles. Expanding private investment in space infrastructure continues to widen the market’s addressable base beyond government programs.

Adoption of Radiation-Hardened ASICs in Emerging Applications

New use cases across autonomous systems, nuclear robotics, and high-altitude platforms are unlocking demand for radiation-hardened ASICs. These environments require electronics that operate reliably under high-radiation or extreme atmospheric conditions. The Global Radiation-Hardened ASIC Market is well-positioned to serve these applications with customized solutions that balance ruggedness and performance. It supports innovation in fields such as deep-sea exploration, high-energy physics, and next-generation energy systems. As industries adopt automation in hazardous conditions, the need for robust, mission-specific ASICs will continue to expand. This trend opens long-term opportunities for vendors capable of delivering resilient designs beyond traditional aerospace and defense domains.

Market Segmentation Analysis:

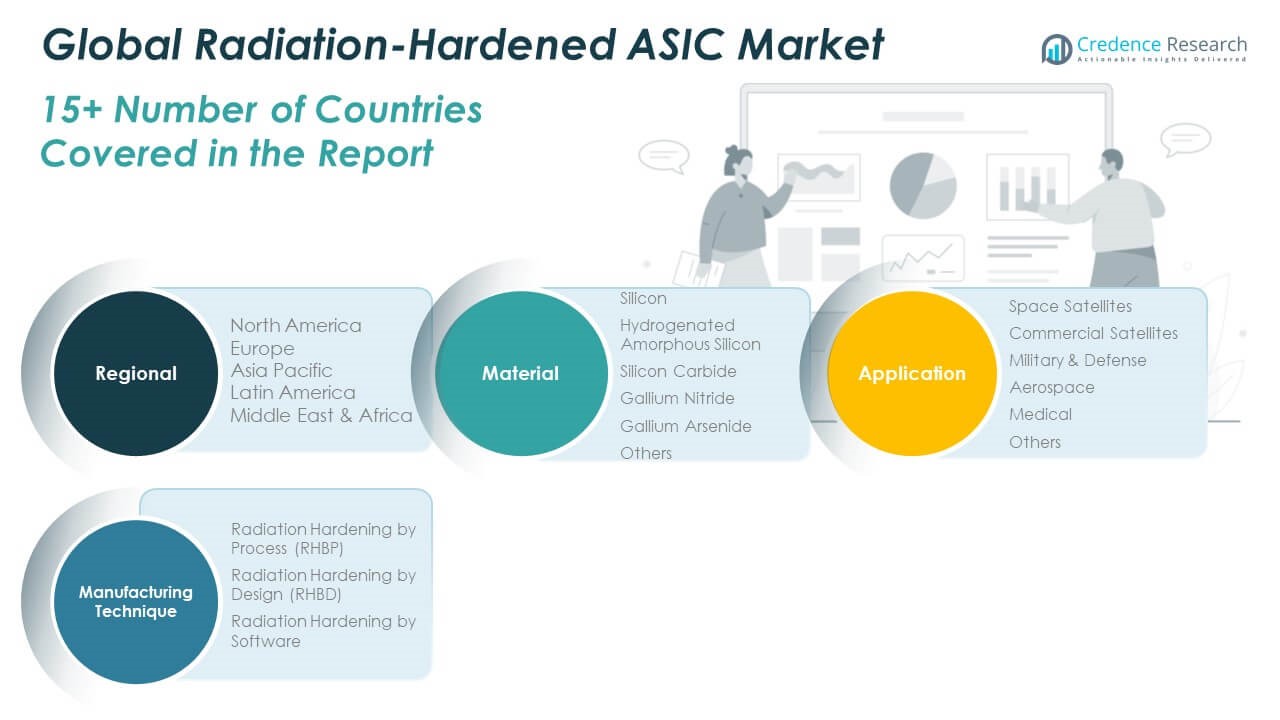

The Global Radiation-Hardened ASIC Market is segmented by material, application, and manufacturing technique.

By material, silicon dominates due to its wide compatibility with existing semiconductor infrastructure and cost efficiency. Hydrogenated amorphous silicon is gaining traction for niche applications that require improved energy efficiency. Silicon carbide and gallium nitride offer superior radiation resistance and thermal conductivity, making them suitable for high-power environments. Gallium arsenide is preferred in high-frequency systems, while the “others” category includes emerging materials used for experimental and specialized uses.

- For example, Cree/Wolfspeeddeveloped SiC-based radiation-hardened power MOSFETs for ESA’s BepiColombo Mercury mission, demonstrating stable operation above 100 krad(Si) TID and high thermal conductivity at up to 225°C.

By application, military and defense lead the market owing to extensive use in missile guidance, radar, and secure communication systems. Space satellites and commercial satellites collectively contribute a significant share due to increased LEO and deep-space missions. Aerospace applications are expanding steadily with demand for onboard computing systems. Medical applications, while smaller in scale, are emerging in nuclear diagnostics and radiation therapy equipment. The “others” segment covers energy and industrial automation systems exposed to radiation.

By manufacturing technique, radiation hardening by design (RHBD) holds the largest share due to its flexibility and cost-effectiveness. Radiation hardening by process (RHBP) is used for applications requiring inherent material-based resilience. Radiation hardening by software is an emerging approach focused on system-level fault tolerance in specific operational environments. The Global Radiation-Hardened ASIC Market continues to evolve across these segments to meet diverse operational demands.

- For example, Microsemi (Microchip)RTG4 FPGAs utilize a radiation-hardened-by-process silicon-on-insulator (SOI) technology. This process provides inherent latchup immunity and reduces SEU rates by >90% relative to bulk CMOS.

Segmentation:

By Material

- Silicon

- Hydrogenated Amorphous Silicon

- Silicon Carbide

- Gallium Nitride

- Gallium Arsenide

- Others

By Application

- Space Satellites

- Commercial Satellites

- Military & Defense

- Aerospace

- Medical

- Others

By Manufacturing Technique

- Radiation Hardening by Process (RHBP)

- Radiation Hardening by Design (RHBD)

- Radiation Hardening by Software

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Regional Analysis:

North America

The North America Radiation-Hardened ASIC Market size was valued at USD 589.91 million in 2018 to USD 786.04 million in 2024 and is anticipated to reach USD 1,150.58 million by 2032, at a CAGR of 4.5% during the forecast period. North America holds the largest share in the Global Radiation-Hardened ASIC Market, accounting for 35.5% of the total revenue in 2024. The presence of leading defense and space organizations such as the U.S. Department of Defense, NASA, and SpaceX drives strong regional demand. The U.S. government’s continued investment in advanced aerospace technologies and nuclear security reinforces adoption of high-reliability ASICs. It also benefits from the established ecosystem of manufacturers including BAE Systems, Microchip Technology, and Texas Instruments. The region’s focus on electronic warfare systems, satellite communication, and missile defense sustains demand. Strong public-private collaborations further accelerate R&D and innovation in radiation-hardened chip design.

Europe

The Europe Radiation-Hardened ASIC Market size was valued at USD 402.59 million in 2018 to USD 522.98 million in 2024 and is anticipated to reach USD 719.27 million by 2032, at a CAGR of 3.7% during the forecast period. Europe accounts for 23.6% of the Global Radiation-Hardened ASIC Market in 2024, driven by space programs and defense initiatives. The European Space Agency (ESA), Airbus Defence and Space, and national defense ministries are key contributors to regional demand. Investments in nuclear power safety systems and long-term space missions also support ASIC adoption. It benefits from growing collaboration between design houses and foundries that specialize in rad-hard electronics. The region’s focus on technological sovereignty and strategic autonomy further enhances market strength. Countries such as France, Germany, and the UK remain major hubs for research and innovation in this domain.

Asia Pacific

The Asia Pacific Radiation-Hardened ASIC Market size was valued at USD 277.48 million in 2018 to USD 404.20 million in 2024 and is anticipated to reach USD 666.06 million by 2032, at a CAGR of 6.1% during the forecast period. Asia Pacific holds a 18.2% share of the Global Radiation-Hardened ASIC Market in 2024 and is the fastest-growing regional segment. China and India are rapidly advancing their space programs and nuclear energy infrastructure, fueling demand for robust ASICs. Japan and South Korea contribute through semiconductor innovation and satellite development. It benefits from state-backed funding, indigenous technology efforts, and a growing emphasis on national security. The region is also expanding domestic ASIC manufacturing capabilities to reduce reliance on external supply chains. Increasing satellite launches and defense modernization projects position Asia Pacific as a high-potential market.

Latin America

The Latin America Radiation-Hardened ASIC Market size was valued at USD 66.00 million in 2018 to USD 87.79 million in 2024 and is anticipated to reach USD 113.38 million by 2032, at a CAGR of 2.9% during the forecast period. Latin America represents 4% of the Global Radiation-Hardened ASIC Market in 2024. Brazil and Argentina are the region’s primary contributors, with ongoing investments in defense modernization and space-based research. It benefits from emerging interest in satellite communications for remote connectivity and climate monitoring. The regional market remains small but shows consistent growth in government-led aerospace programs. Limited local manufacturing capacity remains a challenge, though cross-border partnerships with U.S. and European firms offer access to advanced technologies. Gradual expansion of nuclear infrastructure could further support long-term market development.

Middle East

The Middle East Radiation-Hardened ASIC Market size was valued at USD 39.54 million in 2018 to USD 48.72 million in 2024 and is anticipated to reach USD 60.10 million by 2032, at a CAGR of 2.3% during the forecast period. The Middle East holds a 2.2% share of the Global Radiation-Hardened ASIC Market in 2024. Countries such as the United Arab Emirates and Saudi Arabia are investing in space exploration and national security, generating modest demand for rad-hard ASICs. It gains traction through collaborations with international aerospace and defense technology providers. Growing interest in developing nuclear research reactors and satellite programs adds strategic relevance to the market. However, the regional ecosystem remains in early development stages. Imports and joint ventures play a key role in meeting technical requirements.

Africa

The Africa Radiation-Hardened ASIC Market size was valued at USD 25.03 million in 2018 to USD 36.77 million in 2024 and is anticipated to reach USD 44.09 million by 2032, at a CAGR of 1.9% during the forecast period. Africa contributes 1.6% to the Global Radiation-Hardened ASIC Market in 2024 and remains in a nascent phase of development. South Africa leads the region, driven by academic research, space science programs, and nuclear technology efforts. It shows potential in niche areas such as radio astronomy and satellite-based environmental monitoring. Limited funding and infrastructure constraints hinder widespread adoption. The region depends heavily on imports and international collaboration to access rad-hard semiconductor technologies. With increased investment and policy support, the market could gradually expand its footprint in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BAE Systems

- Honeywell International

- Microchip Technology (including Microsemi)

- STMicroelectronics

- Xilinx (AMD)

- Texas Instruments

- Infineon Technologies

- Renesas Electronics

- Northrop Grumman

- Cobham Advanced Electronic Solutions (CAES)

Competitive Analysis:

The Global Radiation-Hardened ASIC Market is highly competitive, with key players focusing on technology advancement, strategic partnerships, and government contracts. Companies such as BAE Systems, Microchip Technology, Honeywell International, and STMicroelectronics lead the market with proven design capabilities and established manufacturing infrastructure. It demands continuous innovation in radiation-hardening techniques, performance optimization, and size reduction to meet evolving mission requirements. Players compete on reliability, customization, and long-term product support, especially for aerospace and defense applications. New entrants and specialized firms are targeting niche applications through cost-effective, RHBD-based solutions. The market also sees collaboration between semiconductor foundries and defense contractors to accelerate development and ensure supply chain security. With the increasing need for mission-specific rad-hard components, competitive differentiation relies on engineering expertise, scalability, and access to qualified foundry processes. The Global Radiation-Hardened ASIC Market continues to evolve as players expand portfolios to serve both government and commercial space sectors.

Recent Developments:

- In June 2025, BAE Systems launched a new suite of M-Code Global Positioning System (GPS) receivers offering advanced anti-jamming and environmental resilience. This product range is critical for military and aerospace platforms, sectors that heavily rely on radiation-hardened ASICs for reliable operations in harsh environments.

- In June 2025, Infineon Technologies announced a partnership with IDEMIA Secure Transactions to advance secure, automotive access hardware highlighting a focus on hardware security and cryptography relevant to radiation-hardened solutions. Infineon’s late 2024 partnership with Quantinuum to accelerate quantum computing also indicates a path toward more advanced and secure ASIC technologies.

- In February 2025, Honeywell launched a strategic collaboration with ForwardEdge ASIC, a subsidiary of Lockheed Martin Corporation. The purpose of this alliance is to deliver advanced, reliable, and radiation-hardened microelectronics solutions for space applications, with a focus on supporting satellite missions. Honeywell, recognized for its robust foundry capabilities in radiation-insensitive microelectronics, partners with ForwardEdge ASIC to combine leading-edge foundry technology with innovative architecture and design expertise for the next generation of space-ready semiconductor devices.

- In September 2024, the U.S. Department of Defense announced a $25.8 million contract award to Honeywell, based in Plymouth, Minnesota, United States. This contract supports the production or procurement of trusted strategic radiation-hardened microelectronics, further strengthening Honeywell’s leadership and capability in supplying resilient components for defense and aerospace missions.

Market Concentration & Characteristics:

The Global Radiation-Hardened ASIC Market exhibits a moderately concentrated structure, dominated by a few established players with advanced technological capabilities and long-standing defense and aerospace contracts. It features high entry barriers due to the complexity of radiation-hardening design, long product qualification cycles, and limited access to specialized foundries. The market prioritizes reliability, lifecycle support, and customization, which favors experienced firms with deep domain expertise. It is characterized by low production volumes, long lead times, and a strong focus on mission-critical applications. Demand is driven by government-led programs, with commercial adoption growing steadily through miniaturized and cost-optimized ASIC solutions. The market relies on trusted supplier networks and compliance with stringent regulatory standards, reinforcing its specialized and mission-specific nature.

Report Coverage:

The research report offers an in-depth analysis based on material, application, and manufacturing technique. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for LEO satellite constellations will drive consistent growth in space-grade ASIC deployments.

- Increased military spending across major economies will support long-term defense sector demand.

- Advancements in RHBD and SOI technologies will enable more compact and energy-efficient ASIC designs.

- Expanding commercial space ventures will create new opportunities for cost-effective radiation-hardened ASICs.

- Greater use of autonomous systems in high-radiation environments will broaden industrial applications.

- Strategic partnerships between foundries and defense firms will improve supply chain resilience.

- Growth in nuclear energy and particle accelerator projects will reinforce demand for mission-critical components.

- AI integration within ASICs will enable real-time analytics and onboard processing in radiation-prone zones.

- Emerging markets in Asia-Pacific and the Middle East will contribute to regional diversification and new investments.

- Long product lifecycles and government-led R&D initiatives will ensure market stability and innovation continuity.