Market Overview

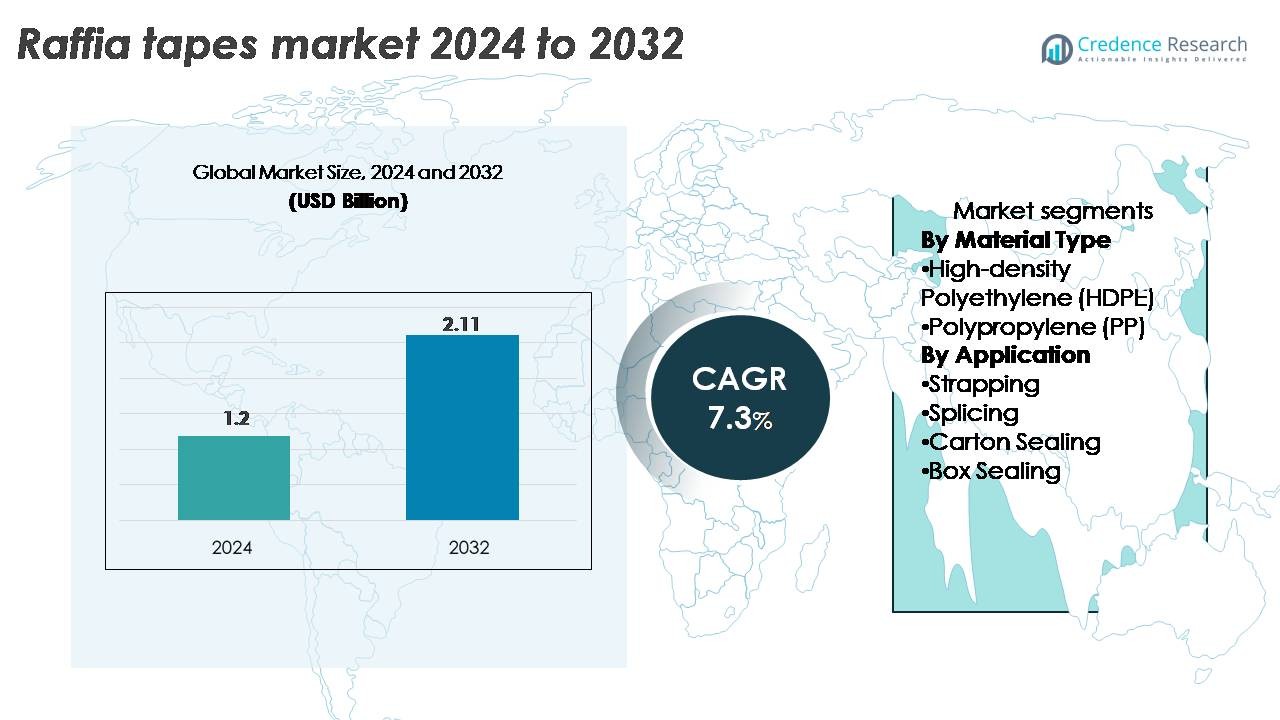

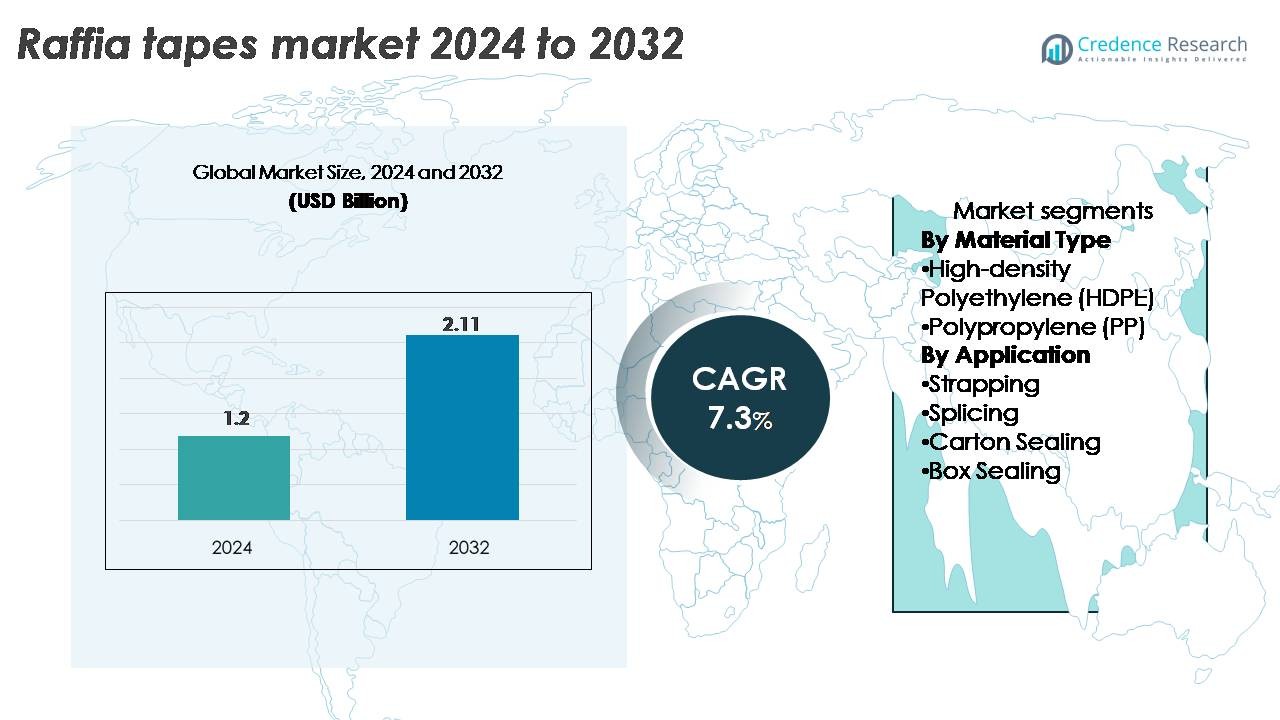

The Raffia Tapes Market was valued at USD 1.2 billion in 2024 and is anticipated to reach USD 2.11 billion by 2032, growing at a CAGR of 7.3% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Raffia Tapes Market Size 2024 |

USD 1.2 Billion |

| Raffia Tapes Market, CAGR |

7.3% |

| Raffia Tapes Market Size 2032 |

USD 2.11 Billion |

The raffia tapes market is led by key players such as LC Packaging International BV, Uflex Ltd., Napco National, Al-Tawfiq Company, Fabrimats, and Raffia Industrial Products. These companies dominate through product innovation, regional expansion, and sustainable manufacturing. Asia-Pacific remains the leading region, accounting for a 38% market share, driven by large-scale production in China and India. European manufacturers focus on eco-friendly polypropylene and HDPE tapes to comply with stringent environmental regulations. In contrast, North American players leverage automation and recycling technologies to enhance efficiency. Strategic collaborations and capacity enhancements continue to strengthen competitive positioning across global markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Raffia Tapes Market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.11 billion by 2032, growing at a CAGR of 7.3% during the forecast period.

- Rising demand from the packaging and logistics sectors drives growth, supported by the increasing use of polypropylene tapes for strapping and sealing applications.

- The market trend toward eco-friendly and recyclable materials is strengthening, with polypropylene-based raffia tapes holding a 64% share due to their strength and sustainability.

- Leading players such as Uflex Ltd., LC Packaging International BV, and Napco National focus on automation and production efficiency to gain a competitive edge.

- Regionally, Asia-Pacific leads with a 38% share, followed by Europe at 27% and North America at 22%, driven by strong industrial, agricultural, and packaging sector adoption across these regions.

Market Segmentation Analysis:

By Material Type

Polypropylene (PP) dominates the raffia tapes market, holding a market share of 64% in 2024. PP-based tapes are preferred for their superior tensile strength, lightweight nature, and resistance to moisture and chemicals. These properties make them suitable for heavy-duty packaging, agriculture, and industrial applications. Their recyclability also aligns with sustainability trends, boosting adoption among eco-conscious manufacturers. In contrast, HDPE tapes are gaining attention for niche uses in high-stress environments due to their durability and UV resistance, particularly in outdoor and construction packaging applications.

- For instance, Lohia Corp introduced advanced PP raffia tape lines capable of producing tapes with tensile strengths exceeding 7 grams per denier, enhancing packaging durability.

By Application

Strapping emerged as the dominant application segment with a 42% market share in 2024. Raffia tapes used in strapping provide excellent load stability, tear resistance, and elongation control, making them ideal for securing pallets, bundles, and heavy goods. The rise in e-commerce logistics and industrial exports has strengthened demand for high-performance strapping tapes. Splicing, carton sealing, and box sealing also contribute to market growth, driven by the need for reliable, high-strength bonding solutions across packaging and material handling industries.

- For instance, Mosca’s EVOLUTION SoniXs TR-6 Pro reaches up to 65 straps per minute on automated lines. Signode’s BXT3-19 battery tool applies tension up to 4,500 N for PP and PET straps.

Key Growth Drivers

Rising Demand in Packaging and Logistics

The growing need for durable and lightweight packaging materials in logistics and e-commerce is driving the demand for raffia tapes. These tapes offer high tensile strength and resistance to tearing, making them ideal for bundling, palletizing, and sealing heavy packages. Rapid expansion of retail distribution networks and increased global trade volumes further enhance market growth. For instance, polypropylene-based raffia tapes are widely used in strapping applications due to their consistent performance under high stress and cost efficiency. Manufacturers are optimizing production lines to meet this demand, ensuring high yield and product uniformity across diverse packaging operations.

- For instance, FROMM’s P331 handles strap widths of 19–32 mm and reaches 7,000 N tension, securing dense loads during export shipping.

Expanding Applications in Agriculture and Construction

Raffia tapes are increasingly used in agriculture for tying plants, bundling produce, and securing greenhouse materials due to their UV stability and flexibility. The construction sector also uses these tapes for splicing and temporary binding, thanks to their strong adhesion and resistance to harsh environmental conditions. For instance, PP raffia tapes with tensile strength exceeding 250 N/mm are employed in construction packaging and scaffolding bindings. The steady rise in agricultural exports and infrastructure investments across developing economies has further fueled tape consumption, encouraging manufacturers to introduce specialized grades optimized for field durability and prolonged exposure.

- For instance, Thrace Group manufactures UV-stabilized polypropylene raffia tapes designed for durability in agricultural applications, which are tested to meet specific UV resistance standards.

Shift Toward Sustainable and Recyclable Materials

Growing environmental awareness and regulatory pressures are encouraging the use of recyclable and eco-friendly raffia tapes. Polypropylene and HDPE tapes align with circular economy goals as they can be recycled and reused with minimal quality loss. Manufacturers are adopting energy-efficient extrusion technologies to reduce emissions and enhance production sustainability. For instance, suppliers are integrating closed-loop recycling systems that recover up to 90% of production waste, significantly lowering material costs. This transition toward sustainable manufacturing strengthens brand reputation and ensures compliance with international packaging standards, positioning eco-focused products for strong market growth over the coming decade.

- For instance, Starlinger introduced its starEX tape extrusion line equipped with the eqoCLEAN filter module, enabling the production of PP tapes with significant shares of recycled polypropylene while maintaining full line speed.

Key Trends & Opportunities

Technological Advancements in Manufacturing

Automation and digital monitoring are transforming raffia tape production, improving efficiency and consistency. Advanced extrusion lines now feature in-line quality control sensors that detect variations in tape thickness and tensile properties in real time. For instance, new biaxially oriented PP tape machines achieve production speeds of up to 400 meters per minute while maintaining uniform tensile strength. This innovation reduces waste and enhances scalability, enabling producers to meet the rising demand from packaging and agriculture sectors. Continuous R&D investment in surface treatment and coating technologies also supports superior adhesion and weather resistance.

- For instance, Lohia Corp. Ltd. developed the duotec StarLiner extrusion line that operates at speeds of 400 meters per minute and delivers polypropylene raffia tapes with tensile strength up to 280 N/mm, significantly increasing production efficiency.

Rising Adoption in E-Commerce and Industrial Packaging

The boom in online retail and global supply chains has created sustained demand for high-performance raffia tapes in shipping and industrial packaging. Their lightweight structure reduces freight costs, while their strength ensures secure sealing during long-distance transportation. For instance, strapping tapes made from PP have elongation rates under 25%, ensuring firm load stability. Packaging manufacturers are also developing customized color and printed tapes for brand identification, adding aesthetic and functional value. This trend is opening new opportunities for suppliers offering durable, high-visibility solutions tailored to logistics and warehouse environments.

Growing Penetration in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and Africa are witnessing rapid industrialization and packaging modernization, creating opportunities for raffia tape manufacturers. Expanding agriculture, construction, and manufacturing sectors in these regions require cost-effective, durable binding materials. For instance, Indian and Vietnamese producers are investing in capacity expansions exceeding 50,000 tons annually to cater to regional demand. Government-backed infrastructure and export initiatives are also accelerating tape adoption. With local producers improving production technologies and export capabilities, these markets are expected to become major contributors to global revenue growth.

Key Challenges

Volatility in Raw Material Prices

Fluctuations in polypropylene and polyethylene prices pose a significant challenge to raffia tape manufacturers. These materials are derived from crude oil, making their cost sensitive to global energy price variations. Sharp price changes disrupt profit margins and hinder long-term production planning. For instance, during recent supply disruptions, PP resin prices increased by nearly USD 150 per ton, impacting the overall cost structure for tape producers. Companies are adopting backward integration strategies and long-term procurement contracts to stabilize supply and mitigate financial risk.

Competition from Alternative Packaging Materials

Raffia tapes face rising competition from other binding and sealing materials, including polyester and paper-based tapes. These alternatives often appeal to brands pursuing eco-friendly packaging solutions. For instance, bio-based adhesive tapes developed from cellulose fibers offer similar sealing performance with enhanced biodegradability. This trend challenges raffia tape adoption in environmentally regulated markets. To remain competitive, manufacturers must innovate with recyclable coatings, hybrid composites, and low-carbon production processes that align with sustainability goals while maintaining mechanical performance and cost efficiency.

Regional Analysis

North America

North America holds a 22% share of the raffia tapes market, driven by strong demand from packaging, agriculture, and construction industries. The U.S. leads regional consumption, supported by advanced logistics networks and the expansion of e-commerce packaging. Sustainable polypropylene tapes are gaining preference due to recycling initiatives and compliance with environmental standards. For instance, U.S.-based manufacturers have integrated closed-loop systems in extrusion facilities to reduce production waste by over 80%. Canada’s agricultural exports further boost the use of UV-stabilized raffia tapes for bundling and crop packaging, reinforcing steady regional growth.

Europe

accounts for 27% of the global raffia tapes market, supported by rising adoption of eco-friendly packaging materials and strict recycling regulations. Countries such as Germany, Italy, and France are key contributors, emphasizing recyclable PP and HDPE tapes in industrial and logistics applications. The European Green Deal has encouraged companies to shift toward low-emission raffia tape production. For instance, European converters are implementing renewable energy-powered extrusion lines, cutting CO₂ emissions by up to 35%. The construction and agricultural sectors in Eastern Europe also represent significant demand centers due to infrastructure and export expansion.

Asia-Pacific

Asia-Pacific dominates the raffia tapes market with a 38% share, fueled by rapid industrialization and packaging growth in China, India, and Southeast Asia. High demand from agriculture, logistics, and FMCG industries drives large-scale production and export. For instance, Indian manufacturers produce over 60,000 metric tons of raffia tapes annually, supported by cost-effective raw materials and expanding export capacity. China’s investment in automated manufacturing enhances efficiency and reduces labor costs. The region’s growing preference for recyclable and lightweight packaging materials further strengthens its leadership in both production and consumption.

Latin America

Latin America represents a 7% share of the global raffia tapes market, with Brazil and Mexico as major contributors. Expanding agricultural activities, coupled with export-oriented packaging needs, fuel steady growth. The use of raffia tapes for crop bundling, fertilizer packaging, and industrial logistics has risen significantly. For instance, Brazilian manufacturers have developed high-tensile PP tapes capable of withstanding over 240 N/mm tension for secure pallet wrapping. Government-backed infrastructure programs and increasing trade with North America and Europe continue to stimulate tape consumption across industrial and agricultural segments.

Middle East & Africa

The Middle East & Africa account for 6% of the raffia tapes market, driven by construction, agriculture, and export packaging sectors. GCC countries, led by the UAE and Saudi Arabia, are investing in new packaging and material handling industries. For instance, local producers in Saudi Arabia have expanded PP raffia tape production capacity beyond 10,000 tons per year to meet export demand. African economies, including South Africa and Kenya, are adopting raffia tapes in agricultural storage and logistics. Growing manufacturing investments and favorable trade policies further enhance regional expansion prospects.

Market Segmentations:

By Material Type

- High-density Polyethylene (HDPE)

- Polypropylene (PP)

By Application

- Strapping

- Splicing

- Carton Sealing

- Box Sealing

By End Use

- Shipping & Logistics

- Building & Construction

- Healthcare

- Electrical & Electronics

- Food & Beverages

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The raffia tapes market is moderately consolidated, with leading players focusing on capacity expansion, sustainable product innovation, and regional diversification. Key companies include LC Packaging International BV, Napco National, Fabrimats, Raffia Industrial Products, Al-Tawfiq Company, and Uflex Ltd. These firms emphasize high-strength polypropylene and HDPE raffia tapes tailored for packaging, agriculture, and industrial use. For instance, Uflex operates automated PP raffia tape lines capable of producing over 30,000 metric tons annually, ensuring consistent quality and volume scalability. European producers prioritize eco-friendly and recyclable solutions, while Asian manufacturers dominate through cost-effective large-scale production. Strategic partnerships, export-oriented operations, and advancements in extrusion technology continue to define competitive differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kalyani Polymers Pvt. Ltd.

- Shanghai Well May Industrial Co., Ltd.

- Cesur Packaging Co.

- FUESERS GARNE GMBH

- Raffia Source Co.

- Huagusite Plastic Products (Shandong) Co., Ltd.

- Yiwu Yaoling Crafts Co., Ltd.

- Thrace Group

- Saudi Yarn and Knitting Technology Factory

- Jiangxi Longtai New Material Co., Ltd.

Recent Developments

- In November 2022, Umasree Texplast, an Indian company, announced entering a joint venture with Packem, a Brazilian company. The partnership will work toward the production of Flexible Intermediate Bulk Container(FIBC) Jumbo Bags that are eco-friendly. In the joint venture, Umasree holds 49% of the equity.

- In 2022, Shenzhen Aimtack Tape Co., Ltd. launches a new line of biodegradable raffia tapes.

Report Coverage

The research report offers an in-depth analysis based on Material type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The raffia tapes market will experience steady expansion driven by global packaging demand.

- Manufacturers will invest in automation to increase production speed and reduce waste.

- Adoption of recyclable polypropylene tapes will rise due to sustainability regulations.

- Asia-Pacific will continue leading production and consumption through large-scale manufacturing.

- Biodegradable and bio-based raffia tapes will gain popularity in eco-conscious industries.

- Advanced coating and adhesive technologies will enhance product durability and performance.

- Strategic partnerships between material suppliers and converters will strengthen global supply chains.

- Digital monitoring systems will improve extrusion precision and product consistency.

- Expansion in agricultural and construction sectors will create new application opportunities.

- Global players will focus on capacity expansion and regional diversification to sustain competitiveness.