Market Overview:

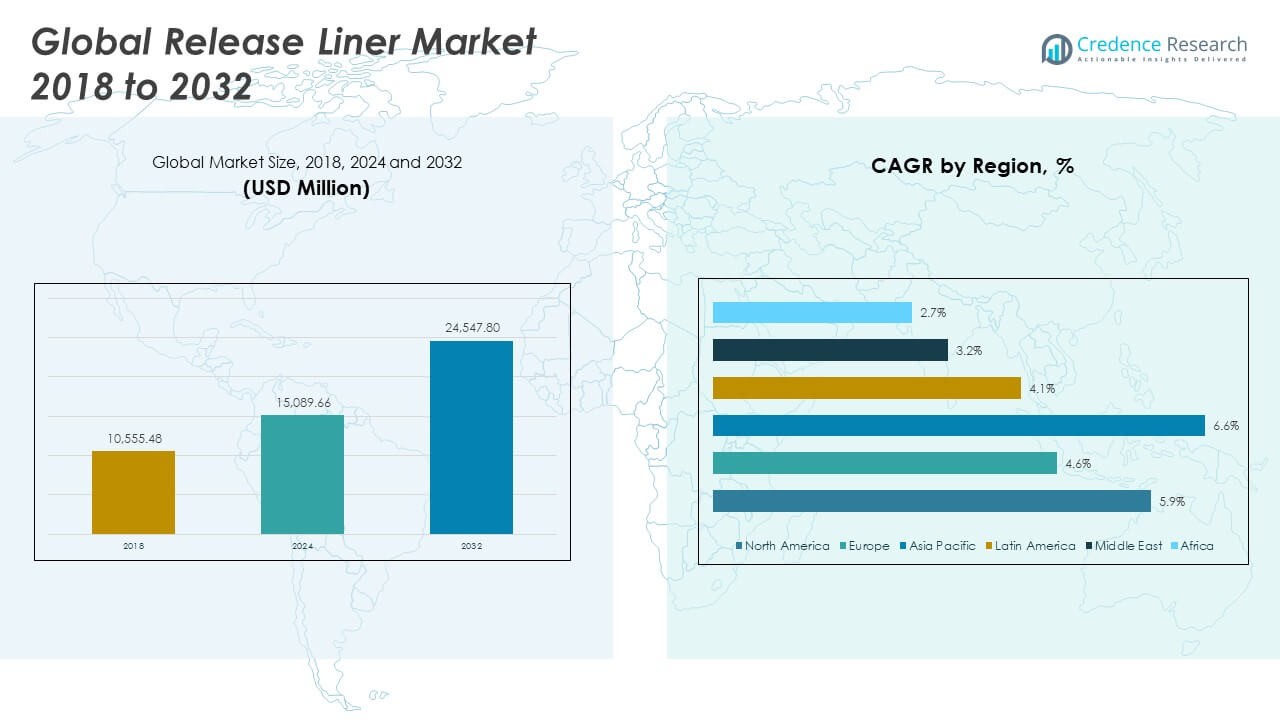

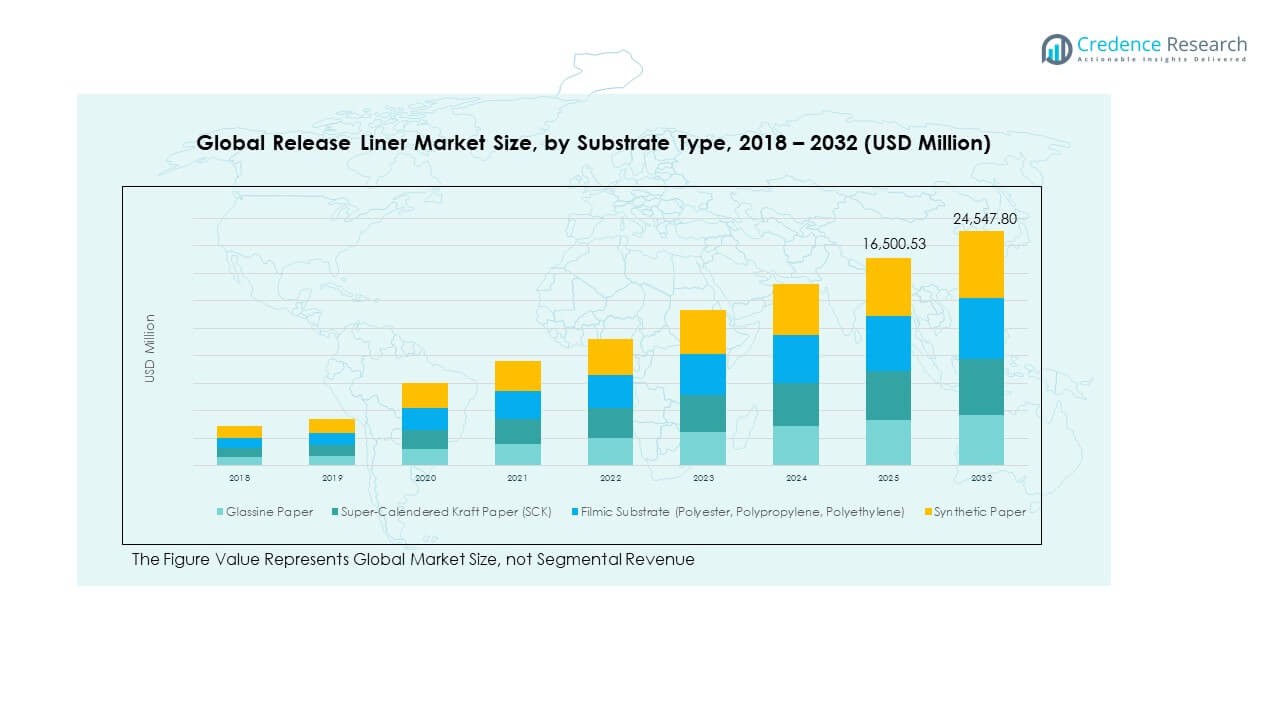

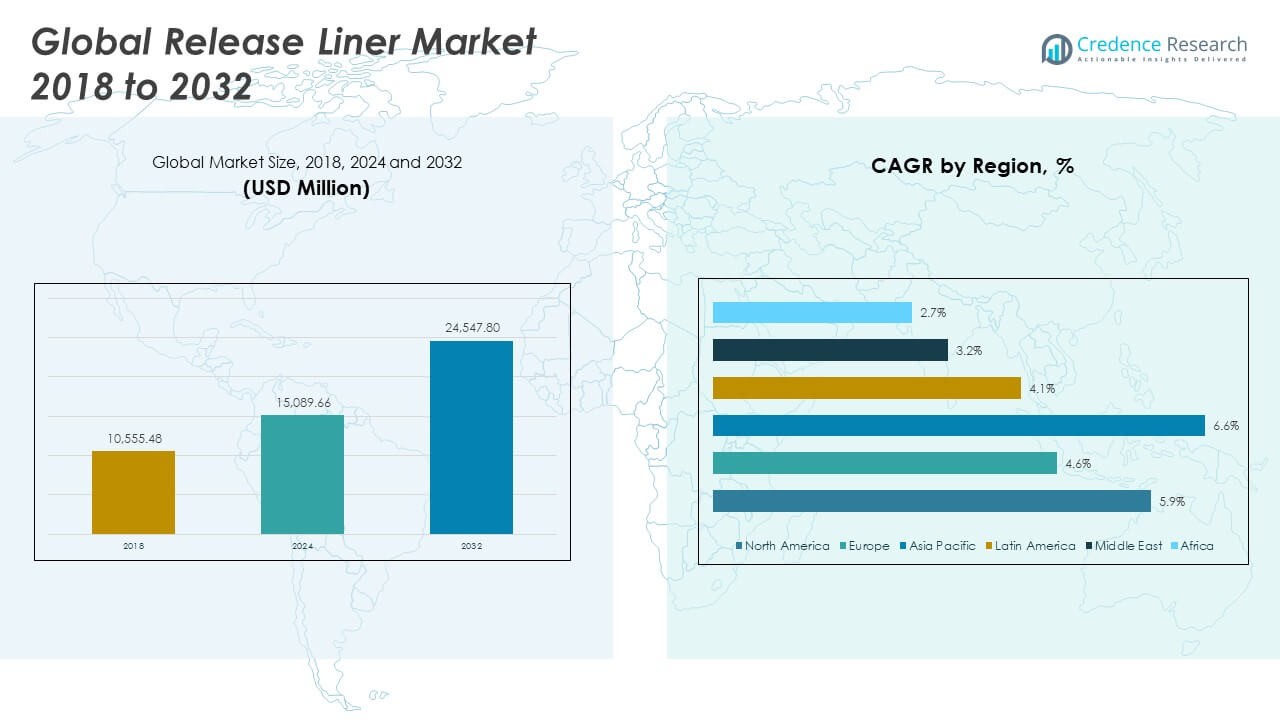

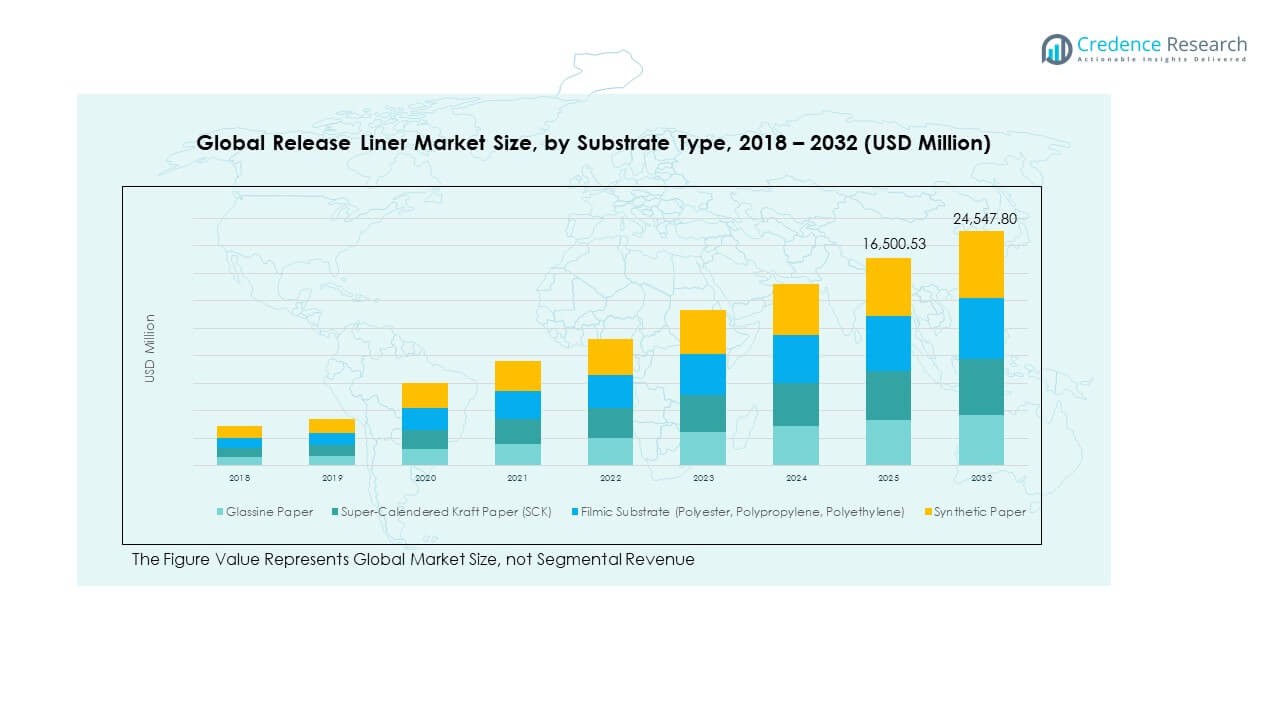

The Global Release Liner Market size was valued at USD 10,555.48 million in 2018 to USD 15,089.66 million in 2024 and is anticipated to reach USD 24,547.80 million by 2032, at a CAGR of 5.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Release Liner Market Size 2024 |

USD 15,089.66 Million |

| Release Liner Market, CAGR |

5.84% |

| Release Liner Market Size 2032 |

USD 24,547.80 Million |

The market is driven by strong demand from packaging, labeling, and tapes across industries, supported by e-commerce expansion and consumer goods growth. Healthcare and hygiene applications enhance adoption, particularly in medical devices, wound care, and personal care products. It benefits from technological improvements in coatings that ensure performance consistency and product durability. Rising sustainability initiatives accelerate the shift toward recyclable and bio-based liner solutions. Manufacturers invest in research and development to meet evolving requirements, driving long-term growth across diverse end-use sectors.

Regionally, Asia Pacific leads with strong manufacturing bases and large-scale packaging consumption in China and India. Europe follows with high regulatory emphasis on sustainability and innovations in recyclable paper substrates. North America shows steady adoption in healthcare, pharmaceuticals, and advanced retail logistics. Latin America is emerging through demand in food, beverage, and consumer goods packaging. The Middle East reflects gradual growth supported by expanding retail and e-commerce sectors. Africa demonstrates potential through rising urbanization and industrial development, though growth is slower due to infrastructure challenges.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Release Liner Market size was USD 10,555.48 million in 2018, USD 15,089.66 million in 2024, and is projected to reach USD 24,547.80 million by 2032, growing at a CAGR of 5.84%.

- Asia Pacific accounted for 73% of the market share in 2024, led by large-scale manufacturing, retail expansion, and e-commerce growth.

- North America held 68% in 2024, supported by strong demand in healthcare, retail, and industrial applications.

- Europe contributed 30% in 2024, driven by strict sustainability regulations and packaging innovation.

- Asia Pacific is the fastest-growing region with a 6.6% CAGR, benefiting from industrialization, rising consumer demand, and digital commerce expansion.

- Glassine paper dominated the substrate segment with 39% share in 2024, favored for labeling and packaging due to its strength and smooth surface.

- Filmic substrates held 28% share in 2024, valued for superior durability and performance in automotive, electronics, and industrial uses.

Market Drivers

Rising Demand from Packaging, Labeling, and Tapes Industry Creates Long-Term Growth Potential

The packaging, labeling, and tapes industry plays a central role in driving the Global Release Liner Market. Demand for pressure-sensitive labels in retail, logistics, and e-commerce sectors continues to expand steadily. Companies use release liners to ensure high performance and durability in end-use applications. The growth of self-adhesive packaging boosts liner use across industries worldwide. Expansion of consumer goods, retail chains, and export activities supports higher consumption levels. It strengthens opportunities for suppliers who deliver quality, efficiency, and consistent coating solutions. The global shift toward fast-moving packaged goods further enhances adoption levels. Industrial reliance on release liners remains strong due to their versatility and reliability.

- For example, In January 2024, UPM Raflatac announced it had reached its target of ensuring all face papers and release liner papers for label products are sourced from certified sustainable forestry schemes, achieving this milestone six year ahead of its original 2030 goal.

Expansion of Healthcare and Hygiene Applications Broadens Scope for Release Liner Adoption

Healthcare, hygiene, and personal care applications create major opportunities in the Global Release Liner Market. Medical devices, wound dressings, and hygiene products depend on advanced liner technologies. Rising health awareness and improved infrastructure drive product usage in growing economies. Multinational manufacturers expand their portfolios with medical-grade release liners. It helps support critical applications with controlled adhesive performance and safety standards. The surge in personal care products further fuels steady consumption of high-quality liners. Growing demand in baby care, feminine hygiene, and adult care products strengthens market growth. Continuous innovation in coatings aligns with stringent safety and comfort requirements.

Sustainability Goals and Regulatory Push Encourage Adoption of Recyclable Release Liners

Sustainability regulations and environmental goals directly influence the Global Release Liner Market. Manufacturers face rising pressure to develop recyclable and bio-based solutions. The growing preference for eco-friendly products reshapes strategies across industries. Adoption of paper-based and compostable liners gains traction in retail and packaging sectors. It supports a lower carbon footprint and compliance with global sustainability targets. Government regulations in Europe and North America accelerate this shift further. Industrial buyers prefer suppliers offering innovative sustainable solutions with proven performance. Strategic investment in clean technologies helps businesses secure long-term competitive advantage.

Technological Improvements in Coatings Enhance Performance Across End-Use Industries

Advanced coating techniques create significant benefits for the Global Release Liner Market. Silicone and non-silicone coatings improve durability, release force, and product life. It ensures consistent adhesive performance across industrial, medical, and consumer uses. Technological upgrades lower waste, optimize material efficiency, and deliver cost savings. Film-based liners with high resistance and smooth release meet complex requirements. The use of UV and solvent-free coatings gains wider acceptance. Manufacturers invest heavily in automation and precision technologies to maintain quality. Adoption of advanced coatings enables greater flexibility in design and applications. Strong innovation pipelines secure future growth opportunities in diverse industries.

- For example, Mondi offers silicone-coated and specialty release liners across many industries including medical, tapes, labels, graphic arts & fibre composites. Their liners come in both single- and double-sided siliconizing, with adjustable release values and base materials like paper and film.

Market Trends

Growing Use of Digital Printing in Labels Drives New Opportunities for Release Liners

Digital printing adoption in labeling reshapes the Global Release Liner Market. Brands demand high-quality, customized, and short-run labels that require reliable liners. It supports faster production cycles and higher flexibility in packaging. The expansion of e-commerce and retail sectors increases the need for variable data printing. It allows businesses to enhance product differentiation and consumer engagement. Release liners ensure adhesive consistency for digital printing applications. Adoption of advanced substrates expands alongside technological improvements in presses. This trend is expected to redefine supplier partnerships and production strategies.

- For instance, Avery Dennison’s Piggyback labels are “label-on-label” constructions with two adhesive layers and two release liners, letting the top label be removed and reapplied while the bottom remains fixed. They support applications like promotional labels, shipping & tracking, and inventory management.

Shift Toward Lightweight Materials Increases Demand for Advanced Liner Solutions

Lightweight material usage is a rising trend in the Global Release Liner Market. Industries aim to reduce shipping costs and improve sustainability targets. It drives adoption of thinner, stronger liners that maintain reliable performance. Manufacturers invest in film-based liners with lower weight and enhanced strength. It supports improved efficiency in logistics and reduces material use. Automotive and electronics industries rely on lightweight solutions for technical applications. Innovations in flexible substrates increase design possibilities for end-use products. This trend encourages cross-industry collaboration and investment in material science.

Rising Focus on Smart Labels and RFID Integration Creates New Applications for Liners

Smart labeling adoption transforms demand in the Global Release Liner Market. RFID and NFC-enabled labels improve supply chain visibility and consumer engagement. It increases the need for specialized liners that support advanced electronics. The rise of intelligent packaging solutions strengthens adoption across retail and logistics. It supports authentication, traceability, and product information sharing. Healthcare and pharmaceuticals use smart labels to improve safety and compliance. Specialized release liners ensure durability and high-performance bonding in these applications. This trend establishes new growth areas for technology-driven suppliers.

- For example, in May 2024, UPM Raflatac won the China IoT Industry Innovation Product Award for its RFID labeling solution. Its RFID label material performs reliably in extreme temperatures ranging from −196 °C to 200 °C

Growth in Construction and Industrial Sectors Expands Use of Release Liners in Tapes

Industrial expansion creates broader uses for release liners in tapes and sealants. The Global Release Liner Market benefits from strong demand in construction and electronics. It provides durable backing solutions for high-performance tapes and adhesives. The automotive industry also drives demand for structural bonding tapes. It allows manufacturers to replace traditional fastening methods with lighter solutions. Industrial sealants supported by liners gain traction in aerospace and machinery. Growing urbanization increases demand for construction tapes in insulation and safety. Suppliers expand capabilities to deliver advanced solutions meeting sector-specific needs.

Market Challenges Analysis

Volatile Raw Material Prices and Supply Chain Instability Pressure Profit Margins

The Global Release Liner Market faces significant challenges from raw material volatility. Paper, films, and silicone costs fluctuate due to energy and resource constraints. It creates uncertainty in pricing and supply for manufacturers and buyers. Disruptions in global logistics and transportation increase delivery risks. Supply shortages impact timely production schedules, weakening industry stability. Manufacturers find it difficult to balance cost efficiency with consistent quality. These pressures often reduce margins and slow investments in new technologies. Businesses must strengthen sourcing strategies to remain resilient in competitive conditions.

Recycling Limitations and Environmental Compliance Issues Create Operational Barriers

Sustainability goals pose challenges for the Global Release Liner Market. Complex recycling processes for paper and film-based liners limit large-scale adoption. It restricts easy compliance with tightening global environmental regulations. Manufacturers face rising operational costs for developing eco-friendly materials. Waste management limitations create barriers in emerging regions with weak infrastructure. Customers demand greener solutions, increasing the burden on suppliers. Meeting regulatory standards without compromising performance remains a constant challenge. These barriers slow down transition timelines for sustainable liner production. Industry-wide collaboration is required to overcome recycling constraints effectively.

Market Opportunities

Rising E-Commerce Packaging and Labeling Needs Create Expansion Opportunities Globally

E-commerce growth offers strong opportunities for the Global Release Liner Market. Rising shipment volumes create higher demand for labeling, tapes, and protective packaging. It supports continuous expansion of release liner applications in logistics and retail. Demand for faster and more efficient labeling systems is increasing worldwide. Online food delivery and consumer goods further strengthen packaging requirements. Growth in global trade routes enhances opportunities in cross-border supply chains. This expansion supports suppliers offering innovative, flexible, and durable liner solutions. The sector holds potential for consistent growth across developing markets.

Adoption of Bio-Based Materials and Advanced Coatings Expands Long-Term Growth Potential

Eco-friendly initiatives create strong opportunities in the Global Release Liner Market. Companies develop bio-based and compostable liner materials to meet sustainability goals. It aligns with global regulations that encourage low-carbon and recyclable products. Technological improvements in coatings expand performance options for multiple applications. Medical and electronics industries demand advanced liners for specialized needs. Adoption of solvent-free and UV-curable coatings ensures compliance and efficiency. Growing investment in clean technologies enhances long-term profitability for market leaders. These opportunities highlight the potential for innovation-driven competitive advantage worldwide.

Market Segmentation Analysis:

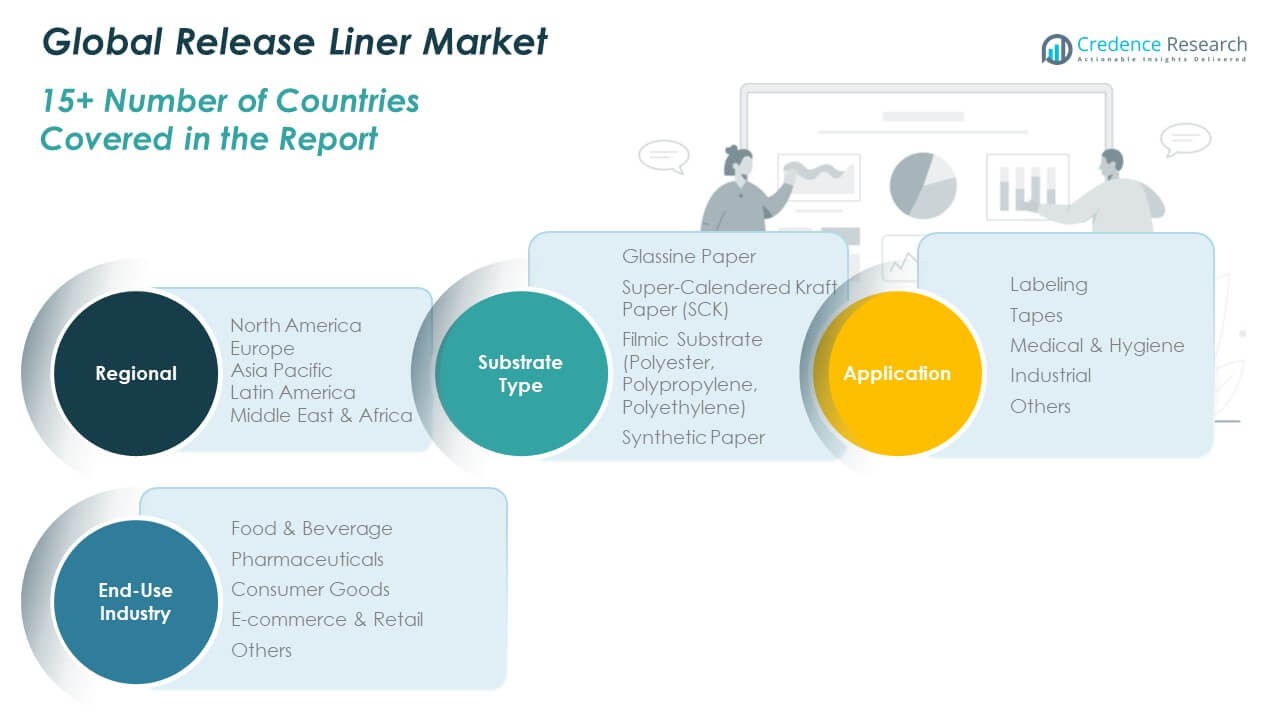

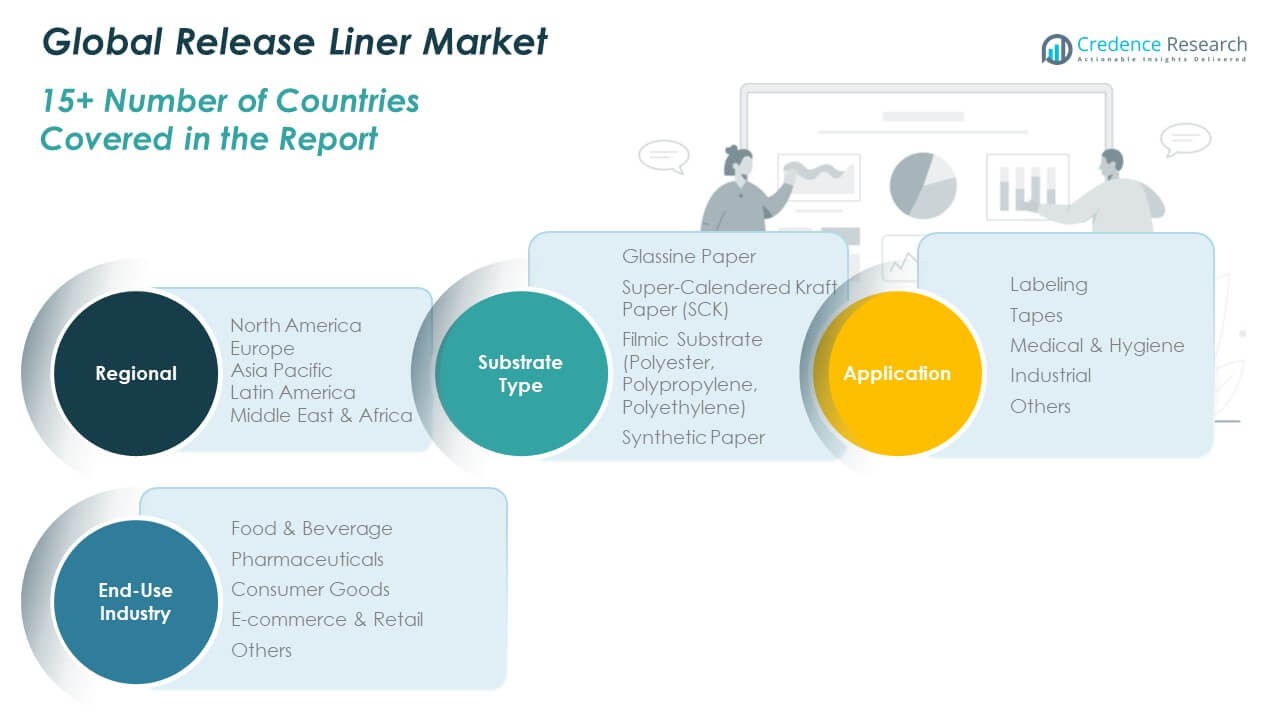

The Global Release Liner Market is segmented

By substrate type

Into glassine paper, super-calendered kraft paper (SCK), filmic substrates including polyester, polypropylene, and polyethylene, and synthetic paper. Glassine paper dominates due to its smooth surface and strength, making it ideal for labeling. SCK holds steady demand in industrial applications requiring high tensile strength. Filmic substrates are gaining traction with their superior resistance and durability, particularly in automotive and electronics. Synthetic paper supports specialized applications where moisture and chemical resistance are critical.

- For example, Keraf Group offers a white 38 g/m² glassine base paper for high-speed automatic labeling. It features tensile strength (MD) ≥ 5.2 kgf/15 mm, tear resistance (MD) ≥ 350 mN, smoothness ≥ 1500 S, and transparency ≥ 50%.

By application

The Global Release Liner Market includes labeling, tapes, medical and hygiene, industrial, and others. Labeling represents the largest segment, driven by retail, e-commerce, and fast-moving consumer goods. Tapes contribute significantly through construction, automotive, and electronics industries. Medical and hygiene applications are expanding rapidly with higher demand for personal care products and wound care solutions. Industrial uses remain strong in machinery, aerospace, and electrical segments.

By end-use industry

The Global Release Liner Market covers food and beverage, pharmaceuticals, consumer goods, e-commerce and retail, and others. Food and beverage packaging ensures consistent adoption of labeling solutions. Pharmaceuticals require medical-grade liners to meet strict safety standards. Consumer goods benefit from flexible labeling and packaging formats. E-commerce and retail drive growth through demand for durable packaging and efficient logistics. It demonstrates diverse applicability across industries, creating broad growth opportunities for manufacturers.

- For example, S&S Paper Industries offers SCK (Super Calendered Kraft) release liners in 65–120 g/m², featuring high tensile strength and tear resistance. Their smooth, uniform surface supports reliable use in self-adhesive labels, tapes, and pharmaceutical packaging.

Segmentation:

By Substrate Type

- Glassine Paper

- Super-Calendered Kraft Paper (SCK)

- Filmic Substrate (Polyester, Polypropylene, Polyethylene)

- Synthetic Paper

By Application

- Labeling

- Tapes

- Medical & Hygiene

- Industrial

- Others

By End-Use Industry

- Food & Beverage

- Pharmaceuticals

- Consumer Goods

- E-commerce & Retail

- Others

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Global Release Liner Market size was valued at USD 2,969.68 million in 2018 to USD 4,176.89 million in 2024 and is anticipated to reach USD 6,824.41 million by 2032, at a CAGR of 5.9% during the forecast period. North America holds a 27.78% share of the Global Release Liner Market in 2024. Growth in this region is driven by a strong presence of healthcare, pharmaceuticals, and retail industries. The United States leads the market, supported by advanced packaging technologies and large-scale adoption of pressure-sensitive labels. Demand from medical applications such as wound dressings and hygiene products strengthens consumption levels. It benefits from regulatory focus on sustainable solutions, with manufacturers investing in recyclable liners. Canada and Mexico contribute through expanding industrial and automotive uses of release liners. The region shows consistent investment in high-performance materials and advanced coating technologies.

Europe

The Europe Global Release Liner Market size was valued at USD 2,039.68 million in 2018 to USD 2,761.52 million in 2024 and is anticipated to reach USD 4,099.66 million by 2032, at a CAGR of 4.6% during the forecast period. Europe accounts for an 18.29% share of the Global Release Liner Market in 2024. The region emphasizes sustainable and recyclable packaging solutions, supported by strict regulatory frameworks. Germany, France, and the UK dominate the demand due to established labeling and automotive industries. It shows strong demand from consumer goods and e-commerce sectors requiring advanced labeling solutions. Innovation in recyclable paper-based liners supports regulatory compliance and green initiatives. Southern European countries add growth through expanding retail and food sectors. Manufacturers invest in eco-friendly production methods, aligning with European sustainability goals. The region continues to be a global leader in environmental adoption within the release liner industry.

Asia Pacific

The Asia Pacific Global Release Liner Market size was valued at USD 4,657.44 million in 2018 to USD 6,901.54 million in 2024 and is anticipated to reach USD 11,905.90 million by 2032, at a CAGR of 6.6% during the forecast period. Asia Pacific contributes 45.73% of the Global Release Liner Market share in 2024. China dominates with large-scale manufacturing, rising packaging consumption, and rapid retail growth. Japan and South Korea provide strong demand from electronics and automotive sectors. It benefits from rising healthcare and hygiene product adoption in India and Southeast Asia. Urbanization and e-commerce expansion accelerate demand for labeling and packaging solutions. The presence of global and regional suppliers strengthens competitive dynamics. Investment in cost-efficient film-based liners helps meet regional industrial requirements. The region remains the fastest-growing market due to high consumption and expanding infrastructure.

Latin America

The Latin America Global Release Liner Market size was valued at USD 477.47 million in 2018 to USD 673.70 million in 2024 and is anticipated to reach USD 964.40 million by 2032, at a CAGR of 4.1% during the forecast period. Latin America holds a 4.46% share of the Global Release Liner Market in 2024. Brazil dominates demand, supported by a strong food and beverage packaging industry. Mexico shows growth in e-commerce and retail labeling applications. It faces challenges from economic fluctuations yet benefits from rising consumer goods demand. Pharmaceutical packaging creates steady adoption across the region. Expanding industrialization enhances the use of tapes and adhesive-backed products. Argentina and Chile contribute through growing healthcare and retail adoption. Suppliers find opportunities by offering cost-effective and durable solutions tailored to regional needs.

Middle East

The Middle East Global Release Liner Market size was valued at USD 255.80 million in 2018 to USD 329.37 million in 2024 and is anticipated to reach USD 437.63 million by 2032, at a CAGR of 3.2% during the forecast period. The region accounts for a 2.18% share of the Global Release Liner Market in 2024. Growth is supported by expanding retail and logistics sectors in GCC countries. Saudi Arabia and UAE drive adoption through strong industrial packaging requirements. It faces slower growth due to lower levels of industrial diversification compared to other regions. Rising e-commerce activities create opportunities for labeling and packaging consumption. Investments in healthcare infrastructure increase demand for medical-grade release liners. Israel contributes through technological innovations and advanced industrial applications. The market is developing steadily with potential for long-term expansion.

Africa

The Africa Global Release Liner Market size was valued at USD 155.41 million in 2018 to USD 246.63 million in 2024 and is anticipated to reach USD 315.80 million by 2032, at a CAGR of 2.7% during the forecast period. Africa represents a 1.63% share of the Global Release Liner Market in 2024. South Africa leads with growing demand from industrial and retail sectors. Egypt contributes significantly through rising food and pharmaceutical packaging. It shows slower growth compared to other regions due to economic and infrastructural challenges. Adoption is supported by expanding consumer goods and urbanization trends. International suppliers invest in cost-effective products tailored for local industries. Limited recycling infrastructure creates challenges for sustainable liner adoption. The region presents long-term opportunities as consumption patterns evolve with population growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- 3M Company

- Avery Dennison Corporation

- Lintec Corporation

- Mondi Group

- Nitto Denko Corporation

- UPM-Kymmene Corporation

- Dow Inc.

- Cosmo Speciality Chemicals

- Mitsubishi Chemical Corporation

- SICPA Holding SA

Competitive Analysis:

The Global Release Liner Market is highly competitive with the presence of multinational corporations and regional suppliers. Leading players such as 3M Company, Avery Dennison Corporation, UPM-Kymmene, Mondi Group, and Lintec Corporation dominate with extensive product portfolios and strong distribution networks. It benefits from continuous investment in innovation, sustainable substrates, and advanced coating technologies. Companies focus on mergers, acquisitions, and partnerships to expand market presence and strengthen regional coverage. Rising demand for eco-friendly solutions pushes manufacturers to invest in recyclable and bio-based liners. Emerging players compete by offering cost-effective and customized solutions for niche applications. Established firms differentiate through technological expertise, strong customer relationships, and large-scale production capabilities. Competitive intensity remains high, with innovation and sustainability serving as the primary levers for market leadership.

Recent Developments:

- In August 2025, LINTEC Corporation announced the introduction of new coating equipment, further advancing its capabilities in the release liner sector. This equipment aims to improve production efficiency and coating precision for release liners and related specialty materials.

- In August 2025, Mondi Group launched the Ad/Vantage Smooth Brown Semi Extensible kraft paper, a technically advanced, recyclable base paper targeted at high-performance packaging, including release liner applications. Developed by Mondi’s R&D team over three years, this substrate delivers strong printability, coating quality, and high strength while supporting process efficiency for converters using certified and sustainable fibers.

Report Coverage:

The research report offers an in-depth analysis based on Substrate Type, Application and End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Release Liner Market will expand steadily, driven by diverse industrial and consumer applications.

- Demand for advanced labeling and packaging solutions will remain a central growth driver worldwide.

- Adoption of sustainable substrates and recyclable liners will strengthen as regulations tighten.

- Investments in bio-based and solvent-free coatings will create new innovation pathways.

- Healthcare and hygiene sectors will contribute significantly to rising demand across multiple regions.

- Digital printing and smart labeling technologies will unlock opportunities for high-performance liner solutions.

- Asia Pacific will continue to lead market expansion, supported by rapid industrialization and e-commerce growth.

- Strategic mergers and acquisitions will help global companies strengthen regional reach and portfolios.

- Industrial applications in automotive, construction, and electronics will increase reliance on durable film-based liners.

- Market competition will intensify, with sustainability and cost-efficiency emerging as key differentiating factors.