Market Overview

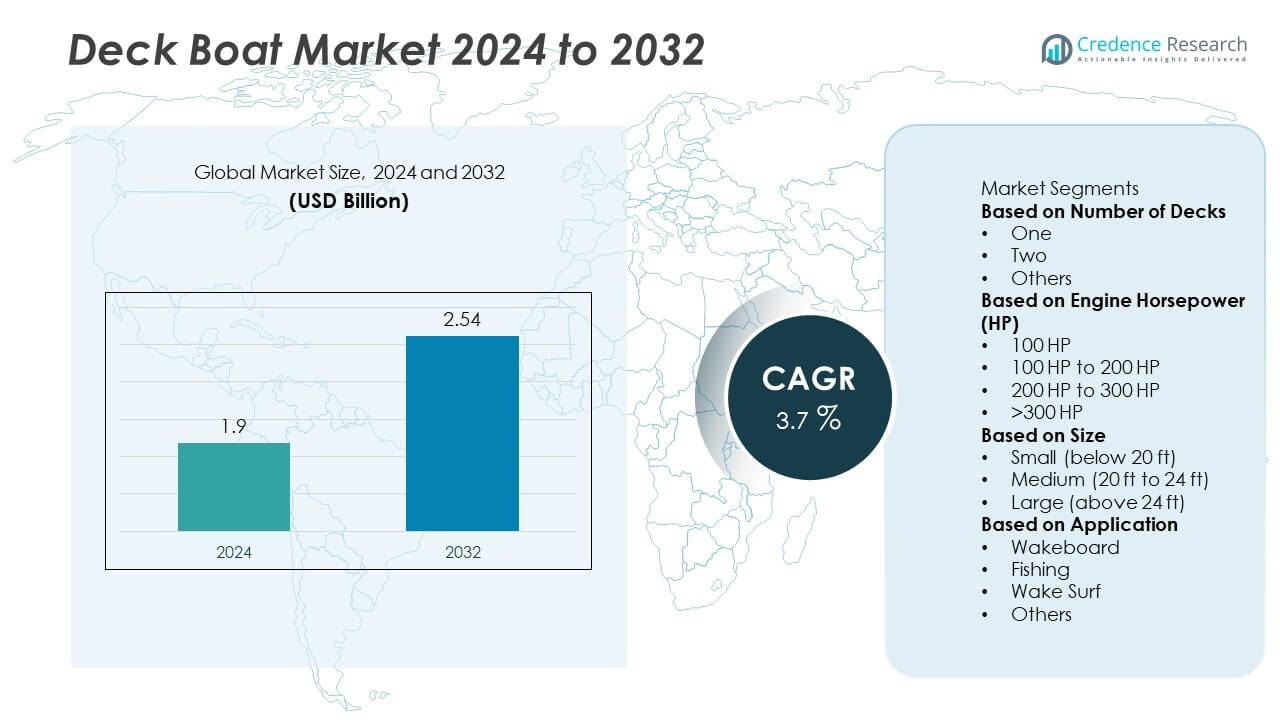

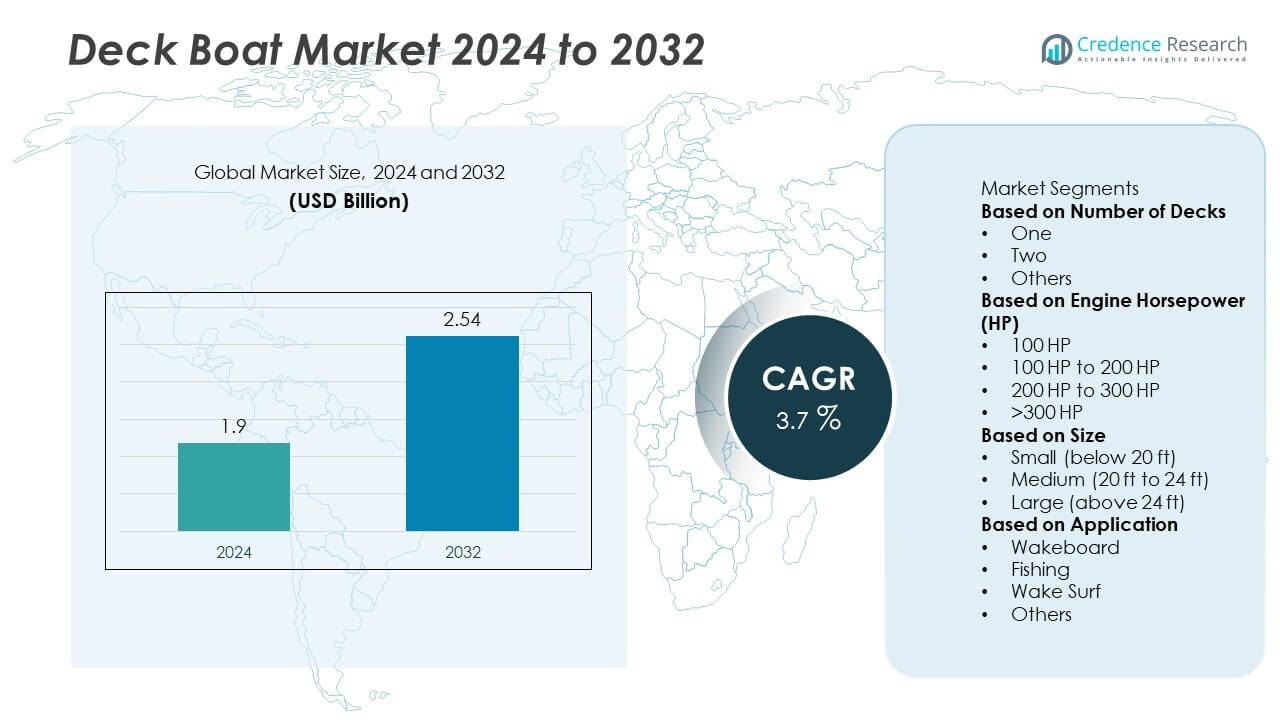

The Deck Boat market size was valued at USD 1.9 billion in 2024 and is anticipated to reach USD 2.54 billion by 2032, growing at a CAGR of 3.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Deck Boat market Size 2024 |

USD 1.9 Billion |

| Deck Boat market, CAGR |

3.7% |

| Deck Boat market Size 2032 |

USD 2.54 Billion |

The Deck Boat market is led by key players including Polaris, Starcraft Marine, MasterCraft Boat, Crownline, Tahoe, Bayliner, Southwind Boats, Glastron, Sea Ray, and Marine Products. These companies dominate the industry through strong product portfolios, technological innovation, and widespread dealership networks. North America emerged as the leading region in 2024 with a 39% share, supported by robust recreational boating culture, advanced marine infrastructure, and high consumer spending. Europe followed with a 27% share, driven by coastal tourism and sustainable boating trends, while Asia-Pacific accounted for 23%, propelled by rising disposable incomes, expanding marina facilities, and growing interest in marine leisure activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Deck Boat market was valued at USD 1.9 billion in 2024 and is projected to reach USD 2.54 billion by 2032, growing at a CAGR of 3.7% during the forecast period.

- Rising popularity of water-based recreation and marine tourism is driving demand for deck boats, supported by increasing consumer spending on leisure and family-oriented boating activities.

- The market is witnessing trends such as adoption of fuel-efficient engines, smart onboard systems, and growing interest in electric and hybrid propulsion models.

- Leading players including Polaris, Starcraft Marine, Sea Ray, and Bayliner are focusing on advanced design, customization, and global distribution to strengthen competitiveness and expand market share.

- North America leads with a 39% share, followed by Europe at 27% and Asia-Pacific at 23%; by size, the medium segment (20–24 ft) dominates with a 52% share, favored for its performance, comfort, and versatility in recreational use.

Market Segmentation Analysis:

By Number of Decks

The single-deck segment dominated the Deck Boat market in 2024, capturing a 63% share. Single-deck boats are highly popular among recreational users due to their versatility, lightweight structure, and ease of handling. Their open layout offers ample seating and space for fishing, cruising, and water sports, making them ideal for families and leisure boating. Manufacturers are enhancing single-deck models with improved stability, storage, and comfort features. Rising participation in coastal and freshwater recreational activities continues to drive demand for single-deck designs across global markets.

- For instance, Bayliner’s Element M15 deck boat weighs approximately 1,385 pounds dry and supports a 60 HP outboard, delivering stable handling in diverse inland waters while maintaining a shallow draft of just over 2 feet to access tighter coastal zones.

By Engine Horsepower (HP)

The 200 HP to 300 HP segment led the Deck Boat market in 2024 with a 47% market share, favored for its balance between power and fuel efficiency. These boats offer excellent performance for water sports, cruising, and offshore activities, appealing to both private owners and rental operators. Advanced propulsion technologies and lightweight hull materials are improving fuel economy and acceleration. Demand for mid-range horsepower boats is also growing among recreational users seeking versatile options for multi-purpose water activities, supporting steady segment expansion.

- For instance, the Hurricane SunDeck 217 OB is rated up to 225 HP, providing sufficient thrust for waterskiing and wakeboarding with its modified deep-V hull design.

By Size

The medium-sized segment (20 ft to 24 ft) held the dominant 52% share of the Deck Boat market in 2024. These boats offer an ideal combination of passenger capacity, stability, and maneuverability, making them the preferred choice for family and group recreation. Their moderate size supports storage efficiency and easy trailering, enhancing user convenience. The popularity of mid-size models is further driven by their affordability compared to larger boats and their capability to perform well in both inland and nearshore waters. Continuous innovation in design and onboard amenities supports their sustained market leadership.

Key Growth Drivers

Rising Popularity of Recreational Boating Activities

Growing interest in leisure and water-based recreational activities is driving demand for deck boats. Consumers are increasingly investing in boating for family outings, fishing, and water sports. The versatility, comfort, and performance of deck boats make them ideal for multi-purpose recreational use. Expanding coastal tourism and lakefront leisure infrastructure further stimulate sales. Manufacturers are focusing on user-friendly designs and enhanced safety features, aligning with the increasing preference for outdoor lifestyles and premium boating experiences.

- For instance, Sea Ray’s SDX 270 deck boat is equipped with seating for up to 12 passengers and a 75-gallon fuel tank, allowing for extended cruising. Its integrated swim platform with a concealable ladder and a standard 9-inch Simrad digital display enhances comfort and safety during leisure outings. A submersible swim step is available as an option.

Advancements in Marine Engine and Design Technology

Technological innovation is transforming the deck boat market through improved hull designs and fuel-efficient engines. Modern boats feature lightweight composites, digital controls, and noise-reduction systems that enhance performance and comfort. The introduction of hybrid and low-emission propulsion systems is supporting environmental compliance and sustainability goals. Smart onboard systems with GPS integration and touchscreen dashboards are improving navigation and user convenience. These advancements collectively boost operational efficiency, appeal to new buyers, and support long-term industry growth.

- For instance, MasterCraft’s Ilmor 6.2L GDI engine delivers 430 horsepower and features an efficient gasoline direct injection system. Supported by digital throttle control, the system pairs with a touchscreen interface that provides precise fuel data and performance analytics.

Rising Disposable Income and Marine Tourism Development

Increasing disposable incomes and expanding marine tourism are major drivers for the deck boat market. Consumers in developed and emerging regions are investing more in leisure and luxury marine activities. Government initiatives to promote waterfront tourism and recreational marinas further enhance demand. Growing rental and charter services also expand market accessibility. Manufacturers are responding with customizable, cost-effective models to cater to diverse consumer preferences. This trend is strengthening global sales and attracting first-time buyers seeking affordable entry into recreational boating.

Key Trends & Opportunities

Growth of Boat Sharing and Rental Services

The rise of boat-sharing and rental platforms is reshaping the deck boat market by improving accessibility and reducing ownership costs. Urban consumers and tourists prefer renting over purchasing for short-term recreation. Companies are introducing app-based booking systems that simplify rental processes and fleet management. This trend enables market players to expand into the leisure and tourism sector while supporting sustainable utilization of marine assets. Increased demand for flexible usage models is creating strong opportunities for rental operators and manufacturers alike.

- For instance, the Brunswick-owned Freedom Boat Club operates over 400 locations globally with a fleet exceeding 5,000 boats, including deck and pontoon models. Its digital platform processes hundreds of thousands of reservations annually and facilitates fleet utilization and member experience, supported by features for scheduling and maintenance.

Shift Toward Eco-Friendly and Electric-Powered Boats

The market is witnessing a clear shift toward electric and hybrid-powered deck boats as sustainability gains importance. Manufacturers are investing in energy-efficient propulsion systems that reduce emissions and noise. Electric boats are gaining traction in inland waterways and eco-sensitive zones. Government incentives for green technologies and rising environmental awareness are accelerating adoption. Battery advancements and charging infrastructure development will further expand the segment. This transition positions eco-friendly deck boats as a key growth area for the future marine industry.

- For instance, Vision Marine introduced its E-Motion 180E outboard delivering 180 horsepower. The system is powered by a standard 60 kWh lithium-ion battery pack, which provides an estimated range of 70 nautical miles, or about 3.5 hours, at a cruising speed of 20 mph (17.4 knots), though this can vary based on the vessel.

Integration of Smart and Connected Technologies

Digitalization is driving innovation in deck boats through the integration of smart control systems and IoT connectivity. Features such as touchscreen interfaces, real-time diagnostics, and GPS tracking enhance safety and user experience. Mobile applications now allow remote monitoring of engine performance, fuel consumption, and navigation. Connectivity also supports predictive maintenance and energy management. The growing demand for tech-equipped recreational boats offers new opportunities for premium manufacturers focusing on digital convenience and high-end customization.

Key Challenges

High Ownership and Maintenance Costs

The high cost of purchasing, insuring, and maintaining deck boats remains a major challenge for widespread adoption. Premium materials, advanced engines, and electronic systems increase overall expenses. Additionally, fuel, docking, and seasonal storage costs discourage potential buyers. These factors push many consumers toward rentals instead of ownership. Manufacturers are responding by introducing modular designs and offering flexible financing or subscription models. However, cost-related concerns continue to limit demand in price-sensitive regions and among entry-level recreational users.

Seasonal Demand Fluctuations and Environmental Constraints

The deck boat market faces strong seasonality, with demand peaking during summer and dropping in colder months. Weather-dependent usage patterns impact production cycles and inventory management for manufacturers. Furthermore, environmental regulations and restrictions on certain waterways can limit operational flexibility. Climate variability also affects tourism and boating activity. To mitigate these challenges, market players are diversifying offerings across different geographies and promoting year-round recreational programs. Nonetheless, seasonality remains a structural challenge for long-term market stabilit

Regional Analysis

North America

North America held a 39% share of the Deck Boat market in 2024, driven by strong participation in recreational boating and expanding marine tourism. The United States leads the region with high consumer spending on leisure activities and a well-established boating infrastructure. The presence of major manufacturers, marinas, and rental operators supports consistent market growth. Canada also contributes through rising lake-based recreational demand and summer tourism. Increasing preference for family-oriented watercraft and adoption of technologically advanced, fuel-efficient models further strengthen North America’s dominance in the global deck boat industry.

Europe

Europe accounted for a 27% share of the Deck Boat market in 2024, supported by growing interest in marine recreation and coastal tourism. Countries such as France, Italy, and the United Kingdom are leading markets, with expanding yacht clubs, leisure ports, and marine rental services. The region’s strong focus on sustainability is encouraging adoption of electric and hybrid deck boats. Rising disposable income and government investment in marine tourism infrastructure are driving sales. Seasonal tourism in the Mediterranean and Northern Europe further boosts demand for medium-sized, high-comfort deck boats designed for family use.

Asia-Pacific

Asia-Pacific captured a 23% share of the Deck Boat market in 2024, fueled by increasing coastal tourism and recreational boating activities in China, Japan, Australia, and India. Expanding middle-class populations and rising interest in luxury marine experiences are key growth factors. Governments are promoting marine tourism through infrastructure investments and marina developments. Manufacturers are targeting the region with affordable, mid-sized models suited for inland and nearshore waters. Growing water sports popularity and adoption of eco-friendly propulsion systems also contribute to regional expansion, positioning Asia-Pacific as a promising future growth hub.

Latin America

Latin America held a 6% share of the Deck Boat market in 2024, supported by expanding tourism sectors in Brazil, Mexico, and Chile. Increasing interest in coastal leisure activities and rising disposable income are driving regional growth. The development of marinas and marine infrastructure across popular coastal destinations is encouraging boat ownership and rentals. However, high import costs and limited local manufacturing remain challenges. Partnerships between global manufacturers and regional distributors are improving availability and affordability. Growing recreational boating participation is expected to strengthen market presence across Latin American coastal economies.

Middle East & Africa

The Middle East and Africa accounted for a 5% share of the Deck Boat market in 2024. Demand is rising due to expanding marine leisure activities, particularly in the UAE, Saudi Arabia, and South Africa. Government initiatives promoting coastal tourism and luxury lifestyle experiences are driving adoption. The development of high-end marinas and waterfront entertainment hubs supports market expansion. However, the high cost of imported boats and limited regional manufacturing present challenges. Increasing interest in private charters, water sports, and eco-friendly vessels is expected to enhance future market growth in this region.

Market Segmentations:

By Number of Decks

By Engine Horsepower (HP)

- 100 HP

- 100 HP to 200 HP

- 200 HP to 300 HP

- >300 HP

By Size

- Small (below 20 ft)

- Medium (20 ft to 24 ft)

- Large (above 24 ft)

By Application

- Wakeboard

- Fishing

- Wake Surf

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Deck Boat market features leading players such as Polaris, Starcraft Marine, MasterCraft Boat, Crownline, Tahoe, Bayliner, Southwind Boats, Glastron, Sea Ray, and Marine Products. These companies hold strong market positions through continuous innovation, brand recognition, and extensive dealer networks. Manufacturers are focusing on enhancing product performance, fuel efficiency, and onboard comfort to cater to growing recreational boating demand. Strategic collaborations, mergers, and acquisitions are being used to expand global footprints and product lines. Many brands are introducing electric and hybrid propulsion systems to align with sustainability trends. Digital integration, including smart navigation, connectivity, and safety features, is emerging as a key differentiator among top players. Premium brands emphasize luxury design and customization, while others target affordability to reach a broader consumer base. Continuous R&D investment and aftersales service expansion remain critical strategies driving long-term competitiveness in the deck boat market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2024, Two Oceans Marine proudly launched its inaugural 27-meter catamaran, the Amavi, as part of the Two Oceans 870 Power Catamaran series. Developed in collaboration with Du Toit Yacht Design, the Amavi combines luxury and practicality with a sophisticated layout spread across four decks, offering an exceptional blend of performance and comfort.

- In October 2024, Polaris / Hurricane Boats launched the SunDeck 3200 deck boat, a new 32-foot model featuring outboard propulsion, a carbon fiber arch, and integrated joystick docking.

- In September 2024, MasterCraft announced its 2025 model-year lineup including the NXT series standardizing “NXT FasterFill Ballast” system with sub-nine-minute fill times.

Report Coverage

The research report offers an in-depth analysis based on Number of Decks, Engine Horsepower (HP), Size, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for deck boats will continue to rise with growing recreational and family boating activities.

- Manufacturers will focus on developing lightweight, fuel-efficient, and eco-friendly boat models.

- Integration of digital dashboards and smart control systems will enhance user experience.

- Electric and hybrid propulsion technologies will gain wider adoption due to sustainability goals.

- Expansion of boat-sharing and rental services will increase accessibility among new users.

- Customization and luxury features will become key differentiators for premium brands.

- Emerging markets in Asia-Pacific will drive future growth through rising marine tourism.

- Online sales and virtual showrooms will transform the boat purchasing experience.

- Partnerships between manufacturers and tourism operators will boost fleet modernization.

- Continuous R&D investment will improve safety, performance, and energy efficiency in upcoming models.