Market Overview

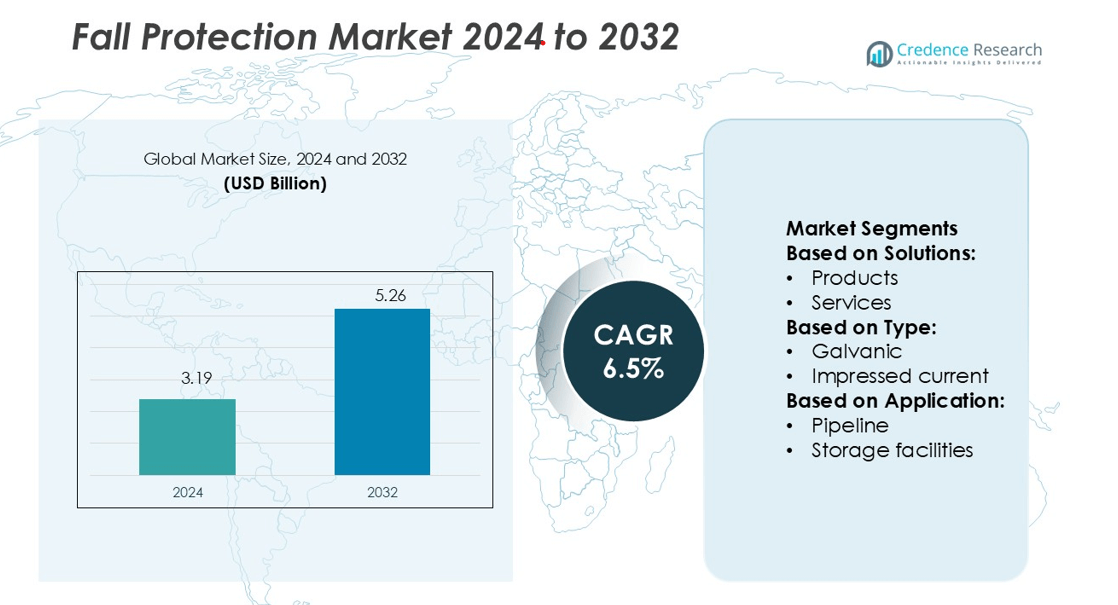

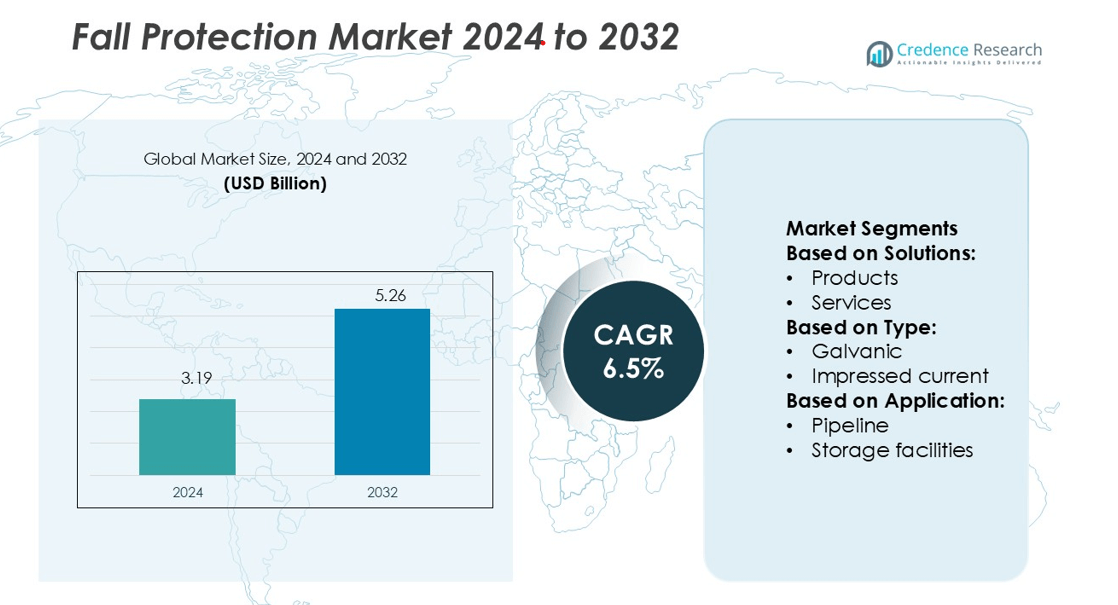

Fall Protection Market size was valued USD 3.19 billion in 2024 and is anticipated to reach USD 5.26 billion by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fall Protection Market Size 2024 |

USD 3.19 billion |

| Fall Protection Market, CAGR |

6.5% |

| Fall Protection Market Size 2032 |

USD 5.26 billion |

The fall protection market is driven by leading players such as Pure Safety Group (PSD), MSA Safety Company, Honeywell Miller, Guardian Industries, Mallcom India Limited, French Creek Production, KARAM, GF Protection Canada, Capital Safety, and 3M. These companies focus on product innovation, regulatory compliance, and global distribution expansion to strengthen their market positions. North America dominates the fall protection market with a 37.6% share, supported by strict safety regulations, rapid infrastructure development, and widespread use of advanced protective equipment. Strong investment in connected safety technologies and worker training further reinforces the region’s leadership, setting high industry standards worldwide.

Market Insights

- The fall protection market was valued at USD 3.19 billion in 2024 and is projected to reach USD 5.26 billion by 2032, growing at a CAGR of 6.5%.

- Strong regulatory frameworks and increased focus on workplace safety drive product demand across construction, manufacturing, and energy sectors.

- Smart wearable technologies and IoT integration are key trends enhancing monitoring, compliance, and operational efficiency.

- The market is competitive with major players focusing on innovation, compliance, and global expansion to strengthen their positions.

- North America leads with a 37.6% market share, while product segments such as harness systems and anchorage solutions account for a significant share of overall revenue growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Solutions

The products segment holds the dominant share of the Fall Protection Market, accounting for 72.3% in 2024. The segment includes harnesses, lanyards, anchor points, guardrails, and self-retracting lifelines that provide safety across high-risk environments. The demand is driven by strict workplace safety regulations, especially in construction and industrial sectors. Continuous product innovation, such as lightweight harnesses and enhanced energy absorbers, supports widespread adoption. Service offerings like inspection, installation, and training are gaining traction but remain secondary due to higher investments in physical safety equipment.

- For instance, MSA’s V-SHOCK® EDGE Leading Edge Self Retracting Lanyard uses a 0.2165 inch (5.5 mm) galvanized steel cable and supports a user weight capacity of 310 lbs.

By Type

The galvanic segment leads the Fall Protection Market with a 65.8% share in 2024. Galvanic systems offer lower maintenance requirements, reliable corrosion resistance, and cost-effective installation, which make them suitable for long-term safety structures. These systems are widely used in industrial and infrastructure projects to secure platforms, towers, and elevated work areas. Impressed current systems are growing steadily due to advanced monitoring capabilities, but they involve higher installation and operational costs compared to galvanic options.

- For instance, Honeywell Miller H100 full-body harness series supports different maximum working loads depending on the safety standard; for example, the capacity is 400 lbs (181.4 kg) under the OSHA standard but 310 lbs (140.6 kg) under the ANSI standard. The model H11110022 has a confirmed weight of 2.54 lbs (1.15 kg).

By Applications

The pipeline segment dominates the Fall Protection Market with a 31.4% share in 2024. Pipeline infrastructure often involves elevated maintenance zones, demanding reliable fall arrest systems for worker safety. Adoption is driven by strict safety protocols in oil, gas, and chemical industries. Storage facilities and processing plants follow closely, driven by high operational risks in confined spaces and elevated platforms. The water and wastewater, transportation, and building sectors are also increasing investments in safety systems as regulatory frameworks strengthen globally.

Key Growth Drivers

Rising Industrial Safety Regulations

The fall protection market is growing due to stricter safety standards across industries. Regulatory bodies enforce mandatory use of fall protection systems in construction, oil and gas, manufacturing, and utilities. Employers invest in personal protective equipment to reduce workplace accidents and legal liabilities. These regulations support continuous demand for advanced harnesses, guardrails, and anchor systems. Regular inspections and certifications strengthen market adoption. Companies focus on compliance to avoid penalties and enhance worker safety, driving steady growth in product installations and upgrades.

- For instance, Guardian’s B7-Comfort Full-Body Harness is rated for a user capacity of 100 to 420 lb under OSHA rules and 130 to 310 lb under ANSI rules. The weight of the harness varies depending on the model and configuration.

Expansion of Construction and Infrastructure Projects

The surge in infrastructure investments boosts demand for fall protection solutions. Large-scale residential, commercial, and industrial projects increase the need for reliable safety systems. Governments prioritize modernization of transport and energy networks, creating new opportunities for equipment suppliers. High-rise building construction especially requires advanced lifelines, scaffolding systems, and anchorage devices. Contractors adopt durable and easy-to-install systems to meet safety targets and reduce project risks. This expansion enhances market growth across both developed and emerging economies.

- For instance, Mallcom’s HARNESS GLO high-visibility safety harness is equipped with reflective tapes, with some versions featuring 50 mm wide Avery Dennison micro-prismatic tape.

Technological Advancements in Protective Equipment

Innovation in materials and smart safety systems drives market expansion. Manufacturers integrate IoT-enabled devices for real-time monitoring and automated alerts during hazardous conditions. Lightweight harnesses and self-retracting lifelines improve worker mobility without compromising safety. Companies also invest in ergonomic designs that reduce fatigue and enhance comfort. The adoption of predictive analytics and connected wearables further boosts operational efficiency. These technological improvements increase equipment reliability, encourage higher compliance, and strengthen customer trust in advanced fall protection solutions.

Key Trends & Opportunities

Growing Adoption of Smart Wearable Devices

The fall protection market is witnessing rising use of connected safety wearables. Smart helmets, vests, and sensors provide real-time location tracking and fall detection. These devices enable faster emergency response and better incident reporting. Integration with cloud-based monitoring systems helps employers analyze safety data and prevent future accidents. This trend offers significant opportunities for solution providers to deliver integrated platforms combining hardware and software.

- For instance, KARAM’s full-body harness model PN16 (Class A) features a webbing width of 45 mm, a weight of 1.10 kg, and is certified under IS 3521 (Part 1):2021.

Increased Focus on Worker Training and Awareness

Companies are investing more in safety training programs to reduce fall-related accidents. Virtual reality (VR) and simulation tools are becoming popular in worker education. These training platforms help employees understand risks and use fall protection systems correctly. Enhanced training improves compliance with safety standards and reduces equipment misuse. This trend supports long-term adoption of fall protection solutions and opens new service-based revenue opportunities.

- For instance, 3M’s Fundamentals of Fall Protection VR PRO consists of 4 modules with scenarios such as steel beam erection and anchorage connection.The VR simulation supports hardware such as an HTC VIVE headset and a PC with at least 4 GB RAM, Intel Core i5-4590 or AMD FX 8350 processor, and NVIDIA GTX 1060 graphics.

Rising Investments in Retrofit Safety Solutions

Older infrastructure and industrial facilities are increasingly adopting retrofit fall protection systems. Facility owners aim to meet updated safety regulations without major structural changes. Retrofit solutions, such as modular guardrails and non-penetrating anchors, are cost-effective and easy to install. This trend creates growth opportunities for manufacturers specializing in adaptable and customizable systems for aging structures.

Key Challenges

High Installation and Maintenance Costs

The cost of installing and maintaining fall protection systems remains a major barrier for small and medium enterprises. Advanced equipment, regular inspections, and specialized training increase total project costs. Budget constraints often delay upgrades or limit adoption, especially in developing regions. High upfront investment can discourage businesses from implementing comprehensive solutions, affecting overall market growth.

Limited Awareness in Developing Regions

Many companies in emerging markets lack awareness of fall protection standards and safety technologies. This results in low adoption of protective systems despite increasing industrial activity. Insufficient regulatory enforcement further slows market expansion. Manufacturers face challenges in promoting compliance and building trust among cost-sensitive buyers. Overcoming this awareness gap is essential to unlock new market opportunities.

Regional Analysis

North America

North America leads the fall protection market with a 37.6% share. The region benefits from strict workplace safety regulations by OSHA and ANSI. High construction activity, strong oil and gas operations, and rapid industrialization drive adoption of personal protective equipment and lifeline systems. Advanced technologies such as IoT-based safety monitoring enhance worker safety compliance. Companies invest heavily in upgrading equipment to meet evolving standards. The growing presence of major market players also supports innovation and accessibility of high-performance solutions. Government infrastructure funding further strengthens market growth across key industries.

Europe

Europe holds a 28.4% share of the fall protection market. Strong regulatory frameworks, including EU Directives on worker safety, push industries to maintain high protection standards. The region’s mature construction and manufacturing sectors create sustained demand for guardrails, anchorage systems, and full-body harnesses. Emphasis on sustainable infrastructure projects further drives product adoption. Technological integration, including smart wearable systems, enhances compliance and monitoring. High awareness levels among employers and employees accelerate equipment replacement and upgrades, solidifying Europe’s position as a key market for fall protection solutions.

Asia Pacific

Asia Pacific accounts for 24.7% of the fall protection market and shows the fastest growth rate. Rapid urbanization and infrastructure expansion in China, India, and Southeast Asia boost demand for protective systems. Governments are tightening safety laws, increasing adoption in construction and manufacturing sectors. The region also benefits from rising foreign investments in industrial projects. Local manufacturers offer cost-effective equipment, expanding accessibility across small and medium enterprises. Ongoing technology adoption, combined with improving safety culture, strengthens Asia Pacific’s role as a key growth engine for this market.

Latin America

Latin America represents 5.2% of the fall protection market. The region is gradually increasing adoption due to growing construction activity and mining operations. Countries like Brazil and Mexico are enforcing stricter occupational safety standards, driving demand for harnesses and anchorage systems. International companies are expanding their presence to meet rising safety awareness. Limited budget allocation in smaller firms still affects full-scale adoption. However, increasing government initiatives and foreign investments are improving compliance rates, supporting steady market growth in the region.

Middle East & Africa

The Middle East & Africa holds a 4.1% share of the fall protection market. High investments in oil and gas, energy, and infrastructure projects drive demand for protective systems. Countries like Saudi Arabia and the UAE are integrating stricter safety protocols in industrial projects. Modernization initiatives and mega construction programs, including smart city developments, support market expansion. Limited awareness and lower enforcement in parts of Africa remain challenges. However, gradual regulatory reforms and training programs are expected to enhance adoption across the region over time.

Market Segmentations:

By Solutions:

By Type:

- Galvanic

- Impressed current

By Application:

- Pipeline

- Storage facilities

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The fall protection market is shaped by key players such as Pure Safety Group (PSD), MSA Safety Company, Honeywell Miller, Guardian Industries, Mallcom India Limited, French Creek Production, KARAM, GF Protection Canada, Capital Safety, and 3M. The fall protection market is becoming increasingly competitive as companies prioritize innovation, safety compliance, and cost efficiency. Rising demand for connected safety solutions and ergonomic designs drives product development. Manufacturers focus on integrating smart sensors, IoT capabilities, and advanced materials to enhance worker protection and mobility. Global expansion strategies, including partnerships and acquisitions, strengthen market reach and supply chain efficiency. Regulatory pressure and growing awareness of workplace safety push companies to adopt continuous product upgrades. This competitive environment encourages consistent technological advancement, faster product launches, and wider availability across industries and regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, SureWerx has announced the acquisition of Reliance Fall Protection Equipment to enhance its portfolio of engineered fall safety solutions. This move adds products like Skyloc® II, MicroLoc®, and Enviroshield™ systems to SureWerx’s offerings.

- In July 2024, Gamgee BV has introduced a new fall detection system for seniors that operates through Wi-Fi, without relying on wearable devices or cameras. It instantly alerts caregivers and family members in the event of a fall. The system also tracks daily movement to provide insights into overall well-being.

- In January 2024, WenerCo introduced a groundbreaking fall protection equipment utility lifeline tailored for utility workers and linemen that provides them with an elevated level of climbing security. This innovative offering includes an anchor strap fall arrest system, which is specifically designed to meet the unique safety requirements of professionals working on utility poles or similar structures.

- In September 2023, ADAMA Ltd., one of the leading crop protection companies, announced the launch of its all-new crop protection products in India. These new products are called Cosayr and Lapidos. These are the first-ever insecticides that are said to contain the active ingredient Chlorantraniliprole (CTPR)

Report Coverage

The research report offers an in-depth analysis based on Solutions, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced fall protection systems will increase with stricter safety regulations.

- Smart wearable technologies will enhance real-time monitoring and safety compliance.

- Construction and infrastructure projects will continue driving market expansion.

- Integration of IoT and AI will improve predictive safety management.

- Retrofit solutions will gain traction in aging industrial facilities.

- Training and awareness programs will boost equipment adoption in developing regions.

- Manufacturers will focus on ergonomic and lightweight designs to improve worker comfort.

- Global partnerships will strengthen supply chains and distribution networks.

- Sustainability goals will drive the development of eco-friendly protective materials.

- Automation and digitalization will enhance overall workplace safety efficiency.