Market Overview

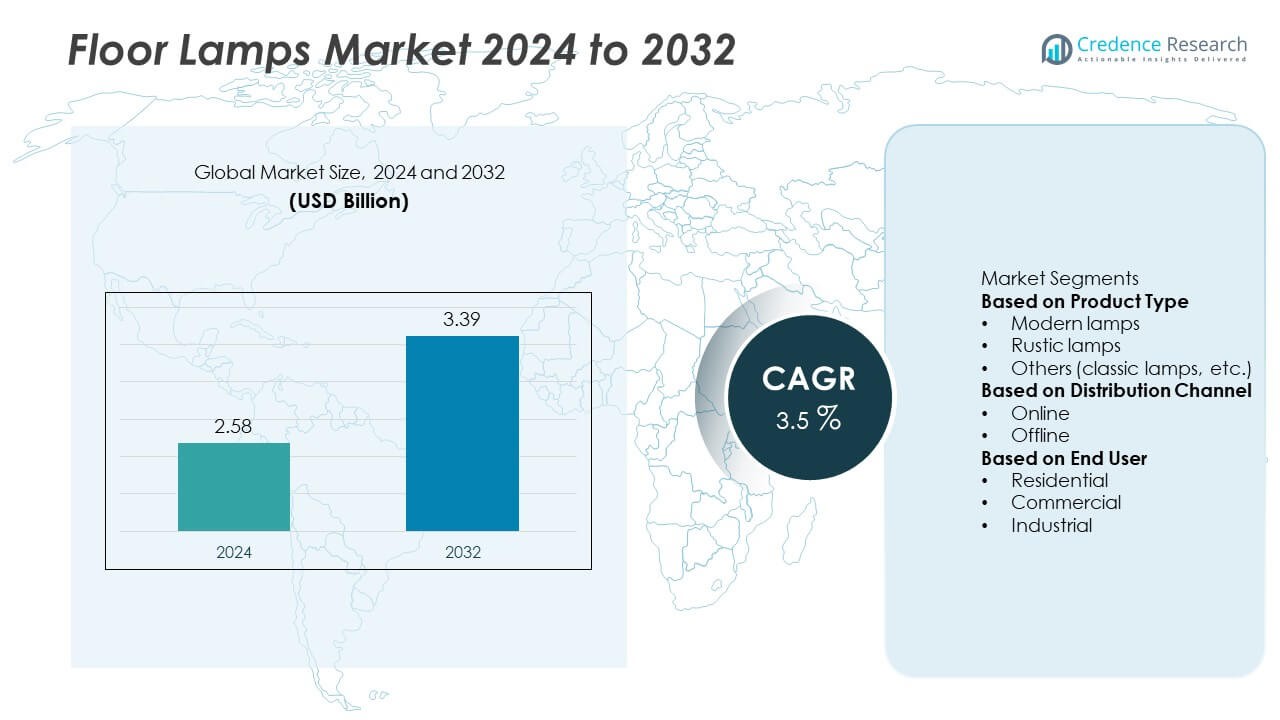

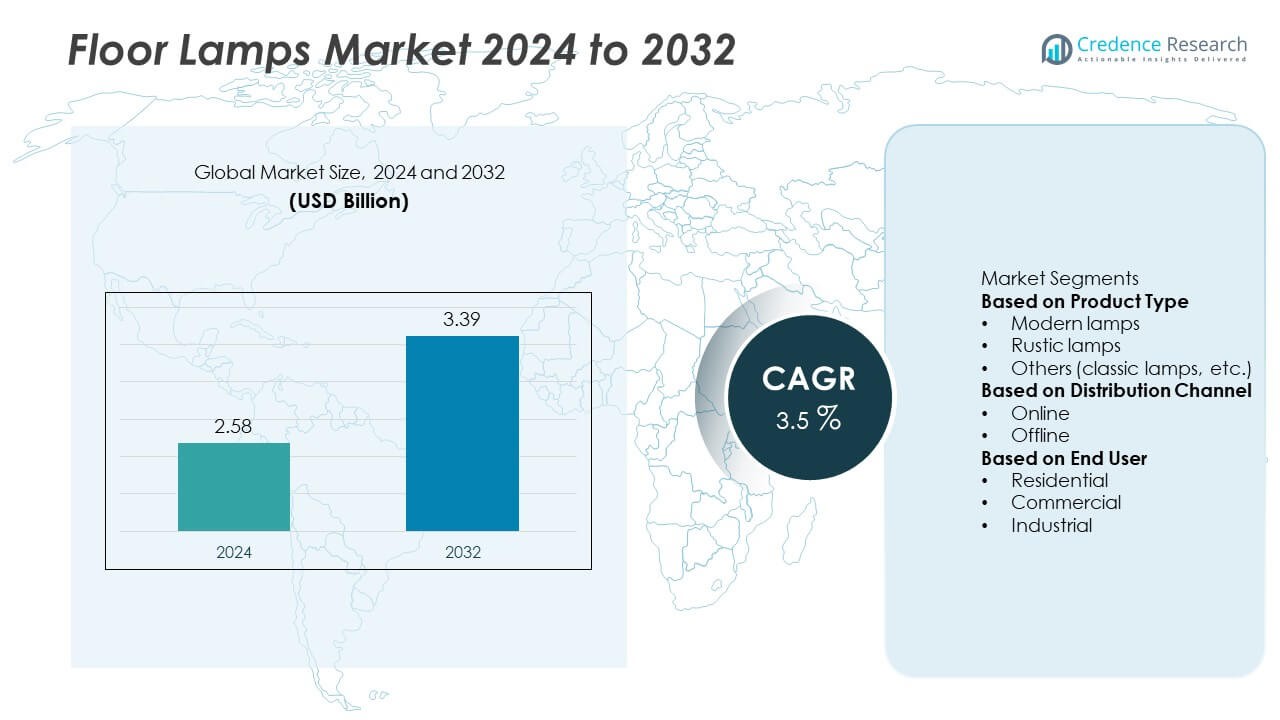

The Floor Lamps Market was valued at USD 2.58 billion in 2024 and is projected to reach USD 3.39 billion by 2032, growing at a CAGR of 3.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Floor Lamps Market Size 2024 |

USD 2.58 Billion |

| Floor Lamps Market, CAGR |

3.5% |

| Floor Lamps Market Size 2032 |

USD 3.39 Billion |

The floor lamps market is led by major companies including IKEA, OPPLE, Philips, VENINI S.p.A., AOZZO, Guangdong PAK Corporation, Matsushita Electric (China) Co. Ltd, Zhongshan Huayi Lighting, GUANYA, and YLighting. These players drive market growth through innovation in LED technology, modern design aesthetics, and smart lighting integration. North America dominated the market in 2024 with a 38% share, supported by high adoption of energy-efficient lighting and strong retail presence. Europe followed with a 30% share, driven by sustainable design trends and regulatory energy standards, while Asia-Pacific held 23%, fueled by rapid urbanization, expanding home décor markets, and rising demand for affordable yet stylish lighting solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The floor lamps market was valued at USD 2.58 billion in 2024 and is projected to reach USD 3.39 billion by 2032, growing at a CAGR of 3.5% during the forecast period.

- Rising consumer focus on modern home décor, energy-efficient lighting, and smart home integration is driving steady market growth across residential and commercial applications.

- The market is trending toward sustainable and smart designs, featuring LED-based, touch-sensitive, and app-controlled lighting systems that enhance functionality and style.

- Key players such as IKEA, Philips, OPPLE, and VENINI S.p.A. are emphasizing eco-friendly materials, innovative aesthetics, and omnichannel retail strategies to strengthen global competitiveness.

- North America led the market with a 38% share, followed by Europe with 30% and Asia-Pacific with 23%; by product type, modern lamps held the largest 47% share, reflecting high demand for minimalist and energy-efficient lighting designs worldwide.

Market Segmentation Analysis:

By Product Type

The modern lamps segment dominated the floor lamps market in 2024, accounting for a 47% share. This dominance is attributed to rising consumer demand for contemporary and minimalist designs that blend functionality with aesthetics. Modern lamps often incorporate energy-efficient LED lighting, smart dimming features, and sustainable materials, aligning with evolving lifestyle trends. Growing adoption of smart homes and increased focus on interior design upgrades are further driving demand. Manufacturers are offering versatile, customizable models suitable for both residential and commercial applications, reinforcing the segment’s leadership in the global market.

- For instance, Philips introduced its Hue Perifo track system with advanced Bluetooth and Zigbee mesh connectivity, allowing for seamless integration with a wide variety of compatible smart lighting devices.

By Distribution Channel

The offline segment held a 58% share of the floor lamps market in 2024, driven by strong consumer preference for in-store purchasing and product assessment before buying. Retail outlets, specialty stores, and home décor showrooms provide hands-on product experience and expert design advice, which supports higher sales. However, online channels are rapidly expanding due to wider product variety, competitive pricing, and convenient delivery. The growth of organized retail networks and brand-exclusive stores continues to strengthen offline dominance while hybrid retail models further enhance consumer accessibility.

- For instance, IKEA welcomed 899 million in-store visitors in FY24 across its 487 global stores, while also using AR product visualization tools in its mobile app to help customers see furniture in their own homes.

By End User

The residential segment led the market with a 62% share in 2024, reflecting the growing demand for decorative and functional lighting solutions in modern homes. Rising urbanization, housing renovation projects, and lifestyle upgrades are driving increased adoption of stylish and energy-efficient floor lamps. Consumers are opting for adjustable, smart-controlled lighting to enhance ambiance and comfort in living spaces. The segment benefits from expanding e-commerce availability and promotional home décor trends, while customization options and sustainable materials further attract environmentally conscious homeowners seeking both design appeal and energy savings.

Key Growth Drivers

Rising Demand for Home Aesthetic and Functional Lighting

Increasing consumer focus on stylish and functional interior design is a major driver of the floor lamps market. Homeowners are investing in modern lighting to create ambient and personalized spaces. The shift toward energy-efficient and decorative lighting solutions, combined with the rising popularity of home renovation and remodeling activities, supports market growth. Additionally, the use of floor lamps as statement décor pieces in living rooms and bedrooms enhances their appeal among design-conscious consumers globally.

- For instance, VENINI S.p.A. produced a range of handcrafted Murano glass lighting pieces in 2024, including modular designs like the Poliedri and limited-edition items inspired by historic collaborations. These collections showcase the company’s tradition of mouth-blown glass and its integration with modern elements such as dimmable LED technology.

Expansion of Smart and Energy-Efficient Lighting Solutions

Technological advancements in lighting are boosting demand for smart, energy-efficient floor lamps. Integration of LED technology, motion sensors, and app-based control systems is driving product innovation. Consumers increasingly prefer lamps that offer dimming, color adjustment, and compatibility with voice assistants. These features not only enhance user convenience but also reduce energy consumption. Growing awareness of sustainability and supportive government regulations promoting energy-efficient lighting further accelerate the adoption of smart floor lamp solutions.

- For instance, Signify (Philips) had a cumulative installed base of 144 million connected light points through its Philips Hue ecosystem by the end of 2024. This ecosystem enables app and voice control compatibility with more than 20 global smart platforms, including Amazon Alexa, Google Assistant, and Apple Home, significantly expanding accessibility and user interaction in intelligent home lighting.

Growth in Urban Housing and Commercial Spaces

Rapid urbanization and the expansion of residential and commercial infrastructure are fueling market demand. New apartment complexes, office buildings, and hospitality spaces are incorporating modern lighting to improve aesthetics and ambiance. The rise of coworking spaces and premium hotels has further increased the need for contemporary and functional lighting fixtures. Manufacturers are responding by introducing designs that combine energy efficiency, durability, and style, supporting the widespread integration of floor lamps across diverse environments.

Key Trends and Opportunities

Adoption of Smart Home Integration

The growing trend of smart homes presents new opportunities for the floor lamps market. Integration with IoT and wireless technologies enables remote operation, scheduling, and light customization through smartphones or virtual assistants. Consumers seek connected lighting systems that align with modern living standards. Manufacturers are leveraging this shift by launching Wi-Fi and Bluetooth-enabled lamps. This trend enhances user experience and convenience while supporting sustainable energy consumption patterns through automated brightness and usage controls.

- For instance, OPPLE Lighting integrates its products with ecosystems such as Google Home, Amazon Alexa, and the Mi Home ecosystem, controlled through the OPPLE Home and OPPLE Smart Lighting apps. The system supports remote control, scheduling, and various customizable lighting scenes.

Sustainable and Eco-Friendly Design Innovations

Sustainability has become a key focus in lighting design, creating opportunities for eco-friendly product development. Manufacturers are increasingly using recyclable metals, bamboo, and energy-efficient LEDs to reduce carbon footprints. Consumer preference for green and long-lasting products is encouraging brands to highlight environmental responsibility in their offerings. Governments promoting energy conservation through efficiency labeling and sustainability standards further strengthen this trend. These innovations appeal to environmentally conscious buyers and enhance brand reputation in competitive markets.

- For instance, Panasonic Corporation developed its “LinkRay LED” lighting system featuring data transmission technology embedded within high-efficiency LED modules.

Key Challenges

High Competition and Price Sensitivity

The floor lamps market faces intense competition from numerous global and local manufacturers. The availability of low-cost alternatives, especially from unorganized sectors, limits profit margins for premium brands. Consumers in price-sensitive regions often prioritize affordability over advanced features, challenging companies focusing on design and technology differentiation. Maintaining quality standards while offering cost-effective pricing remains a key challenge for established players striving to balance innovation with affordability.

Limited Awareness of Smart Lighting in Emerging Economies

Despite technological progress, awareness and adoption of smart lighting solutions remain low in developing regions. High upfront costs and limited internet penetration restrict market expansion for connected lamps. Many consumers in these areas still rely on traditional lighting due to lower purchasing power and limited product accessibility. Manufacturers need to focus on awareness campaigns, product localization, and distribution partnerships to overcome these barriers and unlock potential growth in emerging markets.

Regional Analysis

North America

North America dominated the floor lamps market in 2024 with a 38% share, driven by high consumer spending on home décor and advanced lighting systems. The United States leads the region due to strong adoption of LED and smart lighting technologies integrated with home automation. Rising demand for energy-efficient and customizable designs supports steady growth. Manufacturers are focusing on modern and sustainable products tailored for residential and commercial use. The presence of major retail chains and online platforms further enhances accessibility and drives continuous market expansion across urban households.

Europe

Europe accounted for a 30% share of the global floor lamps market in 2024, supported by strong interior design culture and emphasis on energy-efficient lighting. Countries such as Germany, Italy, and France lead the market, driven by modern aesthetic trends and eco-friendly product preferences. The European Union’s energy regulations and consumer inclination toward sustainable materials are encouraging manufacturers to innovate. Premium and luxury lamp brands dominate urban markets, while growing home renovation activities continue to fuel demand. Technological integration and local craftsmanship also strengthen Europe’s competitive position in the global market.

Asia-Pacific

Asia-Pacific held a 23% share of the global floor lamps market in 2024, emerging as the fastest-growing region due to rapid urbanization and expanding middle-class income levels. China, Japan, and India are leading markets, driven by rising home improvement spending and increased interest in stylish interiors. Local manufacturers are introducing affordable, energy-efficient models catering to diverse consumer preferences. E-commerce growth and government initiatives promoting LED adoption further contribute to expansion. The region’s robust furniture and lighting production base also supports strong export potential and increasing domestic consumption across both residential and commercial sectors.

Latin America

Latin America captured a 5% share of the global floor lamps market in 2024. Growth is supported by increasing urban housing development and a growing preference for decorative lighting solutions. Brazil and Mexico are key contributors, with expanding retail infrastructure and rising consumer awareness of energy-efficient products. The market benefits from the growing influence of international brands and modern design trends. Economic improvement and growth in organized retail channels are fostering steady demand. However, affordability and uneven product availability remain challenges, prompting local manufacturers to focus on cost-effective and functional lighting designs.

Middle East & Africa

The Middle East & Africa region held a 4% share of the floor lamps market in 2024, driven by rising investments in residential and hospitality projects. Countries such as the UAE and Saudi Arabia are leading growth through luxury home décor and modern infrastructure development. Increasing demand for premium and smart lighting solutions in hotels and commercial spaces further supports expansion. Africa’s urban development and growing middle-class population are gradually contributing to demand. Although limited awareness and high import costs pose challenges, expanding retail distribution and smart home adoption present long-term opportunities for growth.

Market Segmentations:

By Product Type

- Modern lamps

- Rustic lamps

- Others (classic lamps, etc.)

By Distribution Channel

By End User

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the floor lamps market includes major players such as IKEA, OPPLE, Philips, VENINI S.p.A., AOZZO, Guangdong PAK Corporation, Matsushita Electric (China) Co. Ltd, Zhongshan Huayi Lighting, GUANYA, and YLighting. These companies compete through product design innovation, energy-efficient lighting technologies, and global distribution networks. Leading brands are focusing on smart and sustainable floor lamp solutions integrating LED and IoT features to meet growing consumer demand for modern home décor. Partnerships with online platforms and expansion into emerging markets are key strategies to increase visibility and sales. Companies are also investing in premium materials, minimalist designs, and eco-friendly manufacturing to align with sustainability goals. While international brands dominate urban markets with smart and luxury collections, regional manufacturers strengthen their presence through cost-effective products catering to diverse consumer segments. The competition remains strong, driven by evolving design preferences and rapid technological advancement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- IKEA

- OPPLE

- Philips

- VENINI S.p.A.

- AOZZO

- Guangdong PAK Corporation

- Matsushita Electric (China) Co. Ltd

- Zhongshan Huayi Lighting

- GUANYA

- YLighting

Recent Developments

- In July 2025, IKEA announced 20+ new Matter-ready smart home products. The update expands IKEA’s connected lighting lineup and ecosystem. It supports simpler multi-brand control.

- In July 2025, OPPLE introduced its “July 2025 innovations” range. Highlights included higher-efficiency retrofit lamps and control upgrades. The release expanded European offerings.

- In 2025, VENINI opened its Euroluce presentation in Milan. The showcase debuted new lighting works during Design Week. It emphasized craft and art lighting.

- In March 2023, IKEA announced a partnership with nonprofit organization Little Sun to release the SAMMANLANKAD collection comprising 2 solar-powered LED lamps: a table lamp and a smaller portable lamp.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing adoption of smart home technologies will increase demand for connected floor lamps.

- Advancements in LED and sensor-based lighting will enhance energy efficiency and lifespan.

- Rising preference for minimalist and modern interior designs will drive aesthetic product demand.

- Expansion of e-commerce platforms will boost global accessibility and product variety.

- Manufacturers will focus on eco-friendly materials and recyclable components to meet sustainability goals.

- Integration of voice control and app-based systems will improve user convenience and functionality.

- Increasing urban housing projects will create strong opportunities in the residential segment.

- Partnerships between lighting brands and furniture retailers will enhance product visibility and sales.

- Demand for customizable and multifunctional designs will shape future innovation in lighting solutions.

- Growth in luxury and premium décor markets will strengthen opportunities for high-end designer floor lamps.