Market Overview

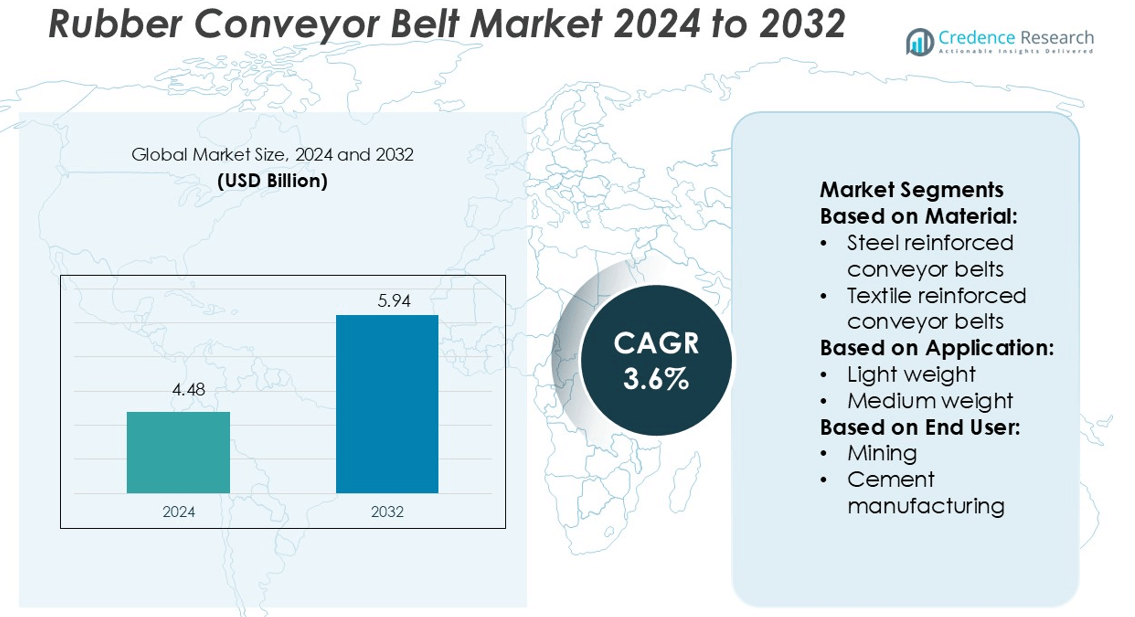

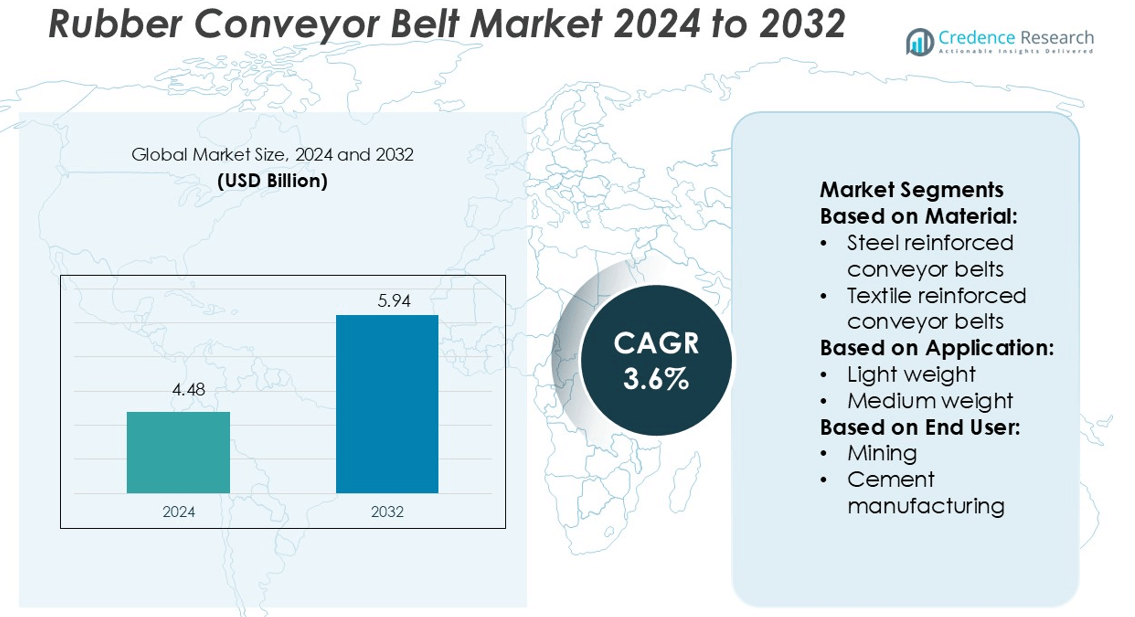

Rubber Conveyor Belt Market size was valued USD 4.48 billion in 2024 and is anticipated to reach USD 5.94 billion by 2032, at a CAGR of 3.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rubber Conveyor Belt Market Size 2024 |

USD 4.48 billion |

| Rubber Conveyor Belt Market, CAGR |

3.6% |

| Rubber Conveyor Belt Market Size 2032 |

USD 5.94 billion |

The Rubber Conveyor Belt Market is shaped by major players such as Oxford Rubbers Private Limited, Bridgestone Corporation, Fuxin Shuangxiang, LUTZE Forder Technik GmbH, Garlock Sealing Technologies LLC, Qingdao Rubber Six Conveyor Belt Co., Ltd., Contitech AG Conveyor Belt Group, ARTEGO S.A., Fenner Group Holdings Limited, and Bando Chemical Industries, Ltd. These companies focus on product innovation, durable material development, and expanding distribution networks to strengthen their market positions. Asia Pacific leads the global market with a 42.6% share, driven by strong mining, cement, and power generation sectors. High infrastructure investment and expanding industrial output across China, India, and Southeast Asia further consolidate the region’s leadership.

Market Insights

- The Rubber Conveyor Belt Market size was valued at USD 4.48 billion in 2024 and is projected to reach USD 5.94 billion by 2032, growing at a CAGR of 3.6%.

- Rising demand from mining, cement, and power generation industries drives market growth, supported by expanding infrastructure projects and automation.

- Asia Pacific dominates the global market with a 42.6% share, fueled by rapid industrialization in China, India, and Southeast Asia. North America and Europe follow due to modernization in manufacturing.

- Steel reinforced conveyor belts hold the largest segment share at 38.5%, driven by their strength and long service life in heavy-duty applications.

- Market growth faces restraints from fluctuating raw material prices and environmental regulations on rubber production, but strong competition among major players is boosting innovation and product quality.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Steel reinforced conveyor belts hold the dominant market share due to their superior tensile strength, high load-bearing capacity, and extended service life. These belts are widely adopted in demanding industries where heavy loads and long-distance transportation are common. Their excellent resistance to wear, impact, and harsh environments makes them a preferred choice over textile and solid woven belts. Growing use in large-scale material handling and bulk transportation further supports segment leadership. Advancements in steel cord technology and improved splice strength are enhancing operational reliability and cost efficiency in industrial applications.

- For instance, Swiss Viaduc de Chillon, mageba supplied lead rubber bearings to improve the viaduct’s resistance to earthquakes. Separately, mageba supplied 203 LASTO® LRB isolator bearings, each with an average diameter of approximately 1,200 mm and engineered to support a design load of approximately 20,000 kN per unit, for a seismic isolation project in Mexico City.

By Application

Heavy weight applications lead the market, supported by their extensive use in mining, power generation, and bulk material handling. This sub-segment benefits from rising investments in large infrastructure projects and the growing demand for efficient, continuous transport systems. Heavy weight conveyor belts provide high durability, stability under stress, and strong resistance to abrasion, making them ideal for harsh operational conditions. Increasing automation and the need for minimal downtime in production lines further accelerate their adoption. This strong performance reinforces their position as the key driver of overall market growth.

By End-user

Mining remains the largest end-user segment, driven by high demand for durable and high-capacity conveyor systems in ore extraction and processing. The sector relies on continuous, large-volume material handling, which boosts the adoption of steel reinforced heavy-duty belts. Conveyor belts offer cost-effective transport solutions, minimizing operational delays and improving productivity in mines. Expanding mining activities across emerging economies and investments in modern extraction technologies further strengthen this segment’s market share. The focus on operational efficiency and longer service life supports steady demand within the mining sector.

Key Growth Drivers

Rising Demand from Mining and Cement Sectors

The increasing adoption of rubber conveyor belts in mining and cement operations is a major growth driver. These belts support heavy material handling with improved efficiency and lower operational costs. Industries favor durable and high-resistance belts for continuous bulk transportation. The expansion of mining activities in emerging markets boosts equipment replacement demand. Strong infrastructure development also increases cement output, fueling belt installations across large-scale plants and quarries. Companies are upgrading conveyor systems to meet rising production needs and enhance operational reliability.

- For instance, the Dhirubhai Ambani Green Energy Giga Complex is home to a solar photovoltaic (PV) module factory with 10 GW annual capacity, expected to scale up in coming years.

Technological Advancements in Belt Design

Advances in belt materials and manufacturing processes are improving performance, flexibility, and lifespan. Modern belts feature better tensile strength, impact resistance, and thermal stability. Integration of smart sensors and monitoring systems enables predictive maintenance, reducing downtime. Lightweight, energy-efficient designs help reduce power consumption in industrial operations. Manufacturers are increasingly using eco-friendly compounds to meet environmental standards and lower emissions. These innovations position rubber conveyor belts as cost-efficient and sustainable solutions for high-capacity industries.

- For instance, Goodyear developed a demonstration tire composed of 70% sustainable material content, using bio-based carbon black alternatives, rice husk silica, and recycled polyester.

Growth in Recycling and Metal Processing Industries

The expansion of recycling and metal processing industries strengthens market demand. Rubber conveyor belts are essential for sorting, transporting, and processing bulk materials in these sectors. The push for circular economy practices and stricter waste management regulations accelerates adoption. Automated conveyor systems support efficient recycling lines with minimal human intervention. Growth in steel production and scrap metal recovery drives the use of heavy-duty belts. These industries favor belts with superior abrasion resistance and higher load-bearing capacities to maintain operational flow.

Key Trends & Opportunities

Shift Toward Energy-Efficient Conveyor Systems

Energy efficiency has become a key focus for industrial operators. Lightweight belt designs and low rolling resistance technologies help lower energy use. Integration of variable frequency drives and sensor-based control systems improves operational precision. Manufacturers offering eco-friendly belts gain an advantage under stricter environmental policies. This trend creates opportunities for product differentiation and green certifications. The shift also aligns with global sustainability targets and corporate carbon reduction goals.

- For instance, ExxonMobil reported a reduction in its greenhouse gas emissions intensity (Scope 1 + Scope 2) in its upstream operations, from 31.7 metric tons CO₂e per 100 metric tons of production in 2016 to 20.4 in [Specific Year], as stated in its sustainability reports [Source Reference].

Rising Adoption of Smart Monitoring Solutions

The use of IoT-enabled sensors in rubber conveyor belts is expanding rapidly. Real-time condition monitoring allows operators to track belt wear, temperature, and tension levels. Predictive maintenance reduces unplanned downtime and extends service life. Companies investing in digital transformation are integrating these systems with plant automation software. This trend creates opportunities for belt manufacturers to provide integrated solutions that enhance efficiency and reduce operational risks.

- For instance, SABIC’s TRUCIRCLE™ programme is set to process one million metric tons of circular materials annually by 2030, enabling materials that can be reused or recycled in multiple product lifecycles. The Cartagena polycarbonate plant will run on 100% renewable power cutting CO₂ emissions by about 70,000 metric tons per year.

Increasing Penetration in Emerging Economies

Developing economies are witnessing rapid industrial expansion across mining, cement, and recycling sectors. Investments in infrastructure and energy projects increase the need for high-performance conveyor belts. Local manufacturing and government-backed industrial programs further support market growth. Suppliers focusing on affordable and durable solutions can capture significant shares in these regions. This creates strong opportunities for both global and regional players to expand their customer base.

Key Challenges

Volatility in Raw Material Prices

The cost of natural and synthetic rubber, along with steel cords, is highly volatile. Price fluctuations impact production costs and reduce profit margins for manufacturers. Unstable supply chains increase procurement risks for end-users. Companies struggle to maintain stable pricing models in competitive markets. These fluctuations make it harder for manufacturers to plan long-term contracts and investment strategies effectively.

Maintenance and Downtime Issues

Rubber conveyor belts are prone to wear, tearing, and abrasion under heavy use. Frequent maintenance and unexpected failures lead to production delays and financial losses. In sectors like mining and cement, operational interruptions can significantly increase costs. While smart monitoring can reduce risks, high adoption costs limit its use for small and mid-sized operators. This remains a major challenge in ensuring continuous, efficient operations.

Regional Analysis

North America

North America holds a 21% share of the rubber conveyor belt market. Strong demand comes from mining, cement, and recycling industries. The region benefits from well-established manufacturing infrastructure and advanced automation. The U.S. leads the market, supported by large-scale mining operations and material handling facilities. High adoption of energy-efficient and sensor-enabled belts enhances operational performance. Stringent workplace safety and emission regulations further drive modernization. Continuous upgrades in production sites, coupled with strong investments in smart conveyor technologies, strengthen market dominance. Key industry players expand their product offerings to meet the growing need for durability and efficiency.

Europe

Europe accounts for a 19% market share, driven by strong industrial and construction activity. Germany, the U.K., and France are major contributors due to advanced cement and metal processing sectors. Strict environmental regulations encourage the use of energy-efficient, low-emission belts. Technological innovation and early adoption of smart monitoring solutions give European industries a competitive edge. Recycling initiatives and circular economy goals also support demand. Manufacturers in this region focus on lightweight, sustainable materials to align with EU climate targets. The region remains a key hub for research, development, and premium conveyor belt solutions.

Asia Pacific

Asia Pacific dominates the market with a 44% share, making it the largest regional segment. China, India, Japan, and Australia drive growth through large-scale mining, cement, and manufacturing activities. Expanding industrialization and infrastructure projects significantly increase belt installations. Rapid adoption of high-performance and heavy-duty belts supports bulk material handling in mining and construction. The region’s cost-effective production capabilities attract global manufacturers. Governments also invest in industrial automation and environmental compliance. Asia Pacific’s strong supply chain network and rising domestic demand position it as the fastest-growing region in the global rubber conveyor belt market.

Latin America

Latin America holds a 9% share of the rubber conveyor belt market. Brazil and Mexico lead the region with strong mining and cement production activities. Infrastructure expansion projects and growth in recycling industries support steady demand. The region is increasingly adopting durable belts to minimize downtime and enhance operational efficiency. Although technology penetration is moderate, international suppliers are entering through partnerships and joint ventures. Government support for industrial modernization strengthens regional prospects. Local industries are also moving toward sustainable and energy-efficient conveyor solutions to comply with stricter operational standards and global trade requirements.

Middle East & Africa

The Middle East & Africa region represents a 7% share of the rubber conveyor belt market. Mining and metal processing are the primary demand drivers, especially in South Africa, Saudi Arabia, and the UAE. Ongoing infrastructure development projects further boost market adoption. Companies in this region are investing in reliable, high-strength belts for harsh operating conditions. Growing foreign investments in mining and construction accelerate market expansion. Although the adoption of advanced technologies remains slower than other regions, the market shows strong potential for growth. Strategic partnerships and localized manufacturing are helping address regional supply challenges.

Market Segmentations:

By Material:

- Steel reinforced conveyor belts

- Textile reinforced conveyor belts

By Application:

- Light weight

- Medium weight

By End User:

- Mining

- Cement manufacturing

By Geograph

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the rubber conveyor belt market features key players such as Oxford Rubbers Private Limited, Bridgestone Corporation, Fuxin Shuangxiang, LUTZE Forder Technik GmbH, Garlock Sealing Technologies LLC, Qingdao Rubber Six Conveyor Belt Co., Ltd., Contitech AG Conveyor Belt Group, ARTEGO S.A., Fenner Group Holdings Limited, and Bando Chemical Industries, Ltd. The rubber conveyor belt market is characterized by strong technological innovation, regional expansion, and strategic collaborations. Manufacturers focus on enhancing product durability, energy efficiency, and operational reliability to meet the growing demand across mining, cement, and recycling industries. Advanced material technologies and sensor-based monitoring solutions are being adopted to improve performance and reduce maintenance costs. Companies are also increasing investments in sustainable manufacturing practices and eco-friendly compounds to align with environmental regulations. Strategic partnerships, mergers, and capacity expansions strengthen their market presence. This competitive environment drives continuous innovation and accelerates the shift toward smart, efficient conveyor systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Oxford Rubbers Private Limited

- Bridgestone Corporation

- Fuxin Shuangxiang

- LUTZE Forder Technik GmbH

- Garlock Sealing Technologies LLC

- Qingdao Rubber Six Conveyor Belt Co., Ltd.

- Contitech AG Conveyor Belt Group

- ARTEGO S.A.

- Fenner Group Holdings Limited

- Bando Chemical Industries, Ltd.

Recent Developments

- In April 2025, Tariff turbulence cast a shadow over the rubber plantations of Kerala. With the U.S. tariff suspension on the Indian rubber industry, prices are affected with a certain drop in the rate.

- In April 2025, Indonesia came forward in forest monitoring to meet the EU deforestation law, to which the rubber industry will face a transitional change.

- In November 2024, Ecore International received a significant investment from General Atlantic’s BeyondNetZero fund to enhance its rubber recycling operations. This funding aims to support Ecore’s efforts in developing sustainable solutions for recycling rubber materials.

- In February 2024, fenner Dunlop and international conveyor and rubber announced their new conveyor belt partnership to offer conveyor belt solutions to service for underground mining sector

Report Coverage

The research report offers an in-depth analysis based on Material, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption of energy-efficient and lightweight conveyor belt designs.

- Smart monitoring systems will become standard in large-scale industrial applications.

- Demand from mining and cement industries will continue to drive steady market expansion.

- Recycling and metal processing industries will boost the need for heavy-duty belts.

- Sustainability and eco-friendly manufacturing will shape future product development.

- Automation and digital integration will improve operational efficiency and reduce downtime.

- Emerging economies will offer strong growth opportunities for global suppliers.

- Strategic partnerships and mergers will increase to strengthen market reach.

- Advanced material innovations will enhance belt strength and durability.

- Predictive maintenance solutions will reduce operational costs and extend belt life.