Market Overview

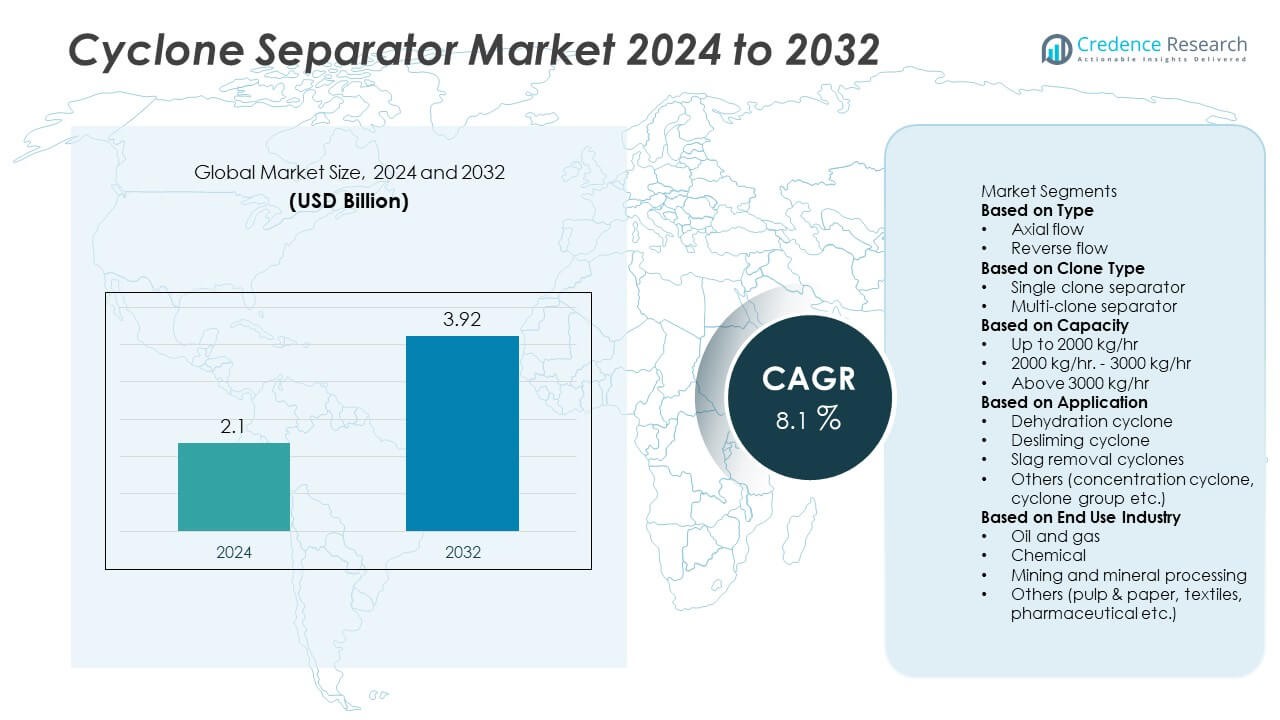

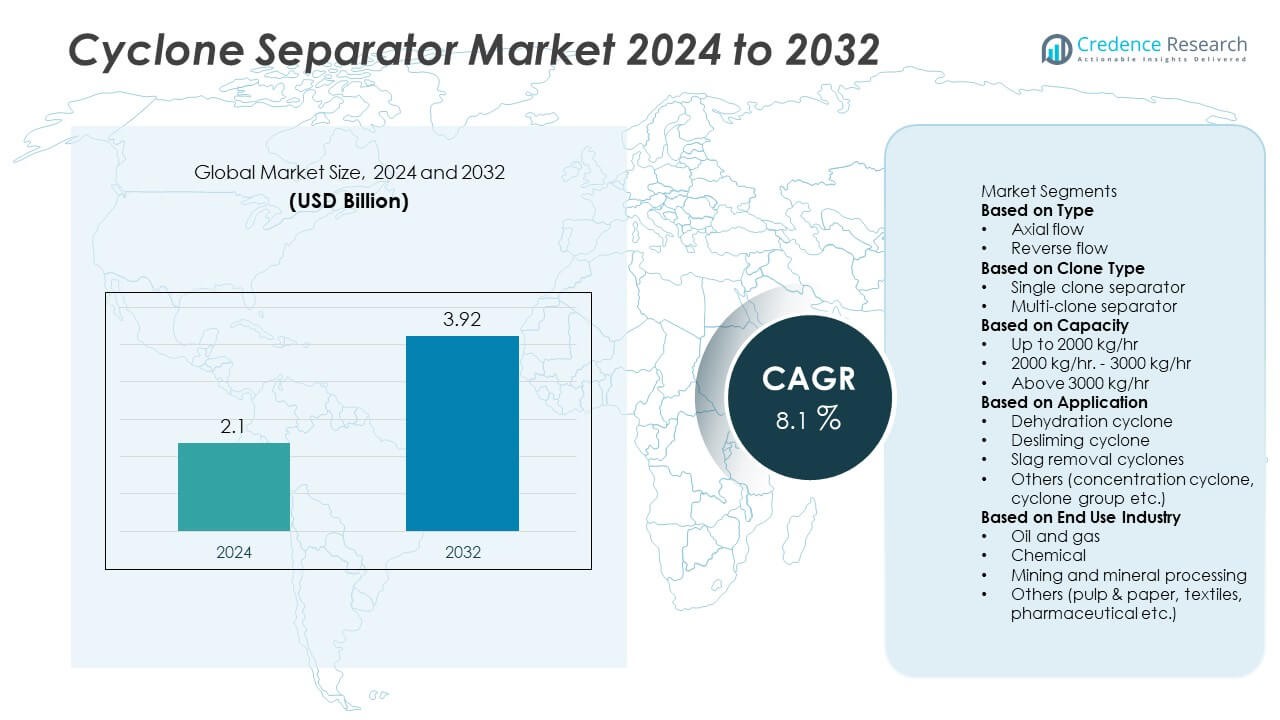

The Cyclone Separator market size was valued at USD 2.1 billion in 2024 and is anticipated to reach USD 3.92 billion by 2032, growing at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cyclone Separator market Size 2024 |

USD 2.1 Billion |

| Cyclone Separator market, CAGR |

8.1% |

| Cyclone Separator market Size 2032 |

USD 3.92 Billion |

The Cyclone Separator market is led by major players including FLSmidth, Cyclotech, Gulf Coast Air & Hydraulics, Haiwang Hydrocyclone, Elgin Separation Solutions, Cyclone Separator Australia, Air Dynamics, Exterran Corporation, KREBS, and Cyclone Engineering Projects. These companies dominate the market through advancements in separation efficiency, durable construction materials, and integrated dust control systems. North America emerged as the leading region in 2024 with a 34% share, supported by strong adoption in oil, gas, and manufacturing industries. Europe followed with a 28% share, driven by strict emission control regulations and sustainability initiatives, while Asia-Pacific held 27%, fueled by rapid industrial expansion and modernization of process industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cyclone Separator market was valued at USD 2.1 billion in 2024 and is projected to reach USD 3.92 billion by 2032, growing at a CAGR of 8.1% during the forecast period.

- Increasing demand from process industries such as cement, chemical, and metal processing is driving market growth, supported by stricter emission regulations and expanding industrial production.

- The market is witnessing trends like advanced material usage, integration of IoT-based monitoring systems, and the growing adoption of multi-clone separators for improved efficiency.

- Key players including FLSmidth, Cyclotech, and KREBS are focusing on technological innovations, product durability, and digital performance monitoring to strengthen their global presence.

- North America leads the market with a 34% share, followed by Europe at 28% and Asia-Pacific at 27%; among product types, reverse flow separators hold a 63% share, while the 2000–3000 kg/hr capacity segment dominates with 46% of total revenue.

Market Segmentation Analysis:

By Type

The reverse flow segment dominated the Cyclone Separator market in 2024, accounting for 63% of total revenue. Reverse flow separators are widely used due to their superior dust separation efficiency, compact design, and adaptability for various industrial processes. Their ability to handle high particulate concentrations makes them preferred in cement, power generation, and metal processing industries. Axial flow separators, while less common, are gaining attention in applications demanding lower pressure drop and compact setups. The consistent performance and lower maintenance needs of reverse flow designs continue to strengthen their market position.

- For instance, FLSmidth’s KREBS® gMAX® hydrocyclones utilize a patented inlet geometry to minimize turbulence, delivering finer and sharper particle separation at high capacities in wet processing applications.

By Clone Type

The multi-clone separator segment held a leading share of 58% in 2024, driven by its high efficiency and capacity to manage large dust loads. Multi-clone systems, consisting of several smaller cyclone units, provide enhanced separation with reduced pressure loss, making them ideal for large-scale industrial operations. These separators are widely used in boilers, mining, and chemical processing. Single-clone separators, though simpler in design, are favored in small to medium facilities for their cost-effectiveness. The flexibility and scalability of multi-clone separators make them the preferred choice across heavy-duty applications.

- For instance, Elgin Separation Solutions provides modular systems utilizing hydrocyclone manifolds for mining operations. These systems are designed to remove solids from slurry and can include pressure monitoring and control systems to optimize performance and reduce downtime.

By Capacity

The 2000 kg/hr to 3000 kg/hr capacity range dominated the Cyclone Separator market with a 46% share in 2024. This category offers an ideal balance between throughput and energy efficiency, catering to mid-sized industrial systems in cement, food processing, and chemical sectors. Units below 2000 kg/hr serve smaller plants and laboratory setups, while those above 3000 kg/hr are adopted in heavy-duty industries requiring high dust removal rates. The mid-capacity separators continue to gain traction due to their operational flexibility, moderate cost, and compatibility with a broad range of industrial filtration systems.

Key Growth Drivers

Rising Demand from Process Industries

The growing use of cyclone separators in cement, chemical, and metal processing industries is a major market driver. These industries rely on efficient particulate separation to meet emission standards and improve product quality. Increasing industrialization and tightening air pollution regulations further boost adoption. The ability of cyclone separators to handle high temperatures and abrasive materials makes them ideal for continuous operations. Their low maintenance requirements and cost-effectiveness enhance their appeal in heavy-duty industrial environments.

- For instance, A FLSmidth case study confirms that its KREBS gMAX® cyclones were installed at a gold mine in Ghana. The implementation was intended to improve the classification performance of the operation.

Stringent Environmental and Emission Regulations

Global environmental policies promoting cleaner industrial processes are accelerating cyclone separator demand. Industries are upgrading filtration systems to comply with air quality standards set by environmental authorities. Cyclone separators offer a reliable, mechanical dust separation method without filters, reducing maintenance and operating costs. Governments’ focus on reducing particulate emissions from manufacturing, power generation, and mining industries is fueling equipment modernization. This regulatory push encourages industries to replace conventional filtration systems with advanced cyclone-based technologies.

- For instance, China’s Ultra-Low Emission (ULE) standard for coal-fired power plants, implemented in 2014, mandates specific concentration ceilings for pollutants, including particulate matter (PM), which led to a significant overall reduction in emissions across the industry.

Growing Adoption in Energy and Power Generation

The energy sector is increasingly deploying cyclone separators for flue gas cleaning and ash removal in boilers and furnaces. Power plants, especially those using coal or biomass, require efficient dust control systems to meet emission norms. Cyclone separators improve operational reliability by preventing particulate buildup in turbines and heat exchangers. Rising electricity demand and investments in clean energy projects strengthen their integration into power systems. Continuous improvements in separator design are enhancing performance under high-temperature and high-pressure conditions.

Key Trends & Opportunities

Integration of Advanced Materials and Design Optimization

Manufacturers are adopting advanced alloys and ceramic linings to enhance cyclone durability and performance. Design improvements using computational fluid dynamics (CFD) enable optimized vortex flow and higher separation efficiency. Compact, modular separator designs are gaining popularity for easier installation and maintenance. These innovations extend product lifespan and reduce operational downtime. The trend toward customized cyclone designs tailored to specific process needs presents new opportunities for equipment suppliers targeting diverse industrial applications.

- For instance, Haiwang Hydrocyclone manufactures FX Series hydrocyclones with wear-resistant liners made from materials like high-alumina ceramics, composite materials, and polyurethane.

Expansion in Renewable and Waste Management Applications

Cyclone separators are finding new uses in biomass plants, recycling facilities, and waste-to-energy systems. They effectively manage particulate emissions during combustion and material recovery processes. The transition toward sustainable energy generation is increasing equipment demand in biomass and biogas facilities. Emerging waste processing industries in developing regions also present strong growth potential. The focus on circular economy principles and stricter environmental standards further supports cyclone deployment in eco-friendly industrial operations.

- For instance, Cyclone Engineering Projects is a South African company primarily focused on mine tailings deposition, hydraulic and mechanical re-mining, and associated civil works.

Automation and IoT-Based Monitoring

The integration of automation and Internet of Things (IoT) technologies is improving cyclone separator efficiency. Smart monitoring systems provide real-time data on pressure, flow, and dust concentration, enabling predictive maintenance and energy savings. Automated control systems help optimize airflow and reduce operational costs. This trend aligns with the growing adoption of Industry 4.0 technologies across manufacturing and energy sectors. Digitalization enhances system reliability and opens opportunities for value-added service models in industrial air management.

Key Challenges

High Energy Consumption in Operations

Cyclone separators require significant energy input to generate the centrifugal force needed for particle separation. High operating costs can limit adoption, especially in small and medium industries. Maintaining consistent airflow and pressure increases power demand in large-scale systems. Energy-efficient design innovations are being pursued, but widespread implementation remains limited due to cost constraints. Balancing separation efficiency with energy consumption is a key technical challenge for manufacturers aiming to enhance product competitiveness.

Competition from Alternative Filtration Technologies

The availability of advanced filtration methods such as bag filters and electrostatic precipitators poses a competitive challenge. These alternatives often provide higher particle removal efficiency, particularly for fine dust. Industries with strict emission targets sometimes prefer these systems despite higher maintenance needs. To stay competitive, cyclone manufacturers are focusing on hybrid systems combining mechanical and electrostatic mechanisms. However, continuous performance optimization is required to maintain the relevance of cyclone separators in evolving industrial applications.

Regional Analysis

North America

North America held a 34% share of the Cyclone Separator market in 2024, driven by strong demand from oil and gas, chemical, and power generation industries. The region’s strict air quality regulations and growing focus on emission control technologies are major contributors to adoption. The United States leads the market with high investment in industrial automation and retrofitting of dust collection systems. Canada’s mining and energy sectors further support demand for durable separators capable of handling high particulate loads. Ongoing advancements in sustainable industrial operations are expected to reinforce steady regional growth.

Europe

Europe accounted for a 28% share of the Cyclone Separator market in 2024, supported by stringent environmental regulations and a growing emphasis on cleaner manufacturing. Countries such as Germany, France, and the United Kingdom are investing in high-efficiency separation systems to comply with EU emission norms. Industrial applications in cement, metal processing, and food manufacturing continue to drive steady adoption. The region also benefits from advanced engineering capabilities and adoption of smart monitoring systems. Rising demand for energy-efficient equipment and sustainability-driven upgrades across European industries further stimulate market expansion.

Asia-Pacific

Asia-Pacific captured a 27% share of the Cyclone Separator market in 2024, making it one of the fastest-growing regions. Rapid industrialization in China, India, and Japan, coupled with expanding manufacturing and mining activities, drives strong demand. Government initiatives to control industrial pollution and modernize processing plants further boost equipment adoption. Local manufacturers are offering affordable, high-capacity cyclone systems suited for regional needs. Continuous infrastructure investment and the development of new power plants are key growth drivers. The shift toward cleaner technologies and regional emission compliance policies strengthen long-term market prospects.

Latin America

Latin America held an 7% share of the Cyclone Separator market in 2024, supported by expanding mining, cement, and chemical industries. Brazil and Mexico are leading markets with increased industrial activity and environmental awareness. The demand for durable, low-maintenance separators is rising as industries modernize dust collection systems. Regional governments are enforcing stricter pollution norms, encouraging the replacement of traditional filters with cyclone-based solutions. However, limited access to advanced manufacturing technologies and higher equipment costs remain challenges. Growing industrial automation and renewable energy projects are expected to support moderate growth ahead.

Middle East & Africa

The Middle East and Africa accounted for a 4% share of the Cyclone Separator market in 2024. The region’s demand is primarily driven by oil refining, construction materials, and power generation sectors. The Gulf countries are investing in industrial filtration and emission control systems as part of broader sustainability goals. South Africa contributes to growth through its strong mining and metal processing industries. Infrastructure expansion and energy diversification projects are creating new opportunities. Although technology adoption is still developing, rising environmental regulation and industrial modernization efforts are set to enhance future market growth.

Market Segmentations:

By Type

By Clone Type

- Single clone separator

- Multi-clone separator

By Capacity

- Up to 2000 kg/hr

- 2000 kg/hr. – 3000 kg/hr

- Above 3000 kg/hr

By Application

- Dehydration cyclone

- Desliming cyclone

- Slag removal cyclones

- Others (concentration cyclone, cyclone group etc.)

By End Use Industry

- Oil and gas

- Chemical

- Mining and mineral processing

- Others (pulp & paper, textiles, pharmaceutical etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Cyclone Separator market features key players such as FLSmidth, Cyclotech, Gulf Coast Air & Hydraulics, Haiwang Hydrocyclone, Elgin Separation Solutions, Cyclone Separator Australia, Air Dynamics, Exterran Corporation, KREBS, and Cyclone Engineering Projects. These companies compete through innovations in design efficiency, material durability, and system integration to meet industrial air quality and process optimization needs. Manufacturers are focusing on developing compact, energy-efficient separators with enhanced particle removal capabilities for demanding sectors like mining, cement, and chemical processing. Strategic partnerships, mergers, and technology licensing agreements are helping expand global reach and service portfolios. Many players are investing in advanced computational fluid dynamics (CFD) modeling and IoT-enabled performance monitoring to improve reliability and reduce maintenance costs. Continuous R&D efforts, regional expansion, and a shift toward sustainable and automated separation solutions remain central to maintaining competitiveness in this evolving industrial filtration market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Sulzer formed a strategic alliance with Avalon Energy Group to deploy BioFlux technology in sustainable aviation fuel (SAF) production. Auckland Energy Group will initially deploy the technology with biofuel plants in Uruguay with plans to expand to India, Eswatini, and the US.

- In June 2025, Haiwang said its hydrocyclone equipment was operating at Ecuador’s Mirador copper project, supporting plant performance.

- In May 2025, Sulzer Partners with Emirates Biotech. Sulzer signed a contract to bill proprietary equipment for the world’s largest PLA bioplastics production facility in the UAE.

- In February 2025, FLSmidth announced a major iron-ore order that includes KREBS pumps and cyclones as part of a full beneficiation package.

Report Coverage

The research report offers an in-depth analysis based on Type, Clone Type, Capacity, Application, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for cyclone separators will rise as industries prioritize cleaner production and emission control.

- Manufacturers will focus on developing energy-efficient designs with reduced pressure loss.

- Integration of IoT and automation will enhance real-time monitoring and maintenance efficiency.

- Advanced materials such as ceramics and composites will improve durability and performance.

- Growing adoption in renewable energy and waste-to-energy plants will create new opportunities.

- Emerging economies will experience strong market growth due to rapid industrialization.

- Custom-built separators for niche applications will gain higher market traction.

- Partnerships between technology providers and industrial operators will expand innovation capacity.

- Environmental regulations will continue to push industries toward modern separation systems.

- Continuous R&D in design optimization and CFD modeling will drive next-generation cyclone technologies.