Market Overview

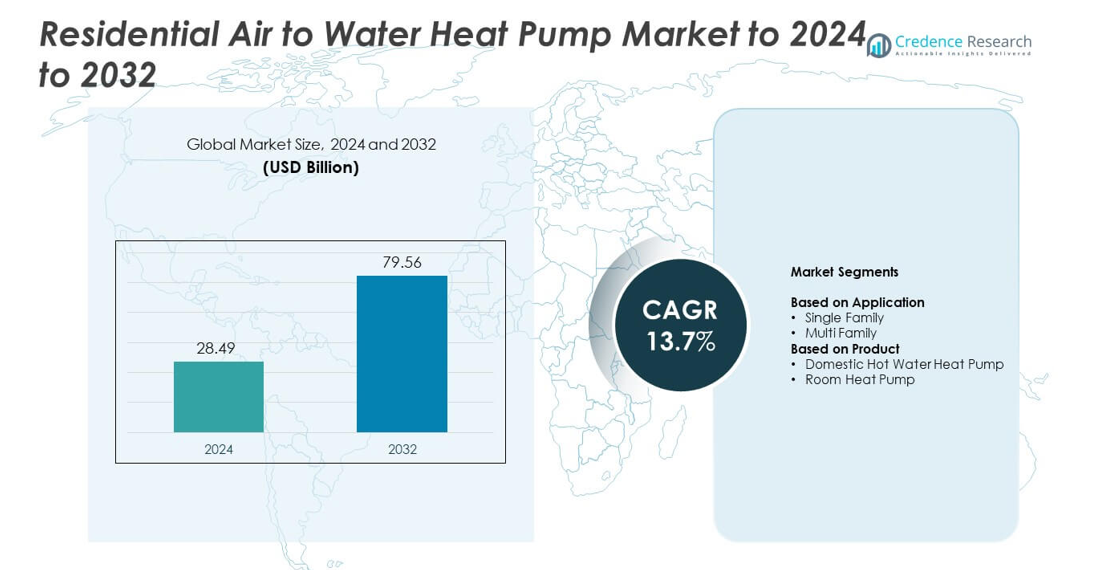

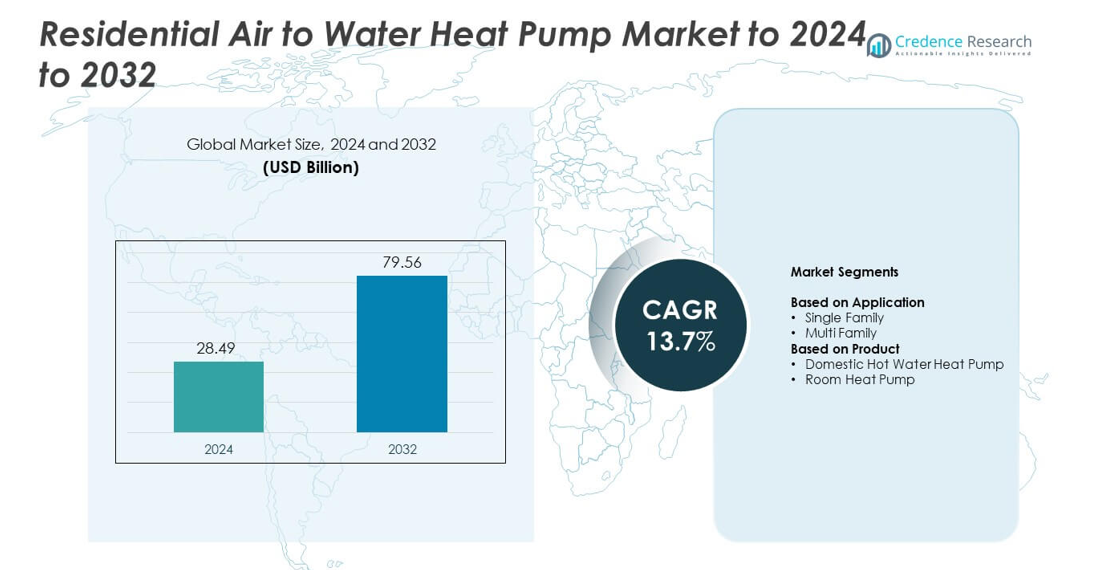

Residential Air to Water Heat Pump Market size was valued at USD 28.49 billion in 2024 and is anticipated to reach USD 79.56 billion by 2032, at a CAGR of 13.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Solar Tracker Market Size 2024 |

USD 28.49 billion |

| Residential Solar Tracker Market, CAGR |

13.7% |

| Residential Solar Tracker Market Size 2032 |

USD 79.56 billion |

The residential air to water heat pump market is dominated by global players such as Mitsubishi Electric Corporation, Panasonic Corporation, LG Electronics, Daikin, Bosch, Vaillant Group, and SAMSUNG. These companies focus on high-efficiency technologies, inverter compressors, and smart home integrations to strengthen their market presence. Continuous innovation in eco-friendly refrigerants and digital control systems supports competitive differentiation. Europe led the market with a 42% share in 2024, driven by strict energy-efficiency regulations and strong government incentives for low-carbon residential heating. Asia-Pacific followed, supported by expanding urban housing projects and rising environmental awareness.

Market Insights

- The residential air to water heat pump market was valued at USD 28.49 billion in 2024 and is projected to reach USD 79.56 billion by 2032, growing at a CAGR of 13.7%.

- Growth is driven by rising energy efficiency standards, carbon reduction goals, and government incentives supporting renewable residential heating solutions.

- Smart and inverter-based technologies are becoming mainstream, with manufacturers focusing on digital controls, IoT integration, and low-GWP refrigerants to enhance performance.

- The market is highly competitive, with key players investing in R&D and partnerships to expand product portfolios and regional presence.

- Europe dominated the market with a 42% share in 2024, followed by Asia-Pacific at 29%, while the single-family application segment accounted for 68% of overall demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

The single-family segment dominated the residential air to water heat pump market with a 68% share in 2024. The strong adoption in single-family homes is driven by rising demand for energy-efficient heating and cooling systems and government incentives for sustainable home retrofits. Increasing construction of detached homes in Europe and Asia-Pacific further supports segment growth. These systems offer easy installation, lower operating costs, and compatibility with underfloor heating. The growing preference for decarbonized residential heating solutions continues to enhance single-family applications across developed and emerging economies.

- For instance, Viessmann’s Vitocal 250-A delivers 70 °C flow for radiators. The unit is designed for retrofits and works in cold climates. This supports single-family uptake.

By Product

The domestic hot water heat pump segment held the largest share of 57% in 2024, supported by its high energy efficiency and integration with smart home systems. Consumers are adopting these systems for year-round water heating while reducing dependence on gas-based boilers. The product’s ability to provide stable performance in varying climates enhances its appeal in regions like Europe and Japan. Advancements in inverter compressors and refrigerants have improved system reliability and reduced energy costs, further driving adoption in modern residential buildings.

- For instance, the A.O. Smith Voltex® MAX 50-gallon HPWH has an ENERGY STAR-certified Uniform Energy Factor (UEF) of up to 3.68. This newer model also delivers a 65-gallon first-hour rating and is verified by ENERGY STAR.

Key Growth Drivers

Rising Focus on Energy Efficiency and Carbon Reduction

Governments and homeowners are increasingly shifting toward energy-efficient heating technologies to reduce carbon emissions. Air to water heat pumps offer higher efficiency than traditional boilers and align with global decarbonization targets. Supportive policies such as the EU’s Green Deal and U.S. energy tax credits encourage adoption. These systems help cut energy consumption by up to 50%, lowering household emissions and costs. This rising emphasis on sustainable heating solutions continues to be a primary driver for market expansion.

- For instance, Midea’s M-Thermal Arctic R290 supplies DHW up to 75 °C. The series carries A+++ ErP claims with inverter control. High temps enable boiler replacement.

Government Incentives and Regulatory Support

Subsidy programs, rebates, and strict emission norms are accelerating market demand. Many countries, including Germany and Japan, provide financial incentives for heat pump installations under clean energy programs. Regulations limiting fossil-fuel heating systems further push homeowners to switch to low-emission technologies. These policy measures are creating a strong demand base for air to water heat pumps, supporting their large-scale residential adoption across both new constructions and retrofit projects.

- For instance, Buderus-class air-to-water installs qualify under KfW Zuschuss 458. Germany’s scheme allows grants up to 70% of eligible costs.

Technological Advancements Enhancing Performance

Continuous innovation in compressor design, refrigerants, and inverter technology is improving system efficiency and reliability. Manufacturers are integrating smart controls and IoT-enabled monitoring to optimize energy use and system performance. These technological upgrades enhance user convenience, enable predictive maintenance, and extend product lifespan. As a result, modern heat pumps can operate efficiently even in colder climates, broadening their applicability and driving adoption across diverse residential settings.

Key Trends & Opportunities

Growing Integration of Smart Home Systems

The integration of air to water heat pumps with smart thermostats and connected energy platforms is gaining momentum. Consumers are favoring intelligent heating systems that offer remote control and real-time energy optimization. These integrations also support demand response programs and dynamic energy pricing models. The trend aligns with broader digitalization efforts in home energy management, creating opportunities for manufacturers to offer connected, automated, and user-centric heating solutions.

- For instance, Google Nest studies show 10–12% heating savings. Cooling savings average 15% after installation and tuning. Heat pumps can participate via demand programs.

Adoption of Low-GWP Refrigerants

The transition to environmentally friendly refrigerants is a major trend reshaping the market. Manufacturers are shifting to low-global-warming-potential (GWP) alternatives like R32 and CO₂ to comply with F-Gas regulations. These refrigerants improve system sustainability while maintaining high efficiency and safety standards. The growing preference for eco-friendly refrigerant technologies positions manufacturers to gain regulatory compliance advantages and strengthen their sustainability credentials in competitive markets.

- For instance, Haier’s R290 range uses refrigerant with GWP = 3. Units can deliver up to 80 °C supply temperatures. This aligns with F-Gas transition.

Key Challenges

High Initial Installation and Equipment Costs

Despite long-term energy savings, the upfront cost of air to water heat pumps remains high. Installation expenses, especially in retrofit applications, limit affordability for many homeowners. The cost of system components and specialized labor adds to the investment barrier. Although government incentives help offset costs, price sensitivity continues to slow market penetration in developing regions, requiring more cost-effective solutions and financing mechanisms.

Performance Limitations in Cold Climates

Heat pump efficiency declines significantly in extreme cold conditions, limiting their suitability in regions with harsh winters. To maintain heating output, auxiliary systems such as electric boosters are often required, raising operational costs. Although hybrid and cold-climate models address this issue, the performance gap persists compared to traditional heating systems. Continuous innovation and adaptation of advanced refrigerant cycles are essential to improve performance under low-temperature environments.

Regional Analysis

North America

North America held a 22% share of the residential air to water heat pump market in 2024, driven by growing demand for energy-efficient home heating systems and government incentives. The U.S. and Canada are witnessing rising adoption of air source technologies due to carbon reduction initiatives and building energy codes. Programs such as the U.S. Inflation Reduction Act and regional rebate schemes are supporting installations in new and retrofit housing. The increasing preference for low-maintenance and sustainable residential systems further strengthens market growth across the region.

Europe

Europe dominated the residential air to water heat pump market with a 42% share in 2024. The region’s leadership is attributed to stringent energy-efficiency policies, high

electricity prices, and rapid decarbonization of the residential sector. Countries such as Germany, France, and the U.K. are implementing large-scale replacement programs for fossil-fuel boilers. The EU’s REPowerEU initiative and national subsidies are further encouraging heat pump adoption. The mature housing infrastructure and growing use of hybrid heating systems continue to sustain Europe’s position as the leading regional market.

Asia-Pacific

Asia-Pacific accounted for a 29% share in 2024, supported by rising residential construction and increasing awareness of energy conservation. China, Japan, and South Korea are key contributors, driven by expanding smart home infrastructure and supportive government policies. Japan’s high penetration of domestic hot water systems and China’s clean heating campaigns are fueling adoption. Rapid urbanization and investments in green housing developments are also boosting market demand. Manufacturers in the region are introducing cost-effective, high-efficiency systems to cater to growing middle-class homeowners and urban housing projects.

Latin America

Latin America captured a 4% market share in 2024, supported by growing investments in sustainable residential energy solutions. Brazil, Chile, and Mexico are witnessing gradual adoption of heat pumps in urban housing projects due to rising electricity prices and climate-friendly initiatives. The region’s warm climate favors efficient operation of air to water systems, especially for domestic hot water production. Increasing awareness of renewable heating solutions and support from regional energy efficiency programs are expected to enhance market expansion in the coming years.

Middle East & Africa

The Middle East & Africa region held a 3% share of the market in 2024, primarily driven by growing residential construction and interest in renewable technologies. Countries such as the UAE, Saudi Arabia, and South Africa are integrating sustainable systems in modern housing developments. Rising electricity consumption and efforts to diversify energy sources are influencing adoption. Although high initial costs remain a challenge, supportive government initiatives and growing demand for year-round hot water solutions are expected to create future growth opportunities in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Application

- Single Family

- Multi Family

By Product

- Domestic Hot Water Heat Pump

- Room Heat Pump

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The residential air to water heat pump market is characterized by strong competition among leading global players such as Mitsubishi Electric Corporation, Panasonic Corporation, LG Electronics, Daikin, SAMSUNG, FUJITSU GENERAL, Bosch, Vaillant Group, STIEBEL ELTRON GmbH & Co. KG, Johnson Controls – Hitachi Air Conditioning Company, Glen Dimplex Group, Midea, WOLF, Maritime Geothermal, and Guangdong PHNIX Eco-energy Solution Ltd. Companies are focusing on expanding their product portfolios through advanced inverter-driven systems, eco-friendly refrigerants, and integrated smart control technologies. Strategic initiatives such as mergers, acquisitions, and joint ventures enhance global market presence and strengthen distribution networks. Leading manufacturers are investing heavily in R&D to improve system efficiency, lower noise levels, and expand cold-climate performance. Increasing emphasis on digitalization and connected solutions is transforming the competitive landscape, with players targeting sustainable and intelligent heating systems to align with regional decarbonization goals and evolving consumer preferences.

Key Player Analysis

- Mitsubishi Electric Corporation

- Panasonic Corporation

- LG Electronics

- Daikin

- SAMSUNG

- FUJITSU GENERAL

- Bosch

- Vaillant Group

- STIEBEL ELTRON GmbH & Co. KG

- Johnson Controls – Hitachi Air Conditioning Company

- Glen Dimplex Group

- Midea

- WOLF

- Maritime Geothermal

- Guangdong PHNIX Eco-energy Solution Ltd.

Recent Developments

- In 2023, Daikin showcased its “next generation” Altherma 4 series, with a planned launch in 2024.

- In 2023, Bosch unveiled its first AWHP using the natural refrigerant propane (R290).

- In 2023, Panasonic completed the acquisition of the commercial hydronic air conditioning business of Systemair AB, strengthening its capabilities in natural refrigerant technology.

Report Coverage

The research report offers an in-depth analysis based on Application, Product and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of energy-efficient residential heating systems will continue to increase globally.

- Governments will expand incentive programs to accelerate clean heating transitions.

- Integration with smart home and IoT platforms will enhance energy management.

- Manufacturers will focus on developing cold-climate and hybrid heat pump models.

- Use of low-GWP refrigerants will rise to meet sustainability regulations.

- Retrofits of existing homes will drive steady demand in developed regions.

- Compact and modular system designs will improve installation flexibility.

- Partnerships between utilities and OEMs will promote large-scale deployment.

- Asia-Pacific will emerge as the fastest-growing regional market.

- Continuous R&D in compressor and inverter technologies will boost efficiency gains.