Market Overview

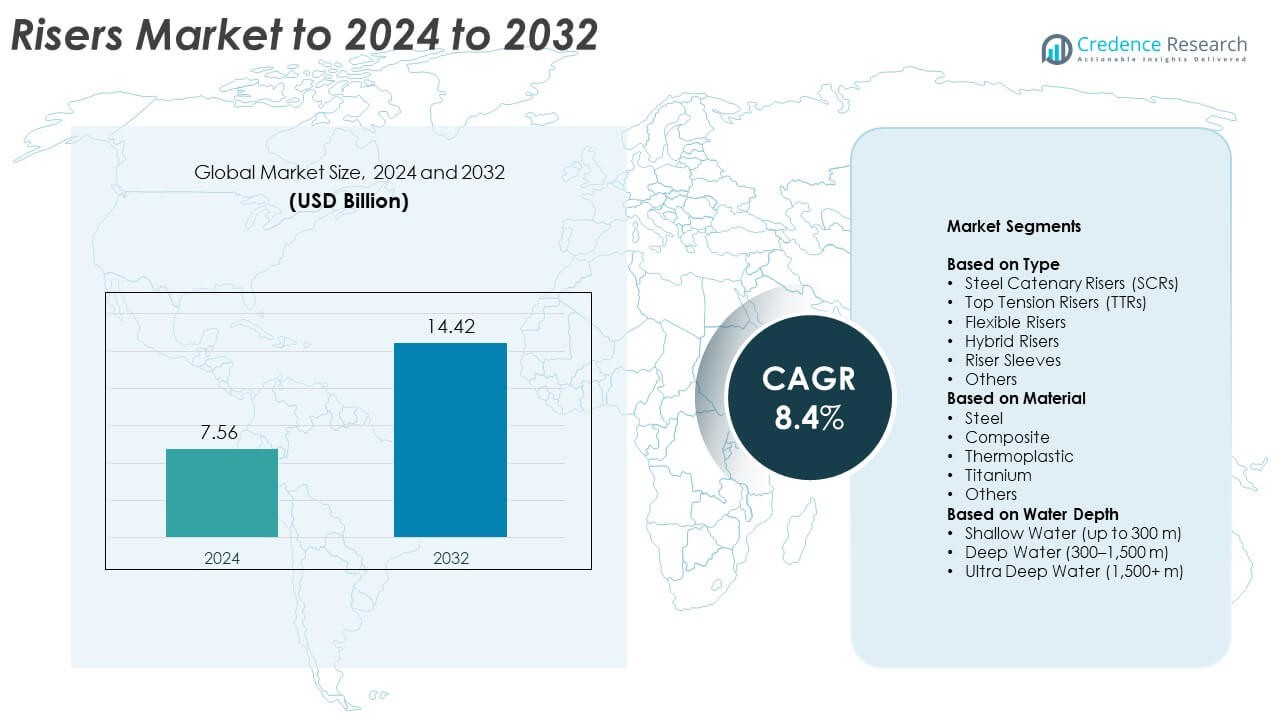

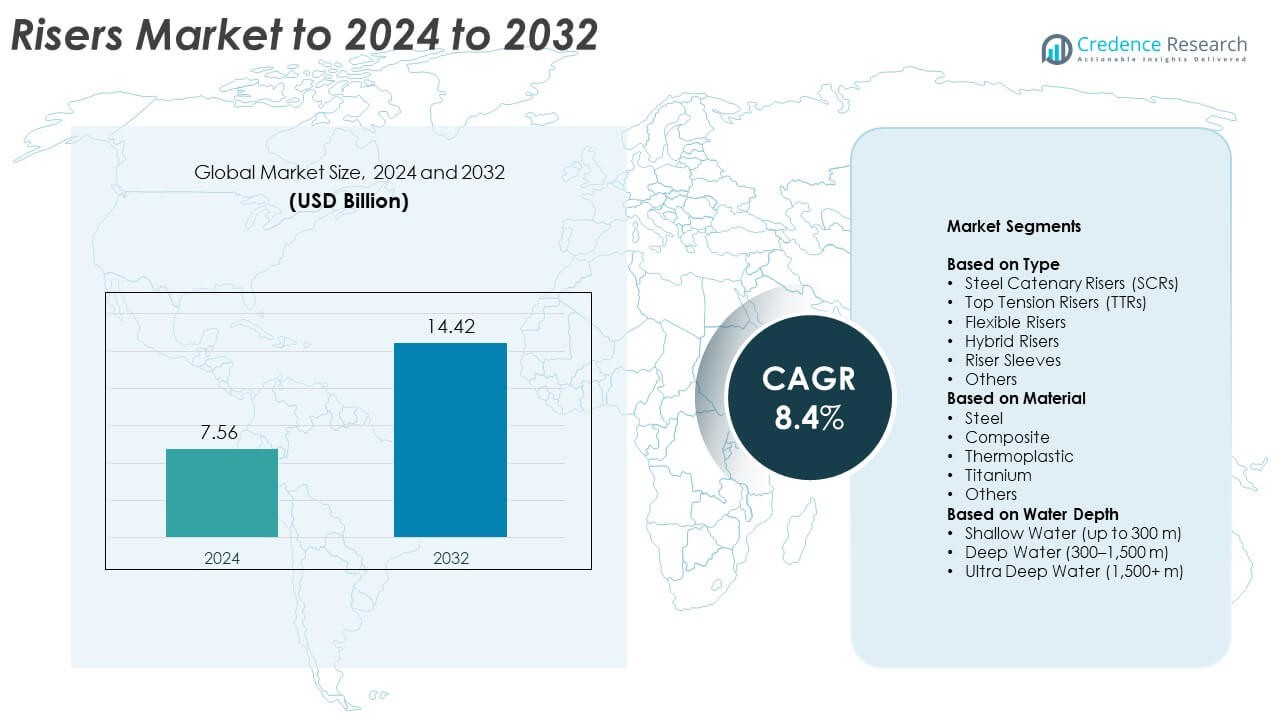

Risers Market size was valued at USD 7.56 billion in 2024 and is anticipated to reach USD 14.42 billion by 2032, at a CAGR of 8.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Risers Market Size 2024 |

USD 7.56 Billion |

| Risers Market, CAGR |

8.4% |

| Risers Market Size 2032 |

USD 14.42 Billion |

The risers market is led by major companies such as TechnipFMC, Saipem, Subsea7, Aker Solutions, Baker Hughes, National Oilwell Varco, Vallourec, DNV, Claxton Engineering, and DeepOcean. These firms maintain strong competitive positions through advanced subsea technologies, material innovations, and integrated offshore solutions. Their focus on flexible and hybrid riser systems supports deepwater and ultra-deepwater operations worldwide. North America emerged as the leading region in 2024, commanding around 35.6% of the global share, driven by extensive offshore exploration and redevelopment activities in the Gulf of Mexico, coupled with technological advancements and ongoing investments in deepwater infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The risers market was valued at USD 7.56 billion in 2024 and is projected to reach USD 14.42 billion by 2032, growing at a CAGR of 8.4%.

- Market growth is driven by rising offshore oil and gas exploration, particularly in deepwater and ultra-deepwater fields.

- A major trend includes the increasing use of flexible and hybrid risers with advanced composite and thermoplastic materials for durability and performance.

- The market is moderately consolidated, with players investing in digital monitoring technologies and material innovation to enhance competitiveness.

- North America led with a 35.6% share in 2024, followed by Europe at 27.4% and Asia-Pacific at 22.7%, while flexible risers dominated the type segment with 42.6% share.

Market Segmentation Analysis:

By Type

The flexible risers segment dominated the market in 2024, accounting for around 42.6% share. This dominance is driven by their adaptability, corrosion resistance, and ability to handle high-pressure, high-temperature offshore conditions. Flexible risers are extensively used in deepwater and ultra-deepwater developments, offering easier installation and maintenance compared to rigid alternatives. Increasing deployment in floating production storage and offloading (FPSO) systems further boosts demand. The growing number of offshore oil and gas projects in Brazil, the Gulf of Mexico, and West Africa continues to reinforce the segment’s leadership position in the global risers market.

- For instance, TechnipFMC was contracted to supply 14 km of gas-injection riser pipe for Brazil pre-salt.

By Material

The steel segment held the largest share of about 56.8% in 2024 due to its high strength, durability, and cost-effectiveness. Steel risers are preferred for deepwater and subsea applications where high-pressure resistance and fatigue performance are critical. Their widespread use in top tension and steel catenary risers contributes to consistent demand across offshore fields. Additionally, advancements in anti-corrosion coatings and cathodic protection systems enhance steel’s lifespan and performance. The continued expansion of offshore drilling projects in Asia-Pacific and North America supports the segment’s dominant position globally.

- For instance, Subsea7 installed 27 steel catenary risers, each 3.9 km, in a buoy-supported system.

By Water Depth

The deepwater segment led the market in 2024, capturing nearly 47.2% share. Growth in offshore exploration at depths between 300 and 1,500 meters drives segment expansion. Deepwater projects require advanced riser systems capable of handling extreme pressures and dynamic environmental loads. Increasing investments in deepwater fields by operators in Brazil, the U.S., and West Africa continue to strengthen this segment. Technological improvements in flexible and hybrid risers, coupled with the shift toward floating production platforms, further enhance deepwater riser adoption, positioning it as the leading sub-segment in the global market.

Key Growth Drivers

Expansion of Deepwater and Ultra-Deepwater Exploration

The rising number of deepwater and ultra-deepwater oil and gas projects is a key growth driver for the risers market. Operators are moving toward challenging offshore fields with depths beyond 1,500 meters, requiring advanced riser systems. Growing investments by major companies in regions such as Brazil, the U.S. Gulf of Mexico, and West Africa continue to fuel demand. The need for high-strength, fatigue-resistant, and corrosion-tolerant risers strengthens the adoption of advanced designs like flexible and hybrid risers in subsea infrastructure development.

- For instance, Baker Hughes agreed to deliver 77 km of flexible pipe systems for Brazil’s pre-salt.

Technological Advancements in Riser Design and Materials

Continuous innovation in riser design and material engineering significantly drives market growth. The development of hybrid and composite risers enhances performance in harsh marine conditions while reducing maintenance costs. Advancements in fatigue-resistant joints, anti-corrosion coatings, and dynamic analysis software improve reliability and service life. These innovations help offshore operators minimize downtime and enhance productivity, making riser systems more efficient for modern floating production platforms and subsea installations in high-pressure, high-temperature environments.

- For instance, Strohm’s 6-inch, 10 ksi carbon-PVDF TCP riser has 7.5 m MBR and single lengths up to 3 km.

Rising Offshore Energy Investments and Field Redevelopment

Increasing capital expenditure in offshore oil and gas exploration and field redevelopment projects supports riser market expansion. Many mature offshore fields are being upgraded with new production systems requiring replacement risers. Government support for offshore energy security and increased focus on maximizing extraction efficiency also stimulate growth. As global energy demand continues to rise, investment in offshore production capacity strengthens, positioning risers as essential components in long-term exploration and production strategies.

Key Trends & Opportunities

Shift Toward Composite and Thermoplastic Materials

A growing trend toward lightweight and corrosion-resistant materials such as composites and thermoplastics is reshaping the market. These materials offer improved flexibility, lower weight, and superior fatigue performance, making them ideal for deepwater applications. Manufacturers are investing in thermoplastic composite riser development to enhance structural integrity and reduce installation costs. This shift provides significant opportunities for innovation, particularly in projects prioritizing extended service life and operational efficiency under harsh subsea environments.

- For instance, Strohm secured a 10 km TCP flowline award in West Africa and delivered multiple km-scale TCP projects.

Integration of Digital Monitoring and Predictive Maintenance

The adoption of digital technologies such as real-time condition monitoring, sensors, and predictive analytics is transforming riser management. Advanced monitoring systems detect early signs of fatigue, corrosion, or stress, allowing preventive maintenance and extending equipment lifespan. Digital integration supports safer operations and reduced downtime. The growing use of data-driven inspection and IoT-enabled sensors across subsea assets offers long-term opportunities for service providers focusing on intelligent riser performance optimization.

- For instance, Expro installed non-intrusive ActiveSONAR metering on ten 12-inch production risers for an operator with deepwater subsea gas condensate wells. The wells had a peak potential production rate of up to 200 MMscf/d, and the SONAR metering was used for flow assurance and production surveillance without disrupting operations.

Key Challenges

High Installation and Maintenance Costs

One of the key challenges in the risers market is the high cost associated with installation, maintenance, and repair. Offshore environments demand complex handling, specialized vessels, and skilled labor, all contributing to elevated operational expenses. In deep and ultra-deepwater projects, these costs rise substantially due to extreme pressure and temperature conditions. The challenge is further amplified by the limited availability of cost-effective solutions, pushing operators to seek innovative technologies that can reduce lifecycle expenses.

Environmental Regulations and Operational Risks

Stringent environmental regulations governing offshore drilling and subsea operations pose significant challenges to market growth. Companies must comply with emission limits, waste disposal norms, and safety standards, which increase project complexity and costs. Additionally, environmental risks such as oil spills, riser leaks, and structural failures can cause severe economic and reputational damage. Maintaining operational safety while ensuring environmental compliance remains a major obstacle, especially as projects extend into ecologically sensitive offshore regions.

Regional Analysis

North America

North America dominated the risers market in 2024, holding around 35.6% share. The United States and Mexico lead regional growth, driven by extensive offshore drilling in the Gulf of Mexico. Rising redevelopment of mature oil fields and ongoing investments in deepwater projects further strengthen the region’s position. Advanced offshore infrastructure and the adoption of hybrid and flexible risers enhance operational reliability. Technological innovation and strong presence of established energy companies continue to boost riser demand across new subsea exploration projects in North American waters.

Europe

Europe accounted for nearly 27.4% share of the global risers market in 2024. The North Sea remains a key production hub, supported by the U.K. and Norway’s offshore energy initiatives. Growing investments in subsea tieback and field redevelopment projects contribute to stable demand. The region’s emphasis on extending the operational life of offshore assets drives the adoption of high-performance risers. The ongoing transition toward cleaner offshore production and integration of digital monitoring technologies further enhance market growth prospects across European waters.

Asia-Pacific

Asia-Pacific captured approximately 22.7% share in 2024, emerging as one of the fastest-growing regions. China, India, Malaysia, and Australia are expanding offshore exploration activities to strengthen energy security. Increasing deepwater projects in the South China Sea and the Bay of Bengal boost riser installations. Regional investments in floating production systems and subsea technology also drive demand. Growing collaboration between international oil companies and regional players supports advancements in riser design and deployment, reinforcing Asia-Pacific’s strategic importance in the global market.

Latin America

Latin America held about 9.3% share of the risers market in 2024, primarily driven by Brazil’s offshore developments. The pre-salt fields off Brazil’s coast continue to attract major investment in deepwater production systems. Mexico’s offshore expansion under private partnerships also supports growth. The demand for flexible and hybrid risers remains high due to challenging subsea conditions. The region benefits from favorable government policies and continued exploration in untapped reserves, positioning Latin America as a vital contributor to future market expansion.

Middle East & Africa

The Middle East and Africa region accounted for nearly 5% share in 2024, driven by new offshore exploration and field development projects. Countries like Angola, Nigeria, and Saudi Arabia are expanding subsea production capacities. The region’s focus on offshore energy diversification supports the adoption of durable and cost-efficient riser systems. Increasing interest in ultra-deepwater reserves and cross-border collaboration among energy companies enhance growth opportunities. Despite moderate share, rising investments in subsea infrastructure and modern drilling technologies are expected to strengthen future market performance.

Market Segmentations:

By Type

- Steel Catenary Risers (SCRs)

- Top Tension Risers (TTRs)

- Flexible Risers

- Hybrid Risers

- Riser Sleeves

- Others

By Material

- Steel

- Composite

- Thermoplastic

- Titanium

- Others

By Water Depth

- Shallow Water (up to 300 m)

- Deep Water (300–1,500 m)

- Ultra Deep Water (1,500+ m)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the risers market features major players such as TechnipFMC, Saipem, Subsea7, Aker Solutions, Baker Hughes, National Oilwell Varco, Vallourec, DNV, Claxton Engineering, and DeepOcean. The market remains moderately consolidated, with companies focusing on technological innovation and cost-efficient subsea solutions. Strategic collaborations and offshore project contracts are central to maintaining global presence and operational excellence. Many firms emphasize digital monitoring technologies and advanced material integration to enhance product reliability. Continuous R&D efforts, expansion of deepwater projects, and alignment with sustainability goals strengthen competition. Overall, global players are investing in hybrid risers, thermoplastic materials, and digitalized lifecycle management to secure long-term market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- TechnipFMC

- Saipem (a subsidiary of Eni)

- Subsea7

- Aker Solutions

- Baker Hughes (BHGE)

- National Oilwell Varco (NOV)

- Vallourec

- DNV (Det Norske Veritas)

- Claxton Engineering

- DeepOcean

Recent Developments

- In 2025, DeepOcean acquired Shelf Subsea, a move that expanded its presence and density of services in the Asia-Pacific and Middle East markets, which are regions with significant offshore riser activity.

- In 2024, Vallourec delivered the full scope of line pipe products for LLOG’s Salamanca project, which required ultra-heavy wall pipes for infield flow lines and risers to be installed using the reel-lay method

- In 2023, TechnipFMC secured the largest-ever integrated Engineering, Procurement, Construction, and Installation (iEPCI) award from Equinor for the BM-C-33 project in Brazil.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Water Depth and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The risers market will expand steadily, supported by increasing offshore oil and gas exploration.

- Deepwater and ultra-deepwater projects will drive strong demand for flexible and hybrid risers.

- Technological progress in composite and thermoplastic materials will enhance riser performance and durability.

- Rising offshore investments in Brazil, the U.S., and West Africa will sustain long-term growth.

- Digital monitoring and predictive maintenance adoption will improve operational safety and reduce downtime.

- Field redevelopment and life extension of existing platforms will create recurring demand for replacement risers.

- Asia-Pacific will emerge as the fastest-growing region, supported by expanding offshore energy projects.

- Collaboration between manufacturers and oil companies will foster innovation in lightweight riser designs.

- Environmental compliance and cost efficiency will guide future product development and installations.

- Growing focus on subsea infrastructure modernization will strengthen the risers market over the next decade.