Market Overview

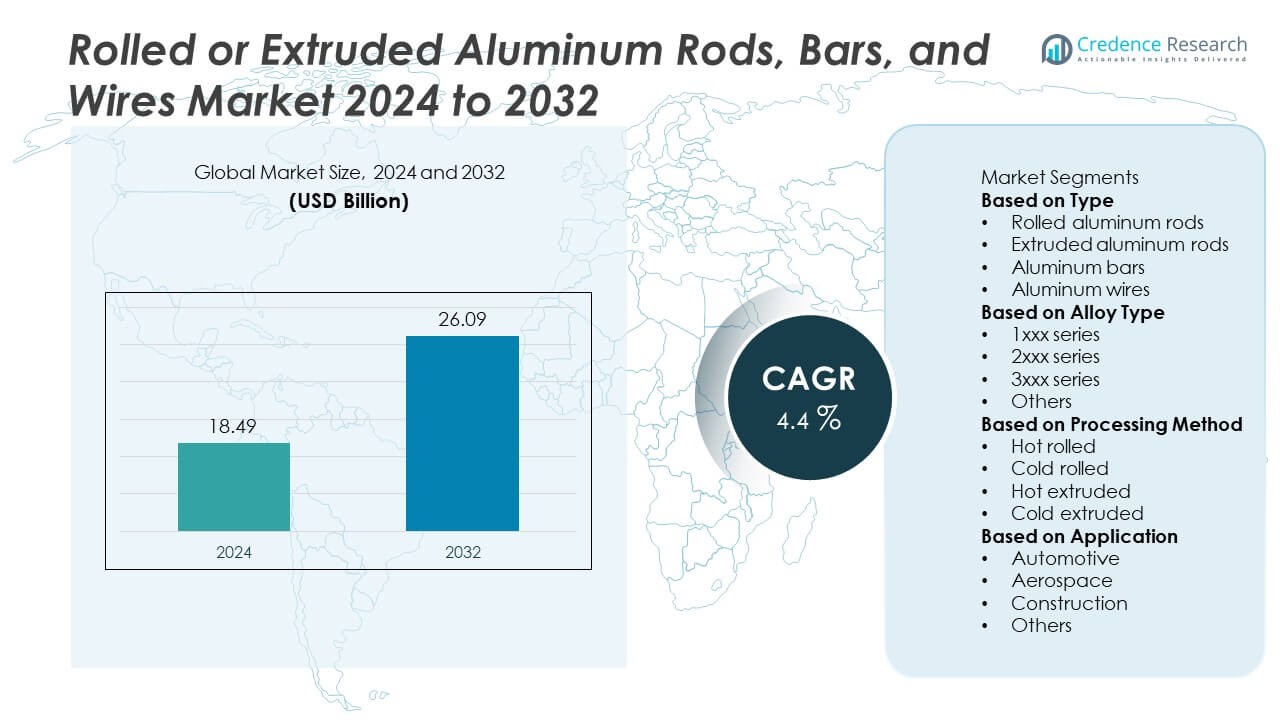

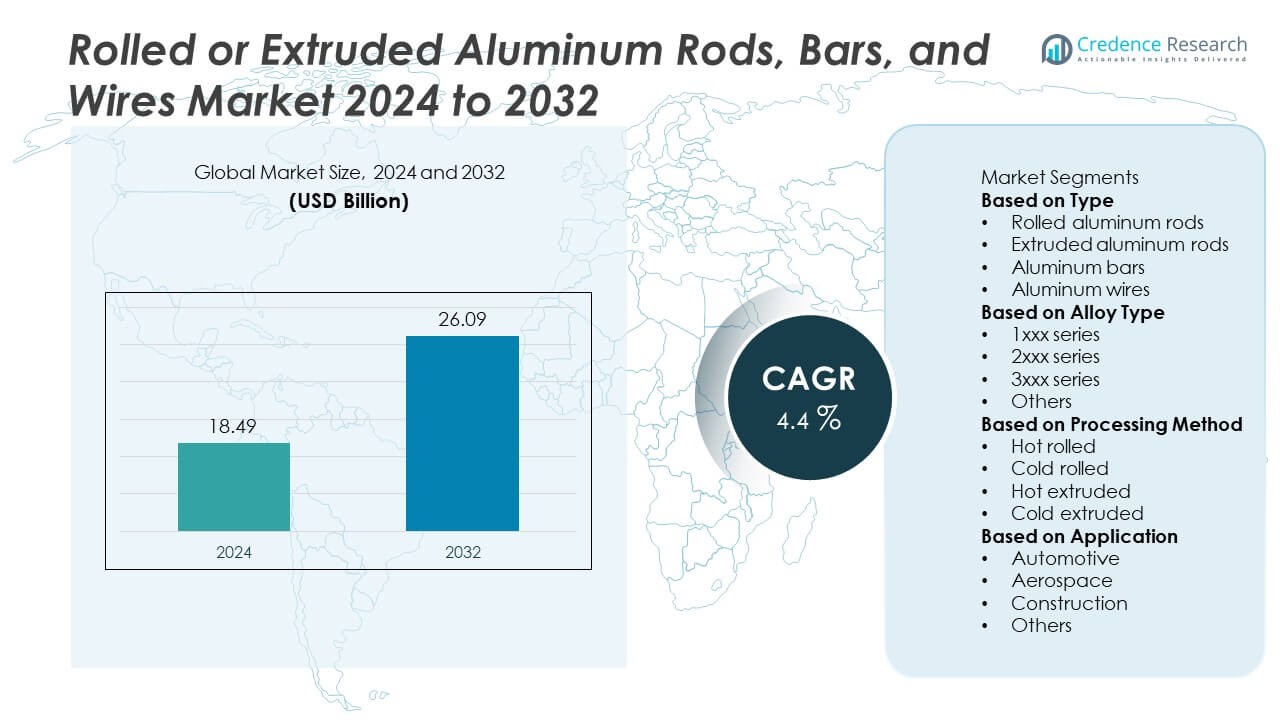

The rolled or extruded aluminum rods, bars and wires market was valued at USD 18.49 billion in 2024 and is projected to reach USD 26.09 billion by 2032, growing at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rolled or Extruded Aluminum Rods, Bars and Wires Market Size 2024 |

USD 18.49 Billion |

| Rolled or Extruded Aluminum Rods, Bars and Wires Market, CAGR |

4.4% |

| Rolled or Extruded Aluminum Rods, Bars and Wires Market Size 2032 |

USD 26.09 Billion |

The rolled or extruded aluminum rods, bars, and wires market is led by key players including Rio Tinto Group, Norsk Hydro ASA, RUSAL, Kaiser Aluminum Corporation, Arconic Corporation, Hindalco Industries Limited, Constellium SE, Alcoa Corporation, China Zhongwang Holdings Limited, and Vedanta Aluminium Limited. These companies dominate through technological innovation, large-scale production, and vertically integrated supply chains. Hindalco and Norsk Hydro lead in global extrusion capacity, while Constellium and Arconic specialize in high-performance alloys for aerospace and automotive sectors. Regional analysis shows North America held the largest share of 34% in 2024, supported by rising demand for lightweight materials and advancements in precision extrusion technology, followed by Europe with 28% and Asia-Pacific with 30%, reflecting strong industrial and construction growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Insights

- The rolled or extruded aluminum rods, bars, and wires market was valued at USD 18.49 billion in 2024 and is projected to reach USD 26.09 billion by 2032, growing at a CAGR of 4.4%.

- Market growth is driven by rising demand for lightweight materials in automotive, aerospace, and construction sectors, supported by expanding renewable energy and power transmission applications.

- The market is witnessing trends such as increasing use of advanced alloy compositions, automation in extrusion processes, and higher focus on recyclable, eco-friendly aluminum production.

- Key players including Rio Tinto Group, Norsk Hydro ASA, Hindalco Industries Limited, and Constellium SE are focusing on sustainability, technological innovation, and expansion of extrusion capacities to maintain competitiveness.

- North America led with a 34% share in 2024, followed by Europe with 28% and Asia-Pacific with 30%, while the hot rolled segment dominated with a 46% share due to its wide industrial and construction applications.

Market Segmentation Analysis:

By Type

Extruded aluminum rods dominated the rolled or extruded aluminum rods, bars, and wires market with a 41% share in 2024. Their dominance is driven by superior mechanical strength, dimensional accuracy, and versatility across automotive, aerospace, and construction applications. Extruded rods are widely used in manufacturing structural components, heat exchangers, and power transmission lines. The segment benefits from ongoing industrial lightweighting trends and increasing investments in extrusion technology. Growing use in electric vehicle frameworks and renewable energy installations further strengthens market demand for high-performance extruded aluminum products.

- For instance, Constellium SE supplies Airbus with a broad range of advanced aluminum rolled and extruded products, including Airware® aluminum-lithium alloys, for the A320, A350, and other aircraft components.

By Alloy Type

The 6xxx series alloy segment held the largest share of 33% in 2024, supported by its excellent corrosion resistance, weldability, and medium-strength characteristics. This alloy type is widely preferred in automotive body frames, structural components, and architectural profiles. Its ability to balance strength and formability makes it ideal for extrusion and rolling processes. Manufacturers favor the 6xxx series for applications requiring enhanced surface finish and fatigue resistance. Continuous development of heat-treatable alloys and adoption of recyclable aluminum materials are further propelling segment growth across major industrial sectors.

- For instance, Rio Tinto Group has produced limited batches of aluminum using the ELYSIS carbon-free smelting process, which were supplied to Apple for its iPhone SE and to AB InBev for Michelob Ultra cans during research and development.

By Processing Method

The hot rolled segment accounted for a 46% share of the rolled or extruded aluminum rods, bars, and wires market in 2024. The segment leads due to its widespread use in producing large-volume aluminum sheets, rods, and bars with superior surface finish and uniform grain structure. Hot rolling enhances material strength and ductility, making it suitable for heavy engineering, construction, and transportation applications. Advancements in continuous rolling technology and energy-efficient furnaces are boosting production efficiency. The growing demand for high-quality rolled aluminum in automotive and industrial machinery sectors continues to drive segment expansion globally.

Key Growth Drivers

Rising Demand from Automotive and Aerospace Industries

The increasing use of aluminum rods, bars, and wires in automotive and aerospace applications is a major growth driver. The shift toward lightweight and fuel-efficient vehicles has accelerated the replacement of steel components with aluminum alloys. Aerospace manufacturers also rely on high-strength extruded aluminum for structural frames and electrical systems. This demand is further supported by advancements in extrusion technology, which enhance precision and durability. The global transition to sustainable mobility continues to drive steady market growth across both sectors.

- For instance, Howmet Aerospace supplies critical titanium and aluminum components for aircraft structures, including the Boeing 737 and Airbus A320 families, utilizing advanced manufacturing technologies for engine parts, fasteners, and airframe structures.

Growing Use in Electrical and Power Transmission Applications

Expanding infrastructure and renewable energy projects are fueling the demand for aluminum conductors and wires. Aluminum’s high conductivity-to-weight ratio makes it ideal for power grids and transmission lines. Utilities are increasingly adopting aluminum-based materials to improve efficiency and reduce energy losses. The metal’s corrosion resistance and recyclability add further advantages in long-term operations. Government initiatives for grid modernization and clean energy expansion are strengthening the use of rolled and extruded aluminum products in power and utility networks.

- For instance, Vedanta Aluminium Limited produces over 600,000 tons of aluminum wire rods annually at its smelters in Jharsuguda and BALCO, which are used for applications including power distribution, renewable energy transmission, and other electrical and industrial uses.

Expansion of Construction and Industrial Manufacturing Sectors

construction sector’s reliance on aluminum for structural frameworks, windows, and façade systems is driving market growth. Its lightweight, corrosion-resistant, and formable properties make it ideal for both residential and commercial applications. Industrial manufacturers also use aluminum bars and rods in machinery, tools, and fabricated components due to their high strength and recyclability. Rapid urbanization in emerging economies, coupled with infrastructure modernization projects, continues to increase demand. Ongoing development of high-performance alloys further enhances aluminum’s suitability for heavy-duty industrial use.

Key Trends & Opportunities

Adoption of Advanced Alloy Compositions

Manufacturers are increasingly investing in advanced alloy compositions to improve mechanical strength, thermal resistance, and corrosion protection. High-performance alloys in the 6xxx and 7xxx series are gaining popularity for aerospace and automotive uses. The development of customized aluminum grades tailored to specific industrial requirements is expanding application diversity. Innovation in alloy design is also enabling greater recyclability and sustainability, aligning with global environmental goals. This trend offers significant growth opportunities for producers focusing on high-quality, value-added aluminum products.

- For instance, Constellium SE produces its proprietary Airware® aluminum-lithium alloys for aerospace fuselage and wing structures. These high-performance aluminum solutions are engineered for low density, high stiffness, and corrosion resistance.

Integration of Automation and Digital Manufacturing

The incorporation of automation and digital process control in rolling and extrusion operations is improving production precision and efficiency. Smart manufacturing technologies allow real-time monitoring, reduced material waste, and optimized thermal management. Companies are adopting digital twins and predictive analytics to ensure consistent quality and operational reliability. These advancements support large-scale production of uniform aluminum profiles for demanding sectors. The growing focus on Industry 4.0 standards is expected to enhance productivity and cost competitiveness across the aluminum value chain.

- For instance, Alcoa Corporation has a technology roadmap that includes developing and deploying innovations for more efficient and sustainable aluminum production, including advancements at facilities like the Davenport Works rolling mill, which produces high-specification aerospace and automotive aluminum products.

Rising Demand for Sustainable and Recyclable Materials

Global sustainability goals are encouraging the adoption of recyclable and low-carbon aluminum products. Aluminum’s high recyclability rate and reduced environmental footprint make it a preferred material for green construction and automotive manufacturing. Many producers are investing in closed-loop recycling systems to lower energy use and carbon emissions. Government regulations promoting circular economy practices further accelerate this transition. The increasing emphasis on eco-friendly production methods creates long-term growth opportunities for environmentally responsible aluminum manufacturers.

Key Challenges

Fluctuating Raw Material Prices

Volatility in raw material and energy prices poses a significant challenge to the aluminum industry. Rising costs of bauxite, alumina, and electricity directly affect production expenses and profit margins. Price fluctuations also disrupt supply contracts and long-term planning for manufacturers. Maintaining stability in sourcing and optimizing energy efficiency are crucial to mitigating these risks. Strategic partnerships and investment in renewable-powered smelting operations are becoming essential to ensure cost stability and competitive pricing.

High Energy Consumption and Environmental Impact

The aluminum production process remains highly energy-intensive, contributing to environmental concerns. Smelting and extrusion operations require substantial power input, leading to higher operational costs and carbon emissions. Regulatory pressures to reduce greenhouse gas output are compelling producers to adopt cleaner technologies. Transitioning to renewable energy and implementing energy recovery systems are becoming key strategies. However, high initial investment costs for sustainability upgrades continue to challenge smaller producers seeking to meet evolving environmental standards.

Regional Analysis

North America

North America held a 34% share of the rolled or extruded aluminum rods, bars, and wires market in 2024. The region’s dominance is driven by growing demand from the automotive, aerospace, and construction industries. The United States remains a key contributor due to strong adoption of lightweight materials in vehicle manufacturing and defense applications. Expanding renewable energy and power transmission projects are further boosting aluminum wire usage. Technological advancements in extrusion processes and recycling capabilities are enhancing production efficiency, while the increasing focus on sustainability continues to support market expansion across the region.

Europe

Europe accounted for 28% of the rolled or extruded aluminum rods, bars, and wires market share in 2024. Growth is fueled by rising demand from automotive, industrial machinery, and infrastructure sectors. Countries such as Germany, France, and Italy are at the forefront of aluminum processing innovations, emphasizing lightweight and eco-friendly materials. The region’s stringent emission standards and transition toward electric mobility are encouraging greater use of extruded aluminum components. Investments in energy-efficient smelting and recycling plants are also improving supply stability. These factors collectively strengthen Europe’s position as a major hub for aluminum manufacturing and exports.

Asia-Pacific

Asia-Pacific dominated with a 30% share in 2024, emerging as the fastest-growing region in the rolled or extruded aluminum rods, bars, and wires market. China, India, Japan, and South Korea are driving growth through large-scale construction, industrialization, and automotive production. Government initiatives promoting renewable energy and infrastructure development are boosting aluminum wire and bar consumption. The region benefits from abundant raw material availability, cost-effective labor, and expanding extrusion capacity. Increasing adoption of aluminum in electric vehicles and urban infrastructure continues to propel market demand across Asia-Pacific’s rapidly evolving industrial landscape.

Latin America

Latin America captured a 5% share of the rolled or extruded aluminum rods, bars, and wires market in 2024. Regional growth is supported by expanding automotive production, rising infrastructure investments, and modernization of electrical grids. Brazil and Mexico are the primary markets, benefiting from improved manufacturing capabilities and growing exports. The adoption of lightweight and corrosion-resistant materials in transport and energy sectors is increasing steadily. Additionally, government efforts to attract foreign investment in industrial and mining projects are boosting demand for aluminum products across various applications in Latin America.

Middle East & Africa

The Middle East & Africa region accounted for a 3% share of the rolled or extruded aluminum rods, bars, and wires market in 2024. Growth is primarily driven by large-scale construction projects, renewable energy investments, and expanding power transmission infrastructure. The UAE and Saudi Arabia are leading markets, supported by strong industrial diversification and aluminum production capacity. Africa’s mining and urban development projects are gradually increasing demand for rolled and extruded aluminum products. Ongoing investments in manufacturing facilities and regional trade partnerships are expected to strengthen the market outlook over the forecast period.

Market Segmentations:

By Type

- Rolled aluminum rods

- Extruded aluminum rods

- Aluminum bars

- Aluminum wires

By Alloy Type

- 1xxx series

- 2xxx series

- 3xxx series

- Others

By Processing Method

- Hot rolled

- Cold rolled

- Hot extruded

- Cold extruded

By Application

- Automotive

- Aerospace

- Construction

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the rolled or extruded aluminum rods, bars, and wires market is characterized by key players such as Rio Tinto Group, Norsk Hydro ASA, RUSAL, Kaiser Aluminum Corporation, Arconic Corporation, Hindalco Industries Limited, Constellium SE, Alcoa Corporation, China Zhongwang Holdings Limited, and Vedanta Aluminium Limited. These companies focus on expanding production capacity, improving alloy performance, and enhancing energy efficiency through advanced rolling and extrusion technologies. Strategic investments in recycling facilities and sustainable production practices are becoming central to competitiveness. Market leaders are also forming partnerships with automotive, aerospace, and construction industries to meet growing demand for lightweight and high-strength aluminum products. Continuous innovation in heat treatment, surface finishing, and precision extrusion enables manufacturers to produce components with improved durability and formability. Global players are further strengthening their market position by expanding supply chains and integrating digital process controls to enhance operational efficiency and product quality.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Rio Tinto Group

- Norsk Hydro ASA

- RUSAL

- Kaiser Aluminum Corporation

- Arconic Corporation

- Hindalco Industries Limited

- Constellium SE

- Alcoa Corporation

- China Zhongwang Holdings Limited

- Vedanta Aluminium Limited

Recent Developments

- In September 2025, Arconic Corporation commissioned a US $57.5 million expansion at its Davenport Works plant, which effectively doubled domestic high-purity aluminium production for aerospace and defence applications.

- In July 2025, Rio Tinto Group, in partnership with Capral Industries and Sims Metal Management, launched a closed-loop aluminium recycling initiative that will produce 1,000 tonnes of billet containing at least 20% recycled content for extrusion downstream.

- In 2024, MAAN Aluminium Limited enhanced the commercial production capacity, further growing the company’s share in the ever-competitive aluminum extrusion market, which is believed to give the company rise in value thus a projected increase in decisions by 3%on shares.

Report Coverage

The research report offers an in-depth analysis based on Type, Alloy Type, Processing Method, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for aluminum rods, bars, and wires will rise with industrial modernization.

- Automotive and aerospace sectors will continue driving the shift toward lightweight materials.

- Advancements in extrusion and rolling technologies will improve product precision and efficiency.

- Recycling and low-carbon aluminum production will become major industry priorities.

- The construction sector will increase adoption of corrosion-resistant aluminum products.

- Digital process control and automation will enhance manufacturing consistency and output.

- Asia-Pacific will emerge as the fastest-growing region due to strong industrial growth.

- Investments in renewable energy and electrical infrastructure will boost aluminum wire demand.

- Manufacturers will focus on alloy development to meet high-performance industrial requirements.

- Strategic mergers and capacity expansions will strengthen global market competitiveness.