Market Overview

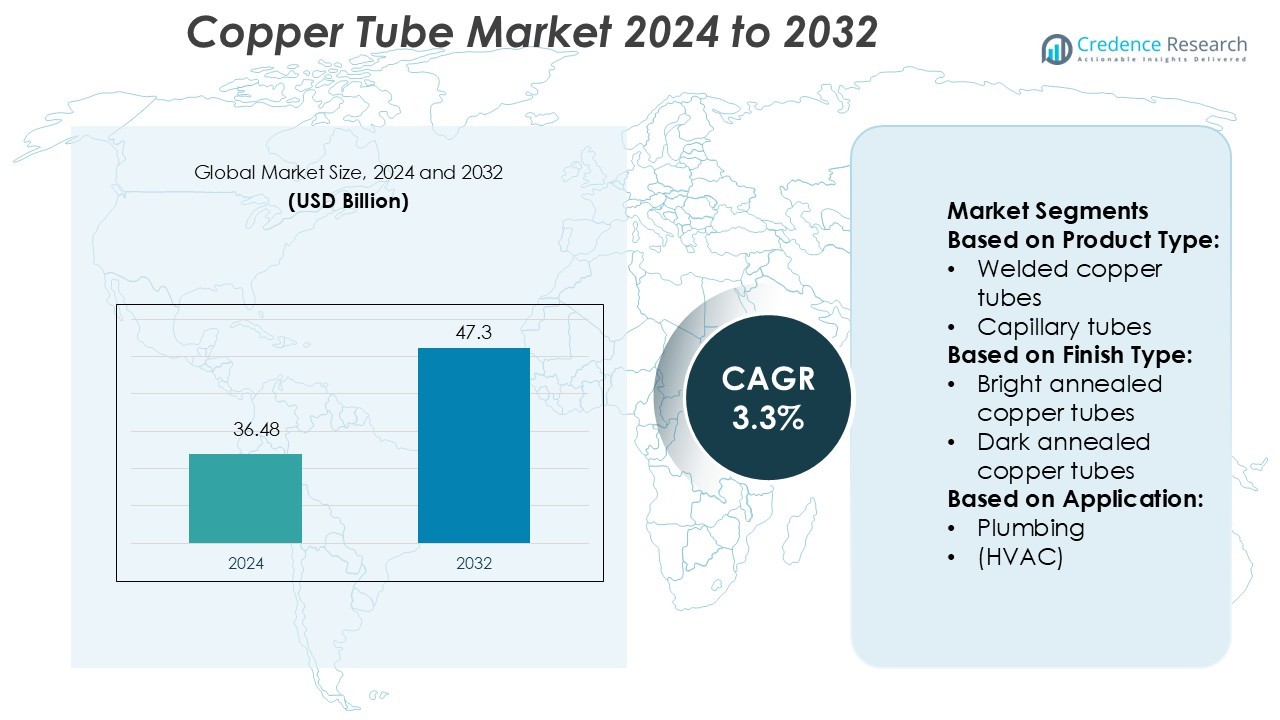

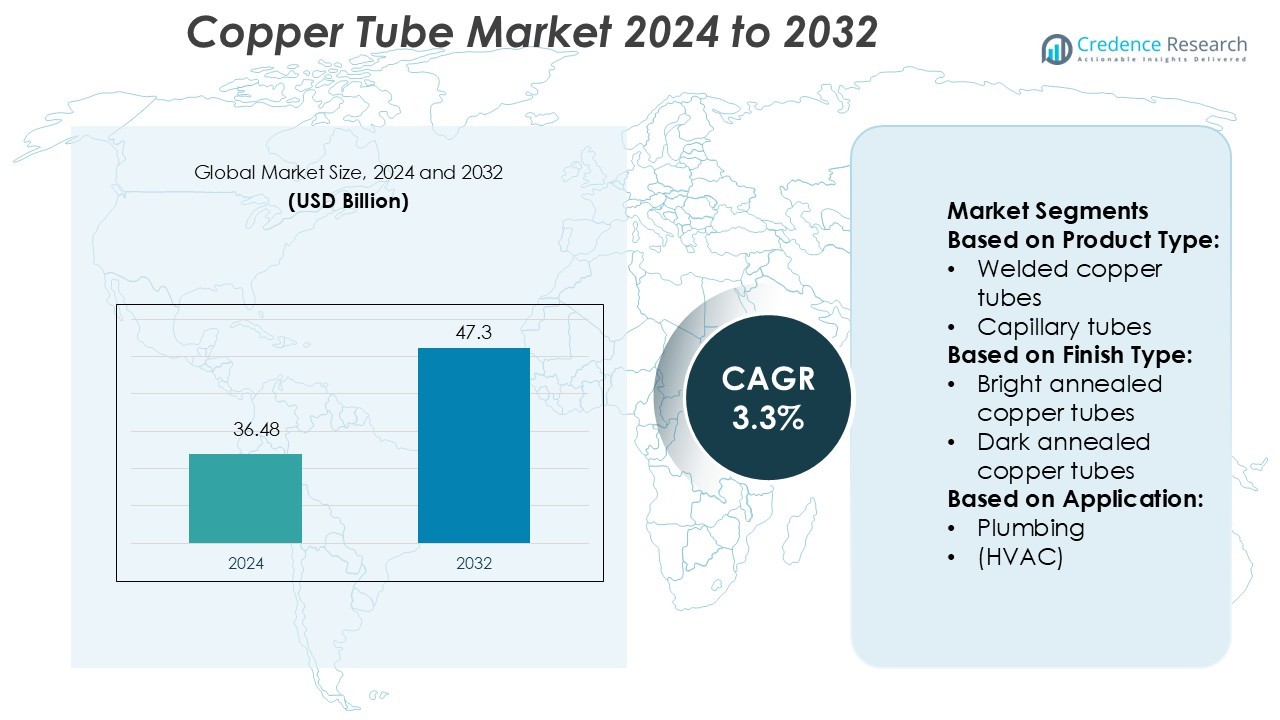

Copper Tube Market size was valued USD 36.48 billion in 2024 and is anticipated to reach USD 47.3 billion by 2032, at a CAGR of 3.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Copper Tube Market Size 2024 |

USD 36.48 Billion |

| Copper Tube Market, CAGR |

3.3% |

| Copper Tube Market Size 2032 |

USD 47.3 Billion |

The copper tube market is shaped by top players such as Mueller Industries Inc., Kobe Steel, Cerro Flow Products LLC, Wieland Group, LUVATA, MetTube Berhad, Cambridge-Lee Industries LLC, Shanghai Metal Corporation, KME Group S.p.A., and MM Kembla. These companies focus on production efficiency, advanced extrusion technologies, and sustainability initiatives to strengthen their global reach. They actively expand their manufacturing capacities and distribution networks to meet growing demand across construction, HVAC, and renewable energy sectors. Asia Pacific leads the market with a 34% share, driven by rapid urbanization, infrastructure expansion, and large-scale investments in energy-efficient building projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The copper tube market was valued at USD 36.48 billion in 2024 and is expected to reach USD 47.3 billion by 2032, growing at a CAGR of 3.3%.

- Rising demand from HVAC and plumbing applications is driving growth, supported by expanding construction projects and energy-efficient building initiatives.

- Key players are focusing on production efficiency, advanced extrusion technologies, and sustainable manufacturing to strengthen their competitive edge.

- Volatile raw material prices and increasing competition from substitutes such as plastic piping remain major market restraints.

- Asia Pacific holds a 34% market share, followed by North America with 28% and Europe with 24%, with HVAC applications accounting for the largest segment share.

Market Segmentation Analysis:

By Product Type

Seamless copper tubes hold the dominant share in the market. Their high strength, corrosion resistance, and superior thermal conductivity make them ideal for plumbing, HVAC, and industrial systems. Seamless tubes provide reliable performance under high pressure, which boosts their adoption in both residential and commercial projects. Welded copper tubes are also gaining traction due to cost efficiency in low-pressure applications. Capillary tubes serve niche segments in refrigeration and medical equipment. The increasing demand for durable piping solutions supports steady growth across these product categories.

- For instance, Mueller’s Streamline ® HVACR copper tubes are rated up to 700 PSI operating pressure at 250 °F for select sizes. Mueller Streamline Co. Welded copper tubes are also gaining traction due to cost efficiency in low-pressure applications.

By Finish Type

Bright annealed copper tubes lead the market with the largest share. Their smooth surface finish, improved flexibility, and clean interior make them highly suitable for HVAC and plumbing use. The bright finish reduces oxidation and ensures long-term reliability in critical applications. Dark annealed tubes are preferred in cost-sensitive projects, while lacquered copper tubes offer extra protection for outdoor installations. Growing infrastructure investment and HVAC expansion strengthen the demand for bright annealed tubes across residential, commercial, and industrial sectors.

- For instance, Cerro Flow reports that its “CerroTube™” plumbing copper tube is produced from 99.9 % pure C12200 alloy (DHP) and is available in straight lengths of 10 ft and 20 ft and coils up to 100 ft.

By Application

HVAC remains the dominant application segment in the copper tube market. Rising demand for energy-efficient air conditioning and refrigeration systems drives the use of copper tubes due to their superior heat transfer properties and ease of installation. Plumbing applications also contribute significantly, supported by rapid urbanization and building construction. Industrial and electrical applications rely on copper tubing for corrosion resistance and conductivity. Global expansion of HVAC systems and infrastructure development are key growth drivers across these end-use segments.

Key Growth Drivers

Rising Demand from HVAC and Plumbing Applications

The rapid growth of HVAC and plumbing projects drives copper tube demand. Copper tubes offer high thermal conductivity, durability, and corrosion resistance, making them ideal for residential and commercial systems. Expanding construction in Asia Pacific and North America further accelerates product adoption. Strict energy efficiency regulations also push the use of copper over less efficient alternatives. Increased spending on green building projects enhances market penetration, especially in urban areas. This trend supports consistent demand across multiple industries.

- For instance, Wieland launched its “cuprolife®” installation tube in March 2023, which is produced with 100 % recycled copper according to the mass-balance approach.

Expansion of Renewable Energy Infrastructure

The increasing shift toward renewable energy boosts the use of copper tubes in solar thermal systems and heat exchangers. These tubes help transfer heat efficiently in concentrated solar power plants and heat pump applications. Growing investments in energy-efficient technologies fuel the replacement of older systems with modern copper-based solutions. Government incentives for clean energy further strengthen this trend. Rising environmental awareness and energy transition goals make copper tubing a preferred material for next-generation infrastructure.

- For instance, Luvata’s “OF-OK®” oxygen-free copper tube offers a thermal conductivity of 390 W/(m·K) at 20 °C. These tubes help transfer heat efficiently in concentrated solar-power (CSP) plants and heat-pump applications.

Technological Advancements and Manufacturing Efficiency

Advances in manufacturing, such as precision extrusion and automated forming, lower production costs and enhance quality. Improved tube coatings increase corrosion resistance and extend service life. This makes copper tubes suitable for demanding applications like industrial refrigeration and medical gas supply. Producers are also integrating automated quality control systems to meet international standards. These developments support mass adoption, boost cost efficiency, and improve reliability in end-use industries.

Key Trends & Opportunities

Rising Adoption of Green Building Standards

Green building certifications like LEED and BREEAM drive the use of sustainable materials. Copper tubes are fully recyclable and offer long operational lifespans, aligning with environmental goals. Developers prefer copper for HVAC and plumbing in energy-efficient buildings. This shift opens new opportunities in both developed and emerging markets. Government initiatives promoting eco-friendly construction further enhance the market outlook.

- For instance, MetTube’s product catalogue shows pancake coil copper tubes of 50 ft (15.24 m) and 100 ft (30.48 m) lengths manufactured for HVAC/plumbing applications.

Growing Use in Electric Vehicle Thermal Management

The expansion of the EV sector creates strong demand for copper tubes in battery cooling systems. These tubes efficiently manage heat, extending battery life and performance. Automakers are adopting lightweight and high-conductivity materials to optimize energy use. With rising EV sales in Asia, Europe, and North America, this trend offers significant growth potential. Manufacturers investing in specialized tubing for EV applications stand to gain a competitive edge.

- For instance, Cambridge-Lee’s copper tubes meet alloy specification UNS C12200, with minimum copper plus silver content of 99.9 % and phosphorus content between 0.015-0.040 %—ensuring high purity needed for sensitive applications.

Urban Infrastructure Modernization

Rapid urbanization is driving infrastructure upgrades in plumbing, district cooling, and energy distribution. Copper tubes provide reliable performance and low maintenance, making them ideal for large-scale projects. Governments are investing heavily in water and energy infrastructure, boosting demand. The shift to smart cities further increases the use of advanced copper solutions.

Key Challenges

Volatile Raw Material Prices

Fluctuating copper prices pose a major challenge to manufacturers and end users. Price instability affects project planning and long-term contracts. Sudden spikes reduce margins and discourage large-scale installations in cost-sensitive markets. This volatility pushes some buyers toward alternative materials like PEX or aluminum. Managing procurement risks becomes critical for sustained growth.

Rising Competition from Substitutes

Cheaper alternatives such as plastic and composite piping systems threaten copper tube demand. These materials offer lower installation costs and are gaining traction in residential plumbing. In HVAC applications, flexible plastic tubes are increasingly adopted for ease of installation. To stay competitive, copper tube manufacturers must focus on quality improvements and innovation. This shift pressures pricing and market positioning strategies.

Regional Analysis

North America

North America holds a 28% market share in the copper tube market, driven by strong demand from HVAC, plumbing, and renewable energy applications. The U.S. leads the region with high adoption of energy-efficient HVAC systems in residential and commercial buildings. The Inflation Reduction Act and green building incentives boost copper tube usage in sustainable infrastructure projects. Manufacturers invest in advanced extrusion and finishing technologies to meet strict quality standards. Growing retrofitting activities in aging buildings further support market expansion, while stable regulatory frameworks enhance long-term growth opportunities.

Europe

Europe accounts for a 24% market share, supported by strict environmental regulations and strong emphasis on energy efficiency. Countries like Germany, France, and the UK lead in adopting copper tubes for HVAC, district heating, and plumbing. The region’s commitment to carbon neutrality accelerates the use of recyclable materials like copper. Modernization of old water networks and district heating infrastructure boosts product demand. Europe’s advanced manufacturing base and R&D investments also drive innovation in corrosion-resistant and high-performance tubes, strengthening its global competitiveness in premium applications.

Asia Pacific

Asia Pacific dominates the market with a 34% market share, driven by rapid urbanization, industrialization, and infrastructure development. China, India, and Japan are major consumers due to growing residential construction and HVAC installations. Government investments in smart cities and renewable energy projects further accelerate demand. Manufacturers benefit from lower production costs and rising domestic consumption. The expansion of district cooling systems and large-scale solar projects creates strong growth potential. Increasing exports from regional producers enhance Asia Pacific’s position as a global manufacturing hub for copper tubing.

Latin America

Latin America holds a 7% market share, supported by expanding construction activities and increased focus on energy-efficient cooling systems. Brazil and Mexico lead in adopting copper tubes for plumbing and HVAC applications. Government initiatives to modernize infrastructure and encourage renewable energy projects strengthen regional demand. However, price fluctuations and import dependency affect market stability. Rising interest in sustainable building materials and investments in urban housing projects present new growth opportunities. Local distribution partnerships are also expanding to improve supply chain efficiency.

Middle East & Africa

The Middle East & Africa region captures a 7% market share, driven by rising investments in large-scale construction, district cooling, and water infrastructure projects. Countries such as the UAE, Saudi Arabia, and South Africa lead regional demand. High-temperature resistance and durability make copper tubes well-suited for extreme climates. Growing tourism infrastructure and urban development boost installation in commercial buildings. Government initiatives promoting sustainable construction further enhance adoption. Although infrastructure gaps and pricing challenges exist, increasing project pipelines and foreign investments strengthen long-term market prospects.

Market Segmentations:

By Product Type:

- Welded copper tubes

- Capillary tubes

By Finish Type:

- Bright annealed copper tubes

- Dark annealed copper tubes

By Application:

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The copper tube market is shaped by leading players such as Mueller Industries Inc., Kobe Steel, Cerro Flow Products LLC, Wieland Group, LUVATA, MetTube Berhad, Cambridge-Lee Industries LLC, Shanghai Metal Corporation, KME Group S.p.A., and MM Kembla. The copper tube market is defined by strong technological advancements, strategic expansions, and sustainability initiatives. Manufacturers are focusing on improving production efficiency through advanced extrusion methods and automated quality control systems. Many companies are investing in eco-friendly manufacturing and recycling processes to meet global green building standards. Expanding distribution networks and forming long-term partnerships with HVAC, plumbing, and construction firms are key strategies to strengthen market positioning. Regional diversification and capacity expansions also help address rising demand across Asia Pacific, North America, and Europe. Continuous R&D drives innovation in corrosion-resistant and high-performance tube solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mueller Industries Inc.

- Kobe Steel

- Cerro Flow Products LLC

- Wieland Group

- LUVATA

- MetTube Berhad

- Cambridge-Lee Industries LLC

- Shanghai Metal Corporation

- KME Group S.p.A.

- MM Kembla

Recent Developments

- In July 2025, Adani Enterprises Limited (AEL) has partnered with MetTube Mauritius Private Limited to strengthen India’s copper tube production. AEL will divest a 50% stake in Kutch Copper Tubes Limited to MetTube and acquire a 50% stake in MetTube Copper India Private Limited.

- In June 2025, Oman inaugurated its first industrial plant to convert legacy copper mining waste into high-purity copper in the Wilayat of Suhar. The plant uses renewable energy and eco-friendly technologies and is developed by Green Tech Mining and Services.

- In March 2025, Lawton Tubes has announced an investment of GBP in an advanced facility to enhance its production of copper tubing products. This strategic expansion is expected to strengthen the company’s position in the copper pipes and tubes market, driving innovation and meeting growing demand.

- In April 2024, Prysmian, a global leader in energy and telecom cable systems, signed a long-term contract with Aurubis, the largest copper recycler and a leading European manufacturer of copper wire rods, to supply significant and progressively increasing volumes of copper wire rods.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Finish Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for copper tubes will increase with rising HVAC and plumbing installations.

- Green building initiatives will boost the use of recyclable copper products.

- Technological innovations will enhance tube durability and performance.

- Renewable energy projects will create new application opportunities.

- Asia Pacific will continue to lead market expansion with strong construction growth.

- Advanced coating technologies will improve corrosion resistance and service life.

- Energy-efficient systems will drive copper adoption in retrofitting projects.

- Recycling and circular economy practices will gain more importance.

- Infrastructure modernization will sustain steady long-term demand.

- Strategic partnerships and capacity expansions will strengthen market competitiveness.