| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Robot Assisted Endoscopy Market Size 2024 |

USD 1,376.79 million |

| Robot Assisted Endoscopy Market, CAGR |

8.32% |

| Robot Assisted Endoscopy Market Size 2032 |

USD 2,729.17 million |

Market Overview

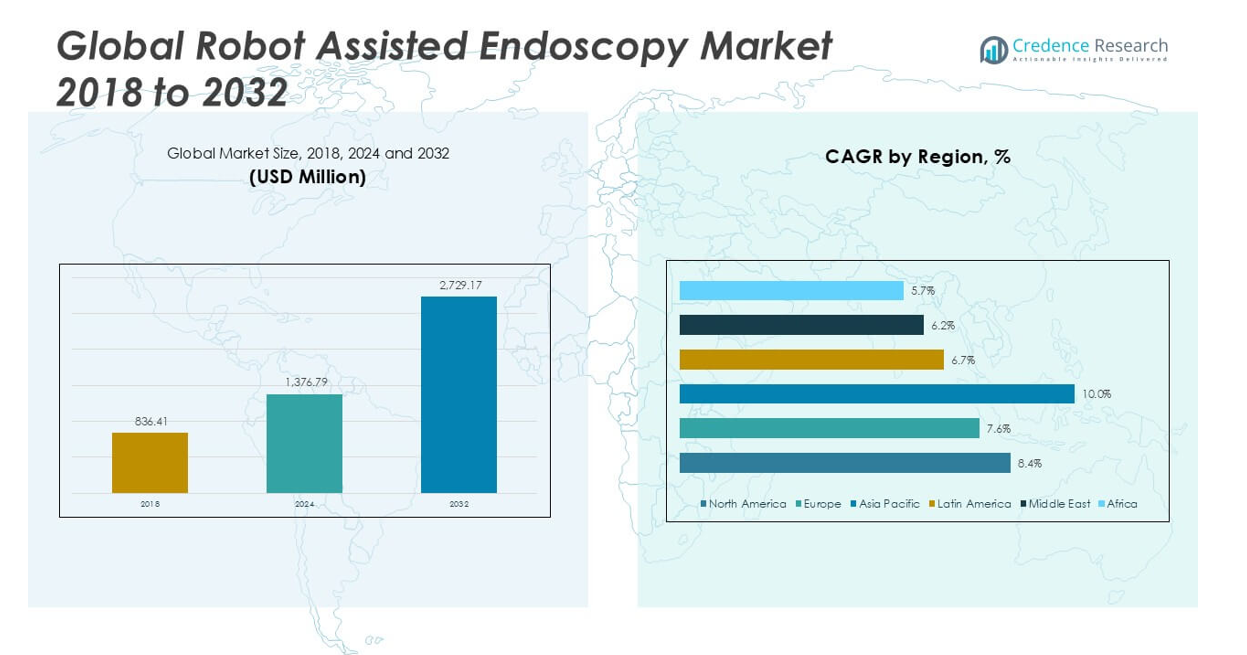

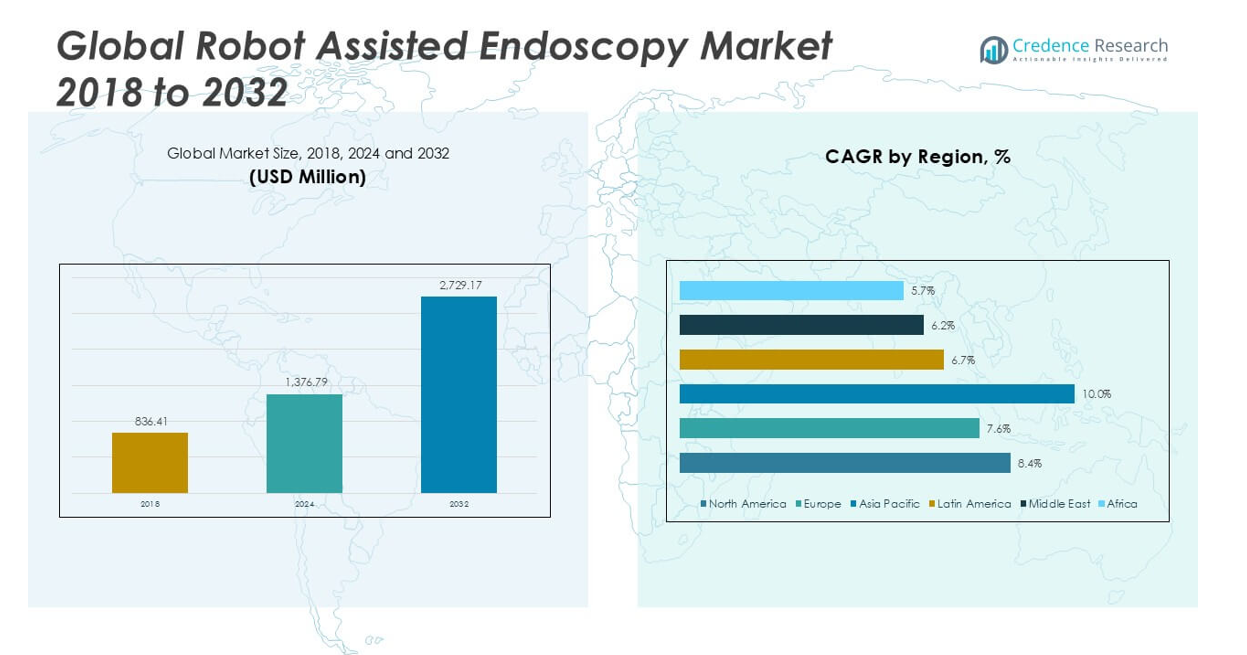

The Robot Assisted Endoscopy Market size was valued at USD 836.41 million in 2018, increased to USD 1,376.79 million in 2024, and is anticipated to reach USD 2,729.17 million by 2032, at a CAGR of 8.32% during the forecast period.

The Robot Assisted Endoscopy Market is experiencing robust growth, fueled by rising demand for minimally invasive procedures, increasing prevalence of gastrointestinal and respiratory disorders, and advancements in robotic technology. Hospitals and surgical centers are rapidly adopting robot-assisted systems to improve procedural accuracy, reduce patient recovery times, and minimize surgical complications. Surgeons benefit from enhanced visualization and precision, enabling complex interventions with greater safety and efficiency. Continuous innovation, including AI integration and improved haptic feedback, is expanding the clinical scope of robot-assisted endoscopy and attracting significant investment from medical device manufacturers. However, the high cost of robotic systems and limited access in lower-income regions remain key challenges. Market trends indicate a shift toward smaller, portable, and more user-friendly robotic platforms, as well as growing utilization in outpatient and ambulatory settings. These factors collectively position robot-assisted endoscopy as a transformative solution in the future of minimally invasive surgery.

The geographical analysis of the Robot Assisted Endoscopy Market highlights significant growth across North America, Europe, and Asia Pacific, driven by advanced healthcare infrastructure, rising demand for minimally invasive procedures, and ongoing technological innovation. North America leads in adoption, with the United States at the forefront due to strong investments in medical robotics and supportive regulatory environments. Europe, with major contributions from Germany and the United Kingdom, continues to embrace robotic solutions to enhance clinical outcomes. Asia Pacific shows rapid expansion, supported by healthcare modernization in China, Japan, and India. Among the key players shaping the competitive landscape are Intuitive Surgical, renowned for its pioneering robotic platforms, Stryker, which offers a diverse range of surgical systems, and Medtronic plc., recognized for its expanding portfolio and global reach. Boston Scientific Corporation is also making notable advancements with innovative technologies for both diagnostic and therapeutic endoscopy applications.

Market Insights

- The Robot Assisted Endoscopy Market is projected to grow from USD 1,376.79 million in 2024 to USD 2,729.17 million by 2032, registering a CAGR of 8.32% during the forecast period.

- Growth is driven by the rising adoption of minimally invasive procedures, with hospitals and surgical centers seeking solutions that reduce patient recovery times and improve clinical outcomes.

- Technological advancements such as artificial intelligence integration, enhanced visualization, and improved haptic feedback are expanding the range of diagnostic and therapeutic applications.

- Key trends include the emergence of compact, portable robotic platforms and the expansion of use beyond hospitals into outpatient and ambulatory surgical centers.

- Leading companies such as Intuitive Surgical, Stryker, Medtronic plc., and Boston Scientific Corporation are focusing on innovation, expanding product portfolios, and strategic collaborations to strengthen their market presence.

- High capital costs, complex learning curves, and limited access in lower-income regions remain major restraints, impacting widespread adoption and technology diffusion.

- North America leads the market due to robust healthcare infrastructure and early adoption, while Europe and Asia Pacific demonstrate strong growth potential fueled by healthcare modernization and increasing procedural volumes

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Increasing Demand for Minimally Invasive Surgical Procedures Drives Adoption

The growing preference for minimally invasive surgical procedures plays a pivotal role in driving the Robot Assisted Endoscopy Market. Patients and healthcare providers are increasingly seeking techniques that offer faster recovery, reduced post-operative pain, and lower complication risks compared to traditional open surgeries. Robot-assisted endoscopy enables surgeons to perform complex procedures through smaller incisions with enhanced precision and control. The benefits of quicker patient discharge and minimized hospital stays support higher adoption rates in both developed and emerging healthcare systems. Hospitals and ambulatory surgical centers are investing in robotic technologies to meet the rising demand for safer, less invasive treatments. The trend toward outpatient procedures further accelerates market growth by expanding the use of advanced endoscopic platforms.

- For instance, Intuitive Surgical’s da Vinci Surgical System has performed over 12 million procedures worldwide, demonstrating the widespread clinical adoption of robot-assisted minimally invasive techniques

Technological Innovations Expand Clinical Capabilities and Application Scope

Technological advancements significantly enhance the capabilities of robot-assisted endoscopic systems, enabling their application in a wider range of clinical specialties. Integration of artificial intelligence, real-time imaging, and improved haptic feedback contributes to superior visualization and surgical accuracy. These innovations not only help surgeons navigate intricate anatomy but also allow for consistent performance in complex and delicate procedures. It enables more predictable patient outcomes and sets a higher standard for minimally invasive interventions. Medical device manufacturers are investing heavily in research and development to bring next-generation robotic systems to market. The ability to address a broader spectrum of conditions continues to position the market for strong, sustained growth.

- For instance, Medtronic’s Hugo™ robotic-assisted surgery system has been installed in more than 20 hospitals since its commercial launch in 2021.

Rising Incidence of Gastrointestinal and Respiratory Disorders Fuels Demand

The increasing prevalence of gastrointestinal and respiratory disorders worldwide generates sustained demand for advanced diagnostic and therapeutic interventions. Robot assisted endoscopy market is benefiting from a surge in procedures targeting colorectal cancer, Barrett’s esophagus, airway obstructions, and other complex conditions. Healthcare systems face growing pressure to deliver high-quality care with improved procedural outcomes and patient safety. Robot-assisted platforms address these challenges by supporting more precise tissue resection, biopsy, and stent placement. It helps clinicians meet rising caseloads efficiently, while patients gain access to state-of-the-art treatments that can improve prognosis and reduce recovery times.

Healthcare Infrastructure Investment and Training Initiatives Accelerate Market Expansion

Global investment in healthcare infrastructure and ongoing surgeon training programs accelerate adoption of robot-assisted endoscopy. Many hospitals and surgical centers are allocating capital to acquire advanced robotic platforms, recognizing the potential for improved operational efficiency and patient satisfaction. The implementation of structured training and certification programs ensures that clinical teams gain proficiency in robotic techniques, further supporting safe and effective adoption. The Robot Assisted Endoscopy Market is also witnessing partnerships between device manufacturers and academic institutions to expand education and awareness. These efforts help to overcome barriers related to cost, usability, and workforce readiness, driving long-term market penetration and growth.

Market Trends

Integration of Artificial Intelligence and Machine Learning Enhances Precision

The integration of artificial intelligence (AI) and machine learning algorithms is a defining trend in the Robot Assisted Endoscopy Market. Advanced AI-driven image recognition supports real-time tissue differentiation, anomaly detection, and procedure planning, helping clinicians make informed decisions during interventions. AI also enables predictive analytics that enhance surgical outcomes and improve workflow efficiency. It allows surgeons to automate repetitive tasks and focus on complex maneuvers, improving consistency and reducing human error. This ongoing evolution toward data-driven surgery positions robotic endoscopy platforms at the forefront of innovation. Companies in the sector are investing heavily in developing proprietary AI solutions tailored for endoscopic applications.

- For instance, Olympus’ ENDO-AID CADe AI technology for colonoscopy has been installed in over 1,000 hospitals since its introduction in 2020.

Expansion of Applications Across Diverse Clinical Specialties

The clinical applications of robot-assisted endoscopy continue to broaden, moving beyond traditional gastrointestinal and pulmonary procedures into urology, gynecology, and ENT surgeries. The Robot Assisted Endoscopy Market benefits from this expansion, as hospitals and ambulatory centers deploy robotic platforms for multiple specialties to optimize capital investment. Multi-specialty integration supports greater utilization rates, while physicians leverage advanced endoscopic capabilities for a wider range of diagnostic and therapeutic procedures. It creates new growth opportunities by addressing unmet needs in minimally invasive care. The trend toward flexible, modular platforms also allows healthcare providers to adapt quickly to evolving clinical requirements and patient demographics.

- For instance, Stryker’s navigation and visualization platforms are now used in over 10,000 operating rooms worldwide, supporting diverse robotic procedures.

Emergence of Portable and User-Friendly Robotic Platforms

A shift toward smaller, more portable, and user-friendly robotic systems is gaining momentum across the market. Compact designs enable easier installation in operating rooms and facilitate use in outpatient and ambulatory settings. The Robot Assisted Endoscopy Market is responding to customer demand for flexible platforms that require less specialized infrastructure and offer intuitive controls. It helps lower the barriers for adoption among smaller healthcare providers and community hospitals. User-centric design and simplified workflows are making robotic endoscopy accessible to a broader segment of the clinical workforce. This trend supports higher penetration rates, particularly in regions with limited access to advanced surgical technology.

Increased Focus on Training, Collaboration, and Remote Capabilities

There is a growing emphasis on comprehensive training, multidisciplinary collaboration, and the development of remote capabilities in the field. Manufacturers and academic institutions are working together to create simulation-based training programs that ensure clinicians achieve proficiency in robotic endoscopy. The Robot Assisted Endoscopy Market is seeing a rise in remote proctoring, tele-mentoring, and virtual support systems, allowing experts to assist and guide procedures from a distance. It supports global knowledge transfer and helps standardize best practices across different healthcare environments. These developments are fostering a collaborative ecosystem that drives innovation and elevates procedural quality worldwide.

Market Challenges Analysis

High Capital Costs and Limited Accessibility Restrict Widespread Adoption

High capital investment requirements for robotic platforms, maintenance, and specialized consumables create significant financial barriers for many healthcare institutions. Smaller hospitals and clinics often struggle to justify the initial expenditure, which limits the reach of advanced robotic endoscopy systems to larger, well-funded medical centers. The Robot Assisted Endoscopy Market must address these cost challenges to broaden adoption, especially in emerging economies. Limited reimbursement policies for robot-assisted procedures further constrain market expansion and put pressure on providers to demonstrate clear clinical and economic benefits. It leads to slower technology diffusion and persistent disparities in patient access to advanced care. The financial constraints also affect the pace of upgrades and adoption of next-generation systems.

Complex Learning Curve and Integration Issues Slow Clinical Uptake

Robotic endoscopy platforms require surgeons and support staff to acquire new technical skills and adapt to novel workflows, which can slow clinical uptake. The complex learning curve can deter some clinicians from fully embracing robotic technologies, especially in facilities with limited training resources. Integration of robotic systems with existing hospital infrastructure, electronic health records, and perioperative processes remains a challenge for many organizations. It can result in workflow disruptions and initial productivity losses during the transition phase. The Robot Assisted Endoscopy Market must prioritize solutions that streamline integration and simplify training to ensure long-term success. Addressing these challenges will be critical for unlocking the full potential of robotic endoscopy in mainstream healthcare.

Market Opportunities

Rising Demand in Emerging Markets and Ambulatory Settings Creates Expansion Potential

Rapid healthcare infrastructure development and increased healthcare expenditure in emerging markets present strong opportunities for the Robot Assisted Endoscopy Market. Hospitals in these regions are seeking advanced technologies to address rising patient volumes and improve procedural outcomes. Growing adoption of minimally invasive procedures in ambulatory surgical centers supports further expansion beyond traditional hospital settings. Manufacturers can tap into these markets by offering cost-effective, compact, and scalable robotic platforms tailored to local needs. It helps to bridge access gaps and accelerates the transition to advanced endoscopic solutions. Partnerships with regional healthcare providers and government initiatives focused on technology adoption can drive robust growth.

Continuous Innovation and Integration of Advanced Technologies Fuel New Use Cases

Ongoing advancements in artificial intelligence, imaging, and remote connectivity open new avenues for clinical application and differentiation in the Robot Assisted Endoscopy Market. Integration of AI-driven analytics and enhanced visualization tools increases the precision, safety, and efficiency of complex endoscopic procedures. Tele-mentoring, remote support, and simulation-based training expand the reach of expert knowledge, supporting clinician proficiency even in resource-limited settings. It enables healthcare providers to achieve higher standards of care while addressing workforce shortages. Companies that prioritize user-friendly interfaces and seamless integration with digital health systems stand to capitalize on these evolving opportunities.

Market Segmentation Analysis:

By Product:

The Robot Assisted Endoscopy Market divides into diagnostic and therapeutic segments, each serving critical roles in modern healthcare. Diagnostic robot-assisted endoscopy has seen increasing adoption, driven by the need for precise visualization and accurate detection of gastrointestinal, respiratory, and urological conditions. Hospitals and clinicians rely on these advanced platforms to improve early disease identification and enhance patient outcomes. The demand for diagnostic solutions remains high as healthcare providers prioritize minimally invasive approaches that lower patient risk and recovery times. The therapeutic segment is also gaining significant momentum, supported by technological advances that allow complex interventions, such as tissue resection, stent placement, and polyp removal, with heightened precision. It enables surgeons to address a broader spectrum of disorders during endoscopic procedures, which supports wider clinical adoption and improved patient satisfaction. The integration of AI, enhanced imaging, and haptic feedback continues to expand the boundaries of both diagnostic and therapeutic applications.

- For instance, Boston Scientific’s SpyGlass™ DS System has been used in more than 350,000 procedures globally since its launch.

By End-User:

End-user segmentation in the Robot Assisted Endoscopy Market includes hospitals, outpatient facilities, ambulatory surgical centers, and others. Hospitals account for the largest share, given their access to capital, skilled professionals, and the infrastructure required to support robotic platforms. Many leading institutions integrate robot-assisted endoscopy into their standard of care to improve procedural outcomes and attract patients seeking advanced treatment options. Outpatient facilities are rapidly adopting robotic systems due to the shift toward same-day procedures and the drive to reduce overall healthcare costs. These settings benefit from compact, portable robotic platforms that deliver high performance while fitting into existing workflows. Ambulatory surgical centers represent a growth area, supported by rising demand for minimally invasive interventions that allow faster patient turnover and lower risk profiles. It is evident that user-friendly interfaces and scalable solutions are expanding the market reach, while the “others” category which includes specialty clinics and research centers—adds to the market’s diversity by embracing robotic systems for both routine and experimental applications.

- For instance, Corindus, a Siemens Healthineers company, reported installation of its CorPath GRX system in over 100 hospitals in the United States for robot-assisted vascular and endoscopic procedures.

Segments:

Based on Product:

Based on End-User:

- Hospitals

- Outpatient Facilities

- Ambulatory Surgical Centers

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Robot Assisted Endoscopy Market

North America Robot Assisted Endoscopy Market grew from USD 334.11 million in 2018 to USD 543.72 million in 2024 and is projected to reach USD 1,081.08 million by 2032, reflecting a compound annual growth rate (CAGR) of 8.4%. North America is holding a 39.6% market share. The United States dominates the region, supported by advanced healthcare infrastructure, robust adoption of new surgical technologies, and strong presence of key industry players. Canada also contributes significantly with its increasing investments in hospital robotics and emphasis on minimally invasive procedures. Hospitals and ambulatory surgical centers in this region continue to lead innovation in clinical practice, expanding the role of robot-assisted endoscopy across multiple specialties.

Europe Robot Assisted Endoscopy Market

Europe Robot Assisted Endoscopy Market grew from USD 257.15 million in 2018 to USD 409.21 million in 2024 and is projected to reach USD 767.51 million by 2032, at a CAGR of 7.6%. Europe is capturing a 28.1% market share. Germany, the United Kingdom, and France are key countries driving market growth, leveraging advanced healthcare systems and favorable reimbursement policies. Hospitals across Europe invest in training and infrastructure to deploy robotic platforms for both diagnostic and therapeutic applications. The region demonstrates a steady increase in adoption, particularly for gastrointestinal and pulmonary procedures.

Asia Pacific Robot Assisted Endoscopy Market

Asia Pacific Robot Assisted Endoscopy Market grew from USD 165.99 million in 2018 to USD 295.45 million in 2024 and is forecast to reach USD 661.09 million by 2032, posting the highest CAGR of 10.0%. Asia Pacific holds a 24.2% market share. China, Japan, and India are central to market expansion, driven by rapid healthcare modernization and rising patient demand for advanced surgical care. The market benefits from government initiatives supporting medical technology upgrades and growing investments by regional healthcare providers. Increasing awareness of the benefits of minimally invasive procedures fuels strong uptake across both urban and rural healthcare settings.

Latin America Robot Assisted Endoscopy Market

Latin America Robot Assisted Endoscopy Market grew from USD 39.60 million in 2018 to USD 64.37 million in 2024 and is projected to reach USD 112.97 million by 2032, with a CAGR of 6.7%. Latin America accounts for 4.1% of the market share. Brazil and Mexico are leading contributors, supported by their large populations and ongoing healthcare reforms. Private hospitals and specialty clinics are at the forefront of adopting robotic technologies to enhance surgical precision and patient outcomes. The market remains relatively nascent but demonstrates promising growth potential as access to capital and awareness increase.

Middle East Robot Assisted Endoscopy Market

Middle East Robot Assisted Endoscopy Market grew from USD 24.64 million in 2018 to USD 37.24 million in 2024 and is estimated to reach USD 62.91 million by 2032, reflecting a CAGR of 6.2%. The Middle East represents a 2.3% market share. The United Arab Emirates and Saudi Arabia lead market development, supported by investments in world-class healthcare facilities and medical tourism initiatives. Hospitals in these countries seek to differentiate their services by offering advanced robotic procedures. The region is witnessing steady progress, although high costs and training requirements remain key barriers.

Africa Robot Assisted Endoscopy Market

Africa Robot Assisted Endoscopy Market grew from USD 14.92 million in 2018 to USD 26.80 million in 2024 and is forecasted to reach USD 43.62 million by 2032, with a CAGR of 5.7%. Africa holds a 1.6% market share. South Africa and Egypt are emerging as key markets, with a growing focus on expanding healthcare access and investing in surgical innovation. Adoption of robot-assisted endoscopy remains limited to top-tier hospitals and urban centers due to high costs and infrastructure constraints. It presents opportunities for manufacturers willing to partner on affordable solutions and training programs to accelerate regional growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Stryker

- Brainlab AG

- Medtronic plc.

- Boston Scientific Corporation

- Auris Health, Inc.

- Johnson & Johnson Services, Inc.

- Asensus Surgical US, Inc.

- Intuitive Surgical

- Corindus Inc.

- Renishaw plc

Competitive Analysis

The competitive landscape of the Robot Assisted Endoscopy Market is shaped by technological innovation, portfolio diversification, and global expansion strategies among leading players. Key companies in this sector include Intuitive Surgical, Stryker, Medtronic plc., Boston Scientific Corporation, Auris Health, Inc., Johnson & Johnson Services, Inc., Asensus Surgical US, Inc., Brainlab AG, Corindus Inc., and Renishaw plc. Intuitive Surgical remains a pioneer with its advanced robotic platforms and strong brand reputation, consistently investing in R&D to maintain technological leadership. The market sees strong emphasis on user-friendly designs, modular solutions, and training programs to boost adoption among hospitals and outpatient facilities. Strategic partnerships, collaborations, and acquisitions are common approaches to enter new markets and strengthen clinical relationships. Competitors also focus on offering comprehensive support services and after-sales training to ensure long-term customer satisfaction and loyalty. The intensity of competition drives rapid technological advancements and helps set new standards for procedural safety, accuracy, and efficiency. Companies strive to gain a competitive edge by addressing unmet clinical needs and continuously enhancing the overall user experience.

Recent Developments

- In October 2024, CMR Surgical (CMR), a global leader in surgical robotics, today announced that the U.S. Food and Drug Administration (FDA) has granted marketing authorization for the Versius Surgical System (Versius). This approval marks a significant milestone, enabling the introduction of a next-generation, versatile, adaptable, and digitally advanced surgical robot into the U.S. market.

- In October 2024, A research team led by Tian Qiu at the German Cancer Research Center (DKFZ) in Dresden has developed an innovative solution to address both challenges. Their creation, the TrainBot, links multiple individual robots on a millimeter scale, with each unit featuring enhanced anti-slip feet for improved functionality.

- In February 2024, A recent study published in the KeAi journal Intelligent Surgery details the first-ever robot-assisted remote radical distal gastrectomy conducted using 5G communication technology. The procedure, carried out by a research team from China, represents a significant advancement in the integration of cutting-edge surgical robotics and high-speed connectivity.

- In January 2023, Fujifilm expanded its endoscopy solutions portfolio for therapeutic gastrointestinal applications. This expansion may help the company to enhance its market positioning and generate greater revenue in coming years.

- In December 2022, Medtronic announced the enrollment of the first patient in the Expand URO U.S. clinical trial for the Hugo robotic-assisted surgery (RAS) system, which is intended to be used for urologic surgical procedures including radical prostatectomy, radical cystectomy, and nephrectomy procedures at sites in the country. This initiative may improve the company’s positioning in the robotic endoscopy device market and enable more customer base.

Market Concentration & Characteristics

The Robot Assisted Endoscopy Market exhibits moderate to high market concentration, with a few global manufacturers holding significant shares due to strong technological expertise and robust product portfolios. It features a blend of established industry leaders and emerging innovators, each driving advancements in robotic technology and clinical applications. The market is characterized by rapid technological evolution, with companies introducing platforms that offer improved visualization, greater precision, and enhanced user interfaces. Hospitals and surgical centers value reliability, comprehensive training, and post-installation support, making service quality a key differentiator. The sector demonstrates high entry barriers due to the need for significant capital investment, regulatory approvals, and complex product development processes. It maintains a strong focus on minimally invasive procedures, user-centric design, and integration with digital healthcare systems, which together support consistent demand and long-term growth prospects.

Report Coverage

The research report offers an in-depth analysis based on Product, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth due to increasing demand for minimally invasive surgical procedures.

- Advancements in robotic technologies will continue to enhance the precision and efficiency of endoscopic interventions.

- Rising prevalence of gastrointestinal disorders will drive the adoption of robot-assisted endoscopy systems.

- Hospitals and specialty clinics will invest more in robotic platforms to improve patient outcomes and reduce recovery times.

- Growing awareness among healthcare professionals about the benefits of robot-assisted techniques will support market expansion.

- Integration of artificial intelligence and machine learning will further refine endoscopic navigation and diagnostics.

- Regulatory approvals for new robotic endoscopy systems will accelerate their availability in emerging markets.

- Strategic collaborations between medical device companies and research institutions will fuel innovation in this space.

- High initial costs may slow adoption in some regions, but rental and leasing models will help mitigate this barrier.

- Asia Pacific and Latin America will emerge as high-potential markets due to rising healthcare infrastructure and surgical demand.