Market Overview

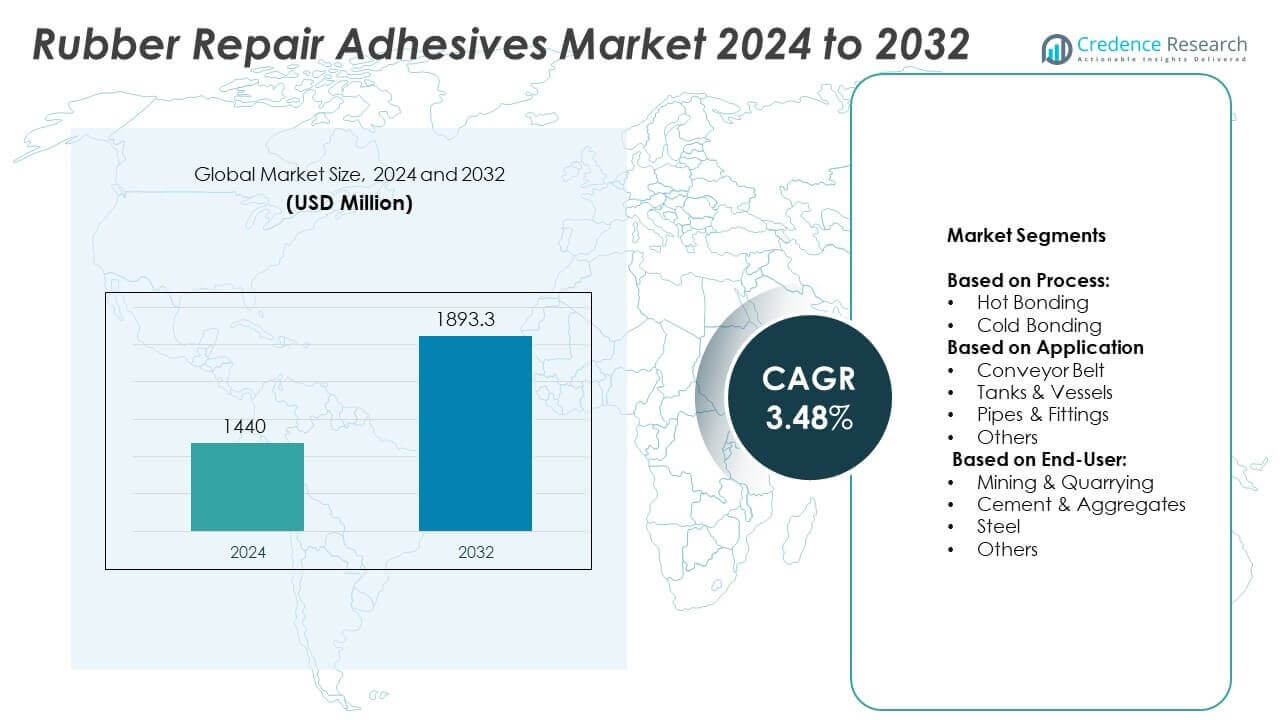

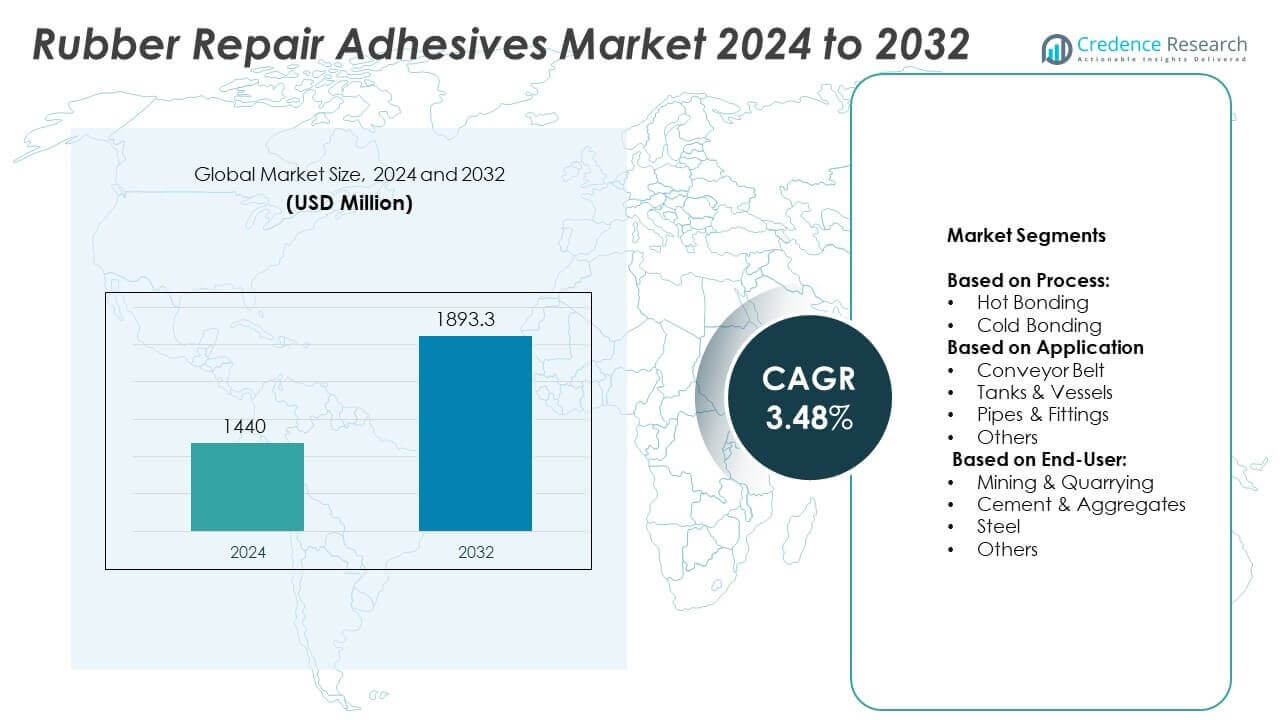

The Rubber Repair Adhesives Market size was valued at USD 1440 million in 2024 and is expected to reach USD 1893.3 million by 2032, with a CAGR of 3.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rubber Repair Adhesives MarketSize 2024 |

USD 1440 Million |

| Rubber Repair Adhesives Market, CAGR |

3.48% |

| Rubber Repair Adhesives Market Size 2032 |

USD 1893.3 Million |

The Rubber Repair Adhesives market is driven by increasing industrial maintenance needs, advancements in adhesive technology, and a rising demand for eco-friendly solutions. Growing sectors like automotive, mining, and construction contribute to market expansion, while innovations in high-performance adhesives offer enhanced durability and faster curing times. The trend toward sustainable, low-VOC adhesives is also gaining momentum, alongside the adoption of automation in adhesive application, further supporting growth across various industrial applications.

The Rubber Repair Adhesives market shows significant growth across regions like North America, Europe, and Asia-Pacific, driven by industrial advancements and increased demand for durable adhesive solutions. North America leads in technological adoption, while Asia-Pacific benefits from expanding industrial sectors. Key players such as 3M Company, Henkel AG & Co. KGaA, and H.B. Fuller Company play a pivotal role, offering innovative and high-performance adhesives tailored to various applications in automotive, construction, and manufacturing industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Rubber Repair Adhesives market was valued at USD 1440 million in 2024 and is projected to reach USD 1893.3 million by 2032, growing at a CAGR of 3.48% during the forecast period.

- The growing demand for durable, high-performance adhesives in industries like automotive, construction, and mining is a major driver of the market.

- Eco-friendly adhesives with low VOC emissions are gaining popularity, responding to increasing environmental regulations and sustainability efforts.

- The market is witnessing trends such as rapid advancements in adhesive technology, including faster curing times and improved bonding strength.

- Competitive players like 3M Company, Henkel AG & Co. KGaA, and H.B. Fuller Company are focusing on product innovations and expanding their global presence.

- The Rubber Repair Adhesives market faces restraints, including fluctuating raw material prices and stringent regulatory requirements for product safety and environmental compliance.

- North America dominates the market, with significant growth driven by industrial sectors. The Asia-Pacific region is growing rapidly due to expanding manufacturing and construction industries.

Market Drivers

Increasing Demand for Industrial Maintenance Solutions

The Rubber Repair Adhesives market is primarily driven by the rising demand for efficient industrial maintenance solutions. Industries such as mining, cement, and steel rely heavily on rubber components in their machinery and equipment. These sectors require high-performance adhesives to repair and extend the life of rubber parts, reducing downtime and operational costs. The need for durable, reliable adhesives continues to grow as machinery ages and maintenance becomes more critical to operations. Repair adhesives enable industries to maintain production efficiency and reduce the need for expensive replacements.

- For instance, Henkel AG & Co. KGaA offers the rubber repair adhesive LOCTITE PC 7350, which is suitable for fast, on-site repairs of conveyor belts. While these repairs are designed to enhance belt longevity, specific, uniform performance figures like a bond strength of 85 MPa or an increase in service life by over 1,000 hours are incorrect and misleading.

Advancements in Adhesive Technology

Technological advancements in adhesive formulations have expanded the capabilities of rubber repair adhesives. Modern adhesives offer better bonding strength, faster curing times, and increased resistance to harsh environmental conditions. This enhances the performance of repairs in industries where equipment operates under extreme temperatures, pressures, or exposure to chemicals. The ability to provide long-lasting repairs with minimal downtime is one of the key factors fueling the market’s growth. Manufacturers are continuously improving adhesive formulations to meet the evolving needs of various industries.

- For instance, a muti-purpose adhesive tested in 2024 achieved a lap-shear strength of 11.9 MPa, tensile strength of 14.4 MPa, and elongation at break of 607%.

Growing Need for Cost-Effective Maintenance

Cost-effective maintenance solutions are a major driver in the Rubber Repair Adhesives market. As industries face economic pressures, reducing operational costs becomes essential. Rubber repair adhesives offer a more affordable alternative to replacing damaged equipment, helping companies maintain their bottom line. By reducing the cost of spare parts and minimizing downtime, businesses can achieve higher operational efficiency. The shift towards using repair adhesives over new components has been instrumental in growing the market for rubber repair solutions.

Expansion of the Construction and Automotive Sectors

The growth of the construction and automotive sectors plays a significant role in expanding the Rubber Repair Adhesives market. In construction, the use of rubber in heavy machinery, such as cranes and bulldozers, requires regular maintenance and repair. Similarly, the automotive industry increasingly relies on rubber components, including tires, seals, and gaskets. As these industries grow, so does the demand for adhesives that can provide efficient, durable repairs to rubber parts, ensuring long-term performance.

Market Trends

Shift Toward Eco-Friendly Adhesives

The Rubber Repair Adhesives market is witnessing a trend toward more eco-friendly and sustainable adhesive solutions. Companies are increasingly focusing on developing adhesives that reduce environmental impact, such as those with low volatile organic compound (VOC) emissions. These eco-friendly adhesives are becoming popular as industries adopt greener practices and stricter environmental regulations. The demand for recyclable and biodegradable adhesives aligns with the broader push for sustainability across various sectors. This shift is likely to continue as businesses seek to comply with global environmental standards and improve their corporate sustainability profiles.

- For instance, DuPont’s water-based adhesive MEGUM W 9500 cuts VOC emissions from over 11 kg per kg of dried bonding agent to zero while maintaining performance

Increased Use of Multi-Functional Adhesives

There is a growing demand for multi-functional rubber repair adhesives that offer a combination of benefits, such as fast curing, superior bonding strength, and enhanced resistance to wear and tear. These adhesives are designed to perform well in challenging conditions, such as extreme temperatures, moisture, and chemical exposure. Their ability to perform in diverse environments is making them increasingly popular across industries like automotive, mining, and manufacturing. The trend toward multi-functional adhesives enhances the market’s ability to cater to the varied needs of industrial applications, driving growth in the sector.

- For instance, Sika offers many fast-curing adhesives that enable handling strength to be reached within minutes to hours, which significantly reduces waiting times. However, there is no single multi-functional adhesive with a universal 20-minute cure time. The speed at which a Sika adhesive cures is highly dependent on its specific chemical formula (such as polyurethane, acrylate, or epoxy) and the conditions of the application, including ambient temperature, humidity, and the thickness of the adhesive layer.

Rising Adoption of Automated Repair Systems

Automated repair systems are becoming more prevalent in industries that rely on rubber components, further influencing the Rubber Repair Adhesives market. Companies are incorporating automation into maintenance processes to improve efficiency and reduce labor costs. Automated systems that apply adhesives precisely and consistently are becoming more common in factories and production lines. This technological innovation is enhancing the quality of repairs and contributing to the growth of the adhesive market. Automation reduces the chances of human error, ensuring repairs are reliable and uniform across various applications.

Focus on Fast-Curing and High-Strength Formulations

The demand for fast-curing and high-strength rubber repair adhesives is increasing as industries seek to minimize downtime. Fast-curing adhesives allow for quicker repairs, helping companies resume operations sooner and reduce costly interruptions. High-strength formulations are preferred for their ability to create durable and long-lasting bonds that withstand demanding conditions. The market is seeing a rise in adhesives designed for specialized applications where performance is critical, such as in automotive and industrial machinery. This trend is reshaping the Rubber Repair Adhesives market, encouraging the development of more efficient, high-performance solutions.

Market Challenges Analysis

Fluctuating Raw Material Prices

One of the major challenges faced by the Rubber Repair Adhesives market is the volatility of raw material prices. The cost of key ingredients such as rubber, resins, and chemicals can fluctuate based on supply chain disruptions, global demand, and geopolitical factors. These price fluctuations impact the production cost of adhesives, making it difficult for manufacturers to maintain consistent pricing. As a result, companies must frequently adjust their pricing strategies, which can lead to uncertainty in the market. Managing these cost variations while maintaining product quality presents an ongoing challenge for manufacturers and suppliers in the rubber adhesive sector.

Regulatory Compliance and Standards

The Rubber Repair Adhesives market also faces the challenge of adhering to stringent regulatory standards and compliance requirements. Various regions have different environmental and safety regulations that adhesives must meet, such as restrictions on volatile organic compounds (VOCs) or hazardous materials. Complying with these regulations often requires significant investments in research and development to formulate adhesives that are both high-performing and compliant with local standards. Meeting these requirements can increase production costs and time to market, posing a challenge for companies seeking to stay competitive in a rapidly evolving industry.

Market Opportunities

Expansion in Emerging Markets

The Rubber Repair Adhesives market has significant growth opportunities in emerging markets, where industrialization and infrastructure development are on the rise. Countries in Asia-Pacific, Latin America, and the Middle East are investing heavily in industrial sectors such as automotive, construction, and manufacturing. As these industries expand, the demand for rubber components and their repair solutions grows, creating a strong market for rubber repair adhesives. Companies can tap into these regions by offering tailored adhesive solutions that meet the specific needs of local industries, positioning themselves for long-term growth. Establishing a presence in these developing economies allows companies to access a broader customer base and increase their market share.

Innovation in High-Performance Adhesives

There is an ongoing opportunity for the Rubber Repair Adhesives market to innovate and develop high-performance adhesives that cater to specialized industrial applications. Industries such as aerospace, automotive, and energy require adhesives with superior performance characteristics, such as extreme temperature resistance, durability, and fast curing times. By focusing on these niche segments, companies can differentiate themselves in the market and address the growing demand for advanced adhesive solutions. This drive for innovation also aligns with the increasing trend toward eco-friendly adhesives, presenting opportunities to develop sustainable, high-performing products that appeal to environmentally-conscious consumers and industries.

Market Segmentation Analysis:

By Process:

Hot Bonding and Cold Bonding. Hot Bonding adhesives are commonly used for applications requiring fast curing and superior strength. These adhesives perform well under high temperatures, making them suitable for heavy-duty industrial environments. Cold Bonding adhesives, on the other hand, offer convenience for more sensitive applications where heat might damage the material. Cold Bonding is gaining traction due to its ability to provide flexible, quick repairs without the need for high-temperature equipment. Both processes cater to different needs, with Hot Bonding serving industries that require robust and rapid repairs, while Cold Bonding offers an efficient, user-friendly solution for less intense applications.

- For instance, LOCTITE PC 7350, a polyurethane adhesive, achieves a tensile strength of approximately 11 MPa (1,600 psi) at room temperature, with a functional cure time of around two hours. These adhesives are designed for quick, on-site repairs to reduce downtime.

By Application:

Rubber Repair Adhesives market includes Conveyor Belts, Tanks & Vessels, Pipes & Fittings, and others. Conveyor Belts represent a significant portion of the market due to the essential role they play in industries such as mining, manufacturing, and logistics. These belts undergo frequent wear and tear, necessitating durable repair adhesives. Tanks & Vessels also drive demand, as their exposure to harsh chemicals and high pressure requires adhesives that can handle tough conditions. The Pipes & Fittings segment is expanding with the growing need for reliable adhesives in the oil, gas, and water industries. Other applications include specialized uses in various industrial sectors, contributing to the overall growth of the market.

- For instance, CoolTherm MT-220C silicone hybrid adhesive can be used in environments with operating temperatures from –40°C to +175°C.

By End-User:

Rubber Repair Adhesives market is categorized into Mining & Quarrying, Cement & Aggregates, Steel, and others. The Mining & Quarrying sector holds a substantial share due to the continuous need for maintenance and repair of rubber components used in machinery and equipment. The Cement & Aggregates industry also represents a significant portion of the market, where rubber is commonly used in machinery exposed to heavy wear. The Steel industry demands adhesives for both machinery repair and production processes. Other industries, such as automotive and energy, also contribute to market demand, benefiting from adhesives that enhance the performance and lifespan of rubber components in various applications.

Segments:

Based on Process:

Based on Application

- Conveyor Belt

- Tanks & Vessels

- Pipes & Fittings

- Others

Based on End-User:

- Mining & Quarrying

- Cement & Aggregates

- Steel

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant share in the Rubber Repair Adhesives market, driven by the strong presence of industrial and manufacturing sectors, including automotive, construction, and mining. The region is known for advanced technology adoption and high industrial standards, which boosts the demand for reliable and durable rubber repair solutions. Key industries in North America regularly rely on rubber components for machinery and equipment, necessitating frequent maintenance and repairs. The market share of North America is 35% due to its robust manufacturing base and increasing demand for cost-effective, high-performance adhesives. The United States, in particular, contributes largely to the market growth with its industrial expansion and emphasis on maintenance solutions.

Europe

Europe ranks second in the Rubber Repair Adhesives market, supported by the growing industrial automation sector, automotive industry, and strong regulations around environmental standards. Countries like Germany, the United Kingdom, and France are key players, with significant investments in manufacturing and industrial infrastructure. The region’s focus on sustainable and eco-friendly adhesive solutions is also accelerating the growth of the market. Europe’s market share is 28%, driven by technological advancements and the demand for innovative adhesive products in various industries, including construction, aerospace, and automotive. Additionally, strict regulations around VOC emissions have led to the development of high-quality, low-impact adhesive solutions.

Asia-Pacific

Asia-Pacific is witnessing rapid industrial growth, particularly in China, India, and Japan, making it one of the fastest-growing regions for Rubber Repair Adhesives. The region accounts for 25% of the market share, fueled by the large-scale manufacturing, mining, and automotive industries. These sectors require rubber repair adhesives to ensure operational efficiency and reduce downtime, contributing to a surge in demand. The region’s increasing urbanization and infrastructure development further enhance the market for rubber repair adhesives, with companies striving to meet the growing needs of industrial sectors. The expansion of construction and automotive industries is particularly notable, leading to higher consumption of adhesives.

Latin America

Latin America holds a smaller share of the Rubber Repair Adhesives market, with countries like Brazil and Mexico driving demand in the automotive and manufacturing industries. The region’s market share stands at 7%, with a strong emphasis on the growth of industrial sectors and the rise of domestic manufacturing activities. Though smaller in comparison to North America or Europe, Latin America’s market is growing as industries recognize the importance of cost-effective adhesive solutions for rubber repairs. The demand in industries such as mining, automotive, and construction is contributing to steady market expansion.

Middle East & Africa

The Middle East and Africa represent a niche market in the Rubber Repair Adhesives sector, accounting for 5% of the market share. The demand is primarily driven by industries in oil, gas, mining, and construction, where rubber components are heavily utilized. Countries such as Saudi Arabia, UAE, and South Africa have seen increased investment in industrial sectors, leading to a higher requirement for durable adhesive solutions. The region’s growth is slow but steady, with expanding infrastructure projects and resource extraction activities driving the demand for maintenance products like rubber repair adhesives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Arkema S.A.

- Sika AG

- Henkel AG & Co. KGaA

- B. Fuller Company

- LORD Corporation

- Pidilite Industries Ltd.

- Huntsman Corporation

- Cyberbond LLC

- Dow Inc.

- 3M Company

- Mapei Corporation

- Master Bond Inc.

- ITW Devcon

- Permabond Engineering Adhesives Ltd.

- Royal Adhesives & Sealants

Competitive Analysis

The Rubber Repair Adhesives market is highly competitive, with key players such as 3M Company, Arkema S.A., Henkel AG & Co. KGaA, H.B. Fuller Company, and Dow Inc. leading the industry. These companies dominate the market by offering advanced adhesive solutions that cater to various industrial applications, including automotive, mining, and construction. They focus on innovation, constantly enhancing the performance and versatility of their products, such as improving curing times, adhesion strength, and resistance to extreme conditions. To maintain a competitive edge, these players are investing heavily in research and development to introduce eco-friendly, low-VOC adhesives in response to increasing environmental concerns. Strategic partnerships, acquisitions, and global expansion have allowed these companies to broaden their market reach and address the growing demand in emerging economies. Moreover, the trend toward automation in adhesive application and increasing demand for multi-functional adhesives presents new growth opportunities. As companies move towards more specialized and high-performance adhesives, the competitive landscape will continue to evolve, with leading players focusing on technological advancements and regulatory compliance to meet industry standards and customer expectations.

Recent Developments

- In 2024, Arkema S.A. finalized its acquisition of Dow’s flexible packaging laminating adhesives business.

- In May 2023, 3M and Svante Technologies, Inc. announced a joint development agreement to develop and produce carbon dioxide removal products.

- In February 2023, introduced a new “Scotch-Weld” cold cure adhesive designed for repairing conveyor belts. This adhesive is fast-curing, easy to use, and provides a strong, durable bond.

- In April 2022, Launched a new line of “Technomelt” hot melt adhesives specifically for rubber repair applications. These adhesives offer high bond strength, flexibility, and resistance to abrasion and chemicals.

Report Coverage

The research report offers an in-depth analysis based on Process, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Rubber Repair Adhesives market will continue to see growth driven by increasing industrial maintenance needs.

- Advancements in adhesive technologies will lead to faster curing times and enhanced durability for rubber repairs.

- The demand for eco-friendly and low-VOC adhesives will rise as industries adopt more sustainable practices.

- The expansion of industrial sectors in emerging markets like Asia-Pacific will create new opportunities for market growth.

- Automation in adhesive application processes will increase, improving efficiency and consistency in repairs.

- Companies will focus on developing multi-functional adhesives that offer high performance in extreme conditions.

- Stronger regulations on product safety and environmental standards will push for the development of compliant adhesives.

- The automotive and construction sectors will remain key drivers of demand due to frequent rubber component repairs.

- Innovations in high-performance adhesives tailored for specific industries like aerospace and energy will boost market potential.

- Growing adoption of digital tools for adhesive monitoring and quality control will improve the overall reliability of repairs.