Market Overview

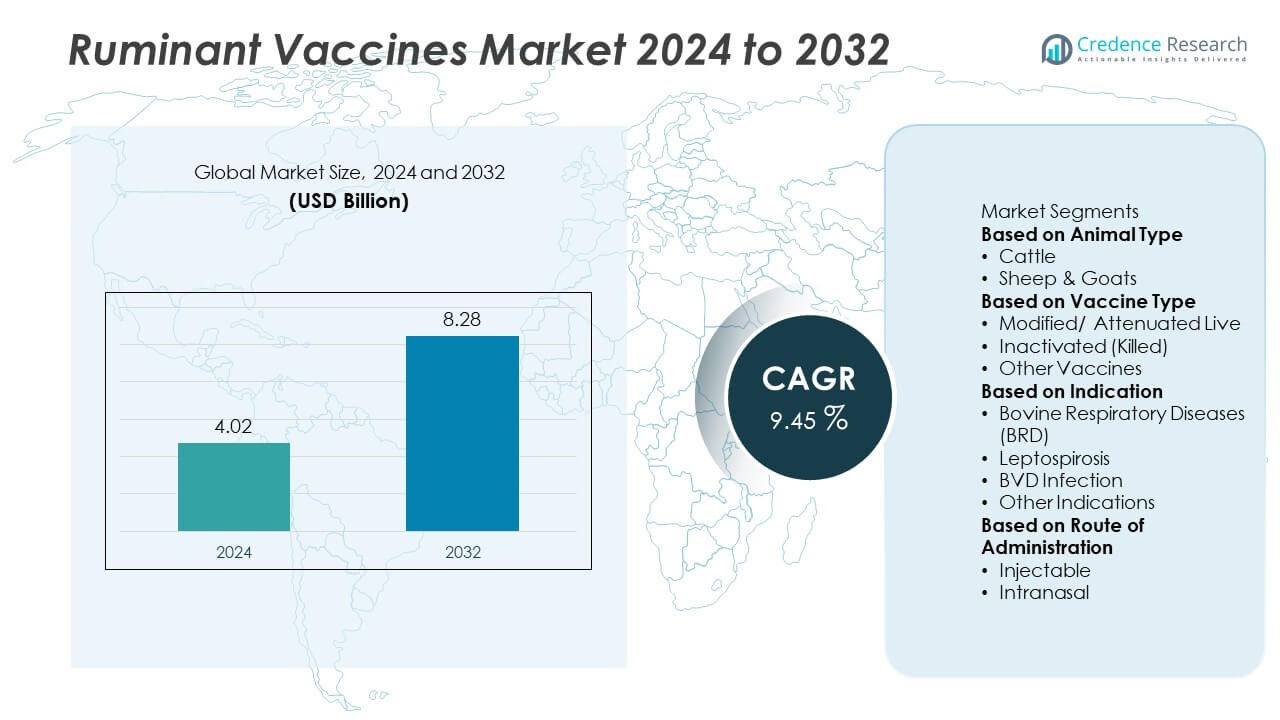

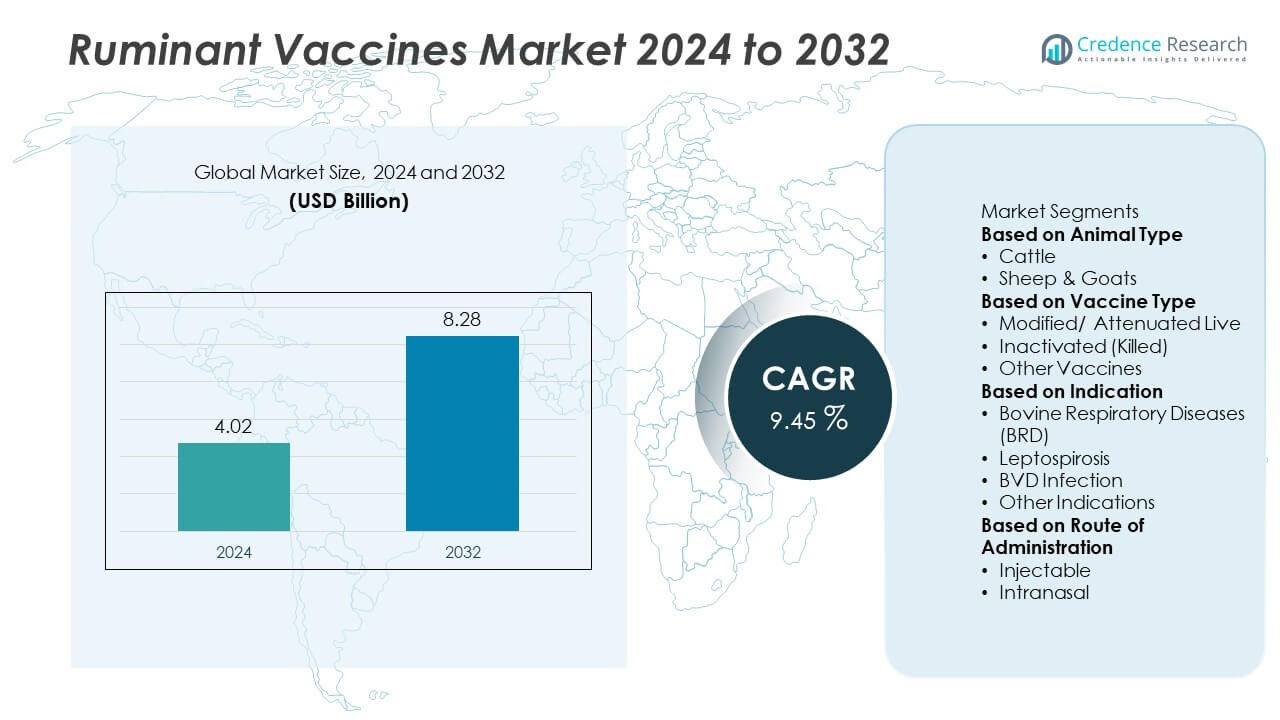

The Ruminant Vaccines market was valued at USD 4.02 billion in 2024 and is projected to reach USD 8.28 billion by 2032, growing at a CAGR of 9.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ruminant Vaccines Market Size 2024 |

USD 4.02 Billion |

| Ruminant Vaccines Market, CAGR |

9.45% |

| Ruminant Vaccines Market Size 2032 |

USD 8.28 Billion |

The Ruminant Vaccines market is led by key players such as Zoetis Services LLC, Boehringer Ingelheim International GmbH, Merck & Co., Inc., Ceva Santé Animale, Virbac, Elanco, Bimeda Animal Health Ltd., Indian Immunologicals Ltd., Vaxxinova International BV, and CZ Vaccines S.A.U. (Zendal Group). These companies dominate the market through strong product portfolios, broad distribution networks, and continuous innovation in veterinary immunization. North America leads the market with a 36.4% share, supported by advanced veterinary infrastructure and strong livestock health awareness. Europe follows with a 31.2% share, driven by strict animal health regulations, while Asia-Pacific holds 24.6%, fueled by rising dairy production and growing investments in livestock disease prevention programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Ruminant Vaccines market was valued at USD 4.02 billion in 2024 and is projected to reach USD 8.28 billion by 2032, growing at a CAGR of 9.45% during the forecast period.

- Rising prevalence of livestock diseases and growing awareness of preventive animal healthcare are key drivers of global market growth.

- Increasing adoption of combination and DNA-based vaccines, along with advancements in cold chain logistics, is shaping current market trends.

- The market is highly competitive, with major players such as Zoetis, Boehringer Ingelheim, and Merck focusing on R&D and regional distribution expansion.

- North America leads the market with a 36.4% share, followed by Europe at 31.2% and Asia-Pacific at 24.6%, while the cattle segment dominates with a 58.7% share due to extensive use in preventing bovine respiratory and viral diseases.

Market Segmentation Analysis:

By Animal Type

The cattle segment dominated the Ruminant Vaccines market in 2024 with a 64.8% share. Its dominance stems from the high global cattle population and the widespread occurrence of bovine diseases such as foot-and-mouth disease, brucellosis, and bovine respiratory infections. Growing demand for milk and beef products has increased the focus on preventive healthcare for cattle. Government vaccination programs and veterinary awareness campaigns continue to promote regular immunization. The sheep and goat segment is also expanding, supported by increasing demand for small ruminant products and rising investments in livestock health in developing regions.

- For instance, CEVA Santé Animale-branded Mucosiffa® (a modified-live vaccine for Bovine Viral Diarrhea) elicited average neutralising antibody titres of 8.5 to 9.2 Log₂ ED₅₀/mL in heifers challenged 363 days post-vaccination.

By Vaccine Type

The modified or attenuated live vaccine segment held a 52.4% share of the Ruminant Vaccines market in 2024. These vaccines are preferred for their long-lasting immunity and ability to stimulate strong cellular responses. They are widely used to control viral diseases such as bovine viral diarrhea and bluetongue. Advancements in live vaccine technology are improving stability and safety during storage and transport. The inactivated vaccine segment is also gaining momentum due to reduced side effects and growing acceptance in intensive livestock farming systems focused on biosafety compliance.

- For instance, the Oregon C24 strain based live vaccine developed by Ceva Ruminants for BVDV-1 in cattle showed that none of the five vaccinated calves became viremic after challenge with BVDV-2, whereas all five control calves did (RT-PCR positive days ranged from 5 to 12 in control).

By Indication

The bovine respiratory diseases (BRD) segment accounted for a 43.6% share of the Ruminant Vaccines market in 2024, leading due to the high prevalence of pneumonia and respiratory infections among feedlot cattle. BRD vaccines are essential for reducing mortality rates and improving herd productivity. The segment’s growth is fueled by the development of multivalent vaccines that target multiple pathogens simultaneously. Leptospirosis and BVD infection vaccines also contribute significantly, driven by rising awareness of zoonotic transmission risks and global initiatives aimed at controlling economically impactful livestock diseases.

Key Growth Drivers

Rising Prevalence of Livestock Diseases

The increasing incidence of contagious livestock diseases such as foot-and-mouth disease, brucellosis, and bovine respiratory infections is a major driver of the Ruminant Vaccines market. Outbreaks result in severe economic losses due to reduced productivity and trade restrictions. Governments and veterinary organizations are implementing large-scale immunization programs to protect herds. Improved diagnostics and surveillance systems are further increasing vaccine adoption, particularly in emerging livestock-producing nations. These efforts are driving consistent demand for effective and broad-spectrum ruminant vaccines globally.

- For instance, Zoetis Services LLC’ ONE SHOT® vaccine family documented lung lesion scores of 0.8 ± 0.4 in vaccinated calves (vs 3.4 ± 0.9 in controls) following a challenge with Mannheimia haemolytica, demonstrating measurable disease reduction.

Growing Demand for Animal-Derived Food Products

Rising global consumption of meat and dairy products is boosting the need for disease-free and productive livestock. Farmers and producers are focusing on preventive healthcare through vaccination to ensure high-quality yields and minimize mortality rates. Population growth, urbanization, and dietary shifts toward protein-rich diets are strengthening vaccine utilization. Additionally, regulatory emphasis on food safety and animal health certifications is pushing the adoption of vaccines across commercial and industrial livestock farms worldwide.

- For instance, Elanco Titanium® cattle vaccine is a modified-live virus (MLV) vaccine that provides effective and sustained immunity against Bovine viral diarrhea virus (BVDV) types 1 and 2, with studies on file supporting claims of efficacy and duration of immunity.

Government Support and Veterinary Infrastructure Development

Government initiatives promoting animal health management and disease eradication programs are significantly contributing to market growth. Public-sector investments in vaccination drives, veterinary infrastructure, and livestock health awareness are improving access to vaccines in rural regions. International organizations such as the FAO and OIE are collaborating with local authorities to strengthen animal immunization systems. Subsidized vaccine distribution and field training for veterinarians are further enhancing vaccination rates, particularly in developing economies with growing livestock sectors.

Key Trends & Opportunities

Adoption of Advanced and Combination Vaccines

The market is witnessing a shift toward multivalent and recombinant vaccines that offer protection against multiple pathogens simultaneously. These advanced formulations reduce vaccination frequency and labor costs while enhancing animal welfare. Technological innovations, including DNA and subunit vaccines, are improving safety and efficacy. Research investments by leading pharmaceutical firms are expanding product portfolios to cover emerging and region-specific diseases. This trend presents new opportunities for manufacturers targeting both developed and developing livestock markets.

- For instance, Zoetis Inc. developed its FMD-LL3B3D vaccine platform which, when administered at doses as low as 0.125 ml (one-sixteenth dose) to cattle, prevented both viremia and clinical signs of foot-and-mouth disease in a challenge trial.

Expansion of Cold Chain and Distribution Networks

Growing investments in vaccine storage and cold chain logistics are improving accessibility in remote and rural areas. Many governments and private organizations are strengthening supply chain infrastructure to ensure effective vaccine delivery. Digital tracking systems and temperature-controlled transport solutions are minimizing wastage and maintaining product potency. This improved distribution network is expanding the reach of veterinary healthcare, particularly in developing regions with growing cattle and small ruminant populations.

- For instance, the United Nations Development Programme (UNDP) partnered with the Department of Animal Husbandry & Dairying (DAHD) in India to implement the “Animal Vaccine Intelligence Network (AVIN)”, which provides real-time monitoring of stock flows and temperatures to maintain the 2-8 °C range in over 30,000 cold-chain points.

Key Challenges

Limited Awareness and Vaccination Compliance

In several developing markets, low awareness among farmers about the benefits of regular vaccination limits market penetration. Poor education on livestock disease management and inadequate access to veterinary services hinder vaccine adoption. Additionally, misconceptions regarding vaccine side effects and improper administration practices reduce effectiveness. Increasing extension programs, awareness campaigns, and farmer training initiatives are essential to overcoming this challenge and improving vaccination coverage globally.

High Production and Storage Costs

The production of ruminant vaccines requires advanced biomanufacturing facilities, stringent quality control, and cold storage systems, leading to high operational costs. Maintaining cold chain logistics, especially in remote regions, adds further financial burden. These factors make vaccines relatively expensive for small-scale livestock farmers, particularly in low-income economies. To address this challenge, manufacturers are focusing on cost-efficient production techniques and public-private partnerships to subsidize vaccine prices and ensure affordability for wider adoption.

Regional Analysis

North America

North America held a 35.2% share of the Ruminant Vaccines market in 2024, driven by strong livestock production and advanced veterinary infrastructure. The United States leads the region with extensive immunization programs supported by regulatory agencies such as the USDA. High awareness among farmers about disease prevention and biosecurity practices sustains consistent vaccine demand. Widespread use of combination and recombinant vaccines, coupled with ongoing R&D by major animal health companies, enhances product availability. The region’s focus on food safety and productivity improvement continues to drive steady market expansion.

Europe

Europe accounted for a 29.7% share of the Ruminant Vaccines market in 2024, supported by stringent animal health regulations and disease control initiatives. Countries such as France, Germany, and the United Kingdom maintain strong vaccination coverage for cattle and sheep herds. Government-backed programs targeting brucellosis and bovine respiratory diseases strengthen regional demand. Continuous advancements in vaccine formulations and monitoring systems enhance efficiency and compliance. The region’s established livestock industry, combined with proactive veterinary care and sustainability-focused farming practices, contributes to its dominant role in the global ruminant vaccines market.

Asia-Pacific

Asia-Pacific captured a 24.8% share of the Ruminant Vaccines market in 2024, driven by large livestock populations and growing dairy and meat consumption. China, India, and Australia lead the region with expanding veterinary healthcare infrastructure and government-supported immunization initiatives. Rising awareness about zoonotic diseases and productivity losses has increased vaccine adoption among small and commercial farmers. International partnerships are improving vaccine accessibility and cold chain logistics. Rapid industrialization in animal farming and growing investments in biotechnology manufacturing are further propelling the region’s strong growth trajectory in the global market.

Middle East & Africa

The Middle East and Africa region held a 6.3% share of the Ruminant Vaccines market in 2024. Increasing livestock disease outbreaks and expanding government-led vaccination campaigns are driving demand. Gulf nations such as Saudi Arabia and the United Arab Emirates are investing in advanced veterinary facilities and disease surveillance systems. In Africa, programs by organizations like the FAO and OIE are improving vaccination coverage in cattle and sheep. However, limited access to cold chain storage and trained veterinarians remains a challenge. Ongoing initiatives to strengthen animal health infrastructure are gradually improving market potential.

Latin America

Latin America accounted for a 4% share of the Ruminant Vaccines market in 2024, supported by a robust cattle industry and increasing focus on disease prevention. Brazil, Argentina, and Mexico dominate regional vaccine consumption due to large-scale dairy and beef production. Government programs targeting diseases such as foot-and-mouth and leptospirosis are boosting immunization rates. The presence of regional vaccine manufacturers and expanding export-driven livestock sectors enhance market development. Despite some logistical and economic constraints, rising awareness and veterinary investments continue to strengthen Latin America’s position in the global ruminant vaccines market.

Market Segmentations:

By Animal Type

By Vaccine Type

- Modified/ Attenuated Live

- Inactivated (Killed)

- Other Vaccines

By Indication

- Bovine Respiratory Diseases (BRD)

- Leptospirosis

- BVD Infection

- Other Indications

By Route of Administration

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Ruminant Vaccines market features major players such as Zoetis Services LLC, Boehringer Ingelheim International GmbH, Merck & Co., Inc., Ceva Santé Animale, Virbac, Elanco, Bimeda Animal Health Ltd., Vaxxinova International BV, Indian Immunologicals Ltd., and CZ Vaccines S.A.U. (Zendal Group). These companies maintain strong market positions through advanced vaccine technologies, extensive product portfolios, and global distribution networks. Strategic initiatives such as mergers, partnerships, and regional expansions enhance their reach in both developed and emerging livestock markets. Key players focus on developing multivalent and temperature-stable vaccines to improve disease prevention in cattle, sheep, and goats. Continuous investments in R&D for next-generation vaccines targeting respiratory and viral infections are strengthening their competitive advantage. Additionally, government collaborations, growing emphasis on animal health programs, and the expansion of veterinary services continue to shape the competitive dynamics of the ruminant vaccines industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zoetis Services LLC

- CZ Vaccines S.A.U. (Zendal Group)

- Virbac

- Bimeda Animal Health Ltd.

- Ceva Santé Animale

- Merck & Co., Inc.

- Vaxxinova International BV

- Boehringer Ingelheim International GmbH

- Elanco

- Indian Immunologicals Ltd.

Recent Developments

- In October 2024, Zoetis Services LLC launched Protivity®, the world’s first modified-live vaccine for Mycoplasma bovis in cattle. The vaccine demonstrated a 74% reduction in lung lesions and improved average daily weight gain by 100 g in calves.

- In May 2024, Boehringer Ingelheim International GmbH released BULTAVO 3™, an inactivated vaccine against Bluetongue disease virus serotype 3 (BTV-3) for cattle and sheep, becoming the first commercially available vaccine targeting this serotype.

- In 2024, Merck & Co., Inc. (via its animal health division) presented new data on its ruminant vaccine portfolio at the World Buiatrics Congress 2024, highlighting efficacy metrics and production-optimization results.

- In June 2023, Bimeda Animal Health Ltd. introduced Stimulator® 5 + PMH, a modified-live virus (MLV) combination vaccine for cattle five months or older, covering IBR, BVD I & II, PI3, BRSV, Mannheimia haemolytica and Pasteurella multocida infections.

Report Coverage

The research report offers an in-depth analysis based on Animal Type, Vaccine Type, Indication, Route of Administration and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising demand for livestock health management will continue to drive vaccine adoption.

- Advancements in biotechnology will lead to the development of next-generation recombinant vaccines.

- Expansion of veterinary infrastructure in emerging economies will strengthen market growth.

- Increasing government support for animal disease control will boost vaccination programs.

- Integration of digital tracking systems will enhance vaccine monitoring and distribution efficiency.

- Growing focus on preventive healthcare will shift farmer preference toward routine immunization.

- Strategic partnerships between pharma companies and research institutes will accelerate innovation.

- Rising exports of meat and dairy products will increase demand for disease prevention measures.

- Development of multivalent vaccines will reduce treatment costs and improve compliance.

- North America, Europe, and Asia-Pacific will remain the leading markets for ruminant vaccines globally.