Market Overview

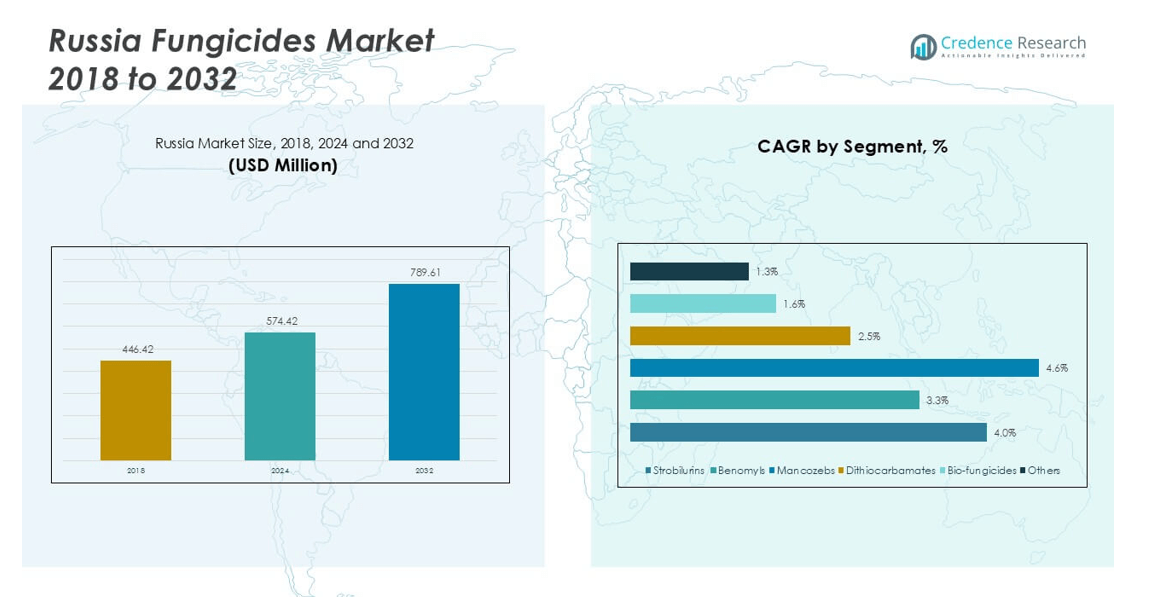

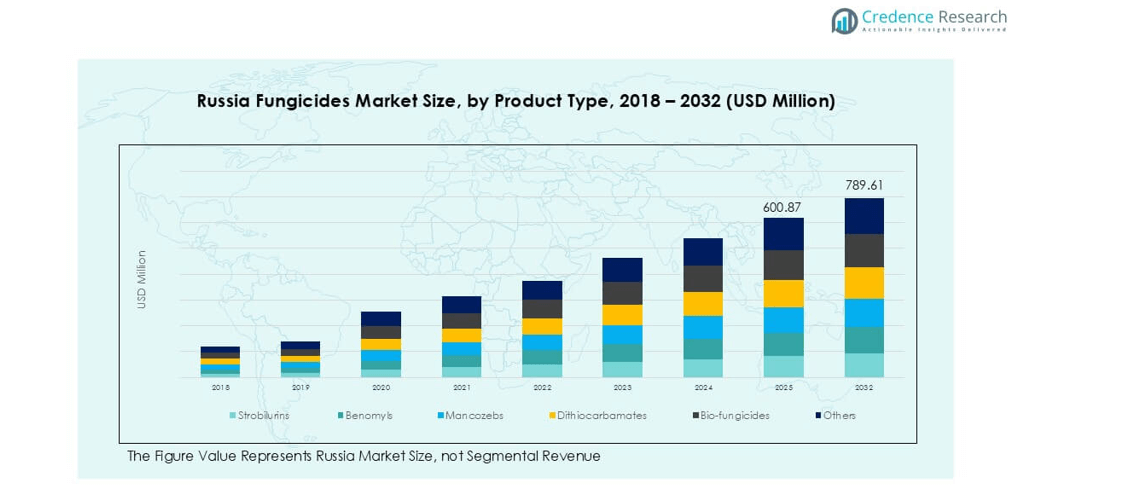

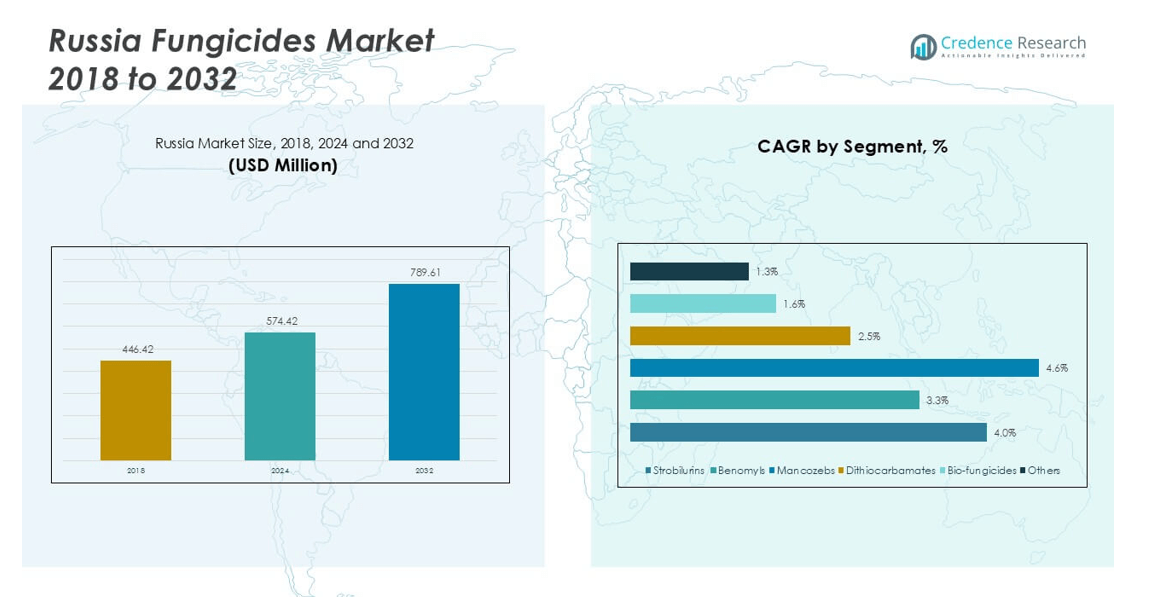

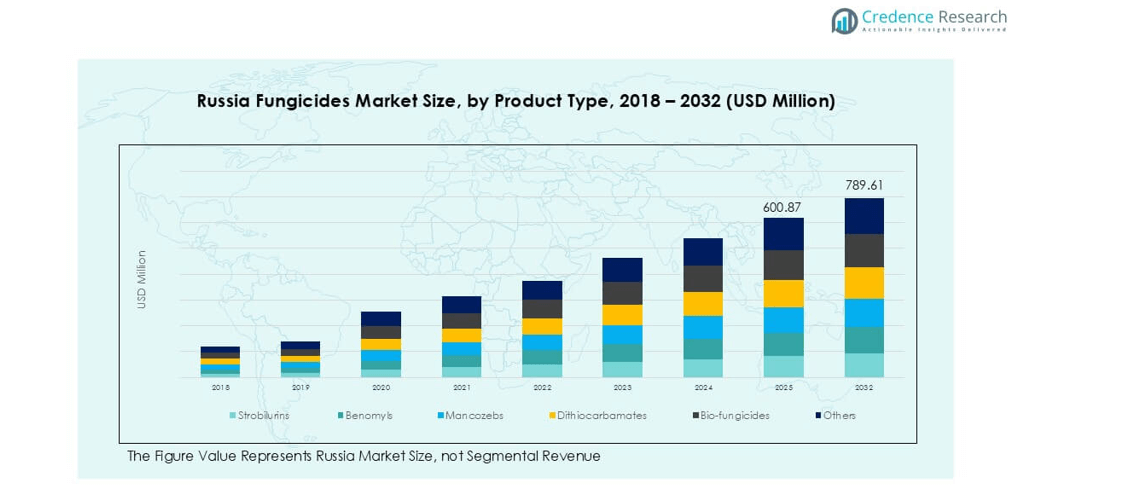

The Russia Fungicides market size was valued at USD 446.42 million in 2018, reached USD 574.42 million in 2024, and is anticipated to reach USD 789.61 million by 2032, at a CAGR of 3.98% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Russia Fungicides Market Size 2024 |

USD 574.42 million |

| Russia Fungicides Market, CAGR |

3.98% |

| Russia Fungicides Market Size 2032 |

USD 789.61 million |

The Russia fungicides market is led by global players such as Syngenta, Bayer CropScience, BASF SE, Corteva Agriscience, FMC Corporation, UPL Limited, and Nufarm, alongside strong domestic firms including Rusagro, Agrochemical Company Alliance, and Phytogarant. These companies drive competition through diverse product portfolios, technological innovation, and region-specific solutions. Central Russia emerges as the leading region, holding 35% of the market share in 2024, supported by extensive wheat and vegetable cultivation. Southern Russia follows with 28%, driven by large-scale cereal and horticulture farming. This regional dominance, combined with strong company presence, underscores a balanced competitive environment.

Market Insights

- The Russia fungicides market was valued at USD 574.42 million in 2024 and is projected to reach USD 789.61 million by 2032, expanding at a CAGR of 3.98%.

- Rising demand for cereals and grains, accounting for the largest application share, drives fungicide adoption as farmers seek higher yields and protection against fungal diseases.

- Key trends include growing use of bio-fungicides supported by sustainability goals, and increasing integration of precision agriculture technologies that enable targeted fungicide application.

- The market is competitive with global leaders such as Syngenta, Bayer CropScience, BASF SE, Corteva Agriscience, and FMC Corporation, while local players like Rusagro and Phytogarant strengthen presence through affordable solutions.

- Central Russia leads with 35% share in 2024, followed by Southern Russia with 28% and the Volga region at 20%, while cereals and grains dominate among applications, reinforcing the regional reliance on effective crop protection products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The Russia fungicides market is segmented into strobilurins, benomyls, mancozebs, dithiocarbamates, bio-fungicides, and others. Strobilurins hold the dominant share in 2024 due to their broad-spectrum disease control and long residual activity. Farmers prefer these products for crops such as cereals and vegetables where fungal outbreaks are frequent. The segment benefits from rising adoption of high-yield crop varieties that require strong disease resistance. Growing awareness of crop protection efficiency, coupled with supportive government programs for food security, further drives demand for strobilurins across large-scale farming regions.

- For instance, in Russia there are 57 registered products containing azoxystrobin (a major strobilurin) among the top fungicide active ingredients, signaling strong regulatory approval and adoption.

By Application

The market by application includes fruits and vegetables, cereals and grains, ornamentals, pulses and oilseeds, and others. Cereals and grains represent the largest share in 2024, reflecting Russia’s vast wheat and barley cultivation. The prevalence of fungal diseases like rust and powdery mildew in these crops increases the reliance on fungicides. Rising exports of cereals further support the need for effective protection to maintain quality. Farmers invest in modern crop protection practices to ensure higher yields and better global competitiveness, strengthening the dominance of this segment in the fungicide market.

- For instance, Russia harvested about 91.5 million tons of wheat in 2023/24 from approximately 28.8 million hectares, making it one of the world’s top wheat producers.

Market Overview

Expansion of Cereal and Grain Cultivation

Russia’s dominance as a global grain exporter drives higher fungicide consumption. Large-scale wheat and barley cultivation face constant threats from fungal diseases like rust and blight. Farmers adopt advanced fungicides to safeguard yields and maintain export competitiveness. Government initiatives supporting grain production further accelerate adoption. With cereals forming a critical part of Russia’s agricultural exports, consistent demand for effective crop protection ensures steady growth in fungicide use across the country’s key agricultural regions.

- For instance, Russia harvested 92.8 million tons of wheat in 2023 from a total harvested area of around 29.7 million hectares.

Rising Adoption of Modern Crop Protection Technologies

The increasing shift toward precision agriculture boosts fungicide usage efficiency. Farmers integrate digital monitoring systems and drones for early detection of crop diseases. This enhances the effectiveness of fungicide application while reducing wastage and costs. Modern formulations, such as systemic fungicides with longer protection cycles, gain popularity. These technological improvements support sustainable farming practices and appeal to both large-scale and mid-size producers. The trend strengthens Russia’s position in adopting advanced agricultural methods, driving continuous growth in the fungicide market.

- For instance, research from the Moscow Agricultural Academy found precision farming technologies reduce use of pesticides and working solutions by 25-30% in some crops.

Growing Demand for High-Value Horticulture Crops

The expansion of fruit and vegetable farming in Russia raises fungicide requirements. High-value horticultural crops such as apples, berries, and tomatoes face frequent fungal infections that reduce yield and quality. Rising domestic demand, coupled with export opportunities to Europe and Asia, encourages farmers to invest in fungicides. The increasing consumer preference for fresh and high-quality produce supports stronger adoption rates. This trend highlights horticulture’s growing role in the fungicides market, reinforcing the need for effective and targeted crop protection solutions.

Key Trends & Opportunities

Shift Toward Bio-fungicides

Sustainability concerns push Russian farmers to adopt bio-fungicides derived from natural organisms. These products reduce environmental risks while maintaining crop protection effectiveness. Bio-fungicides also align with stricter food safety regulations and consumer demand for eco-friendly farming practices. The opportunity for companies lies in expanding bio-based product portfolios and offering integrated pest management solutions. As awareness grows, this segment is expected to expand faster than conventional fungicides, creating opportunities for innovation and market entry for both domestic and international players.

- For instance, the European biopesticides market—of which bio-fungicides are a key part—saw Russia’s segment valued at about USD 316.91 million in 2024, highlighting rising biofungicide demand

Integration of Precision Application Practices

The adoption of precision farming practices opens new opportunities for targeted fungicide application. Russian growers increasingly use drones, satellite imaging, and IoT sensors to monitor crop health. This approach minimizes chemical use while maximizing effectiveness, reducing environmental impact. Companies offering fungicides compatible with precision spraying systems gain a competitive edge. As farms modernize, the demand for advanced fungicides designed for digital agriculture platforms is expected to rise, positioning this trend as a critical driver of efficiency and sustainability.

- For instance, a review of unmanned aerial vehicle (UAV) use in Russian crop production finds UAV treatment to be economically effective for plots larger than 2 hectares and beneficial especially where 9-19% of land is infertile, helping optimize application of agrochemicals.

Key Challenges

Stringent Regulatory Framework

The Russia fungicides market faces challenges from evolving regulatory norms on chemical use. Authorities impose restrictions on certain active ingredients due to environmental and health concerns. Farmers must adapt to new compliance standards, which can increase costs and limit product availability. These regulations also pressure companies to invest in research for safer alternatives, prolonging product development cycles. While essential for food safety, stricter rules create hurdles for rapid product launches and restrict market expansion, especially for smaller players.

High Dependence on Weather Conditions

Fungicide demand in Russia heavily depends on climatic variations that influence fungal outbreaks. Harsh winters and unpredictable rainfall patterns can reduce or delay disease prevalence, lowering fungicide use in certain years. This dependence creates volatility in demand and impacts the sales of manufacturers and distributors. Farmers also face challenges in predicting the right application timing, leading to inconsistent fungicide adoption. Seasonal uncertainties therefore remain a significant obstacle for sustained market growth, affecting both producers and end-users.

Regional Analysis

Central Russia

Central Russia holds the largest share of the fungicides market, accounting for nearly 35% in 2024. The region’s dominance is linked to extensive cultivation of wheat, barley, and vegetables, which face high fungal risks such as rust and mildew. Farmers rely heavily on strobilurin-based fungicides for broad-spectrum protection. Proximity to major processing hubs and export corridors also drives adoption. Supportive government schemes for crop intensification further strengthen demand. Central Russia’s well-developed infrastructure and high farm density make it the core contributor to overall fungicide consumption in the country.

Southern Russia

Southern Russia contributes around 28% of the market in 2024, driven by favorable climatic conditions that support cereal, sunflower, and horticulture farming. The prevalence of diseases like leaf spots and downy mildew intensifies reliance on fungicides. Farmers in Krasnodar and Rostov, Russia’s agricultural powerhouses, are major consumers. The region’s export-oriented production amplifies demand for effective crop protection. With a shift toward high-value fruits and vegetables, bio-fungicides also gain traction. Southern Russia’s fertile black soils, coupled with large commercial farms, reinforce its strong share in the fungicides market.

Volga Region

The Volga region accounts for approximately 20% of the fungicides market in 2024, supported by large-scale grain and oilseed cultivation. Farmers face frequent fungal attacks, especially root rot and powdery mildew in pulses and cereals. The region’s growing agro-industrial clusters promote the use of modern crop protection chemicals. Fungicide adoption is reinforced by strong mechanization and improving distribution channels. With rising demand for oilseed exports, fungicide use is expected to increase steadily. The Volga’s significant role in domestic food security ensures a consistent market share and steady demand growth.

Siberia and Far East

Siberia and the Far East together represent nearly 17% of the fungicides market in 2024. Harsh climatic conditions limit the growing season, but the expansion of grain and soybean cultivation is increasing fungicide adoption. Farmers mainly depend on systemic fungicides to handle rust and smut infections in cereals. Although farm sizes are smaller compared to western regions, government initiatives to expand arable land support growth. Logistics challenges remain a constraint, yet rising investments in infrastructure are improving accessibility. These regions show steady growth potential, with increasing adoption of crop protection technologies.

Market Segmentations:

By Product Type

- Strobilurins

- Benomyls

- Mancozebs

- Dithiocarbamates

- Bio-fungicides

- Others

By Application

- Fruits & Vegetables

- Cereals & Grains

- Ornamentals

- Pulses & Oilseeds

- Others

By Geography

- Central Russia

- Southern Russia

- Volga Region

- Siberia and Far East

Competitive Landscape

The competitive landscape of the Russia fungicides market is shaped by the presence of global leaders and strong domestic players. Multinational companies such as Syngenta, Bayer CropScience, BASF SE, Corteva Agriscience, FMC Corporation, UPL Limited, and Nufarm dominate with broad portfolios covering strobilurins, dithiocarbamates, and bio-fungicides. These firms leverage advanced R&D, strong distribution networks, and brand reliability to capture large market shares. Domestic companies like Rusagro, Agrochemical Company Alliance, and Phytogarant strengthen their position by offering cost-effective products tailored to local needs. Strategic collaborations with Russian distributors, growing investment in bio-based solutions, and regulatory compliance enhance competitiveness. Price sensitivity among farmers favors companies that balance affordability with performance. Global leaders focus on innovation and digital integration in crop protection, while local firms expand access in regional markets. This mix of international expertise and local adaptability defines the competitive dynamics, making the market highly contested yet growth-oriented.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Syngenta

- Bayer CropScience

- BASF SE

- Corteva Agriscience

- FMC Corporation

- UPL Limited

- Nufarm

- Rusagro

- Agrochemical Company Alliance

- Phytogarant

Recent Developments

- In June 2024, BASF Agricultural Solutions announced the launch of Cevya, a new rice fungicide in China. This is the first isopropanol triazole fungicide approved for rice applications in two decades, designed to combat rice false smut and manage fungicide resistance. Cevya’s active ingredient, mefentrifluconazole, offers rice growers an innovative solution to enhance crop yields. BASF has conducted extensive field trials since 2020, collaborating with leading agricultural institutions to ensure its effectiveness and safety in disease management.

- In October 2023, “Bayer”, one of the well-known agriculture products companies based in the U.K., received approval from the Chemicals Regulation Division (CRD) for its new active substance to be used in fungicides. The new substance is isoflucypram, which will be used in its product called Vimoy.

- In August 2023, Bayer AG announced a significant investment of EUR 220 million in a new research and development facility at its Monheim site, marking its largest commitment to Crop Protection in Germany in 40 years. This state-of-the-art facility focuses on developing innovative fungicides and other chemicals that prioritize environmental and human safety.

- In September 2022, BASF, a well-known agriculture nutrition manufacturer, announced the launch of its all-new innovative fungicide product called Revylution, which received approval for use in New Zealand.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with increasing demand for crop protection solutions.

- Cereals and grains will continue to dominate applications due to extensive cultivation.

- Bio-fungicides will gain momentum as farmers adopt eco-friendly crop protection practices.

- Precision farming will drive efficient fungicide usage and reduce overall chemical consumption.

- Global players will strengthen their portfolios with advanced systemic fungicides.

- Domestic companies will expand by offering cost-effective products tailored to local needs.

- Government support for agriculture will boost adoption of modern fungicides.

- Climatic variability will continue to influence yearly demand fluctuations.

- Southern Russia and Central Russia will remain the leading regional markets.

- Innovation in formulations and disease-specific fungicides will shape future growth.