Market Overview

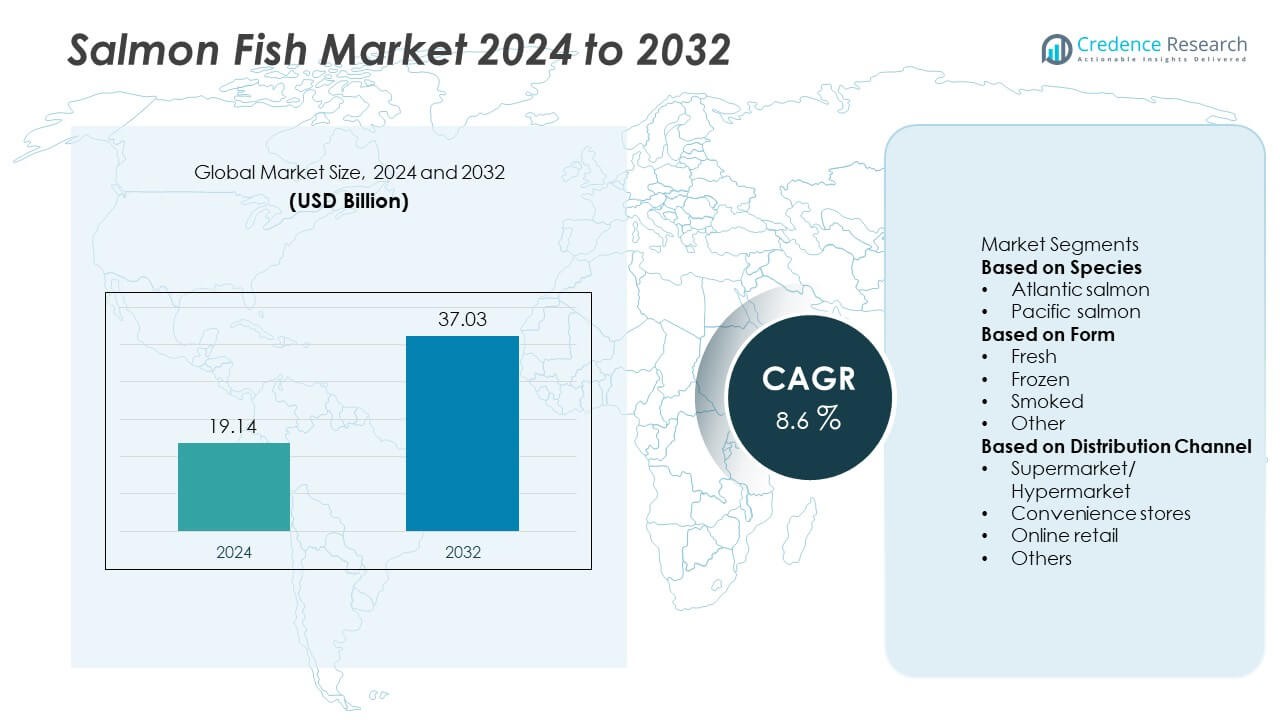

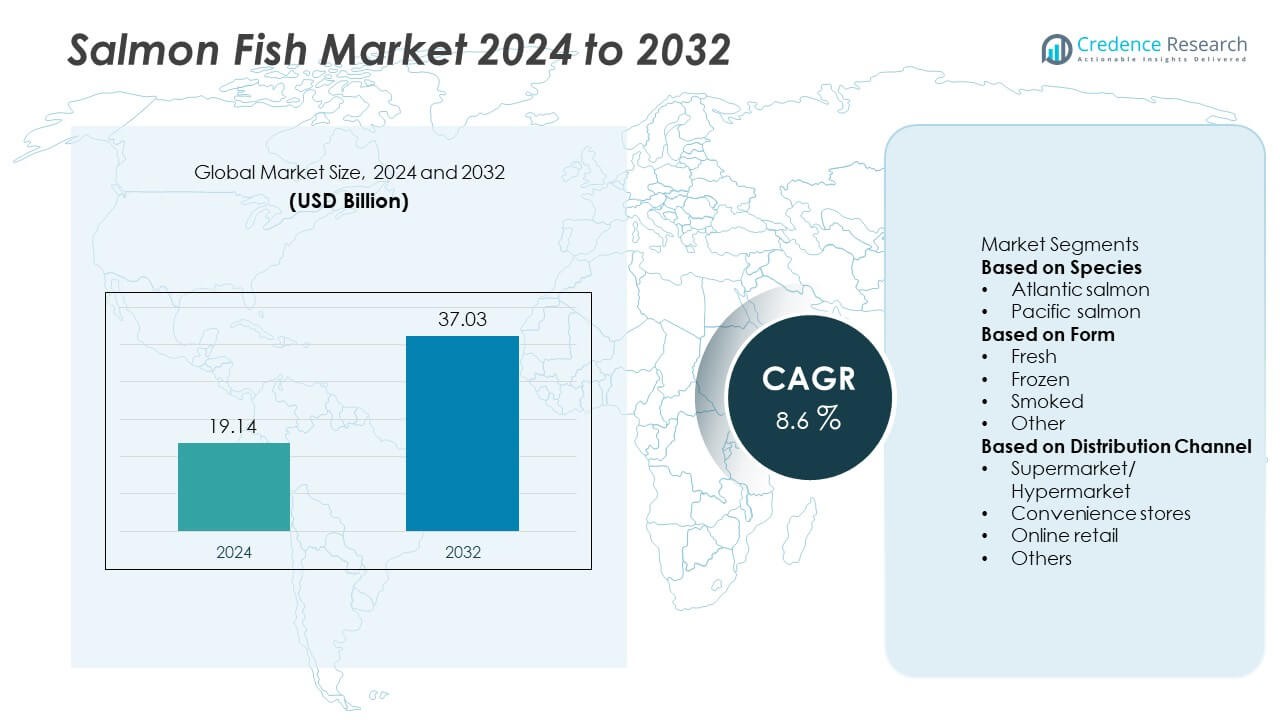

The global salmon fish market was valued at USD 19.14 billion in 2024 and is projected to reach USD 37.03 billion by 2032, growing at a CAGR of 8.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Salmon Fish Market Size 2024 |

USD 19.14 Billion |

| Salmon Fish Market, CAGR |

8.6% |

| Salmon Fish Market Size 2032 |

USD 37.03 Billion |

The salmon fish market is led by major players such as Mowi ASA, Salmar, Cermaq, Bakkafrost, Leroy, SEA DELIGHT GROUP, BluGlacier, Nordlaks Produkter, Atlantic Sapphire, and Ideal Foods. These companies maintain strong positions through advanced aquaculture operations, sustainability initiatives, and expanding global trade networks. Europe dominated the market in 2024 with a 38% share, supported by large-scale salmon farming in Norway and Scotland and growing demand for sustainable seafood. North America followed with a 29% share, driven by strong consumption in the U.S. and Canada, while Asia-Pacific accounted for 24%, fueled by rising seafood demand, rapid urbanization, and expanding import capacity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global salmon fish market was valued at USD 19.14 billion in 2024 and is projected to reach USD 37.03 billion by 2032, growing at a CAGR of 8.6% during 2025–2032.

- Growing consumer awareness of healthy, protein-rich diets and the nutritional benefits of omega-3 fatty acids is driving steady demand for salmon products worldwide.

- Key trends include the expansion of sustainable aquaculture, adoption of smart monitoring technologies, and growing consumption of ready-to-eat and premium salmon varieties.

- Major players such as Mowi ASA, Salmar, Bakkafrost, Cermaq, and Leroy are strengthening market positions through innovation, vertical integration, and global distribution networks.

- Europe led the market with a 38% share, followed by North America at 29% and Asia-Pacific at 24%, while the Atlantic salmon segment dominated with a 61% share, supported by high production efficiency and global trade demand.

Market Segmentation Analysis:

By Species

The Atlantic salmon segment dominated the global salmon fish market in 2024, accounting for a 61% share. Its dominance is attributed to large-scale aquaculture production in Norway, Chile, and Scotland, ensuring consistent supply and quality. Atlantic salmon’s rich nutritional profile and mild flavor make it highly preferred for both fresh consumption and processed products. The species benefits from strong export demand across Europe, North America, and Asia-Pacific. Advancements in sustainable aquaculture and feed technology continue to enhance yields, reinforcing the leadership of Atlantic salmon in global seafood markets.

- For instance, Mowi ASA operates aquaculture sites across several countries, including Norway, Scotland, and Canada, and in 2024 harvested over 500,000 metric tons of Atlantic salmon. The company uses a variety of feed formulations and farming technologies, including land-based post-smolt facilities with high water reuse rates and offshore closed containment systems, as part of its “Leading the Blue Revolution” sustainability strategy.

By Form

The fresh segment held the largest share of 47% in 2024, driven by growing consumer preference for premium, high-quality seafood. Increasing consumption of fresh salmon in restaurants, retail outlets, and households supports this dominance. The segment benefits from improvements in cold chain logistics and air freight, enabling efficient global distribution. Health-conscious consumers favor fresh salmon for its superior taste and high omega-3 content. Expanding sushi and sashimi culture, particularly in Japan, the U.S., and Europe, further strengthens the demand for fresh salmon over frozen or processed forms.

- For instance, Bakkafrost employs a fully integrated supply chain with advanced chilling and packaging technology, processing large volumes of fresh salmon daily. The system uses flake ice to maintain low temperatures, typically around 2°C (35.6°F) for fresh products, throughout transportation.

By Distribution Channel

The supermarket and hypermarket segment led the salmon fish market in 2024 with a 54% share, supported by wide product availability and enhanced retail infrastructure. Consumers prefer these outlets for reliable quality, diverse product varieties, and attractive promotions. Supermarkets also feature dedicated seafood sections offering fresh, smoked, and frozen salmon, catering to varied dietary preferences. Growing partnerships between producers and retail chains have strengthened cold storage and supply networks. Meanwhile, online retail is rapidly expanding, driven by convenience, home delivery options, and increasing digital adoption among seafood consumers.

Key Growth Drivers

Rising Demand for Protein-Rich and Healthy Food Products

Growing consumer awareness of nutrition and wellness is driving strong demand for salmon as a rich source of protein and omega-3 fatty acids. Health-conscious consumers increasingly prefer salmon over red meat due to its cardiovascular and cognitive health benefits. The rising prevalence of lifestyle-related diseases and dietary shifts toward lean proteins further support market expansion. Food service industries and restaurants are also promoting salmon-based dishes, enhancing its global appeal across both developed and emerging economies.

- For instance, Leroy Seafood Group expanded its ready-to-eat salmon product line in 2023, harvesting approximately 160,000 metric tons of salmon and trout and supplying major retailers with fillets known to be rich in protein and omega-3 fatty acids.

Expansion of Sustainable Aquaculture Practices

Sustainable aquaculture production is a key growth driver for the salmon market. Governments and producers are investing in eco-friendly fish farming systems to meet growing demand while minimizing environmental impact. Countries like Norway, Chile, and Scotland are adopting advanced technologies, including recirculating aquaculture systems (RAS) and responsible feed sourcing. Certification programs such as ASC and MSC enhance consumer trust and market credibility. These initiatives ensure long-term production stability and align with global sustainability goals, fueling continued growth in the farmed salmon sector.

- For instance, Cermaq Group has implemented closed-containment recirculating aquaculture systems (RAS) in Norway, with one facility approved in 2023 to produce 12 million post-smolt annually.

Rising Global Trade and Processed Product Demand

Increasing international trade and demand for processed salmon products are accelerating market growth. Global consumption is expanding as frozen, smoked, and ready-to-eat salmon varieties gain popularity among urban consumers. Advanced freezing and packaging technologies ensure extended shelf life and quality preservation during export. The expansion of cold-chain logistics networks supports distribution across North America, Europe, and Asia-Pacific. This rising global accessibility of value-added salmon products strengthens industry profitability and widens the consumer base across multiple demographics.

Key Trends & Opportunities

Adoption of Technological Innovations in Aquaculture

Automation and digitalization in aquaculture are transforming salmon farming efficiency. Technologies such as AI-based feeding systems, underwater drones, and IoT sensors help monitor fish health, optimize feed usage, and reduce waste. These innovations improve yield consistency and cost-effectiveness. Major producers are leveraging data-driven insights to manage environmental variables and ensure sustainability. The adoption of smart aquaculture technologies presents significant opportunities for improving operational efficiency, profitability, and traceability across the global salmon supply chain.

- For instance, Grieg Seafood partners with technology providers like AKVA group to implement advanced recirculation aquaculture systems (RAS) and other digital tools across its operations, including Norwegian facilities.

Rising Popularity of Ready-to-Eat and Premium Salmon Products

The growing demand for convenience and premium seafood is creating new opportunities in the salmon market. Consumers prefer ready-to-cook and ready-to-eat salmon meals that align with fast-paced lifestyles. Premium offerings such as organic and smoked salmon attract health-conscious and high-income consumers. Companies are expanding product portfolios through innovative packaging and flavor profiles. Expanding retail and e-commerce channels further support accessibility, making high-quality salmon products more appealing across global markets.

- For instance, Thai Union Group launched its “King Oscar” smoked salmon range, producing over 12 million ready-to-eat packs annually using high-pressure processing technology that extends shelf life by 45 days without chemical preservatives.

Key Challenges

Environmental and Disease Management Concerns

The salmon industry faces persistent challenges related to environmental sustainability and disease outbreaks. Issues such as sea lice infestations, water pollution, and genetic degradation threaten production efficiency. Disease control requires significant investments in monitoring and biosecurity, increasing operational costs for farmers. Regulatory pressure to reduce antibiotics and improve fish welfare further complicates production. Strengthening ecosystem management and adopting innovative biological controls remain essential to overcoming these environmental challenges and maintaining steady supply chains.

Price Volatility and Supply Chain Disruptions

Fluctuations in feed prices, weather conditions, and global logistics affect salmon production costs and supply consistency. Climate change and trade restrictions have occasionally disrupted export flows, influencing price stability. Seasonal variations and dependency on specific producing countries increase vulnerability to market shocks. Additionally, rising transportation costs and labor shortages affect margins. Developing localized production networks and investing in supply chain resilience are critical to reducing exposure to these economic and logistical uncertainties.

Regional Analysis

North America

North America held a 29% share of the global salmon fish market in 2024, driven by strong demand for premium seafood and protein-rich diets. The U.S. dominates regional consumption due to widespread availability of fresh, frozen, and smoked salmon in retail and food service channels. Rising health awareness and preference for omega-3-rich diets continue to fuel growth. Canada remains a key producer, exporting large volumes to the U.S. and Asia. Increasing adoption of sustainable aquaculture practices and product diversification across retail formats are further strengthening the regional market outlook.

Europe

Europe accounted for a 38% share in 2024, emerging as the leading regional market. Norway and Scotland remain major producers, supplying high-quality farmed salmon to global markets. Strong consumer preference for sustainable and traceable seafood supports continued demand. The European Union’s focus on sustainable fisheries and stricter import standards reinforces product quality and supply chain transparency. Growing consumption of ready-to-eat and smoked salmon, particularly in Germany, France, and the UK, further boosts the market. Advanced cold-chain infrastructure and rising exports to Asia are expected to sustain Europe’s dominance through 2032.

Asia-Pacific

Asia-Pacific captured a 24% share in 2024, supported by rising seafood consumption and urban population growth. China, Japan, and South Korea lead regional demand, fueled by expanding middle-class incomes and Western dietary influences. Japan remains a major importer for sushi and sashimi markets, while China’s domestic aquaculture expansion strengthens regional supply. The growing popularity of ready-to-eat salmon and e-commerce seafood delivery services drives demand. Favorable trade policies, along with government support for sustainable aquaculture, are expected to enhance Asia-Pacific’s contribution to global salmon production and consumption.

Latin America

Latin America held a 6% share in 2024, with Chile dominating as one of the world’s largest salmon producers. Chile’s advanced aquaculture infrastructure and export-oriented production drive regional market growth. The country supplies significant volumes to North America, Europe, and Asia. Domestic consumption is also rising, supported by increasing awareness of salmon’s nutritional benefits. Brazil and Mexico show growing retail sales through supermarkets and online channels. However, environmental concerns and disease management challenges remain key issues. Continuous investment in sustainable farming practices is expected to strengthen Latin America’s market position.

Middle East & Africa

The Middle East & Africa region accounted for a 3% share in 2024, driven by rising demand for healthy and protein-rich seafood. The UAE and Saudi Arabia are leading markets, supported by growing urbanization and premium seafood imports. High-income consumers increasingly favor fresh and smoked salmon for its quality and health benefits. South Africa also contributes through expanding retail distribution and tourism-led food service demand. Limited local production and high import dependence remain challenges, but expanding cold-chain networks and rising health awareness are gradually boosting regional consumption levels.

Market Segmentations:

By Species

- Atlantic salmon

- Pacific salmon

By Form

- Fresh

- Frozen

- Smoked

- Other

By Distribution Channel

- Supermarket/ Hypermarket

- Convenience stores

- Online retail

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the salmon fish market is shaped by key players including Ideal Foods, Salmar, BluGlacier, Nordlaks Produkter, SEA DELIGHT GROUP, Mowi ASA, Atlantic Sapphire, Bakkafrost, Cermaq, and Leroy. These companies dominate through strong aquaculture operations, advanced processing capabilities, and extensive global distribution networks. Leading producers focus on sustainability, innovation, and disease management to enhance productivity and environmental compliance. Strategic investments in recirculating aquaculture systems (RAS), traceability solutions, and eco-friendly feed technologies strengthen competitiveness. Collaborations with retailers and food service providers are expanding product accessibility across regions. Additionally, mergers, acquisitions, and product diversification into smoked and ready-to-eat salmon categories are reshaping the market landscape. Continuous R&D in genetics, feed optimization, and automation technologies further support efficiency and quality enhancement, ensuring long-term leadership in the global salmon industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ideal Foods

- Salmar

- BluGlacier

- Nordlaks Produkter

- SEA DELIGHT GROUP

- Mowi ASA

- Atlantic Sapphire

- Bakkafrost

- Cermaq

- Leroy

Recent Developments

- In 2025, Atlantic Sapphire ASA disclosed that it harvested approximately 1,167 tons head-on-gutted in Q2 2025, with a net biomass gain of 1,697 tons round-live-weight, and achieved an average harvest weight of 3.1 kg per fish.

- In 2025, Mowi ASA reported a first-quarter harvest of about 108,000 metric tons gutted weight, including 62,000 tons from its Norway farms, 17,500 tons from Scotland, 14,000 tons from Chile, 5,000 tons from Canada and 4,000 tons from the Faroes.

- In 2025, Mowi noted record-high global supply for Atlantic salmon in the second quarter and reported its Q2 2025 presentation forecast of about 545,000 tons production volume for 2025.

- In 2024, Nordlaks revealed its offshore “Hydra” semi-closed farm will hold up to 3,120 metric tons of salmon once operational.

Report Coverage

The research report offers an in-depth analysis based on Species, Form, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow due to rising global seafood consumption.

- Sustainable aquaculture will remain a key focus for long-term industry stability.

- Technological advances will improve fish health monitoring and feed efficiency.

- Ready-to-eat and premium salmon products will gain stronger consumer preference.

- Expansion in e-commerce and retail channels will increase product accessibility worldwide.

- Asia-Pacific will emerge as a major demand center for imported and processed salmon.

- Producers will invest more in traceability and certification to meet regulatory standards.

- Climate change adaptation and environmental management will shape future operations.

- Consolidation among global players will strengthen production capacity and market control.

- Innovation in packaging and cold-chain logistics will enhance quality and global trade efficiency.