Market Overview

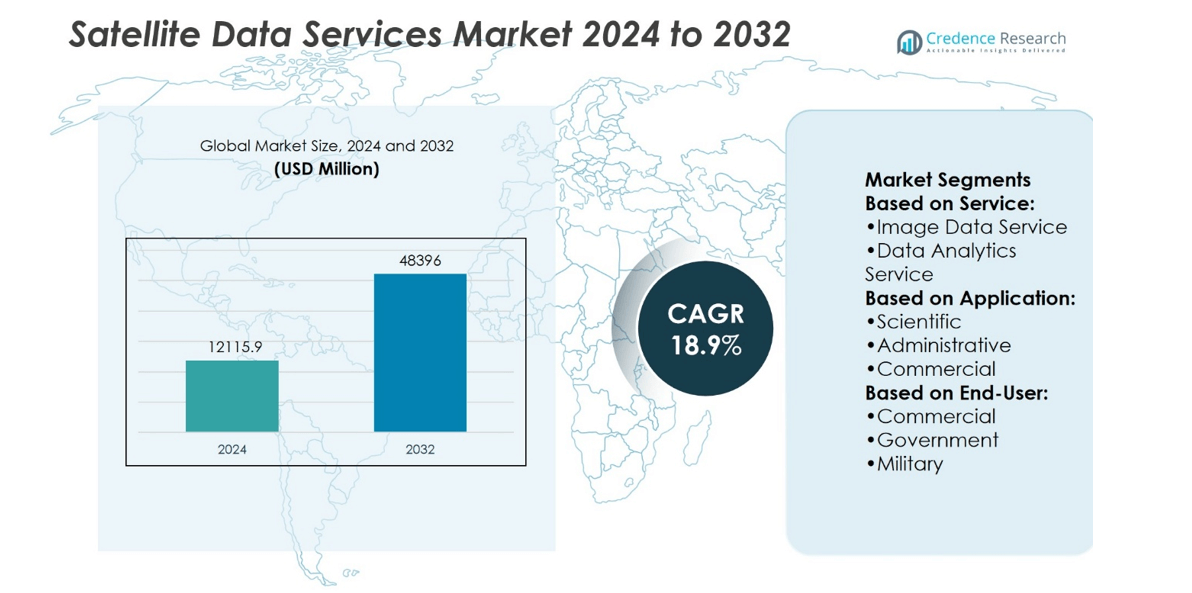

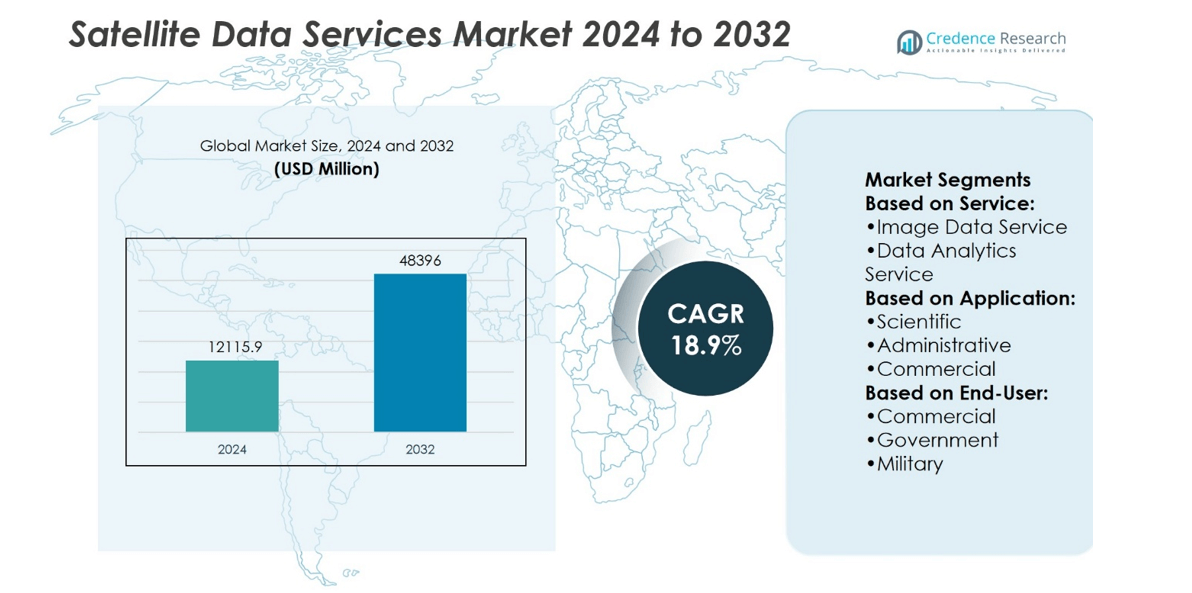

Satellite Data Services Market size was valued at USD 12115.9 million in 2024 and is anticipated to reach USD 48396 million by 2032, at a CAGR of 18.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Satellite Data Services Market Size 2024 |

USD 12115.9 million |

| Satellite Data Services Market, CAGR |

18.9% |

| Satellite Data Services Market Size 2032 |

USD 48396 million |

The Satellite Data Services Market is driven by rising demand for Earth observation, defense surveillance, and real-time monitoring across industries. Governments invest in satellite programs to enhance national security, environmental tracking, and infrastructure planning. Commercial sectors adopt satellite data for precision farming, logistics optimization, and risk assessment in insurance. Advances in high-resolution imagery, synthetic aperture radar, and cloud platforms strengthen accessibility and reliability. Integration of artificial intelligence and machine learning improves predictive analytics and data usability. Growing use of Low Earth Orbit constellations further supports rapid data delivery, reinforcing the market’s role in global decision-making and strategic operations.

North America leads the Satellite Data Services Market with strong government and commercial adoption, followed by Europe with programs like Copernicus driving growth. Asia-Pacific shows rapid expansion through rising investments from China, India, and Japan, while Latin America and the Middle East & Africa grow steadily in agriculture, mining, and defense applications. Key players include Maxar Technologies, Planet Labs, Airbus, ICEYE, L3Harris Technologies, NV5 Global, Geocento, Earth-i, Satellite Imaging Corporation, and Satpalda, each contributing through advanced imaging, analytics, and tailored geospatial solutions.

Market Insights

- Satellite Data Services Market size was valued at USD 12115.9 million in 2024 and is projected to reach USD 48396 million by 2032, at a CAGR of 18.9%.

- Rising demand for Earth observation, defense surveillance, and real-time monitoring drives growth across industries.

- High-resolution imagery, synthetic aperture radar, and cloud platforms define the major technological trends.

- Competition is strong with companies advancing imaging quality, analytics speed, and global coverage capabilities.

- High infrastructure and operational costs remain key restraints, limiting adoption for smaller enterprises.

- North America leads the market, Europe follows with Copernicus, and Asia-Pacific grows rapidly with China, India, and Japan.

- Latin America and the Middle East & Africa expand steadily in agriculture, mining, and defense sectors, supported by international collaborations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Earth Observation and Remote Sensing

The growing reliance on Earth observation for weather forecasting, environmental monitoring, and disaster management drives the Satellite Data Services Market. Governments and private organizations invest in advanced satellite systems to improve accuracy and efficiency. High-resolution imagery and data analytics support decision-making across multiple industries. Energy, agriculture, and urban planning sectors benefit from access to precise geospatial information. It enhances predictive capabilities and supports critical infrastructure management. The consistent demand for real-time monitoring creates steady market momentum.

- For instance, Finland’s Ministry of Defense signed a Letter of Intent with ICEYE to acquire Synthetic Aperture Radar (SAR) satellites that deliver 25-centimeter ground resolution. The agreement leverages ICEYE’s large constellation of SAR satellites, which includes the 54 satellites launched as of June 2025.

Expansion of Defense and Security Applications

Defense agencies adopt satellite data services for surveillance, reconnaissance, and threat assessment. The ability to provide secure, near real-time information strengthens national security frameworks. High-quality satellite imagery aids in border monitoring and maritime surveillance. Governments continue to allocate funding to enhance defense capabilities with satellite-based data. It ensures situational awareness in both peacetime and conflict scenarios. The strategic role of satellite data in modern defense pushes continuous investments in the market.

- For instance, Planet’s Pelican‑3 and Pelican‑4 satellites—launched in August 2025—deliver up to 40 cm‑class resolution imagery across six multispectral bands and each hosts an NVIDIA Jetson AI module for real‑time on‑orbit processing.

Growth in Commercial and Enterprise Adoption

Enterprises increasingly adopt satellite data services for operational efficiency. Industries such as mining, logistics, and insurance integrate geospatial data into decision-making processes. Satellite data helps track assets, assess risks, and streamline supply chain operations. The agricultural sector leverages data for crop health monitoring and yield optimization. It supports business continuity planning by providing critical insights. The market expands as enterprises recognize the value of satellite-derived intelligence.

Technological Advancements and Integration with Emerging Systems

Advancements in data analytics, AI, and cloud platforms enhance the utility of satellite data services. Integration with IoT and 5G networks improves connectivity and real-time data access. Miniaturization of satellites and reduced launch costs support frequent deployments. The Satellite Data Services Market benefits from these innovations, increasing accessibility for government and private users. It supports broader adoption across developing economies where traditional infrastructure is limited. The integration of advanced technologies ensures long-term growth for the market.

Market Trends

Increasing Adoption of High-Resolution Imagery

The demand for high-resolution imagery is shaping the Satellite Data Services Market. Governments and enterprises require detailed images for urban planning, defense surveillance, and resource mapping. Advances in imaging sensors deliver sharper images with better spectral accuracy. It allows more reliable analysis in agriculture, forestry, and infrastructure projects. Commercial providers invest in constellations that supply sub-meter resolution data. This trend supports critical operations that rely on precise visual information.

- For instance, as an official Value‑Added Reseller (VAR), Satellite Imaging Corporation distributes high‑resolution optical products with ground sample distance ranging from 30 cm to 2 m, including orthorectified mosaics, digital elevation models (DEMs), and 3D digital terrain models (DTMs).

Expansion of Cloud-Based Data Delivery Platforms

Cloud integration is becoming central to how satellite data is distributed and analyzed. Providers use scalable platforms to offer faster access and storage for large volumes of geospatial data. Cloud-based delivery reduces processing time and improves collaboration across industries. It helps enterprises integrate satellite insights with their existing digital ecosystems. Flexible subscription models make satellite data more affordable for small and medium businesses. The move to cloud services strengthens efficiency and accessibility in the market.

- For instance, Airbus, in partnership with Google Cloud, reduced image access time for customers from several hours to under half a second and currently adds 500 terabytes of imagery data per year, with plans to scale up to 2 petabytes annually as their satellite and drone capabilities expand.

Integration of AI and Advanced Analytics

Artificial intelligence and machine learning are increasingly applied to satellite data. Automated processing identifies patterns, tracks changes, and improves predictive modeling. It enhances the speed and accuracy of insights for disaster management, defense, and logistics. Advanced analytics reduce human error and increase the usability of large datasets. AI-based applications expand the value of satellite services for both public and private clients. The integration of AI drives innovation and competitiveness among providers.

Growth in Demand for Real-Time Monitoring

The need for real-time monitoring supports continuous growth in satellite services. Industries such as energy, transportation, and maritime operations require up-to-date geospatial intelligence. It enables proactive decision-making and rapid response to changing conditions. Low Earth Orbit constellations play a key role in delivering near real-time data. Governments also rely on real-time monitoring for climate studies and security missions. The trend emphasizes the importance of timeliness and accuracy in satellite data services.

Market Challenges Analysis

High Costs and Limited Accessibility

The Satellite Data Services Market faces significant challenges due to the high cost of infrastructure, launch, and data processing. Developing and maintaining advanced satellite systems requires large capital investment, which restricts participation for smaller companies and emerging economies. Pricing models for high-resolution data remain expensive, limiting broader adoption across industries. It creates barriers for enterprises that could benefit from satellite intelligence but lack financial capacity. Limited accessibility impacts sectors like agriculture and logistics in developing regions. High upfront and operational costs slow down market expansion and restrict scalability.

Data Security, Privacy, and Regulatory Constraints

Data security and privacy concerns present another major challenge in the Satellite Data Services Market. Sensitive information derived from high-resolution imagery and surveillance requires strong protection against cyber threats. Governments enforce strict regulations to control data sharing, which restricts commercial applications in defense and critical infrastructure monitoring. It complicates cross-border collaborations and delays project approvals. The lack of uniform international standards adds complexity for global operators. Compliance requirements increase costs and slow innovation. These regulatory and security challenges continue to test the resilience of market participants.

Market Opportunities

Expanding Role in Climate Monitoring and Sustainable Development

The growing focus on environmental sustainability creates strong opportunities in the Satellite Data Services Market. Governments and organizations depend on satellite-derived insights to track deforestation, melting glaciers, and rising sea levels. High-resolution data supports accurate modeling of climate change effects and enables proactive resource management. It assists in monitoring greenhouse gas emissions and enforcing environmental compliance standards. International programs encourage the adoption of satellite data for sustainable agriculture and water management. This growing demand for environmental intelligence strengthens the long-term role of satellite services.

Rising Adoption in Commercial and Enterprise Applications

Commercial industries present a wide scope for satellite data service providers. Logistics companies use geospatial intelligence to optimize routes and improve supply chain transparency. Insurance firms apply satellite data to assess risks and verify claims with greater accuracy. It supports precision farming by enabling crop yield estimation and soil health monitoring. Maritime operators benefit from real-time tracking of vessels for safety and efficiency. The Satellite Data Services Market gains from this enterprise adoption, expanding its reach beyond government and defense into diverse economic sectors.

Market Segmentation Analysis:

By Service

The Satellite Data Services Market is segmented into image data services and data analytics services. Image data services provide raw or processed satellite imagery, which supports applications in defense, agriculture, urban development, and disaster management. High-resolution images enable accurate mapping, environmental monitoring, and infrastructure planning. Data analytics services expand the value chain by converting imagery into actionable insights through advanced modeling, predictive analysis, and AI-driven processing. It increases the utility of satellite data for sectors requiring timely intelligence, including energy, mining, and logistics. The growing need for real-time and customized solutions strengthens the role of analytics in market growth.

- For instance, BlackSky’s Gen‑3 satellites deliver very-high-resolution imagery at 35 cm spatial resolution (NIIRS‑5+) with hourly revisit capability, and enabled delivery of the first AI‑processed imagery just five days after a February 18 launch.

By Application

Applications of satellite data services extend to scientific, administrative, and commercial domains. Scientific applications focus on space research, environmental studies, and climate monitoring, supporting long-term global initiatives. Administrative use includes disaster response, land management, and national security, where timely information is critical. Commercial applications dominate with sectors such as agriculture, transportation, insurance, and maritime depending on geospatial data for efficiency. It supports revenue generation across industries by enabling operational optimization and risk assessment. The ability to serve both public and private needs highlights the versatility of satellite data services across applications.

- For instance, Capella delivers SAR imagery at 50 cm spot resolution, achieving up to five revisits per location per day, and processes new tasking requests in under 15 minutes.

By End-user

End-users of the market include commercial, government, and military organizations. Commercial enterprises adopt satellite data for logistics tracking, insurance validation, and precision farming. Governments use it for policy planning, infrastructure development, and environmental compliance monitoring. Military and defense agencies rely on high-resolution imagery and data analytics for surveillance, reconnaissance, and tactical planning. It ensures mission success by providing near real-time intelligence in conflict zones and border security operations. The diverse demand from end-users strengthens the Satellite Data Services Market, reflecting its growing strategic and operational importance.

Segments:

Based on Service:

- Image Data Service

- Data Analytics Service

Based on Application:

- Scientific

- Administrative

- Commercial

Based on End-User:

- Commercial

- Government

- Military

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Satellite Data Services Market, accounting for around 40% of the global market. The region benefits from the presence of leading satellite operators and technology providers such as Maxar Technologies, Planet Labs, and SpaceX. Strong government support through agencies like NASA and NOAA drives demand for Earth observation and environmental monitoring services. The U.S. Department of Defense also invests heavily in satellite data for reconnaissance, surveillance, and defense applications. Commercial adoption is significant, with enterprises using geospatial insights for logistics, agriculture, and insurance. It strengthens the region’s dominance by combining government initiatives with private sector growth. Expanding investments in AI-based data analytics and cloud delivery platforms further enhance North America’s position.

Europe

Europe accounts for approximately 25% of the global market share in satellite data services. The region benefits from strong collaborations under the European Space Agency (ESA) and the Copernicus program, which provides free and open access to satellite data. Countries such as France, Germany, and the United Kingdom invest in high-resolution imaging and advanced data analytics for defense, security, and environmental monitoring. Commercial applications are rising, with enterprises leveraging satellite intelligence for infrastructure development, climate monitoring, and maritime navigation. It supports growth by integrating government-backed projects with expanding private sector adoption. The emphasis on sustainable development and monitoring greenhouse gas emissions further drives demand for satellite data services in Europe.

Asia-Pacific

Asia-Pacific represents nearly 20% of the global market share and is one of the fastest-growing regions in satellite data services. Countries such as China, India, and Japan are leading with ambitious satellite programs and expanding Earth observation constellations. China’s Gaofen series and India’s ISRO projects supply extensive data for agriculture, weather forecasting, and defense applications. Japan invests in disaster monitoring and climate observation through its ALOS and Himawari satellites. Commercial demand is increasing as industries adopt satellite data for smart city planning, logistics, and resource management. It demonstrates strong growth potential due to rising government investments and increasing enterprise adoption. Regional players collaborate with global providers, further strengthening market expansion.

Latin America

Latin America contributes around 8% of the global market share in satellite data services. Countries like Brazil, Mexico, and Argentina are adopting satellite data for environmental monitoring, agriculture, and disaster management. Brazil’s National Institute for Space Research (INPE) uses satellite imagery for rainforest monitoring and deforestation control. Commercial usage is growing, especially in mining, oil exploration, and maritime navigation. It reflects rising demand for regional data solutions, although infrastructure limitations slow adoption compared to developed regions. Partnerships with international providers and government-backed projects continue to boost growth opportunities across Latin America.

Middle East & Africa

The Middle East & Africa region accounts for nearly 7% of the global market share. Governments in the Middle East invest in satellite programs to strengthen defense surveillance, border security, and communication networks. The United Arab Emirates, through its space agency and projects like KhalifaSat, focuses on Earth observation and regional monitoring. African nations increasingly adopt satellite data for agriculture, water resource management, and disaster relief. It faces challenges from limited infrastructure and funding, but international collaborations help bridge capability gaps. Growing private sector interest and investments in smart city development also contribute to market expansion in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Geocento Limited

- ICEYE

- Satpalda

- NV5 Global, Inc.

- Planet Labs PBC.

- Earth-i Ltd

- L3Harris Technologies, Inc.

- Satellite Imaging Corporation

- Airbus SE

- Maxar Technologies Holdings Inc. (Maxar)

Competitive Analysis

The competitive landscape of the Satellite Data Services Market data providers. Maxar Technologies Holdings Inc. (Maxar), Planet Labs PBC, Airbus SE, ICEYE, L3Harris Technologies Inc., Earth-i Ltd, Geocento Limited, NV5 Global Inc., Satellite Imaging Corporation, and Satpalda. The Satellite Data Services Market is highly competitive, driven by continuous innovation in imaging, analytics, and data delivery. Companies differentiate themselves through advancements in high-resolution imagery, synthetic aperture radar technology, and cloud-based platforms that enable faster data access. Competition also centers on revisit frequency, accuracy, and integration of artificial intelligence for predictive analytics. Service providers expand their offerings beyond traditional Earth observation to include applications in agriculture, logistics, energy, insurance, and disaster management. Strategic partnerships, mergers, and collaborations are common as players aim to enhance global coverage and improve service scalability. The market continues to evolve with a focus on affordability, accessibility, and real-time intelligence for both government and commercial users.

Recent Developments

- In August 2025, BlackSky Technology received a contract from the Australian startup HEO to provide imagery of space objects, thereby enhancing the capabilities of defense, intelligence, and commercial applications. Under this contract, BlackSky is expected to integrate its high-resolution Synthetic Aperture Radar (SAR) imagery into HEO’s non-Earth imaging sensor network.

- In July 2025, Planet Labs PBC released atellite imagery will provide critical insights into agricultural operations, enabling more precise crop detection, geographical boundary.These platforms leverage Planet’s daily global imagery for agriculture, insurance, energy, and climate resilience applications.

- In September 2024, ICEYE US secured a five-year contract with NASA to provide synthetic aperture radar (SAR) data to the agency’s Commercial Smallsat Data Acquisition Program, helping NASA enhance its Earth Science Division’s research objectives and fortifying ICEYE’s market presence as a SAR data leader going into 2025.

- In June 2024, Ursa Space Systems partnered with NEC Corporation to offer satellite image analysis services through one of the largest “virtual constellations” of SAR and optical satellites worldwide. By combining NEC’s SAR-based monitoring with Ursa’s global image analysis platform, the partnership initially targets Japanese enterprises with plans for global expansion.

Report Coverage

The research report offers an in-depth analysis based on Service, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for Earth observation and climate monitoring.

- Governments will continue to invest in satellite programs for defense and security.

- Commercial adoption will grow in agriculture, logistics, and insurance sectors.

- Artificial intelligence will enhance predictive analytics and data processing speed.

- Cloud platforms will improve scalability and global accessibility of satellite data.

- Low Earth Orbit constellations will increase real-time monitoring capabilities.

- Synthetic aperture radar satellites will gain importance for all-weather data collection.

- International collaborations will strengthen data-sharing and multi-region coverage.

- Miniaturization of satellites will reduce costs and accelerate constellation deployments.

- The market will focus on integrating satellite data with IoT and 5G networks.