Market Overview

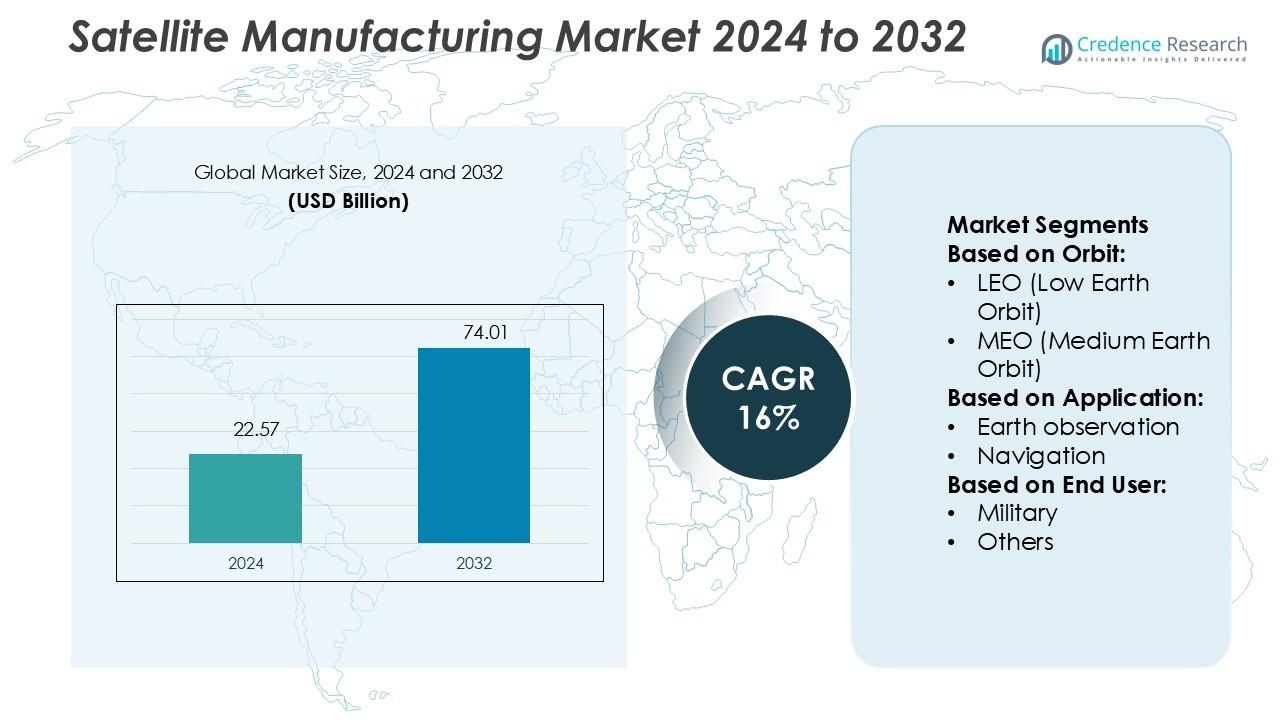

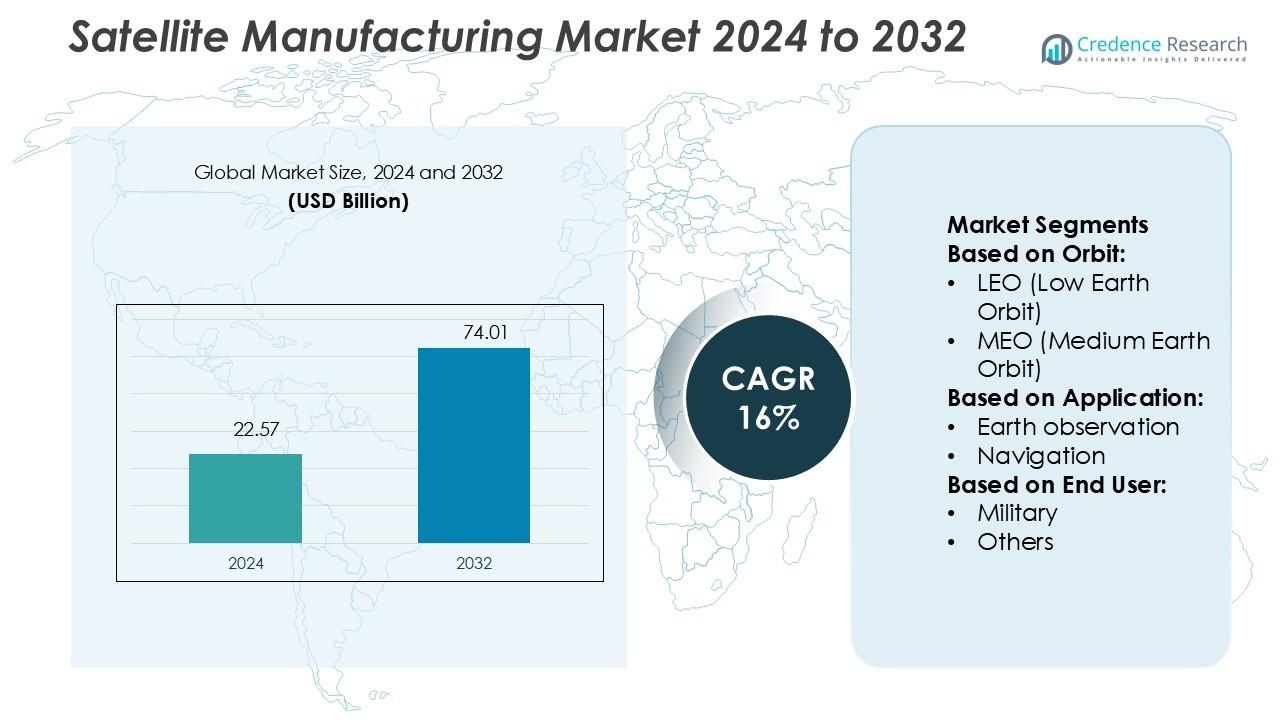

Satellite Manufacturing Market size was valued USD 22.57 billion in 2024 and is anticipated to reach USD 74.01 billion by 2032, at a CAGR of 16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Satellite Manufacturing Market Size 2024 |

USD 22.57 Billion |

| Satellite Manufacturing Market, CAGR |

16% |

| Satellite Manufacturing Market Size 2032 |

USD 74.01 Billion |

The satellite manufacturing market is shaped by leading players including Airbus, Boeing, Lockheed Martin, BAE Systems, Blue Canyon Technologies, Dhruva Space, EnduroSat, INVAP, Beijing Smart Satellite, and the Indian Space Research Organisation. These companies compete through technological innovation, large-scale production, and partnerships across commercial, government, and defense sectors. Established global leaders maintain dominance with advanced manufacturing capabilities, while emerging firms strengthen their presence through small satellite solutions and cost-efficient platforms. Regionally, North America leads the market with a 40% share, driven by strong government contracts, defense investments, and robust private sector initiatives supporting satellite constellations and communication programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Satellite Manufacturing Market was valued at USD 22.57 billion in 2024 and will reach USD 74.01 billion by 2032, growing at a CAGR of 16%.

- Rising demand for broadband connectivity, Earth observation, and navigation services is driving market expansion, supported by increasing government and defense investments worldwide.

- The market is witnessing a trend toward small satellite constellations, cost-efficient manufacturing, and advanced technologies such as electric propulsion, AI integration, and software-defined payloads.

- Competition remains intense, with established players leveraging advanced capabilities while emerging firms focus on affordable, scalable solutions; however, high manufacturing and launch costs continue to restrain smaller participants.

- North America leads with 40% share due to strong defense contracts and private sector initiatives, while Europe holds 25% with programs like Galileo; Asia Pacific accounts for 22% driven by China, India, and Japan, and communication satellites remain the dominant segment with over 45% share globally.

Market Segmentation Analysis:

By Orbit

Low Earth Orbit (LEO) satellites dominate the market with over 60% share, driven by growing demand for Earth observation, broadband connectivity, and small satellite constellations. Their lower launch costs and shorter latency make them highly attractive for commercial and defense applications. Medium Earth Orbit (MEO) satellites are mainly used for navigation services, while Geostationary Earth Orbit (GEO) satellites serve large-scale communication and broadcasting needs. However, the shift toward flexible, high-capacity LEO constellations continues to push investment and innovation, strengthening their lead in global satellite manufacturing.

- For instance, Boeing’s O3b mPOWER satellites use fully software-defined payloads that can dynamically allocate power among beams; Boeing delivered its 9th and 10th O3b mPOWER units featuring this flexibility.

By Application

Communication satellites account for the largest share, exceeding 45% of the market, supported by rising demand for broadband internet and global connectivity. Telecom operators and space tech companies are investing heavily in high-throughput communication satellites to reduce latency and expand coverage. Earth observation follows closely, driven by its use in weather monitoring, agriculture, and defense. Navigation satellites remain critical for GPS and global positioning systems, while other applications, such as scientific research, also contribute to steady growth. Increasing commercial reliance on space-based communication ensures communication remains the dominant segment.

- For instance, Dhruva Space offers the BOLT module, a hybrid connectivity solution designed for satellite applications.The module is capable of switching between terrestrial 4G/5G mobile networks and Dhruva Space’s satellite network to ensure continuous coverage.

By End User

The commercial segment leads the market with over 50% share, fueled by private sector investments in communication constellations, Earth observation services, and broadband deployment. Companies like SpaceX and OneWeb drive strong growth through satellite internet projects, creating a robust commercial demand base. Government agencies continue to play a significant role, particularly in funding space exploration and scientific missions. Military users drive demand for secure communication and reconnaissance satellites. However, expanding commercial applications in telecommunication and imaging make commercial players the key growth engine in satellite manufacturing.

Key Growth Drivers

Rising Demand for Broadband Connectivity

The surge in global internet demand, particularly in underserved regions, is a major driver of satellite manufacturing. Companies are deploying large-scale low Earth orbit (LEO) constellations to deliver high-speed broadband with low latency. Increasing adoption of smart devices, digital services, and e-commerce is further fueling demand for improved connectivity. Governments and private players are investing in satellite internet projects to bridge digital divides, positioning broadband-focused satellite manufacturing as a critical growth enabler in both developed and emerging economies.

- For instance, Lockheed Martin is contracted to build 36 Transport Layer (T2TL) small data-comms satellites under the Space Development Agency, each supporting software-defined payloads and mesh network interconnects.

Government and Defense Investments

Government agencies and defense organizations continue to drive significant investments in satellite manufacturing. Defense demand includes secure communication, surveillance, reconnaissance, and navigation systems, while governments prioritize weather forecasting, disaster monitoring, and space exploration. National space programs are expanding, with countries like the U.S., China, and India leading satellite launches. These initiatives support domestic manufacturing capabilities and encourage collaboration with private players. As national security and scientific research remain critical, sustained government and defense expenditure creates a strong growth pillar for the satellite manufacturing industry.

- For instance, INVAP developed a series of secondary monopulse surveillance radars for civil air traffic control, which were deployed across Argentine airfields in compliance with ICAO standards. In defense systems, INVAP created the RPA-240T primary radar, featuring an instrumented detection range of 240 nautical miles, with units produced for national deployment.

Advancements in Satellite Technology

Technological innovation is reshaping the satellite manufacturing landscape. The development of small, lightweight satellites with higher efficiency and improved payload capacity reduces costs and increases deployment speed. Advancements such as electric propulsion, miniaturized components, and software-defined payloads enhance satellite flexibility and lifecycle performance. These improvements allow manufacturers to meet diverse requirements across communication, Earth observation, and navigation applications. Growing integration with emerging technologies, including artificial intelligence (AI) and 5G, further strengthens the value proposition, making innovation a core driver of market expansion.

Key Trends & Opportunities

Growth of Small Satellite Constellations

The increasing use of small satellite constellations is a prominent trend creating new opportunities. These satellites offer cost efficiency, faster production cycles, and scalable deployment, making them ideal for Earth observation, scientific research, and commercial communication. Companies are capitalizing on this trend to build global coverage networks. The rising interest of startups and private players further accelerates innovation, lowering barriers to entry. As demand for flexible and frequent launches rises, small satellite manufacturing provides a lucrative opportunity for both established and emerging industry participants.

- For instance, ISRO’s Small Satellite Launch Vehicle (SSLV) accommodates payloads from 10 kg up to 500 kg into a 500 km LEO orbit, enabling rapid deployment of small satellites.

Integration with Emerging Technologies

Satellite manufacturing is benefiting from integration with advanced technologies like artificial intelligence, machine learning, and 5G. AI-powered data analytics improves Earth observation efficiency, while 5G-enabled satellites enhance communication speed and connectivity. The use of digital twins and advanced simulation tools streamlines design and production processes, reducing development costs. These innovations create opportunities for manufacturers to deliver smarter, adaptable satellites that align with modern connectivity requirements. The synergy between satellites and terrestrial networks also strengthens long-term opportunities in commercial communication and data-driven industries.

- For instance, Saturn-400, scales power and payload for smarter missions it accommodates payloads up to 600 kg and supports scalable power up to 2 kW, with optional built-in Control Moment Gyroscope (CMG) for finer attitude agility.

Key Challenges

High Manufacturing and Launch Costs

Satellite manufacturing and deployment involve significant capital expenditure, posing a major challenge for market growth. High costs of advanced materials, testing facilities, and integration processes limit accessibility for smaller players and startups. Launch costs, though declining due to reusable rockets, still represent a substantial investment for satellite operators. This financial barrier slows innovation adoption and restricts participation to well-funded companies. Managing affordability while delivering advanced capabilities remains a pressing challenge for the industry.

Regulatory and Space Debris Concerns

The rapid increase in satellite launches raises regulatory and environmental challenges. Congested orbital paths heighten the risk of collisions and space debris, threatening both new and existing satellites. Regulatory frameworks differ across countries, creating complexities for global operators. Compliance with spectrum allocation, orbital slots, and international agreements adds to operational burdens. Without effective regulations and debris mitigation strategies, satellite sustainability faces risks. Addressing these challenges is critical for maintaining safe, reliable satellite manufacturing and deployment in the future.

Regional Analysis

North America

North America dominates the satellite manufacturing market with over 40% share, supported by strong government, defense, and commercial investments. The U.S. leads with its advanced space programs, spearheaded by NASA, the Department of Defense, and private firms such as SpaceX, Northrop Grumman, and Lockheed Martin. Growing demand for communication satellites, Earth observation systems, and national security applications drives the region’s leadership. Rising investments in broadband connectivity through low Earth orbit (LEO) constellations further strengthen market expansion. Canada also contributes with advancements in robotics and satellite imaging, reinforcing North America’s global leadership position.

Europe

Europe holds a market share of around 25%, driven by robust programs led by the European Space Agency (ESA) and national agencies. The region emphasizes scientific research, Earth observation, and sustainable satellite technologies. Countries such as France, Germany, and the UK lead manufacturing activities through key players like Airbus Defence and Space and Thales Alenia Space. Investments in navigation systems, including Galileo, enhance regional positioning. Growing demand for climate monitoring satellites aligns with Europe’s sustainability goals. The region also benefits from collaborative international projects, enabling steady growth across both governmental and commercial segments.

Asia Pacific

Asia Pacific accounts for nearly 22% share of the satellite manufacturing market, fueled by rapid advancements in China, India, and Japan. China leads with strong government-backed programs, large-scale LEO constellation projects, and investments in defense satellites. India’s ISRO continues to expand capabilities in cost-efficient satellite launches and Earth observation. Japan focuses on advanced imaging and communication systems, supported by Mitsubishi Electric and NEC. Rising demand for navigation and communication satellites in Southeast Asia further boosts growth. Urbanization, digital connectivity initiatives, and defense modernization make Asia Pacific the fastest-growing region in satellite manufacturing.

Latin America

Latin America captures a modest share of around 7%, with steady growth driven by increasing communication and Earth observation needs. Brazil leads the region with satellite programs focused on telecommunication, defense, and agricultural monitoring. Partnerships with global manufacturers and agencies support technology transfer and capacity building. Mexico, Argentina, and Chile also show growing interest in satellite-based services to improve connectivity and disaster management. Despite limited domestic manufacturing capabilities, the region benefits from rising demand for broadband expansion and environmental monitoring, creating opportunities for collaborations with established global players.

Middle East & Africa

The Middle East & Africa region holds approximately 6% share of the satellite manufacturing market, with growth supported by national security, telecommunication, and space exploration initiatives. Countries such as the UAE and Saudi Arabia are investing in indigenous satellite programs to enhance defense and commercial communication capacity. South Africa remains a key player in Africa, contributing through research and Earth observation projects. The growing demand for broadband connectivity in remote areas, coupled with increasing government-led space investments, is driving market expansion. Strategic collaborations with international manufacturers further accelerate technological adoption in the region.

Market Segmentations:

By Orbit:

- LEO (Low Earth Orbit)

- MEO (Medium Earth Orbit)

By Application:

- Earth observation

- Navigation

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the satellite manufacturing market features key players such as EnduroSat, Boeing, Dhruva Space, BAE Systems, Lockheed Martin, INVAP, Beijing Smart Satellite, Airbus, Indian Space Research Organisation, and Blue Canyon Technologies. The satellite manufacturing market is highly competitive, driven by technological advancements, government investments, and growing commercial demand. Companies focus on developing cost-efficient, lightweight, and high-performance satellites to address the rising need for broadband connectivity, Earth observation, and navigation services. Increasing adoption of small satellite constellations and software-defined payloads intensifies competition, as players strive to offer flexible and scalable solutions. Strategic collaborations, mergers, and partnerships with space agencies and private operators are central to gaining market presence. The competitive environment continues to evolve with innovations in propulsion, miniaturization, and integration of artificial intelligence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- EnduroSat

- Boeing

- Dhruva Space

- BAE Systems

- Lockheed Martin

- INVAP

- Beijing Smart Satellite

- Airbus

- Indian Space Research Organisation

- Blue Canyon Technologies

Recent Developments

- In Oct 2024, SpaceX collaborated with OneWeb and launched 20 satellites for Eutelsat Group as a part of their first mission. The launch highlights a significant step for Eutelsat to expand its low earth orbit satellite communications network, which offers service for different telecommunication and broadcasting clients.

- In August 2024, Northrop Grumman launched the constellation of Arctic satellite broadband mission which is developed for space Norway. This signifies a historic partnership between the U.S. space force and space Norway. It’s the first operational U.S. military payload worked on an international commercial space mission.

- In April 2024, Airbus SE announced that the EUTELSAT 36D telecommunications satellite built by the company was launched via a Falcon 9 rocket from the Kennedy Space Center in Florida, U.S. The satellite, part of the Eurostar Neo family, aimed to provide TV broadcasting and government services across Africa, Europe, and Eastern countries, with a planned operational lifetime exceeding 15 years.

- In December 2023, Thales Alenia Space and PT Len Industri signed a contract to deliver an advanced Earth observation system for the Indonesian Ministry of Defence. This system will combine radar and optical sensors in a satellite constellation. The two companies will work together to create a complete end-to-end solution, including both space and ground components in Indonesia.

Report Coverage

The research report offers an in-depth analysis based on Orbit, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for low Earth orbit constellations.

- Communication satellites will remain the dominant application segment.

- Governments will continue to invest heavily in defense and scientific missions.

- Commercial players will drive growth through broadband and imaging services.

- Small satellite manufacturing will increase due to cost and time efficiency.

- Advancements in propulsion and payload systems will enhance satellite performance.

- Integration with 5G and AI will strengthen future satellite applications.

- Regional players will emerge through national space programs and collaborations.

- Space sustainability measures will shape satellite design and deployment.

- Strategic partnerships will accelerate innovation and competitive positioning.