Market Overview:

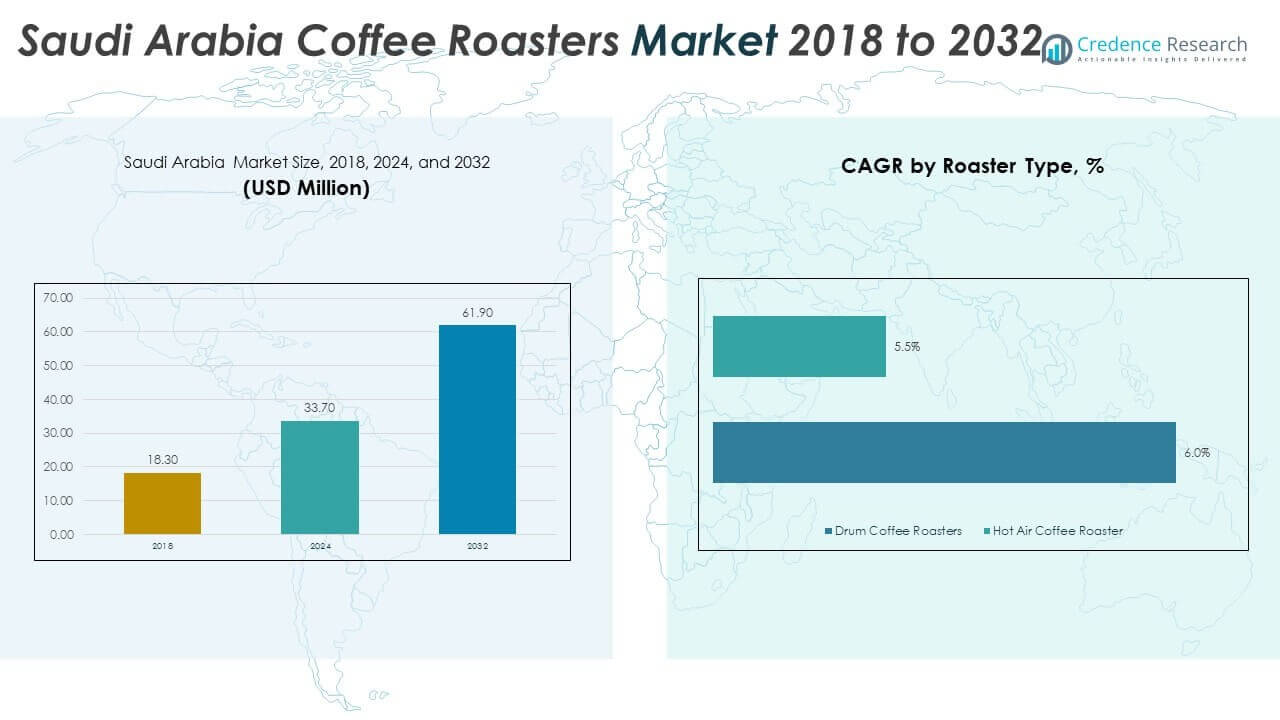

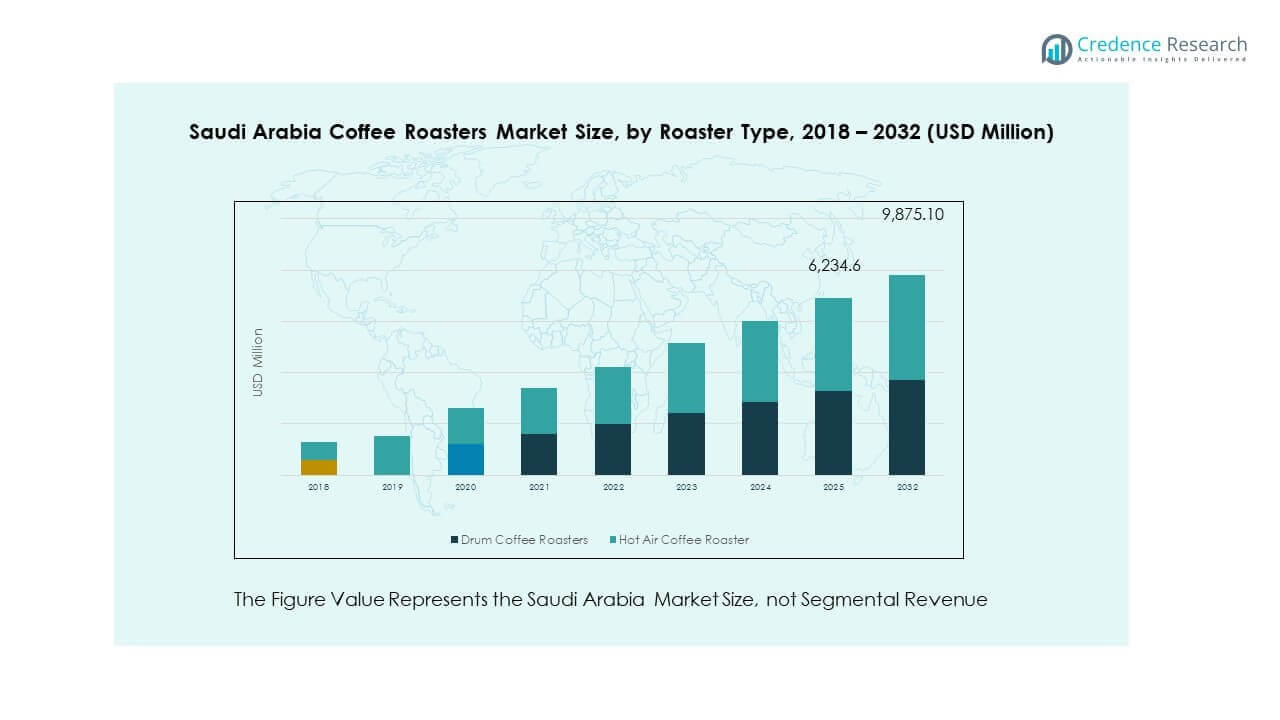

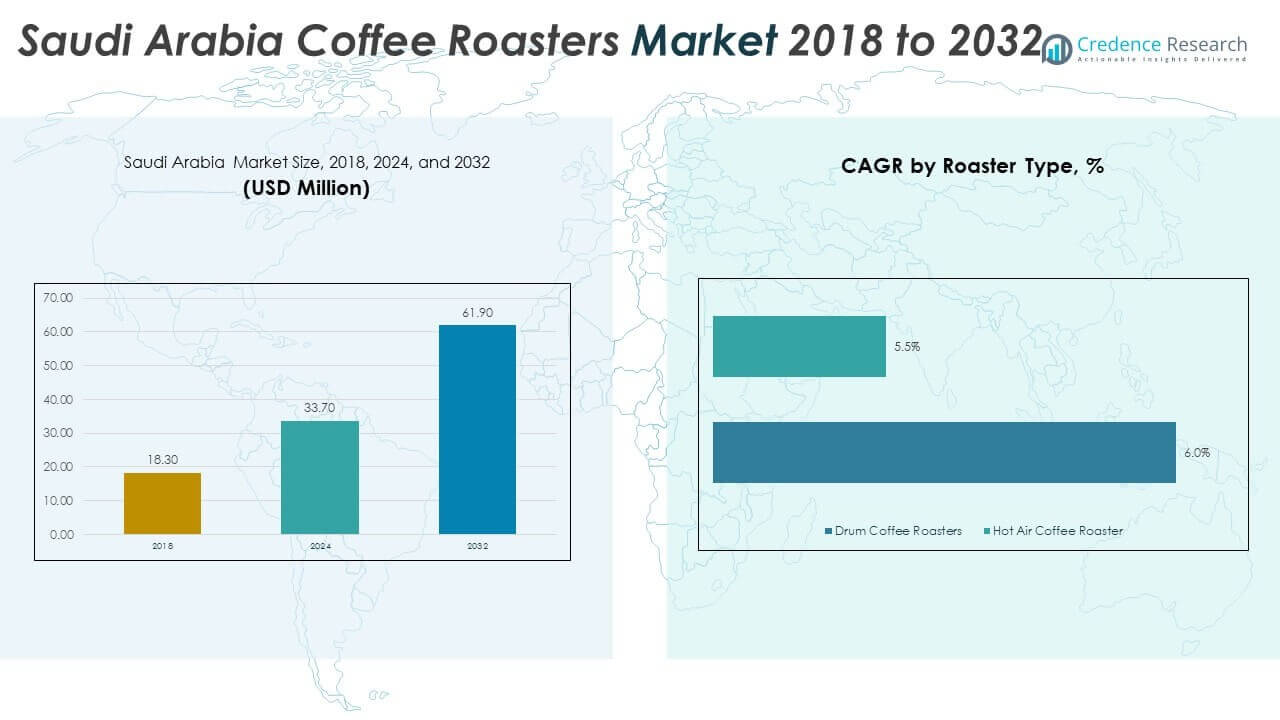

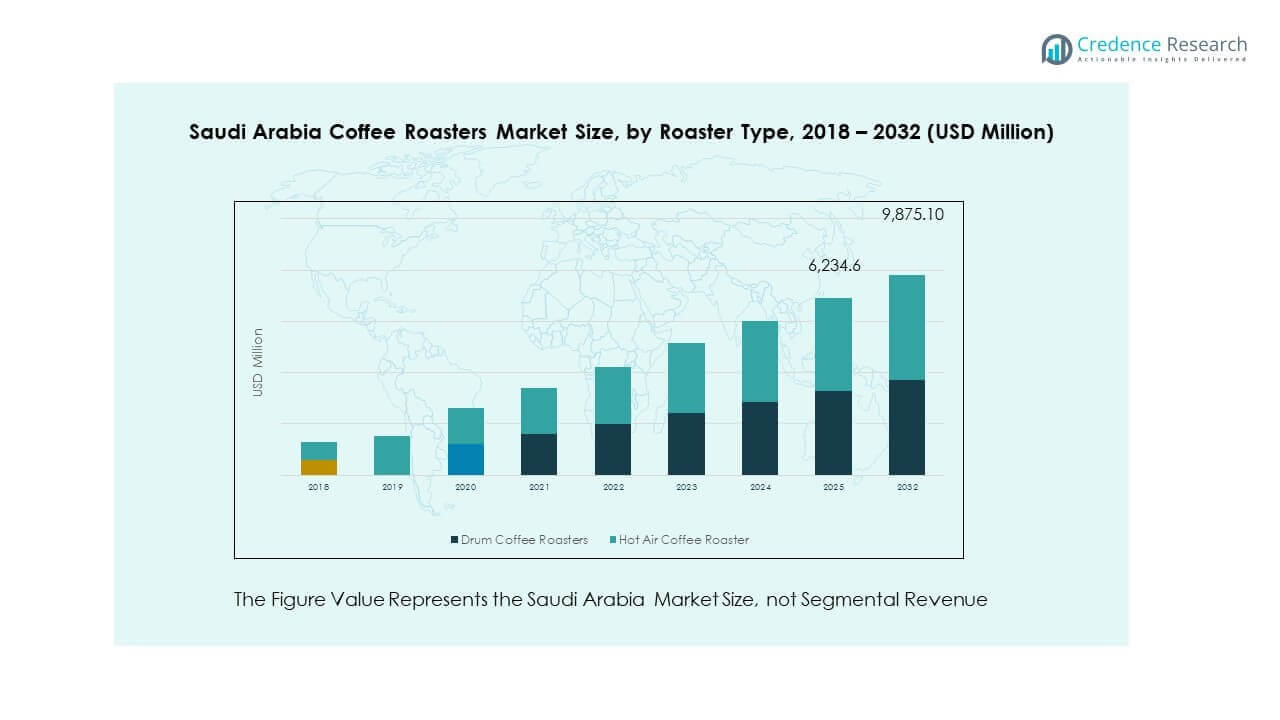

The Saudi Arabia Coffee Roasters Market size was valued at USD 18.3 million in 2018 to USD 33.7 million in 2024 and is anticipated to reach USD 61.9 million by 2032, at a CAGR of 7.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Saudi Arabia Coffee Roasters Market Size 2024 |

USD 33.7 Million |

| Saudi Arabia Coffee Roasters Market, CAGR |

7.90% |

| Saudi Arabia Coffee Roasters Market Size 2032 |

USD 61.9 Million |

The market is witnessing strong growth due to shifting consumer preferences toward specialty coffee and premium blends. Younger demographics are driving demand by adopting café culture and exploring diverse roasting styles. Rising disposable incomes, coupled with greater awareness of global coffee trends, are also shaping purchasing patterns. The growing presence of international and local coffee chains enhances competition and expands choices, while investments in modern roasting technologies improve quality and efficiency. These factors collectively strengthen the market outlook, fostering a competitive yet innovative environment for roasters.

Within Saudi Arabia, the Western and Central regions are the strongest markets, largely influenced by high urbanization, tourism inflows, and a vibrant café culture in cities like Jeddah and Riyadh. Emerging regions, particularly the Eastern Province, are showing growing interest due to rising youth populations and expanding hospitality sectors. Rural areas are slower in adoption but present untapped opportunities as awareness spreads. Overall, geographic diversity in consumer demand supports both large-scale coffee chains and niche local roasters, making Saudi Arabia a key hub for regional coffee roasting growth.

Market Insights:

- The Saudi Arabia Coffee Roasters Market was valued at USD 18.3 million in 2018, reached USD 33.7 million in 2024, and is projected to hit USD 61.9 million by 2032, growing at a CAGR of 7.90%.

- The Western region leads with 40% share, supported by strong tourism inflows and vibrant café culture; the Central region follows with 35%, driven by Riyadh’s urban demand; and the Eastern Province accounts for 15% with industrial expansion and youth-driven preferences.

- The Northern and Southern regions together hold 10% share but represent the fastest-growing areas due to improving retail penetration and rising awareness of specialty coffee.

- Drum coffee roasters dominate with an estimated 65% segment share, reflecting their precision and popularity among commercial roasters and specialty cafés.

- Hot air coffee roasters account for around 35% share, benefiting from their speed, experimental roasting suitability, and adoption among smaller-scale roasters.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Consumer Shift Toward Specialty Coffee Consumption:

The Saudi Arabia Coffee Roasters Market is expanding due to rising interest in specialty coffee among younger demographics. Consumers are drawn to unique flavors, higher quality beans, and diverse roasting methods. Coffee shops and roasteries increasingly highlight single-origin beans, which appeal to educated and health-conscious buyers. Urban millennials and expatriates are fueling demand by embracing café culture. This cultural shift has strengthened retail and online sales of roasted coffee products. Increased social media influence further encourages experimentation with brewing styles. It is driving strong growth in both premium and mid-range product categories.

- For instance, Bühler Group’s InfinityRoast technology, which maintains temperature stability to within plus or minus 1 degree Celsius during roasting, enables roasters to precisely control flavor profiles across different single-origin beans, accommodating rapid recipe adjustments needed for specialty coffee.

Influence of Rising Disposable Incomes and Lifestyle Changes:

Rising household incomes have supported spending on premium roasted coffee in Saudi Arabia. Consumers prefer better quality coffee experiences, both at home and in cafés. Coffee is increasingly positioned as a lifestyle product rather than a routine beverage. Expanding malls, luxury outlets, and international coffee brands reinforce this premiumization trend. Local roasters are also benefiting by offering innovative blends that cater to evolving tastes. Coffee-drinking rituals have become symbols of social status among younger consumers. This cultural and financial shift sustains demand for diverse roasting profiles. The Saudi Arabia Coffee Roasters Market continues to thrive under this dynamic.

- For example, JOPER’s BR 15 STANDARD model supports this trend with its batch size of up to 15 kg (60 kg per hour), equipped with manual controls for drum speed, airflow, and burner power. Its datalogger software compatibility allows roasters to track roast curves and repeat profiles accurately, ensuring consistency in delivering premium lifestyle coffee experiences.

Expansion of Café Culture and Hospitality Industry Development:

The growing number of cafés and coffee lounges strongly supports roasted coffee demand. Riyadh, Jeddah, and Dammam lead in café openings, reflecting urban lifestyle growth. Hospitality investments in hotels, restaurants, and resorts also drive roasted coffee sales. International chains and local brands compete to capture market share with new menu innovations. Coffee consumption in social and professional settings has become deeply embedded in daily routines. Demand for freshly roasted beans is accelerating through direct retail and café purchases. It is reshaping consumer preferences toward higher quality, locally roasted options. Continuous expansion of the hospitality sector reinforces the growth of roasters.

Government Initiatives and Support for Local Coffee Sector:

Government programs that promote coffee farming and local roasting support the industry’s long-term expansion. The Ministry of Environment, Water, and Agriculture has initiated projects to boost domestic coffee cultivation. Training programs and funding are enhancing the expertise of local roasters. Saudi Vision 2030 emphasizes diversification, which includes building a stronger food and beverage ecosystem. Partnerships with global players also enable knowledge sharing and quality improvements. These steps strengthen the domestic value chain, from farming to roasting and retail. It ensures that local roasters can compete with international brands effectively. This government backing provides strong momentum for sustained market growth.

Market Trends:

Market Trends:

Rapid Digitalization and Growth of Online Coffee Sales Channels:

The Saudi Arabia Coffee Roasters Market is adapting quickly to digital retail growth. Online platforms allow roasters to sell directly to consumers across the country. E-commerce growth has boosted demand for subscription models and doorstep delivery services. Social media marketing enhances brand recognition and creates direct engagement with coffee enthusiasts. Digital payment systems and loyalty apps simplify customer retention strategies. Home-brewing kits and roasted coffee packs dominate online purchases due to convenience. It supports wider market access, especially for small and emerging roasters. This trend makes digital retail a cornerstone of the future growth strategy.

- For example, Home-brewing kits and roasted coffee packs dominate online purchases due to convenience. It supports wider market access, especially for small and emerging roasters. This trend makes digital retail a cornerstone of the future growth strategy. Burns Roasters exemplifies this with its B270R model, delivering up to 612 kg per hour roasting capacity with a patented perforated drum for consistent convective heat transfer.

Rising Demand for Sustainable and Ethically Sourced Coffee Beans:

Sustainability has become an important consumer preference, driving demand for responsibly sourced beans. Buyers increasingly ask about the origin of coffee and its environmental footprint. Certifications like Fair Trade and Rainforest Alliance influence purchasing decisions. Roasters focus on traceability and ethical supply chains to align with consumer expectations. Sustainability campaigns also appeal to young professionals with strong environmental awareness. Local players are introducing eco-friendly packaging and carbon-reduction initiatives. It shapes purchasing behavior and enhances brand loyalty across urban markets. Sustainable practices are becoming a mainstream trend in coffee roasting and retailing.

- For example, Bühler plans to introduce a green coffee pre-heating system to further reduce energy use, signaling measurable sustainability efforts embraced by leading technology providers.

Integration of Advanced Roasting Technologies to Enhance Quality:

Technology adoption is improving roasting precision and consistency across the market. Advanced roasting machines with automated controls are becoming standard in professional setups. Roasters leverage software to adjust roasting profiles based on bean type and origin. This ensures uniformity in taste and quality, meeting the expectations of premium buyers. Investments in roasting labs and training enhance the skill base of local producers. Automated machines also reduce waste, improve efficiency, and lower production costs. It creates an environment where both large-scale and boutique roasters can compete effectively. Technology-driven operations are transforming the competitive landscape of roasted coffee supply.

Emergence of Local Artisan Roasters and Niche Market Growth:

Local artisan roasters are gaining popularity by offering personalized blends and craft roasting experiences. These businesses attract consumers seeking unique flavors and authenticity in their coffee. Artisan roasters host tasting sessions and workshops to educate buyers about brewing techniques. Niche products such as organic, cold brew, and flavored roasts are expanding rapidly. Smaller roasters benefit from strong consumer support for locally owned brands. It reflects cultural pride and a desire to support domestic businesses. Growth in artisan roasting adds diversity and depth to the competitive field. This trend strengthens the overall dynamism of the Saudi Arabia Coffee Roasters Market.

Market Challenges Analysis:

Market Challenges Analysis:

Volatile Raw Coffee Bean Prices and Dependence on Imports:

The Saudi Arabia Coffee Roasters Market faces major challenges due to global coffee price volatility. Roasters rely heavily on imported beans, making them vulnerable to fluctuations in global supply chains. Weather disruptions in producing nations often raise costs for local businesses. Currency exchange rates further complicate pricing strategies for imported raw coffee. Small and mid-sized roasters struggle to absorb these rising costs without passing them to consumers. Competition with international brands pressures local players to maintain affordable prices. It limits profitability and increases the financial risks of operating in this sector. Long-term reliance on imports remains a critical vulnerability.

High Market Competition and Pressure on Local Roasters:

Intense competition from global brands presents a strong barrier to local growth. International coffee chains bring established reputations, consistent quality, and premium positioning. Local roasters must invest in branding, technology, and marketing to retain consumer attention. Maintaining consistent quality standards is challenging for smaller businesses with limited resources. Consumers expect continuous innovation, which adds pressure to diversify product offerings. Café partnerships with international suppliers often restrict opportunities for domestic roasters. It requires strategic differentiation and investment to build long-term market presence. Balancing price competitiveness with quality remains a constant challenge for local roasters.

Market Opportunities:

Expansion of Premium Coffee Segments and Experiential Offerings:

Growing demand for high-quality specialty blends provides strong opportunities for local and international roasters. Consumers seek unique flavors, origin-based beans, and roasting precision for elevated experiences. Premium coffee offerings in luxury cafés, hotels, and online channels reinforce this trend. Hosting tasting events, workshops, and coffee festivals can create stronger brand loyalty. Younger demographics are particularly receptive to experiential coffee formats. It positions premium roasting as a key growth segment for the future. Domestic roasters can capitalize by offering authentic and innovative blends to this market.

Government Vision and Investments Driving Domestic Coffee Ecosystem:

Saudi Vision 2030 creates opportunities to strengthen domestic coffee production and roasting. Investments in training programs, agricultural research, and roasting infrastructure support this agenda. Government focus on food and beverage diversification enhances coffee’s strategic importance. Partnerships with universities and international organizations advance knowledge transfer. It supports innovation and boosts the competitiveness of domestic roasting businesses. Local roasters benefit from policy support and favorable funding programs. These opportunities align long-term growth with national economic development goals.

Market Segmentation Analysis:

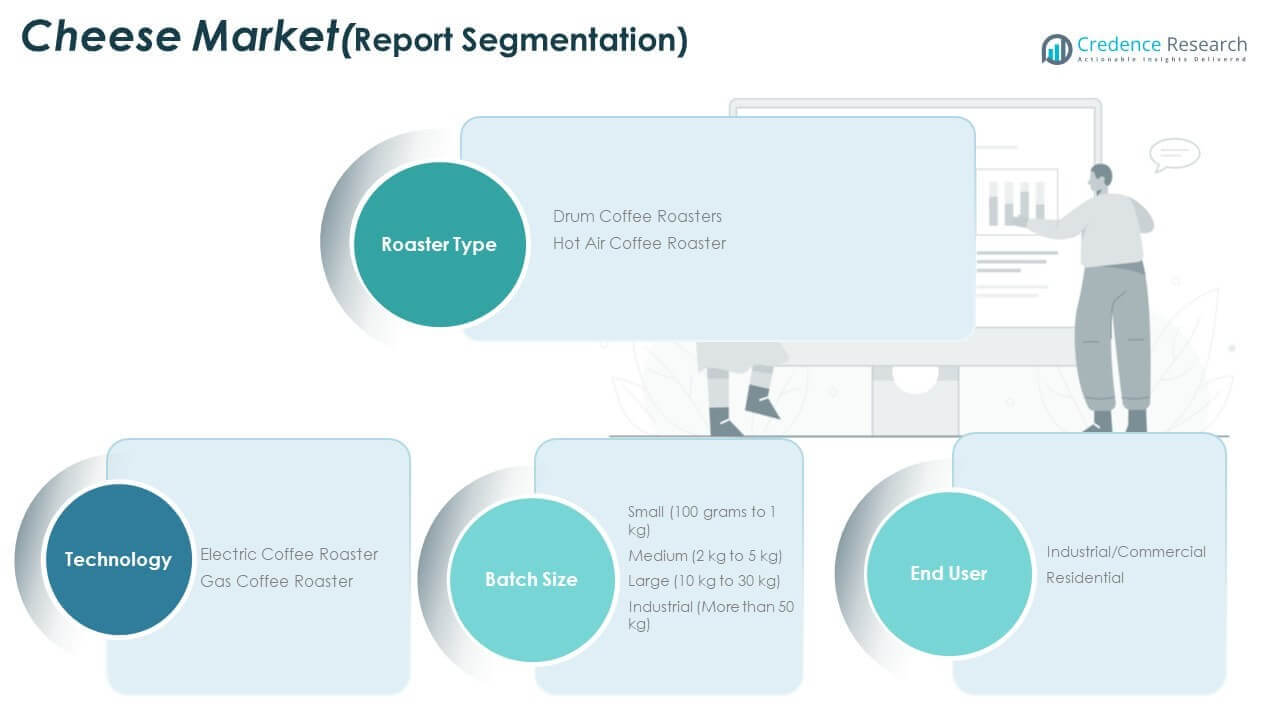

By Roaster Type

Drum coffee roasters dominate the Saudi Arabia Coffee Roasters Market due to their precision and ability to produce consistent roasting results. They are widely preferred by commercial roasters and specialty cafés. Hot air coffee roasters, though smaller in market share, are gaining attention for their faster roasting process and suitability for experimental blends. Both categories cater to evolving consumer preferences for quality and variety.

- For example, JOPER offers drum roasters with adjustable drum and fan speed controls, delivering roasting capacities from 1 to 25 kg per batch and energy savings of approximately 20% owing to motor speed variation technology. These allow roasters to craft precise roast curves tailored to different beans, meeting the demands for variety and quality.

By Technology

Electric coffee roasters hold strong adoption among residential users due to ease of use and lower maintenance. They are energy-efficient and appeal to small-scale operations. Gas coffee roasters remain popular in industrial and commercial segments, offering greater control, scalability, and cost efficiency in bulk production. It highlights a clear divide between home-based roasting convenience and large-scale professional needs.

For example, Gas coffee roasters remain popular in industrial and commercial segments, offering greater control, scalability, and cost efficiency in bulk production. It highlights a clear divide between home-based roasting convenience and large-scale professional needs.

By Batch Size

Small roasters ranging from 100 grams to 1 kilogram are increasingly adopted by home brewers and boutique cafés. Medium and large roasters serve the needs of mid-sized coffee shops and local roasting businesses. Industrial roasters, with capacities above 50 kilograms, are central to large-scale roasting operations, ensuring mass production and consistent supply. Each batch size category reflects the diversity of demand across consumer and commercial markets.

By End User

Industrial and commercial users represent the largest demand segment, driven by cafés, restaurants, and large roasteries. Their preference lies in advanced technologies and higher batch capacities. Residential users, though smaller in scale, are expanding steadily due to the rise of home-brewing culture. It ensures that both professional and domestic markets contribute to long-term growth.

Segmentation:

Segmentation:

By Roaster Type

- Drum Coffee Roasters

- Hot Air Coffee Roasters

By Technology

- Electric Coffee Roasters

- Gas Coffee Roasters

By Batch Size

- Small (100 grams to 1 kg)

- Medium (2 kg to 5 kg)

- Large (10 kg to 30 kg)

- Industrial (More than 50 kg)

By End User

- Industrial/Commercial

- Residential

Regional Analysis:

Western Region – Leading Market Hub

The Western region accounts for the largest share of the Saudi Arabia Coffee Roasters Market, holding nearly 40%. Cities such as Jeddah and Makkah drive this dominance through strong tourism inflows, a vibrant café culture, and higher adoption of specialty coffee. International visitors and expatriates have significantly influenced consumer preferences, leading to wider acceptance of premium roasted beans. The hospitality industry, supported by hotels and restaurants, creates consistent demand for bulk roasting solutions. Local artisan roasters have also gained visibility in this region, offering diverse blends and single-origin varieties. It positions the Western region as the leading hub for roasted coffee consumption and retail growth.

Central Region – Expanding Urban Demand

The Central region holds around 35% of the market share, anchored by Riyadh’s strong purchasing power and rapid lifestyle changes. The capital city fosters a growing network of cafés, roasteries, and boutique coffee outlets. Rising disposable incomes and youth-driven demand for premium coffee experiences strengthen market penetration. Government-backed initiatives under Vision 2030 to diversify the economy further encourage investment in hospitality and food services. Local and international players are leveraging Riyadh’s urban concentration to test new roasting technologies and product formats. It reflects a market that balances strong consumption with significant room for innovation and expansion.

Eastern and Emerging Regions – Rising Growth Potential

The Eastern Province contributes close to 15% of the overall market, supported by industrial expansion and a younger population embracing modern coffee culture. Cities such as Dammam and Khobar are witnessing higher café openings and growing demand for specialty roasting solutions. The Northern and Southern regions, though smaller with a combined 10% share, are gradually expanding due to improved retail networks and awareness campaigns. These regions represent untapped opportunities for roasters targeting first-time buyers and emerging middle-class households. Regional players are expected to benefit from expanding distribution channels and targeted consumer education. It highlights how emerging geographies are shaping the long-term potential of the Saudi Arabia Coffee Roasters Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Bühler Group

- JOPER

- Burns

- Giesen

- Origins Coffee

- Kaapi Machines

- Other Key Players

Competitive Analysis:

The Saudi Arabia Coffee Roasters Market is moderately fragmented, with a mix of international and domestic players competing for share. Global companies such as Bühler Group, JOPER, and Giesen bring advanced technologies and established brand credibility. Local roasters and equipment suppliers compete by offering customized solutions and cost advantages. The presence of niche artisan roasters strengthens diversity and appeals to younger demographics. Market leaders focus on product innovation, distribution expansion, and sustainability practices. It reflects an environment where both global expertise and local adaptability shape competitive positioning.

Recent Developments:

- Giesen Roasting Solutions announced on July 8, 2025, the launch of new flagship coffee roaster models, the Giesen 6 and Giesen 15, which include advanced features like wireless control and AI-driven options. These will be fully available by the end of 2025 and will boost coffee roasting capabilities in markets including Saudi Arabia.

- Kaapi Machines, a company focused on enhancing coffee business technology and training, continues to empower coffee businesses in India mainly but also draws on international collaborations that may benefit the Saudi market indirectly through technology transfer. Their latest offerings and partnerships were noted as of mid-2025.

- In early 2025, JOPER has expanded its presence in Saudi Arabia by installing new coffee roasting machines, reflecting growth and investment in the region’s coffee roasting infrastructure, including at least two new roasters installed as of February 2025.

- In Saudi Arabia, Bühler Group has been actively involved in the coffee sector by providing roasting technology that allows coffee producers to set their own flavor signature and achieve high-quality blends. Their innovative solutions in coffee processing are based on strong R&D and collaborations, supporting premium coffee production standards as of late 2023.

Report Coverage:

The research report offers an in-depth analysis based on roaster type, technology, batch size, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising café culture will continue to drive demand for premium roasters.

- Local artisan roasters will strengthen niche market presence through craft roasting.

- Government support under Vision 2030 will enhance domestic production capabilities.

- Expansion of online retail will boost roasted coffee sales and distribution networks.

- Technological adoption will improve efficiency and product consistency for roasters.

- Sustainability initiatives will increase demand for ethically sourced coffee beans.

- International partnerships will foster training and knowledge transfer across the sector.

- Residential demand will expand further with rising interest in home-brewing.

- Emerging regions will create opportunities through untapped consumer segments.

- Competitive dynamics will push both global and local players toward continuous innovation.

Market Trends:

Market Trends: Market Challenges Analysis:

Market Challenges Analysis: Segmentation:

Segmentation: