Market Overview

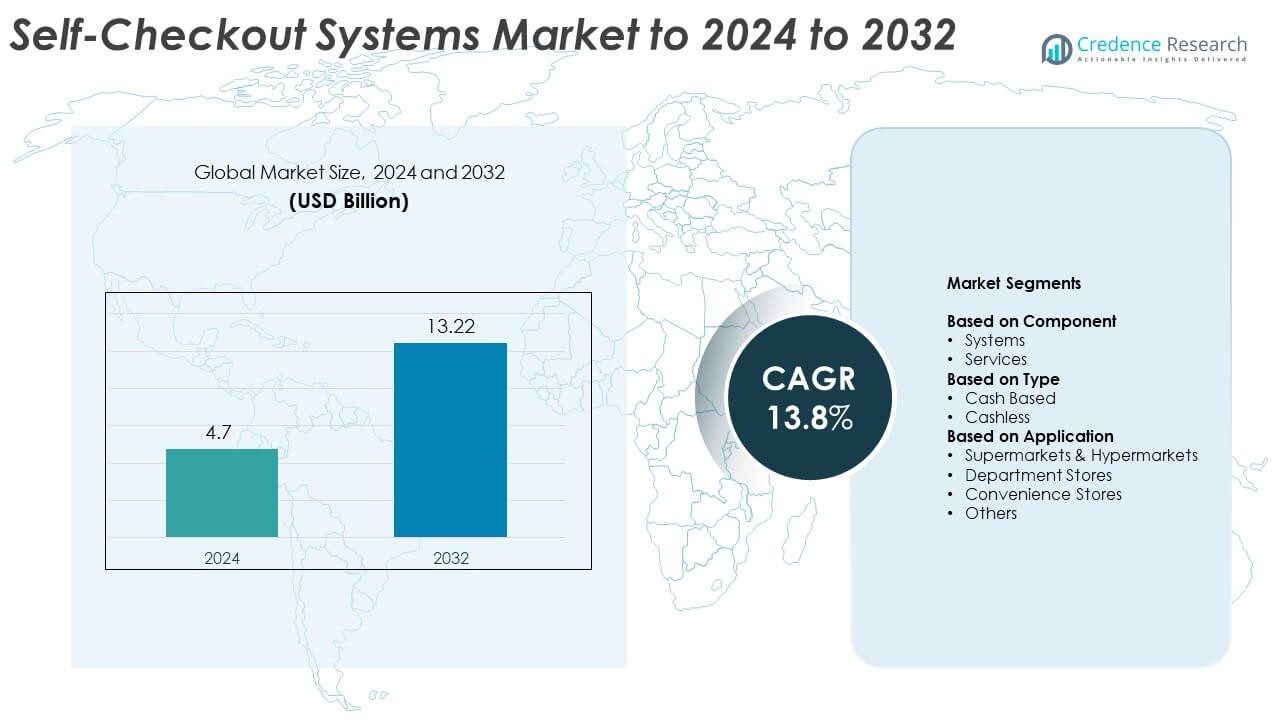

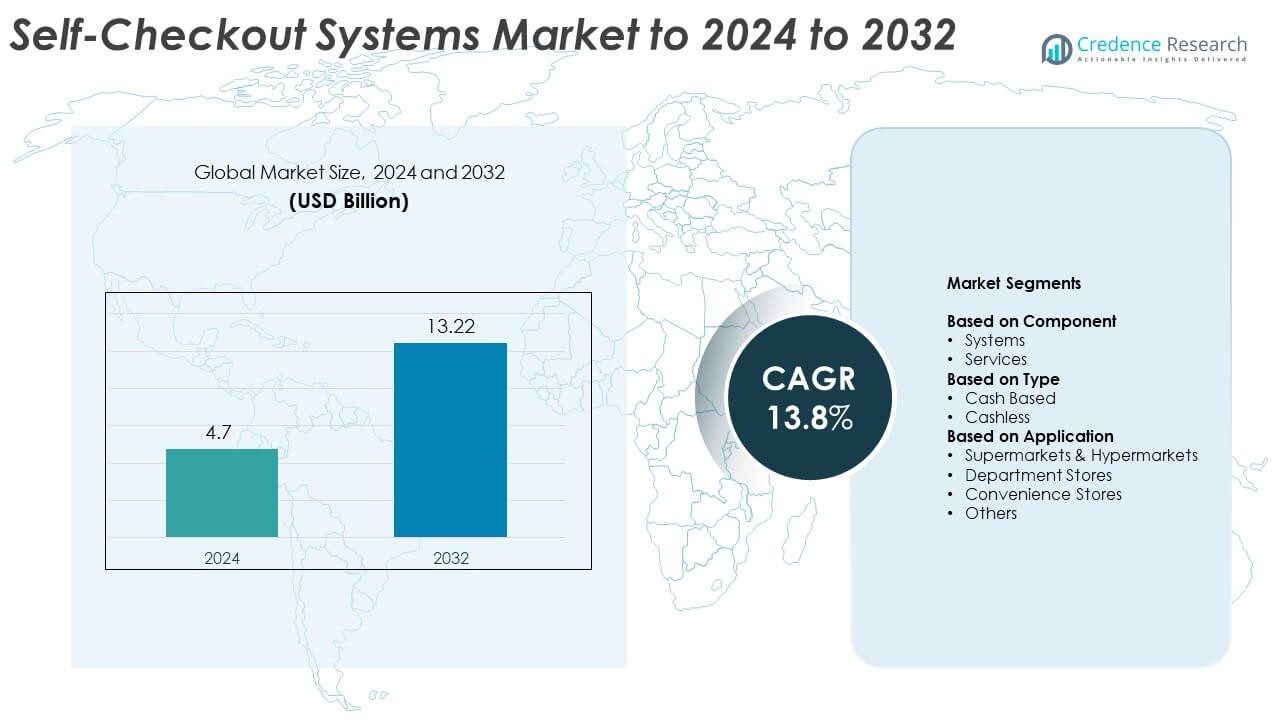

The Self-Checkout System Market size was valued at USD 4.7 billion in 2024 and is anticipated to reach USD 13.22 billion by 2032, at a CAGR of 13.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Self-Checkout System Market Size 2024 |

USD 4.7 Billion |

| Self-Checkout System Market , CAGR |

13.8% |

| Self-Checkout System Market Size 2032 |

USD 13.22 Billion |

The self-checkout system market is led by major players including NCR Corporation, Toshiba Global Commerce Solutions, Diebold Nixdorf, Incorporated, Fujitsu, ITAB, Pyramid Computer GMBH, StrongPoint, Gilbarco Veeder-Root Company, ePOS HYBRID, MetroClick, and Metcalfe. These companies focus on innovation through AI integration, contactless payment solutions, and cloud-based management platforms to enhance retail efficiency. Strategic partnerships with retailers and technology providers further strengthen their global presence. North America dominated the market in 2024 with a 38.6% share, supported by advanced retail infrastructure and widespread adoption of digital payment systems across supermarkets, hypermarkets, and convenience stores.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The self-checkout system market was valued at USD 4.7 billion in 2024 and is projected to reach USD 13.22 billion by 2032, growing at a CAGR of 13.8%.

- Rising demand for contactless transactions, automation in retail, and reduced labor dependency are key drivers supporting rapid adoption across global retail chains.

- The market is witnessing strong trends in AI-enabled, cashless, and hybrid checkout models that enhance customer convenience and operational efficiency.

- The industry is highly competitive, with companies focusing on product innovation, security integration, and strategic collaborations to expand market presence.

- North America led with 38.6% share in 2024, followed by Europe at 27.4% and Asia-Pacific at 23.8%, while the systems segment dominated by accounting for 68.5% share in the same year.

Market Segmentation Analysis:

By Component

The systems segment dominated the self-checkout system market in 2024, accounting for around 68.5% share. This dominance is driven by rising deployment of advanced kiosks integrated with AI, computer vision, and touchless payment features. Retailers increasingly prefer self-service systems to reduce labor costs and enhance checkout speed. Meanwhile, the services segment is growing steadily due to ongoing maintenance, software upgrades, and technical support requirements. The expansion of smart retail infrastructure across supermarkets and convenience chains continues to strengthen demand for both hardware and managed service offerings.

- For instance, Toshiba Global Commerce Solutions has an installed base of over 3 million POS and self-checkout units worldwide.

By Type

The cashless segment held the largest share of approximately 61.3% in 2024, reflecting the accelerating shift toward digital and contactless payment modes. Growing consumer adoption of mobile wallets and card-based transactions has made cashless self-checkout systems the preferred choice among modern retailers. These systems offer faster transactions, reduced theft risk, and enhanced hygiene. However, cash-based systems remain relevant in regions with limited digital penetration. The global trend toward cashless economies and omnichannel retailing continues to support segment expansion.

- For instance, Datos Insights found 71% of 2024 self-checkout units shipped were card-only (no cash acceptance).

By Application

The supermarkets and hypermarkets segment led the market in 2024, capturing about 49.7% share. The segment’s dominance is driven by the widespread adoption of self-checkout kiosks to manage high customer volumes and optimize floor operations. Large retail chains are deploying multiple terminals per store to minimize queue times and improve customer experience. Department and convenience stores are also adopting compact, modular systems to improve space efficiency. The surge in self-service retail models, especially in urban centers, continues to propel this segment’s growth.

Key Growth Drivers

Rising Demand for Contactless and Efficient Checkout Solutions

Retailers are rapidly adopting self-checkout systems to enhance shopping convenience and minimize queue times. The surge in contactless payment adoption and hygiene awareness since the pandemic has accelerated this shift. Consumers prefer fast, touch-free experiences, while retailers benefit from reduced labor dependency and operational costs. This growing emphasis on automation and digital payment infrastructure continues to drive system deployment across global retail formats.

- For instance, Mashgin processed 440 million transactions in 2024, surpassing 1 billion lifetime by April 2025

Expansion of Smart Retail and AI Integration

The integration of AI, machine learning, and computer vision is transforming self-checkout capabilities. These technologies enable automated product recognition, fraud prevention, and personalized promotions. Retailers are leveraging data analytics from self-checkout systems to improve inventory management and customer engagement. The push for intelligent and connected retail environments is expanding adoption, particularly in developed markets with strong technology infrastructure.

- For instance, Wesco doubled its locations using Mashgin’s AI-powered checkout kiosks after a successful pilot, recording a median checkout time of 18.7 seconds

Labor Cost Reduction and Operational Efficiency

Rising labor costs and staffing shortages have pushed retailers toward automation solutions. Self-checkout systems reduce dependency on cashiers, streamline transaction handling, and optimize store management. Large retail chains are investing in scalable kiosk networks to manage increasing customer traffic efficiently. The ability to maintain service quality while minimizing overheads has made these systems a strategic investment across the retail sector.

Key Trends & Opportunities

Adoption of Mobile and Hybrid Checkout Models

The combination of mobile scanning apps and self-checkout kiosks is reshaping retail operations. Customers can scan products using smartphones and complete payments through integrated digital wallets. Hybrid models, combining manned and self-service counters, are gaining traction to balance automation with customer assistance. This shift enhances flexibility and customer satisfaction, creating growth opportunities in both large and small retail formats.

- For instance, FutureProof Retail deployed Scan & Go across 73 Big Y supermarkets, enabling app-based scan-pay-go journeys.

Expansion in Emerging Markets and Small-Format Stores

Emerging economies in Asia-Pacific and Latin America present strong potential for market growth. The rapid modernization of retail infrastructure and digital payment systems supports adoption. Compact and cost-effective self-checkout solutions are being introduced for convenience stores and local retail chains. Increasing urbanization and the rise of organized retail in these regions continue to expand market reach.

- For instance, Carrefour France set a new record for franchise convenience store openings in 2024, with 454 new stores opened.

Key Challenges

High Initial Setup and Maintenance Costs

The deployment of advanced self-checkout systems involves significant upfront investments in hardware, software, and integration. Smaller retailers often face cost barriers when adopting these solutions. Maintenance expenses, including software updates and security management, further add to the total cost of ownership. These financial constraints limit adoption in price-sensitive and developing markets.

Security Risks and System Misuse

Self-checkout systems face challenges related to theft, barcode fraud, and scanning errors. Retailers must invest in AI-driven monitoring tools and smart cameras to prevent losses. Despite advancements, system misuse and intentional under-scanning remain common issues. Balancing customer convenience with robust security mechanisms continues to be a critical operational challenge for market players.

Regional Analysis

North America

North America dominated the self-checkout system market in 2024, holding around 38.6% share. The region’s growth is supported by the strong presence of retail giants and advanced payment infrastructure. High consumer preference for contactless shopping and labor cost optimization drives adoption across supermarkets, hypermarkets, and department stores. The United States remains the primary contributor, with rapid expansion of AI-integrated and cashless kiosks. Growing focus on operational efficiency and customer experience continues to boost the deployment of self-checkout systems across major retail chains in the region.

Europe

Europe accounted for approximately 27.4% share of the global market in 2024. The region benefits from strong regulatory support for digital payments and the widespread adoption of self-service technologies in retail. Major retailers in the United Kingdom, Germany, and France are expanding the use of advanced kiosks to improve customer throughput. The growing emphasis on sustainability and automation within European retail operations is further enhancing system deployment. Increasing demand for hybrid checkout formats combining convenience and security strengthens the market’s position across the continent.

Asia-Pacific

Asia-Pacific held about 23.8% market share in 2024 and is expected to grow at the fastest pace. The region’s expansion is driven by rapid retail digitization in China, Japan, South Korea, and India. Rising disposable incomes, urbanization, and smartphone-based payments are promoting self-checkout adoption. Local and international retailers are integrating AI-enabled kiosks in hypermarkets and convenience stores to improve operational efficiency. The region’s growing young consumer base, preference for digital experiences, and government support for cashless economies continue to fuel market growth.

Latin America

Latin America captured nearly 6.1% share of the self-checkout system market in 2024. The region’s growth is supported by increasing adoption of modern retail formats in Brazil, Mexico, and Chile. Expanding supermarket chains and greater use of mobile payments are driving system installations. However, high deployment costs and limited digital infrastructure in smaller economies restrain wider adoption. Retailers are gradually introducing low-cost and modular solutions to enhance affordability and scalability, supporting steady market penetration in the coming years.

Middle East & Africa

The Middle East and Africa region held a 4.1% share of the global market in 2024. Growth is supported by expanding retail investments in the UAE, Saudi Arabia, and South Africa. Rising preference for contactless shopping experiences and smart retail environments drives system deployment in malls and supermarkets. However, adoption remains moderate due to infrastructure gaps in several African markets. Increasing entry of international retail brands and growing consumer acceptance of digital payments are expected to enhance regional adoption over the forecast period.

Market Segmentations:

By Component

By Type

By Application

- Supermarkets & Hypermarkets

- Department Stores

- Convenience Stores

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The self-checkout system market is highly competitive, with key players such as NCR Corporation, Toshiba Global Commerce Solutions, Diebold Nixdorf, Incorporated, Fujitsu, ITAB, Pyramid Computer GMBH, StrongPoint, Gilbarco Veeder-Root Company, ePOS HYBRID, MetroClick, and Metcalfe shaping industry dynamics. Market participants focus on integrating advanced technologies like AI, IoT, and cloud-based analytics to enhance user experience and operational efficiency. Companies are investing heavily in R&D to develop scalable and customizable kiosk solutions suitable for different retail formats. Strategic partnerships with payment solution providers and retail chains are driving product innovation and regional expansion. Vendors also emphasize after-sales services, software upgrades, and data security enhancements to maintain long-term customer relationships. The rising demand for hybrid checkout models and contactless payment systems continues to intensify competition, pushing manufacturers to prioritize design flexibility, system reliability, and cost-effectiveness to strengthen their market presence globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Toshiba Global Commerce Solutions introduced its new Modular eXpansion Platform (MxP™) family of self-service solutions.

- In 2024, NCR Voyix (now a separate entity from NCR Atleos) launched its Next Generation Self-Checkout Solution, driven by the NCR Voyix Commerce Platform.

- In 2023, Metcalfe’s Market expanded its self-service infrastructure by adding eight self-checkout lanes with Toshiba’s Self Checkout System 7.

Report Coverage

The research report offers an in-depth analysis based on Component, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The global self-checkout system market will continue expanding due to automation in retail operations.

- Cashless and contactless systems will dominate as digital payments become standard.

- AI-powered kiosks with image recognition and fraud prevention will gain strong adoption.

- Supermarkets and hypermarkets will remain key users, while convenience stores expand adoption.

- Cloud-based software and remote monitoring will enhance kiosk management efficiency.

- Retailers will increasingly adopt hybrid checkout models combining self-service and staff assistance.

- Emerging markets in Asia-Pacific and Latin America will drive future installation growth.

- Compact and modular kiosk designs will attract small-format and urban retail stores.

- Collaboration between payment providers and technology firms will accelerate innovation.

- Sustainability and reduced operational costs will remain major focus areas for retailers globally.