Market Overview

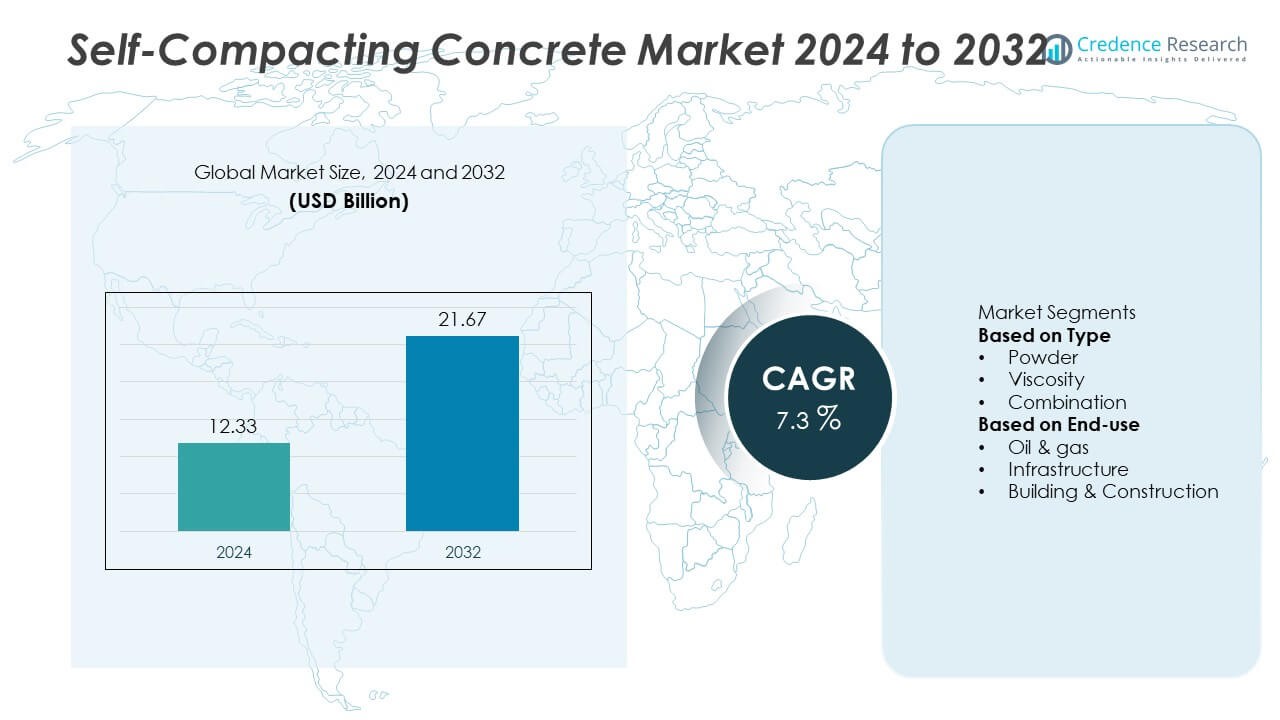

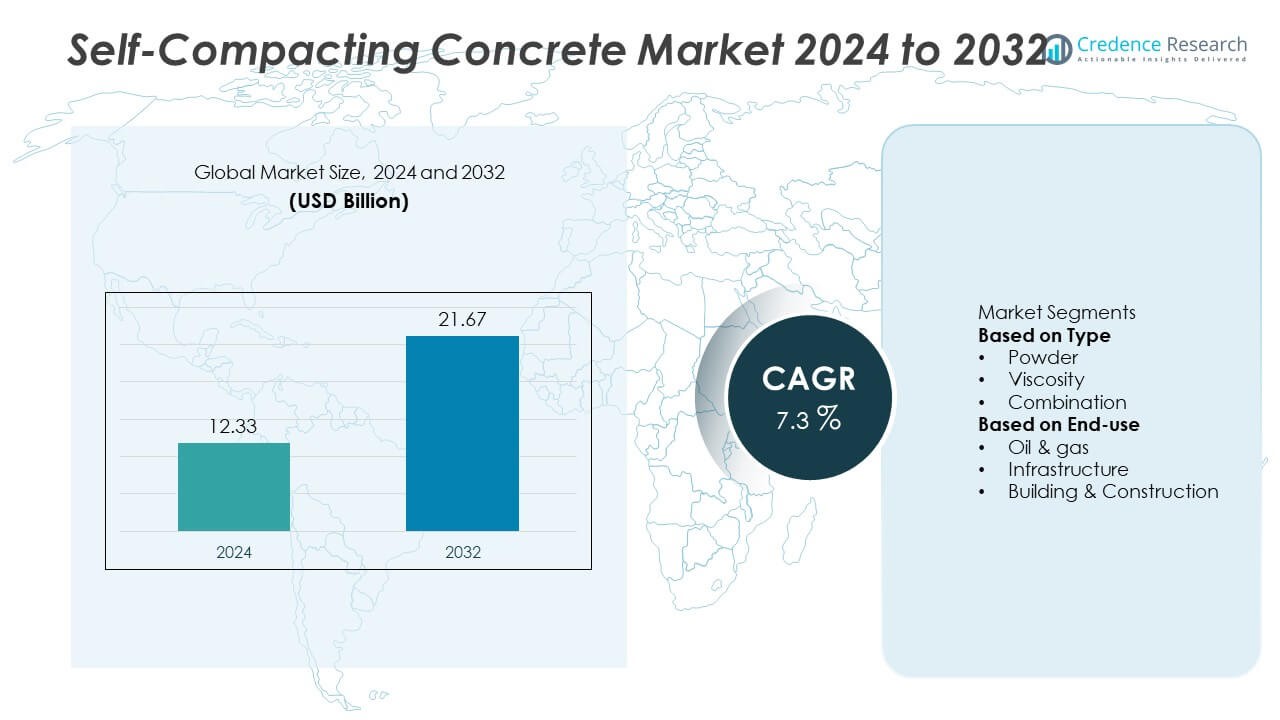

The Self-Compacting Concrete market was valued at USD 12.33 billion in 2024 and is projected to reach USD 21.67 billion by 2032, growing at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Self-Compacting Concrete Market Size 2024 |

USD 12.33 Billion |

| Self-Compacting Concrete Market, CAGR |

7.3% |

| Self-Compacting Concrete Market Size 2032 |

USD 21.67 Billion |

The top players in the Self‑Compacting Concrete market-BASF SE, CEMEX S.A.B. de C.V., ACC Limited, SIKA AG, and LafargeHolcim-sharpen their competitive edge through advanced admixture solutions, global production reach, and tailored mix designs. Meanwhile, the Asia Pacific region leads the market with a 45.8% share in 2024, propelled by large-scale urbanization and infrastructure growth in China, India and Southeast Asia. These companies leverage regional strengths, such as efficient supply chains and local standards compliance, to reinforce their leadership and drive sustained growth in the high-performance concrete sector.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global self‑compacting concrete market stood at USD 12.33 billion in 2024 and is expected to grow at a CAGR of 7.3%.

- Rising demand for high‑efficiency and high‑quality concrete solutions in urban infrastructure drives market growth, especially in high‑rise and complex structures.

- Increased adoption of automatic placement technologies and improved mix designs supports growth; the combination type holds about 60% of the Type segment, while the Building & Construction end‑use segment holds 45%.

- Competitive dynamics feature major players such as BASF SE, CEMEX S.A.B. de C.V., ACC Limited and SIKA AG, leveraging global networks and innovation to gain advantage, while smaller local firms focus on cost‑led strategies.

- Regionally, Asia Pacific commands a 45.8% share of the global market, followed by North America at 24% and Europe at 18%, driven by strong infrastructure development and urbanization trends.

Market Segmentation Analysis:

By Type

In the Self-Compacting Concrete market, the Combination type leads with a 60% market share due to its balanced mix of powder and viscosity-modifying agents that enhance flowability and stability. This type is preferred in projects with dense reinforcement and complex formwork because it eliminates the need for vibration and improves placement quality. The Powder type holds 25%, supported by strong demand in applications requiring high strength and smooth finishes. The Viscosity type accounts for the remaining 15%, mainly serving specialized projects. Growth is driven by the rising focus on labor efficiency and durable structural performance.

- For instance, the Sika ViscoFlow® series is tailored for projects requiring enhanced workability and extended slump retention in varying environmental conditions, including both hot and cold weather, and is recommended for use in high-precision applications such as tunnel linings and precast elements.

By End-Use

The Building & Construction segment dominates with a 45% market share, driven by rapid urban development, high-rise construction, and the need for superior concrete finishes. SCC is widely used in slabs, walls, and foundations due to its ease of placement and reduced labor requirements. The Infrastructure segment follows with 35%, supported by extensive use of SCC in bridges, tunnels, and metro systems where complex formwork and durability are essential. The Oil & Gas segment holds 20%, using SCC for offshore platforms and heavy-duty foundations. Growth across all segments is fueled by stricter standards for structural quality and faster construction timelines.

- For instance, Saudi Aramco utilizes nonmetallic materials, such as Glass Fiber Reinforced Polymer (GFRP) rebars and Reinforced Thermoplastic Pipes (RTP), in its construction projects, including in building and construction applications and pipelines in offshore and high-humidity areas, to ensure enhanced durability and corrosion resistance.

Key Growth Drivers

Growing Demand for Sustainable Construction

The increasing emphasis on sustainable construction practices is a significant driver for the Self-Compacting Concrete market. SCC reduces the need for vibration, resulting in less energy consumption and reduced labor costs. Its use in high-rise buildings and infrastructure projects contributes to higher construction quality and fewer defects, which aligns with the global push for more efficient and eco-friendly construction practices. The growing trend of using low-carbon concrete and the adoption of sustainable building materials are further fueling demand for SCC.

- For instance, the Holcim Group (formerly LafargeHolcim) supplied its Agilia Light Weight self-compacting concrete during the extensive renovation of the Mandarin Oriental Ritz hotel in Madrid, Spain. This project achieved a high-quality finish using advanced concrete solutions promoted for their efficiency and performance.

Technological Advancements in Concrete Production

Advancements in concrete production technologies have played a crucial role in the growth of the Self-Compacting Concrete market. Innovations in mix design and the integration of advanced additives have improved SCC’s workability, durability, and performance, making it a preferred choice in challenging construction environments. These technological improvements enable SCC to be used in a broader range of applications, including complex structures, which has accelerated its adoption in infrastructure, residential, and commercial projects.

- For instance, SIKA’s use of advanced polycarboxylate ether-based admixtures has enhanced SCC’s durability, resulting in fewer repairs and longer service life for buildings exposed to harsh weather conditions.

Urbanization and Infrastructure Development

Rapid urbanization and ongoing infrastructure development are key factors driving the demand for Self-Compacting Concrete. As cities grow, the need for high-quality, durable, and efficient construction materials becomes more critical. SCC, with its ability to be used in densely reinforced structures, urban housing, and complex forms, has gained widespread acceptance. Additionally, infrastructure projects such as bridges, highways, and tunnels require materials that offer long-term strength and ease of use, boosting the demand for SCC in these sectors.

Key Trends & Opportunities

Rise in Smart Construction Practices

The rise of smart construction practices and the integration of automation in building processes present an opportunity for the Self-Compacting Concrete market. As construction methods evolve, there is a growing shift towards minimizing manual labor while ensuring high precision. SCC, being a self-leveling and self-compacting material, fits perfectly with the increasing adoption of automated and robotic construction technologies. The trend towards smart construction is likely to further boost SCC’s demand, especially in large-scale infrastructure and residential projects.

- For instance, researchers and construction tech companies are actively developing automated robotic systems for highly accurate concrete placement in various construction scenarios, from 3D printed facades to flat floor finishing. These innovations aim to reduce labor costs, increase construction speed, and improve precision in the overall building process.

Adoption of Green Building Certifications

The growing focus on green building certifications, such as LEED (Leadership in Energy and Environmental Design), presents a significant opportunity for the Self-Compacting Concrete market. As sustainability becomes a key priority in construction, the use of environmentally friendly materials like SCC, which reduces energy consumption and waste during construction, becomes more desirable. The adoption of green building standards by governments and private developers is driving the shift towards using sustainable materials, offering substantial growth prospects for SCC.

- For instance, Turner Construction’s use of innovative low-carbon concrete solutions in the development of energy-efficient commercial buildings has contributed to meeting LEED Platinum standards, ensuring reduced carbon footprints throughout the building’s life cycle.

Key Challenges

High Cost of Self-Compacting Concrete

Despite its advantages, the high cost of Self-Compacting Concrete remains a key challenge in its widespread adoption. The production of SCC requires advanced raw materials, additives, and specialized mixing processes, which makes it more expensive than traditional concrete. This cost barrier limits its adoption, particularly in price-sensitive markets and small-scale projects. However, as production processes improve and economies of scale come into play, the cost of SCC may become more competitive in the future.

Lack of Skilled Workforce

Another challenge for the Self-Compacting Concrete market is the lack of skilled workforce capable of handling the advanced production, application, and finishing techniques associated with SCC. Properly mixing and placing SCC requires technical expertise to ensure its optimal performance. The shortage of trained professionals in construction and concrete-related fields can hinder the effective use of SCC, especially in regions with limited access to specialized training programs. This gap in skill development could slow the adoption of SCC in certain markets.

Regional Analysis

Asia Pacific

The Asia Pacific region commanded a market share of 45.8% in the self‑compacting concrete market in 2024. Rapid urbanization and robust infrastructure development in countries such as China, India, and Southeast Asian economies drove demand for high‑quality, labour‑efficient concrete solutions. The presence of large residential and commercial construction projects and government investment in transport and industrial facilities further boosted uptake. Growing preference for materials that simplify complex formwork and reduce vibration requirements supported the region’s dominance and established it as the primary growth engine.

North America

North America held a market share of 24% in 2024 for self‑compacting concrete. Mature construction markets in the US and Canada, combined with the rise of modular and precast building techniques, fostered strong demand. Stringent building codes and a focus on sustainability encouraged use of SCC in commercial and heavy‑civil applications. Manufacturers and contractors increasingly incorporated SCC to reduce labour input and improve finish quality, supporting steady expansion in this region’s market.

Europe

Europe represented a 18% share of the global self‑compacting concrete market in 2024. The region’s long‑standing emphasis on durable infrastructure, high‑rise buildings, and green construction standards supported adoption. Countries like Germany, France, Italy and the UK leveraged SCC for premium architectural projects and densely reinforced structures. Regulatory focus on construction quality and efficiency further incentivised use of SCC, enabling Europe to maintain its strong position despite competition from emerging markets.

Latin America

Latin America accounted for 9% of the self‑compacting concrete market in 2024. Countries such as Brazil, Mexico and Chile drove demand through growing residential and commercial construction as well as export‑oriented horticulture and infrastructure projects. Challenges like varying industrial capacity and investment levels influenced growth, yet the region offered tangible potential as contractors shifted toward higher‑efficiency materials and sought lower‑labour, quality‑enhancing solutions.

Middle East & Africa

The Middle East & Africa region captured a market share of 8% in 2024 for self‑compacting concrete. Arid climates and infrastructure‑intensive economies such as Saudi Arabia, UAE and South Africa adopted SCC to cope with complex formwork and large‑scale construction demands. Public investment in urban development and industrial hubs propelled uptake. Despite regional disparities in infrastructure and construction expertise, the push for sustainable and high‑end materials created notable growth opportunities in the region.

Market Segmentations:

By Type

- Powder

- Viscosity

- Combination

By End-use

- Oil & gas

- Infrastructure

- Building & Construction

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the self‑compacting concrete market features major players such as BASF SE, CEMEX S.A.B. de C.V., ACC Limited, SIKA AG, LafargeHolcim, Kilsaran, HeidelbergCement AG, Tarmac, Unibeton Ready Mix and UltraTech Concrete. These companies maintain strong positions by leveraging extensive product portfolios, global supply chains and strategic partnerships to meet demand for high‑performance concrete solutions. They focus on developing admixtures and formulations tailored for self‑compacting applications, investing in research and innovation to enhance flowability, strength and sustainability. Regional manufacturers compete by offering cost‑effective local solutions, while global firms benefit from scale and brand credibility. With adoption growing in infrastructure and high‑rise construction, differentiation increasingly relies on sustainability credentials and product performance rather than price alone.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LafargeHolcim

- BASF SE

- ACC Limited

- Ultratech Concrete

- SIKA AG

- HEIDELBERGCEMENT AG

- Unibeton Ready Mix

- Tarmac

- CEMEX S.A.B. de C.V

- Kilsaran

Recent Developments

- In July 2025, HEIDELBERGCEMENT AG (operating as Heidelberg Materials) launched an industrial‑scale facility in Poland for enforced carbonation of concrete, supporting performance enhancements in SCC mixes through carbon‑cured concrete technology.

- In May 2025, BASF SE introduced Pluriol® A 2400 I in Europe, a reactive polyethylene glycol designed for third‑generation superplasticisers used in concrete including SCC applications.

Report Coverage

The research report offers an in-depth analysis based on Type, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing urbanization will drive greater use of self‑compacting concrete in high‑rise and dense‑build environments.

- Stricter building codes and sustainability regulations will elevate demand for advanced self‑compacting mixes.

- Technological improvements in admixtures and mix design will enhance performance and reduce cost of SCC.

- Growth in infrastructure investment will accelerate adoption of self‑compacting concrete in bridges, tunnels and airports.

- Rising demand for retrofit and refurbishment projects will push use of self‑compacting concrete for faster placement and reduced disruption.

- Expansion into emerging markets in Asia‑Pacific, Latin America and Middle East will create new growth corridors for self‑compacting concrete.

- Integration of self‑compacting concrete in 3D printing of concrete structures will present novel applications.

- Development of low‑carbon and eco‑friendly self‑compacting concrete variants will align with sustainability goals and drive uptake.

- Collaboration between material producers and construction firms will foster customized self‑compacting concrete solutions for niche projects.

- Training and workforce upskilling in placing and curing self‑compacting concrete will support higher adoption rates among contractors.