Market Overview

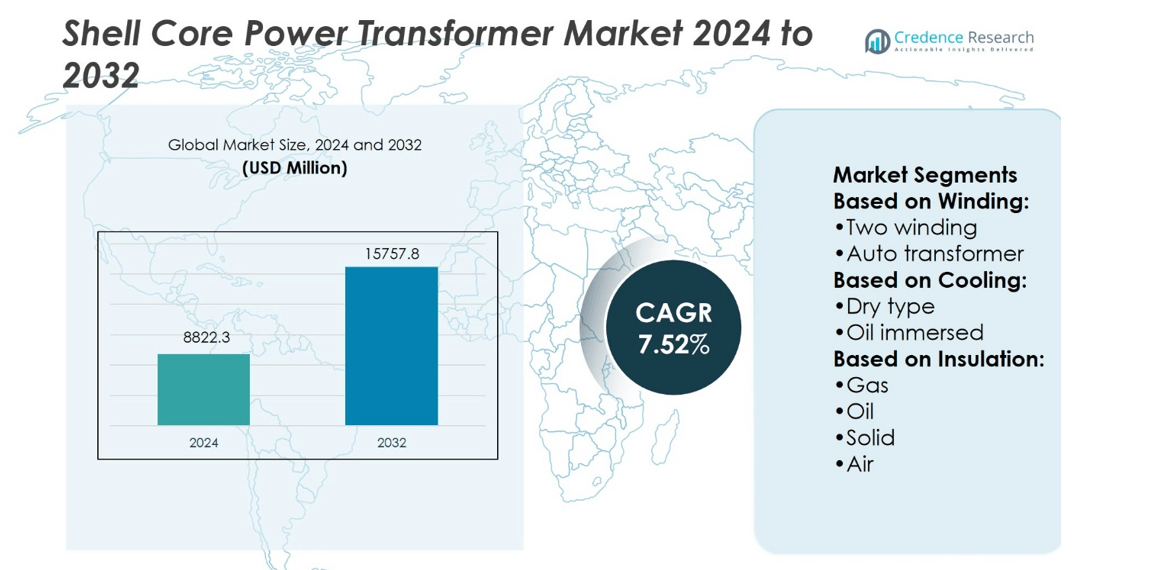

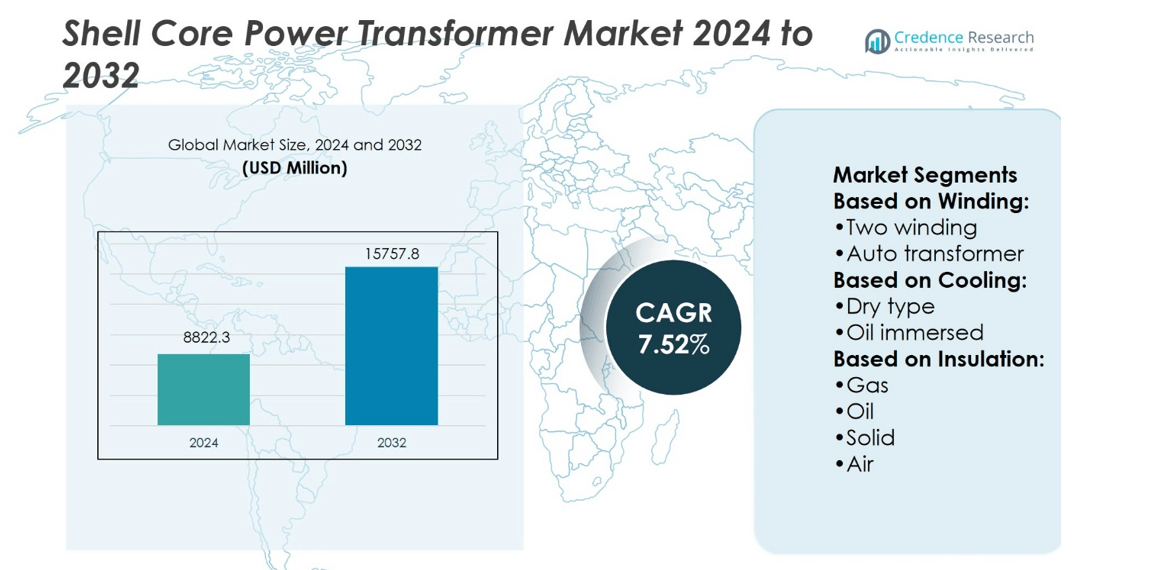

Shell Core Power Transformer Market size was valued at USD 8822.3 million in 2024 and is anticipated to reach USD 15757.8 million by 2032, at a CAGR of 7.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Shell Core Power Transformer Market Size 2024 |

USD 8822.3 million |

| Shell Core Power Transformer Market, CAGR |

7.52% |

| Shell Core Power Transformer Market Size 2032 |

USD 15757.8 million |

The Shell Core Power Transformer Market grows with rising electricity demand, grid modernization, and renewable energy integration. Increasing urbanization and industrial expansion fuel the need for reliable power distribution. Governments enforce stricter efficiency regulations, encouraging adoption of advanced transformer designs with improved cooling and insulation. Utilities invest in replacing aging infrastructure to reduce transmission losses and enhance stability. The market benefits from digital monitoring solutions that support predictive maintenance and operational control. Compact designs gain traction in urban areas, while high-capacity models serve industrial needs. These drivers and trends collectively strengthen market growth across developed and emerging economies.

The Shell Core Power Transformer Market shows strong presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific leads growth with rapid electrification, industrial projects, and renewable integration. North America and Europe emphasize modernization and compliance with efficiency standards. Latin America and the Middle East & Africa expand through infrastructure development and grid upgrades. Key players shaping the market include General Electric, ABB, Mitsubishi Electric Corporation, Eaton Corporation, and Hitachi Energy Ltd.

Market Insights

- Shell Core Power Transformer Market size was valued at USD 8822.3 million in 2024 and is projected to reach USD 15757.8 million by 2032, at a CAGR of 7.52%.

- Rising electricity demand, industrial expansion, and urbanization drive market adoption.

- Grid modernization and renewable integration create consistent demand for efficient transformers.

- Trends highlight digital monitoring systems, predictive maintenance, and compact urban-friendly designs.

- Competition intensifies as global players focus on advanced insulation and cooling technologies.

- High initial costs and regulatory compliance challenges restrain growth in some regions.

- Asia Pacific leads market growth, while North America and Europe focus on modernization, and Latin America and Middle East & Africa expand through electrification and infrastructure upgrades.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Reliable and Efficient Power Distribution Infrastructure

The Shell Core Power Transformer Market grows with increasing investments in modernizing power grids. Utilities focus on enhancing efficiency and reducing transmission losses to meet rising energy demands. It supports stable electricity delivery for industrial, commercial, and residential sectors. Governments implement regulations promoting energy-efficient transformers to curb operational costs. Urbanization and industrial expansion create a need for high-capacity, durable transformers. It enables utilities to integrate renewable energy sources without compromising grid stability. Continuous upgrades in distribution networks further drive market adoption.

- For instance, Hyosung Heavy Industries’ oil‑immersed transformers support voltage ratings up to 77 kV and power handling from 100 kVA to 80 MVA, and the company has shipped more than 150000 units to date.

Technological Advancements in Transformer Design and Materials

Innovations in insulation, cooling techniques, and magnetic materials propel the Shell Core Power Transformer Market forward. It delivers higher efficiency and longer service life through advanced core designs. Manufacturers introduce compact models suitable for urban substations with limited space. Digital monitoring and smart sensors allow predictive maintenance and operational control. Improved thermal management reduces energy losses and enhances load handling capabilities. It helps operators optimize asset performance and lower maintenance costs. Research in eco-friendly insulating oils supports sustainability initiatives.

- For instance, Bharat Bijlee plans to boost transformer manufacturing capacity by 7,000 MVA at its Airoli facility in Navi Mumbai, raising total capacity from 28,000 MVA to 35,000 MVA. The board approved this expansion on August 25, 2025.

Expansion of Renewable Energy Integration and Smart Grid Implementation

Rising renewable energy projects, including solar and wind, increase the need for versatile transformers. It facilitates efficient power transfer from variable generation sources to the grid. Smart grid initiatives require transformers that handle real-time monitoring and load adjustments. Utilities rely on advanced transformers to maintain voltage stability and grid reliability. Growing investments in distributed energy resources create new deployment opportunities. It strengthens infrastructure resilience against peak demand and outages. Collaborative projects with technology providers accelerate adoption of intelligent transformers.

Regulatory Support and International Standards Driving Market Growth

Government policies and international standards mandate energy-efficient transformer deployment. It ensures compliance with environmental and safety regulations. Incentives for renewable energy and grid modernization encourage utilities to upgrade equipment. Certification requirements for load capacity, efficiency, and safety enhance market credibility. It promotes adoption of transformers that meet stringent technical specifications. Environmental initiatives drive the replacement of aging, less efficient units. Long-term infrastructure development plans support steady market expansion.

Market Trends

Shift Towards Digital Monitoring and Smart Transformer Solutions

The Shell Core Power Transformer Market adopts digital monitoring technologies to enhance operational efficiency. It enables real-time condition tracking, fault detection, and predictive maintenance. Utilities implement smart transformers to reduce downtime and optimize energy distribution. Data-driven insights support better asset management and prolong equipment life. It integrates with SCADA systems for seamless grid control. Growing demand for automation in substations accelerates technology adoption. Manufacturers focus on embedding IoT sensors and remote diagnostics in new models.

- For instance, GE’s transformer and grid‑support portfolio spans medium through ultra‑high voltage domains. They offer power transformers ranging from 5 MVA up to 2,750 MVA, and voltage capabilities from 1200 kV AC to ±1100 kV DC.

Adoption of Eco-Friendly Materials and Sustainable Transformer Designs

Environmental regulations push the Shell Core Power Transformer Market toward sustainable solutions. It uses biodegradable insulating oils and low-loss core materials to minimize environmental impact. Manufacturers design lightweight, compact transformers for urban and industrial installations. It reduces carbon footprint while maintaining performance and reliability. Compliance with international efficiency standards drives innovation in materials and cooling techniques. Utilities prioritize transformers that balance energy efficiency with operational durability. It supports renewable energy integration through reduced losses and improved thermal management.

- For instance, in May 2025 HPS unveiled EV Charging Distribution Transformers—three-phase units rated from 15 kVA up to 1000 kVA, with 220 °C insulation class (150 °C rise) and optional rugged 3RE+ enclosures tested to withstand blowing snow and rain at speeds up to 120 km/h.

Rising Preference for High-Capacity and Modular Transformers

The Shell Core Power Transformer Market witnesses increased deployment of high-capacity units for industrial and utility applications. It addresses growing electricity demand in urban centers and industrial hubs. Modular designs allow scalable installations and easier maintenance. It facilitates rapid replacement and upgrades in transmission and distribution networks. Utilities adopt these transformers to ensure reliable power supply during peak demand periods. It supports integration with smart grid infrastructure for load management. Manufacturers focus on flexible configurations to meet diverse operational needs.

Integration with Renewable Energy and Distributed Energy Resources

Renewable energy adoption shapes trends in the Shell Core Power Transformer Market. It enables stable power transfer from solar, wind, and other intermittent sources. Utilities rely on advanced transformers to manage voltage fluctuations and maintain grid stability. It supports distributed energy systems, microgrids, and energy storage integration. Manufacturers develop solutions that handle variable loads efficiently and reliably. It reduces operational risks while maximizing energy output from renewable sources. Collaboration with energy developers accelerates adoption of grid-ready transformers.

Market Challenges Analysis

High Capital Investment and Complex Manufacturing Requirements Limiting Adoption

The Shell Core Power Transformer Market faces challenges due to significant upfront costs and intricate production processes. It requires advanced materials, precision engineering, and strict quality control, raising manufacturing expenses. Utilities may delay upgrades or replacements due to budget constraints. Long lead times for custom designs hinder rapid deployment in fast-growing regions. It demands skilled labor and specialized maintenance, increasing operational complexity. Supply chain disruptions for core materials or insulating oils further constrain production. Manufacturers focus on efficiency improvements, but cost remains a key barrier to widespread adoption.

Regulatory Compliance and Technological Integration Challenges Affecting Market Growth

Stringent regulations and evolving technical standards create challenges for the Shell Core Power Transformer Market. It must comply with international efficiency, safety, and environmental norms, adding to design and certification requirements. Integration with smart grid systems and renewable energy infrastructure requires advanced control and monitoring capabilities. It faces interoperability issues when connecting with legacy equipment in older networks. Utilities may encounter difficulties in training personnel for digital and automated transformer operations. Rapid technology changes increase the risk of obsolescence for existing installations. Manufacturers invest in innovation, but regulatory and integration hurdles slow market expansion.

Market Opportunities

Expansion of Renewable Energy Projects Creating New Deployment Opportunities

The Shell Core Power Transformer Market benefits from growing renewable energy installations worldwide. It supports efficient transmission from solar, wind, and hydro power plants to the main grid. Utilities require transformers capable of handling variable loads and maintaining voltage stability. It enables integration of microgrids and distributed energy resources for localized energy management. Investments in large-scale renewable projects drive demand for high-capacity, reliable transformers. It encourages manufacturers to develop solutions tailored for grid modernization and clean energy initiatives. Collaborative ventures with energy developers accelerate market penetration in emerging regions.

Adoption of Smart Grid Technologies and Digital Solutions Driving Growth Potential

Smart grid expansion presents significant opportunities for the Shell Core Power Transformer Market. It integrates with digital monitoring systems to optimize energy distribution and predictive maintenance. Utilities implement intelligent transformers to enhance grid resilience and reduce operational costs. It enables real-time data analytics for load management and fault detection. Manufacturers innovate in IoT-enabled and remotely controllable transformer models. It supports urban electrification and industrial infrastructure development projects. Growing interest in energy-efficient and compact transformer designs further strengthens adoption prospects.

Market Segmentation Analysis:

By Winding

The Shell Core Power Transformer Market includes two primary winding types: two winding and auto transformers. Two winding transformers dominate industrial and utility applications due to their high reliability and straightforward operation. It ensures stable voltage transformation for large-scale transmission and distribution networks. Auto transformers find increasing use in cost-sensitive projects with moderate voltage requirements. It delivers compact design and reduced material usage while maintaining efficiency. Utilities adopt winding types based on load demand, network configuration, and operational flexibility. The choice of winding affects maintenance schedules, safety standards, and overall lifecycle costs.

- For instance, CG Power manufactures a wide spectrum of transformers—from 25 kVA up to 1,500 MVA, with voltage classes spanning 11 kV to 765 kV. It also produces reactors rated 10 MVAr to 990 MVAr in the same voltage range.

By Cooling

Cooling methods significantly influence transformer performance, durability, and installation environment. Dry type transformers gain preference in urban areas, commercial complexes, and indoor substations due to their fire-resistant properties. It requires minimal maintenance and avoids risks of oil leakage. Oil immersed transformers remain critical for high-capacity applications, including industrial plants and long-distance transmission. It provides efficient heat dissipation, enabling stable operation under heavy loads. Utilities select cooling types depending on environmental regulations, load intensity, and space constraints. Oil immersed models benefit from enhanced thermal stability and longer service life, supporting continuous power delivery in demanding settings.

- For instance, Hyundai manufactures power transformers with ratings up to 1,500 MVA and voltage capability up to 800 kV—spanning generator step-up, transmission, and distribution transformers.

By Insulation

Insulation type determines transformer safety, reliability, and efficiency under varying operational conditions. The Shell Core Power Transformer Market offers gas, oil, solid, and air insulation solutions. Gas-insulated transformers provide compact design for space-limited installations while ensuring high voltage reliability. It supports high-voltage urban networks and renewable energy integration. Oil-insulated transformers remain widely used due to superior cooling and insulation performance. Solid insulation suits medium-voltage applications with minimal maintenance needs. Air-insulated transformers provide simple, lightweight solutions for smaller distribution networks. Utilities select insulation based on voltage rating, operational environment, and long-term reliability requirements.

Segments:

Based on Winding:

- Two winding

- Auto transformer

Based on Cooling:

Based on Insulation:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America represents 25% of the Shell Core Power Transformer Market, with strong growth driven by infrastructure upgrades and regulatory compliance. Utilities invest in smart grid technologies and high-efficiency transformers to reduce energy losses. It supports aging power networks requiring modernization and digital monitoring solutions. The United States and Canada prioritize renewable energy integration and grid resilience projects. Utilities select dry type transformers for indoor installations in urban centers and oil-immersed transformers for heavy industrial applications. It enables predictive maintenance and operational control, enhancing reliability. Focus on eco-friendly materials and compliance with environmental standards strengthens market growth.

Europe Contributes

Europe captures 20% of the Shell Core Power Transformer Market, driven by stringent efficiency regulations and renewable energy targets. Countries such as Germany, France, and the UK focus on reducing carbon emissions and upgrading aging grids. It facilitates integration of wind, solar, and hydro power into distribution networks. Utilities adopt gas-insulated and solid-insulated transformers for compact and reliable installations. It supports smart grid initiatives to manage variable loads efficiently. Manufacturers prioritize innovation in materials, cooling techniques, and digital monitoring solutions. Collaborative projects with renewable energy developers expand transformer deployment across urban and rural areas.

Asia-Pacific

Asia-Pacific leads the Shell Core Power Transformer Market with a 38% share, driven by rapid industrialization and urbanization. Countries such as China, India, and Japan invest heavily in power infrastructure and grid modernization. It benefits from large-scale renewable energy integration, including solar and wind projects, requiring advanced transformer solutions. Utilities adopt high-capacity and oil-immersed transformers for industrial hubs and urban substations. It supports expanding electrification programs in rural areas, increasing demand for reliable distribution networks. Government initiatives promoting energy efficiency further stimulate adoption. Manufacturers focus on local production to meet growing demand efficiently.

Latin America

Latin America contributes 10% to the Shell Core Power Transformer Market, with growth driven by rising electrification and industrial development. Countries including Brazil, Mexico, and Chile invest in upgrading transmission and distribution networks. It facilitates integration of renewable energy projects, particularly solar and wind, into regional grids. Oil-immersed transformers dominate due to high capacity and reliable performance. Utilities adopt dry type transformers in urban centers with space limitations. It supports infrastructure resilience and reduces technical losses in long-distance transmission. Market expansion benefits from government programs promoting energy access and modernization.

Middle East & Africa

The Middle East & Africa region holds 7% of the Shell Core Power Transformer Market, driven by oil and gas sector projects and urban infrastructure development. Countries like Saudi Arabia, UAE, and South Africa invest in industrial electrification and power distribution networks. It supports high-voltage transmission and large industrial loads through robust transformer solutions. Utilities prioritize oil-immersed transformers for high-capacity and reliable operations. It enables integration with renewable energy sources, including solar farms, to diversify energy mix. Investment in smart grids and digital monitoring enhances efficiency and reduces operational risks. Manufacturers explore local partnerships to meet regional demand efficiently.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hitachi Energy Ltd.

- Hyosung Heavy Industries

- Celme S.r.l.

- Bharat Bijlee Limited

- General Electric

- Hammond Power Solutions

- CG Power & Industrial Solutions Ltd.

- Hyundai Electric & Energy Systems Co., Ltd.

- DAIHEN Corporation

- Bharat Heavy Electricals Limited

Competitive Analysis

The Shell Core Power Transformer Market players include Bharat Heavy Electricals Limited, General Electric, Hitachi Energy Ltd., CG Power & Industrial Solutions Ltd., Hyosung Heavy Industries, Celme S.r.l., Hyundai Electric & Energy Systems Co., Ltd., Bharat Bijlee Limited, DAIHEN Corporation, and Hammond Power Solutions. The Shell Core Power Transformer Market continues to expand with growing energy demand and modernization of transmission infrastructure. Rising focus on grid reliability drives adoption of advanced designs with higher efficiency and reduced operational losses. Utilities and industries prioritize transformers that support renewable integration, digital monitoring, and flexible load handling. Governments implement stricter efficiency standards, which accelerates replacement of aging equipment with modern shell core units. The market also benefits from smart grid projects, where shell core transformers ensure stability and optimized power distribution.

Recent Developments

- In February 2024, power transformers utilizing advanced natural ester insulating fluids. These transformers offer enhanced thermal stability and safety features, supporting sustainable grid upgrades and reducing environmental impact across the utility and industrial sectors.

- In September 2023, Servokon Systems Ltd., announced its plan to invest over Rs 200 Crore in setting up a new manufacturing facility in Hapur, Uttar Pradesh. The establishment, set to cover an area of 25,000 square meters, was part of Servokon’s strategy to enhance its production capabilities.

- In August 2023, in a noteworthy development, the last of the 12 power transformers were delivered at the future Valenzuela 500 KV substation, marking the completion of a critical phase in the project. The enormous units, crucial to the functioning of the electrical grid, assisted in bolstering the energy capacity of the region.

- In March 2023, GE Renewable Energy announced the deployment of its latest transformers for offshore wind projects, particularly for the Dogger Bank Wind Farm in the UK. These transformers are designed to handle the unique challenges of offshore energy production and distribution.

Report Coverage

The research report offers an in-depth analysis based on Winding, Cooling, Insulation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow with rising global electricity demand.

- Smart grid projects will increase adoption of efficient shell core transformers.

- Renewable energy integration will drive demand for flexible transformer designs.

- Urbanization will expand the need for compact, high-capacity transformers.

- Digital monitoring systems will support predictive maintenance in transformers.

- Governments will enforce stricter efficiency and emission regulations.

- Industrial expansion will fuel investments in durable transformer solutions.

- Technological advancements will improve cooling and insulation methods.

- Emerging economies will adopt shell core transformers for electrification programs.

- Replacement of aging infrastructure will create steady long-term demand.