Market Overview

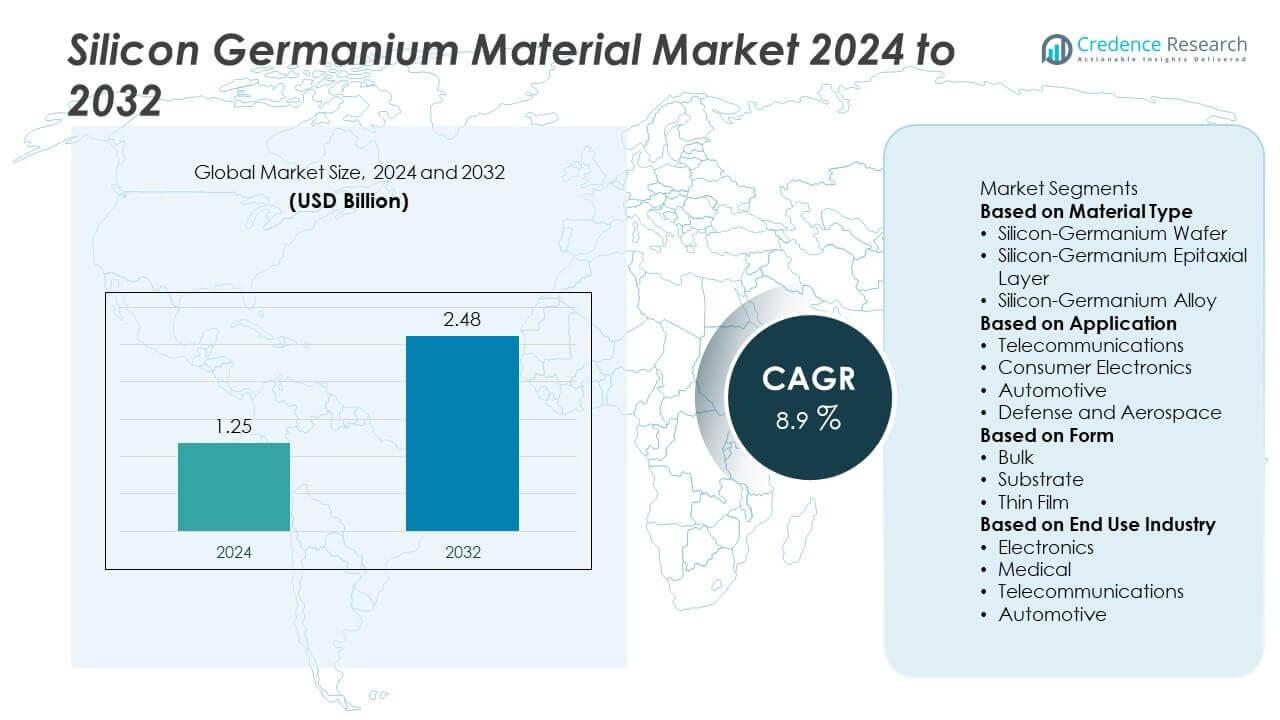

The Silicon Germanium Material Market was valued at USD 1.25 billion in 2024 and is projected to reach USD 2.48 billion by 2032, registering a CAGR of 8.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silicon Germanium Material Market Size 2024 |

USD 1.25 Billion |

| Silicon Germanium Material Market, CAGR |

8.9% |

| Silicon Germanium Material Market Size 2032 |

USD 2.48 Billion |

The silicon germanium material market is led by key players including Qorvo, Silicon Valley Silicon Germanium, Texas Instruments, Global Foundries, MUSIC, and Lattice Semiconductor, who focus on producing high-performance SiGe wafers and epitaxial layers for RF, photonics, and automotive applications. These companies invest in BiCMOS process scaling, optical integration, and cost-efficient manufacturing to serve 5G, radar, and data communication markets. North America leads with over 38% share in 2024, driven by strong semiconductor manufacturing and 5G deployment. Europe follows with 27% share supported by automotive and aerospace demand, while Asia-Pacific holds 25% and remains the fastest-growing region due to large-scale electronics production and government-backed semiconductor initiatives.

Market Insights

Market Insights

- The silicon germanium material market was valued at USD 1.25 billion in 2024 and is projected to reach USD 2.48 billion by 2032, growing at a CAGR of 8.9% during the forecast period.

- Rising demand for 5G infrastructure and RF communication devices drives adoption, with silicon-germanium wafers holding over 50% share in 2024 due to their superior high-frequency performance and energy efficiency.

- Key trends include integration of SiGe with CMOS technology, growing use in optoelectronics and LiDAR systems, and increasing investment in photonics for data center and automotive applications.

- The market is competitive with players such as Qorvo, Global Foundries, Texas Instruments, and IIVI Incorporated focusing on R&D, BiCMOS process innovation, and expanding production capacity to serve telecom and automotive sectors.

- North America leads with over 38% share, followed by Europe at 27%, while Asia-Pacific holds 25% and is the fastest-growing region, driven by electronics manufacturing and government-backed semiconductor programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material Type

Silicon-Germanium wafers dominate the market with over 50% share in 2024, driven by their widespread use in high-frequency integrated circuits and RF devices. These wafers enable improved electron mobility and lower power consumption, making them ideal for 5G infrastructure, radar systems, and high-speed data communication applications. Silicon-Germanium epitaxial layers follow, gaining traction for advanced semiconductor processes and precision doping requirements. Silicon-Germanium alloys are used in niche applications like thermoelectric devices and optical sensors but represent a smaller portion of demand compared to wafers and epitaxial layers.

- For instance, advanced semiconductor fabrication facilities worldwide have developed optimized epitaxial processes for silicon-germanium (SiGe) wafers. These processes achieve tight control over material properties, with research demonstrating layer thickness uniformity within sub-nanometer ranges.

By Application

Telecommunications hold over 45% share in 2024, making it the largest application segment for silicon germanium materials. The demand is fueled by the expansion of 5G networks, satellite communications, and high-frequency transceivers that rely on SiGe technology for superior performance. Consumer electronics contribute significantly, with adoption in smartphones, wearables, and IoT devices. Automotive applications are rapidly growing as SiGe is used in advanced driver-assistance systems (ADAS) and radar sensors, while defense and aerospace sectors deploy these materials in high-reliability, radiation-tolerant systems for secure communications and surveillance.

- For instance, Qorvo produces silicon-germanium (SiGe) heterojunction bipolar transistors (HBTs) and other advanced RF technologies optimized for satellite communication and automotive radar systems.

By Form

Bulk form silicon germanium materials lead the market with around 48% share in 2024, favored for cost-effective mass production of wafers and IC substrates. Substrates represent the second-largest share, supporting epitaxial growth and offering excellent thermal conductivity for high-power applications. Thin-film SiGe is gaining attention for next-generation optoelectronics, MEMS devices, and energy-efficient applications due to its precise thickness control and integration potential. Growing demand for miniaturized, high-performance semiconductor devices continues to drive the adoption of bulk and substrate forms, with thin-film technologies expected to see faster growth over the forecast period.

Key Growth Drivers

Rising Demand for 5G and High-Frequency Communication Devices

The rollout of 5G networks is driving strong demand for silicon germanium materials due to their superior high-frequency performance. SiGe technology enables faster data transmission, lower power consumption, and improved noise performance, making it ideal for RF front-end modules, transceivers, and power amplifiers. Telecom operators and device manufacturers are rapidly adopting SiGe wafers for base stations, small cells, and user equipment. This demand is expected to grow significantly as 5G penetration expands globally, supporting network densification and deployment of mmWave technologies across key markets.

- For instance, Qorvo introduced their QPQ3550 BAW filter operating in the 3.55–3.7 GHz CBRS band, featuring maximum insertion loss of 2.7 dB, input power handling of +27 dBm, and thermally reliable packaging at 2.0 x 1.6 mm, designed specifically to enhance 5G massive MIMO small cell radios.

Growing Adoption in Automotive and ADAS Systems

Automotive applications are emerging as a major growth driver for silicon germanium materials. SiGe-based sensors and radar systems play a critical role in advanced driver-assistance systems (ADAS), collision avoidance, and autonomous vehicle technologies. The ability of SiGe to deliver high-frequency performance in harsh environments supports reliable vehicle-to-vehicle and vehicle-to-infrastructure communication. Rising production of electric and connected vehicles, along with regulatory mandates for safety features, is accelerating SiGe adoption in automotive electronics, creating significant opportunities for suppliers over the forecast period.

- For instance, GlobalFoundries has shipped more than 4 billion SiGe-based chips using its SiGe technology on 200 mm wafers.

Expansion of Consumer Electronics and IoT Devices

The consumer electronics industry is driving demand for SiGe components used in smartphones, wearables, and IoT devices. These materials support miniaturized, power-efficient chips that deliver high-speed data processing for wireless communication and sensor applications. The growth of smart home devices, AR/VR technologies, and connected health monitoring solutions further boosts SiGe usage. With IoT device proliferation expected to reach billions of connected nodes by 2032, the need for cost-effective, high-performance semiconductors is likely to sustain strong market growth for silicon germanium materials in the coming years.

Key Trends & Opportunities

Integration with Advanced Semiconductor Processes

A major trend is the integration of silicon germanium materials with CMOS technology for enhanced device performance. SiGe BiCMOS processes enable higher transistor speeds while maintaining compatibility with standard silicon manufacturing, lowering production costs. This trend is particularly beneficial for high-speed data communication, photonics, and radar applications. Foundries and IDMs are investing in scaling SiGe technologies to smaller nodes, creating opportunities for innovative chip designs and expanding adoption in telecommunications, automotive, and consumer electronics segments.

- For instance, Sandia National Laboratories demonstrated integration of atomic precision advanced manufacturing (APAM) with a 0.35 µm CMOS process, successfully doping silicon with phosphorus to achieve a doping density exceeding the solid solubility limit, while preserving transistor electrical characteristics. This advancement supports direct integration of boutique processes into commercial CMOS workflows for enhanced transistor performance.

Rising Focus on Optoelectronics and Photonics

Silicon germanium is increasingly being used in photonics applications such as optical transceivers, LiDAR, and infrared sensors. Its ability to integrate optical components with electronic circuits on the same chip makes it highly attractive for next-generation data centers and autonomous vehicle sensing systems. Growing demand for high-speed optical communication and precise sensing solutions is driving research into SiGe-based photonic devices, presenting opportunities for semiconductor companies to capture value in emerging high-bandwidth and imaging markets.

- For instance, Forschungszentrum Jülich and the Leibniz Institute for Innovative Microelectronics developed a novel quaternary alloy CSiGeSn combining carbon, silicon, germanium, and tin, enabling epitaxial layer deposition with atomic precision on CMOS-compatible substrates. This material offers tunable optical and electronic properties for advanced photonic and quantum computing devices.

Key Challenges

High Manufacturing and Material Costs

The production of high-purity silicon germanium wafers and epitaxial layers involves complex processes, resulting in higher costs compared to traditional silicon. These costs can limit adoption in price-sensitive applications and restrict smaller semiconductor manufacturers from scaling production. Continuous investment in process optimization and yield improvement is required to lower costs and make SiGe solutions more competitive, particularly as alternatives like GaAs and SiC are also gaining traction in high-frequency markets.

Competition from Emerging Semiconductor Materials

Silicon germanium faces competition from alternative semiconductor materials such as gallium nitride (GaN) and silicon carbide (SiC), which offer superior performance in certain high-power and high-frequency applications. As these materials become more cost-competitive, they may capture a portion of the market share, especially in RF power devices and power electronics. SiGe suppliers must focus on innovation, improving device efficiency, and expanding application scope to maintain their competitive edge in a rapidly evolving semiconductor landscape.

Regional Analysis

North America

North America leads the silicon germanium material market with over 38% share in 2024, driven by strong demand from telecommunications, data centers, and defense applications. The region benefits from significant investments in 5G infrastructure and RF semiconductor manufacturing. The United States dominates with leading foundries and technology companies developing SiGe-based solutions for high-speed communication and radar systems. Rising adoption of ADAS technologies in automotive manufacturing and ongoing R&D investments in advanced semiconductor processes further support market growth, positioning North America as a key hub for innovation and commercialization of silicon germanium materials.

Europe

Europe holds around 27% share in 2024, supported by robust demand from automotive and aerospace sectors. Countries such as Germany, France, and the UK are driving adoption through advanced driver-assistance systems (ADAS), radar, and industrial automation applications. European semiconductor companies are focusing on integrating silicon germanium with CMOS processes to meet growing needs for high-performance communication devices. EU initiatives promoting microelectronics R&D and funding programs for semiconductor manufacturing are strengthening the regional ecosystem. The rising deployment of 5G networks and investments in photonics research continue to boost the silicon germanium material market across Europe.

Asia-Pacific

Asia-Pacific accounts for over 25% share in 2024 and represents the fastest-growing regional market. China, Japan, South Korea, and Taiwan are leading adoption with strong semiconductor manufacturing capabilities and government-backed investments in 5G, IoT, and automotive electronics. The expansion of consumer electronics production, coupled with rising demand for radar and communication chips, is fueling silicon germanium consumption. Foundries in the region are focusing on cost-efficient manufacturing and scaling of BiCMOS processes. Asia-Pacific’s growing EV production and smart city projects also drive demand for SiGe-based sensors and communication modules, making it a major growth engine through 2032.

Latin America

Latin America captures around 6% share in 2024, with Brazil and Mexico leading regional demand. Growth is supported by increasing adoption of advanced communication infrastructure, industrial automation, and emerging automotive electronics markets. The rollout of 4G and early 5G networks is driving demand for high-frequency RF components, where silicon germanium is a preferred material. Government initiatives to expand connectivity and develop local manufacturing capabilities are creating opportunities for global suppliers. Although the region faces challenges related to high import costs and limited semiconductor production, growing digitalization is expected to support gradual market expansion.

Middle East & Africa

The Middle East & Africa hold around 4% share in 2024, with demand concentrated in Gulf countries and South Africa. The market is driven by investments in telecom infrastructure, defense systems, and energy sector digitization. Adoption of silicon germanium materials is rising for radar, satellite communication, and secure defense electronics. Governments are investing in local manufacturing and R&D capabilities to strengthen technology ecosystems. Although the market is still emerging, growing interest in 5G rollouts, smart city projects, and aerospace applications will provide opportunities for silicon germanium suppliers to expand their footprint in the coming years.

Market Segmentations:

By Material Type

- Silicon-Germanium Wafer

- Silicon-Germanium Epitaxial Layer

- Silicon-Germanium Alloy

By Application

- Telecommunications

- Consumer Electronics

- Automotive

- Defense and Aerospace

By Form

By End Use Industry

- Electronics

- Medical

- Telecommunications

- Automotive

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the silicon germanium material market features key players such as Qorvo, Silicon Valley Silicon Germanium, Texas Instruments, Global Foundries, MUSIC, Lattice Semiconductor, Boeing, IIVI Incorporated, Applied Materials, and Rohm Semiconductor. These companies focus on developing high-performance SiGe wafers, epitaxial layers, and substrates to meet growing demand from telecommunications, automotive, and aerospace sectors. Leading players are investing in scaling BiCMOS processes, improving wafer yield, and integrating photonic capabilities to address next-generation applications like 5G, radar, and optical communication. Strategic partnerships with foundries, R&D collaborations, and acquisitions are being pursued to strengthen manufacturing capacity and global presence. Many vendors are also working on cost optimization and process innovation to enhance competitiveness against emerging semiconductor materials such as GaN and SiC. Continuous innovation and expansion into Asia-Pacific manufacturing hubs remain crucial strategies to capture the growing demand for silicon germanium solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Qorvo

- Silicon Valley Silicon Germanium

- Texas Instruments

- Global Foundries

- MUSIC

- Lattice Semiconductor

- Boeing

- IIVI Incorporated

- Applied Materials

- Rohm Semiconductor

Recent Developments

- In August 2025, Applied Materials planning a new advanced manufacturing facility in Chandler, Arizona, to produce equipment components.

- In June 2025, GF announced a US investment plan totaling US$16 billion to expand its New York and Vermont facilities. Part of this includes R&D in silicon photonics, GaN-based power solutions, and advanced packaging.

- In April 2025, Applied Materials made a strategic investment in BE Semiconductor Industries (Besi), acquiring 9 percent of its shares, to co-develop hybrid bonding equipment.

- In March 2025, Qorvo launched silicon Ku-band beamformer ICs (AWMF-0240, AWMF-0241) for SATCOM terminals. While this is not explicitly SiGe material, the domain (RF / mmWave / beamforming) commonly uses SiGe or similar RF material.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Application, Form, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The silicon germanium material market will expand with rising demand for high-frequency communication devices.

- Adoption in 5G infrastructure and mmWave applications will continue to be a major growth driver.

- Automotive radar and ADAS systems will increasingly use SiGe for reliable high-speed performance.

- Integration with CMOS processes will enable cost-efficient manufacturing and wider adoption.

- Growth in photonics and optical communication will boost demand for SiGe-based components.

- Consumer electronics and IoT device proliferation will create steady demand for miniaturized SiGe chips.

- Asia-Pacific will emerge as the fastest-growing region due to semiconductor production and 5G rollouts.

- Companies will invest in process scaling and yield improvement to lower manufacturing costs.

- Competition with GaN and SiC materials will push innovation in SiGe performance.

- Strategic partnerships and foundry collaborations will drive technology advancement and global market expansion.