Market Overview

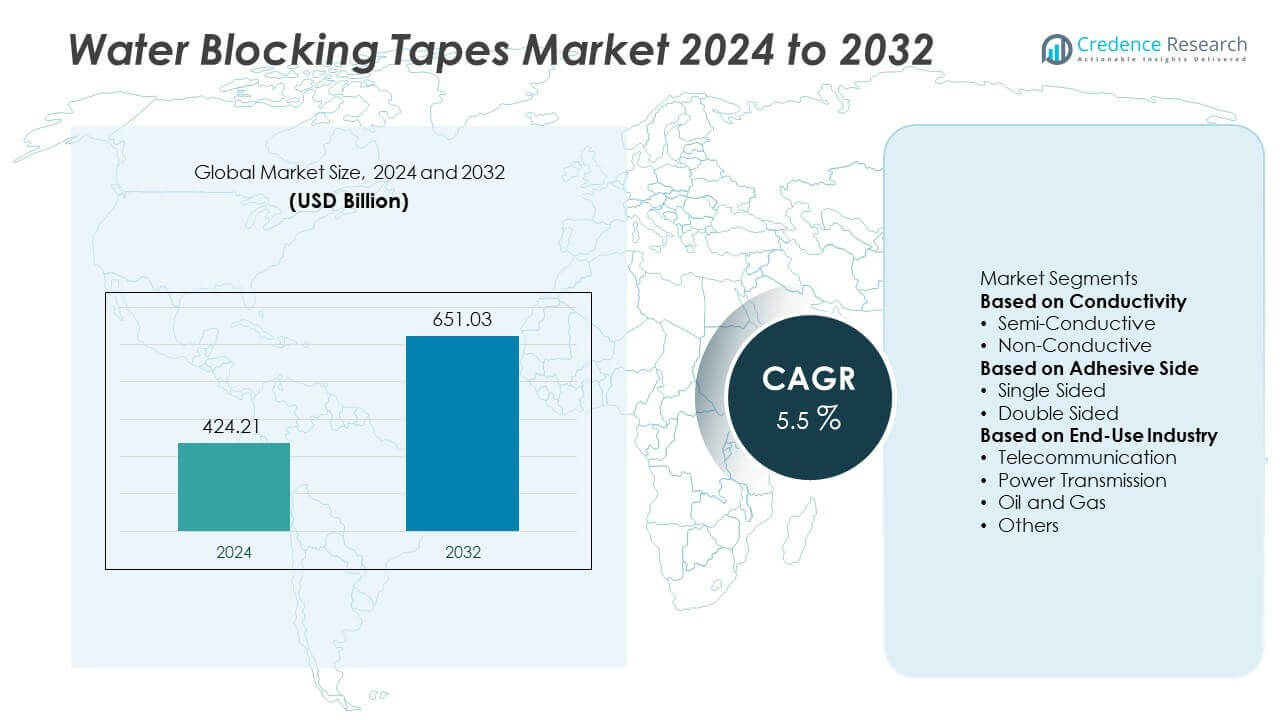

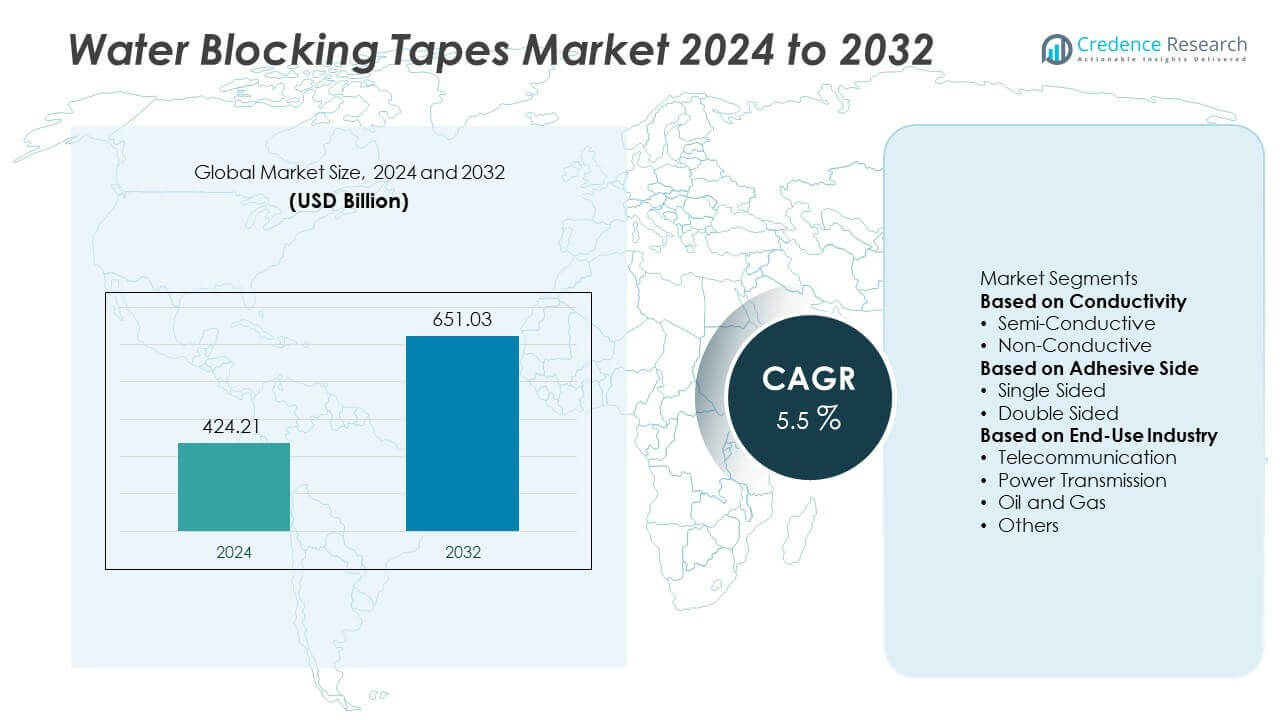

The Water Blocking Tapes Market was valued at USD 424.21 billion in 2024 and is projected to reach USD 651.03 billion by 2032, expanding at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Water Blocking Tapes Market Size 2024 |

USD 424.21 Billion |

| Water Blocking Tapes Market, CAGR |

5.5% |

| Water Blocking Tapes Market Size 2032 |

USD 651.03 Billion |

The water blocking tapes market is led by major players including Intertape Polymer Group (Canada), Nantong Siber Communication, Navank Consultants, Berry Global Group, Inc. (US), 3M, Star Materials, Scapa Group Ltd (UK), Nichiban Co., Ltd. (Japan), Advance Tapes International Ltd (UK), and Fori Group. These companies focus on developing high-performance, halogen-free, and recyclable tapes to meet evolving industry standards. Asia-Pacific dominated the market with 30% share in 2024, driven by extensive telecom infrastructure development, fiber-optic deployments, and grid expansion projects in China, India, and Japan. North America and Europe followed with 32% and 27% shares, supported by 5G rollouts, offshore wind projects, and strong compliance regulations.

Market Insights

Market Insights

- The water blocking tapes market was valued at USD 424.21 billion in 2024 and is projected to reach USD 651.03 billion by 2032, growing at a CAGR of 5.5% during the forecast period.

- Rising demand for fiber-optic networks, 5G rollouts, and power transmission upgrades is driving market growth, with non-conductive tapes holding over 60% share due to superior insulation performance.

- Key trends include adoption of halogen-free, recyclable materials and automation in cable production to ensure consistent quality and compliance with global standards.

- The market is competitive with players such as Intertape Polymer Group, Berry Global, 3M, and Scapa Group focusing on product innovation, partnerships, and capacity expansions to meet increasing demand from telecom and energy sectors.

- Asia-Pacific leads the market with 30% share, followed by North America at 32% and Europe at 27%, while telecommunication applications dominate with 45% share supported by FTTH and submarine cable projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Conductivity

The water blocking tapes market by conductivity is segmented into semi-conductive and non-conductive types. Non-conductive tapes dominated the market with over 60% share in 2024 due to their superior insulation properties and wide use in fiber-optic and copper telecommunication cables. These tapes prevent water ingress and maintain signal integrity, driving their preference in telecom and data center infrastructure projects. Semi-conductive tapes also hold a significant share, especially in medium- and high-voltage cable applications, where conductivity control and stress grading are essential for safe power distribution.

- For instance, Mativ (formerly Scapa Group) manufactures SAP-based, non-conductive, water-blocking tapes with enhanced swell performance for use in fiber-optic cables, and supplies major cable manufacturers throughout Europe and Asia.

By Adhesive Side

Based on adhesive side, the market is divided into single-sided and double-sided tapes. Single-sided water blocking tapes accounted for around 65% of the market in 2024, supported by their ease of application and cost-effectiveness for large-scale cable production. They are widely used in telecommunication and power transmission cables, where fast processing and consistent performance are critical. Double-sided tapes, though smaller in share, are gaining adoption in specialty applications that require stronger bonding and enhanced water-blocking capability in compact cable designs.

- For instance, a company like Advance Tapes International Ltd. manufactures specialist pressure-sensitive tapes, including high-performance polythene and duct tapes engineered for demanding sectors such as the military, marine, and electrical industries, that meet demanding waterproofing specifications.

By End-Use Industry

The market by end-use industry is categorized into telecommunication, power transmission, oil and gas, and others. Telecommunication led the segment with nearly 45% share in 2024, driven by rapid fiber-to-the-home (FTTH) deployments, 5G network rollouts, and submarine cable projects worldwide. Power transmission followed closely, boosted by grid modernization and renewable energy integration requiring reliable cable infrastructure. Oil and gas applications also contribute significantly, as water blocking tapes protect subsea and onshore pipelines from moisture-related failures, supporting long-term operational reliability in harsh environments.

Key Growth Drivers

Rising Demand for Fiber-Optic Networks

The expansion of fiber-optic infrastructure for broadband and 5G networks is a primary driver. Water blocking tapes protect cables from moisture intrusion, ensuring reliable high-speed data transmission. Growing investments in data centers and submarine cable projects worldwide boost demand. Government programs supporting digital connectivity, especially in developing regions, further accelerate adoption. This strong demand from telecom operators positions water blocking tapes as critical components in next-generation communication networks.

- For instance, Scapa Industrial, manufactured a semi-conductive cable tape, the SC37/98, in 2024 for power cable projects, with market reports highlighting North America’s demand for high-voltage cables.

Modernization of Power Transmission Infrastructure

Grid upgrades and renewable energy integration drive the use of high-performance power cables. Water blocking tapes offer moisture protection and electrical stability in medium- and high-voltage applications. Utilities are investing in resilient cable systems to minimize outages and improve reliability. Rising electricity demand in industrializing economies also fuels market growth. The shift toward smart grids and underground power networks strengthens the need for advanced water blocking solutions.

- For instance, manufacturers such as 3M and others produce high-performance water-blocking tapes for specialized applications like submarine cables, where the product is tested to meet rigorous industry standards for water pressure resistance.

Growing Oil & Gas and Subsea Projects

The oil and gas sector contributes significantly to demand for water blocking tapes. Offshore exploration and subsea pipeline installations require moisture-resistant cables to ensure safety and reliability. These tapes prevent corrosion and mechanical damage, extending the service life of assets. Increased investments in LNG terminals, offshore wind, and deepwater projects create additional opportunities. Harsh operating environments make water-blocking technology indispensable in this sector.

Key Trends & Opportunities

Shift Toward Eco-Friendly and Halogen-Free Materials

Manufacturers are developing halogen-free, low-smoke water blocking tapes to meet environmental standards. These tapes support compliance with RoHS and REACH regulations, making them ideal for green infrastructure projects. The move toward sustainable materials creates opportunities for innovation in bio-based adhesives and recyclable carriers. This trend aligns with global sustainability targets and is likely to attract preference in public infrastructure projects.

- For instance, Berry Global Group is a manufacturer of specialty tapes, including those used in infrastructure and industrial applications. Berry Global sold its specialty tapes business to Nautic Partners in early 2025, a transaction that separated these products from the main company.

Rising Adoption of Automation in Cable Manufacturing

Automation in cable production is boosting demand for easy-to-process water blocking tapes. Tapes with consistent thickness and high-speed processability reduce production downtime. Cable makers prefer materials that offer stable bonding and minimal dust generation. This trend encourages suppliers to focus on precision manufacturing and high-quality adhesive formulations to meet the needs of high-volume automated plants.

- For instance, Prysmian Group, a major cable manufacturer, announced in 2025 that it is accelerating the adoption of automation across its manufacturing operations. This strategic focus on automation and process improvement is aligned with the broader industry trend toward increasing efficiency, enhancing product quality, and reducing waste in high-volume production facilities. Prysmian has committed to significant capital expenditures from 2025 to 2028 to support this growth through innovation and automation.

Key Challenges

Volatility in Raw Material Prices

Fluctuations in the cost of polymers, adhesives, and superabsorbent materials affect production economics. Manufacturers face margin pressures during periods of price spikes. Dependence on petrochemical derivatives makes the market sensitive to crude oil price changes. Companies must adopt strategic sourcing and long-term supplier agreements to mitigate volatility risks and maintain profitability.

Complex Regulatory Compliance Requirements

The market faces stringent environmental and safety regulations across regions. Compliance with standards such as UL, IEC, and EU environmental directives requires additional testing and certifications. These processes increase time-to-market and cost for manufacturers. Smaller players may struggle to meet these requirements, creating entry barriers and slowing innovation in some regions.

Regional Analysis

North America

North America held 32% share of the water blocking tapes market in 2024, driven by strong investment in telecom and power transmission infrastructure. The United States leads demand with extensive fiber-to-the-home (FTTH) deployments and 5G network expansion. Utilities are upgrading underground cable networks to improve grid reliability, further boosting consumption. The region also benefits from oil and gas pipeline projects and offshore energy developments requiring moisture-protected cables. Strict industry standards such as UL and ASTM ensure high product quality, encouraging adoption of advanced water blocking tapes across key applications.

Europe

Europe accounted for 27% of the global market in 2024, supported by robust renewable energy and submarine cable projects. Countries like Germany, the UK, and France are investing in offshore wind farms and interconnectors, driving high-performance cable demand. The region has strict environmental regulations, encouraging the use of halogen-free and recyclable water blocking tapes. Growing data center capacity and telecom upgrades across Western and Northern Europe also support market growth. The presence of major cable manufacturers and strong compliance culture ensures steady demand for premium water blocking solutions.

Asia-Pacific

Asia-Pacific dominated with 30% market share in 2024, driven by rapid industrialization and large-scale infrastructure projects. China, India, and Japan are leading contributors, with massive investments in telecom networks, smart cities, and power grid expansion. Fiber-optic deployment for 5G connectivity and rural broadband projects fuels demand. The region’s cable manufacturers focus on cost-effective and high-volume production, supporting wider adoption. Growth in offshore wind farms and subsea power links in China and Southeast Asia further strengthens market prospects, making Asia-Pacific the fastest-growing regional market during the forecast period.

Latin America

Latin America represented 6% of the water blocking tapes market in 2024, with Brazil and Mexico leading demand. Investments in telecom expansion and power transmission projects support steady consumption. Rising urbanization drives underground cabling projects in key cities. The oil and gas industry, particularly in offshore fields, creates additional opportunities for water blocking solutions. Local cable manufacturers are increasingly partnering with global suppliers to meet performance standards and improve reliability. Government-led digital connectivity programs also encourage infrastructure upgrades, supporting long-term market growth across the region.

Middle East & Africa

The Middle East & Africa captured 5% share of the global market in 2024, with demand concentrated in Gulf countries and South Africa. Expansion of oil and gas infrastructure and large-scale power transmission projects are major growth drivers. The region is investing in renewable energy projects, including solar and wind farms, requiring reliable cable networks. Subsea cable projects connecting Africa and Europe also support adoption. However, price sensitivity and limited local manufacturing capacity can restrict growth, creating opportunities for international suppliers to expand distribution networks and meet rising demand.

Market Segmentations:

By Conductivity

- Semi-Conductive

- Non-Conductive

By Adhesive Side

- Single Sided

- Double Sided

By End-Use Industry

- Telecommunication

- Power Transmission

- Oil and Gas

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the water blocking tapes market features leading players such as Intertape Polymer Group (Canada), Nantong Siber Communication, Navank Consultants, Berry Global Group, Inc. (US), 3M, Star Materials, Scapa Group Ltd (UK), Nichiban Co., Ltd. (Japan), Advance Tapes International Ltd (UK), and Fori Group. These companies focus on expanding product portfolios with high-performance, halogen-free, and recyclable solutions to meet global regulatory standards. Strategic collaborations with cable manufacturers, investments in automation, and R&D initiatives for advanced adhesive technologies strengthen their market presence. Players are also targeting growth in Asia-Pacific through capacity expansion and partnerships with local distributors to capture rising demand from telecom and power infrastructure projects. Mergers and acquisitions remain a key strategy to enhance geographic reach and technological capabilities, enabling these companies to maintain a competitive edge in an increasingly innovation-driven and sustainability-focused market environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Intertape Polymer Group (Canada)

- Nantong Siber Communication

- Navank Consultants

- Berry Global Group, Inc. (US)

- 3M

- Star Materials

- Scapa Group Ltd (UK)

- Nichiban Co., Ltd. (Japan)

- Advance Tapes International Ltd (UK)

- Fori Group

Recent Developments

- In May 2025, 3M expanded its non-conductive water blocking tape portfolio to include advanced adhesive technology that improves moisture resistance and durability in harsh environments. Their patented water blocking tapes provide instant protection from water ingress, fire, smoke, and sound, with tape thickness options ranging from 0.15 mm to 0.30 mm for diverse industrial applications.

- In 2025, IPG launched an automated water-activated tape packaging system that can customize tape length for random case sizes, improving material efficiency and reducing waste. Their new water-blocking tape formulations focus on high adhesion and enhanced moisture resistance, suitable for packaging up to 25 kg in weight capacity.

- In 2023, Scapa Group Ltd launched a new SAP-based non-conductive water-blocking tape with improved swell performance and reduced thickness.

Report Coverage

The research report offers an in-depth analysis based on Conductivity, Adhesive Side, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily, supported by rising demand for fiber-optic and power cables.

- 5G network deployment will significantly boost the consumption of high-performance water blocking tapes.

- Adoption of halogen-free and recyclable materials will grow due to stricter environmental regulations.

- Cable manufacturers will increase focus on automation, driving demand for process-friendly tape solutions.

- Subsea cable projects and offshore wind farms will create strong opportunities for advanced tapes.

- Power grid modernization and underground cabling will strengthen market growth globally.

- Strategic partnerships between tape producers and cable manufacturers will increase.

- Innovation in superabsorbent and dust-free tapes will enhance reliability and product life.

- Asia-Pacific will remain the fastest-growing region with strong infrastructure investments.

- Competitive pressure will drive mergers, acquisitions, and R&D spending to gain market advantage.

Market Insights

Market Insights