Market Overview

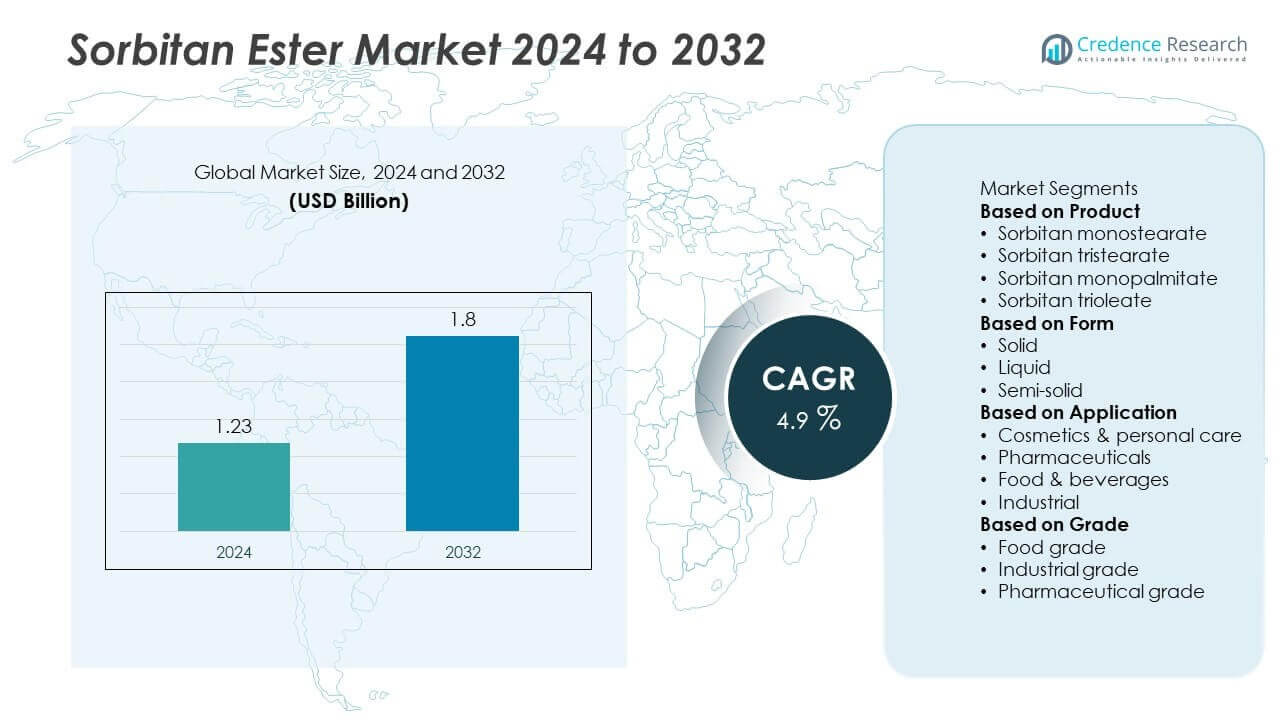

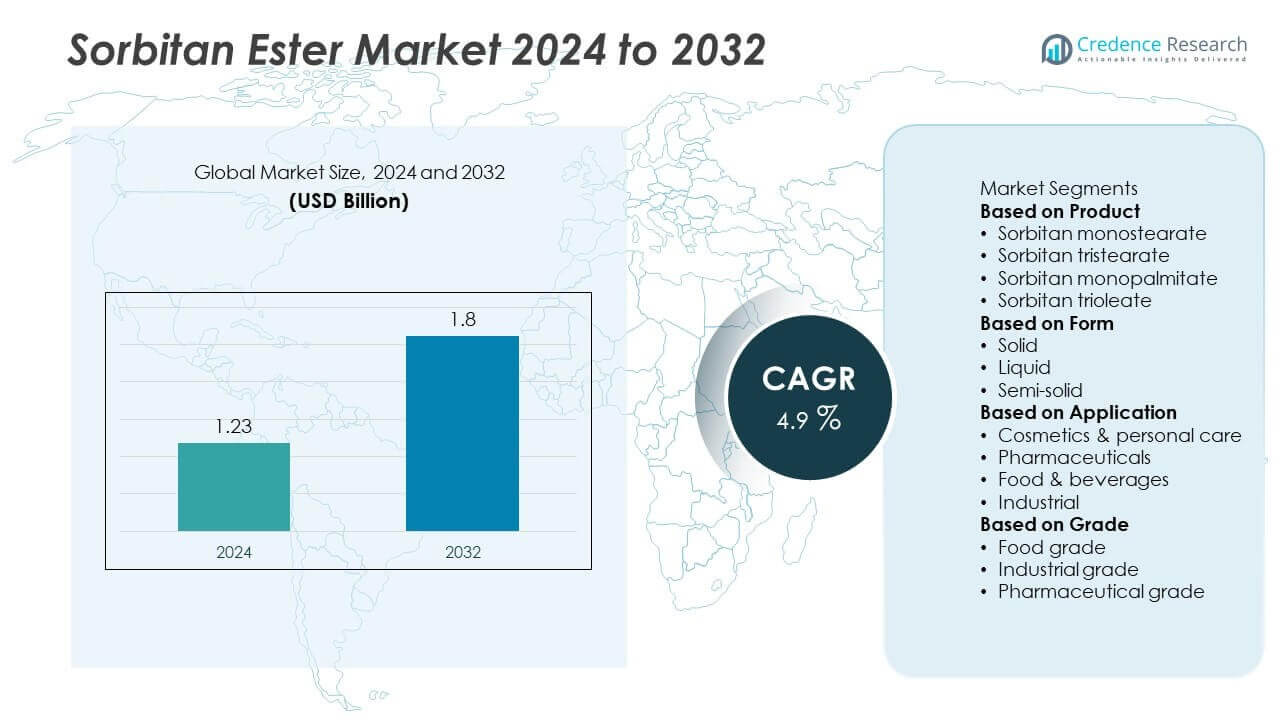

The sorbitan ester market was valued at USD 1.23 billion in 2024 and is projected to reach USD 1.8 billion by 2032, registering a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sorbitan Ester Market Size 2024 |

USD 1.23 Billion |

| Sorbitan Ester Market, CAGR |

4.9% |

| Sorbitan Ester Market Size 2032 |

USD 1.8 Billion |

The sorbitan ester market is led by major players including Croda International Plc., BASF SE, Mitsubishi Chemical Holdings Corporation, Evonik Industries AG, Stepan Company, AkzoNobel N.V., Kao Chemicals, Solvay SA, Lonza Group Ltd, and Emery Oleochemicals. These companies focus on innovation, sustainable production, and global distribution to strengthen their market position. North America dominated the market with 32% share in 2024, supported by strong demand from food, cosmetics, and pharmaceutical sectors. Europe followed with 28% share, driven by strict regulatory standards and growing preference for bio-based ingredients, while Asia-Pacific held 25% share and is the fastest-growing region due to rapid industrialization and rising consumption of processed food and personal care products.

Market Insights

Market Insights

- The sorbitan ester market was valued at USD 1.23 billion in 2024 and is projected to reach USD 1.8 billion by 2032, growing at a CAGR of 4.9% during the forecast period.

- Rising demand for emulsifiers in food and beverages, cosmetics, and pharmaceuticals is driving market expansion, supported by increasing clean-label product launches and consumer preference for safe, biodegradable ingredients.

- Key trends include the development of bio-based sorbitan esters, innovation in sustainable production processes, and growing use in industrial applications such as lubricants, coatings, and polymer processing.

- Competitive landscape features Croda International Plc., BASF SE, Mitsubishi Chemical Holdings Corporation, Evonik Industries AG, and Stepan Company, focusing on capacity expansion, partnerships, and R&D investment to meet global demand.

- North America led the market with 32% share in 2024, followed by Europe at 28% and Asia-Pacific at 25%, while food and beverages remained the leading application segment with over 40% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Sorbitan monostearate dominated the market in 2024, accounting for over 35% share due to its wide use as an emulsifier in food and cosmetic formulations. Its stability, non-toxicity, and compatibility with oils make it highly preferred in bakery, dairy, and confectionery products. Demand is also supported by growing applications in skincare creams and lotions for improved texture and moisture retention. Sorbitan tristearate and sorbitan trioleate are gaining traction in industrial lubricants and pharmaceuticals, but they remain secondary compared to monostearate’s extensive adoption across multiple end-use sectors.

- For instance, Croda International Plc is a major supplier of sorbitan esters, such as sorbitan monostearate, for the global food and personal care sectors. In its 2024 and 2025 reporting, Croda has noted its focus on developing high-performance ingredients to meet diverse market demands, rather than announcing massive, specific production volumes of commodity-grade products.

By Form

The solid form held the largest share, exceeding 50% of the market in 2024, driven by its ease of storage, transport, and stable performance in manufacturing processes. Solid sorbitan esters are widely used in bakery mixes, powdered food products, and solid cosmetic formulations, where long shelf life and controlled release are critical. The liquid form is growing steadily in industrial and pharmaceutical emulsions, offering easy dispersion and faster solubility. Semi-solid grades are used in niche applications but contribute a smaller share compared to solid and liquid forms.

- For instance, Mitsubishi Chemical Group, a major producer of sugar esters, increased its production capacity by building a new facility at its Kyushu Plant with a 2,000 tons/year output, which began operation in March 2024.

By Application

Food and beverages emerged as the dominant application segment, capturing over 40% share in 2024, fueled by increasing demand for emulsifiers in baked goods, dairy, and confectionery. The rise of processed food consumption and clean-label trends drives manufacturers to prefer sorbitan esters for their safety and functionality. Cosmetics and personal care also show strong growth, with rising use in creams, lotions, and makeup products for texture enhancement. Pharmaceuticals use sorbitan esters as stabilizers and excipients, while industrial applications focus on lubricants, coatings, and plastics processing.

Key Growth Drivers

Rising Demand in Processed Foods

The global shift toward processed and convenience foods is significantly boosting sorbitan ester consumption. These esters function as vital emulsifiers, enhancing texture, stability, and shelf life in bakery, dairy, and confectionery products. Their non-toxic and biodegradable nature makes them an ideal choice for clean-label food formulations. Rapid urbanization, rising disposable incomes, and changing dietary patterns in Asia-Pacific and Latin America are amplifying demand. This trend is set to continue as food manufacturers scale production to meet the growing appetite for packaged and ready-to-eat products.

- For instance, the overall market for food emulsifiers in the Asia-Pacific and Latin American regions is experiencing significant growth, driven by demand from the expanding bakery and dairy industries. Companies such as BASF SE, which offers a range of ingredients for the food industry, including pharmaceutical-grade polysorbate and sorbitan esters, are active in these growing markets.

Expanding Cosmetics and Personal Care Industry

Sorbitan esters are extensively used as emulsifying agents in creams, lotions, and makeup products, improving texture and spreadability. Growth in premium skincare and natural cosmetic products is driving adoption, as these esters are safe and skin-friendly. Consumers are increasingly spending on personal grooming products, particularly in emerging markets. Global cosmetic brands are also using sorbitan esters to comply with clean-label regulations and ensure product consistency, making this segment a key contributor to overall market expansion.

- For instance, Evonik Industries AG has significantly increased its production capacity for sustainable cosmetic emollients, including certain esters, by opening a new, double-digit million-euro plant in Germany in September 2024. This expansion was implemented to meet growing global demand from personal care product manufacturers for more eco-friendly ingredients, aligning with clean-label trends.

Increasing Pharmaceutical Applications

The pharmaceutical industry is rapidly incorporating sorbitan esters as excipients, stabilizers, and emulsifiers in formulations. They enhance bioavailability, dosage consistency, and controlled-release profiles for oral, topical, and injectable drugs. Rising production of generic medicines, coupled with the demand for topical creams and ointments, is driving adoption. Regulatory approvals across major markets further strengthen their role in drug development, encouraging pharmaceutical companies to expand the use of sorbitan esters in advanced and specialty formulations globally.

Key Trends & Opportunities

Shift Toward Bio-Based and Sustainable Ingredients

Sustainability is a major trend shaping the sorbitan ester market, with growing development of bio-based variants derived from renewable feedstocks. These solutions meet consumer preference for natural ingredients while aligning with global ESG goals. Regulatory pressure to reduce reliance on petrochemical-based additives is pushing R&D toward greener production processes. Companies focusing on carbon-efficient and biodegradable sorbitan esters are well-positioned to capture market share, particularly in food, cosmetics, and pharmaceutical applications where clean-label demand continues to rise.

- For instance, Stepan Company expanded its Alpha Olefin Sulfonates (AOS) production capacity by 25% across its North American facilities by June 2025, to meet the rising demand for sustainable surfactants used in cleaning and personal care products.

Expansion in Industrial Applications

Sorbitan esters are increasingly used in lubricants, coatings, and polymer processing industries due to their surfactant properties. They help reduce friction, improve dispersion, and enhance process efficiency in multiple manufacturing sectors. Growing demand from automotive, construction, and packaging industries is opening new revenue streams. Development of high-performance industrial-grade sorbitan esters is a major opportunity, enabling manufacturers to expand beyond traditional food and cosmetic applications and strengthen their competitive position in diverse end-user markets.

- For instance, Emery Oleochemicals manufactures and delivers industrial-grade esters, including sorbitan esters, for use in metalworking fluids and plasticizers. These bio-lubricants are designed to improve technical performance, enhance stability, and increase efficiency in industrial applications, such as automotive component manufacturing, by offering friction-reducing and sustainable solutions.

Key Challenges

Price Volatility of Raw Materials

Fluctuations in the prices of palm oil and soybean oil, the key feedstocks for sorbitan ester production, pose a challenge for manufacturers. Supply chain disruptions, climatic variability, and geopolitical factors contribute to unstable input costs, impacting profit margins. Small and mid-sized producers are most vulnerable to these price swings. Industry players are working on long-term sourcing strategies and diversifying raw material bases, but volatility remains a major risk affecting pricing strategies and overall market stability.

Regulatory Compliance Requirements

Compliance with international regulations such as FDA, EFSA, and REACH presents operational and financial challenges for producers. Continuous product testing, documentation, and certification are required to meet safety standards across different regions. Any regulatory updates can lead to reformulation delays, increasing costs and affecting time-to-market. To stay competitive, companies are investing in robust quality control systems and global compliance frameworks, ensuring that their sorbitan ester products meet evolving standards without disrupting supply to key industries.

Regional Analysis

North America

North America held the largest share of 32% in the sorbitan ester market in 2024, driven by strong demand from food and beverage, cosmetics, and pharmaceutical sectors. The United States leads the region with high consumption of processed foods and premium skincare products, boosting emulsifier usage. Growth is supported by well-established manufacturing facilities and strict regulatory compliance encouraging safe and approved additives. Rising investments in R&D for bio-based ingredients further strengthen the market. Canada contributes steadily with growing demand in personal care and industrial applications, while Mexico’s expanding food processing industry supports future growth potential.

Europe

Europe accounted for 28% share of the global sorbitan ester market in 2024, supported by strict EU regulations promoting safe food additives and sustainable ingredients. The region benefits from advanced production technology and a strong focus on clean-label products. Countries such as Germany, France, and the UK drive demand through bakery, confectionery, and cosmetic applications. Rising adoption of bio-based emulsifiers aligns with Europe’s circular economy goals, encouraging innovation in manufacturing. Industrial use of sorbitan esters is also increasing, particularly in coatings and lubricants, as regional players target environmentally compliant formulations and high-performance process additives.

Asia-Pacific

Asia-Pacific captured 25% share of the sorbitan ester market in 2024 and is the fastest-growing region. China, India, and Japan lead the demand due to expanding food processing, pharmaceutical, and cosmetic industries. Rising disposable incomes, rapid urbanization, and growing consumption of convenience foods drive significant growth. Domestic production capacity expansion is helping meet demand, reducing import dependence. Government support for local manufacturing and increasing adoption of clean-label products also boost the market. The region’s focus on cost-efficient and scalable manufacturing makes Asia-Pacific a key hub for global supply of sorbitan esters in the coming years.

Latin America

Latin America represented 9% of the global sorbitan ester market in 2024, with Brazil and Mexico being the largest contributors. Growing middle-class populations and rising consumption of packaged food products support demand. The cosmetics sector is also expanding rapidly, especially in Brazil, where sorbitan esters are widely used in skincare and haircare formulations. Industrial applications are gradually increasing as local manufacturers focus on improving product performance. Economic recovery and foreign investments in food processing and personal care manufacturing facilities are expected to create growth opportunities, strengthening the region’s share over the forecast period.

Middle East & Africa

The Middle East & Africa held 6% share of the global sorbitan ester market in 2024, supported by growing demand for processed foods and pharmaceuticals. The Gulf countries are witnessing strong investments in food manufacturing and personal care sectors to meet domestic consumption needs. South Africa contributes with rising industrial use in coatings and lubricants. Limited local production capacity makes the region reliant on imports, but government initiatives to promote manufacturing are expected to improve supply chain efficiency. Growing awareness of clean-label ingredients is further supporting market expansion in both food and cosmetic applications.

Market Segmentations:

By Product

- Sorbitan monostearate

- Sorbitan tristearate

- Sorbitan monopalmitate

- Sorbitan trioleate

By Form

By Application

- Cosmetics & personal care

- Pharmaceuticals

- Food & beverages

- Industrial

By Grade

- Food grade

- Industrial grade

- Pharmaceutical grade

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the sorbitan ester market features key players such as Croda International Plc., Mitsubishi Chemical Holdings Corporation, BASF SE, Stepan Company, Evonik Industries AG, AkzoNobel N.V., Kao Chemicals, Lonza Group Ltd, Solvay SA, and Emery Oleochemicals. These companies focus on expanding production capacity, developing bio-based sorbitan esters, and strengthening their global distribution networks to meet rising demand. Strategic partnerships and acquisitions are common as players aim to enhance market reach and diversify product portfolios. Innovation in clean-label and sustainable ingredients is a priority, driven by growing regulatory requirements and consumer preference for natural formulations. Leading manufacturers invest in R&D to improve product performance, ensure compliance with international food and cosmetic standards, and achieve cost efficiency in large-scale production. Expanding presence in high-growth regions like Asia-Pacific further helps these players capture emerging opportunities and secure long-term market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Croda International Plc.

- Mitsubishi Chemical Holdings Corporation

- BASF SE

- Stepan Company

- Evonik Industries AG

- AkzoNobel N.V.

- Kao Chemicals

- Lonza Group Ltd

- Solvay SA

- Emery Oleochemicals

Recent Developments

- In July 2025, Stepan Company increased its sorbitan ester capacity by launching a 10,000-ton annual expansion at its North American facility. The expansion focuses on specialty sorbitan esters used in personal care and pharmaceutical markets, aligned with clean-label consumer trends.

- In May 2025, BASF introduced novel sorbitan esters with enhanced emulsifying properties for use in bakery and confectionery products. The new product line reached a shipment volume of 12,000 metric tons by May 2025, strengthening BASF’s market position in the food-grade surfactant segment.

- In 2023, Evonik TEGO® SML 20 is polyoxyethylene(20) sorbitan monolaurate with HLB 32. Listed as a wetter/co-emulsifier for agro formulations.

Report Coverage

The research report offers an in-depth analysis based on Product, Form, Application, Grade and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to maintain steady growth with a CAGR of 4.9% through 2032.

- Demand for bio-based sorbitan esters will rise as sustainability regulations tighten globally.

- Food and beverages will remain the dominant application, driven by processed food consumption.

- Cosmetics and personal care will see strong growth with premium and natural product launches.

- Pharmaceutical usage will expand with higher production of topical and oral drug formulations.

- Asia-Pacific will record the fastest growth supported by industrialization and rising disposable incomes.

- Manufacturers will invest in capacity expansion to meet growing global demand efficiently.

- Innovation will focus on cost-effective and low-carbon production technologies.

- Strategic collaborations and acquisitions will increase to strengthen distribution networks and market reach.

- Regulatory compliance and quality assurance will stay critical for maintaining global competitiveness.

Market Insights

Market Insights