Market Overview:

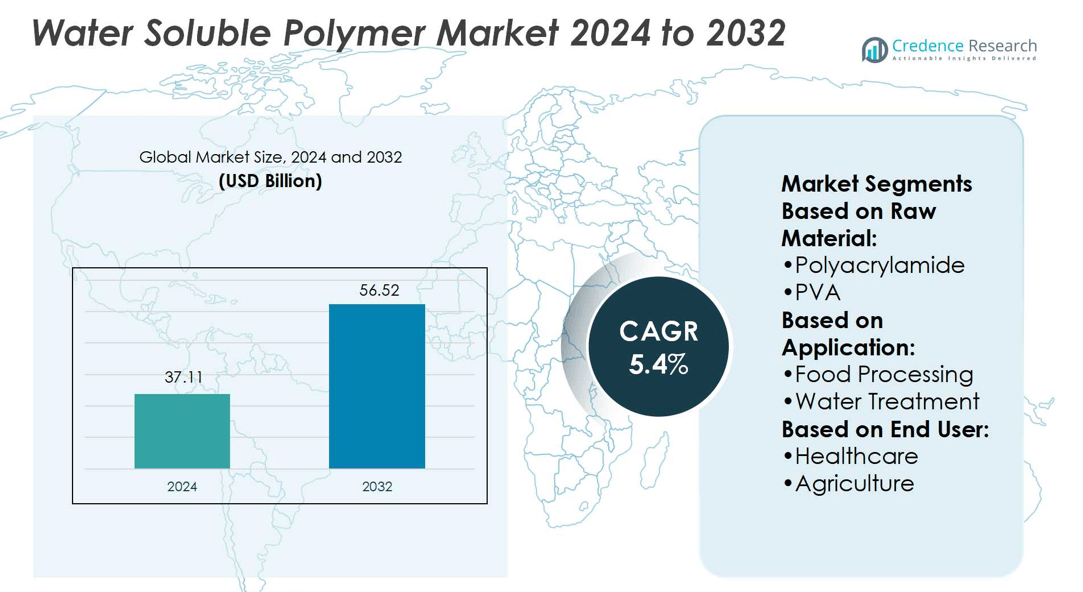

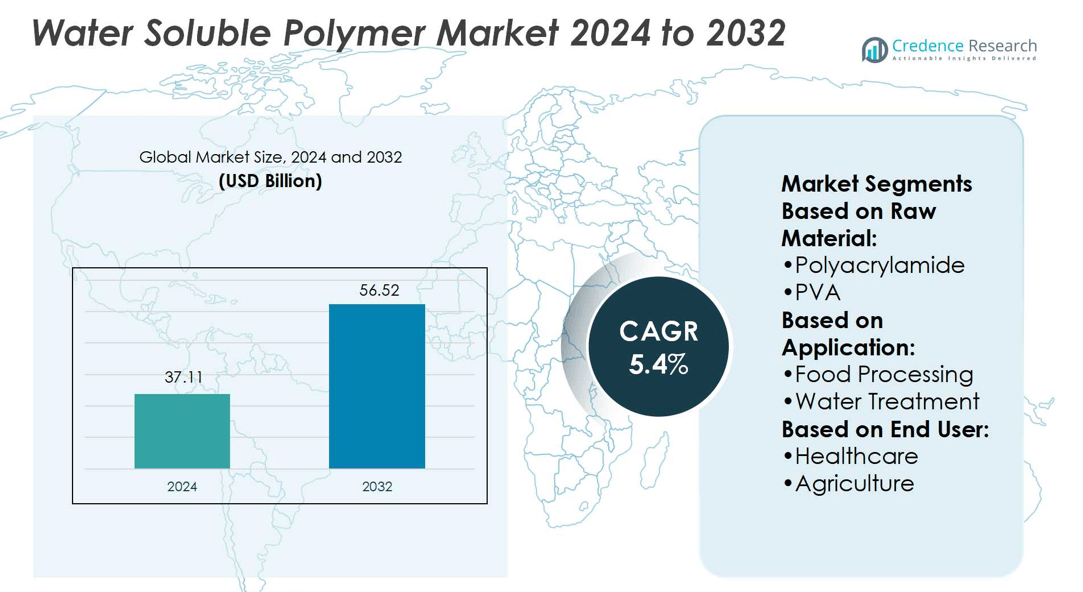

Water Soluble Polymer Market size was valued USD 37.11 billion in 2024 and is anticipated to reach USD 56.52 billion by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Water Soluble Polymer Market Size 2024 |

USD 37.11 billion |

| Water Soluble Polymer Market, CAGR |

5.4% |

| Water Soluble Polymer Market Size 2032 |

USD 56.52 billion |

The water-soluble polymer market is highly competitive, with top players including Arkema, Ashland, BASF, DuPont, CP Kelco U.S., Inc., Solvay, KURARAY CO., LTD., Akzo Nobel N.V., NITTA GELATIN, INC., and SNF. These companies focus on developing advanced formulations, expanding production capacities, and adopting sustainable solutions to address diverse applications in water treatment, food processing, petroleum, and papermaking. North America leads the global market with a 34% share in 2024, supported by strong regulatory frameworks, advanced industrial infrastructure, and extensive use of polymers in wastewater management and enhanced oil recovery. This dominance highlights the region’s pivotal role in driving technological innovation and sustainable adoption

Market Insights

- The Water Soluble Polymer Market size was valued at USD 37.11 billion in 2024 and is anticipated to reach USD 56.52 billion by 2032, growing at a CAGR of 5.4%.

- Increasing demand in water treatment, food processing, and petroleum industries drives market growth, supported by rising environmental concerns and regulatory compliance.

- Key players such as Arkema, Ashland, BASF, DuPont, Solvay, and SNF focus on sustainable innovations, capacity expansion, and tailored formulations to strengthen their competitive position.

- Volatility in raw material prices and stringent environmental regulations related to synthetic polymers remain significant restraints, limiting growth opportunities for smaller manufacturers.

- North America leads with 34% market share, followed by Europe at 28% and Asia Pacific at 25%, while water treatment holds the largest application share at over 40%, reflecting the sector’s critical role in addressing water scarcity and sustainability challenges.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Raw Material

The synthetic raw material segment leads the water-soluble polymer market, accounting for nearly 55% share in 2024. Polyacrylamide dominates this category due to its widespread use in water treatment and petroleum recovery, driven by strong flocculation and viscosity-modifying properties. Rising demand for polyvinyl alcohol (PVA) in textiles and adhesives also strengthens the segment. Drivers include growing industrial water treatment needs, enhanced oil recovery practices, and cost-effectiveness of synthetic polymers compared to natural and semisynthetic options, ensuring their dominance in high-volume industrial applications.

- For instance, Ashland has commercialized the easy-wet™ 300 n super wetting agent platform. This product is biodegradable per OECD Test No. 302B; field trials over a full year demonstrated substantial reduction in spray drift and superior wettability at lower concentrations when compared to benchmark non‐ionic surfactants.

By Application

Water treatment represents the dominant application segment, capturing over 40% market share in 2024. Rising industrial effluent discharge, scarcity of clean water, and strict government regulations drive adoption. Polyacrylamide and polyacrylic acid are extensively used in municipal and industrial treatment plants for sludge dewatering and contaminant removal. Expanding urbanization and industrialization in emerging economies further boost consumption. This segment’s growth is also supported by sustainability initiatives promoting eco-friendly water recycling and reuse solutions, ensuring steady demand for water-soluble polymers in this critical application area.

- For instance, BASF bio-acrylamide capacity globally, including the opening of a plant in Nanjing, China, that produces more than 50,000 metric tons annually.rfactants.

By End User

Within end-user sectors, the petroleum industry remains a leading consumer, contributing nearly 30% of market share in 2024. Demand is fueled by enhanced oil recovery (EOR) techniques where polyacrylamide improves crude extraction efficiency. Shale gas exploration and deep-water drilling also expand usage, particularly in the U.S. and Middle East. Additionally, cost savings and efficiency improvements through polymer flooding strengthen reliance on these materials. Increasing energy demand, coupled with investments in advanced drilling technologies, secures the petroleum industry as a core driver of market growth for water-soluble polymers.

Market Overview

Rising Demand in Water Treatment

The growing need for clean and safe water drives the adoption of water-soluble polymers in municipal and industrial treatment plants. Polymers such as polyacrylamide and polyacrylic acid are widely applied for flocculation, sludge dewatering, and contaminant removal. Stringent environmental regulations and rising concerns over water scarcity further accelerate demand. Rapid industrialization in emerging economies increases wastewater output, strengthening the reliance on polymers for treatment efficiency. This strong linkage between sustainability initiatives and regulatory compliance positions water treatment as a key growth driver.

- For instance, DuPont’s ultrafiltration membrane product line, PES In-Out (Multibore™), features inner pores of approximately 20 nanometers, enabling virus rejection above 4 log units without pre-coagulation.

Expansion of the Petroleum Industry

Enhanced oil recovery (EOR) continues to fuel the demand for water-soluble polymers, particularly polyacrylamide. These polymers improve viscosity, optimize flooding techniques, and enhance crude recovery rates. Growing investments in shale gas and offshore exploration across North America, the Middle East, and Asia Pacific further expand consumption. Rising global energy demand pushes oil producers to maximize yield from existing reservoirs, making polymers vital in advanced recovery processes. Their ability to boost operational efficiency while reducing costs ensures petroleum applications remain a strong driver for market expansion.

- For instance, Solvay introduced a new grade of Rhodianyl polyamide 6.6, produced at its Santo André plant, made from 100% pre-consumer recycled content, achieving SCS Recycled Content Certification.

Growth of Food Processing Applications

The food processing industry is increasingly utilizing natural water-soluble polymers such as gelatin, guar gum, and xanthan gum as thickeners, stabilizers, and emulsifiers. Changing consumer preferences for convenience foods, bakery products, and ready-to-eat meals supports this demand. Polymers also play a crucial role in improving product texture, shelf life, and consistency. Expanding global population and urbanization further strengthen reliance on processed food solutions. With rising clean-label and natural ingredient trends, biopolymer-based solutions offer strong growth opportunities in the food and beverage sector.

Key Trends & Opportunities

Shift Toward Sustainable and Bio-Based Polymers

Environmental regulations and consumer demand for eco-friendly solutions are accelerating the adoption of natural and bio-based water-soluble polymers. Materials like guar gum and xanthan gum are gaining traction in food, cosmetics, and pharmaceutical industries. Companies are investing in biopolymer R&D to reduce reliance on petrochemical feedstocks and improve biodegradability. This transition not only aligns with sustainability goals but also helps manufacturers differentiate in competitive markets. Rising bans on non-biodegradable plastics further position bio-based polymers as a significant long-term opportunity for the industry.

- For instance, Kuraray’s SEPTON™ BIO-series, made from beta-farnesene and styrene blocks, has biomass content between 50-80%, offering strong adhesive force and damping properties.

Technological Advancements in Polymer Formulations

Innovations in polymer chemistry are enabling the development of advanced formulations with higher efficiency, improved stability, and cost-effectiveness. Customized polymers for water treatment, oil recovery, and specialty food applications are gaining momentum. Smart polymers with pH- or temperature-responsive properties are also being explored in healthcare and pharmaceuticals. Such advancements expand the application scope of water-soluble polymers across diverse industries. By delivering superior performance and supporting energy-efficient processes, technological innovation opens opportunities for broader adoption and market growth.

- For instance, Akzo Nobel holds a patent for controlled-release polymers whose water solubility toggles with pH and salt concentration: the polymers are copolymers or terpolymers containing 2 to 60 mole % of an amine functionality that is neutralised with a fixed acid.

Key Challenges

Volatility in Raw Material Prices

The water-soluble polymer market faces significant pressure from fluctuating raw material costs, particularly petrochemical derivatives like acrylamide and acrylic acid. Price instability impacts production costs and reduces profit margins for manufacturers. Dependence on crude oil supply and geopolitical uncertainties further complicates cost predictability. Small- and mid-scale producers often struggle to absorb such fluctuations, affecting competitiveness. Managing supply chains and diversifying raw material sources have become essential strategies to counter this challenge and sustain long-term market growth.

Stringent Environmental and Safety Regulations

While water-soluble polymers aid in sustainability, their manufacturing processes face tight regulatory scrutiny due to environmental and health concerns. Synthetic polymers, especially acrylamide-based products, must comply with safety limits regarding toxicity and biodegradability. Compliance requires high investment in advanced production facilities, waste treatment, and monitoring systems. These regulations increase operational costs and create entry barriers for new players. The need to balance innovation with compliance poses a continuous challenge, pushing companies toward greener alternatives and stricter quality assurance practices.

Regional Analysis

North America

North America leads the water-soluble polymer market with a 34% share in 2024, driven by strong demand in water treatment, food processing, and petroleum industries. The U.S. dominates regional consumption due to stringent wastewater treatment regulations and the extensive use of polymers in enhanced oil recovery. Canada shows rising adoption in food and packaging applications, supported by sustainability policies. Well-developed infrastructure, technological advancements in polymer formulations, and robust industrial growth ensure consistent demand. Government initiatives promoting environmental compliance further strengthen the region’s leadership, positioning North America as a key growth hub through the forecast period.

Europe

Europe accounts for 28% of the global market in 2024, supported by strict environmental regulations and rising demand for bio-based polymers. Germany, France, and the U.K. dominate due to their advanced food processing and paper industries. The European Union’s initiatives toward circular economy and sustainable product development are accelerating the shift toward natural and biodegradable water-soluble polymers. Significant adoption in wastewater treatment facilities also strengthens regional growth. With increasing focus on reducing carbon footprints and regulatory compliance, Europe maintains its position as a major consumer and innovator in the global water-soluble polymer market.

Asia Pacific

Asia Pacific holds a 25% market share in 2024, fueled by rapid industrialization and growing water treatment requirements. China leads regional demand with large-scale consumption in textiles, papermaking, and petroleum sectors. India and Southeast Asian countries are also experiencing robust adoption, supported by urbanization and rising processed food demand. Expanding infrastructure projects and the shift toward efficient water management solutions further drive growth. Cost-effective production capabilities and abundant raw materials position Asia Pacific as a major manufacturing hub. The region is expected to witness the fastest growth, driven by expanding population and industrial modernization efforts.

Latin America

Latin America represents 7% of the global water-soluble polymer market in 2024, with Brazil and Mexico leading consumption. Demand is mainly driven by applications in food processing, water treatment, and oil recovery industries. Rising investments in wastewater treatment facilities and petroleum exploration are boosting regional adoption. The food and beverage industry’s growth, particularly in convenience and packaged foods, further supports usage of natural polymers such as guar gum and gelatin. Although relatively smaller in share, Latin America is emerging as a promising growth region due to increasing regulatory focus on environmental sustainability and water resource management.

Middle East & Africa (MEA)

The Middle East & Africa account for 6% share in 2024, primarily supported by the petroleum and water treatment sectors. Gulf countries such as Saudi Arabia and the UAE lead regional demand, with polymers extensively used in enhanced oil recovery. Africa shows rising adoption in municipal water treatment and agriculture-related applications, particularly in South Africa. Investments in desalination and wastewater recycling projects also support growth. Despite infrastructure challenges, MEA offers long-term opportunities due to growing energy demand and water scarcity concerns, positioning the region as a strategic consumer of water-soluble polymers.

Market Segmentations:

By Raw Material:

By Application:

- Food Processing

- Water Treatment

By End User:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the water-soluble polymer market is shaped by leading players including Arkema, Ashland, BASF, DuPont, CP Kelco U.S., Inc., Solvay, KURARAY CO., LTD., Akzo Nobel N.V., NITTA GELATIN, INC., and SNF. The water-soluble polymer market is defined by continuous innovation, sustainability initiatives, and capacity expansion. Companies are investing heavily in research and development to create advanced polymer formulations that meet the rising demand in water treatment, food processing, petroleum, and papermaking industries. A strong focus is placed on bio-based and biodegradable alternatives, aligning with global sustainability goals and regulatory requirements. Strategic collaborations, acquisitions, and regional expansions are driving market consolidation while enhancing supply chain resilience. Additionally, the integration of advanced manufacturing technologies and customized solutions enables firms to strengthen their competitive edge and capture diverse application opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Arkema

- Ashland

- BASF

- DuPont

- CP Kelco U.S., Inc.

- Solvay

- KURARAY CO., LTD.

- Akzo Nobel N.V.

- NITTA GELATIN, INC.

- SNF

Recent Developments

- In January 2025, Bayer Crop Science launched a product for its crop health product Wojiarun, which is a new-generation water-soluble secondary fertilizer. Wojiarun is also a new-generation calcium fertilizer developed by Bayer. The launch of the product is a demonstration of Bayer’s strong commitment to fertilizer research and manufacture in China.

- In August 2024, SNF announced that it has signed agreements to acquire Ace Fluid Solutions and PfP Industries. The company aims to offer advanced solutions to its upstream oil and gas customers. PfP Industries specializes in slurry friction reducer technologies and related applications, while Ace Fluid Solutions develops innovative products in fluid management.

- In June 2024, Grove Bags introduced ExcIse, an environmentally friendly storage solution for preserving fresh frozen cannabis. ExcIse completely dissolves in water without leaving microplastic residue, making it biodegradable, compostable, and safe for marine environments.

- In February 2024, Kemira announced the expansion of its renewable solutions portfolio via the launch of two biomass-balanced wet strength resins and polyamines with ISCC PLUS certification for the papermaking industry. The wet strength resins are the first ISCC-certified formulations based on PAE (polyamideamine epichlorohydrin) in the market, obtained from renewable feedstocks

Report Coverage

The research report offers an in-depth analysis based on Raw Material, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising adoption of polymers in municipal and industrial water treatment.

- Demand will grow in petroleum applications as enhanced oil recovery techniques gain wider usage.

- Food processing will increasingly rely on natural polymers to meet clean-label and convenience trends.

- Bio-based and biodegradable polymers will see accelerated development under stricter environmental regulations.

- Advances in polymer chemistry will enable tailored solutions for pharmaceuticals and healthcare sectors.

- Asia Pacific will emerge as the fastest-growing region due to industrialization and urbanization.

- Europe will strengthen its position through regulatory-driven adoption of sustainable polymer solutions.

- Strategic collaborations and acquisitions will shape competitive dynamics and global market reach.

- Technological integration will enhance efficiency and reduce costs across manufacturing processes.

- Growing awareness of water scarcity will reinforce long-term demand for water-soluble polymers worldwide.