Market Overview

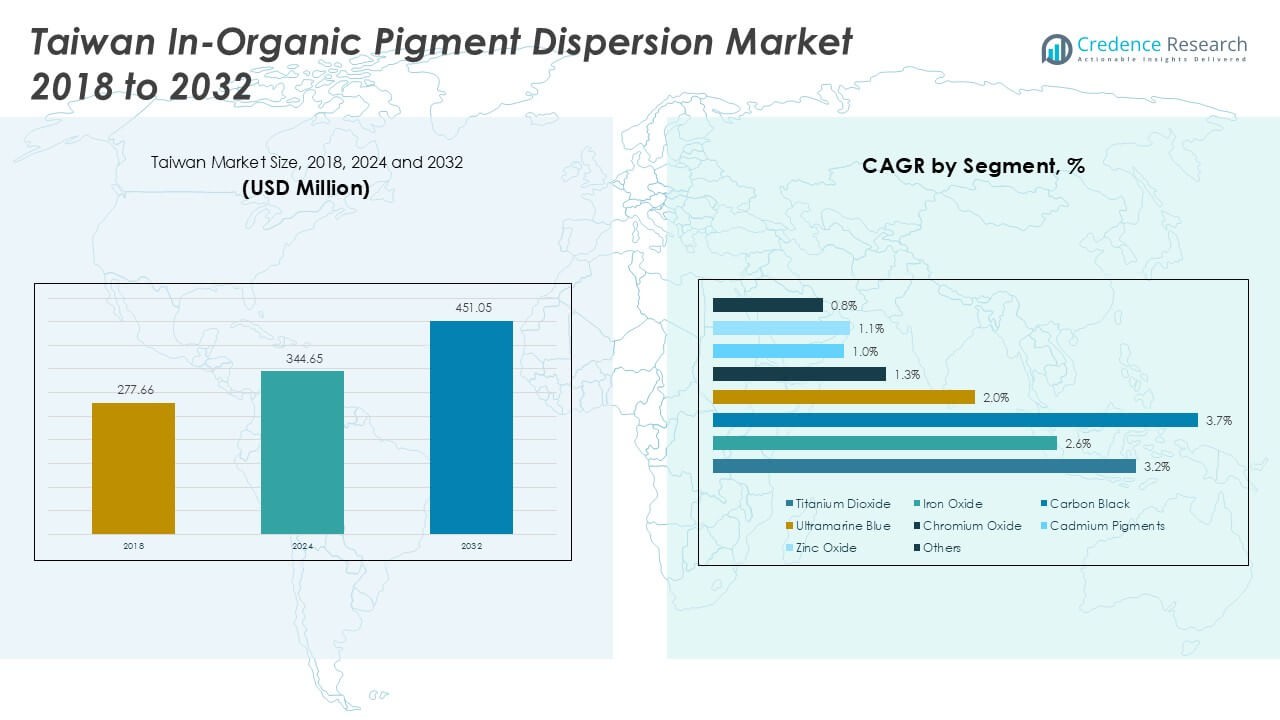

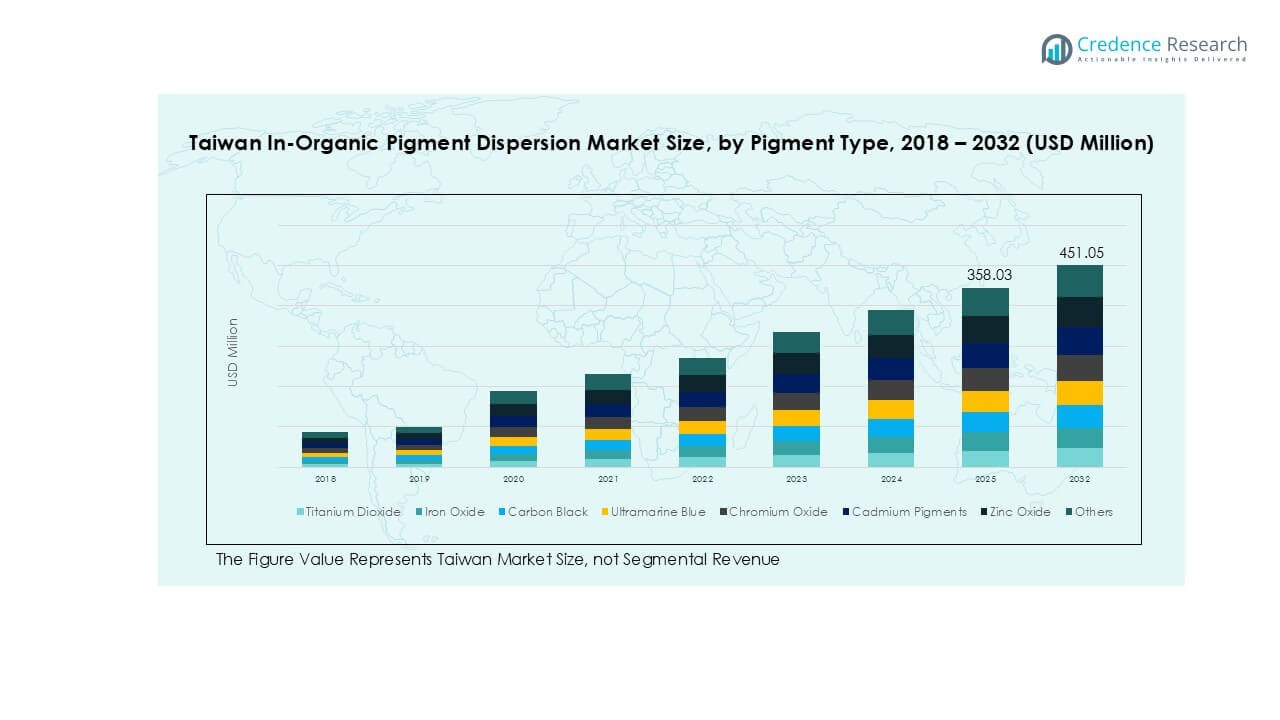

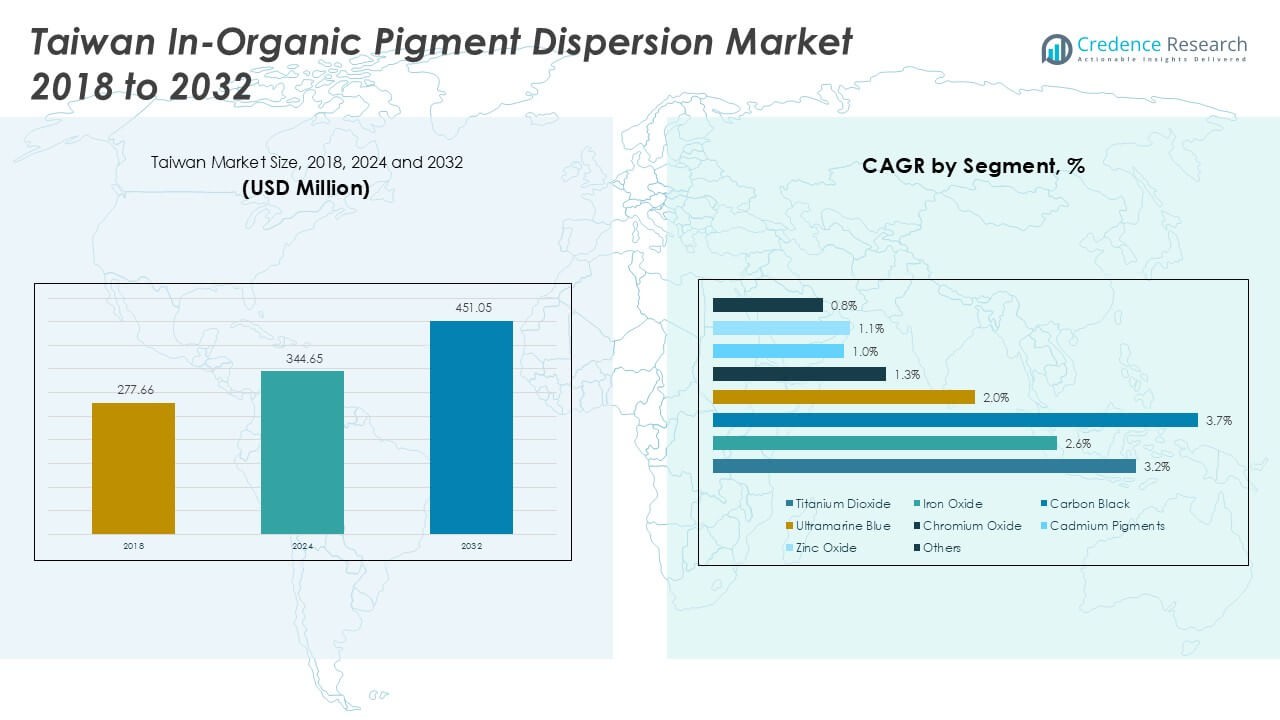

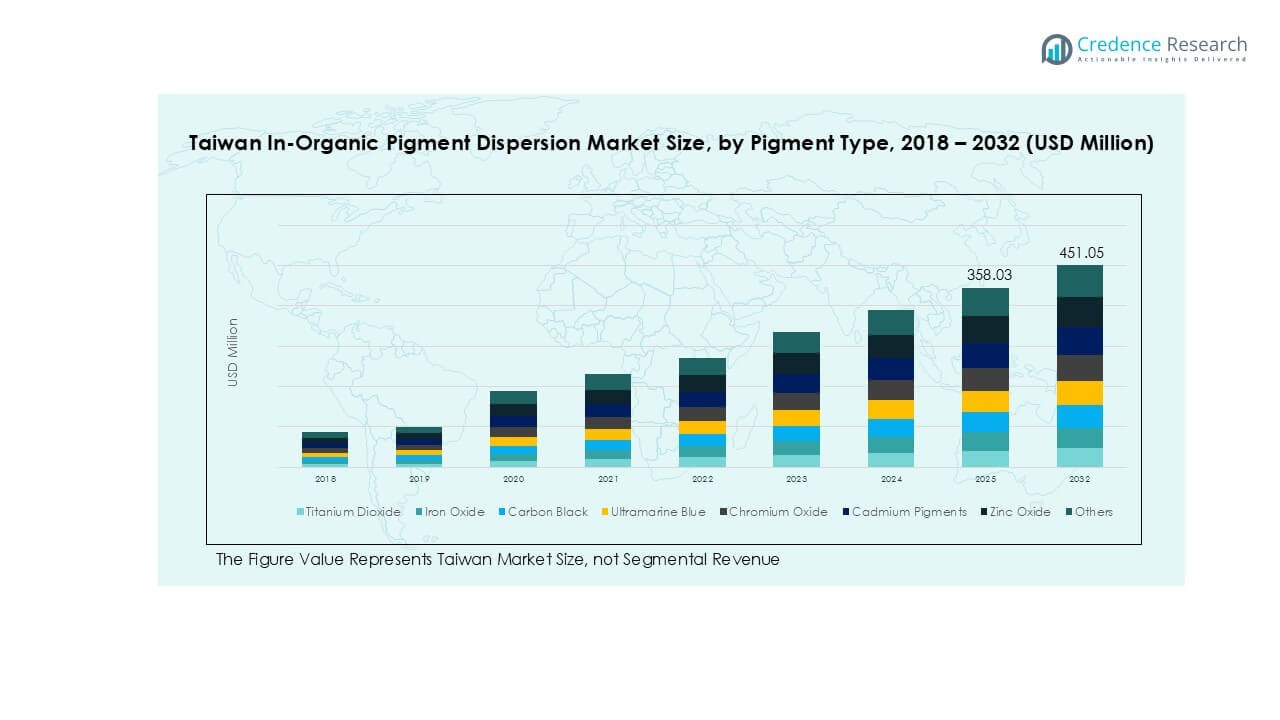

Taiwan In-Organic Pigment Dispersion Market size was valued at USD 277.66 million in 2018, grew to USD 344.65 million in 2024, and is anticipated to reach USD 451.05 million by 2032, expanding at a CAGR of 3.35% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Taiwan In-Organic Pigment Dispersion Market Size 2024 |

USD 344.65 Million |

| Taiwan In-Organic Pigment Dispersion Market, CAGR |

3.35% |

| Taiwan In-Organic Pigment Dispersion Market Size 2032 |

USD 451.05 Million |

The Taiwan in-organic pigment dispersion market is driven by major players such as BASF SE, Cheng Feng Group, Crown Color Technology Co., Ltd., Taiwan Dyestuffs & Pigments, Colorwen, and Tah Kong Chemical Industrial Corp. These companies focus on producing high-quality pigment dispersions for paints, coatings, plastics, and construction materials, meeting stringent performance and regulatory standards. Northern Taiwan leads the market with over 40% share in 2024, supported by its strong manufacturing base, construction activities, and packaging industries. Central Taiwan follows with nearly 25% share, driven by industrial output and ceramics production. Southern Taiwan contributes around 20% share, with high demand from petrochemical and plastics sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Taiwan in-organic pigment dispersion market was valued at USD 344.65 million in 2024 and is projected to reach USD 451.05 million by 2032, expanding at a CAGR of 3.35% during the forecast period.

- Rising demand from construction, infrastructure, and paints & coatings sectors is the primary driver, supported by government-backed urban development and industrial expansion projects.

- Key trends include the shift toward eco-friendly, low-VOC pigment dispersions and growing adoption of advanced dispersion technologies for high-performance coatings and plastics applications.

- The market is moderately consolidated, with major players including BASF SE, Cheng Feng Group, Crown Color Technology, Taiwan Dyestuffs & Pigments, Colorwen, and Tah Kong Chemical Industrial Corp. focusing on product innovation and strategic capacity expansion.

- Northern Taiwan holds over 40% share, Central Taiwan nearly 25%, and Southern Taiwan around 20%, while paints & coatings remain the dominant segment with more than 45% market share.

Market Segmentation Analysis:

By Pigment Type

Titanium dioxide led the Taiwan in-organic pigment dispersion market in 2024, holding over 35% share. Its dominance is supported by its superior opacity, brightness, and UV resistance, making it the preferred choice in paints, coatings, and plastics applications. Iron oxide followed, driven by its use in construction materials, tiles, and decorative coatings. Carbon black is widely used in plastics and printing inks due to its tint strength and conductivity. Ultramarine blue and chromium oxide are niche pigments catering to specialty applications. Cadmium pigments and zinc oxide maintain stable demand in ceramics, plastics, and cosmetics sectors.

- For instance, in early 2024, Venator announced a major restructuring plan to reduce its titanium dioxide capacity in Europe. This plan included shutting down its 50,000-ton TiO₂ plant in Duisburg, Germany, and keeping its 80,000-ton facility in Scarlino, Italy, offline.

By Application

Paints and coatings dominated the market, accounting for more than 45% share in 2024, driven by growth in construction, automotive refinishing, and protective coatings. Printing inks followed, supported by demand from packaging and publishing sectors. Plastics consumption is rising with growing production of consumer goods and packaging materials. Construction materials such as tiles and pavers use iron oxide dispersions for color consistency. Ceramics and glass applications continue to adopt specialty pigments for aesthetics. Cosmetics applications are expanding, using zinc oxide for UV protection and skin-safe colorants. Other applications contribute moderately to overall growth.

- For instance, Asian Paints utilizes significant quantities of titanium dioxide dispersions in its manufacturing facilities across India for architectural and industrial coatings. As the primary and largest consumed raw material in the paint industry, TiO2 is essential for ensuring gloss retention, durability, and UV protection in Asian Paints’ products.

Key Growth Drivers

Rising Demand from Construction and Infrastructure

The market benefits from Taiwan’s growing construction and infrastructure activities, which drive strong demand for iron oxide and titanium dioxide pigments. These pigments are widely used in concrete, pavers, tiles, and coatings to enhance color stability and durability. Government investments in public works and urban renewal projects further support consumption. Increased housing projects and commercial developments create steady demand for pigment dispersions. The push for sustainable and long-lasting building materials strengthens adoption of high-performance pigments with improved UV stability and weather resistance.

- For instance, LANXESS is a major manufacturer of iron oxide pigments. Its products, sold under brands like Bayferrox®, are used globally for coloring construction materials like tiles and pavers, and are known for their consistency and weather resistance. The company has a presence in the Asian market and increased its overall earnings in 2024, despite a challenging global economic climate.

Expansion of Paints and Coatings Industry

The paints and coatings segment contribute the largest share to market growth, driven by rising demand from automotive, industrial, and decorative sectors. Taiwan’s growing export-oriented manufacturing sector fuels demand for protective coatings and specialty finishes. Titanium dioxide remains the dominant pigment due to its superior opacity and brightness. The trend toward water-based and low-VOC coatings also supports pigment dispersions with better dispersion stability. Continuous investments in smart coatings and anti-corrosion technologies are expected to create new opportunities for pigment suppliers in the coming years.

- For instance, Nippon Paint Taiwan, like other paint manufacturers in the Nippon Paint Group, uses titanium dioxide dispersions in its water-based architectural coatings to achieve high hiding power and UV protection.

Growth in Plastics and Packaging Applications

Expanding plastics and packaging production significantly boosts pigment dispersion consumption in Taiwan. Carbon black and titanium dioxide dispersions are widely used to provide color, opacity, and UV protection in films, bottles, and molded products. Rising e-commerce and consumer goods demand have increased packaging requirements, driving higher use of colored plastics. Manufacturers are focusing on recyclable and eco-friendly formulations, which further encourage adoption of advanced pigment dispersions that meet regulatory compliance. The shift toward lightweight, durable packaging solutions continues to fuel steady growth in this segment.

Key Trends & Opportunities

Shift Toward Eco-Friendly and Regulatory-Compliant Pigments

Taiwanese manufacturers are increasingly adopting eco-friendly pigment dispersions to comply with strict environmental regulations. Demand for low-VOC, heavy-metal-free, and REACH-compliant pigments is rising across coatings and plastics. This shift encourages innovation in water-based dispersion technologies and non-toxic alternatives, particularly in packaging, construction, and cosmetics. Suppliers investing in green chemistry and sustainable production methods are well-positioned to capture market share. This trend aligns with global sustainability goals and Taiwan’s commitment to reducing industrial emissions, presenting strong opportunities for new product development.

- For instance, in 2024, DIC Corporation’s subsidiaries in India expanded production by commencing operations at a new coating resins facility. The DIC Group has been advancing environmentally friendly, waterborne product lines to reduce VOCs and support global compliance, and the new India plant features eco-friendly practices.

Technological Advancements in Dispersion Processes

Opportunities are emerging from improved dispersion technologies that deliver higher color strength, stability, and consistency. Developments in nano-pigment dispersion and surface treatment methods enable better performance in demanding applications such as automotive coatings and high-end plastics. Taiwanese producers are adopting advanced milling and wet dispersion equipment to enhance efficiency and reduce production costs. These innovations open doors for premium products, including high-durability coatings and specialty effect pigments, supporting manufacturers targeting export markets with stringent quality requirements.

- For instance, in 2022, Heubach Group and SK Capital acquired Clariant’s pigment business, including its plant facilities. However, in April 2024, the Heubach Group filed for insolvency in Germany due to a high debt burden and financial struggles. The company’s global pigment operations, which included former Clariant assets, were later acquired by Sudarshan Chemical Industries in October 2024.

Key Challenges

Volatility in Raw Material Prices

Price fluctuations in raw materials such as titanium dioxide, iron oxides, and energy inputs pose a major challenge for manufacturers. Sudden cost increases can compress profit margins and lead to pricing pressure across the supply chain. Taiwan’s reliance on imported raw materials exposes producers to global price swings and logistical disruptions. Companies are adopting long-term procurement strategies and diversifying suppliers to mitigate risks, but managing cost competitiveness remains a constant concern in the market.

Environmental and Waste Management Regulations

Stringent regulations on waste disposal, emissions, and chemical use challenge manufacturers in Taiwan. Compliance with environmental standards requires significant investment in wastewater treatment, emission control systems, and safe handling practices. Smaller players often struggle with the cost burden, leading to industry consolidation. Failure to meet regulatory requirements can result in penalties and loss of customer trust. Continuous focus on sustainability and green production processes is essential to remain competitive and maintain market access.

Regional Analysis

Northern Taiwan

Northern Taiwan accounted for over 40% of the market share in 2024, driven by its concentration of industrial and construction activities. Taipei and New Taipei City lead demand for paints, coatings, and infrastructure materials. The presence of major manufacturing hubs supports high consumption of titanium dioxide and iron oxide pigments for coatings and plastics applications. Growth in real estate and urban redevelopment projects fuels additional demand. Strong presence of printing and packaging industries further contributes to steady consumption. The region remains the dominant market and is expected to retain leadership through continued investments in commercial and residential projects.

Central Taiwan

Central Taiwan held nearly 25% share of the market in 2024, supported by its thriving manufacturing base and expanding construction sector. Taichung serves as a key production hub for machinery, automotive components, and industrial coatings. Demand for pigment dispersions in paints and coatings remains robust, while growing ceramics production drives use of specialty pigments such as ultramarine blue and chromium oxide. Increasing infrastructure development and industrial parks are expected to sustain pigment consumption. The region’s focus on technological advancements in manufacturing enhances demand for high-performance pigment dispersions with improved dispersion stability and color consistency.

Southern Taiwan

Southern Taiwan captured around 20% market share in 2024, with Kaohsiung and Tainan being major contributors. The petrochemical and plastics industries dominate pigment consumption in this region, particularly carbon black and titanium dioxide dispersions for polymer production. Growth in packaging materials, agricultural films, and consumer plastics supports continued demand. The paints and coatings segment is also expanding due to industrial refurbishment and marine coating applications. Southern Taiwan’s export-oriented industries create opportunities for suppliers offering high-quality, cost-effective dispersions. Ongoing infrastructure development projects and port expansion programs further drive market growth in this region.

Eastern Taiwan

Eastern Taiwan represented about 10% of the market share in 2024, characterized by lower industrial activity but growing infrastructure development. Hualien and Taitung are witnessing rising construction projects, boosting demand for iron oxide pigments in concrete and paving materials. The ceramics and glass sector contributes significantly, with local producers utilizing specialty pigments for decorative applications. Though relatively small, the region offers growth opportunities due to government investments in tourism-related infrastructure and green building initiatives. Rising interest in eco-friendly materials supports adoption of low-VOC and heavy-metal-free dispersions, aligning with Taiwan’s sustainability objectives for regional development.

Market Segmentations:

By Pigment Type

- Titanium Dioxide

- Iron Oxide

- Carbon Black

- Ultramarine Blue

- Chromium Oxide

- Cadmium Pigments

- Zinc Oxide

- Others

By Application

- Paints & Coatings

- Printing Inks

- Plastics

- Construction Materials

- Ceramics and Glass

- Cosmetics

- Others

By Geography

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

Competitive Landscape

The Taiwan in-organic pigment dispersion market is moderately consolidated, with a mix of global leaders and domestic manufacturers competing for market share. BASF SE, Cheng Feng Group, Crown Color Technology, Taiwan Dyestuffs & Pigments, Colorwen, and Tah Kong Chemical Industrial Corp. are among the key participants. These companies focus on offering high-performance dispersions that meet quality, color consistency, and regulatory compliance standards. Global players such as BASF leverage advanced R&D capabilities and extensive product portfolios to serve multiple end-use sectors, while local players maintain a strong foothold by providing cost-effective solutions and tailored services to regional customers. Strategic initiatives include expanding production capacity, developing eco-friendly and heavy-metal-free pigment dispersions, and forming partnerships with coatings and plastics manufacturers. Continuous innovation in dispersion technology and rising demand from construction, paints, and packaging sectors are pushing competitors to enhance product performance and diversify their offerings to maintain a competitive edge.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Cheng Feng Group

- Crown Color Technology Co., Ltd.

- Taiwan Dyestuffs & Pigments

- Colorwen

- Tah Kong Chemical Industrial Corp.

Recent Developments

- In March 2025, Sudarshan Chemical Industries Limited (SCIL) completed its acquisition of the Heubach Group, establishing a global pigment leader with operations across 19 sites worldwide. The combined company will offer a wide, technologically advanced pigment portfolio and strengthen its presence in key markets like Europe and the Americas.

- In January 2023, BASF announced an investment to expand its polymer dispersions production capacity at its Merak site in Indonesia. The expansion aimed to meet the rising demand for styrene-butadiene and acrylic dispersions, driven by the growth of new paper mills and the high-quality packaging sector across Southeast Asia, Australia, and New Zealand. The Merak site, strategically located near key raw material suppliers and customers, played a vital role in supporting this regional demand.

- In January 2023, Cabot Corporation expanded its inkjet production facility in Haverhill, Massachusetts, to meet growing demand for digital printing applications. The expansion will increase capacity for aqueous inkjet dispersions, which support the shift from analog to digital printing by offering benefits like greater design customization, faster speed to market, and improved sustainability through reduced waste. Recent upgrades at the facility also include enhanced manufacturing equipment and processes that improve operational efficiency and reduce water usage. This investment positions Cabot to better serve the rapidly evolving inkjet market with a broader product portfolio and reliable global supply.

Report Coverage

The research report offers an in-depth analysis based on Pigment Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for titanium dioxide and iron oxide dispersions will remain strong due to construction growth.

- Adoption of eco-friendly, heavy-metal-free pigment dispersions will accelerate with stricter regulations.

- Technological advancements in nano-dispersion and surface treatments will enhance product performance.

- Plastics and packaging industries will drive higher consumption of carbon black and titanium dioxide pigments.

- Local manufacturers will expand production capacity to meet rising domestic and export demand.

- Strategic partnerships between global and Taiwanese players will boost innovation and market reach.

- Growth in automotive and industrial coatings will support sustained pigment dispersion consumption.

- Increased investment in wastewater treatment and compliance will improve sustainability across the supply chain.

- Regional demand will be led by Northern Taiwan, followed by Central and Southern regions.

- Competitive pressure will drive price optimization and introduction of value-added dispersion solutions