Market Overview

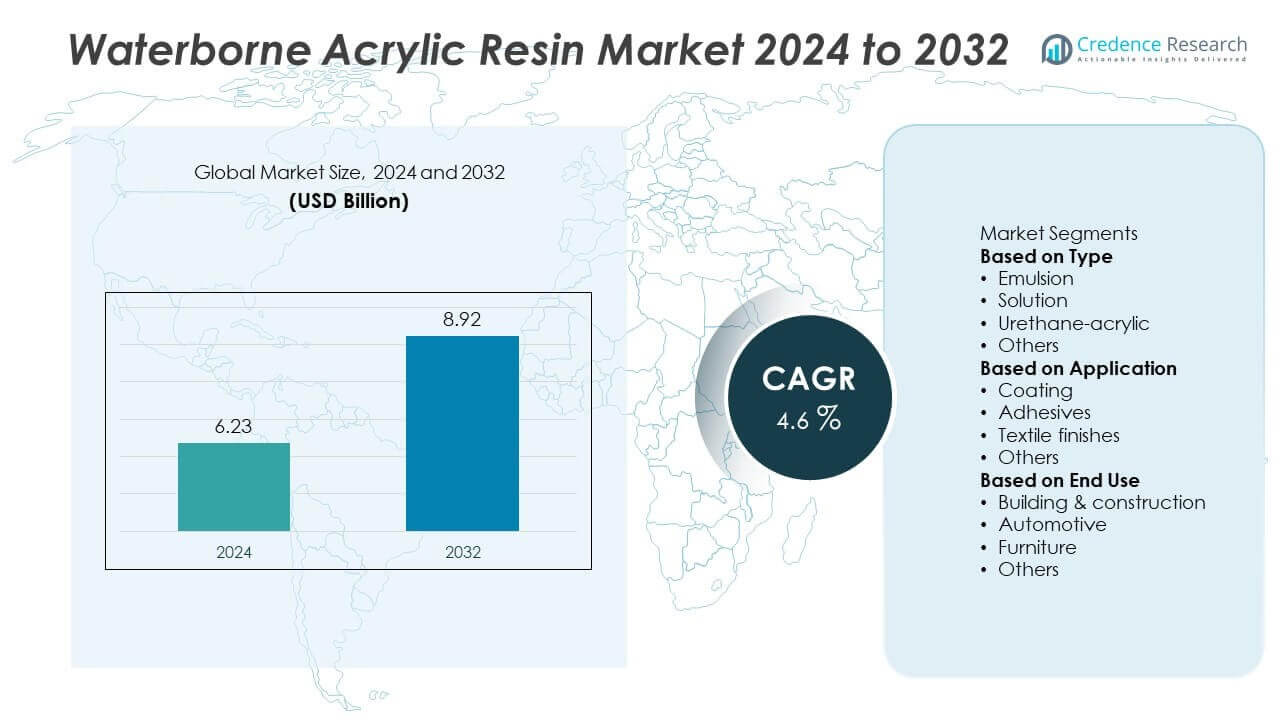

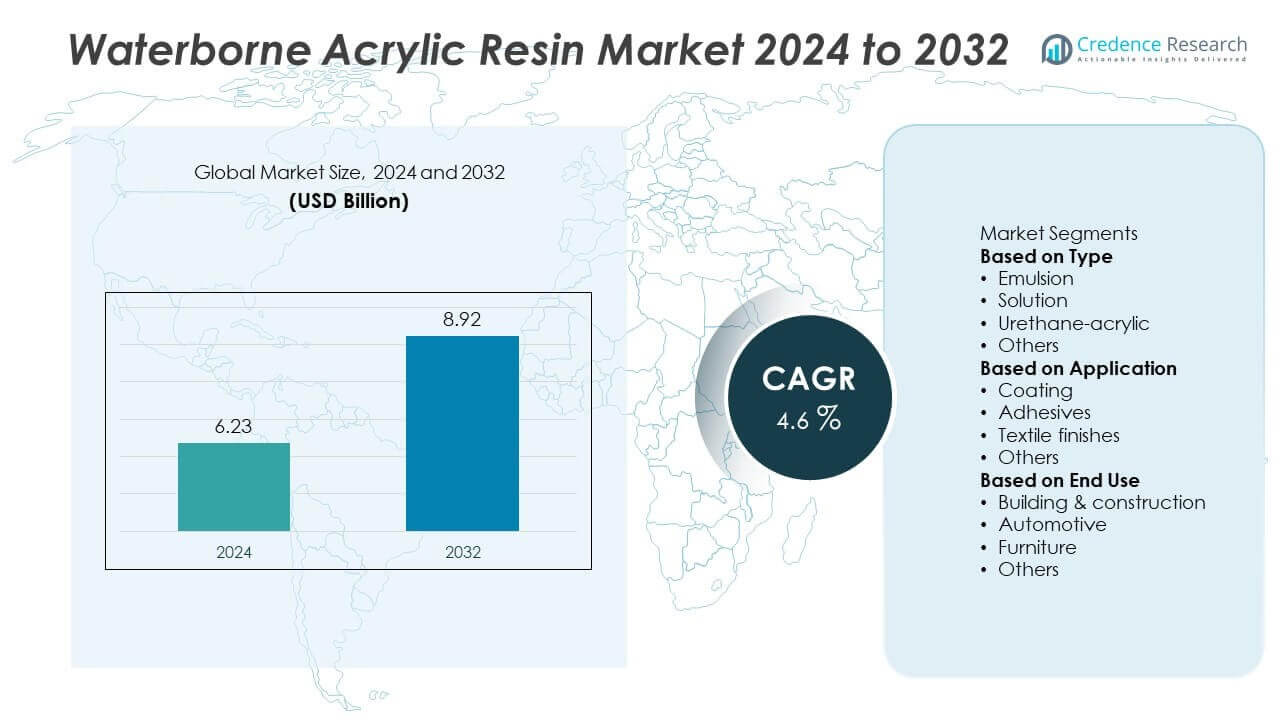

The waterborne acrylic resin market was valued at USD 6.23 billion in 2024 and is projected to reach USD 8.92 billion by 2032, growing at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Waterborne Acrylic Resin Market Size 2024 |

USD 6.23 Billion |

| Waterborne Acrylic Resin Market, CAGR |

4.6% |

| Waterborne Acrylic Resin Market Size 2032 |

USD 8.92 Billion |

The waterborne acrylic resin market is led by key players including Nippon Shokubai, BASF, Huntsman, Eastman Chemical, PPG Industries, AkzoNobel, Evonik Industries, Nippon Paint, Dow Chemical, and Arkema. These companies dominate through extensive product portfolios, global distribution networks, and strong focus on sustainable resin technologies. Asia-Pacific emerged as the leading region, holding 30% share in 2024, driven by rapid industrialization, infrastructure growth, and rising demand for low-VOC coatings. North America followed with 32% share, supported by stringent environmental regulations and advanced automotive and construction sectors. Europe accounted for 28% share, fueled by EU Green Deal initiatives and rising adoption of bio-based solutions.

Market Insights

Market Insights

- The waterborne acrylic resin market was valued at USD 6.23 billion in 2024 and is projected to reach USD 8.92 billion by 2032, growing at a CAGR of 4.6% during the forecast period.

- Rising demand for low-VOC, eco-friendly coatings and adhesives is a key driver, supported by strict environmental regulations and adoption in construction, automotive, and furniture industries.

- Market trends include increasing use of bio-based resins, development of self-crosslinking technologies, and expansion of high-performance waterborne solutions for industrial and architectural coatings.

- The market is competitive with major players like Nippon Shokubai, BASF, Huntsman, Eastman Chemical, PPG Industries, and AkzoNobel focusing on innovation, capacity expansion, and partnerships to strengthen market presence.

- Asia-Pacific led with 30% share, followed by North America at 32% and Europe at 28%; by application, coatings dominated with 50% share, making it the most significant contributor to overall demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Emulsion resins dominated the market in 2024, holding over 45% share due to their versatility, low VOC content, and cost-effectiveness. These resins are widely used in architectural coatings and industrial finishes, offering strong adhesion and durability. Their water-based formulation supports compliance with environmental regulations, driving adoption across regions with strict emission norms. The growing demand for eco-friendly materials in paints and coatings is further boosting emulsion resin consumption. Solution and urethane-acrylic types follow, serving niche applications where higher performance or chemical resistance is required.

- For instance, Dow offers advanced emulsion resins for architectural coatings, with formulations designed to meet stringent environmental standards for low VOCs and provide high-performance properties like strong adhesion and durability across diverse applications.

By Application

Coatings led the market with more than 50% share in 2024, driven by rising construction activities and automotive refinishing demand. Waterborne acrylic coatings are favored for their excellent gloss retention, corrosion resistance, and fast drying time. Regulatory pressure to reduce VOC emissions has accelerated the shift from solvent-based systems to waterborne solutions in industrial and architectural applications. Adhesives and textile finishes also show steady growth, supported by packaging industry expansion and functional fabric production. Increasing adoption of high-performance, eco-friendly coatings in infrastructure projects sustains the dominance of this segment.

- For instance, AkzoNobel offers high-performance waterborne acrylic coatings that are widely used in the automotive refinishing sector, delivering excellent gloss retention and corrosion resistance.

By End Use

Building and construction accounted for the largest share, exceeding 40% in 2024, due to extensive use in architectural coatings, sealants, and waterproofing systems. Rapid urbanization, infrastructure investment, and renovation activities are major demand drivers, particularly in Asia-Pacific and North America. Waterborne acrylic resins offer excellent weatherability, crack resistance, and color retention, making them ideal for exterior applications. The automotive sector is the second-largest end-user, benefiting from growing demand for waterborne coatings in OEM and refinish markets to meet stringent emission standards and improve environmental sustainability.

Key Growth Drivers

Rising Demand for Low-VOC Coatings

The shift toward low-VOC and eco-friendly coatings is a major driver of market growth. Waterborne acrylic resins offer excellent film-forming ability, low odor, and reduced emissions, meeting strict environmental regulations such as REACH and EPA standards. Construction, automotive, and industrial sectors are increasingly adopting these resins to comply with sustainability goals. This shift is particularly strong in North America and Europe, where green building certifications like LEED encourage the use of waterborne systems. This regulatory push continues to fuel the steady replacement of solvent-based resins with waterborne alternatives.

- For instance, Sherwin-Williams offers numerous waterborne acrylic resin products, such as its ProMar 200 Zero VOC interior paint line, which contain less than 5 grams per liter of VOCs and are designed to meet or exceed LEED certification criteria and other green building standards.

Expansion of Construction and Infrastructure Projects

Growing investments in infrastructure and real estate development are creating strong demand for architectural coatings. Waterborne acrylic resins are preferred for their durability, weather resistance, and fast drying times, making them ideal for exterior and interior coatings. Rapid urbanization in Asia-Pacific, along with government-backed housing and infrastructure programs, is driving large-scale adoption. These resins are also used in sealants and adhesives for flooring, wall finishes, and waterproofing applications. This demand is expected to stay robust as developing economies focus on sustainable, long-lasting construction materials.

- For instance, PPG Industries is a global supplier of waterborne acrylic resin coatings, which are used for a variety of architectural applications in the Asia-Pacific region and elsewhere. Some of PPG’s fast-drying waterborne coatings can be ready for recoating in as little as one to two hours, depending on the product and conditions..

Growth in Automotive Production and Refinishing

The automotive industry is a significant end-user, favoring waterborne acrylics for OEM and refinish coatings. These resins provide superior gloss, chemical resistance, and UV stability, meeting performance standards while reducing emissions. Rising vehicle production in China, India, and Southeast Asia is boosting demand for eco-friendly coatings. Additionally, stricter regulations on solvent emissions in Europe and North America are accelerating the transition to waterborne solutions. Increasing consumer preference for high-quality, durable automotive finishes is reinforcing the segment’s dominance, making automotive applications a consistent growth driver for resin suppliers.

Key Trends & Opportunities

Innovation in High-Performance Resins

Manufacturers are developing resins with enhanced weatherability, chemical resistance, and crosslinking capabilities to meet demanding applications. Advanced waterborne technologies enable improved adhesion to metal, wood, and plastic substrates, expanding their use in industrial coatings. The introduction of self-crosslinking and hybrid acrylic-urethane systems offers improved hardness and flexibility, appealing to automotive and furniture sectors. These innovations present growth opportunities by opening new markets and replacing traditional solvent-based coatings in high-performance applications where durability and environmental compliance are equally critical.

- For instance, in 2024, Covestro AG launched its Bayhydrol® UA 2961, a solvent-free one-component waterborne hybrid resin designed for building product finishes, offering fast film hardness development within 4 hours and pencil gouge hardness exceeding 3H, alongside excellent chemical resistance and weathering performance.

Shift Toward Bio-Based and Sustainable Materials

There is a rising opportunity in bio-based waterborne acrylic resins, developed using renewable raw materials. This shift supports carbon reduction initiatives and corporate ESG commitments. Companies are investing in research to enhance the performance of bio-based resins without compromising cost-effectiveness or application properties. The increasing preference for green products among construction firms and end consumers is creating a lucrative market for sustainable resins. This trend is expected to gain momentum as regulatory pressure and consumer awareness around climate impact continue to grow worldwide.

- For instance, Westlake Epoxy, a division of Westlake Corporation, launched its EpoVIVE™ portfolio of epoxy products, which uses ISCC PLUS mass-balanced bio-circular or circular raw materials to reduce carbon emissions compared to traditional formulas.

Key Challenges

Fluctuating Raw Material Prices

Price volatility of key feedstocks like acrylic acid and butyl acrylate remains a major challenge for manufacturers. These fluctuations impact production costs and narrow profit margins for resin producers, especially in competitive markets. Dependence on petrochemical supply chains makes the industry vulnerable to crude oil price changes and global trade disruptions. Manufacturers are focusing on long-term contracts and backward integration strategies to minimize the impact. However, sustained cost pressure could hinder adoption in price-sensitive applications like low-cost coatings and adhesives.

Performance Limitations in Extreme Conditions

Waterborne acrylic resins, while environmentally friendly, may underperform in extreme humidity or cold weather conditions compared to solvent-based systems. Their longer drying times in high-moisture environments and potential for surfactant leaching can limit use in certain industrial and heavy-duty applications. End-users in marine, oil & gas, and high-performance protective coatings sometimes prefer solvent-based alternatives for superior barrier properties. Continuous product innovation is required to overcome these limitations and expand waterborne acrylics into more demanding performance segments without compromising on sustainability.

Regional Analysis

North America

North America held 32% share of the waterborne acrylic resin market in 2024, driven by stringent VOC regulations and strong adoption of eco-friendly coatings. The U.S. leads the region due to its advanced construction sector, rising renovation activities, and rapid shift to waterborne coatings in industrial applications. Automotive OEMs and refinish segments are major contributors, supported by growing demand for durable, high-gloss coatings. Canada shows consistent growth with government-backed green building initiatives and infrastructure projects. The presence of key global coating manufacturers and robust R&D investment further supports the dominance of North America in this market.

Europe

Europe accounted for 28% share in 2024, supported by strict EU emission regulations and widespread use of sustainable construction materials. Germany, France, and the UK are leading markets, driven by demand for architectural coatings and industrial finishes. The automotive sector is a key consumer, with major OEMs adopting waterborne systems to meet CO₂ reduction targets. Renovation projects under EU Green Deal programs continue to support the market. Rising adoption of bio-based resins and growing awareness of circular economy principles are driving innovation, making Europe a leading region for high-performance and environmentally friendly resin development.

Asia-Pacific

Asia-Pacific dominated the global market with 30% share in 2024, fueled by rapid urbanization, industrialization, and infrastructure development. China and India are the largest contributors, with high demand for architectural coatings, adhesives, and waterproofing solutions in residential and commercial projects. Automotive production growth and expanding furniture manufacturing hubs also boost resin consumption. Supportive government regulations encouraging low-VOC products are accelerating the shift from solvent-based to waterborne resins. Strong local manufacturing capacity, combined with competitive production costs, positions Asia-Pacific as the fastest-growing region for waterborne acrylic resin over the forecast period.

Latin America

Latin America captured 6% share of the market in 2024, with Brazil and Mexico leading demand. Construction sector recovery and growth in automotive production are key drivers for waterborne acrylic resin adoption. Rising awareness of sustainable construction materials and stricter environmental regulations are encouraging the switch from solvent-based coatings. Infrastructure investment in commercial real estate and public works projects is supporting demand for architectural coatings and sealants. However, economic fluctuations and limited local manufacturing capacity remain challenges. International players are increasing presence through partnerships and local production facilities to meet rising regional demand efficiently.

Middle East & Africa

The Middle East & Africa region accounted for 4% share in 2024, driven by large-scale infrastructure and housing projects. The Gulf Cooperation Council (GCC) countries are leading adopters, with strong demand for weather-resistant coatings suited to hot climates. Waterborne acrylic resins are gaining traction in decorative paints, waterproofing, and protective coatings for commercial buildings and industrial assets. Africa is seeing rising demand from urban development initiatives, particularly in South Africa and Nigeria. Limited awareness and higher cost compared to solvent-based options slightly restrict adoption, but government-backed sustainability programs are expected to accelerate growth in coming years.

Market Segmentations:

By Type

- Emulsion

- Solution

- Urethane-acrylic

- Others

By Application

- Coating

- Adhesives

- Textile finishes

- Others

By End Use

- Building & construction

- Automotive

- Furniture

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the waterborne acrylic resin market is characterized by the presence of major players such as Nippon Shokubai, BASF, Huntsman, Eastman Chemical, PPG Industries, AkzoNobel, Evonik Industries, Nippon Paint, Dow Chemical, and Arkema. These companies focus on expanding product portfolios, developing eco-friendly resin technologies, and enhancing regional manufacturing capacity to meet rising demand for low-VOC and high-performance coatings. Strategic initiatives include joint ventures, capacity expansions, and partnerships with coating manufacturers to strengthen supply chains. Investments in R&D for bio-based and self-crosslinking resins are gaining traction, aligning with global sustainability goals. Mergers and acquisitions remain a key strategy for global market penetration, particularly in Asia-Pacific, where rapid urbanization drives growth. Competitive pricing, product innovation, and compliance with strict environmental standards are central to maintaining market share and achieving long-term customer retention in this highly regulated and innovation-driven market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, BASF achieved mechanical completion of its new acrylics complex at the Zhanjiang Verbund site. This includes glacial acrylic acid and butyl acrylate plants.

- In February 2025, AkzoNobel launched Sikkens Autowave Optima, a waterborne basecoat for vehicle repair with faster process times and lower emissions.

- In 2025, BASF’s 2025 Factbook listed its Dispersions & Resins division includes water-based resins, acrylic oligomers, high-solid polyols, etc.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for waterborne acrylic resins will grow steadily with rising adoption of low-VOC coatings.

- Innovation in bio-based and sustainable resin technologies will gain momentum across major markets.

- Asia-Pacific will remain the fastest-growing region due to infrastructure development and manufacturing expansion.

- Automotive OEM and refinish sectors will continue driving demand for high-performance waterborne coatings.

- Manufacturers will invest more in R&D for resins with superior durability and weather resistance.

- Strict environmental regulations will accelerate the replacement of solvent-based systems globally.

- Hybrid acrylic-urethane resins will gain wider acceptance for industrial and furniture applications.

- Strategic partnerships and acquisitions will help global players expand regional presence.

- Digitalization and smart manufacturing will enhance production efficiency and quality consistency.

- Growing renovation activities in developed economies will sustain long-term demand for architectural coatings.

Market Insights

Market Insights