Market Overview

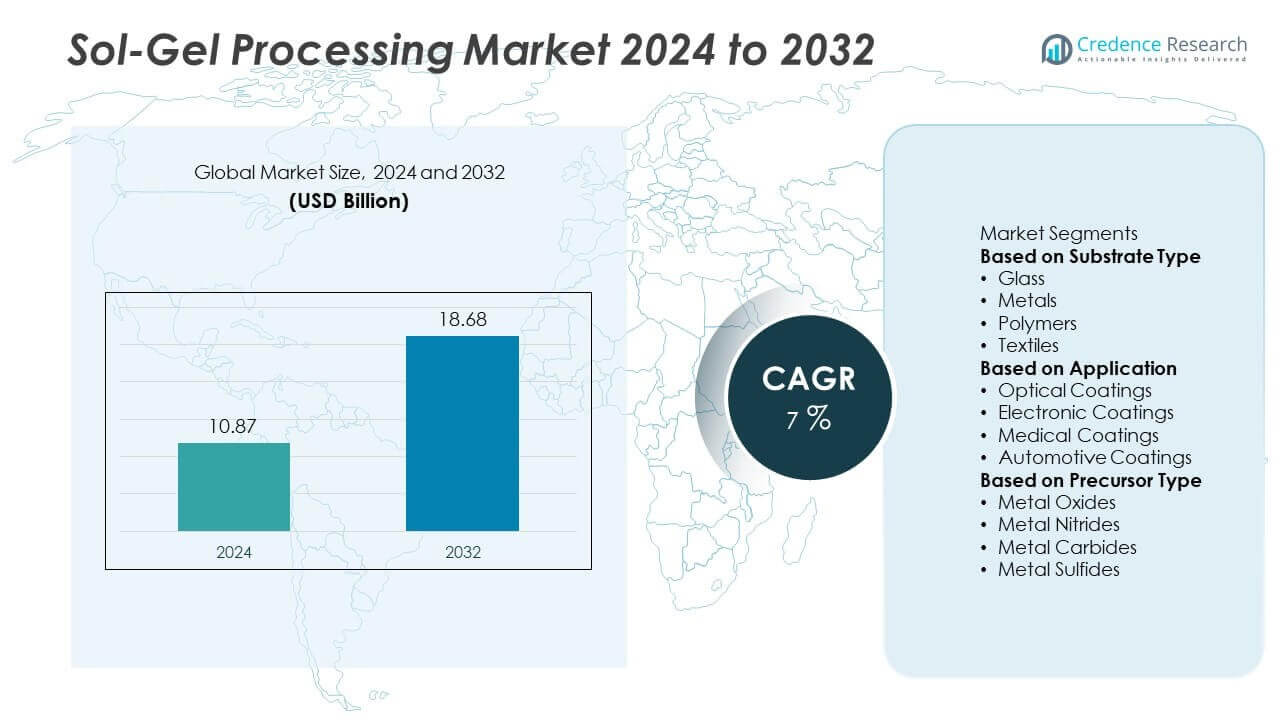

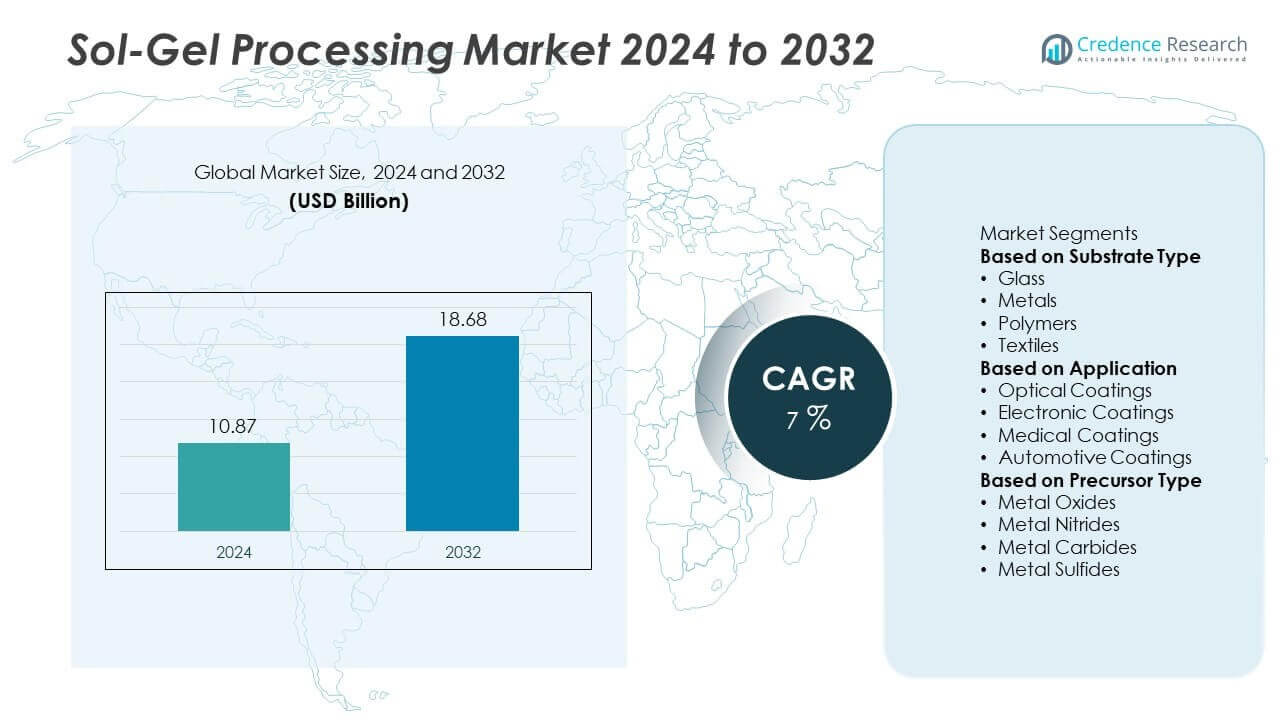

The Sol-Gel Processing Market was valued at USD 10.87 billion in 2024 and is expected to reach USD 18.68 billion by 2032, growing at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sol-Gel Processing Market Size 2024 |

USD 10.87 Billion |

| Sol-Gel Processing Market, CAGR |

7% |

| Sol-Gel Processing Market Size 2032 |

USD 18.68 Billion |

The Sol-Gel Processing Market grows with rising demand for advanced coatings, catalysts, and biomedical materials across industries. Increasing adoption in automotive, aerospace, and electronics drives need for corrosion-resistant and functional coatings. It benefits from healthcare applications such as bioactive glass coatings and drug delivery systems. North America leads the Sol-Gel Processing Market driven by strong adoption in automotive, aerospace, and healthcare sectors, supported by robust R&D and advanced manufacturing capabilities. Europe follows closely with high demand for eco-friendly coatings and strong presence of specialty chemical companies developing innovative sol-gel materials for construction, energy, and optical applications. Asia-Pacific shows fastest growth with expanding electronics, solar energy, and medical device production, supported by growing government initiatives and cost-effective manufacturing infrastructure. Latin America and Middle East & Africa show steady adoption with investments in infrastructure, protective coatings, and renewable energy projects. Key players shaping the market include Merck KGaA, Solvay, and 3M Company, which focus on developing nanostructured coatings, high-performance catalysts, and scalable sol-gel solutions. Companies such as Momentive Performance Materials Inc. and Asahi Glass Company continue to expand their product portfolios, supporting innovation and industrial applications across multiple regions.

Market Insights

- The Sol-Gel Processing Market was valued at USD 10.87 billion in 2024 and is projected to reach USD 18.68 billion by 2032, growing at a CAGR of 7 %.

- Rising demand for advanced coatings, catalysts, sensors, and biomedical materials drives global adoption of sol-gel technology.

- Growing focus on nanostructured and hybrid materials, 3D printing integration, and eco-friendly formulations strengthens innovation and product development.

- Leading players such as Merck KGaA, Solvay, 3M Company, Momentive Performance Materials Inc., and Asahi Glass Company invest in scalable solutions, nanomaterials, and sustainable production technologies.

- High production costs, complex process control, and slow gelation times act as restraints, limiting adoption in cost-sensitive industries.

- North America leads growth with strong R&D infrastructure, Europe drives innovation with stringent environmental standards, and Asia-Pacific emerges as the fastest-growing region with expanding electronics and medical sectors.

- Opportunities arise from renewable energy, water purification, and advanced healthcare applications, where sol-gel coatings and bioactive materials offer superior performance and efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Advanced Functional Coatings Across Industries

The Sol-Gel Processing Market grows with strong adoption in protective and functional coatings for automotive, aerospace, and electronics applications. These coatings offer superior hardness, corrosion resistance, and thermal stability. It supports development of anti-reflective, self-cleaning, and scratch-resistant surfaces that enhance product durability. Manufacturers adopt sol-gel solutions to improve performance of optical devices and consumer electronics. Demand for energy-efficient windows and solar panels further boosts market penetration. This trend positions sol-gel coatings as a preferred solution for high-performance surface treatment.

- For instance, the aerospace industry utilizes sol-gel coatings to replace hexavalent chrome primers, with products like SOCOMORE’s SOCOGEL being qualified by OEMs such as AIRBUS and BOEING to improve paint adhesion and corrosion resistance on aluminum alloys.

Expanding Use in Biomedical and Healthcare Applications

Sol-gel technology finds growing application in drug delivery systems, bioactive glass coatings, and tissue engineering scaffolds. The Sol-Gel Processing Market benefits from its ability to produce biocompatible materials with controlled porosity. It enables sustained release of therapeutic agents and improved bone regeneration. Hospitals and research institutes invest in sol-gel-based biomaterials for orthopedic and dental implants. Rising prevalence of chronic diseases drives the need for innovative medical solutions. This healthcare-focused demand strengthens the market’s long-term growth potential.

- For instance, Unither Pharmaceuticals collaborated on sol-gel technology to develop in-situ gel-forming formulations for prolonged drug delivery. In tissue engineering, scaffolds made of 13–93 bioactive glass with an oriented pore structure (50% porosity, 50–150 µm pore diameter) promoted bone regeneration in rat calvarial defects, with new bone formation increasing from 37% at 12 weeks to 55% at 24 weeks

Increasing Application in Catalysts and Sensors

The market witnesses strong demand from chemical and environmental sectors for high-performance catalysts and sensors. Sol-gel-derived materials provide high surface area and tunable properties for efficient catalytic reactions. It improves sensitivity and stability of gas sensors, biosensors, and humidity detectors. Industrial players integrate sol-gel catalysts to achieve higher reaction yields and lower energy consumption. Growing focus on air quality monitoring and emission control supports adoption of sol-gel-based sensors. These applications expand revenue opportunities across multiple industries.

Supportive R&D Investments and Sustainable Manufacturing Focus

Governments and private players invest heavily in sol-gel research to develop eco-friendly processes. The Sol-Gel Processing Market gains from its low-temperature synthesis routes that reduce energy use and emissions. It aligns with global sustainability goals and stricter environmental regulations. Universities collaborate with material science companies to commercialize innovative sol-gel applications. Rising preference for green chemistry methods accelerates technology transfer from labs to large-scale production. This support enhances industry competitiveness and fosters continuous innovation.

Market Trends

Growing Adoption of Nanostructured and Hybrid Materials

The Sol-Gel Processing Market witnesses a shift toward nanostructured and hybrid material development. Researchers use sol-gel techniques to create materials with controlled porosity and tailored surface properties. It enhances performance in applications such as optics, sensors, and filtration systems. Hybrid organic-inorganic coatings improve flexibility and chemical resistance in demanding environments. Manufacturers invest in scalable production to meet rising industrial demand. This trend drives innovation and enables high-value applications across multiple sectors.

- For instance, researchers employed sol-gel derived super-hydrophilic TiO2 coatings for solar panel glass, achieving a self-cleaning efficiency exceeding 92% and improving maximum transmittance by 26.5% compared to bare glass.

Integration with 3D Printing and Advanced Manufacturing

Combining sol-gel technology with additive manufacturing is emerging as a key trend. This integration allows production of complex geometries for functional coatings, catalysts, and biomedical scaffolds. It improves design freedom and accelerates prototyping for customized solutions. The Sol-Gel Processing Market benefits from the ability to produce lightweight components with high mechanical strength. Industries leverage this combination to reduce material waste and improve process efficiency. This synergy supports rapid commercialization of advanced material solutions.

- For instance, additive manufacturing of multicomponent glasses using a sol-gel derived silica colloidal feedstock enabled processing at temperatures of 1150°C, significantly lower than the >1350°C required by traditional methods. This technique was used to create complex, 3D architectured structures with tailored optical properties. In the biomedical field, 3D printing with sol-gel materials has enabled the fabrication of tissue engineering scaffolds with controlled pore sizes typically in the range of 300 to 600 microns, overcoming previous limitations.

Focus on Eco-Friendly and Energy-Efficient Solutions

Sustainability is becoming a major driver for technology selection across industries. Sol-gel processes operate at relatively low temperatures, reducing energy consumption and carbon footprint. It supports development of water-based and solvent-free formulations for safer production. Manufacturers align product development with regulatory compliance and green chemistry principles. Demand grows for coatings and catalysts that meet environmental standards without compromising performance. This trend strengthens the market’s position in environmentally sensitive industries.

Rising Use in Electronics and Photonics Applications

Electronics and photonics industries increasingly adopt sol-gel-derived materials for optical coatings, thin films, and dielectric layers. The Sol-Gel Processing Market benefits from demand for anti-reflective coatings in displays, solar panels, and precision optics. It provides excellent control over refractive index and film thickness, ensuring high optical clarity. Telecommunication and semiconductor sectors integrate sol-gel solutions for waveguides and insulating layers. This adoption supports miniaturization and higher efficiency in electronic devices. Growth in consumer electronics and renewable energy boosts this trend further.

Market Challenges Analysis

High Production Costs and Complex Process Control

The Sol-Gel Processing Market faces challenges related to high production costs and process complexity. Raw materials, precision equipment, and controlled processing conditions increase overall manufacturing expenses. It requires strict monitoring of parameters such as pH, temperature, and reaction time to achieve consistent product quality. Small variations can lead to defects or reduced performance, affecting large-scale production. Manufacturers must invest in automation and quality control systems to maintain reliability. These factors limit adoption in cost-sensitive applications and slow expansion in price-competitive markets.

Limited Scalability and Long Processing Times

Scaling sol-gel production from laboratory research to industrial scale remains a significant challenge. The Sol-Gel Processing Market struggles with slow gelation and drying steps that lengthen production cycles. It increases operational costs and reduces throughput, impacting commercial viability. Moisture sensitivity and shrinkage during processing can cause cracking or structural defects. Companies need advanced drying technologies and process optimization to improve efficiency. These hurdles restrict market penetration in high-volume sectors requiring fast, cost-effective material solutions.

Market Opportunities

Expanding Applications in Energy and Environmental Technologies

The Sol-Gel Processing Market holds strong opportunities in renewable energy and environmental applications. Demand grows for sol-gel-based coatings used in solar panels, fuel cells, and energy-efficient windows. It enhances light transmission, thermal insulation, and overall device efficiency. Water purification and air filtration systems use sol-gel-derived membranes for superior adsorption and durability. Governments support development of sustainable solutions, creating funding opportunities for research and commercialization. These factors position sol-gel technology as a key enabler of clean energy and green infrastructure projects.

Growth Potential in Healthcare and Electronics Industries

Healthcare and electronics sectors create new avenues for sol-gel technology adoption. The Sol-Gel Processing Market benefits from its ability to produce bioactive coatings for implants and controlled drug delivery systems. It improves biocompatibility and enables precision release of therapeutic agents. Electronics manufacturers adopt sol-gel thin films for optical coatings, dielectric layers, and high-performance sensors. Rising consumer demand for advanced devices fuels investment in sol-gel-enabled innovations. This growth potential supports continuous product diversification and revenue expansion across global markets.

Market Segmentation Analysis:

By Substrate Type

The Sol-Gel Processing Market is segmented by substrate type into glass, metal, and ceramics. Glass substrates dominate due to their compatibility with optical coatings, anti-reflective films, and protective layers. It offers excellent transparency and smooth surfaces, supporting applications in displays, solar panels, and precision optics. Metal substrates are widely used for corrosion-resistant and wear-resistant coatings in automotive, aerospace, and industrial sectors. Ceramic substrates find applications in high-temperature environments where thermal stability and durability are critical. Demand for flexible substrates is also rising, driven by adoption in electronics and energy storage devices. Manufacturers invest in surface modification techniques to improve adhesion and coating performance across all substrate types.

- For instance, Borosil Renewables manufactures anti-reflective coated solar glass that achieves a high transmission rate of over 94%. Boeing developed a sol-gel surface treatment, patented in 1999, for titanium and aluminum alloys to create durable adhesive bonds and reduce the use of toxic chemicals.

By Application

Applications of sol-gel technology span coatings, catalysts, sensors, optics, and biomedical uses. The Sol-Gel Processing Market sees highest demand from coatings, used in protective, decorative, and functional layers for glass, metals, and polymers. It provides benefits such as scratch resistance, anti-corrosion protection, and hydrophobicity. Catalysts represent another major application, with sol-gel methods enabling high surface area materials for efficient chemical reactions. Sensor applications grow rapidly, supported by demand for gas, humidity, and biosensors in environmental and healthcare monitoring. Biomedical uses include bioactive glass, drug delivery carriers, and tissue engineering scaffolds. Expanding application diversity drives continuous research and product innovation.

- For instance, a commercial antireflection (AR) glass coating made with a porous SiO2 sol-gel layer was shown to increase the current output of multicrystalline silicon solar cells by 2.65% under standard test conditions.

By Precursor Type

Precursors used in sol-gel processes include metal alkoxides, metal chlorides, and organometallic compounds. Metal alkoxides hold a major share due to their ability to form high-purity oxides with controlled composition. It enables production of advanced coatings, thin films, and nanostructures. Metal chlorides serve as cost-effective precursors for bulk applications, though they require careful handling due to corrosive by-products. Organometallic precursors find use in specialized applications where precise control of chemical composition is essential. The development of eco-friendly and low-toxicity precursors supports sustainability goals and regulatory compliance. Growing demand for high-performance materials drives innovation in precursor formulation and process optimization.

Segments:

Based on Substrate Type

- Glass

- Metals

- Polymers

- Textiles

Based on Application

- Optical Coatings

- Electronic Coatings

- Medical Coatings

- Automotive Coatings

Based on Precursor Type

- Metal Oxides

- Metal Nitrides

- Metal Carbides

- Metal Sulfides

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Sol-Gel Processing Market, accounting for nearly 35% of the global market. Strong presence of advanced manufacturing industries, robust R&D infrastructure, and government support for nanotechnology drive growth. It benefits from high adoption of sol-gel coatings in automotive, aerospace, and electronics applications. Universities and research labs collaborate with industry players to commercialize innovative materials and processes. The United States leads regional demand, supported by large-scale investments in energy-efficient windows, optical coatings, and biomedical applications. Canada contributes with growing focus on green technologies and sustainable material production. The region’s emphasis on high-performance materials continues to support innovation and commercial adoption.

Europe

Europe represents about 30% of the global market share, supported by strong presence of specialty chemical companies and advanced research institutes. Leading economies such as Germany, France, and the UK focus on sol-gel coatings for automotive, construction, and solar panel applications. It benefits from stringent environmental regulations that encourage adoption of eco-friendly and low-VOC solutions. European Union funding for nanotechnology research accelerates development of hybrid materials and functional coatings. Manufacturers in this region leverage sol-gel technology to meet demand for corrosion-resistant, self-cleaning, and optical coatings. Rising use of sol-gel catalysts in chemical processing industries supports additional growth. The region remains a hub for innovation, driving global adoption of sol-gel materials.

Asia-Pacific

Asia-Pacific accounts for nearly 22% of the global market, fueled by rapid industrialization, urbanization, and healthcare infrastructure expansion. China, Japan, and South Korea lead adoption, with strong demand from electronics, semiconductors, and solar energy sectors. It benefits from cost-effective production and availability of skilled labor, enabling large-scale manufacturing of sol-gel-based coatings and catalysts. India shows rising adoption, supported by government initiatives promoting advanced material research and local manufacturing. Medical device and pharmaceutical sectors in the region increasingly use sol-gel bioactive materials for implants and drug delivery systems. Expanding R&D centers and cross-industry collaborations position Asia-Pacific as a high-growth market for sol-gel technology.

Latin America

Latin America holds around 7% of the global market share, driven by growth in construction, automotive, and renewable energy projects. Brazil and Mexico lead adoption, supported by increasing investments in protective coatings and optical films. It faces cost challenges due to import dependence on raw materials, but local production capacities are gradually expanding. Research collaborations with international universities enhance technology transfer and adoption in regional industries. Government-backed initiatives for infrastructure development create demand for sol-gel-based anti-corrosion and weather-resistant coatings. The market shows potential for growth as industrial modernization gains momentum.

Middle East & Africa

The Middle East & Africa region accounts for nearly 6% of the global market share, with growth driven by infrastructure projects and adoption of advanced coatings in oil and gas facilities. It benefits from rising demand for heat-resistant and anti-corrosive coatings to withstand harsh environmental conditions. Gulf countries invest in nanotechnology and material science research, promoting regional development of sol-gel applications. South Africa contributes to growth through adoption in mining and industrial equipment coatings. Increasing focus on energy-efficient building materials and solar projects supports future market expansion. Gradual development of local manufacturing capabilities is expected to reduce dependence on imports and enhance competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Merck KGaA

- Momentive Performance Materials Inc.

- 3M Company

- Solvay

- Heraeus Holding GmbH

- JSR Corporation

- Asahi Glass Company

- Sumitomo Chemical

- Ferro Corporation

- DuPont de Nemours, Inc.

Competitive Analysis

Competitive landscape of the Sol-Gel Processing Market features leading players such as Merck KGaA, Solvay, 3M Company, Momentive Performance Materials Inc., Asahi Glass Company, JSR Corporation, Heraeus Holding GmbH, Sumitomo Chemical, Ferro Corporation, and DuPont de Nemours, Inc. These companies focus on developing high-performance sol-gel coatings, nanostructured materials, and catalysts to meet growing industrial demand. Many invest in sustainable production methods, low-temperature processing, and eco-friendly formulations to comply with global regulations. Strategic partnerships with research institutes and universities accelerate the commercialization of next-generation sol-gel technologies. Companies expand their portfolios by targeting high-value applications such as optical coatings, biomedical devices, and renewable energy solutions. Investments in automation and scalable production systems help address process complexity and ensure consistent quality. Competition encourages continuous innovation, with players focusing on cost-effective solutions for price-sensitive markets. This strong innovation pipeline and global reach position these companies to drive long-term growth and market leadership.

Recent Developments

- In August 2025, Merck KGaA’s Life Science business sector is a leading provider of tools, services, and expertise for the biopharmaceutical and life science industries, serving research laboratories, pharmaceutical and biotech companies, and diagnostic labs.

- In June 2024, ZincFive officially announced it had surpassed 1 gigawatt (GW) in mission-critical power solutions delivered and contracted.

- In February 2023, 3M offers sol-gel coatings such as 3M AC 131, relevant for protective and functional coatings in electronics and industrial applications.

Report Coverage

The research report offers an in-depth analysis based on Substrate Type, Application, Precursor Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sol-gel coatings will rise across automotive, aerospace, and construction sectors.

- Adoption of nanostructured and hybrid materials will expand high-performance applications.

- Integration with 3D printing will enable customized components and faster prototyping.

- Eco-friendly and low-temperature processes will gain preference to meet sustainability goals.

- Use of sol-gel materials in renewable energy devices like solar panels will grow rapidly.

- Healthcare applications such as bioactive glass coatings and drug delivery systems will increase.

- Electronics and photonics industries will drive demand for optical coatings and thin films.

- Automation and process optimization will improve scalability and reduce production costs.

- Collaborations between research institutions and industry players will accelerate innovation.

- Competitive pressure will lead to more cost-effective and commercially viable sol-gel solutions.