Market Overview

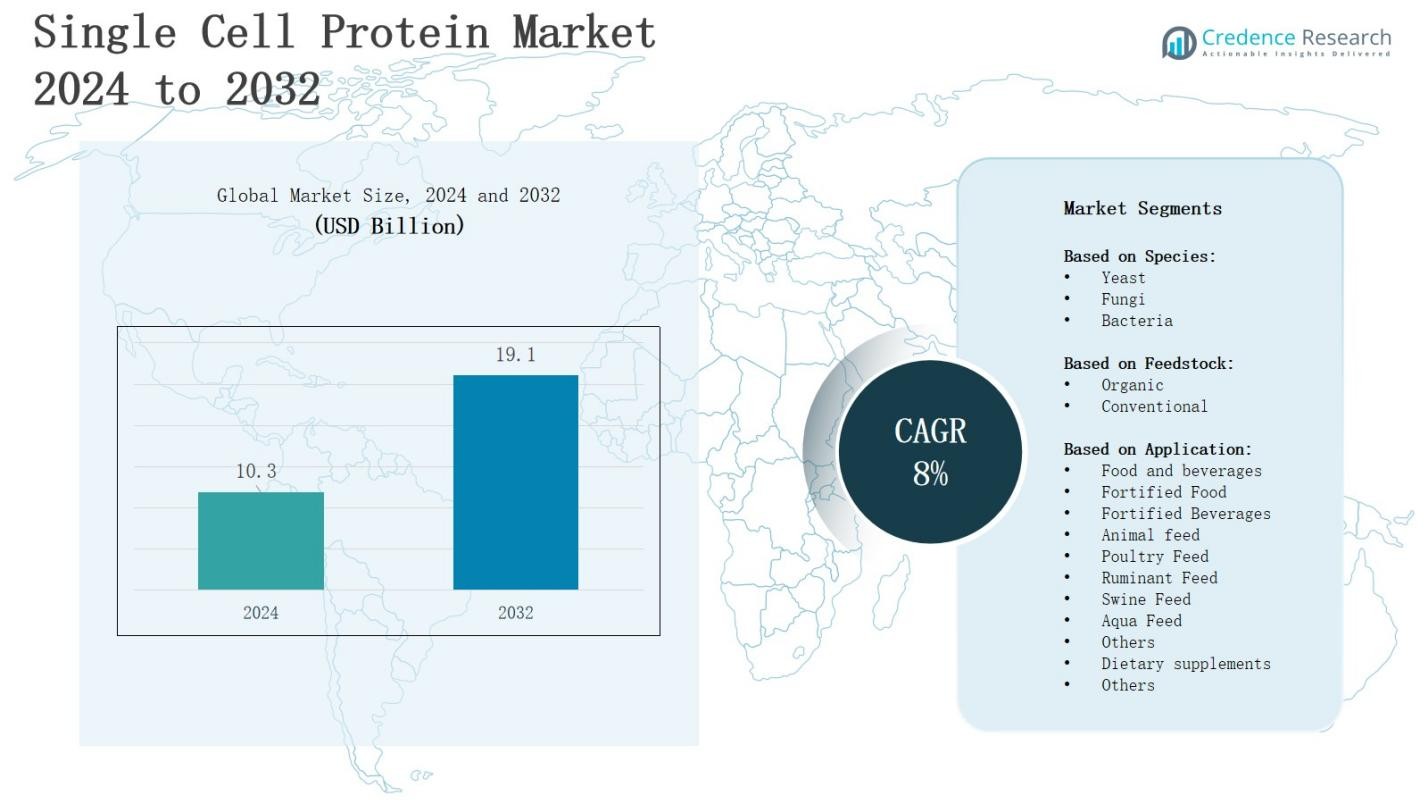

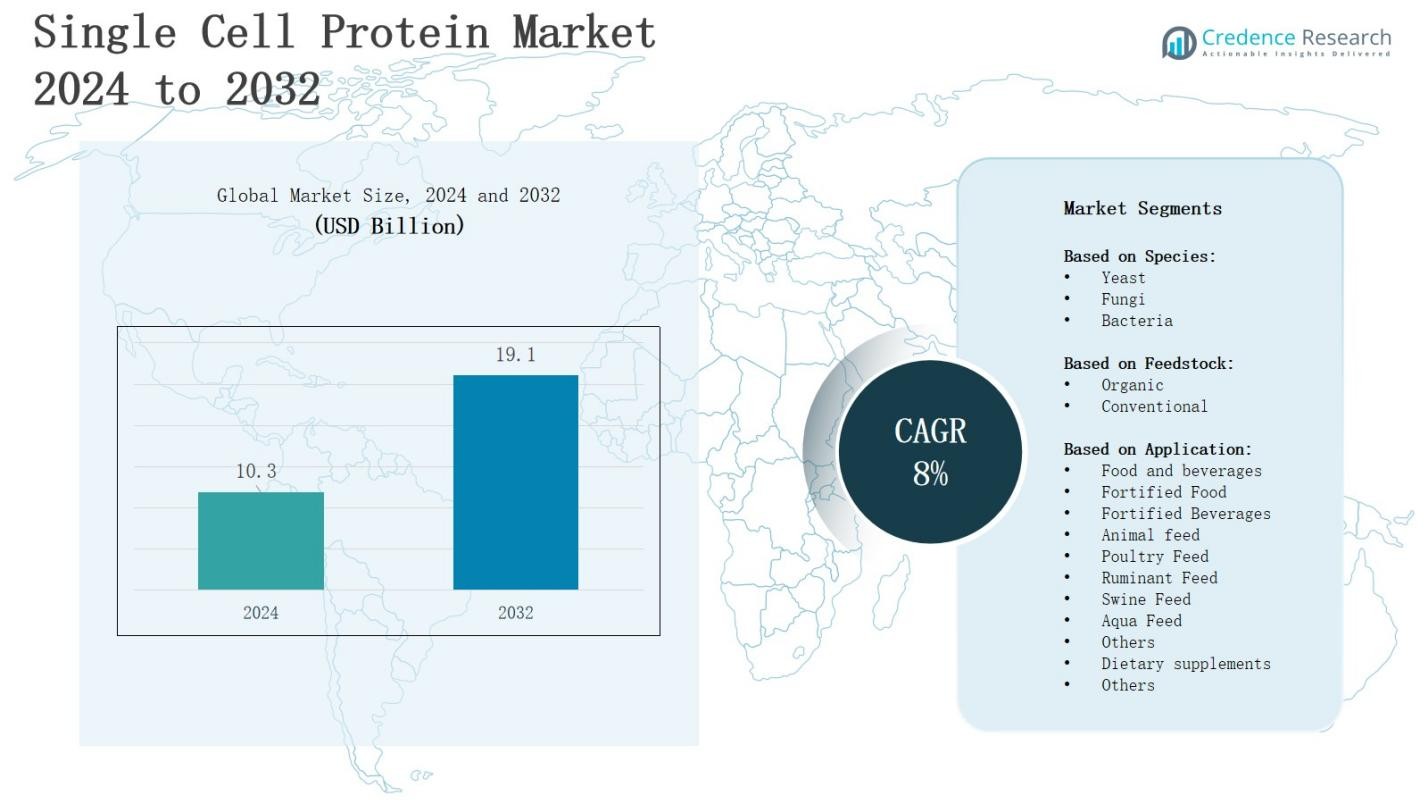

The Single Cell Protein Market is projected to grow from USD 10.3 billion in 2024 to USD 19.1 billion by 2032, registering a CAGR of 8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Single Cell Protein Market Size 2024 |

USD 10.3 Billion |

| Single Cell Protein Market, CAGR |

8% |

| Single Cell Protein Market Size 2032 |

USD 19.1 Billion |

The Single Cell Protein Market grows as rising global protein demand, sustainability concerns, and resource-efficient food production drive adoption. It benefits from increasing acceptance of alternative proteins in food, feed, and nutraceutical industries, supported by innovations in microbial fermentation and bioprocessing. Government initiatives promoting food security and environmental conservation strengthen market expansion. Trends include the integration of biotechnology for higher yield, use of renewable feedstocks, and applications in aquaculture and animal nutrition. Growing investments by food-tech startups, partnerships for large-scale production, and consumer preference for eco-friendly protein sources further position it as a critical segment in the future protein economy.

The Single cell protein market demonstrates diverse geographical presence with North America leading at 32% share, followed by Europe at 28% and Asia Pacific at 26%, while Latin America and the Middle East & Africa each account for 7%. It benefits from strong adoption in food, feed, and dietary applications across these regions. Key players include Calysta Inc., Evonik Industries AG, Biomin Holding GmbH, Unibio A/S, Charoen Pokphand Food PCL, Novus International, Church & Dwight Co. Inc., BioProcess Algae LLC, Devenish Nutrition Limited, and BEC Feed Solutions Pty Ltd.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Single Cell Protein Market is projected to grow from USD 10.3 billion in 2024 to USD 19.1 billion by 2032, registering a CAGR of 8% during the forecast period.

- Rising global demand for sustainable and resource-efficient protein sources is driving adoption in food, feed, and nutraceutical industries.

- Technological advancements in microbial fermentation and bioprocessing enable higher yields, cost efficiency, and improved scalability.

- Government initiatives promoting food security and environmental sustainability strengthen commercialization across developed and emerging economies.

- High production costs, scale-up limitations, and regulatory complexities remain key challenges, alongside consumer acceptance concerns.

- Geographically, North America leads with 32% share, followed by Europe at 28% and Asia Pacific at 26%, while Latin America and the Middle East & Africa each account for 7%.

- Key players include Calysta Inc., Evonik Industries AG, Biomin Holding GmbH, Unibio A/S, Charoen Pokphand Food PCL, Novus International, Church & Dwight Co. Inc., BioProcess Algae LLC, Devenish Nutrition Limited, and BEC Feed Solutions Pty Ltd.

Market Drivers

Rising Global Demand for Sustainable Protein Sources

The growing need for sustainable protein alternatives acts as a primary driver for the Single cell protein market. Population growth and limited availability of conventional protein sources create strong demand for microbial-based proteins. It provides high nutritional value while reducing reliance on traditional animal farming. The market gains momentum from consumer preference for eco-friendly and ethical food choices. It supports global protein security by addressing challenges in meat and plant-based production.

- For instance, Unibio has commercialized its methane-fed protein Uniprotein®, and in 2023 signed licensing agreements to establish large-scale production plants in North America.

Advancements in Bioprocessing and Fermentation Technologies

The Single cell protein market benefits from continuous improvements in fermentation and bioprocessing technologies. Innovations enable higher yields, cost efficiency, and scalability, making production commercially viable. It leverages biotechnology to optimize strain development and nutrient efficiency. Enhanced production methods lower environmental footprint compared to traditional agriculture. It strengthens applications across food, feed, and industrial sectors. Growing investments in R&D push the market toward wider adoption and technological maturity.

Government Support and Regulatory Encouragement

The Single cell protein market expands under strong government support and favorable regulations promoting sustainable food production. Policies encouraging resource-efficient protein sources align with global climate and food security goals. It benefits from funding initiatives that reduce production barriers for startups and large firms. Governments actively endorse protein diversification strategies to minimize dependency on conventional farming. It drives investment confidence and accelerates commercialization across developed and emerging economies.

- For instance, in 2023, the European Commission approved funding under its Horizon Europe program to support microbial protein research, including single-cell protein, to reduce reliance on traditional animal feed.

Expanding Applications Across Food and Feed Industries

The Single cell protein market grows with its expanding use in food, animal feed, aquaculture, and nutraceuticals. High protein content and functional properties attract food manufacturers and feed formulators. It improves animal nutrition while reducing reliance on fishmeal and soy. Demand from aquaculture and poultry industries strengthens adoption. It provides flexibility for tailored nutritional solutions across multiple end users. Rising consumer awareness of sustainable diets further boosts industrial uptake.

Market Trends

Integration of Biotechnology and Precision Fermentation in Production

The Single cell protein market is experiencing strong growth through biotechnology integration and precision fermentation. It enables enhanced strain engineering, improved nutrient conversion, and optimized scalability. Companies are focusing on tailoring microorganisms to deliver higher yields and specific amino acid profiles. Advanced fermentation lowers costs and supports consistent quality, making large-scale adoption feasible. It creates opportunities for wider industrial use and positions microbial protein as a reliable alternative to traditional food and feed proteins.

- For instance, companies using CRISPR-Cas and RNAi technologies to enhance strain engineering, optimizing protein production efficiency while using agricultural and industrial by-products as substrates.

Adoption of Renewable and Low-Cost Feedstocks

The Single cell protein market gains traction with the rising adoption of renewable, low-cost feedstocks. It utilizes agricultural residues, food waste, and industrial byproducts to improve sustainability and lower dependence on conventional inputs. This trend enhances cost competitiveness and reduces environmental impact across production chains. Companies are prioritizing circular economy models to integrate resource efficiency. It supports large-scale expansion and aligns well with global climate objectives by promoting waste-to-value strategies for protein generation.

- For instance, Calysta produces its FeedKind® protein using natural gas via microbial fermentation, reducing reliance on land and water-intensive crops while providing an alternative protein source for aquaculture.

Expansion into Animal Nutrition and Aquaculture Sectors

The Single cell protein market is diversifying its applications through expansion in animal feed and aquaculture. It offers high-quality protein that improves digestibility and nutritional balance for livestock, poultry, and fish. Aquaculture demand is accelerating due to declining fishmeal availability and rising feed costs. It provides a scalable solution to replace conventional feed sources. This trend strengthens supply chains and supports sustainable growth across global livestock and seafood production industries.

Strategic Collaborations and Investments by Food-Tech Companies

The Single cell protein market is witnessing rising collaborations and investments from food-tech firms and established corporations. It benefits from joint ventures, mergers, and funding that accelerate innovation and market reach. Startups secure financial backing to commercialize production at scale. Established players are forming partnerships to strengthen product portfolios and enter new geographies. It highlights a competitive landscape where innovation and alliances drive growth, pushing microbial protein closer to mainstream adoption globally.

Market Challenges Analysis

High Production Costs and Scale-Up Limitations

The Single cell protein market faces significant challenges from high production costs and technical barriers in scaling up operations. It requires advanced fermentation infrastructure, costly feedstocks, and skilled expertise to ensure efficiency. Limited economies of scale restrict price competitiveness with conventional protein sources. It struggles to achieve affordability for mass markets, particularly in developing economies. Companies must invest heavily in R&D to optimize strains, improve yields, and reduce energy consumption. These constraints slow down rapid commercialization despite rising demand.

Regulatory Barriers and Consumer Acceptance Issues

The Single cell protein market encounters hurdles from complex regulatory frameworks and consumer acceptance concerns. It must meet stringent safety standards before approval for human consumption or animal feed use. Regulatory variations across regions delay global market entry for producers. It also faces skepticism from consumers unfamiliar with microbial proteins or wary of biotechnology-based products. Building trust through transparent labeling, education, and product quality assurance remains critical. Overcoming these issues is essential to expand adoption and strengthen industry growth.

Market Opportunities

Rising Demand for Alternative Proteins and Sustainable Solutions

The Single cell protein market presents strong opportunities through growing global demand for sustainable and alternative protein sources. It provides high nutritional value while using less land, water, and energy compared to conventional farming. Consumer interest in eco-friendly diets and food security is driving rapid acceptance. It holds potential to replace or complement plant-based and animal proteins in multiple industries. Expanding applications in functional foods, dietary supplements, and livestock feed reinforce its commercial growth potential.

Technological Advancements and Strategic Industry Collaborations

The Single cell protein market is positioned to benefit from rapid advancements in biotechnology, fermentation, and process optimization. It creates pathways for cost reduction, enhanced scalability, and new product formulations tailored for specific nutritional needs. Strategic collaborations among food-tech startups, established corporations, and research institutions are expanding commercialization opportunities. It also opens doors to new geographic markets, especially in regions facing protein shortages. Growing investment interest and favorable policies further strengthen the prospects for long-term adoption and expansion.

Market Segmentation Analysis:

By Species

The Single cell protein market is segmented into yeast, fungi, and bacteria, each offering unique nutritional and functional benefits. Yeast dominates with its wide use in food, beverages, and dietary supplements due to rich protein and vitamin content. Fungi provide strong applications in fortified foods and animal feed, while bacteria support efficient large-scale production with higher protein yields. It benefits from ongoing research that enhances strain performance and positions microbial sources as vital alternatives to conventional proteins.

- For instance, Angel Yeast (China) produces nutritional yeast extracts widely used in plant-based meat and fortified foods, with its 2023 annual report noting strong growth in the nutrition and health sector.

By Feedstock

The Single cell protein market is divided into organic and conventional feedstock. Organic feedstock gains preference due to rising demand for natural and sustainable food production. It aligns with consumer trends toward eco-friendly diets and premium nutritional products. Conventional feedstock remains significant for cost-effective mass production, particularly in animal nutrition. It enables producers to achieve commercial scalability while maintaining product quality. The balance between organic innovation and conventional affordability drives steady adoption.

- For instance, Calysta produces protein using methane as feedstock in its proprietary fermentation process, enabling a natural protein source branded as FeedKind, which is certified for aquaculture use in Europe.

By Application

The Single cell protein market spans applications in food and beverages, animal feed, dietary supplements, and others. Fortified foods and beverages leverage microbial protein for enhanced nutrition, while animal feed remains the largest segment, covering poultry, ruminant, swine, aqua, and other categories. It ensures better digestibility and reduces dependency on fishmeal and soy. Dietary supplements benefit from its rich amino acid profile. Expanding use across industries strengthens its role in supporting sustainable nutrition solutions globally.

Segments:

Based on Species:

Based on Feedstock:

Based on Application:

- Food and beverages

- Fortified Food

- Fortified Beverages

- Animal feed

- Poultry Feed

- Ruminant Feed

- Swine Feed

- Aqua Feed

- Others

- Dietary supplements

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The Single cell protein market in North America holds 32% share, driven by strong adoption of alternative proteins and advanced biotechnology infrastructure. It benefits from high consumer awareness of sustainable diets and the growing preference for plant and microbial-based nutrition. The region supports commercialization through significant investments in research and development. Food-tech startups and established corporations actively collaborate to expand applications across food, beverages, and dietary supplements. It also gains support from government initiatives promoting resource-efficient food systems.

Europe

Europe accounts for 28% share of the Single cell protein market, supported by stringent sustainability policies and strong focus on food security. It demonstrates high adoption in fortified food, beverages, and animal feed industries. Consumer demand for clean-label and eco-friendly proteins enhances market growth across the region. Governments and industry stakeholders promote circular economy practices that utilize renewable feedstocks. It positions microbial protein as a strategic solution to reduce reliance on imported soy and fishmeal for feed.

Asia Pacific

The Single cell protein market in Asia Pacific commands 26% share, fueled by rapid urbanization, population growth, and protein consumption needs. It gains strong traction in aquaculture, poultry, and livestock feed sectors where demand for protein-rich feed is rising. Countries such as China, India, and Japan support adoption through investments in sustainable food technologies. It also benefits from expanding consumer awareness of alternative proteins in food and dietary supplements. The region is emerging as a critical hub for market expansion.

Latin America

Latin America represents 7% share of the Single cell protein market, supported by growing aquaculture and livestock industries. It benefits from increasing protein consumption and efforts to replace fishmeal with sustainable feed sources. Countries like Brazil and Chile show rising adoption of microbial proteins in poultry and aqua feed. It also presents opportunities in fortified foods as health-focused diets expand. Strategic partnerships with global players enhance regional accessibility and strengthen industry growth prospects.

Middle East & Africa

The Single cell protein market in the Middle East & Africa holds 7% share, with growth centered on food security initiatives and demand for affordable protein alternatives. It supports applications in animal feed to address livestock productivity challenges. Countries facing arid climates and limited agricultural land adopt microbial protein for sustainable production. It also gains traction in fortified food and dietary supplements due to rising urban populations. Partnerships with international firms foster technology transfer and market entry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Single cell protein market is highly competitive with a mix of established corporations and innovative biotechnology firms driving growth through product innovation, strategic partnerships, and capacity expansion. Key players such as Calysta Inc., Evonik Industries AG, Biomin Holding GmbH, Unibio A/S, and Charoen Pokphand Food PCL focus on large-scale production and diversification of applications across food, feed, and dietary supplements. Companies like Novus International, Church & Dwight Co. Inc., BioProcess Algae LLC, Devenish Nutrition Limited, and BEC Feed Solutions Pty Ltd invest in research to improve microbial strains, reduce production costs, and enhance nutritional value. It strengthens its position through collaborations with food-tech startups and joint ventures that support commercialization in global markets. Competitive strategies also include regional expansion, with strong emphasis on meeting sustainability goals and aligning with government-backed initiatives for food security. Innovation in feedstock utilization, particularly renewable resources, further shapes differentiation among competitors, positioning the market toward long-term scalability and broader acceptance across multiple end-user industries.

Recent Developments

- In January 2024, Calysta Inc. secured regulatory approval from China’s Ministry of Agriculture and Rural Affairs (MARA) for its FeedKind® single-cell protein in aquaculture feeds, enabling distribution through its Calysseo joint venture with Adisseo.

- In March 2025, Marsapet, a German pet food producer, introduced MicroBell, a dog kibble formulated with Calysta’s fermentation-derived FeedKind® protein, marking Europe’s first pet food product using single-cell protein.

- In August 2024, Calysta’s Calysseo joint venture completed its first shipment of FeedKind Pet from its Chongqing facility to a GMP+ certified warehouse in Poland, marking the entry of single-cell protein into the European pet food market.

- On May 26, 2025, Solar Foods achieved a major milestone by scaling up its Solein production technology 100-fold—from pilot to industrial scale—at its Factory 01, enabling commercial operations in the U.S.

Market Concentration & Characteristics

The Single cell protein market demonstrates moderate to high concentration, with a limited number of established players holding strong positions through technological expertise, production capacity, and global reach. It is characterized by intense focus on innovation in fermentation technologies, renewable feedstock utilization, and sustainable production practices. Companies compete through product diversification, cost optimization, and strategic partnerships to strengthen their presence across food, feed, and nutraceutical sectors. It benefits from rising collaborations between startups and large corporations that accelerate commercialization and expand regional penetration. Market characteristics highlight sustainability-driven demand, growing government support, and consumer interest in eco-friendly protein alternatives, creating an environment where research investment and regulatory alignment are critical for success. It also features a balance of competition and cooperation, as players work together on technology sharing while pursuing individual strategies to secure market share and expand their influence in the global protein economy.

Report Coverage

The research report offers an in-depth analysis based on Species, Feedstock, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for sustainable protein alternatives across food and feed sectors.

- Biotechnology and fermentation advancements will improve efficiency and scalability of production.

- Renewable and low-cost feedstocks will gain importance to reduce costs and environmental impact.

- Applications in aquaculture and animal nutrition will strengthen due to declining reliance on fishmeal and soy.

- Consumer acceptance of microbial proteins will improve through awareness and transparent labeling.

- Strategic partnerships and collaborations will accelerate commercialization and global expansion.

- Regulatory frameworks will evolve to support faster approvals and encourage industry growth.

- Investments from food-tech startups and established corporations will increase innovation and competitiveness.

- Emerging economies will become critical markets due to population growth and protein demand.

- Sustainability goals and climate initiatives will drive adoption, positioning microbial protein as a mainstream solution.