Market Overview

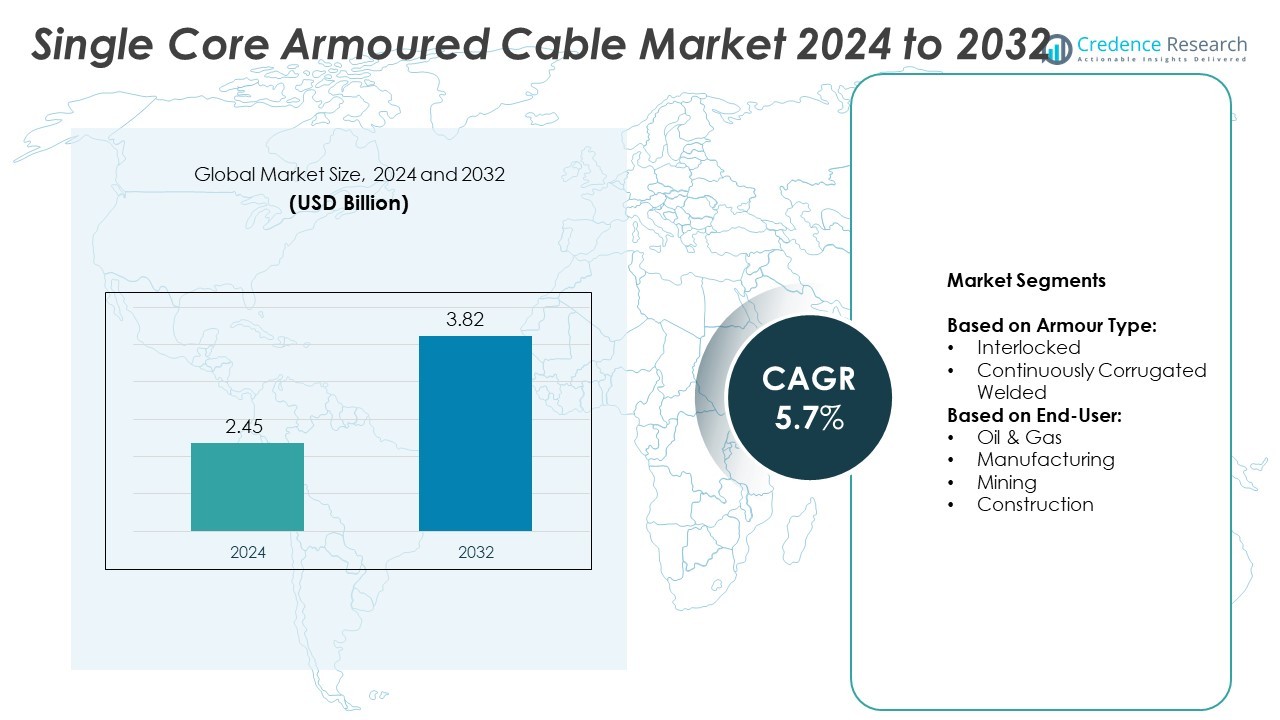

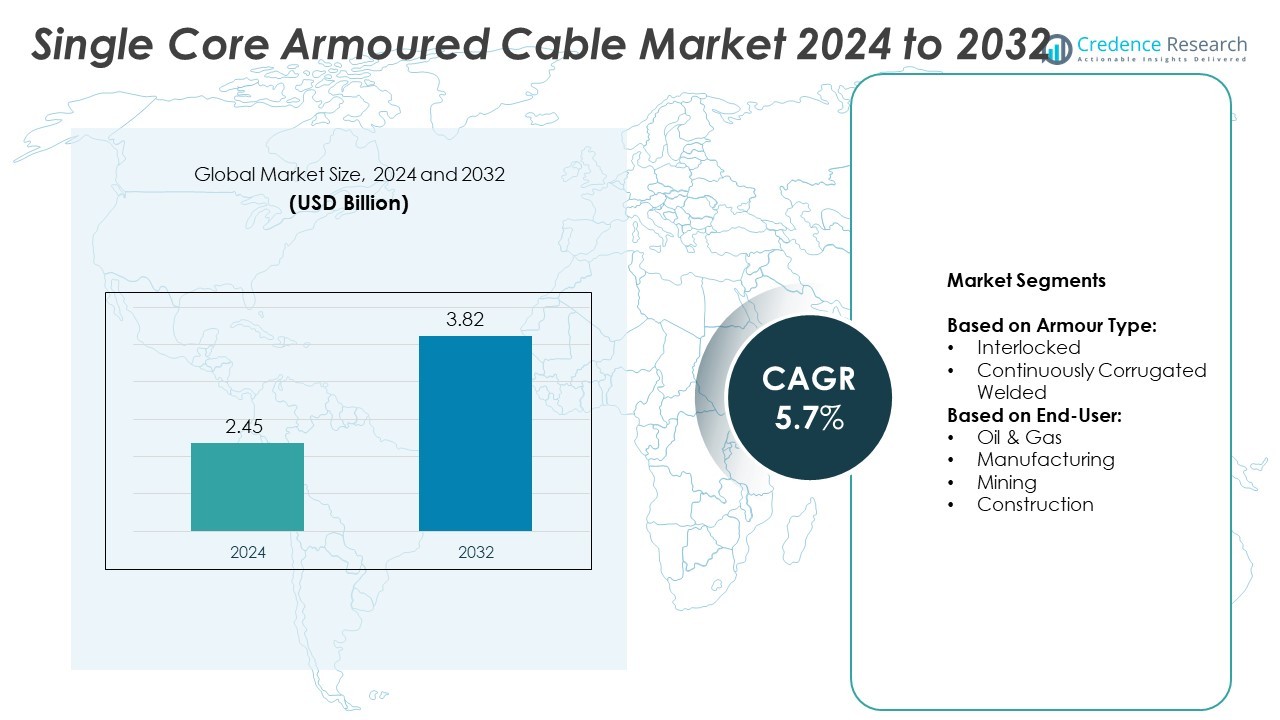

The Single Core Armoured Cable market size was valued at USD 2.45 billion in 2024 and is anticipated to reach USD 3.82 billion by 2032, growing at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Single Core Armoured Cable Market Size 2024 |

USD 2.45 Billion |

| Single Core Armoured Cable Market, CAGR |

5.7% |

| Single Core Armoured Cable Market Size 2032 |

USD 3.82 Billion |

The Single Core Armoured Cable market is driven by rapid infrastructure expansion, rising renewable energy projects, and increasing demand for reliable underground power distribution. Strong adoption in oil and gas, mining, and manufacturing sectors highlights the need for durable and safety-compliant solutions. Urbanization and smart city initiatives further accelerate installations, while stricter regulations reinforce the shift toward certified and fire-resistant products. The market also trends toward technological innovation, with manufacturers introducing advanced insulation materials, eco-friendly designs, and lightweight structures.

The Single Core Armoured Cable market demonstrates strong presence across Asia-Pacific, North America, Europe, Latin America, and the Middle East & Africa, supported by infrastructure growth, industrialization, and renewable energy expansion. Asia-Pacific leads with rapid urban development, while North America and Europe emphasize safety compliance and modernization. Latin America and the Middle East & Africa show steady growth through oil, gas, and mining activities. Key players shaping the market include Nexans, Prysmian, Polycab, and KEI Industries, each focusing on innovation and regional expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Single Core Armoured Cable market was valued at USD 2.45 billion in 2024 and is projected to reach USD 3.82 billion by 2032, growing at a CAGR of 5.7%.

- Strong demand is driven by infrastructure development, renewable energy expansion, and rising construction activities requiring reliable underground power distribution.

- Market trends highlight growing adoption in smart grids, fire-resistant solutions, and sustainable designs with eco-friendly materials.

- Competitive analysis shows global leaders focusing on innovation and advanced technologies, while regional players strengthen their presence with cost-effective localized offerings.

- Market restraints include high raw material costs, technical installation complexities, and ongoing maintenance challenges, which limit adoption in cost-sensitive projects.

- Regional analysis shows Asia-Pacific leading due to rapid industrialization and urbanization, North America focusing on modernization and energy projects, Europe emphasizing regulatory compliance, while Latin America and the Middle East & Africa expand steadily through mining and oil and gas sectors.

- The industry continues to evolve with opportunities from industrial automation, renewable integration, and government-backed initiatives that promote safe, reliable, and long-term energy infrastructure.

Market Drivers

Rising Infrastructure Development and Urbanization

The Single Core Armoured Cable market gains momentum from large-scale infrastructure expansion in both developed and emerging economies. Governments allocate significant funds to power distribution, smart cities, and transportation projects, all of which demand durable and high-performance cabling solutions. It plays a critical role in supporting underground installations that require resistance to mechanical stress and environmental challenges. The growing emphasis on resilient and safe electrical networks drives contractors to prefer armoured cables over conventional options. Rapid urban growth and the need for reliable utilities enhance the adoption rate. Expanding metropolitan areas continue to create steady demand across multiple applications.

- For instance, Nexans has installed over 5 000 km of its HYPRON® armoured cable in oil, gas, and chemical environments globally

Expanding Renewable Energy and Power Generation Projects

Global energy transition reinforces the requirement for secure power transmission, benefiting the Single Core Armoured Cable market. Large-scale solar and wind projects rely on robust cable systems that ensure reliable current flow under varying conditions. It demonstrates higher resilience in renewable installations exposed to harsh terrains and environmental stressors. Utilities prioritize these cables for substations, transmission lines, and offshore applications where long-term reliability is crucial. Government-backed renewable targets further stimulate deployment in advanced and emerging markets. This trend secures long-term opportunities by aligning with sustainability goals.

- For instance, Southwire’s Armorlite® Type AC aluminum armored cable weighs up to 45 % less than equivalent steel-armored options, improving handling and reducing installation effort

Industrial Growth and Strengthening Safety Standards

The Single Core Armoured Cable market strengthens its position through growing industrialization across mining, oil and gas, and manufacturing sectors. Industrial plants require durable cabling that ensures protection against mechanical damage, chemicals, and fire hazards. It aligns with strict safety regulations that mandate compliance with robust power infrastructure standards. Manufacturers continue to introduce variants that enhance resistance to corrosion and high temperatures. Regulatory authorities enforce certifications that promote the use of armoured cables in hazardous environments. The rising focus on occupational safety and equipment protection drives consistent procurement.

Technological Advancements and Product Innovations

Continuous innovation fosters adoption across diverse applications within the Single Core Armoured Cable market. Manufacturers integrate advanced materials and designs to increase current-carrying capacity while reducing installation complexities. It supports evolving requirements for compact, flexible, and durable solutions suited for both indoor and outdoor systems. Smart manufacturing practices enable cables with extended lifespan and lower maintenance needs. Enhanced insulation technologies improve performance in demanding conditions. Product differentiation strategies by key players encourage end users to adopt premium variants that meet both safety and efficiency demands.

Market Trends

Growing Adoption in Underground and Subterranean Applications

The Single Core Armoured Cable market witnesses rising demand from underground power distribution networks and infrastructure projects. Urban planners and utilities prefer armoured cables for their superior protection against moisture, soil pressure, and accidental mechanical damage. It ensures operational reliability where overhead lines are not feasible due to space constraints or safety risks. Expansion of metro systems, railways, and smart city projects continues to drive installation of underground cabling systems. Contractors view these cables as a cost-effective solution for long-term durability. This trend enhances their presence in both public and private sector developments.

- For instance, Nexans achieved the world’s first electrical type test of a 525 kV HVDC cable system using SF₆‑free accessories in 2023

Increasing Use in Renewable and Green Energy Projects

Sustainability initiatives accelerate demand for specialized cabling in renewable energy projects, strengthening the Single Core Armoured Cable market. Solar farms, wind parks, and hydropower facilities require high-strength cables capable of withstanding outdoor stress and varying environmental conditions. It supports the transmission of clean energy from generation sites to the grid with improved safety. Offshore wind installations create further opportunities due to the need for robust underwater and coastal transmission lines. Governments emphasize eco-friendly infrastructure, which further promotes investment in armoured cables. This growing segment underscores the role of cables in global energy transition.

- For instance, Prysmian achieved record-breaking submarine cable installation at a depth of 2 150 m in July 2024, underscoring technological leadership in deep-water projects

Rising Focus on Fire-Resistant and Safety-Enhanced Cables

Safety-driven procurement policies are shaping the Single Core Armoured Cable market, with customers seeking products that guarantee higher resilience against fire and hazardous conditions. Manufacturers innovate with advanced insulation and fire-retardant materials to comply with evolving safety codes. It caters to industries such as oil and gas, chemicals, and mining where environmental risks remain high. Building and construction regulations also push for enhanced fire-resistant cable installations in commercial complexes and residential towers. Clients increasingly choose certified products to ensure compliance and reduce liability. This emphasis positions armoured cables as a standard requirement across sensitive industries.

Shift Toward Smart Manufacturing and Advanced Materials

Technological progress is reshaping product development in the Single Core Armoured Cable market. Manufacturers adopt automation, precision testing, and advanced materials to boost performance and efficiency. It leads to improved mechanical strength, flexibility, and reduced installation time for end users. Advanced polymers and eco-friendly compounds gain traction in insulation and sheathing, enhancing reliability in demanding environments. The introduction of lightweight yet durable designs supports easier handling in large-scale projects. Industry players focus on product differentiation to address sector-specific requirements and maintain competitiveness. This trend reflects a growing shift toward innovation-driven growth in the market.

Market Challenges Analysis

High Material Costs and Fluctuating Raw Material Prices

The Single Core Armoured Cable market faces significant challenges due to volatility in raw material prices, particularly copper, aluminum, and steel. Rising global demand and supply chain disruptions often lead to unpredictable cost structures that impact manufacturers’ profitability. It forces producers to adjust pricing strategies frequently, which creates uncertainty for contractors and project developers. Import restrictions and tariffs in certain regions further add to cost pressures. Small and medium-scale manufacturers struggle to maintain margins when raw material prices surge. This challenge continues to restrict market growth despite steady end-user demand.

Complex Installation Requirements and Maintenance Issues

Technical complexity in installation poses another restraint for the Single Core Armoured Cable market. The cables are heavier and less flexible compared to non-armoured alternatives, requiring skilled labor and specialized equipment during deployment. It increases project timelines and raises overall installation expenses for infrastructure developers. Inadequate handling can lead to cable damage, reducing efficiency and lifespan. Harsh environmental conditions demand regular inspection and maintenance, adding to operational costs. These factors discourage adoption in projects with limited budgets or tight deadlines, limiting broader penetration in some sectors.

Market Opportunities

Expansion of Renewable Energy and Smart Grid Projects

The Single Core Armoured Cable market presents strong opportunities through the expansion of renewable energy infrastructure and smart grid networks. Solar, wind, and hydro projects require durable cables to ensure reliable power transmission across challenging terrains and variable weather conditions. It supports safe and efficient connections in offshore wind farms, desert-based solar arrays, and high-capacity hydropower facilities. Governments and utilities are investing heavily in grid modernization, creating consistent demand for robust cabling solutions. Integration of distributed energy systems further strengthens the case for advanced armoured cables. This opportunity positions the market as a key enabler of sustainable power networks.

Growth in Industrial Automation and Emerging Economies

Widespread adoption of industrial automation and rapid urbanization in developing regions generate new avenues for the Single Core Armoured Cable market. Industries such as oil and gas, chemicals, and mining rely on armoured cables to ensure operational safety in hazardous environments. It provides protection against mechanical stress, moisture, and fire, making it essential for large-scale industrial facilities. Expanding infrastructure in Asia-Pacific, Latin America, and Africa further supports long-term growth. Manufacturers have opportunities to introduce cost-effective, high-performance products that meet local requirements and regulatory standards. Rising industrial investment in emerging markets enhances the potential for broader cable deployment.

Market Segmentation Analysis:

By Armour Type:

The Single Core Armoured Cable market is divided into interlocked and continuously corrugated welded (CCW) cables, each serving distinct operational needs. Interlocked cables are widely used in commercial and industrial facilities where flexibility and easier installation are required. It offers strong mechanical protection against crushing and impact, making it suitable for environments with frequent handling and movement. These cables are preferred in applications where re-routing or modifications may be needed over time. On the other hand, continuously corrugated welded cables provide superior strength and resistance against moisture, chemicals, and fire. They are often chosen for high-risk environments such as oil refineries, petrochemical plants, and mining operations. The segment reflects a clear demand for specialized armour designs that balance durability with operational efficiency.

- For instance, Nexans’ HYPRON® technology delivered up to 20 % direct savings versus lead-covered alternatives while reducing total cost of ownership by threefold.

By End-User:

The end-user segmentation highlights oil and gas, manufacturing, mining, and construction as major contributors to the Single Core Armoured Cable market. Oil and gas facilities depend on armoured cables for safe power transmission in explosive-prone areas, where reliability and compliance with safety standards are non-negotiable. It supports critical functions in upstream, midstream, and downstream operations. Manufacturing industries employ these cables in heavy machinery setups, assembly lines, and automated facilities to ensure consistent energy supply under tough working conditions. Mining operations represent another vital sector, as cables withstand abrasive terrains, high stress, and exposure to harsh underground environments. Construction projects across commercial complexes, residential towers, and infrastructure systems also fuel demand, with cables offering long-term durability for embedded and exposed installations. Each sector’s requirements underscore the versatility of armoured cables and their indispensable role in ensuring reliable and safe power distribution.

- For instance, Prysmian supplied a full 17 km single‑length export cable run for a large offshore wind project in 2018, demonstrating capability in long and continuous installation delivery.

Segments:

Based on Armour Type:

- Interlocked

- Continuously Corrugated Welded

Based on End-User:

- Oil & Gas

- Manufacturing

- Mining

- Construction

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

Asia-Pacific

The Asia-Pacific region holds the largest share of the Single Core Armoured Cable market, accounting for 38% in 2024. This dominance stems from rapid industrialization, urban expansion, and growing energy demand across China, India, Japan, and Southeast Asia. Governments continue to invest in power grid modernization, metro systems, and renewable energy projects, which require large-scale deployment of durable armoured cables. It supports underground cabling for smart cities and industrial corridors where safety and reliability are top priorities. Mining and manufacturing hubs in China and Australia further strengthen demand by relying on robust cable systems for high-stress environments. The rise of offshore wind projects in China and growing solar capacity in India add further opportunities. The region’s mix of infrastructure development, industrial growth, and renewable integration secures its leadership position in the market.

North America

North America represents 24% of the Single Core Armoured Cable market, driven by investments in oil and gas, construction, and manufacturing sectors. The United States leads the regional demand with its extensive shale gas and offshore drilling projects requiring cables that meet stringent safety standards. It plays an essential role in infrastructure upgrades, particularly in modernizing transmission and distribution networks. The region’s strong regulatory framework enforces the use of certified armoured cables across critical installations. Canada contributes steadily through mining operations and renewable power projects, including hydropower and wind farms. Expansion in commercial construction and data centers further accelerates cable adoption. The push for grid resilience and modernization continues to secure demand across diverse industries.

Europe

Europe accounts for 20% of the Single Core Armoured Cable market, supported by strict regulatory requirements and sustainability goals. The region prioritizes underground power distribution to reduce environmental and visual impacts, creating consistent demand for armoured cabling. It aligns with the European Union’s emphasis on renewable energy projects, where offshore wind capacity in Germany, the UK, and Denmark requires highly durable cabling solutions. The construction sector also contributes significantly, particularly in residential and commercial buildings that follow fire-safety codes. Mining activities in Eastern Europe add niche demand, while advanced manufacturing across Germany and France further sustains the market. Strong investment in green infrastructure and cross-border power interconnections boosts long-term opportunities. Europe’s strict standards ensure steady replacement demand and innovation-led adoption.

Latin America

Latin America secures 10% of the Single Core Armoured Cable market, with growth anchored in oil and gas exploration, mining operations, and urban infrastructure projects. Brazil leads the regional market through its extensive oil reserves and construction of large-scale commercial and residential complexes. It supports high-capacity power projects, including hydroelectric facilities in Brazil and Chile that rely on reliable cable systems. Mining activities in Peru and Chile, especially copper and lithium extraction, require durable cables capable of withstanding harsh conditions. Rapid urbanization across Mexico and Colombia also expands demand for underground power distribution. While regulatory frameworks vary across countries, the steady pace of industrial and infrastructure investment ensures sustained growth. Latin America remains a promising region with gradual increases in adoption.

Middle East & Africa

The Middle East & Africa contributes 8% of the Single Core Armoured Cable market, influenced by large-scale oil and gas projects and expanding construction activities. The Gulf countries invest heavily in energy infrastructure, petrochemical plants, and mega real estate developments that demand advanced cabling solutions. It plays a critical role in safeguarding power transmission in high-temperature and hazardous environments. Africa demonstrates rising demand through mining activities in South Africa and Zambia, as well as infrastructure expansion in Nigeria and Kenya. Renewable initiatives, including solar parks in the UAE and South Africa, strengthen opportunities for cable deployment. Though the region faces budget constraints in some economies, ongoing industrialization and large government-backed projects sustain growth. The combined oil-driven wealth and rising energy access initiatives reinforce long-term demand for armoured cables.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The leading players in the Single Core Armoured Cable market include Atkore, Belden, Finolex, Furukawa Electric, Havells, Helukabel, KEI Industries, Leoni Cables, LS Cable & System, and Nexans. These companies compete through innovation, product differentiation, and expansion of their global distribution networks. They focus on delivering high-performance cables that meet stringent safety standards, particularly for industries such as oil and gas, mining, construction, and manufacturing. Strong investment in research and development allows them to introduce advanced materials and fire-resistant solutions tailored for demanding applications.The competitive landscape is defined by strategic partnerships, acquisitions, and localization of manufacturing to cater to regional demands effectively. Many companies emphasize sustainability by developing eco-friendly insulation and sheathing materials that comply with international regulations. It strengthens their ability to secure government contracts and large infrastructure projects. Leading players also expand capacity and diversify their portfolios to address rising demand from renewable energy and smart grid networks. Competitive intensity remains high, with global brands maintaining their dominance while regional players strengthen their position through cost-effective solutions and strong local presence. This balance ensures steady competition and continuous innovation across the market.

Recent Developments

- In 2025, Polycab released its updated price list (LDC LP No. 02/2025‑26), which includes Single Core XLPE Unarmoured/Armoured Cables among other products.

- In 2025, Nexans completed a key phase in the grid connection for the Dieppe–Le Tréport offshore wind farm, marking progress in electrification infrastructure

- In March 2023, NKT secured record orders for the world’s first 525 kV XLPE HVDC submarine cable projects, reinforcing its position in offshore wind infrastructure.

Market Concentration & Characteristics

The Single Core Armoured Cable market demonstrates moderate concentration, with a mix of global leaders and regional players competing across diverse end-use industries. Large multinational manufacturers dominate through scale, advanced product portfolios, and established distribution networks, while regional companies strengthen their positions by offering cost-effective and locally tailored solutions. It reflects characteristics of a technology-driven market, where product quality, compliance with safety standards, and durability remain decisive factors for adoption. The market shows steady demand from infrastructure, oil and gas, mining, and construction sectors, reinforcing its essential role in critical applications. Competition is marked by continuous product innovation, sustainability initiatives, and capacity expansion to meet the growing need for reliable and safe power distribution. Regulatory frameworks across regions further shape the landscape, ensuring that certified products with fire resistance, mechanical strength, and long service life gain preference. The balance between global expertise and regional agility sustains competitive intensity and drives ongoing development in this sector.

Report Coverage

The research report offers an in-depth analysis based on Armour Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Single Core Armoured Cable market will expand with growing infrastructure development and smart city projects.

- Renewable energy installations will drive consistent demand for durable cabling solutions.

- Industrial automation and modernization will strengthen the need for reliable power distribution.

- Underground cabling for safety and space optimization will see wider adoption.

- Rising construction activities in residential and commercial sectors will boost consumption.

- Mining and oil and gas projects will continue to require high-strength armoured cables.

- Technological advancements in insulation and fire resistance will shape product innovation.

- Regional players will increase competition through cost-effective solutions.

- Regulatory compliance and safety standards will influence procurement decisions.

- Sustainable materials and eco-friendly designs will become a focus for leading manufacturers.