Market Overview

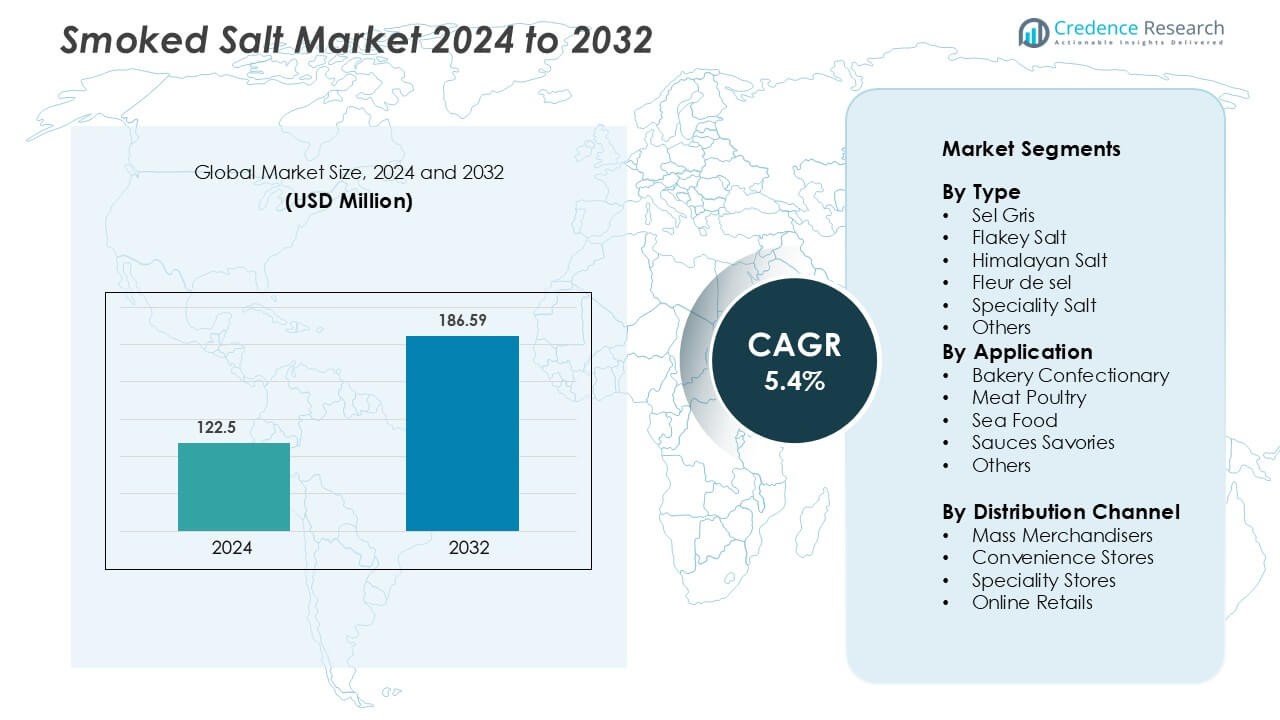

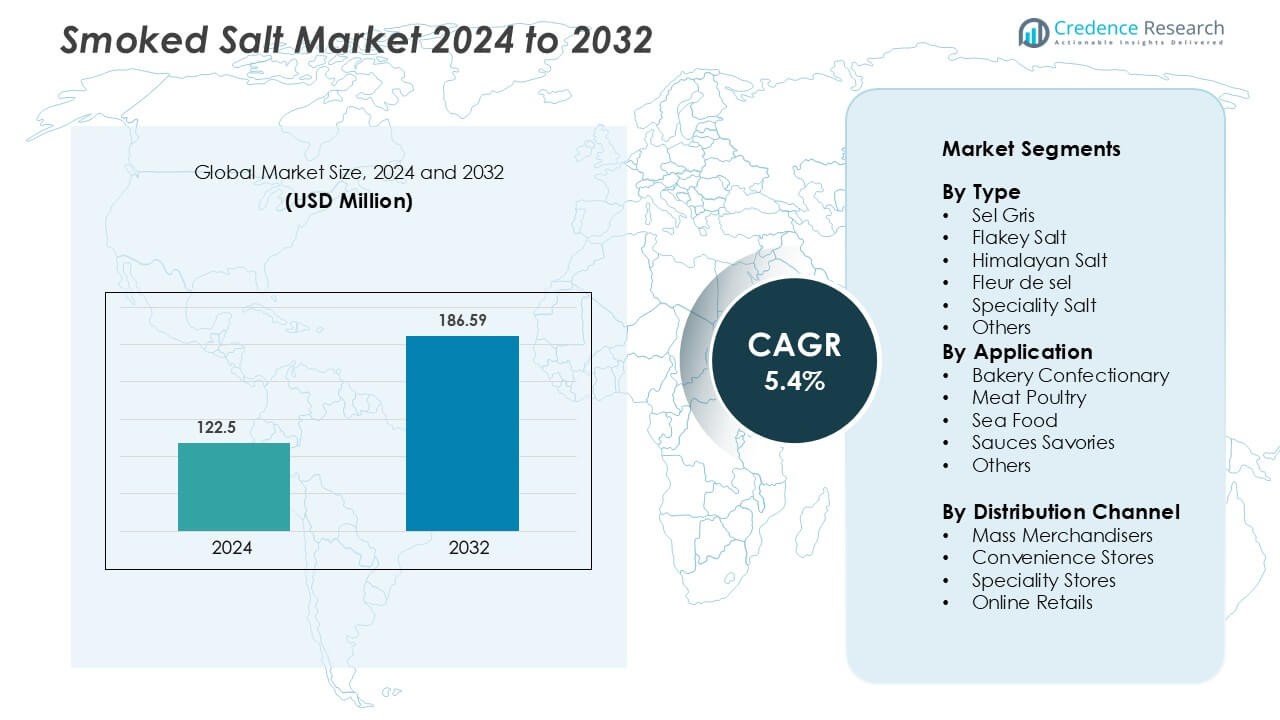

Smoked Salt Market was valued at USD 122.5 million in 2024 and is anticipated to reach USD 186.59 million by 2032, growing at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smoked Salt Market Size 2024 |

USD 122.5 Million |

| Smoked Salt Market, CAGR |

6.1% |

| Smoked Salt Market Size 2032 |

USD 186.59 Million |

The smoked salt market features a competitive mix of established producers and emerging artisanal brands focused on innovation and sustainability. Key players such as Besmoke, Saltverk, Jacobsen Salt Co., and SaltWorks lead the market through advanced smoking processes, eco-friendly production methods, and diverse product portfolios catering to gourmet and industrial applications. Companies like Maine Sea Salt Company, Viva Doria, and Frontier Natural Products Co-op strengthen their presence through clean-label offerings and online retail growth. North America dominates the global smoked salt market with a 36% share, driven by high consumer demand for natural, premium seasonings and strong distribution networks across retail and foodservice channels.

Market Insights

- The global smoked salt market was valued at USD 122.5 million in 2024 and is projected to grow at a CAGR of 5.4 % from 2025 to 2032, supported by rising demand for premium and natural seasonings.

- Growing consumer inclination toward clean-label and artisanal food products drives consistent market expansion, especially in meat, poultry, and seafood applications that together hold 58% segment share.

- Increasing innovation in infused and flavored smoked salts, along with expanding e-commerce distribution, shapes emerging market trends, fostering stronger global penetration.

- The competitive landscape remains fragmented, with players like Saltverk, Besmoke, and SaltWorks focusing on sustainable sourcing, flavor diversification, and eco-friendly packaging to maintain leadership.

- Regionally, North America leads with a 36% market share, followed by Europe at 29% and Asia Pacific at 22%, driven by growing consumer awareness, expanding gourmet food sectors, and the rising popularity of global cuisines across major economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Sel Gris dominates the smoked salt market with nearly 32% share due to its mineral-rich composition and coarse texture, enhancing flavor complexity in gourmet dishes. Its natural moisture retention and smoky aroma make it ideal for grilling, roasting, and finishing applications. Flakey salt and Himalayan salt follow closely, driven by their premium positioning and visual appeal in high-end culinary products. Specialty salt variants, including infused and wood-smoked types, continue to gain popularity as chefs and manufacturers seek distinctive flavor profiles for gourmet and artisanal food products.

- For instance, SaltWorks, Inc. reports it offers over 110 varieties of salts including a smoked Grey Sea Salt line, and uses wood-smoke ageing periods from 24 hours up to 7 days to develop aroma.

By Application

The meat and poultry segment holds the largest market share of 38%, fueled by rising consumer demand for natural preservatives and enhanced flavoring agents. Smoked salt acts as a clean-label ingredient, replacing artificial additives in processed meats and barbecue products. The seafood and sauces categories are expanding due to increased adoption in marinades and ready-to-eat foods. Bakery and confectionery applications are also emerging, as smoked salt introduces a unique balance of sweetness and umami that appeals to premium snack and dessert manufacturers.

- For instance, SaltWorks, Inc. invested more than $2 million in its “Perfect Smoke™” cold-smoking technology.

By Distribution Channel

Mass merchandisers lead the smoked salt market with 41% share, supported by wide product availability, bulk packaging, and competitive pricing strategies. Specialty stores maintain strong traction in urban markets, catering to gourmet consumers seeking premium and exotic salt variants. Online retail channels are growing rapidly, driven by the expansion of e-commerce platforms and rising awareness of artisanal food ingredients. Convenience stores continue to serve impulse and small-scale buyers, contributing to consistent market penetration across developed and developing regions.

Key Growth Drivers

Rising Demand for Natural and Artisanal Food Products

The growing preference for natural, minimally processed, and additive-free foods strongly supports smoked salt adoption. Consumers are increasingly drawn to artisanal ingredients that enhance flavor without synthetic additives. Smoked salt aligns with this trend by offering a clean-label alternative to conventional seasonings. Its use in gourmet and organic product formulations adds value to premium brands in both retail and foodservice sectors. Moreover, as consumers associate smoked salt with authentic culinary experiences and craftsmanship, producers are scaling up small-batch production methods and expanding distribution to capitalize on this evolving preference for high-quality, natural food enhancers.

- For instance, Maldon Salt Company continues hand-harvesting pyramid-shaped salt flakes in Essex, England using the same methods since 1882 and provides smoked sea salt flake variants in 125 g and 500 g tubs.

Expanding Applications in Processed and Ready-to-Eat Foods

The smoked salt market benefits from growing demand in processed meat, seafood, and ready-to-eat food categories. Manufacturers use smoked salt to impart smoky flavor, improve shelf life, and replace artificial flavor enhancers. As convenience foods gain global popularity, the inclusion of smoked salt enhances product appeal while maintaining clean-label standards. Food processors are leveraging its natural preservative properties to reduce sodium chloride levels in formulations. This versatility across meat rubs, sauces, and snack foods is fueling adoption among large-scale manufacturers seeking premium, natural flavoring alternatives that meet evolving consumer preferences for taste and health balance.

- For instance, SaltWorks lists over 110 distinct salt varieties including smoked salts, and offers bulk packaging to food-manufacturers from 5 ounces up to 40,000 pounds per SKU.

Growth of Premium Culinary and Restaurant Segments

Restaurants, gourmet food producers, and high-end culinary brands increasingly use smoked salt to elevate menu offerings and differentiate their flavors. The ingredient’s ability to add depth, aroma, and visual appeal supports its use in fine dining and luxury food preparation. The hospitality sector’s focus on ingredient authenticity and unique dining experiences further drives demand. Chefs worldwide experiment with varied wood-smoked salts—such as applewood, hickory, and mesquite to achieve signature flavors. This trend, combined with rising international exposure to global cuisines, strengthens the role of smoked salt in the premium culinary space, reinforcing its long-term market expansion potential.

Key Trend & Opportunity

Product Innovation through Flavored and Infused Variants

Manufacturers are developing innovative smoked salt products infused with herbs, spices, and exotic wood smoke to cater to evolving consumer palates. These innovations include chili-smoked, truffle-infused, and wine-barrel-aged salts, targeting the gourmet and specialty segment. The diversification allows brands to differentiate themselves and attract culinary professionals and home cooks seeking unique sensory experiences. Additionally, premium packaging and small-batch branding appeal to gifting and online retail markets. This innovation-driven approach not only expands application scope but also enables companies to command higher margins and strengthen brand loyalty in the competitive flavoring and seasoning industry.

- For instance, Bourbon Barrel Foods produces a “Bourbon Smoked Sea Salt” available in three SKUs: 0.75 oz mini, 5 oz tin, and 18 oz food-service container.

Rapid Expansion of E-commerce and Direct-to-Consumer Channels

The shift toward digital retail platforms has opened new growth avenues for smoked salt producers. E-commerce allows small and niche brands to reach global audiences, offering variety and convenience to consumers. Online platforms also enable storytelling and transparency about sourcing and production methods, aligning with the growing demand for traceable and sustainable products. Subscription boxes, gourmet ingredient kits, and customized packaging further enhance customer engagement. This digital transformation, coupled with the rising number of health-conscious and culinary-focused online shoppers, positions e-commerce as a pivotal growth enabler for both established players and emerging smoked salt brands.

- For instance, Bulls Bay Saltworks offers its smoked sea salt in units as small as ½ ounce mini bags, solar-evaporated and smoked using oak from the farm, highlighting full traceability from bay water to bottle.

Key Challenge

High Production and Distribution Costs

Producing smoked salt requires specialized smoking processes, temperature control, and high-quality wood or flavoring materials, leading to elevated production costs. Additionally, transportation and packaging expenses rise due to the product’s sensitivity to moisture and contamination. These factors make smoked salt more expensive than standard table salt, limiting its affordability in mass-market applications. Smaller producers also face logistical challenges in scaling operations and maintaining consistent flavor profiles. Managing cost efficiency while ensuring product quality and artisanal authenticity remains a core challenge for manufacturers seeking to balance premium pricing with market competitiveness.

Supply Chain and Raw Material Limitations

The availability of quality sea salt and sustainable wood sources used for smoking presents supply chain vulnerabilities. Seasonal fluctuations and environmental factors affecting salt harvesting can disrupt production volumes. Furthermore, regulatory pressures regarding sustainable sourcing and emissions from wood-smoking processes may constrain traditional production methods. Exporters face additional hurdles in meeting varying food safety and labeling standards across regions. These constraints compel producers to invest in traceable sourcing systems and environmentally friendly smoking technologies, increasing operational complexity while maintaining the product’s authentic characteristics in a growing and competitive global market.

Regional Analysis

North America

North America holds the largest share of 36% in the global smoked salt market, driven by strong consumer preference for gourmet and natural food products. The U.S. leads regional consumption, supported by the popularity of barbecue culture, premium seasoning blends, and clean-label packaged foods. Canada also contributes significantly, emphasizing artisanal salt varieties in specialty retail and restaurant sectors. The presence of major producers and growing online retail penetration further strengthen market expansion. Continuous innovation in flavor-infused variants and partnerships with premium foodservice brands sustain North America’s leadership in smoked salt production and consumption.

Europe

Europe accounts for 29% of the global smoked salt market, fueled by high demand for natural flavor enhancers and culinary diversity. Countries such as Germany, France, and the U.K. lead consumption, with smoked salt widely used in gourmet cooking, charcuterie, and specialty bakery applications. The region’s strong focus on organic and sustainable food sourcing supports steady growth. European manufacturers continue to innovate with regional wood-smoked varieties like oak and beechwood salts. The market benefits from established distribution networks and premium retail channels that cater to the expanding clean-label and fine-dining food segments across Western Europe.

Asia Pacific

Asia Pacific captures 22% market share, emerging as the fastest-growing region due to increasing awareness of Western cuisines and flavor experimentation. Countries such as Japan, South Korea, and Australia drive demand through high-end culinary applications and luxury restaurants. India and China are experiencing rising adoption in premium packaged foods and online retail. The growing middle-class population, expanding hospitality industry, and preference for fusion cuisines contribute to robust demand. Local producers and international brands are introducing customized smoked salt variants to align with regional flavor preferences and enhance penetration in emerging urban markets.

Latin America

Latin America holds an 8% market share, supported by expanding use of smoked salt in meat, seafood, and snack applications. Brazil and Mexico are key contributors, leveraging smoked salt in barbecue seasoning and gourmet product lines. Increasing interest in natural and handcrafted ingredients is fostering demand in urban retail markets. Artisanal producers are experimenting with tropical wood varieties and regional flavor infusions, appealing to local tastes. Although adoption remains niche, growing culinary tourism and export opportunities for premium salts are expected to strengthen Latin America’s position within the global smoked salt industry.

Middle East & Africa

The Middle East & Africa region accounts for 5% of the smoked salt market, characterized by gradual growth in premium food consumption and Western culinary adoption. The UAE and South Africa lead regional demand, supported by rising hospitality investments and international restaurant expansion. Smoked salt finds applications in gourmet seasoning, meat processing, and luxury retail segments. Limited domestic production and high import dependency pose challenges, but growing consumer interest in flavor innovation and natural seasonings drives steady market entry opportunities for global and regional salt producers across the region.

Market Segmentations:

By Type

- Sel Gris

- Flakey Salt

- Himalayan Salt

- Fleur de sel

- Speciality Salt

- Others

By Application

- Bakery Confectionary

- Meat Poultry

- Sea Food

- Sauces Savories

- Others

By Distribution Channel

- Mass Merchandisers

- Convenience Stores

- Speciality Stores

- Online Retails

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the smoked salt market is characterized by a mix of established producers and emerging artisanal brands focusing on product differentiation and flavor innovation. Leading companies such as Besmoke, Saltverk, and Jacobsen Salt Co. emphasize sustainable sourcing, premium wood-smoking techniques, and distinctive flavor profiles to strengthen brand positioning. Firms like Frontier Natural Products Co-op and SaltWorks leverage extensive distribution networks and e-commerce channels to enhance global market reach. Meanwhile, emerging players such as Viva Doria and Hepps Salt Co. focus on small-batch production and gourmet packaging to attract health-conscious and culinary-driven consumers. Strategic partnerships with restaurants, gourmet retailers, and food processors are common to expand visibility and build customer loyalty. Companies are also investing in organic certifications, innovative infusions, and eco-friendly packaging to align with evolving consumer trends toward clean-label, natural, and environmentally responsible products, maintaining competitive advantage in a fragmented and innovation-driven market.

Key Player Analysis

- Besmoke

- Viva Doria

- Frontier Natural Products Co-op

- Saltverk

- Laguna Salt Co.

- Jacobsen Salt Co.

- Random Harvest Pty Ltd.

- Maine Sea Salt Company

- SaltWorks

- Hepps Salt Co.

Recent Developments

- In June 2025, Besmoke advanced its PureTech™ filtration technology, which removes up to 95% of carcinogenic PAHs from smoked ingredients, ensuring clean-label smoked salt solutions for food producers

- In October 2024, Eden Mill, an independent distillery from Scotland, launched a new product named Eden Mill Smoked Salt—a sugar syrup designed for cocktails and mocktails. It was made in partnership with East Neuk Salt Company, a small-batch salt producer based in St Monans. According to them, the syrup offered a blend of sweetness, saltiness, and smoky flavor.

- In September 2024, Viva Doria continued to offer its hickory smoked sea salt, which is slowly smoked over hickory wood for a distinctive savory-sweet flavor. The process is designed to produce a balanced, strong but subtle smokiness suitable for meats, fish, vegetables, and specialty cocktails. The product is available in several grain sizes and packages.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The smoked salt market will expand as consumers increasingly prefer natural flavoring ingredients.

- Demand for clean-label and additive-free products will continue to drive premium product development.

- Innovative infusions with herbs, spices, and exotic wood smokes will strengthen brand differentiation.

- E-commerce and direct-to-consumer channels will remain major growth enablers for niche producers.

- Foodservice and gourmet restaurant adoption will rise with the focus on authentic culinary experiences.

- Sustainable sourcing and eco-friendly packaging will become critical factors for market competitiveness.

- Manufacturers will invest in process optimization to reduce production costs and improve consistency.

- Asia Pacific and Latin America will emerge as key growth regions due to rising culinary diversification.

- Strategic collaborations between salt producers and food processors will expand industrial applications.

- Increasing consumer education on flavor quality and health benefits will sustain long-term market growth.