Market Overview:

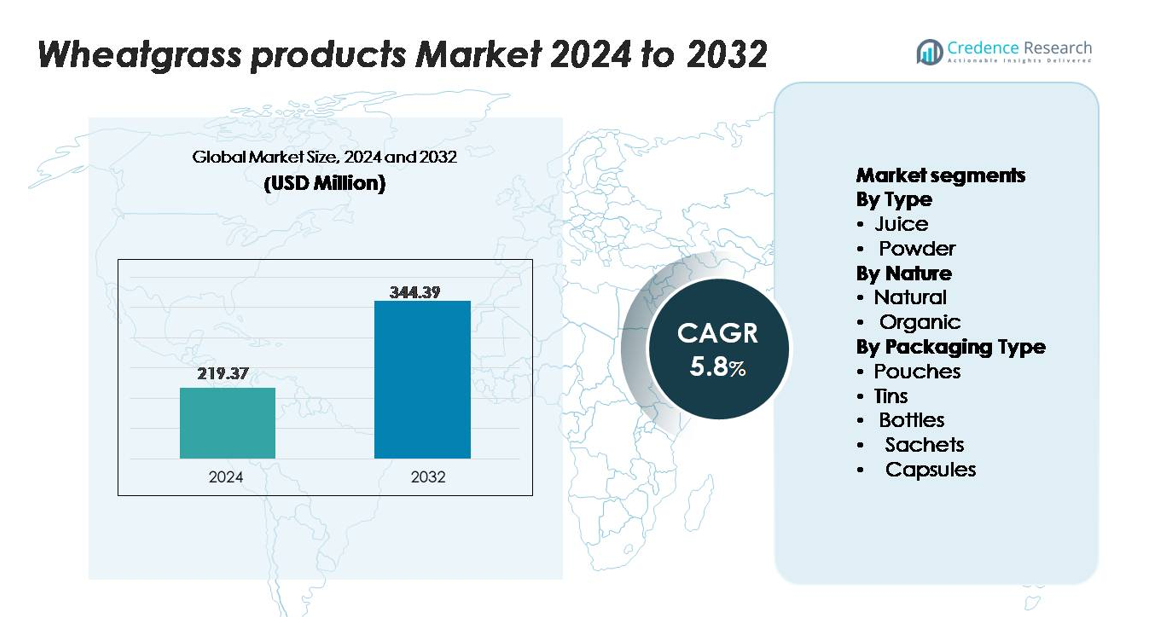

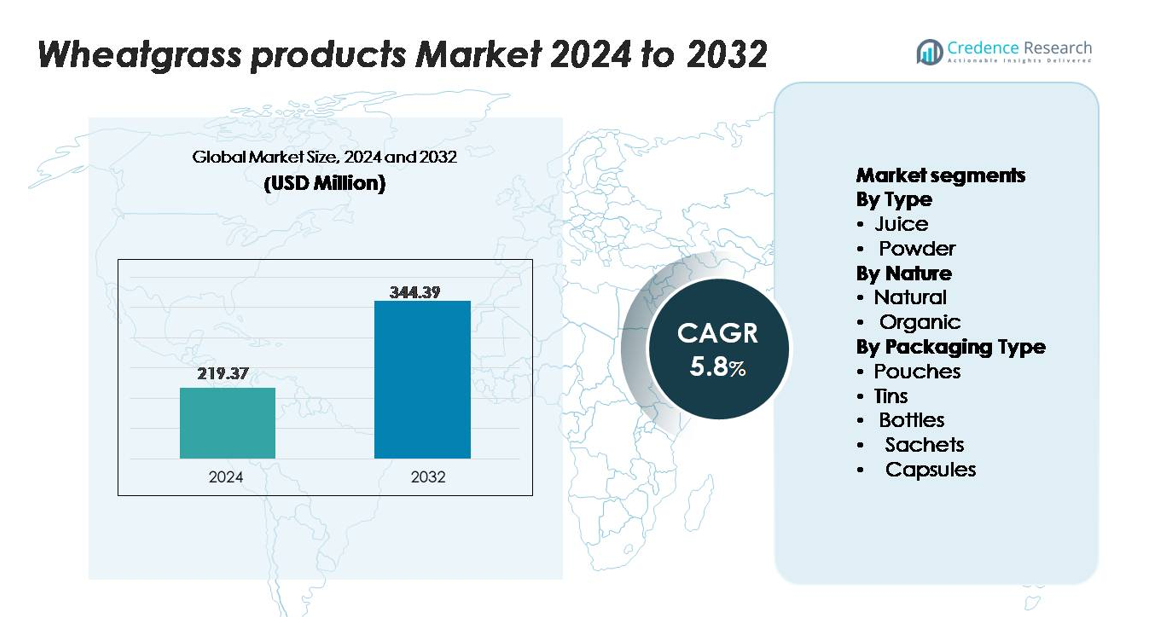

The global wheatgrass products market was valued at USD 219.37 million in 2024 and is projected to reach USD 344.39 million by 2032, reflecting a CAGR of 5.8% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wheatgrass Products Market Size 2024 |

USD 219.37 million |

| Wheatgrass Products Market, CAGR |

5.8% |

| Wheatgrass Products Market Size 2032 |

USD 344.39 million |

The wheatgrass products market features several prominent players, including Naturya, Dr. Berg, Pines International Inc., Nature Bell, Girmes Wheatgrass, Navitas Organics, Amazing Grass, Nutriblade, Terrasoul Superfoods, Synergy Natural, Dynamic Greens Wheatgrass Juice, Myprotein, Now Foods, Herbco International Inc., ABE’S Organics, and E-Phamax. These companies compete through organic-certified offerings, diversified powder and juice formats, and strong online distribution. North America remains the leading regional market with approximately 34% share, supported by high adoption of functional foods and advanced retail networks. Europe, holding around 28%, follows closely due to strong clean-label preferences and expanding nutraceutical consumption.

Market Insights:

- The global wheatgrass products market was valued at USD 219.37 million in 2024 and is projected to reach USD 344.39 million by 2032, expanding at a 5.8% CAGR, supported by rising demand for plant-based functional nutrition.

- Strong market drivers include growing consumer focus on immunity, detoxification, and clean-label wellness, boosting adoption of wheatgrass powders, juices, capsules, and functional blends across mainstream and premium categories.

- Key trends reflect rapid expansion of organic and freeze-dried formats, single-serve sachets, and e-commerce–driven personalization, while powder remains the dominant segment due to stability and formulation versatility.

- Competitive intensity increases as brands emphasize organic certification, nutrient retention technologies, and sustainable packaging, while market restraints include raw material variability, short harvesting cycles, and limited consumer familiarity in emerging markets.

- Regionally, North America leads with ~34% share, followed by Europe at ~28% and Asia-Pacific at ~23%, reflecting strong health awareness and rising integration of wheatgrass in nutraceutical and beverage applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type (Juice, Powder)

Powder-based wheatgrass products remain the dominant sub-segment, capturing the largest share due to their longer shelf life, higher stability, and suitability for diverse formulations including smoothies, capsules, and functional blends. Manufacturers prefer powder formats because they allow concentrated nutrient retention and easier integration into nutraceuticals and food applications. Juice formats continue to expand in fresh-pressed and ready-to-drink categories, driven by rising consumer interest in detox beverages. However, the scalability, portability, and lower transportation costs of powder solidify its lead across global B2B and retail channels.

- For instance, Amazing Grass Organic Wheat Grass Powder is based on an 8-gram (about 1 scoop) serving size, which provides approximately 30 calories, 2 grams of protein, 4 grams of carbohydrates, and 240 milligrams of potassium.

By Nature (Natural, Organic)

The organic sub-segment holds the dominant market share, supported by growing consumer preference for pesticide-free, minimally processed green superfoods. Certified-organic wheatgrass attracts premium demand in nutraceuticals, cold-pressed juice brands, and specialty health stores, where clean-label positioning significantly influences purchase decisions. Regulatory emphasis on chemical-free cultivation and expanding organic farming acreage further enhance availability. Meanwhile, natural variants remain important in mainstream retail and industrial applications, offering cost-effective alternatives. Yet the strong alignment of organic wheatgrass with wellness trends, vegan lifestyles, and toxin-free formulations continues to reinforce its leadership.

- For instance, Pines International’s Organic Wheat Grass Powder is processed within 90 minutes of harvesting under low-temperature dehydration below 107°F (41.6°C) to preserve chlorophyll and enzyme activity. Each standard 3.5 g (1 1/4 teaspoon) serving provides approximately 1 g protein, 10 kcal energy, and about 0.72 mg (4% DV) of iron, which are measures of its nutrient retention.

By Packaging Type (Pouches, Tins, Bottles, Sachets, Capsules)

Pouches represent the leading packaging sub-segment, driven by their lightweight structure, lower material usage, and suitability for both powder and capsule formats. Their barrier properties enhance product freshness and extend shelf life, making them preferred for e-commerce and retail distribution. Sachets are gaining traction for single-serve convenience, especially in travel-friendly and on-the-go nutrition products. Bottles maintain relevance in juice formats, while capsules target nutraceutical buyers seeking precise dosing. Tins serve niche premium categories but lag in volume. Overall, cost efficiency, sustainability, and portability secure pouches as the market leader.

Key Growth Drivers

Rising Consumer Shift Toward Functional and Plant-Based Nutrition

A major growth driver for wheatgrass products is the accelerating consumer transition toward plant-based, functional, and immunity-supporting nutrition. Wheatgrass offers a dense profile of chlorophyll, essential amino acids, antioxidants, and micronutrients, making it desirable in detox formulations, digestive health supplements, and daily wellness routines. With increasing urban stress, dietary imbalances, and lifestyle-related health concerns, consumers consistently seek convenient natural solutions such as powders, juices, tablets, and blends. Retailers expand their superfood assortments, while nutraceutical brands integrate wheatgrass into green mixes, effervescent drinks, and clean-label supplements. This widespread adoption across both preventive healthcare and routine wellness supports steady market expansion.

- For instance, Amazing Grass Organic Wheat Grass Powder typically provides 30 kcal energy, 2 g protein, and 4 g carbohydrates per 8 g serving. Key micronutrients include approximately 240 mg potassium and a naturally rich source of chlorophyll, which can be around 42 mg on some labels.

Expansion of Nutraceuticals and Functional Beverage Categories

The rapid penetration of nutraceuticals, sports nutrition, and functional beverages significantly accelerates demand for wheatgrass-based formulations. Brands increasingly position wheatgrass as a core ingredient in antioxidant-rich drink powders, cold-pressed juices, superfood shots, and wellness tonics. Athletes and fitness-focused consumers adopt wheatgrass for its alkalizing benefits and micronutrient density. Manufacturers invest in micro-milled powders, freeze-dried extracts, and flavor-neutral blends to improve mixability and product performance. Complementary positioning with spirulina, moringa, barley grass, and probiotics enhances cross-category usage. Growing retail placement in pharmacies, health stores, and online wellness platforms strengthens visibility, while private-label lines further broaden affordability and reach.

- For instance, Navitas Organics Superfood+ Greens Blend containing organic moringa, kale, and wheatgrass juice powders provides approximately 167 mg of calcium, 2 g of fiber, and 147 mg of potassium per 6 g serving.

Growing Adoption in Cosmetics, Pet Nutrition, and Natural Household Care

Wheatgrass is increasingly utilized in diverse non-food applications, driving incremental market growth. In personal care, its antioxidant and anti-inflammatory properties make it suitable for skin rejuvenation creams, botanical cleansers, and scalp-nourishing formulations. Brands highlight its natural chlorophyll content and trace minerals to appeal to clean beauty consumers. In pet nutrition, wheatgrass powder is added to digestive support chews, nutrient-enhanced kibble, and feline grass blends. Similarly, natural household categories incorporate wheatgrass extracts in eco-friendly cleaners and air-purifying products. This broadening versatility helps manufacturers diversify revenue streams while reinforcing wheatgrass’s position as a multi-functional, plant-derived ingredient.

Key Trends & Opportunities:

Premiumization Through Organic, Cold-Processed, and Freeze-Dried Formats

Premium product formats represent a major trend shaping innovation in wheatgrass offerings. Consumers increasingly prefer organic-certified, cold-processed, and freeze-dried products that preserve nutrient integrity and flavor profiles more effectively than conventional dehydration methods. Freeze-dried powders maintain higher chlorophyll and enzyme levels, allowing brands to position them as superior-quality superfoods. Cold-pressed juice shots gain traction in wellness cafés and subscription-based detox programs. The opportunity lies in developing differentiated product grades, transparent labeling, and traceability-backed sourcing. Manufacturers leverage contract farming and integrated cultivation facilities to ensure pesticide-free production while tapping into the rising global demand for cleaner, premium green nutrition.

- For instance, Terrasoul Superfoods’ Freeze-Dried Wheatgrass Juice Powder delivers approximately 7 kcal, 1 g protein, and 0.5 g carbohydrates per 4 g serving (which is 2 teaspoons), reflecting the high nutrient density retained through freeze-drying.

Growing Online Penetration and Personalized Wellness Formulations

The surge of digital retail and personalized nutrition platforms opens new opportunities for wheatgrass products. E-commerce brands benefit from high search demand for green superfoods, enabling growth through small-batch offerings, subscription kits, and bundle packs. Personalized wellness companies increasingly use AI-based assessments to recommend wheatgrass powders or capsules tailored to lifestyle, diet, and microbiome profiles. This enhances consumer engagement and drives usage consistency. Online channels also support niche innovations such as flavored wheatgrass shots, effervescent tablets, fortified blends with adaptogens, and functional sachets for on-the-go consumption. Enhanced product education, influencer-driven marketing, and digital detox trends further strengthen this trajectory.

- For instance, Naturya sells its Organic Wheatgrass Powder in 100 g and 200 g packs, with a recommended daily amount of 10g to 15g which can provide chlorophyll, iron, and magnesium.

Key Challenges:

Variability in Raw Material Quality and Supply Chain Constraints

Wheatgrass quality is highly sensitive to agricultural conditions, creating challenges in nutrient consistency, color uniformity, and microbial safety. Variations in soil nutrition, harvest timing, and growing environments affect chlorophyll, enzyme, and antioxidant levels, making standardization difficult for large-scale producers. Additionally, short harvesting cycles and perishability require rapid processing to maintain bioactive compounds. Seasonal fluctuations and limited high-grade organic farming acreage further strain supply chains. Manufacturers must invest in controlled-environment cultivation, quality assurance protocols, and rapid cold-chain processing to ensure reliable output. These complexities increase production costs and limit the scalability of premium product lines.

Limited Consumer Awareness and Misconceptions About Taste and Benefits

Despite its nutritional profile, wheatgrass faces adoption barriers due to misconceptions about its strong taste, grassy aroma, and perceived complexity of use. Casual consumers may underestimate its functional benefits or compare it unfavorably to more familiar superfoods like matcha, spirulina, or moringa. Lack of standardized serving guidelines also leads to confusion around dosage and daily consumption. Brands must address these gaps through palatable flavor innovations, better consumer education, and clear labeling. Blending wheatgrass with fruit extracts, botanicals, or probiotics helps improve acceptance, but persistent sensory concerns and low awareness continue to challenge broader market penetration.

Regional Analysis:

North America

North America accounts for around 34% of the global wheatgrass products market, driven by widespread adoption of functional foods, detox beverages, and organic supplements. Strong retail penetration through health stores, specialty nutrition chains, and e-commerce platforms supports steady demand. The U.S. leads consumption due to high awareness of plant-based wellness, while Canada sees rising interest in cold-pressed juices and superfood blends. Innovation in freeze-dried powders, flavored shots, and clean-label formulations strengthens category expansion. Regulatory support for organic farming and increasing vegan population further enhance the region’s competitive position.

Europe

Europe represents approximately 28% of market share, supported by strong regulatory focus on organic certification, clean-label nutrition, and sustainable sourcing. Germany, the U.K., and France lead consumption through established wellness retail networks and high acceptance of superfoods. Demand for wheatgrass powders and capsules continues to increase across nutraceutical and functional beverage applications. The region benefits from expanding organic agriculture and heightened consumer focus on digestive and immune health. Private-label offerings and functional food innovation contribute to accelerating category momentum, while regional manufacturers emphasize traceability and premium cold-processed formats to differentiate offerings.

Asia-Pacific

Asia-Pacific captures nearly 23% of the global market, fueled by rising health consciousness, urbanization, and increased disposable income. Countries like Japan, China, South Korea, and India witness rapid uptake of wheatgrass in nutraceuticals, smoothies, herbal supplements, and natural detox products. Local manufacturers leverage traditional wellness associations to introduce affordable powder and capsule variants. Expanding e-commerce access and demand for preventive health solutions further strengthen adoption. Growing interest in organic cultivation and superfood exports enhances regional production capabilities, positioning Asia-Pacific as one of the fastest-growing markets for wheatgrass-based functional products.

Latin America

Latin America holds approximately 8% market share, driven by rising interest in natural detox solutions, plant-based diets, and functional beverages. Brazil and Mexico lead adoption, supported by expanding health-store networks and growing consumer preference for nutrient-rich superfoods. Local brands increasingly incorporate wheatgrass into smoothie powders, wellness mixes, and herbal supplements. Limited regional production makes markets reliant on imports, particularly from the U.S. and Europe. However, improving awareness of organic agriculture and the expansion of premium product lines in urban centers contribute to stable long-term growth opportunities.

Middle East & Africa

The Middle East & Africa region represents nearly 7% of global market share, supported by increasing interest in holistic health, plant-based nutrition, and natural detox solutions. Urban markets such as the UAE, Saudi Arabia, and South Africa show rising demand for wheatgrass juices, tablets, and powder sachets through pharmacies and specialty retailers. Growing expatriate populations and expanding online wellness platforms further boost visibility. However, limited local cultivation and higher import dependency constrain broader market penetration. Despite these constraints, premium positioning and sustained consumer shift toward natural wellness products support steady regional growth.

Market Segmentations:

By Type

By Nature

By Packaging Type

- Pouches

- Tins

- Bottles

- Sachets

- Capsules

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the wheatgrass products market is moderately fragmented, with a mix of established nutraceutical companies, specialty superfood brands, and emerging organic producers competing for market share. Leading players focus on expanding their portfolios across powder, juice, capsule, and ready-to-drink formats while emphasizing organic certification, clean-label positioning, and high-nutrient retention through cold-processed or freeze-dried technologies. Many companies adopt contract farming and vertically integrated cultivation models to ensure consistent quality and traceability. Strategic priorities include geographic expansion through e-commerce channels, partnerships with wellness retailers, and product innovations such as flavored shots, fortified blends, and single-serve sachets. Private-label competition is also increasing, particularly in North America and Europe, as retailers introduce cost-effective alternatives. Branding differentiation, sustainable packaging, and transparent sourcing remain critical competitive levers. As consumer awareness grows, companies that align with premium organic standards, diversify distribution, and emphasize scientific validation of health benefits maintain stronger competitive positioning in the global wheatgrass products market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Naturya

- Berg

- Pines International Inc.

- Nature Bell

- Girmes Wheatgrass

- Navitas Organics

- Amazing Grass

- Nutriblade

- Terrasoul Superfoods

- Synergy Natural

Recent Developments:

- In March 2025, Sunfood announced a strategic partnership with Amazing Grass to co-develop and jointly market a line of organic wheatgrass powder products specifically targeting North American retailers. This partnership combines the strengths of both companies, leveraging Sunfood’s expertise in superfood sourcing and Amazing Grass’s established distribution networks and brand presence in the North American market. The collaboration aims to expand the reach and availability of premium organic wheatgrass products across major retail channels in the region.

- In January 2025, Terrasoul Superfoods unveiled a new 100% organic wheatgrass powder line featuring enhanced freshness and a dedicated premium packaging strategy. This product launch represents the company’s commitment to maintaining premium quality standards and improving the consumer experience through better packaging solutions that preserve the nutritional integrity of the wheatgrass powder.

- In October 2024, BulkSupplements announced the acquisition of a wheatgrass powder production facility from Green Foods Corporation. This strategic acquisition significantly expanded BulkSupplements’ manufacturing capacity, enabling the company to increase production volumes and meet the rising demand for wheatgrass products in the market. The acquisition strengthens BulkSupplements’ competitive position by providing greater control over the supply chain and production capabilities

Report Coverage:

The research report offers an in-depth analysis based on Type, Nature, Packaging type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will continue expanding as consumers increasingly integrate wheatgrass into daily wellness, sports nutrition, and detox routines.

- Organic and clean-label wheatgrass products will gain stronger momentum, driven by stricter quality standards and rising preference for chemical-free ingredients.

- Freeze-dried and cold-processed formats will see accelerated adoption due to superior nutrient retention and premium positioning.

- E-commerce and subscription-based health platforms will strengthen distribution, enabling personalized product bundles and recurring purchases.

- Wheatgrass will gain broader applications in functional beverages, nutraceutical formulations, and blend-based superfood powders.

- Innovation will increase in flavored shots, ready-to-drink mixes, and single-serve sachets targeting on-the-go consumers.

- Sustainable packaging, especially pouches and biodegradable formats, will become a competitive differentiator among leading brands.

- Expansion of organic farming and controlled-environment cultivation will improve product consistency and supply reliability.

- Emerging markets such as India, China, and Southeast Asia will drive faster growth through rising health awareness and urbanization.

- Companies will intensify investments in branding, scientific validation, and premium-grade certifications to enhance market competitiveness.