Market overview

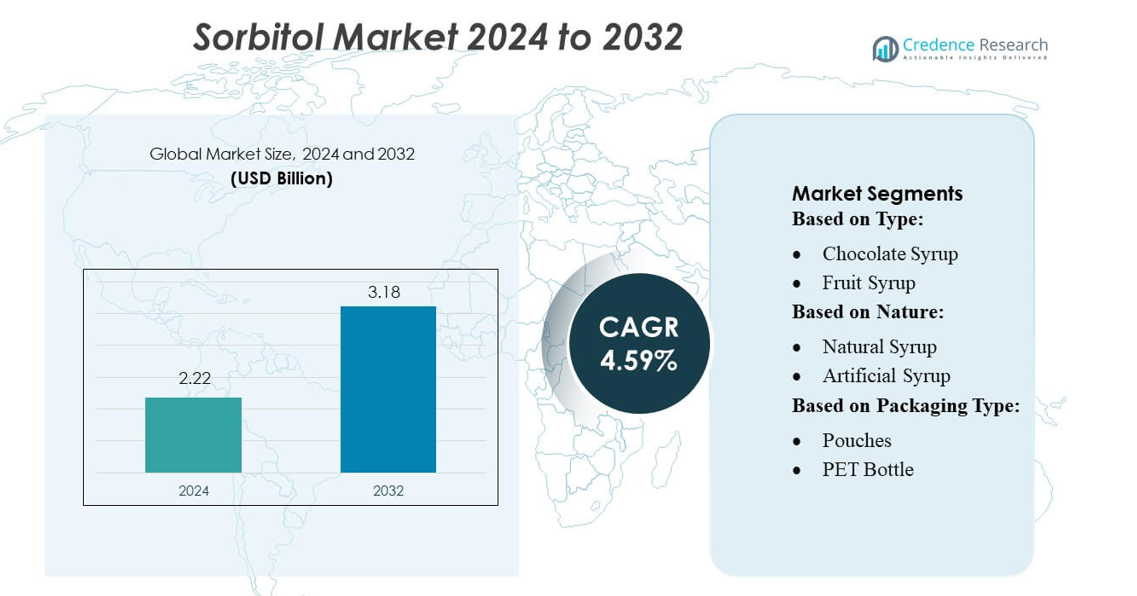

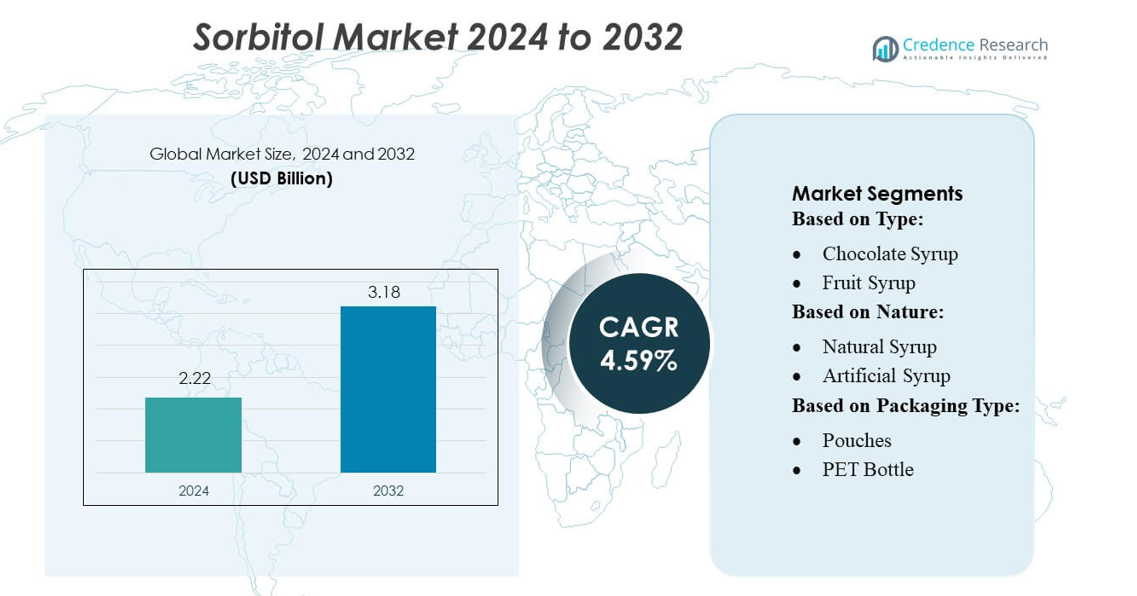

Sorbitol Market size was valued USD 2.22 billion in 2024 and is anticipated to reach USD 3.18 billion by 2032, at a CAGR of 4.59% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sorbitol Market Size 2024 |

USD 2.22 billion |

| Sorbitol Market, CAGR |

4.59% |

| Sorbitol Market Size 2032 |

USD 3.18 billion |

The sorbitol market features strong competition among leading global manufacturers, including Roquette Frères, ADM, Cargill Incorporated, Gulshan Polyols Ltd., Ecogreen Oleochemicals GmbH, DuPont, Merck KGaA, SPI Pharma, American International Foods, Inc., and Qinhuangdao Lihua Starch Co., Ltd., each expanding capabilities across food, pharmaceutical, and personal care applications. Asia-Pacific stands as the leading region, accounting for approximately 42–45% of total market share, supported by large-scale production capacity, abundant raw material availability, and rapidly growing consumption in end-use industries. Continuous investments in technology, sustainability initiatives, and product innovation further reinforce the leadership of these companies in the global sorbitol landscape.

Market Insights

- The Sorbitol Market was valued at USD 2.22 billion in 2024 and is projected to reach USD 3.18 billion by 2032, registering a CAGR of 4.59% during the forecast period.

- Rising demand for low-calorie sweeteners in food, pharmaceutical, and personal care applications continues to drive market expansion, supported by increasing consumer preference for healthier formulations.

- The market is witnessing notable trends such as advancements in bio-based production, growing use of sorbitol in oral care, and sustained innovation by leading players to enhance purity and application versatility.

- Challenges emerge from fluctuating raw material prices and stringent regulatory frameworks, which may limit operational flexibility for manufacturers across key markets.

- Asia-Pacific leads the global landscape with 42–45% market share, while liquid sorbitol remains the dominant segment with the highest consumption; growth is reinforced by strong industrial capacity, expanding end-use sectors, and competitive pricing across major regional producers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The sorbitol market demonstrates strong adoption across type categories, with fruit syrup emerging as the dominant sub-segment, accounting for the largest market share due to its extensive use in confectionery, bakery, and beverage applications. Manufacturers prefer fruit syrup-based sorbitol for its higher stability, natural sweetness profile, and compatibility with clean-label product formulations. Demand is further driven by its role as a low-calorie sugar substitute and humectant in processed foods. Chocolate syrup and maple syrup variants continue to grow steadily, supported by rising utilization in dessert toppings and premium food products.

- For instance, Roquette Frères operates more than 30 manufacturing sites globally and produces sorbitol at its Lestrem facility, which is recognized as one of the world’s largest polyol production complexes, supporting large-scale supply for fruit syrup applications.

By Nature

Within the nature-based segmentation, natural syrup leads the market with a major share, supported by strong consumer preference for plant-derived sweeteners and increasing regulatory encouragement for clean-label formulations. Food and beverage producers increasingly adopt natural sorbitol to replace synthetic ingredients, leveraging its reduced glycemic response and multifunctional properties such as moisture retention and texture enhancement. Artificial syrup sorbitol maintains relevance due to cost efficiency and consistent quality, but its growth remains comparatively moderate as brands shift toward more sustainable and health-supportive alternatives in product development.

- For instance, ADM processes more than 2.4 million bushels of corn per day across its global wet-milling network, supplying the carbohydrate feedstocks required for large-scale sorbitol production, and operates 47 innovation centers worldwide where teams develop advanced carbohydrate-conversion technologies.

By Packaging Type

In packaging type segmentation, PET bottles hold the dominant market share, driven by their durability, lightweight structure, and superior barrier properties that maintain sorbitol stability during storage and transport. Manufacturers prefer PET due to cost-effectiveness, recyclability, and compatibility with bulk distribution channels. Pouches are gaining traction for their convenience and suitability for single-use or small-portion formats, particularly in foodservice applications. Glass bottles retain a niche presence, primarily in premium and pharmaceutical-grade sorbitol products where product purity, chemical resistance, and premium branding are prioritized.

Key Growth Drivers

Expanding Applications Across Food & Beverage Formulations

The sorbitol market grows as manufacturers increasingly use the ingredient in reduced-sugar and sugar-free products due to its sweetness profile, humectant functionality, and caloric advantage over sucrose. Food producers strengthen product stability and texture by leveraging sorbitol in confectionery, bakery, and beverage formulations. Rising consumer demand for healthier sweetening agents accelerates its penetration in fortified and functional foods. Regulatory support for polyol-based sweeteners across major economies further reinforces adoption, especially as brands diversify their low-calorie product portfolios.

- For instance, SPI Pharma offers Sorbogem SD 250 and SD 500, spray-dried crystalline sorbitol grades with nominal particle sizes of 250 µm and 500 µm, respectively, which deliver excellent flow and superior compactibility for direct-compression tablets.

Rising Demand from Pharmaceutical & Personal Care Industries

Pharmaceutical manufacturers drive demand as sorbitol serves as a stabilizer, excipient, and sweetener in syrups, tablets, and nutraceuticals. Its non-cariogenic, moisture-retaining, and solubility-enhancing properties position it as an essential ingredient in oral care and dermatology products. Cosmetic brands incorporate sorbitol into lotions, creams, gels, and toothpaste to enhance texture and hydration. The continued shift toward gentle, skin-friendly formulations in personal care and expanding OTC medication consumption globally significantly boost sorbitol uptake across these high-volume industries.

- For instance, Ecogreen Oleochemicals’ Sorbitol TF grade is spray-dried to 98% purity, remains stable to 180 °C, and resists Maillard browning even at low and high pH, making it ideal for oral-care and dermatology formulations.

Increasing Use of Sorbitol as a Biomass-Derived Chemical Intermediate

Sorbitol’s role as a platform chemical for producing bio-based derivatives—such as isosorbide, propylene glycol, and vitamin C intermediates—fuels long-term market expansion. The global focus on decarbonization and sustainable chemical production encourages manufacturers to adopt sorbitol as a renewable feedstock. Its cost-effective conversion and compatibility with green chemistry processes position it as a preferred input for polymer, resin, and specialty chemical producers. Growing investment in bio-refineries and renewable raw material value chains supports rising industrial demand globally.

Key Trends & Opportunities

Transition Toward Bio-Based and Non-GMO Sorbitol

Manufacturers capitalize on rising demand for naturally sourced, non-GMO, and clean-label sweetening agents. Production strategies increasingly focus on maize-, wheat-, and cassava-based feedstock certified for sustainability. Investment in green processing technologies and enzymatic conversion methods enhances yield efficiency, reducing environmental footprint. The clean-label movement across food, nutraceuticals, and cosmetics creates an opportunity for producers offering verified eco-friendly sorbitol grades that meet stringent consumer and regulatory expectations.

- For instance, its Parteck® SI 400 LEX sorbitol grade is directly-compressible and meets Ph. Eur., BP, NF, and JP standards, offering a melting point of 94–96 °C and a solubility of 2,350 g/L in water.

Growing Adoption in Bioplastics and Sustainable Polymers

A key market opportunity emerges as sorbitol-derived isosorbide gains traction in bioplastics, particularly in bio-polyethylene terephthalate (bio-PET) and polycarbonates. Brands increasingly evaluate renewable polymers to meet circular-economy targets. Sorbitol serves as a cost-efficient pathway to high-performance, bio-based monomers that enhance transparency, thermal stability, and mechanical properties. The expansion of sustainable packaging, automotive lightweighting initiatives, and green construction materials creates a strong demand outlook for sorbitol-based chemical intermediates.

- For instance, Gulshan Polyols Ltd. produces sorbitol at its integrated corn-to-sorbitol facility in Jhagadia, Gujarat, with a nameplate capacity of 72,000 MTPA, according to its annual report.

Expansion of Sorbitol in Oral Care and Dermatology Innovations

Opportunities grow as global oral-care and skincare manufacturers develop high-hydration and sensitive-skin formulations. Sorbitol enhances moisture retention, improves product aesthetics, and supports compatibility with active ingredients used in toothpaste, mouthwashes, gels, and serums. Rising consumer interest in premium and dermatologically tested products drives stronger use of polyols for texture optimization. As companies expand portfolios into sulfate-free, alcohol-free, and mild-care formulations, sorbitol becomes a critical ingredient for performance enhancement.

Key Challenges

Volatility in Raw Material Prices and Supply Chain Constraints

Sorbitol production heavily depends on agricultural feedstock such as corn, wheat, and cassava, making the market vulnerable to fluctuations caused by weather disruptions, crop disease, and geopolitical trade issues. Unpredictable price movements in raw materials directly elevate production costs for manufacturers. Additionally, supply chain disruptions—especially in major producing regions—affect the consistency of sorbitol availability, limiting the ability of downstream industries to maintain stable procurement and long-term pricing strategies.

Availability of Alternative Sweeteners and Polyols

The market faces competitive pressure from alternative low-calorie sweeteners and polyols such as xylitol, maltitol, and erythritol, which offer similar functional advantages. Food and beverage manufacturers often evaluate substitutes based on cost, flavor profile, digestion tolerance, and formulation performance. The increasing R&D investment in next-generation sweeteners with improved taste and reduced digestive side effects intensifies competition. As consumers seek natural sweetness with fewer gastrointestinal concerns, these alternatives can limit wider sorbitol adoption.

Regional Analysis

North America

North America holds a significant position in the global sorbitol market, capturing approximately 18–20% of total share, driven by strong penetration of pharmaceutical excipients and sugar-free food and beverage formulations. The region benefits from advanced manufacturing capabilities, stringent quality standards, and rising consumer preference for low-calorie sweeteners. Increasing adoption of sorbitol in oral care, particularly toothpaste and mouthwash, further strengthens demand. Moreover, innovation in personal care formulations by leading manufacturers supports steady market expansion. Growth remains reinforced by rising health awareness and the availability of well-established distribution channels across the United States and Canada.

Europe

Europe accounts for around 22–24% of the global sorbitol market, supported by robust demand from food processing, personal care, and pharmaceutical industries. The region’s regulatory focus on reducing sugar intake has accelerated the adoption of sorbitol in confectionery, bakery, and diet-friendly beverages. Strong presence of multinational cosmetic brands further enhances consumption in skincare and haircare products. Additionally, expansion of bio-based chemical production across Germany, France, and the Netherlands fosters steady market growth. Europe’s well-developed manufacturing infrastructure and rising consumer interest in clean-label ingredients continue to sustain its prominent market share and long-term growth outlook.

Asia-Pacific

Asia-Pacific dominates the global sorbitol market with the largest share of 42–45%, driven by expanding food and beverage industries, increasing diabetic population, and cost-effective manufacturing capabilities. China and India serve as major production hubs due to abundant raw material availability and large-scale industrial output. Rising demand for personal care products, growing awareness of sugar substitutes, and rapid urbanization further propel regional consumption. Pharmaceutical applications continue to accelerate, supported by expanding generic drug production. The region’s dynamic economic environment and increasing investments in bioprocessing technologies reinforce Asia-Pacific’s leadership in the global sorbitol landscape.

Latin America

Latin America holds around 8–10% of the global sorbitol market, with growth supported by increasing use in confectionery, beverages, and personal care formulations. Brazil and Mexico lead regional consumption due to a growing middle-class population and rising demand for low-calorie sweeteners. Expanding usage in oral care and cosmetics further boosts adoption across major brands operating in the region. Additionally, the region’s gradual shift toward healthier diets is encouraging manufacturers to incorporate sorbitol into processed foods. Although production capacity remains limited, improving industrial infrastructure and trade partnerships support steady market expansion.

Middle East & Africa

The Middle East & Africa region represents approximately 6–8% of the global sorbitol market, driven by increasing demand for processed foods, confectionery products, and affordable personal care items. Growing urbanization and changing consumer lifestyles contribute to higher adoption of sugar substitutes, including sorbitol. Pharmaceutical applications continue to expand, particularly in countries with developing healthcare infrastructure. While domestic production remains limited, rising imports and strategic partnerships with global suppliers sustain market availability. Additionally, increasing investments in food processing and retail modernization support a gradual upward trend in sorbitol consumption across key MEA economies.

Market Segmentations:

By Type:

- Chocolate Syrup

- Fruit Syrup

By Nature:

- Natural Syrup

- Artificial Syrup

By Packaging Type:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the sorbitol market remains moderately consolidated, with key players such as Roquette Frères, ADM, SPI Pharma, Ecogreen Oleochemicals GmbH, Cargill Incorporated, Merck KGaA, American International Foods, Inc., Gulshan Polyols Ltd., DuPont, and Qinhuangdao Lihua Starch Co., Ltd. The sorbitol market remains moderately consolidated, shaped by continuous advancements in production technologies, expanding application scope, and increasing focus on sustainable ingredient development. Manufacturers are prioritizing high-purity grades to meet stringent requirements across pharmaceuticals, food and beverages, and personal care formulations. The market is witnessing growing investments in efficient starch conversion processes, capacity expansion in cost-effective production regions, and product innovation aimed at improving stability and performance. Strategic collaborations, long-term supply agreements, and diversification of end-use portfolios further support competitive positioning. Companies are also strengthening distribution networks and enhancing regulatory compliance to maintain global competitiveness and address rising consumer demand for low-calorie, clean-label solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Roquette Frères

- ADM

- SPI Pharma

- Ecogreen Oleochemicals GmbH

- Cargill Incorporated

- Merck KGaA

- American International Foods, Inc.

- Gulshan Polyols Ltd.

- DuPont

- Qinhuangdao Lihua Starch Co., Ltd.

Recent Developments

- In January 2024, Sanstar Limited announced its capacity expansion at the Dhule facility by an additional 1,000 tons per day for maize-based specialty products, including sorbitol, to meet rising global demand for plant-based ingredients.

- In November 2023, Valeo Foods launched a new maple syrup range called Maple Crest Maple Syrup in the UK. This new product is a dark, robust-flavored syrup priced at for a 330g package, aimed at helping the company sell Canadian syrups to UK consumers.

- In November 2023, the Canadian Maple Company launched a new digital platform to improve its export business by enabling direct-to-consumer sales and ensuring product authenticity. This move leverages digital innovation to expand its market reach and connect with global consumers more efficiently

Report Coverage

The research report offers an in-depth analysis based on Type, Nature, Packaging Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience rising demand as food and beverage manufacturers increasingly adopt sorbitol as a preferred low-calorie sweetener.

- Pharmaceutical applications will expand due to growing utilization of sorbitol in formulations such as syrups, tablets, and oral care products.

- Personal care and cosmetics will drive steady growth as brands prioritize humectants that enhance texture and moisture retention.

- Manufacturing capacity will increase across Asia-Pacific as producers invest in cost-efficient starch processing technologies.

- Innovation in bio-based and sustainable production methods will strengthen the market’s environmental positioning.

- Regulatory support for sugar reduction in packaged foods will accelerate adoption across global markets.

- Product diversification will intensify as companies introduce high-purity and application-specific sorbitol grades.

- Supply chain integration will improve as manufacturers optimize raw material sourcing and distribution networks.

- Strategic partnerships and mergers will rise as companies aim to strengthen geographic presence and technology capabilities.

- Market competitiveness will heighten as players focus on quality certification, consistency, and adherence to global standards.