Market Overview

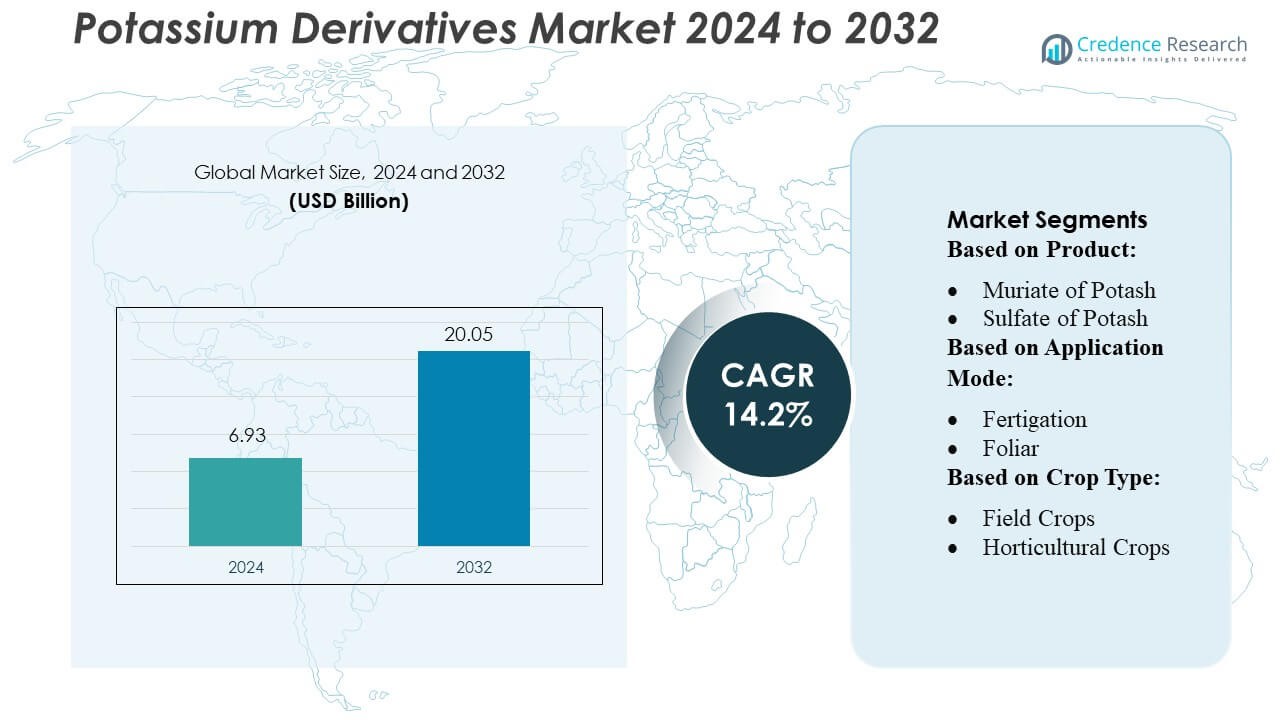

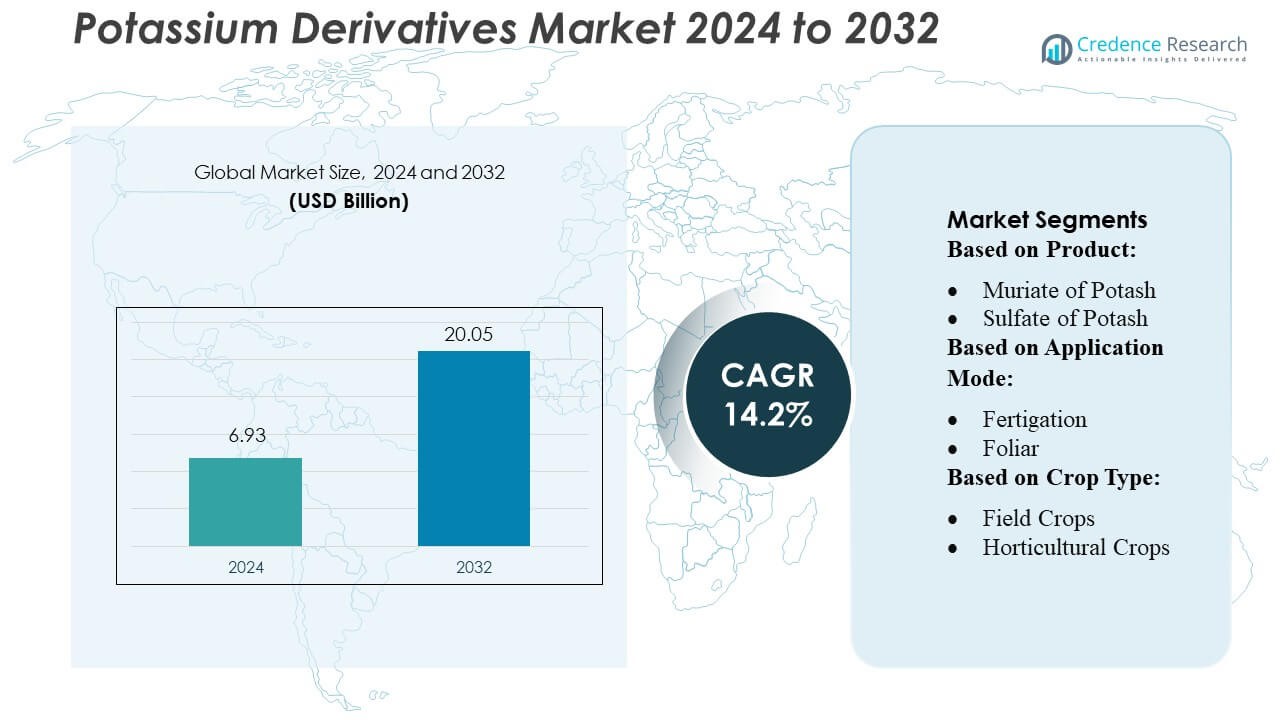

Potassium Derivatives Market size was valued USD 6.93 billion in 2024 and is anticipated to reach USD 20.05 billion by 2032, at a CAGR of 14.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Potassium Derivatives Market Size 2024 |

USD 6.93 Billion |

| Potassium Derivatives Market, CAGR |

14.2% |

| Potassium Derivatives Market Size 2032 |

USD 20.05 Billion |

The potassium derivatives market features strong competition among major global producers, including Eurochem, Intrepid Potash Inc., Rio Tinto Ltd., Compass Minerals Intl. Ltd., Encanto Potash Corp., Red Metal Ltd., Uralkali, Mosaic Company, BHP Billiton Ltd., and JSC Belaruskali. These companies compete aggressively on capacity expansion, cost-efficient extraction, and downstream purification to supply both fertilizer and industrial markets. They also emphasize sustainability by investing in low-emission mining technologies and circular waste management. North America currently leads the market, holding approximately 40% of global revenue, driven by a mature agricultural sector and robust demand from chemical and pharmaceutical industries.

Market Insights

- The Potassium Derivatives Market was valued at USD 6.93 billion in 2024 and is projected to reach USD 20.05 billion by 2032, registering a 14.2% CAGR during the forecast period.

- Market growth is driven by rising fertilizer consumption, increasing demand for high-purity potassium compounds, and expanding industrial applications across chemicals, pharmaceuticals, and specialty materials.

- Key trends include rapid adoption of low-chloride potassium derivatives, sustainability-focused production upgrades, and capacity expansion by major players to strengthen global supply.

- Competitive intensity remains high as leading producers enhance extraction efficiency, invest in cleaner technologies, and diversify portfolios; however, high production costs and environmental regulations act as restraints.

- Regionally, North America leads with around 40% market share, while Asia Pacific shows the fastest growth; the fertilizer segment remains the dominant application, accounting for the largest share of total potassium derivative consumption.

Market Segmentation Analysis:

By Product

The product segment in the potassium derivatives market is dominated by Muriate of Potash (MOP), accounting for over 65% of total market share, driven by its cost-effectiveness and high potassium content suitable for large-scale farming. MOP remains the preferred option across major agricultural economies due to its wide applicability in staple crops such as cereals and oilseeds. Demand strengthens further with increasing fertilizer consumption in Asia-Pacific and expanding acreage of potassium-responsive crops. Sulfate of Potash (SOP) grows steadily in high-value horticulture due to its chloride-free nature, while other potassium derivatives serve niche and specialty applications.

- For instance, EuroChem produced over 3 million tonnes of MOP in 2023 across its Usolskiy and VolgaKaliy sites. EuroChem is further expanding capacity — it recently broke ground on a second flotation line with an annual capacity of 1.8 million tonnes, raising its total planned KCl production to 4.7 million tonnes per year by 2027.

By Application Mode

The application mode segment is led by Soil application, holding around 55% of the market share, supported by its extensive use in traditional farming systems and broad compatibility with solid fertilizers like MOP and SOP. Soil-based application remains dominant due to its simplicity, lower operational cost, and suitability for widespread field crop cultivation. Fertigation is the fastest-growing mode as precision agriculture and micro-irrigation systems expand, particularly in horticulture. Foliar application maintains moderate adoption, driven by the need for rapid nutrient correction and enhanced uptake efficiency in high-value crops.

- For instance, Intrepid Potash Inc. completed its Eddy Shaft Brine Extraction Project in late 2023, enabling extraction from a 270-million-gallon brine pool concentrated at over 9% KCl, with an extraction rate of around 750 gallons per minute.

By Crop Type

The crop type segment is dominated by Field Crops, contributing over 60% of total market share, supported by large-scale production of cereals, pulses, and oilseeds that require substantial potassium inputs for growth, yield improvement, and stress tolerance. Rising food demand and increased adoption of balanced fertilizer practices further reinforce this dominance. Horticultural crops show strong growth driven by expanding fruit and vegetable cultivation under protected farming. Turf and ornamental applications remain smaller but steadily increase with landscaping activities and urban greenery development.

Key Growth Drivers

- Expanding Use in Agricultural Fertilizers

The potassium derivatives market grows steadily as global agriculture intensifies its focus on high-yield farming and soil nutrient optimization. Potassium chloride, potassium sulfate, and potassium nitrate remain essential inputs for enhancing crop resilience, improving water uptake, and boosting overall plant productivity. Rising population-driven food demand and the rapid adoption of precision farming practices further stimulate consumption. Additionally, emerging economies increase fertilizer application rates to reduce yield gaps, creating sustained demand for potassium derivatives across diverse crop categories.

- For instance, Rio Tinto Ltd., through its joint venture in the KP 405 project with North Atlantic Potash, holds an inferred resource of 1.4 billion tonnes at an average grade of 31% KCl.

- Increasing Adoption in Industrial Applications

Industrial demand strengthens the potassium derivatives market, driven by their use in pharmaceuticals, glass manufacturing, detergents, and specialty chemicals. Potassium carbonate and potassium hydroxide play critical roles in processes requiring high purity and strong alkalinity. The shift toward advanced materials, cleaner chemical reactions, and high-performance formulations accelerates industrial uptake. Growth in sectors such as cosmetics, electrolytes for batteries, and specialty cleaning solutions further broadens application scope, ensuring consistent, long-term consumption across manufacturing and processing industries worldwide.

- For instance, Compass Minerals produces its signature Protassium+™ SOP, which contains about 50% potassium (K₂O) and 47% sulfate sulfur, while maintaining less than 1% chloride, as detailed in its “Making of Protassium+” briefing.

- Rising Demand for Eco-Friendly and High-Quality Inputs

Environmental sustainability initiatives significantly boost demand for potassium derivatives, particularly those with low chloride content and minimal ecological impact. Regulatory pressure to reduce soil degradation and promote cleaner agricultural inputs encourages farmers and industries to shift toward more environmentally acceptable potassium compounds. The market benefits from the growing preference for organic fertilizers, water-efficient crops, and high-purity industrial chemicals. As end users prioritize efficiency, quality, and lower emissions, manufacturers increasingly innovate cleaner production technologies, supporting faster adoption of sustainable potassium-based solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Trends & Opportunities

1. Transition Toward Specialty and High-Purity Derivatives

The market witnesses rising interest in high-purity potassium derivatives used in pharmaceuticals, electronics, and precision agriculture. Manufacturers invest in advanced refining technologies to meet stringent quality and safety standards. This trend creates opportunities for companies offering value-added formulations such as ultra-pure potassium nitrate, pharmaceutical-grade potassium chloride, and specialty potassium sulfate. Growing demand for precise nutrient delivery systems and high-performance industrial chemicals strengthens this segment, attracting premium pricing and expanding long-term revenue potential.

- For instance, Encanto Potash Corp. (EPC) is advancing a uniquely scalable solution-mining model to serve that demand. Encanto’s technical reports, including its 2017 Preliminary Economic Assessment (PEA), detail a development plan that targets an eventual annual extraction rate of 3.4 million tonnes of MOP production.

2. Market Expansion in Emerging Economies

Emerging regions present substantial opportunities as governments invest heavily in modernizing agriculture and strengthening domestic chemical production. Increasing fertilizer consumption, expanding manufacturing bases, and supportive trade policies drive higher uptake of potassium derivatives. Infrastructure improvements and technology transfer initiatives further ease market penetration. Companies entering these markets benefit from rising demand for balanced crop nutrition, industrial diversification, and the development of localized production capacities that reduce dependence on imported raw materials.

- For instance, Red Metal Ltd. has evaluated solution-mining potential in its Colorado potash project, where subsurface potash beds reach 15–30 meters in cumulative thickness, as indicated from historical oil-well logs.

3. Innovation in Sustainable Extraction and Production

Growing environmental scrutiny creates opportunities for innovations that minimize energy use and emissions in potassium production. Companies exploring low-carbon processing, waste recovery, and alternative brine or mineral sources gain competitive advantages. The development of greener extraction technologies and circular manufacturing practices enhances brand credibility and regulatory compliance. As end users increasingly prefer products with superior sustainability credentials, producers that adopt environmentally responsible methods stand to capture new customer segments and strengthen long-term market positioning.

Key Challenges

1. Volatile Raw Material and Energy Costs

The potassium derivatives market faces uncertainty due to fluctuating extraction, mining, and energy costs, which directly affect production economics. Variations in global potash prices, transportation expenses, and fuel costs create margin pressure for manufacturers. These fluctuations often lead to supply chain disruptions, higher operational risks, and inconsistent pricing structures. Companies must manage cost volatility through long-term contracts, diversification of supply sources, and efficiency improvements to maintain competitiveness and ensure stable product availability.

2. Regulatory and Environmental Compliance Pressure

Stringent environmental regulations governing mining operations, waste disposal, and chemical production present significant challenges for industry players. Compliance requirements increase operational complexity and elevate investment needs for cleaner technologies and monitoring systems. Restrictions on chloride-based fertilizers in certain regions and rising scrutiny of industrial emissions further constrain market expansion. Companies must balance regulatory demands with cost efficiency while adopting sustainable practices to meet evolving environmental standards without compromising productivity or profitability.

Regional Analysis

North America

North America holds around 40% of the potassium derivatives market, supported by advanced agriculture, strong demand for potash-based fertilizers, and a well-established industrial sector. The U.S. leads consumption due to large-scale farming and widespread adoption of precision nutrient management. The region also benefits from strong chemical and pharmaceutical manufacturing that uses potassium hydroxide, carbonate, and nitrate. Continued investments in sustainable fertilizers and efficient crop production systems help maintain steady market growth. Imports remain high despite some domestic potash production, keeping demand consistent across key applications.

Asia Pacific

Asia Pacific represents around 38–39% of the global market, driven by extensive agriculture in China, India, and Southeast Asia. Large populations and rising food demand push governments and farmers to increase fertilizer usage, especially potassium sulfate and nitrate for high-value crops. Industrial growth in chemicals, electronics, and manufacturing also supports higher consumption of potassium-based compounds. Rapid urbanization and improving agricultural infrastructure contribute to long-term expansion. The region remains the fastest-growing market due to strong domestic production capacities and heavy reliance on potassium derivatives for both farming and industrial processes.

Europe

Europe accounts for around 27% of the potassium derivatives market, supported by highly regulated and technology-driven agriculture. Farmers across Germany, France, and the UK prefer chloride-free potassium derivatives to maintain soil balance and support high-value crops. The region’s advanced chemical, pharmaceutical, and food industries create continuous demand for high-quality potassium compounds. Strict sustainability regulations further encourage the use of environmentally safe fertilizers and industrial inputs. Despite slow population growth, Europe maintains stable consumption due to its productivity-focused farming practices and high standards for nutrient efficiency.

Latin America

Latin America holds a smaller but expanding share of the market, driven by the region’s strong export agriculture sector. Countries such as Brazil, Argentina, and Chile significantly increase their use of potassium chloride and sulfate to boost crops like soybeans, sugarcane, and fruits. Demand grows steadily as governments promote fertilizer accessibility and invest in soil-nutrient improvement. Although the region’s exact market share is lower than major global players, ongoing agricultural expansion and reliance on high-yield farming practices make Latin America an important growth contributor in the potassium derivatives market.

Middle East & Africa (MEA)

The Middle East & Africa region contributes around 9% to the global market, primarily due to expanding irrigated agriculture and import-dependent fertilizer use. Gulf countries focus on improving controlled-environment farming, which increases the need for potassium nitrate and sulfate. African nations rely on potassium fertilizers to improve soil productivity and support staple crop growth. Industrial applications remain limited but gradually rise with regional manufacturing development. Although MEA has the smallest share, investments in food security, modern farming, and fertilizer subsidies are expected to support gradual market expansion.

Market Segmentations:

By Product:

- Muriate of Potash

- Sulfate of Potash

By Application Mode:

By Crop Type:

- Field Crops

- Horticultural Crops

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Potassium Derivatives Market remains highly consolidated, with leading companies such as Eurochem, Intrepid Potash Inc., Rio Tinto Ltd., Compass Minerals Intl. Ltd., Encanto Potash Corp. (EPC), Red Metal Ltd., Uralkali, Mosaic Company, BHP Billiton Ltd., and JSC Belaruskali. The Potassium Derivatives Market remains defined by strong production capabilities, continuous capacity expansion, and rising investments in advanced processing technologies. Companies focus on improving extraction efficiency, lowering operational costs, and enhancing product purity to meet growing demand from agriculture, chemicals, pharmaceuticals, and industrial sectors. Sustainability initiatives, including energy-efficient mining practices and environmentally responsible waste management, increasingly influence competitive positioning. Market participants also prioritize supply chain resilience through long-term procurement contracts and regional diversification. As demand accelerates in emerging economies, producers strengthen global distribution networks and pursue strategic partnerships to expand their footprint and maintain a competitive edge.

Key Player Analysis

Recent Developments

- In May 2025, the Indian government successfully auctioned the country’s first-ever potash mining blocks in Rajasthan, a move aimed at reducing the nation’s 100% reliance on imported potash for fertilizers. The blocks, located in the Hanumangarh district, were awarded to companies like Hindustan Zinc and Oil India Ltd.

- In September 2024, QatarEnergy signed an MoU with Mesaieed Petrochemical, QIMC, and Türkiye’s Atlas Yatirim Planlama to establish Qatar Salt Products Company (QSalt). The new plant will produce industrial and table salt, including potassium chloride, enhancing Qatar’s self-sufficiency, export potential, and localization of its chemical and fertilizer industries.

- In March 2024, EuroChem celebrated the launch of its new phosphate fertilizer production facility today. The new phosphate mine and plant complex, which required a nearly project investment, was built in record time and will be able to produce one million tonnes of advanced phosphate fertilizers annually, greatly enhancing the dependability of domestic phosphate fertilizer supplies for Brazilian farmers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Application Mode, Crop Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as agriculture increases its use of high-efficiency potassium-based fertilizers.

- Demand will rise for low-chloride and high-purity potassium derivatives due to stricter environmental standards.

- Industrial applications will grow as manufacturers adopt potassium compounds for advanced materials and specialty chemicals.

- Emerging economies will drive significant consumption through agricultural modernization and infrastructure development.

- Producers will invest more in sustainable mining and low-emission processing technologies.

- Supply chain diversification will strengthen to reduce reliance on limited global potash sources.

- Technological improvements will enhance extraction yields and production efficiency.

- Companies will focus on long-term contracts to secure stable demand from agricultural and industrial sectors.

- Innovation in specialty potassium derivatives will create new high-value market segments.

- Regulatory support for balanced nutrient management will continue shaping market growth.