| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| South Africa Data Center Containment Market Size 2024 |

USD 21.26 Million |

| South Africa Data Center Containment Market, CAGR |

9.25% |

| South Africa Data Center Containment Market Size 2032 |

USD 43.14 Million |

Market Overview

The South Africa Data Center Containment Market is projected to grow from USD 21.26 million in 2024 to an estimated USD 43.14 million by 2032, with a compound annual growth rate (CAGR) of 9.25% from 2025 to 2032. The market’s growth is driven by increasing data traffic, the need for energy-efficient solutions, and the rise in digital transformation across various industries in South Africa.

The key market drivers include the rising demand for efficient cooling solutions, the need for better energy management, and the growing trend of cloud computing and big data analytics. Additionally, government initiatives and increasing investments in data center infrastructure further fuel the market growth. The market is also witnessing a shift towards modular data center designs that offer scalability and cost-effectiveness, which is contributing to the demand for containment solutions.

Geographically, South Africa is emerging as a hub for data centers due to its robust ICT infrastructure and strategic position within Africa. The market is driven by increasing data center investments from both local and international players. Key players in the South Africa Data Center Containment Market include companies like Stulz, Schneider Electric, and Vertiv, which are focusing on providing innovative and energy-efficient containment solutions tailored to the region’s unique needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The South Africa Data Center Containment Market is projected to grow from USD 21.26 million in 2024 to USD 43.14 million by 2032, with a CAGR of 9.25% from 2025 to 2032.

- Rising data traffic and the growing trend of digital transformation are driving the need for efficient cooling and energy management systems in data centers.

- The demand for energy-efficient containment solutions is increasing due to high operational costs and the need to reduce data center energy consumption.

- The shift towards modular data center designs is contributing to the demand for flexible, scalable, and cost-effective containment solutions.

- Johannesburg, Cape Town, and Durban are emerging as key regions for data center investments due to their robust infrastructure and strategic positioning in Africa.

- Government initiatives aimed at improving ICT infrastructure and fostering investments in data centers are further accelerating market growth in South Africa.

- High initial investment and the shortage of skilled labor in the region are significant barriers limiting the widespread adoption of advanced containment systems.

Market Drivers

Market Drivers

Cloud Computing and the Digital Transformation Trend

The rise of cloud computing and the ongoing digital transformation of various industries in South Africa are major factors driving the demand for data center containment solutions. As businesses and organizations increasingly migrate their operations to the cloud, the need for efficient data storage and processing infrastructures becomes more critical. The cloud provides scalable, flexible, and cost-effective solutions for companies, but it also places immense pressure on data centers to handle larger volumes of data and more complex workloads. As a result, data centers in South Africa are evolving to accommodate this growing demand for cloud services and digital applications. This shift toward cloud computing is driving investment in data center infrastructure and the adoption of advanced containment solutions. Data centers need to ensure that they can maintain uptime, reduce latency, and optimize energy use, which is where containment solutions come into play. These solutions are particularly useful in cloud-based data centers, which require high-density storage systems and precise airflow management. By ensuring that these facilities operate at peak performance with minimal downtime, containment solutions support the growth of the cloud services sector and contribute to the expansion of the data center market.

Government Support and Investment in ICT Infrastructure

South Africa’s government is increasingly recognizing the importance of robust ICT infrastructure as a foundation for economic growth. As part of the country’s broader economic development strategy, there have been initiatives to promote the growth of the information and communication technology (ICT) sector, with a particular focus on data centers. These efforts include policy reforms, infrastructure development, and incentives to attract both local and international investment in the data center sector. The government’s focus on improving internet connectivity, encouraging foreign investments, and supporting the growth of local data centers directly benefits the data center containment market. With the government’s commitment to enhancing the country’s ICT infrastructure, South Africa is becoming an attractive destination for data center operators. This is further bolstered by the increasing demand for reliable data storage and processing facilities across industries such as banking, healthcare, and telecommunications. As a result, government support is driving the development of new data centers, creating more opportunities for the adoption of containment solutions. These investments are crucial in ensuring that the country can meet its growing data needs while maintaining cost-effective, energy-efficient operations.

Growing Data Traffic and Demand for Data Storage

One of the primary drivers of the South Africa Data Center Containment Market is the substantial increase in data traffic across the region. The proliferation of digital content, such as video streaming, cloud services, social media, and IoT devices, is leading to an exponential rise in the amount of data generated and processed. As organizations, governments, and enterprises continue to embrace digital transformation, the need for efficient data storage solutions becomes critical. For instance, the South African government’s initiatives to enhance digital infrastructure have led to increased data usage, necessitating robust data storage systems. The growing reliance on data centers to store and process this vast amount of data necessitates advanced cooling and containment solutions to ensure optimal performance and reliability of data centers. Data center operators are focusing on adopting containment solutions to improve the efficiency of cooling systems, manage power consumption, and ensure proper airflow. This trend aligns with the rising demand for higher processing power and storage, pushing data centers to adopt energy-efficient, scalable containment solutions. As data traffic increases, these systems enable operators to maximize data center capacity while minimizing energy consumption and operational costs.

Energy Efficiency and Cost Management

Energy efficiency is a significant concern for data center operators in South Africa, primarily due to the high operational costs associated with running large-scale data centers. Cooling systems, which account for a large portion of energy consumption in data centers, are essential for maintaining optimal conditions and preventing equipment failure. Data center containment solutions play a crucial role in optimizing cooling by isolating hot and cold air streams, thereby improving the overall energy efficiency of the facility. In South Africa, energy costs are relatively high, making it imperative for companies to adopt solutions that minimize energy consumption while maintaining cooling efficiency. For instance, government policies encourage data centers to reduce their reliance on the national grid by implementing alternative energy sources, which aligns with the broader goal of improving energy efficiency. Containment solutions, such as hot aisle and cold aisle containment, help reduce the amount of energy needed for cooling, which directly leads to lower operating expenses. As energy efficiency becomes increasingly important, operators are investing in containment solutions that help them meet sustainability goals while reducing energy waste. This drive for more sustainable, cost-effective data center operations is a significant factor contributing to the market’s growth.

Market Trends

Integration of Advanced Cooling Technologies

Another prominent trend in the South Africa Data Center Containment Market is the integration of advanced cooling technologies. As data center operators face the challenge of managing growing data volumes and higher server densities, traditional cooling methods are becoming less efficient. In response, there is a shift towards incorporating cutting-edge cooling technologies such as liquid cooling, direct-to-chip cooling, and free cooling techniques. These systems are more efficient than traditional air-based cooling, reducing the overall energy consumption and improving the performance of data center equipment. In particular, liquid cooling systems, which involve the use of water or other liquids to cool the hardware directly, have gained traction in South Africa. These systems are particularly well-suited for high-performance computing environments where the heat generation from servers is significant. By integrating liquid cooling with data center containment solutions, operators can achieve a higher level of cooling efficiency and ensure that equipment remains at optimal operating temperatures. This trend reflects the broader global push towards more efficient and sustainable cooling solutions, and it is expected to continue gaining momentum in the South African market as data center operators seek to reduce their environmental impact and operating costs.

Growth of Hyperscale Data Centers and Multi-Tenant Facilities

The South African data center market is experiencing a shift toward the development of hyperscale data centers and multi-tenant facilities. Hyperscale data centers, characterized by their massive size, high capacity, and advanced infrastructure, are designed to meet the needs of large enterprises, cloud service providers, and other organizations requiring vast amounts of computing power and storage. This trend is being driven by the increasing demand for cloud-based services, artificial intelligence (AI), machine learning, and big data analytics, all of which require highly efficient, scalable data centers capable of supporting heavy workloads. As hyperscale data centers grow in number, they are adopting sophisticated containment solutions to manage the thermal loads and ensure efficient cooling. These facilities typically house thousands of servers in a compact space, which necessitates the integration of advanced containment solutions such as liquid cooling, hot and cold aisle containment, and row-based containment strategies. Additionally, multi-tenant data centers, which provide space for multiple customers within a single facility, are also on the rise. These data centers offer a cost-effective solution for businesses that require data storage but do not have the resources to build their own dedicated data centers. The increased demand for hyperscale and multi-tenant facilities is fueling the adoption of data center containment solutions, as these systems are critical to optimizing space, reducing cooling costs, and enhancing operational efficiency.

Adoption of Modular Data Centers

One of the key trends in the South Africa Data Center Containment Market is the growing adoption of modular data centers. These are prefabricated, scalable, and flexible solutions that can be deployed quickly and efficiently. Modular data centers are designed to accommodate the dynamic nature of modern data demands, providing operators with the ability to scale up operations without extensive infrastructure overhauls. For instance, companies like Digital Parks Africa are expanding their modular facilities to meet the increasing demand for cloud-based services and artificial intelligence. Modular data centers are particularly attractive in a market where businesses and industries are still adapting to digital transformation. With companies focusing on cost-efficiency and operational agility, modular data centers offer a convenient alternative to traditional data centers. These systems are easy to expand as demand grows, and they typically incorporate energy-efficient containment solutions to optimize cooling, manage airflow, and reduce energy consumption.

Increased Focus on Energy Efficiency and Sustainability

The drive towards energy efficiency and sustainability is a significant trend in the South Africa Data Center Containment Market. As energy costs in the country remain relatively high, data center operators are increasingly prioritizing energy-efficient containment solutions that reduce the carbon footprint of their facilities while also minimizing operational expenses. South Africa has faced energy challenges in recent years, with electricity supply constraints and high utility costs driving the need for more sustainable practices across industries, including data centers. For instance, Teraco has initiated a project to build a solar photovoltaic power plant to supply renewable energy to its data centers, aligning with the government’s push for self-provisioning energy. Data center operators are adopting a range of energy-efficient containment systems, such as hot aisle and cold aisle containment, which help to separate the hot and cold air within a data center. This segregation enables more efficient cooling and reduces the amount of energy needed for air conditioning systems. Additionally, there is an increasing demand for innovative containment designs that incorporate advanced cooling technologies, which further enhance energy efficiency.

Market Challenges

High Initial Investment and Infrastructure Costs

One of the major challenges facing the South Africa Data Center Containment Market is the high initial investment required for setting up state-of-the-art containment solutions. The installation of advanced containment systems, such as hot aisle/cold aisle containment, in-row cooling, and liquid cooling technologies, often requires substantial upfront capital. For instance, the African Datacenter Association survey highlights that large-scale data centers in South Africa have achieved impressive energy efficiency metrics due to their adoption of advanced containment solutions. However, this level of efficiency often comes at a steep cost, which can be prohibitive for small- and medium-sized enterprises. In addition to the high installation costs, the integration of containment systems into existing data centers can be complex and may require extensive modifications to the infrastructure. Retrofitting older data centers with advanced containment solutions can lead to increased downtime and further expenses, making it a less appealing option for operators with limited financial resources. For instance, Africa Data Centres has invested heavily in expanding its Midrand facility with advanced cooling and containment systems to meet growing demand. Despite the long-term benefits of energy savings and operational efficiency, the initial financial burden remains a key challenge for the broader adoption of containment technologies in South Africa.

Limited Availability of Skilled Labor

Another challenge hindering the growth of the South Africa Data Center Containment Market is the shortage of skilled labor. The installation, operation, and maintenance of sophisticated containment solutions require specialized knowledge in areas such as thermal management, energy efficiency, and advanced cooling systems. The demand for skilled technicians, engineers, and data center operators with expertise in data center containment is outpacing the supply, resulting in a talent gap. This shortage of skilled professionals can lead to delays in the implementation of containment solutions, higher labor costs, and potential operational inefficiencies. Additionally, the lack of adequate training programs for local personnel can further exacerbate the issue. To address this challenge, data center operators may need to invest in training and development programs to upskill their workforce or consider hiring skilled labor from outside the country, which could increase costs and further strain resources. The talent shortage is a critical issue that may slow the growth of the data center containment market in South Africa.

Market Opportunities

Rising Demand for Cloud Services and Digital Transformation

One of the key opportunities in the South Africa Data Center Containment Market lies in the rapid growth of cloud services and the ongoing digital transformation across various industries. As more businesses and government entities embrace cloud computing, the demand for data centers capable of handling large volumes of data, processing power, and storage capacity is increasing. These data centers require advanced containment solutions to optimize energy usage, manage thermal loads, and ensure the efficient operation of their infrastructure. With the increasing reliance on data-intensive applications such as big data analytics, artificial intelligence (AI), and the Internet of Things (IoT), there is a growing need for scalable and efficient containment systems to meet these demands. This presents a significant market opportunity for containment solution providers to cater to the evolving requirements of cloud service providers, telecommunications companies, and large enterprises in South Africa.

Government Support and Infrastructure Development

Another key opportunity stems from the South African government’s focus on boosting ICT infrastructure as part of its broader economic development initiatives. Policies aimed at improving internet connectivity, attracting foreign investment, and supporting the expansion of data center facilities provide a favorable environment for the growth of the data center containment market. As data center operators in the region benefit from these policies and investments, there is a clear opportunity for containment solution providers to play a pivotal role in ensuring that new and existing data centers are optimized for efficiency, sustainability, and performance. The combination of government support and a growing demand for digital services creates a conducive environment for the continued expansion of the data center containment market in South Africa.

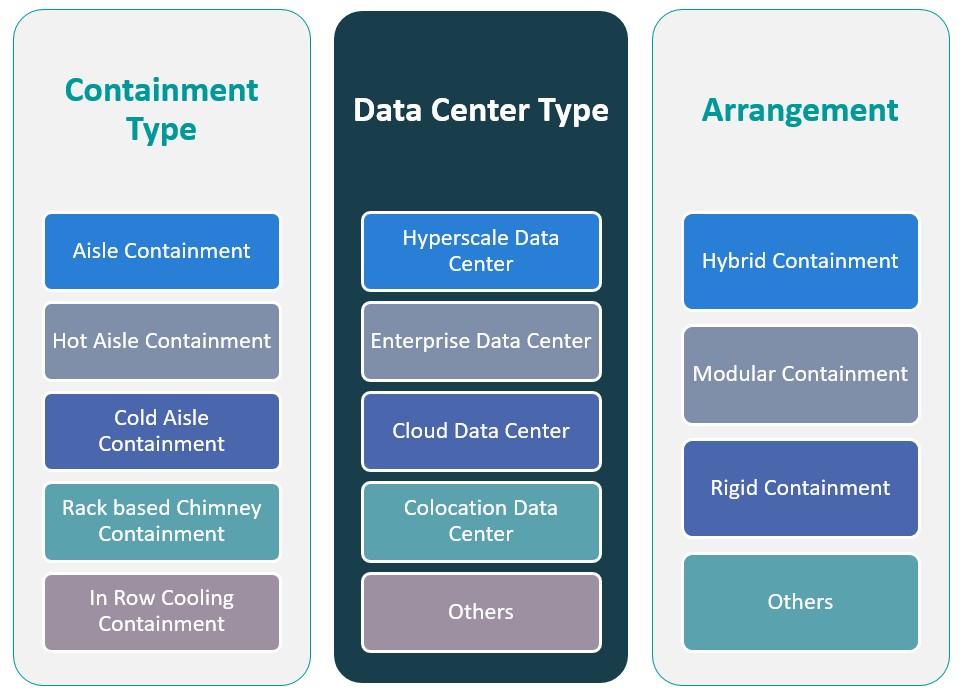

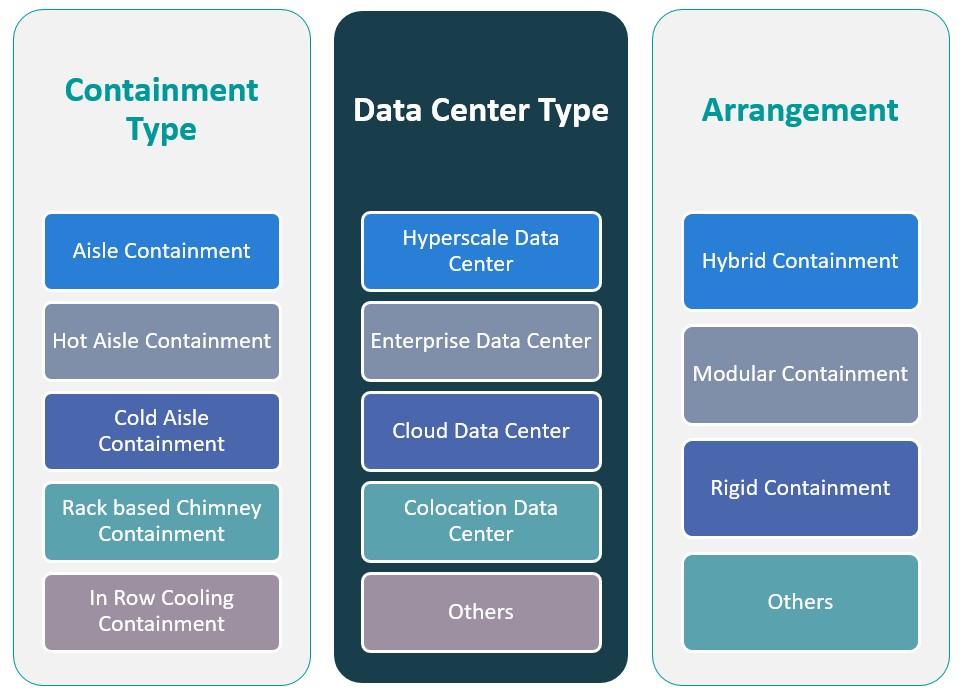

Market Segmentation Analysis

By Containment Type

The South Africa Data Center Containment Market is primarily driven by various containment solutions that optimize cooling efficiency and manage airflow within data centers. Hot Aisle Containment (HAC) is one of the leading solutions, isolating hot air from cold air by sealing hot aisles where equipment generates heat. This system is highly effective in high-density server racks, commonly used in large-scale data centers, as it minimizes energy consumption and improves cooling efficiency. The Cold Aisle Containment (CAC) system seals cold air aisles, directing cool air toward server intakes. It is a cost-effective solution for data centers with moderate cooling needs and is gaining traction due to its ease of implementation. Rack-based Chimney Containment is another solution where chimneys are installed atop racks, directing hot air into a central exhaust system. This approach is particularly popular in small and medium-sized data centers, providing efficient cooling without extensive modifications. Lastly, In-Row Cooling Containment is a localized cooling solution placed directly between server racks to manage thermal loads. As high-density data centers continue to rise, this method is expected to grow, offering precision cooling and reducing overall energy requirements.

By Data Center Type

The type of data center significantly influences the demand for specific containment solutions, as each data center type has unique operational requirements. Hyperscale Data Centers, designed to handle vast amounts of data for cloud service providers, require highly efficient containment systems to manage substantial thermal loads. This sector is one of the primary drivers of the containment market. Enterprise Data Centers, which serve individual organizations focusing on internal data storage and management, are increasingly adopting containment systems to improve cooling and reduce operational costs. Cloud Data Centers, crucial for on-demand cloud services, rely on containment solutions to ensure energy-efficient, scalable cooling systems. The growth of cloud computing in South Africa is pushing the demand for these solutions. Colocation Data Centers, where multiple customers share physical space and resources, also require advanced containment solutions to optimize space and cooling efficiency. Additionally, the growing trend of Edge Data Centers, designed for low-latency processing and localized data storage, is driving demand for tailored containment solutions, especially as edge computing expands.

Segments

Based on Containment Type

- Aisle Containment

- Hot Aisle Containment

- Cold Aisle Containment

- Rack based Chimney Containment

- In Row Cooling Containment

Based on Data Center Type

- Hyperscale Data Center

- Enterprise Data Center

- Cloud Data Center

- Colocation Data Center

- Others

Based on Arrangement

- Hybrid Containment

- Modular Containment

- Rigid Containment

- Others

Based on Region

- Johannesburg

- Cape Town

- Durban

Regional Analysis

Johannesburg (45%)

Johannesburg holds the largest share of the South African data center market due to its status as the country’s economic hub. The city is home to a significant number of multinational companies, service providers, and enterprises that rely on data centers for business continuity, cloud services, and digital transformation. As a result, Johannesburg accounts for approximately 45% of the data center containment market share in South Africa. The high concentration of commercial activity and increasing demand for efficient cooling systems, driven by the region’s high-density data centers, make Johannesburg a central player in the adoption of containment solutions. Additionally, with continuous infrastructure development and improved connectivity, Johannesburg’s role as the country’s technology and business center ensures sustained growth in the data center containment market.

Cape Town (30%)

Cape Town follows as a key region in the South African data center landscape, contributing to about 30% of the market share. The city has emerged as a prominent hub for tech companies, cloud providers, and telecommunications operators due to its well-established infrastructure and strategic location for serving the southern African region. Cape Town has seen significant growth in data center development driven by the increasing demand for cloud computing, colocation services, and improved network connectivity. The region’s growing tech ecosystem is pushing the demand for energy-efficient and scalable containment solutions, particularly as data centers aim to meet the high-performance requirements of digital services.

Key players

- Teraco

- Dimension Data

- MetroFibre Networx

- CubeTech

- Datacentrix

Competitive Analysis

The South Africa Data Center Containment Market is highly competitive, with key players focusing on providing advanced containment solutions to optimize cooling efficiency and energy consumption in data centers. Teraco, as a leading player, offers comprehensive containment solutions tailored for high-density data centers, benefiting from its strong market presence and extensive infrastructure. Dimension Data leverages its global expertise to provide scalable containment systems, enhancing its competitiveness in the enterprise and cloud data center segments. MetroFibre Networx and CubeTech focus on offering innovative containment solutions, particularly in response to the increasing demand for modular and energy-efficient data centers in South Africa. Datacentrix, known for its strong IT and networking solutions, also integrates containment technologies to support data center operations. These players differentiate themselves based on their technological innovations, sustainability efforts, and ability to meet the growing demand for energy-efficient data center solutions. The competitive landscape is marked by continual investment in infrastructure and the development of customized solutions.

Recent Developments

- In November 2023, Huawei introduced two new additions to its Smart Modular Data Center and SmartLi uninterruptible power supply (UPS) series – FusionModule2000 6.0, a modular small/medium-sized data center solution, and UPS2000-H, a small-footprint power supply solution running on SmartLi Mini.

- In February 2025, Trane Technologies expanded its data center solutions to include liquid cooling thermal management systems, introducing the Trane 1MW Coolant Distribution Unit for high-performance workloads.

- In 2025, Honeywell launched a data center management suite to improve efficiency and sustainability by integrating operational and IT infrastructure data.

- In March 2025, Vertiv introduced new solutions to support dense AI and high-performance computing workloads, including consolidated infrastructure management software and prefabricated modular overhead infrastructure.

- In March 2025, Siemens announced a $285 million investment in U.S. manufacturing, including establishing new facilities in California and Texas. This investment aims to enhance manufacturing capabilities and advance AI technologies, supporting sectors such as commercial, industrial, construction, and AI data centers.

Market Concentration and Characteristics

The South Africa Data Center Containment Market exhibits a moderately concentrated structure, with a few key players dominating the landscape while several smaller firms contribute to specialized solutions. Major players such as Teraco, Dimension Data, and MetroFibre Networx hold significant market shares due to their extensive infrastructure, technological expertise, and comprehensive service offerings. These leading companies focus on energy-efficient, scalable containment solutions to cater to the increasing demand for high-performance, sustainable data center operations. The market is characterized by rapid technological advancements, such as the adoption of liquid cooling and modular containment systems, and a growing trend towards energy efficiency. Additionally, the presence of both local and international players indicates a competitive environment where companies strive for innovation and operational optimization to meet the evolving needs of businesses investing in cloud computing, digital transformation, and colocation services. The market’s growth is also fueled by government support for ICT infrastructure development and the expansion of digital services across the country.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Containment Type, Data Center Type, Arrangement and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- As energy costs continue to rise, demand for energy-efficient containment solutions will grow. Data center operators will increasingly focus on reducing energy consumption while maintaining optimal performance.

- The rise of cloud services and edge computing will drive the need for scalable containment solutions. Data centers will require more advanced cooling systems to handle the growing complexity of workloads.

- In-row cooling and liquid cooling technologies will become more prevalent as data centers strive for better energy efficiency. These advanced systems will reduce the carbon footprint of data center operations.

- The continued expansion of hyperscale data centers will contribute to market growth. These large-scale facilities require high-density containment solutions to ensure efficient thermal management.

- Data center operators will prioritize sustainable practices, including adopting containment systems that reduce energy waste and contribute to achieving environmental goals.

- The demand for modular data centers will rise due to their scalability and flexibility. Containment solutions will evolve to integrate seamlessly with these modular systems, offering efficient cooling and airflow management.

- As technological advancements continue, containment systems will become more sophisticated. Future solutions will focus on precision cooling and enhanced airflow control to meet the needs of high-density data centers.

- Government policies aimed at improving ICT infrastructure will foster growth in the data center sector. Investments in data centers and containment systems will continue to rise, especially in key regions like Johannesburg and Cape Town.

- With businesses looking for cost-effective solutions, the demand for colocation data centers will increase. Containment systems will play a critical role in managing space and cooling for multiple tenants within a single facility.

- The market will witness increased competition as both local and international players enter the market. Key players will focus on differentiation through technological innovation, customer service, and energy-efficient containment solutions.

Market Drivers

Market Drivers