| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| South Korea Cheese Market Size 2024 |

USD 4,149.81 Million |

| South Korea Cheese Market, CAGR |

5.76% |

| South Korea Cheese Market Size 2032 |

USD 6,495.68 Million |

Market Overview

South Korea Cheese Market size was valued at USD 4,149.81 million in 2024 and is anticipated to reach USD 6,495.68 million by 2032, at a CAGR of 5.76% during the forecast period (2024-2032).

The South Korea cheese market is primarily driven by the growing Westernization of dietary habits and the increasing demand for cheese-based fast food and ready-to-eat meals. Rising disposable incomes, coupled with a shift toward high-protein diets, have further supported cheese consumption across various demographics. The expansion of foodservice outlets, particularly quick-service restaurants and international chains, continues to boost cheese usage in culinary applications. In addition, heightened consumer interest in home cooking and baking has increased retail cheese sales. Market players are also introducing diverse product variants, including organic, lactose-free, and low-fat options, to cater to evolving health and dietary preferences. Technological advancements in cold-chain logistics and improved packaging solutions are enhancing product availability and shelf life. Moreover, the growing popularity of premium and imported cheeses reflects a rising demand for gourmet and specialty products, shaping a more sophisticated cheese consumption culture across South Korea.

The geographical landscape of the South Korea cheese market reveals strong consumption patterns concentrated in urbanized regions such as Seoul, Gyeonggi Province, Busan, Ulsan, and Daegu, where modern retail infrastructure and exposure to global food trends drive demand. These areas show increased adoption of Western dietary habits and a rising preference for convenient, ready-to-use dairy products, including various types of cheese. Growth is supported by expanding foodservice sectors, rising disposable income, and greater culinary experimentation among younger consumers. In terms of key players, the market features a mix of domestic and international dairy companies. Prominent players include Meiji Holdings Co., Ltd., Yili Group, Mengniu Dairy, Fonterra Co-operative Group, Vinamilk, Mother Dairy, Parag Milk Foods, Britannia Industries, and Bega Cheese Limited. These companies compete through product innovation, flavor diversification, and strategic distribution partnerships to capture the evolving preferences of South Korean consumers, especially in metropolitan and high-income regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The South Korea cheese market was valued at USD 4,149.81 million in 2024 and is projected to reach USD 6,495.68 million by 2032, growing at a CAGR of 5.76% during the forecast period.

- The global cheese market was valued at USD 97,440.00 million in 2024 and is projected to reach USD 1,46,171.12 million by 2032, growing at a CAGR of 5.20% during the forecast period.

- Rising adoption of Western food culture and increased consumption of fast food are key drivers fueling cheese demand across urban and suburban regions.

- Consumers are increasingly drawn to premium, flavored, and spreadable cheeses due to changing dietary preferences and greater interest in global cuisines.

- The market is highly competitive with key players like Meiji Holdings, Fonterra, Britannia, and Vinamilk focusing on innovation and regional distribution strategies.

- Heavy reliance on cheese imports and price volatility due to fluctuating international trade conditions remain significant market restraints.

- Major growth is observed in urban centers such as Seoul, Gyeonggi, Busan, and Daegu, supported by strong retail networks and modern consumer behavior.

- E-commerce and ready-to-eat cheese products are rapidly gaining popularity among younger consumers.

Report Scope

This report segments the South Korea Cheese Market as follows:

Market Drivers

Rising Westernization of Diets and Fast-Food Culture

The increasing influence of Western culinary practices has significantly reshaped dietary patterns in South Korea, positioning cheese as a key ingredient in both restaurant and home-prepared meals. For instance, the Korea Foodservice Industry Association has reported a surge in cheese-based menu items introduced by fast food chains like McDonald’s and Domino’s Pizza, which have adapted their offerings to include local flavors such as bulgogi burgers and kimchi pizzas. This cultural shift has normalized cheese consumption, turning it from a niche ingredient into a staple item in urban households. The growing appetite for Western cuisine continues to drive cheese demand across various foodservice formats, reflecting a broader integration of global food trends into the South Korean market.

Expanding Foodservice Sector and Retail Availability

The robust growth of the foodservice industry, particularly quick-service restaurants (QSRs), cafés, and bakery chains, is a major driver of the cheese market in South Korea. For instance, data from the Korea Agro-Fisheries & Food Trade Corporation highlights the increasing incorporation of cheese into menus at popular bakery chains like Paris Baguette and Tous Les Jours. Simultaneously, supermarkets and hypermarkets have expanded their cheese offerings, including both domestic and imported brands, to meet rising consumer interest. Retailers are also investing in better in-store display and refrigeration solutions, ensuring cheese products remain fresh and accessible. This dual growth in foodservice and retail availability is amplifying consumer exposure to a diverse range of cheese products, thus sustaining market momentum.

Health Awareness and Demand for Nutrient-Rich Foods

With increasing health consciousness among South Korean consumers, there is a growing appreciation for cheese as a rich source of protein, calcium, and essential nutrients. Consumers, particularly fitness enthusiasts and working professionals, are integrating cheese into their diets for its nutritional value and convenience. In response, manufacturers are introducing healthier cheese alternatives, such as low-fat, reduced-sodium, organic, and lactose-free options, to attract health-minded buyers. This trend aligns with broader wellness movements and diet-centric lifestyles gaining popularity in the country. As cheese is perceived not only as a flavorful ingredient but also a nutritious one, its demand is witnessing strong support from the health and wellness sector.

Rising Affluence and Preference for Premium Products

The steady increase in disposable incomes and a growing middle class have elevated consumer spending power, leading to a greater willingness to explore premium and imported cheese varieties. South Korean consumers are increasingly drawn to gourmet cheeses such as Brie, Camembert, Gouda, and blue cheese, particularly those sourced from Europe and North America. This preference for high-quality and specialty cheeses is further encouraged by online platforms and specialty food stores offering convenient access to international brands. The shift toward premiumization reflects a broader trend of lifestyle upgrading and culinary exploration. As more consumers seek unique taste experiences, the premium cheese segment is expected to witness robust growth, adding significant value to the overall market.

Market Trends

Surge in Home Cooking and Cheese-Based Recipes

One of the most prominent trends in the South Korea cheese market is the surge in home cooking, particularly since the COVID-19 pandemic, which led consumers to explore new recipes and international cuisines at home. Cheese has become a widely used ingredient in homemade dishes such as baked goods, pasta, and Korean-Western fusion meals like cheese tteokbokki and cheese ramen. Social media platforms and cooking shows have further popularized cheese-centric recipes, influencing consumer behavior and increasing retail cheese purchases. As cooking at home continues to be seen as both a leisure activity and a health-conscious choice, this trend is expected to sustain strong demand for a variety of cheese products.

Growth of Imported and Artisanal Cheese Consumption

South Korean consumers are showing increased interest in imported and artisanal cheeses, reflecting a growing appreciation for global flavors and premium quality. For instance, the Korea Customs Service has reported a steady increase in imports of high-end cheeses from France, Italy, and the Netherlands, which are now widely available in supermarkets and specialty stores. The expansion of international gourmet food sections and collaborations with foreign suppliers have made these products more accessible than ever. This trend is particularly prevalent among affluent consumers and young professionals seeking unique taste experiences and indulgent food products. As consumer palates become more sophisticated, demand for imported cheese is poised to grow steadily, driving premiumization in the market.

Digital Retail and E-Commerce Expansion

The rapid growth of e-commerce platforms and digital grocery services in South Korea is transforming the way consumers purchase cheese. For instance, online platforms like Coupang and Gmarket are offering a wide selection of local and imported cheeses, often bundled with subscription boxes and next-day delivery options. The convenience of browsing and purchasing cheese online, combined with informative product descriptions and customer reviews, enhances the buying experience. Moreover, digital platforms are enabling small-scale and niche cheese producers to reach a broader audience. As online grocery shopping becomes increasingly mainstream, the digital channel is set to play a vital role in shaping the distribution and marketing strategies within the cheese market.

Product Innovation and Diversification in Cheese Offerings

Manufacturers and brands are actively innovating to meet evolving consumer preferences, introducing a wide range of cheese products tailored to various dietary needs and taste profiles. This includes the launch of low-fat, high-protein, lactose-free, organic, and plant-based cheese alternatives that appeal to health-conscious consumers and individuals with dietary restrictions. In addition, flavored and processed cheese variants—such as cheddar with herbs, mozzarella sticks, and cheese spreads—are gaining popularity due to their versatility and convenience. Such diversification not only enhances customer choice but also allows brands to capture niche segments, fueling the overall expansion of the cheese market in South Korea.

Market Challenges Analysis

High Import Dependency and Price Volatility

One of the key challenges facing the South Korea cheese market is its significant dependency on imported cheese, particularly from countries like the United States, Australia, and various European nations. For instance, the Korea Customs Service has reported that over 80% of the cheese consumed in South Korea is imported, with the United States being the largest supplier. These factors can lead to unpredictable price movements, affecting both suppliers and consumers. In recent years, global disruptions such as logistical bottlenecks, inflation, and geopolitical tensions have contributed to increased import costs and supply uncertainties. Small retailers and local producers, in particular, face difficulties maintaining competitive pricing amid these external pressures. As a result, the overall market faces constraints in ensuring price stability and consistent product availability, especially for premium and specialty cheeses.

Limited Domestic Production and Consumer Perception Barriers

South Korea’s domestic cheese production remains relatively underdeveloped compared to its high consumption rate, which limits the country’s self-sufficiency in meeting demand. Local dairy farms and cheese manufacturers struggle with scalability, technological limitations, and cost competitiveness, making it difficult to rival imported brands in quality or variety. Additionally, despite growing acceptance, cheese still faces cultural and dietary perception barriers among certain consumer segments, particularly the older generation who may view cheese as foreign or non-essential. Concerns over high fat content and lactose intolerance also contribute to selective consumption patterns. While younger consumers are more open to incorporating cheese into their diets, the market must address lingering skepticism through education and product innovation. Overcoming these challenges is crucial for ensuring sustained market growth and encouraging a stronger domestic cheese production ecosystem.

Market Opportunities

The South Korea cheese market presents substantial opportunities driven by evolving consumer preferences and increasing culinary experimentation. As younger generations embrace global food trends and Western dining habits, there is a growing appetite for innovative cheese products that go beyond traditional offerings. This opens the door for manufacturers to introduce a broader range of cheese types, including gourmet, artisanal, and plant-based alternatives, catering to niche yet expanding consumer segments. The rise in home cooking, influenced by food-related social media content and cooking shows, provides further momentum for retail cheese consumption. Brands that offer convenient, ready-to-use, or pre-portioned cheese products stand to gain traction among busy urban households and novice home chefs seeking quality and ease of use.

Moreover, the expansion of digital retail channels and the growing popularity of online grocery platforms offer promising avenues for cheese brands to reach tech-savvy consumers. E-commerce not only enables broader product visibility but also supports direct-to-consumer sales models, allowing brands to build customer loyalty and personalize marketing efforts. Additionally, rising health awareness among South Koreans creates opportunities for functional and fortified cheese products, including low-fat, high-protein, and lactose-free variants. Collaborations with health and wellness influencers, nutritionists, and food bloggers can also help promote these offerings effectively. As South Korea continues to develop its domestic dairy infrastructure, investments in local production and artisanal craftsmanship could help reduce import reliance and foster consumer trust in homegrown brands. These factors collectively suggest a favorable environment for innovation, premiumization, and digital expansion within the South Korean cheese market.

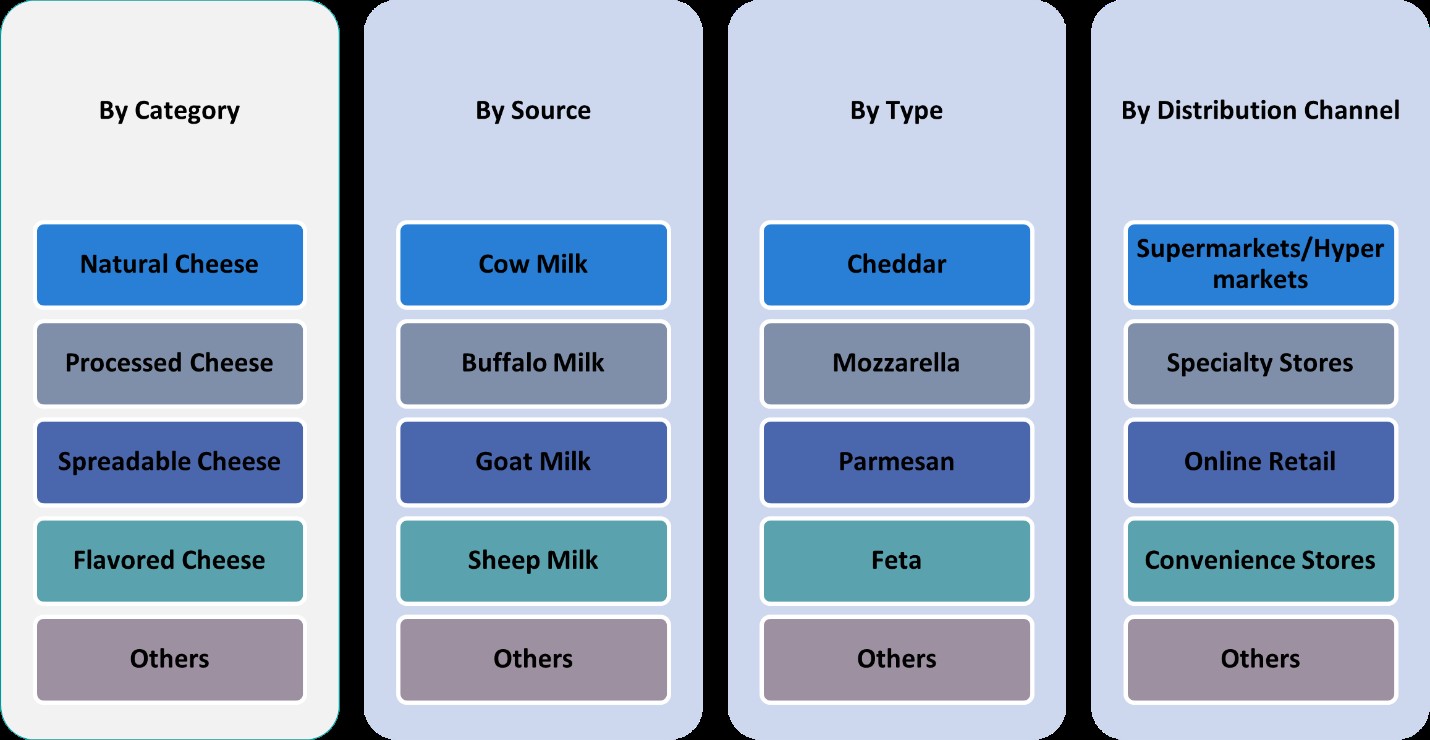

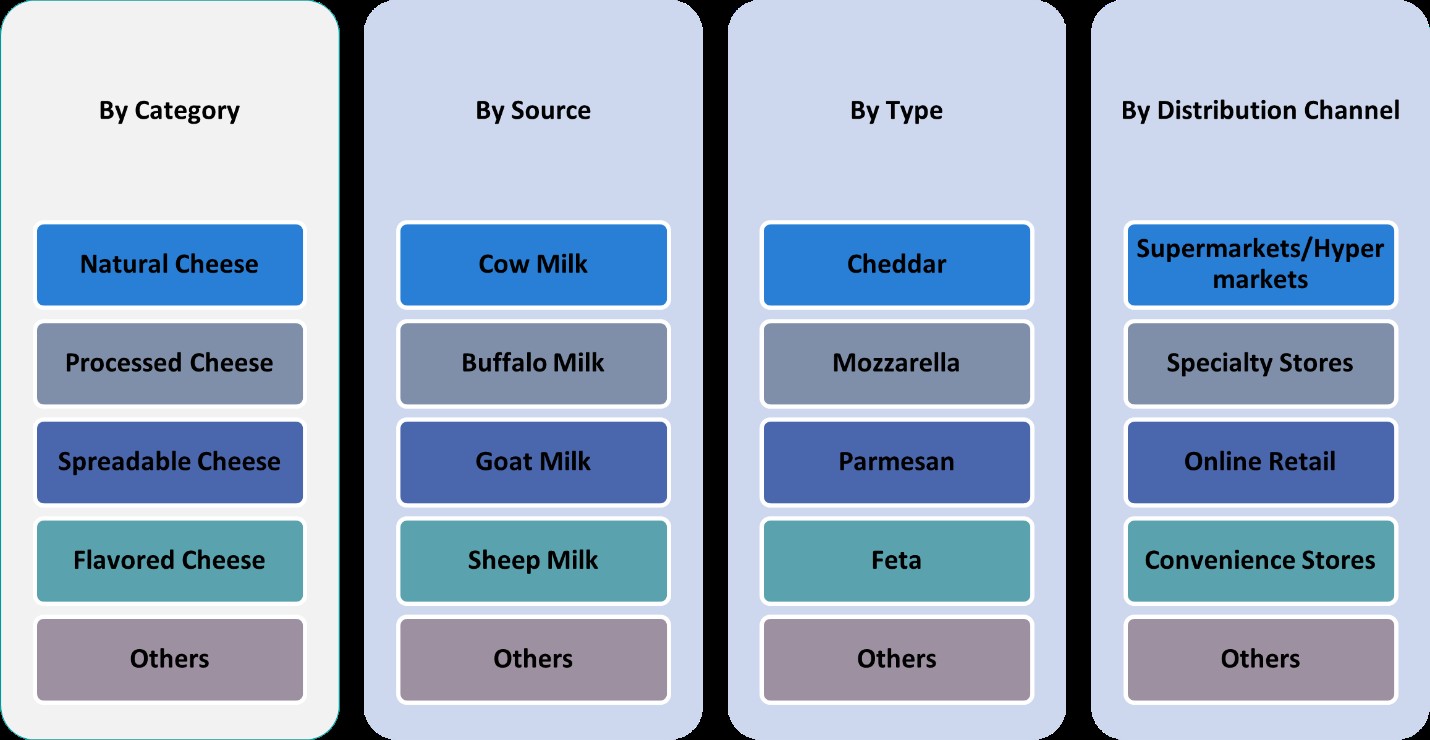

Market Segmentation Analysis:

By Category:

The South Korea cheese market is segmented into cheddar, processed cheese, spreadable cheese, flavored cheese, and others. Among these, processed cheese holds a dominant share, driven by its widespread use in fast food, convenience meals, and home-cooked dishes. Its longer shelf life and versatility in cooking applications have made it particularly popular among urban consumers and younger demographics. Cheddar cheese is also witnessing growing demand due to increasing exposure to Western cuisines and its suitability for gourmet and premium dishes. Spreadable cheese has carved a niche segment, especially among health-conscious individuals and snack-oriented consumers seeking convenient breakfast or light meal options. Flavored cheese is gaining popularity as consumers seek variety and innovation in taste profiles, often inspired by global cheese offerings. The “others” segment includes specialty and artisanal cheeses that appeal to premium and imported cheese consumers. Continuous innovation in flavors, packaging, and applications is expected to drive further growth across these categories, catering to both mainstream and niche markets.

By Source:

By source, the South Korea cheese market is segmented into cow milk, buffalo milk, goat milk, sheep milk, and others. Cow milk-based cheese dominates the market, as it is the most widely available and commonly used source due to its affordability, familiar taste, and large-scale dairy infrastructure. It supports mass production and aligns well with consumer preferences, especially in the processed and cheddar cheese categories. Goat and sheep milk cheeses are gaining recognition among health-conscious and premium product consumers due to their perceived nutritional benefits and unique flavor profiles. These variants are often featured in gourmet offerings and artisanal cheese selections, appealing to sophisticated palates. Buffalo milk cheese, while limited in availability, presents an emerging niche, particularly for mozzarella and other specialty cheeses. The “others” segment may include plant-based or non-dairy alternatives, which are slowly entering the market as consumer awareness around sustainability and lactose intolerance grows. As dietary preferences evolve, demand for diverse cheese sources is expected to expand steadily.

Segments:

Based on Category:

- Cheddar

- Processed Cheese

- Spreadable Cheese

- Flavored Cheese

- Others

Based on Source:

- Cow Milk

- Buffalo Milk

- Goat Milk

- Sheep Milk

- Others

Based on Type:

- Cheddar

- Mozzarella

- Parmesan

- Feta

- Others

Based on Distribution Channel:

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Convenience Stores

- Others

Based on the Geography:

- Seoul Metropolitan Region

- Gyeonggi Province

- Busan and Ulsan Regions

- Daegu Region

Regional Analysis

Seoul Metropolitan Region

The Seoul Metropolitan Region holds the largest share of the South Korea cheese market, accounting for approximately 39% of the total market in 2024. This dominance can be attributed to the region’s high population density, elevated urbanization rate, and a concentration of middle- to high-income consumers with evolving dietary preferences. The widespread presence of modern retail outlets, premium supermarkets, and gourmet food stores ensures easy accessibility to both domestic and imported cheese varieties. Moreover, Seoul’s cosmopolitan lifestyle and strong inclination toward Western dining culture have accelerated demand for cheese-based food products. With a thriving foodservice industry, including numerous international fast-food chains, bakeries, and fine dining establishments, the region continues to lead in terms of cheese consumption. Additionally, consumer exposure to global culinary trends and digital food platforms further boosts the uptake of specialty and premium cheese products in this urban hub.

Gyeonggi Province

Gyeonggi Province captures around 27% of the South Korean cheese market, positioning it as the second-largest regional contributor. As the most populous province surrounding the Seoul Metropolitan Area, Gyeonggi benefits from a spillover of urban influence and consumer behavior. The region is home to a rising number of middle-class families and working professionals who favor convenience foods and nutrition-rich dairy products, including cheese. Retail development has been particularly strong in this area, with several hypermarkets, specialty grocers, and e-commerce platforms expanding their presence. Gyeonggi’s growing residential communities also show a preference for home-cooked fusion meals and Western food habits, both of which include cheese as a key ingredient. The combination of increasing disposable income, suburban growth, and better retail outreach continues to strengthen the region’s role in the cheese market.

Busan and Ulsan Regions

The Busan and Ulsan Regions collectively account for approximately 19% of the South Korea cheese market. As major industrial and port cities, these areas exhibit a growing appetite for diversified food experiences, especially among younger populations and expatriate communities. The foodservice sector in Busan, driven by tourism and a robust café culture, has increasingly incorporated cheese into its offerings, including pizzas, pasta, and baked goods. In Ulsan, rising urban development and income levels are encouraging more frequent consumption of cheese-based snacks and ready-to-eat meals. Although still trailing behind Seoul and Gyeonggi, the cheese market in these coastal regions is poised for steady growth due to expanding retail infrastructure and a gradual cultural shift toward global cuisines.

Daegu Region

The Daegu Region holds an estimated 16% share of the national cheese market. While smaller in scale compared to the aforementioned regions, Daegu is experiencing a notable increase in cheese consumption, particularly among the younger and more health-conscious demographic. The city’s education hubs and growing number of single-person households contribute to rising demand for convenient, portion-controlled cheese products. Retailers are responding by expanding cheese selections and offering promotional deals to encourage trial and repeat purchases. Moreover, the region’s mid-sized urban setup fosters a balance between traditional food preferences and modern dining trends. As consumer awareness of cheese’s nutritional value grows, Daegu is expected to see continued development in both retail and foodservice demand, gradually boosting its market share in the national landscape.

Key Player Analysis

- Meiji Holdings Co., Ltd.

- Yili Group

- Mengniu Dairy

- Fonterra Co-operative Group (APAC Operations)

- Vinamilk

- Mother Dairy

- Parag Milk Foods

- Britannia Industries

- Bega Cheese Limited

Competitive Analysis

The competitive landscape of the South Korea cheese market is characterized by the presence of both international and regional players competing through innovation, pricing strategies, and distribution networks. Leading companies such as Meiji Holdings Co., Ltd., Yili Group, Mengniu Dairy, Fonterra Co-operative Group (APAC Operations), Vinamilk, Mother Dairy, Parag Milk Foods, Britannia Industries, and Bega Cheese Limited are actively expanding their footprint by introducing diverse cheese offerings tailored to South Korean tastes. These players focus on premiumization, product differentiation, and strategic collaborations with retail and foodservice sectors to strengthen brand visibility and consumer reach. Many companies are also leveraging digital platforms and e-commerce channels to tap into tech-savvy and convenience-oriented urban consumers. With rising demand for healthy, functional, and gourmet cheeses, market leaders are investing in R&D and sustainable packaging to align with evolving consumer preferences. Despite strong competition, the fragmented nature of the market allows new entrants and smaller brands to gain traction through niche products, particularly in flavored, plant-based, and artisanal cheese categories.

Recent Developments

- In March 2025, Arla Foods Ingredients partnered with Valley Queen in South Dakota to increase production of Nutrilac® ProteinBoost, a high-protein whey concentrate, to meet growing demand in North America.

- In March 2025, Sargento introduced three innovations—Natural American Cheese, Seasoned Shredded Cheese in collaboration with McCormick, and Shareables snack trays in partnership with Mondelez International.

- In March 2025, Saputo USA debuted its spicy mozzarella cheese at the International Pizza Expo, combining traditional mozzarella with habanero jack for a zesty twist.

- In February 2025, Kraft Heinz emphasized innovation across three platforms—taste elevation, easy-ready meals, and snacking. This includes new product launches like Lunchables Spicy Nachos and value-sized Kraft Mac & Cheese to cater to shifting consumer preferences.

- In November 2024, Lactalis highlighted emerging trends such as premiumization, hot eating cheeses like Président Extra Creamy Brie, and sustainability-focused products like Seriously Spreadable Black Pepper cheese.

Market Concentration & Characteristics

The South Korea cheese market exhibits a moderately concentrated structure, with a mix of established multinational corporations and emerging domestic brands competing for market share. Leading players dominate the premium and processed cheese segments, while smaller producers focus on niche categories such as artisanal, flavored, and plant-based cheeses. The market is characterized by rapid product diversification, strong urban demand, and growing consumer awareness of global cheese varieties. Retail channels, including supermarkets, hypermarkets, and online platforms, play a crucial role in product accessibility and brand visibility. Additionally, the market is highly responsive to international culinary trends, with younger consumers driving experimentation and adoption of Western-style cheese products. Despite growing competition, significant entry barriers such as import regulations, brand loyalty, and the need for cold-chain logistics present challenges for new players. Overall, the market reflects a dynamic balance between innovation, consumer education, and strategic positioning to meet the evolving dietary preferences across South Korea.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Category, Source, Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for cheese in South Korea is expected to grow steadily due to increasing adoption of Western food habits.

- Urbanization and rising disposable incomes will continue to drive cheese consumption in metropolitan regions.

- Consumers will show greater interest in premium, organic, and flavored cheese options.

- The foodservice sector will play a major role in expanding the cheese market, especially through fast food and bakery applications.

- Online grocery platforms will boost the sales of packaged and ready-to-eat cheese products.

- Plant-based and lactose-free cheese alternatives will gain popularity among health-conscious and vegan consumers.

- Domestic production of cheese may increase to reduce dependency on imports and stabilize pricing.

- Innovations in cheese packaging and shelf-life extension will support broader distribution and convenience.

- Companies will invest more in marketing and consumer education to promote new cheese varieties.

- The market will witness increased competition, encouraging players to diversify offerings and strengthen local partnerships.