| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| South Korea Protein Based Sports Supplements Market Size 2024 |

USD 313.96 Million |

| South Korea Protein Based Sports Supplements Market, CAGR |

8.07% |

| South Korea Protein Based Sports Supplements Market Size 2032 |

USD 583.95 Million |

Market Overview

South Korea Protein Based Sports Supplements Market size was valued at USD 313.96 million in 2024 and is anticipated to reach USD 583.95 million by 2032, at a CAGR of 8.07% during the forecast period (2024-2032).

The South Korea protein-based sports supplements market is primarily driven by increasing health consciousness and a rising focus on fitness among the youth and working population. The growing popularity of gym culture, coupled with the influence of social media and fitness influencers, is encouraging the adoption of protein supplements to enhance muscle growth and recovery. Additionally, the expanding aging population is contributing to demand, as protein intake becomes essential for maintaining muscle mass and overall wellness in older adults. The market is also benefiting from innovations in plant-based and clean-label protein formulations, catering to consumers with dietary preferences and allergies. Trends such as personalized nutrition, convenient on-the-go supplement formats, and the integration of functional ingredients like probiotics and superfoods are further enhancing product appeal. Moreover, the increasing availability of these supplements through online retail channels is broadening consumer access, thus supporting sustained market growth throughout the forecast period.

The geographical landscape of the South Korea protein-based sports supplements market is shaped by strong consumer demand from key urban regions such as Seoul, Gyeonggi, Busan, Ulsan, and Daegu. These areas exhibit high health awareness, advanced fitness infrastructure, and widespread access to retail and digital sales channels, fueling the uptake of protein supplements among fitness enthusiasts and general consumers. The market is highly competitive, with a blend of domestic and international players actively expanding their footprint. Key companies operating in the space include Herbalife Nutrition Ltd., Yakult Honsha Co., Ltd., Shandong Minqiang Biotechnology Co., Ltd., Bright LifeCare Pvt. Ltd. (MuscleBlaze), Wipro Consumer Care and Lighting (Nutrition Business), Nongfu Spring Co., Ltd., Dymatize, Oziva (Zywie Ventures Pvt. Ltd.), and Nestlé Health Science. These players focus on innovation, clean-label formulations, and localized marketing strategies to appeal to South Korean consumers’ evolving dietary preferences and lifestyle needs.Top of FormBottom of Form

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The South Korea protein-based sports supplements market was valued at USD 313.96 million in 2024 and is projected to reach USD 583.95 million by 2032, growing at a CAGR of 8.07% during the forecast period.

- The global protein-based sports supplements market was valued at USD 7,372.05 million in 2024 and is projected to reach USD 13,140.51 million by 2032, growing at a CAGR of 7.49%.

- Increasing health consciousness, active lifestyles, and rising gym memberships are driving demand for protein supplements across the country.

- Consumers are shifting toward convenient formats like ready-to-drink beverages and protein bars, fueled by urbanization and busy lifestyles.

- Key players such as Herbalife Nutrition, Nestlé Health Science, Dymatize, and MuscleBlaze are expanding product portfolios to meet diverse consumer preferences.

- High prices of premium protein supplements and limited awareness in rural areas pose challenges to market penetration.

- Urban regions such as Seoul, Gyeonggi, Busan, and Daegu lead in product adoption due to better fitness infrastructure and health-focused populations.

- The market is also seeing a rising preference for plant-based and allergen-free protein sources, especially among younger demographics.

Report Scope

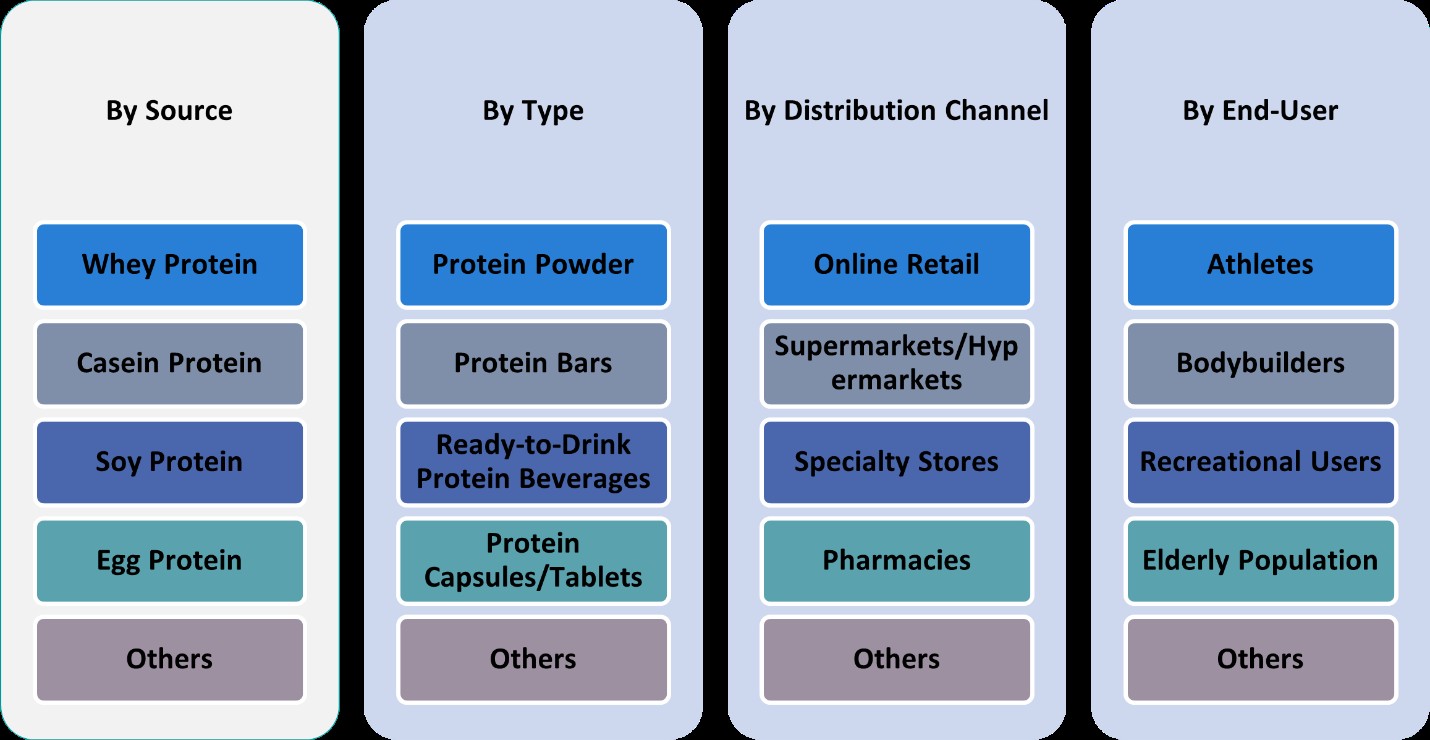

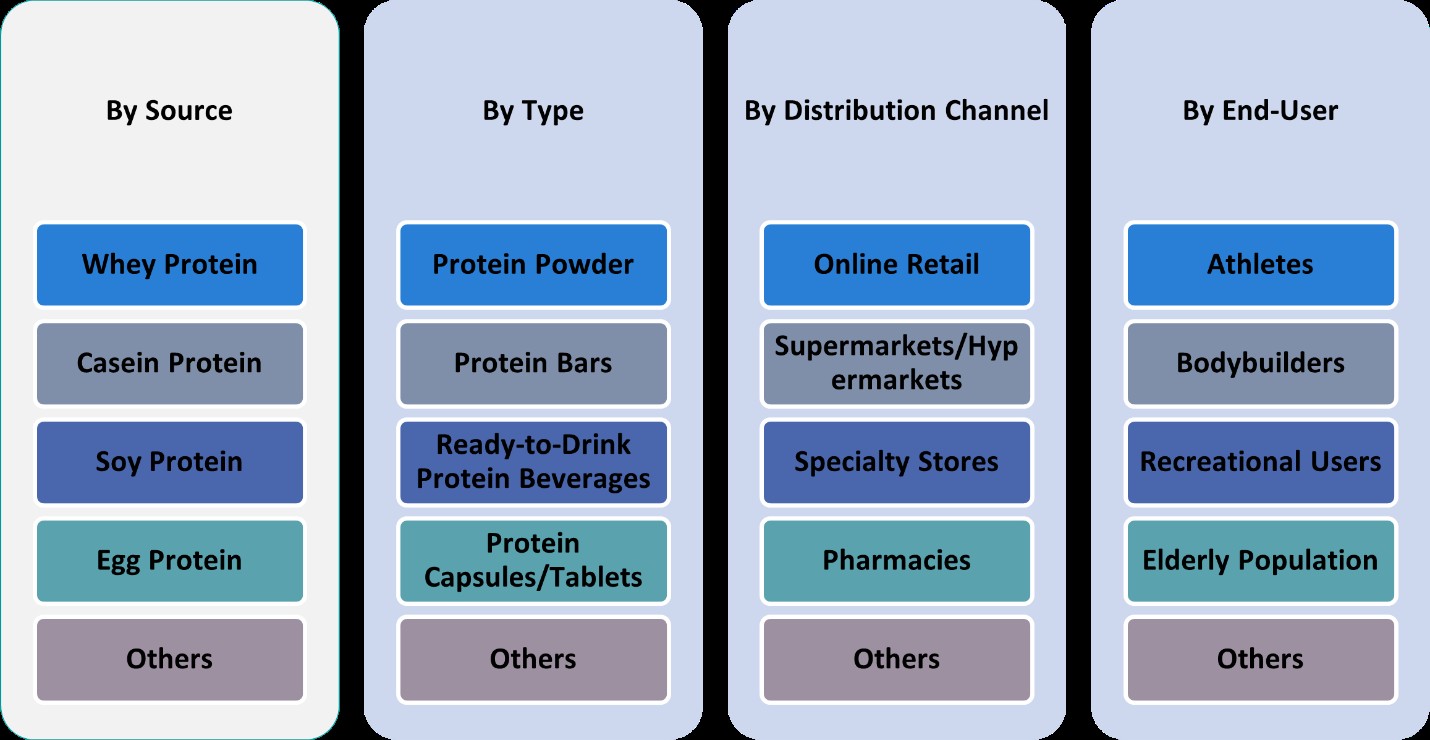

This report segments the South Korea Protein Based Sports Supplements Market as follows:

Market Drivers

Rising Health Awareness and Fitness Culture

The increasing health consciousness among South Koreans has significantly fueled the demand for protein-based sports supplements. For instance, a report by the Korea Ministry of Health and Welfare indicated a steady rise in health campaigns encouraging physical activity and balanced diets, resulting in greater adoption of fitness routines. Urban populations, in particular, are turning toward nutritional products that support physical endurance and faster recovery. The government’s promotion of healthy living and fitness campaigns has further reinforced this trend. Additionally, the rise of fitness influencers and widespread health-related content on social media platforms is motivating consumers to adopt high-protein diets, including supplement use, to achieve their fitness goals more effectively.

Expanding Gym and Sports Participation

An increase in gym memberships and sports participation across various age groups has positively impacted the market. For instance, a report by the Korean Association of Sports and Fitness highlighted that metropolitan areas like Seoul and Busan have seen a surge in fitness facilities and personalized workout programs. This growing infrastructure encourages individuals to adopt supplement products to enhance athletic performance, build muscle mass, and improve post-exercise recovery. Moreover, there is a growing culture of endurance sports such as marathons, cycling, and mixed martial arts that drives demand for performance-enhancing products. The accessibility of fitness facilities and personalized workout regimes has made protein-based supplements a staple for many fitness enthusiasts and athletes alike.

Growing Demand from Aging Population

The aging population in South Korea is increasingly contributing to the demand for protein-based supplements. With age, muscle degradation and reduced protein synthesis become critical concerns, prompting older adults to seek nutritional solutions to maintain strength and mobility. Protein supplements are widely acknowledged for their role in muscle maintenance, immune support, and energy production—key concerns for senior consumers. Companies are targeting this demographic with specially formulated protein products that offer easy digestibility and added functional ingredients like collagen or calcium. As South Korea faces a rapidly aging population, this segment represents a valuable growth driver for the sports supplements market, beyond traditional athletic users.

Innovation in Product Offerings and Distribution Channels

Continuous innovation in product formulation and expansion in distribution channels are strengthening market growth. Manufacturers are introducing a variety of protein types—such as whey, casein, and plant-based alternatives—to meet the diverse needs of consumers, including those with lactose intolerance or vegan preferences. The demand for clean-label, organic, and sugar-free products is rising, prompting brands to develop supplements free from artificial additives. Simultaneously, the growing influence of e-commerce and mobile shopping platforms is making protein supplements more accessible to tech-savvy South Korean consumers. With the convenience of online delivery, product comparisons, and tailored subscription models, consumers are more inclined to explore and adopt high-quality sports nutrition products.

Market Trends

Shift Toward Plant-Based and Clean-Label Protein Supplements

A significant trend reshaping the South Korea protein-based sports supplements market is the growing consumer preference for plant-based and clean-label products. Health-conscious individuals are increasingly opting for alternatives to traditional whey and casein proteins, particularly soy, pea, and rice proteins, due to dietary preferences, lactose intolerance, and environmental concerns. The rising vegan and vegetarian population, coupled with a broader awareness of sustainable nutrition, is accelerating this shift. Consumers are also prioritizing transparency in ingredients and sourcing, demanding supplements that are free from artificial additives, allergens, and genetically modified organisms (GMOs). This has pushed manufacturers to reformulate existing products and introduce new, plant-powered options that meet clean-label criteria, thereby expanding their consumer base across fitness enthusiasts and lifestyle users alike.

E-Commerce and DTC Channels Driving Market Expansion

The rapid digital transformation in South Korea has made e-commerce and direct-to-consumer (DTC) platforms major drivers of growth in the protein-based sports supplements market. For instance, a study by the Korea Internet & Security Agency revealed that South Korea’s tech-savvy population increasingly prefers to purchase supplements online due to ease of access, product variety, and the ability to compare prices and reviews. Subscription-based services, personalized nutrition apps, and influencer-led promotions further boost engagement and brand loyalty in this segment. Many brands are now investing heavily in their online presence through mobile-optimized websites, social media campaigns, and influencer collaborations to tap into this lucrative channel. Additionally, the COVID-19 pandemic accelerated the shift to digital retail, making online platforms a dominant force in supplement distribution.

Influence of Fitness Culture and Western Wellness Trends

Western fitness ideals and the rise of Korea’s own fitness subculture are significantly shaping consumer behavior. The popularity of gym workouts, CrossFit, pilates, and functional training has surged, especially among millennials and Gen Z. Inspired by international fitness influencers, K-pop celebrities, and actors who emphasize strength and aesthetics, consumers are actively seeking performance-boosting protein supplements to support muscle gain, endurance, and recovery. The increased visibility of these trends on platforms like Instagram and YouTube has made protein supplements more mainstream, transitioning from niche bodybuilder products to essential wellness aids. As a result, manufacturers are tailoring their marketing strategies to align with aspirational lifestyles, incorporating fitness challenges, community events, and success stories into their branding efforts.

Functional Innovation and Premiumization of Products

Innovation continues to play a vital role in driving the South Korean sports nutrition market. For instance, a report by the Korea Health Industry Development Institute emphasized the integration of added functionalities, such as gut health support (probiotics), immune boosters (vitamin D and zinc), and joint health (collagen and glucosamine), into traditional protein supplements. This convergence of sports nutrition with general wellness is attracting a broader demographic, including women and older adults. Moreover, consumers are willing to invest in premium products that promise better bioavailability, superior taste, and scientifically backed results. Premiumization is further supported by the emergence of ready-to-drink (RTD) protein beverages, protein-enriched snacks, and convenient sachets tailored to on-the-go lifestyles. These product innovations are not only diversifying the market but also raising the value perception of protein-based sports supplements in South Korea.

Market Challenges Analysis

Stringent Regulatory Framework and Labeling Compliance

One of the primary challenges facing the South Korea protein-based sports supplements market is navigating the country’s stringent regulatory landscape. For instance, the Ministry of Food and Drug Safety (MFDS) enforces strict compliance related to health claims, ingredient approvals, and labeling standards, as highlighted in a report by the Korea Health Supplements Association. Any deviation or unsubstantiated health benefit claim may result in severe penalties, product recalls, or bans. For international brands, localization of packaging and adherence to Korean language labeling requirements present additional hurdles, often delaying product launches. Moreover, manufacturers must ensure transparency in ingredient sourcing and declare allergen information to meet consumer expectations for safety and authenticity. These regulatory obligations, while essential for consumer protection, increase the operational complexity and cost for companies, especially smaller firms or new market entrants trying to establish a foothold in the region.

High Competition and Consumer Skepticism Toward Efficacy

The South Korean protein supplement market is highly competitive, with a growing number of domestic and global players offering a wide range of products. This saturation creates pricing pressure and limits differentiation among brands. As consumers become more informed, they also become more skeptical about exaggerated claims regarding muscle gain, weight loss, or performance enhancement. Many South Koreans, particularly first-time users, question the efficacy and necessity of protein supplements in a regular diet, which can hinder repeat purchases and slow market expansion. Additionally, a segment of consumers perceives protein powders as being overly processed or unnatural, preferring whole-food protein sources instead. This skepticism, combined with a lack of widespread nutritional education, poses a barrier to deeper market penetration. To overcome this, brands must invest in evidence-backed marketing strategies, transparent communication, and educational initiatives that build trust and promote the scientifically proven benefits of their products.

Market Opportunities

The South Korea protein-based sports supplements market presents notable growth opportunities driven by shifting consumer lifestyles and expanding health awareness. As South Koreans increasingly prioritize wellness and fitness, the demand for nutritional supplements tailored to support muscle recovery, weight management, and general health continues to grow. Urban populations, particularly millennials and Gen Z, are embracing fitness trends such as high-intensity interval training (HIIT), strength training, and recreational sports, creating a receptive market for protein supplements. Furthermore, the rise of fitness influencers and health-conscious celebrities on digital platforms has heightened public interest in protein intake as an essential component of a balanced diet. This cultural shift opens up substantial opportunities for both domestic and international brands to introduce innovative products that cater to diverse goals, including muscle toning, endurance, and healthy aging.

In addition, the market holds significant potential in niche segments such as female-specific formulations, senior nutrition, and plant-based or allergen-free options. Female consumers are increasingly participating in fitness routines and seeking supplements designed to meet their unique physiological needs, while the aging population is exploring protein supplements to maintain muscle mass and support mobility. Simultaneously, the plant-based movement offers brands the chance to capitalize on the demand for clean-label, vegan-friendly products. Customization and personalization, including protein blends for specific body types or fitness objectives, also present untapped opportunities. Digitalization plays a vital role in this growth, with e-commerce and mobile health platforms facilitating easy access and tailored marketing. By leveraging data-driven strategies, brands can effectively target consumers with personalized recommendations, thus improving engagement and retention. Overall, the South Korean market offers a fertile landscape for companies willing to innovate, educate, and adapt to the evolving needs of a health-conscious, tech-savvy consumer base.

Market Segmentation Analysis:

By Type:

The South Korea protein-based sports supplements market is categorized by type into protein powder, protein bars, ready-to-drink (RTD) protein beverages, protein capsules/tablets, and others. Among these, protein powder dominates the market owing to its widespread availability, affordability, and ease of use in post-workout routines. It remains a preferred choice for gym-goers and athletes focused on muscle gain and recovery. However, the growing demand for convenience and on-the-go nutrition is boosting the popularity of RTD protein beverages and protein bars. These formats appeal to busy consumers seeking quick, nutritious options that align with active lifestyles. Protein bars, in particular, have seen increased adoption among young professionals and women, driven by their portability and improved taste profiles. Additionally, protein capsules and tablets are gaining attention among consumers seeking minimal-calorie supplementation or structured dosage. As South Korean consumers become more informed and diverse in their preferences, manufacturers are increasingly offering product variants across these categories to meet functional and lifestyle-specific demands.

By Source:

Based on the source, the market includes whey protein, casein protein, soy protein, egg protein, and others. Whey protein holds the largest market share due to its high bioavailability, rapid absorption, and strong clinical backing for muscle recovery and performance enhancement. It remains a top choice for fitness enthusiasts and bodybuilders. However, soy protein is rapidly gaining momentum, especially among vegetarians, vegans, and consumers with lactose intolerance. South Korea’s growing inclination toward plant-based diets has significantly supported soy protein’s expansion. Casein protein, with its slow-release properties, appeals to consumers focused on prolonged muscle nourishment, often taken before bedtime. Egg protein, valued for its complete amino acid profile, maintains a niche but steady demand. Other sources, such as rice and pea protein, are gaining traction as clean-label, hypoallergenic alternatives. The increasing diversification of protein sources reflects rising consumer awareness of dietary needs, allergens, and ethical consumption patterns. This evolving preference landscape offers ample opportunity for innovation and product differentiation across various consumer segments.

Segments:

Based on Type:

- Protein Powder

- Protein Bars

- Ready-to-Drink Protein Beverages

- Protein Capsules/Tablets

- Others

Based on Source:

- Whey Protein

- Casein Protein

- Soy Protein

- Egg Protein

- Others

Based on End- User:

- Athletes

- Bodybuilders

- Recreational Users

- Elderly Population

- Others

Based on Distribution Channel:

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Pharmacies

- Others

Based on the Geography:

- Seoul Metropolitan Region

- Gyeonggi Province

- Busan and Ulsan Regions

- Daegu Region

Regional Analysis

Seoul Metropolitan Region

The Seoul Metropolitan Region leads the South Korea protein-based sports supplements market, accounting for approximately 39% of the total market share in 2024. This dominance is driven by a densely populated urban setting, high disposable income levels, and a strong culture of fitness and wellness. Seoul is home to a large number of fitness centers, gyms, and wellness clubs, making it a primary consumption hub for protein supplements. The presence of tech-savvy consumers and early adopters also fosters high engagement with digital platforms, accelerating online sales of supplements. Additionally, the region hosts many product launches and marketing campaigns by both international and domestic brands, strengthening brand visibility. With an increasing number of consumers integrating protein supplements into their daily routines for muscle development and overall health, Seoul remains the most lucrative regional market.

Gyeonggi Province

The Gyeonggi Province follows closely, holding a market share of around 27% in 2024. As the most populous province surrounding Seoul, Gyeonggi benefits from proximity to the capital and shares many of its lifestyle trends, including a growing interest in health and fitness. Suburban growth, rising middle-class income, and the spread of gym chains have contributed to increasing demand for protein-based sports supplements in this region. E-commerce platforms and health-focused retail chains have expanded their reach in Gyeonggi, enabling better product accessibility. The younger population segment is particularly responsive to ready-to-drink protein beverages and bars, seeking convenient and functional nutrition. With continued urbanization and wellness awareness, the region is expected to witness steady market growth in the coming years.

Busan and Ulsan Regions

The Busan and Ulsan Regions collectively account for approximately 18% of the market share in 2024. As major coastal industrial hubs, these regions host a working population that is gradually adopting healthier lifestyle practices. Busan, being the second-largest city in South Korea, has seen a rise in gym memberships and fitness events that have contributed to higher consumption of protein supplements. Ulsan, though more industrial, is witnessing a similar shift as local populations begin to invest more in personal health. Retail outlets in both cities are increasingly stocking diverse protein supplement formats, from powders to ready-to-consume drinks, catering to varied consumer needs. Market players are also tapping into the tourism and hospitality sectors to promote fitness-centric products, creating new growth channels.

Daegu Region

The Daegu Region holds a smaller but growing share of the market, contributing around 11% in 2024. Known for its cultural heritage and emerging urban infrastructure, Daegu is gradually developing into a health-conscious city with increasing adoption of fitness routines. The local government’s investment in public health initiatives, including sports promotion and fitness education, is fostering demand for sports nutrition products. Daegu’s younger consumers, particularly students and working professionals, are beginning to incorporate protein supplements into their diet plans. Although traditional values still influence consumer behavior, changing perceptions around modern fitness and nutrition are paving the way for future growth. With continued investment in wellness infrastructure and awareness, Daegu is poised to become an important secondary market for protein-based sports supplements.

Key Player Analysis

- Herbalife Nutrition Ltd.

- Yakult Honsha Co., Ltd.

- Shandong Minqiang Biotechnology Co., Ltd.

- Bright LifeCare Pvt. Ltd. (MuscleBlaze)

- Wipro Consumer Care and Lighting (Nutrition Business)

- Nongfu Spring Co., Ltd.

- Dymatize

- Oziva (Zywie Ventures Pvt. Ltd.)

- Nestlé Health Science

Competitive Analysis

The competitive landscape of the South Korea protein-based sports supplements market is characterized by the presence of both global and regional players competing through innovation, branding, and distribution strategies. Leading companies such as Herbalife Nutrition Ltd., Yakult Honsha Co., Ltd., Shandong Minqiang Biotechnology Co., Ltd., Bright LifeCare Pvt. Ltd. (MuscleBlaze), Wipro Consumer Care and Lighting (Nutrition Business), Nongfu Spring Co., Ltd., Dymatize, Oziva (Zywie Ventures Pvt. Ltd.), and Nestlé Health Science are actively expanding their presence in the market by offering tailored products that cater to South Korean consumers’ growing demand for high-quality, functional nutrition. These players focus on offering diverse protein formats including powders, bars, RTD beverages, and plant-based alternatives to meet evolving preferences. Innovation in flavor, clean-label formulations, and convenient packaging also serve as key differentiators. Moreover, strategic partnerships with fitness centers, digital campaigns through influencers, and strong retail and e-commerce presence have become essential tools for maintaining competitiveness. As consumers become increasingly aware of the health benefits associated with protein supplementation, these companies are investing in localized product development and expanding their outreach through health-focused marketing to retain market share and build brand loyalty in this fast-evolving segment.

Recent Developments

- In March 2025, Quest Nutrition introduced Quest Protein Milkshakes, ready-to-drink beverages with a category-leading 45 grams of protein per bottle. Available in chocolate, vanilla, and strawberry flavors, these shakes cater to high-protein diets with minimal sugar and carbs.

- In December 2024, Dymatize launched Performance Protein Shakes and Energyze Pre-Workout Powder. The ready-to-drink shakes contain 30 grams of high-quality proteins along with BCAAs for muscle recovery and growth.

- In November 2024, Myprotein expanded operations in India by manufacturing locally to meet growing demand. The brand introduced localized flavors such as Kesar Badam and Nimbu Pani and launched Clear Whey Isolate as a refreshing alternative to traditional protein shakes.

- In January 2024, Abbott launched Protality, a high-protein weight-loss shake designed for individuals on weight-loss medications. Each serving contains 30 grams of protein and is tailored to preserve muscle mass while supporting weight loss.

Market Concentration & Characteristics

The South Korea protein-based sports supplements market demonstrates moderate to high market concentration, with a few prominent players holding significant influence through extensive brand recognition and diverse product offerings. Established global brands and leading regional companies compete by continuously innovating in product formats, formulations, and flavors to cater to evolving consumer preferences. The market is characterized by a strong inclination toward health and wellness, with consumers actively seeking protein supplements that align with fitness goals, dietary choices, and lifestyle needs. Urban centers with advanced retail infrastructure and digital access play a pivotal role in shaping purchasing behavior. Consumers are increasingly drawn to clean-label, plant-based, and convenient protein formats, prompting brands to adapt quickly. Additionally, brand trust, quality assurance, and clinical backing significantly influence buying decisions. The presence of tech-savvy, informed consumers further drives demand for transparent labeling and scientifically supported benefits, making differentiation through quality, innovation, and localized marketing essential in this competitive landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Source, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and c

onstraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for protein-based sports supplements in South Korea will continue to rise due to increasing health and fitness awareness among consumers.

- Growing participation in gym and fitness activities will fuel the market for whey and plant-based protein supplements.

- E-commerce platforms will play a major role in expanding the reach of sports nutrition products across urban and semi-urban areas.

- Rising disposable incomes and premiumization trends will support the growth of high-quality protein supplement products.

- Innovative product formats such as ready-to-drink protein beverages and protein bars will attract younger consumers.

- Local brands are expected to increase their market share through targeted marketing and competitive pricing.

- International players will continue to enter the market, offering diverse formulations and performance-focused supplements.

- Clean-label and natural ingredient-based protein products will gain traction due to increasing consumer preference for transparency.

- Strategic partnerships between supplement manufacturers and fitness centers will boost product visibility and sales.

- Regulatory developments and product standardization will enhance consumer trust and support sustainable market growth.