| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Soy Lecithin Market Size 2024 |

USD 643.42 Million |

| Soy Lecithin Market , CAGR |

9.14% |

| Soy Lecithin Market Size 2032 |

USD 1,290.08 Million |

Market Overview:

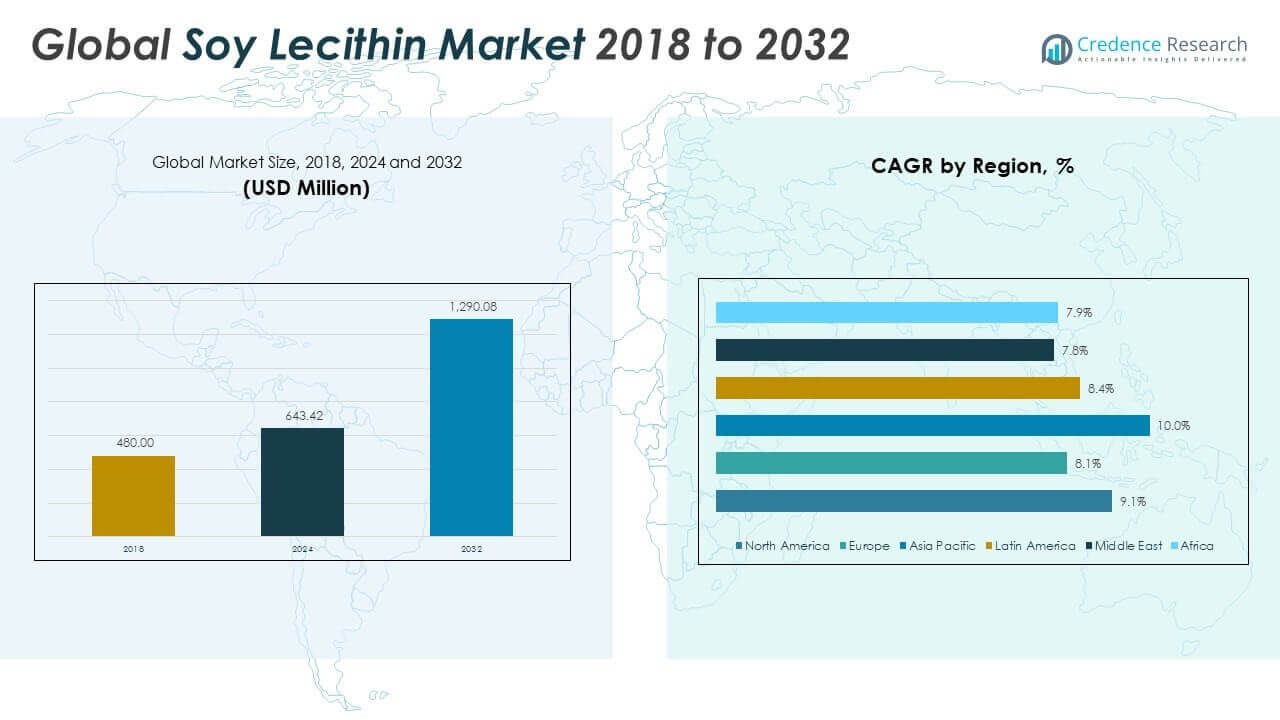

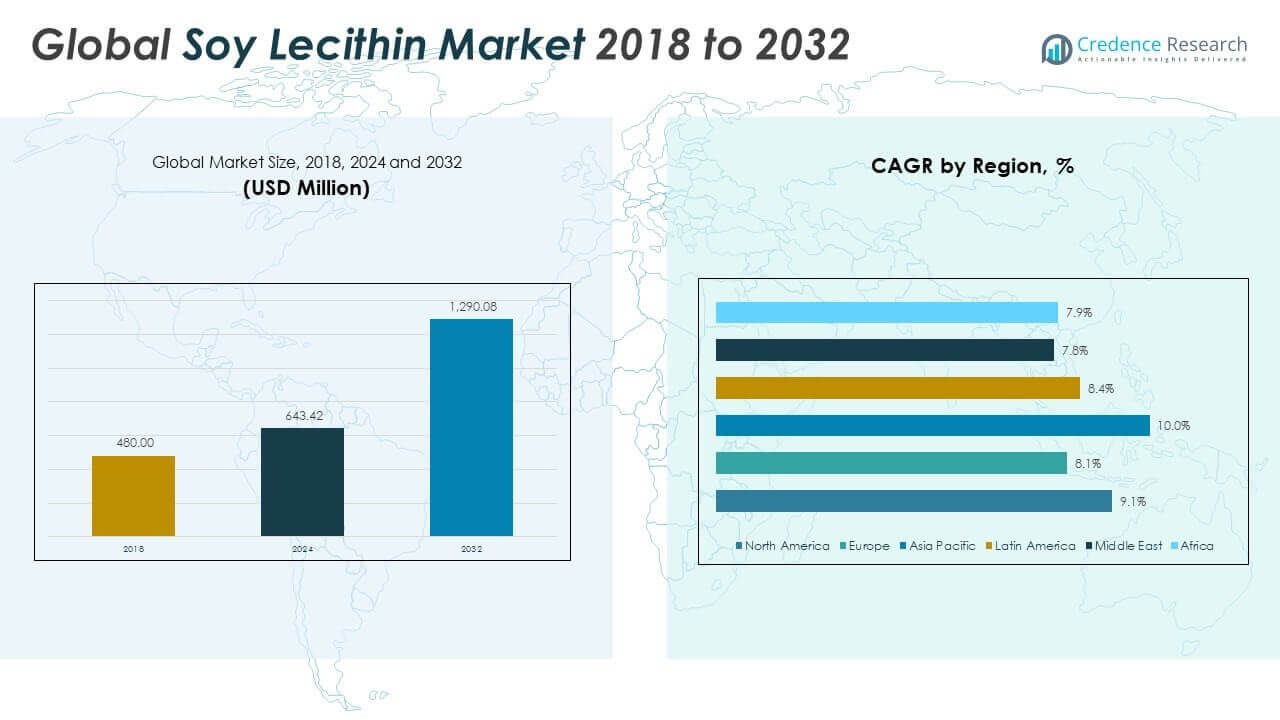

The Global Soy Lecithin Market size was valued at USD 480.00 million in 2018 to USD 643.42 million in 2024 and is anticipated to reach USD 1,290.08 million by 2032, at a CAGR of 9.14% during the forecast period.

Key market drivers include the growing consumption of processed foods, bakery products, and confectionery items that use soy lecithin for texture enhancement, shelf-life extension, and improved mixing properties. The pharmaceutical and nutraceutical sectors are contributing significantly to demand, leveraging soy lecithin in liposomal drug delivery systems and dietary supplements. Additionally, the cosmetics and personal care industries are adopting soy lecithin for its moisturizing, stabilizing, and biocompatibility benefits in creams, lotions, and hair care products. Rising awareness around health and wellness, along with regulatory encouragement for plant-based, allergen-free, and non-synthetic ingredients, is further pushing adoption rates. Moreover, innovations in soy lecithin manufacturing—such as development of heat-stable and de-oiled variants—are expanding its functionality in high-performance formulations. However, competition from alternative emulsifiers like sunflower lecithin and regulatory concerns over GMO sourcing may pose short-term challenges for certain segments.

Regionally, North America holds the largest share of the soy lecithin market, supported by a mature food processing industry, high R&D investments, and consumer demand for nutritional and functional ingredients. The United States dominates the regional landscape, with widespread adoption in health supplements and clean-label food categories. Europe follows closely, driven by strict food labeling regulations and a strong inclination toward organic and non-GMO products. Countries such as Germany, France, and the United Kingdom are key markets, especially in the bakery, confectionery, and pharmaceutical sectors. Asia-Pacific is the fastest-growing region, fueled by rapid industrialization, growing disposable income, and increasing demand for functional food ingredients in emerging economies like China and India. The region is also seeing heightened interest in organic soy lecithin as health awareness grows. Latin America and the Middle East & Africa are emerging regions with expanding food and personal care industries, where soy lecithin is gaining ground as a cost-effective and natural additive. Overall, regional dynamics reflect a balanced mix of mature markets and high-growth opportunities, with global demand for soy lecithin expected to rise steadily throughout the decade.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Soy Lecithin Market was valued at USD 480.00 million in 2018, reached USD 643.42 million in 2024, and is projected to reach USD 1,290.08 million by 2032, registering a CAGR of 9.14% during the forecast period.

- Processed food, bakery, and confectionery sectors continue to drive demand as soy lecithin enhances texture, extends shelf life, and improves mixability in consumer products.

- The pharmaceutical and nutraceutical industries are contributing significantly to market growth, using soy lecithin in liposomal drug delivery systems, soft gel capsules, and dietary supplements.

- Cosmetics and personal care segments are adopting soy lecithin in creams, lotions, and shampoos for its moisturizing, emulsifying, and stabilizing properties, supporting vegan and non-toxic product claims.

- Regulatory support for clean-label, non-GMO, and plant-based ingredients across Europe and North America is boosting demand, as health-conscious consumers shift away from synthetic additives.

- Market challenges include volatility in soybean supply from countries like the U.S., Brazil, and Argentina, rising costs of non-GMO sourcing, and growing competition from sunflower lecithin and synthetic emulsifiers.

- North America holds the largest market share due to its advanced food processing sector and R&D capabilities, while Asia-Pacific is the fastest-growing region driven by rising disposable incomes and functional food demand in China and India.

Market Drivers:

Rising Demand from Food and Beverage Industry Driven by Functional and Clean-Label Applications:

The food and beverage sector is a primary growth engine for the Global Soy Lecithin Market. It benefits from the ingredient’s functional role as an emulsifier, stabilizer, and wetting agent across a range of processed food products. Baked goods, chocolates, dressings, margarine, and infant formulas rely on soy lecithin to improve texture, extend shelf life, and ensure consistency. Consumer preference for clean-label and plant-based ingredients continues to accelerate demand. Manufacturers value soy lecithin’s natural origin and allergen-labeling advantages compared to synthetic alternatives. It fits the growing movement toward transparency and minimal processing, particularly in North America and Europe. The market is seeing deeper integration into premium and health-focused product lines.

- For instance, Cargill’s lecithin solutions are widely adopted in dairy, bakery, and chocolate applications to enhance machinability, moisture retention, and reduce cocoa butter usage, supporting clean-label and sustainable product trends.

Pharmaceutical and Nutraceutical Growth Fueled by Bioavailability and Delivery Efficiency:

Soy lecithin is gaining widespread traction in the pharmaceutical and nutraceutical sectors due to its ability to enhance bioavailability and aid in controlled drug delivery. It plays a key role in liposomal formulations, soft gel capsules, and emulsified nutrient systems. The Global Soy Lecithin Market is expanding with increased use in dietary supplements, cognitive enhancers, and cardiovascular health products. Its biocompatibility and functional versatility make it suitable for complex drug delivery solutions. Consumer focus on preventive healthcare and daily supplementation has raised interest in lecithin-based products. It is also supported by the demand for naturally derived excipients in over-the-counter and prescription drug formulations. Pharmaceutical manufacturers benefit from its multifunctional profile, which simplifies formulation while ensuring stability.

- For instance, Lipoid’s Phospholipon® 90G, a high-purity soy lecithin, is incorporated into pharmaceutical and cosmetic formulations to increase extracellular hyaluronic acid and reduce enzymes responsible for collagen breakdown.

Personal Care and Cosmetics Industry Adopting Soy Lecithin for Moisturizing and Stabilizing Properties:

The cosmetics and personal care industry is contributing to the growth of soy lecithin through its inclusion in skincare and haircare formulations. It offers moisturizing, emulsifying, and stabilizing properties that improve the performance of creams, lotions, shampoos, and conditioners. The Global Soy Lecithin Market benefits from its compatibility with a wide range of ingredients, including oils, botanical extracts, and active compounds. Its natural origin appeals to environmentally conscious consumers and supports claims for vegan, cruelty-free, and non-toxic product lines. Growing awareness about skin health and aging is prompting brands to include lecithin for enhanced delivery of actives and smoother application. It is also being integrated into eco-conscious packaging formats due to its biodegradability and minimal environmental impact.

Health Awareness and Regulatory Support Enhancing Market Growth for Plant-Based Ingredients:

Health-conscious consumers are seeking alternatives to synthetic emulsifiers and additives, fueling demand for soy lecithin as a plant-based, label-friendly solution. Regulatory agencies across Europe and North America are encouraging the adoption of natural ingredients through stricter rules on labeling, traceability, and additive transparency. The Global Soy Lecithin Market is gaining momentum in this context as it aligns with safety and sustainability standards. Food manufacturers are reformulating legacy products to eliminate artificial emulsifiers, creating new demand for soy-derived alternatives. It offers cost-effectiveness and broad compatibility with industry standards. Clean-label certification, non-GMO sourcing, and organic variants are expanding its appeal in premium product categories. This trend continues to reinforce its relevance in global supply chains.

Market Trends:

Shift Toward Organic and Non-GMO Soy Lecithin Reflects Evolving Consumer Preferences:

The increasing preference for organic and non-GMO products is reshaping procurement and production practices in the Global Soy Lecithin Market. It is prompting manufacturers to invest in certified organic soybeans and GMO-free processing methods. Retailers and foodservice operators are demanding ingredient traceability, pushing suppliers to meet higher certification and sourcing standards. This trend aligns with a broader movement toward ethical consumption and sustainable farming. Soy lecithin suppliers are differentiating their offerings by launching USDA-certified and EU-compliant organic lecithin lines. The demand for non-GMO lecithin is especially strong in regions like Europe, where regulatory restrictions and consumer sentiment strongly oppose genetically modified ingredients. It continues to influence strategic sourcing and product positioning across key markets.

- For instance, ADM introduced its non-GMO, IP-certified soy lecithin line in 2023, sourcing exclusively from identity-preserved soybeans and achieving Non-GMO Project Verified status for all lecithin products distributed in North America and Europe, supplying over 30 major food manufacturers.

Emergence of De-Oiled and Powdered Lecithin to Support High-Performance Formulations:

Product innovations such as de-oiled and powdered lecithin are gaining traction for their utility in specialized formulations. These variants offer higher concentration of phospholipids and better functional performance in dry mixes, capsules, and instant beverages. The Global Soy Lecithin Market is witnessing increased adoption of these forms in applications where flowability, dispersibility, and dosage control are essential. De-oiled lecithin is preferred in nutraceutical and bakery sectors for its enhanced purity and stability. Powdered lecithin is also replacing liquid emulsifiers in convenience foods and dry nutrition products. Suppliers are investing in advanced drying and filtration technologies to improve quality and shelf life. This trend supports formulation flexibility and caters to evolving end-user demands.

- For instance, Bunge’s new deoiled soybean lecithin, launching in North America in late 2025, will be available in both powdered and granulated formats. This product is designed to improve mixing efficiency, offer clean taste and light color, and is produced from locally sourced soybeans near Bunge’s Bellevue, Ohio facility, supporting bakery, beverage, and supplement manufacturers.

Expansion into Aquaculture and Pet Nutrition Reflects New Application Areas:

The market is expanding into animal nutrition beyond traditional livestock feed, particularly in aquaculture and pet food segments. The Global Soy Lecithin Market is capitalizing on the need for digestibility, energy efficiency, and improved palatability in aquatic and companion animal diets. Lecithin improves feed texture and nutrient absorption, which enhances growth performance in fish and shrimp. In pet food, it supports fat emulsification and provides essential phospholipids for skin and coat health. Growing consumer focus on pet wellness is driving demand for premium, human-grade ingredients in companion animal nutrition. It is enabling lecithin suppliers to diversify revenue streams and develop tailored product lines for non-traditional feed markets. These new applications reflect broader protein diversification trends.

Integration of Soy Lecithin in Industrial and Technical Applications for Sustainability Goals:

Industrial sectors are exploring soy lecithin for applications in paints, coatings, plastics, and agriculture where bio-based surfactants are in demand. The Global Soy Lecithin Market is evolving as sustainability becomes central to procurement policies in non-food sectors. It serves as a dispersant and anti-static agent in water-based inks and biodegradable polymers. In agriculture, lecithin is used in pesticide formulations and seed coatings to improve adhesion and delivery. Industrial manufacturers view soy lecithin as a renewable, low-toxicity alternative to petrochemical-based additives. This cross-sectoral usage is prompting new partnerships and R&D investment into technical-grade lecithin production. The trend enhances market resilience and creates long-term opportunities beyond traditional consumer industries.

Market Challenges Analysis:

Volatility in Raw Material Supply Chain and Price Instability Affecting Production Economics:

The Global Soy Lecithin Market faces ongoing challenges related to fluctuations in soybean supply and pricing. Variability in crop yields, weather patterns, and global trade policies impacts the cost and availability of soybeans, especially in key producing countries like the United States, Brazil, and Argentina. These disruptions create inconsistencies in raw material procurement and lead to higher input costs for lecithin manufacturers. The market also contends with shifting tariffs and export restrictions that complicate international sourcing strategies. Non-GMO and organic soybeans are even more susceptible to supply shortages, tightening margins for producers operating in premium product segments. It must absorb these price shocks while maintaining competitive pricing in end-use sectors. Unpredictable agricultural dynamics weaken supply chain stability and hinder long-term production planning.

Competitive Pressure from Alternative Emulsifiers and Growing Regulatory Complexity:

Intensifying competition from alternative emulsifiers such as sunflower lecithin, enzymatic emulsifiers, and synthetic blends poses a major threat to the Global Soy Lecithin Market. Sunflower lecithin, in particular, is gaining popularity due to its non-allergenic profile and GMO-free status, especially in European markets. Food manufacturers seeking label-friendly formulations are increasingly evaluating substitutes that offer similar or superior performance. Regulatory complexity further complicates market operations, with varying standards across regions for GMO labeling, allergen declarations, and organic certification. Compliance costs are rising, especially for exporters serving diverse regulatory environments. It must adapt to these evolving legal frameworks without compromising operational efficiency. These pressures require strategic product differentiation and continuous investment in quality assurance to remain competitive.

Market Opportunities:

Expansion of Plant-Based and Functional Food Segments Creating New Demand Channels:

The growing consumer shift toward plant-based diets presents a significant opportunity for the Global Soy Lecithin Market. It is well-positioned to support the development of dairy alternatives, meat substitutes, and functional beverages that require effective emulsification and texture enhancement. Food manufacturers are formulating new products with clean-label, allergen-free profiles, increasing reliance on soy lecithin as a natural stabilizer. Functional food trends related to gut health, immunity, and cognitive wellness also open new application areas. Soy lecithin’s phospholipid content supports these health claims, aligning with evolving consumer expectations. It can strengthen its market position by targeting high-growth product categories and expanding partnerships with food innovators.

Innovation in Pharmaceutical and Cosmetic Delivery Systems Driving Specialty Demand:

Advancements in drug delivery and cosmetic formulation technologies present untapped potential for the Global Soy Lecithin Market. It plays a vital role in liposomal delivery systems, transdermal patches, and controlled-release formulations. Pharmaceutical firms seek bioavailable, non-toxic excipients that can support complex therapeutic profiles, and soy lecithin meets these requirements. The cosmetics industry is also expanding its use of lecithin in anti-aging, hydration, and nutrient delivery products. Growth in personalized medicine and dermaceuticals allows it to enter specialized, high-margin markets. These innovation-led applications offer long-term value beyond traditional bulk emulsifier use.

Market Segmentation Analysis:

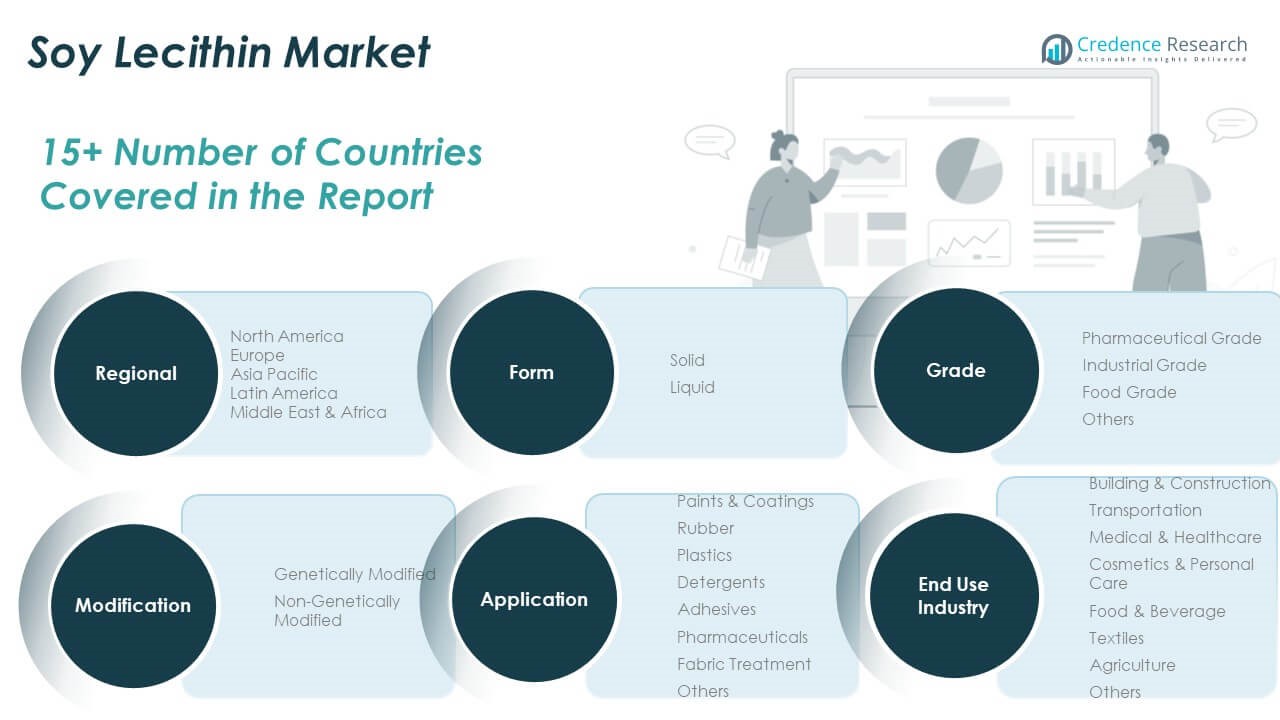

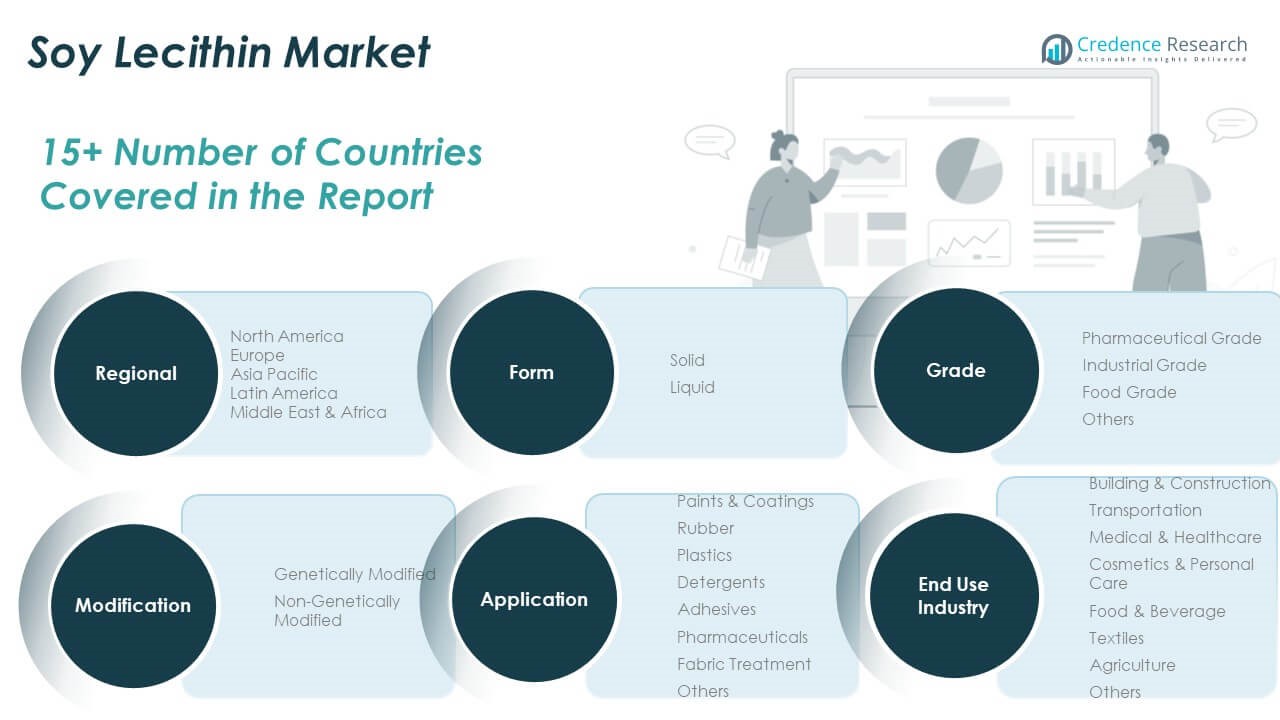

By Form

The market includes solid and liquid forms of soy lecithin. Liquid lecithin dominates due to its ease of incorporation in food, pharmaceutical, and industrial applications. Solid lecithin is preferred in powdered formulations and offers advantages in shelf stability and concentrated use.

By Grade

Soy lecithin is segmented into pharmaceutical grade, industrial grade, food grade, and others. Food grade holds the largest market share due to its extensive application in bakery, confectionery, and processed foods. Pharmaceutical grade is growing steadily, supported by its use in drug delivery and supplement formulations.

By Modification

The market differentiates between genetically modified and non-genetically modified soy lecithin. Non-GMO lecithin is gaining traction in Europe and North America due to consumer demand for clean-label and sustainable ingredients, while GMO variants remain prominent in cost-sensitive markets.

- For instance, Lecico GmbH, following its acquisition by Avril Group in 2025, has implemented blockchain-based digital traceability for its non-GMO lecithin, ensuring end-to-end supply chain transparency and compliance with new EU digital product passport regulations.

By Application

Applications include paints & coatings, rubber, plastics, detergents, adhesives, pharmaceuticals, fabric treatment, and others. Pharmaceuticals and adhesives show strong growth, driven by the shift to bio-based, non-toxic emulsifiers in high-performance products.

- For instance, Lipoid GmbH’s Phospholipon® 90G, a high-purity, non-GMO soy lecithin, is incorporated into over 200 registered pharmaceutical and cosmetic formulations worldwide.

By End-Use Industry

Key end-use industries are building & construction, transportation, medical & healthcare, cosmetics & personal care, food & beverage, textiles, agriculture, and others. Food & beverage leads the market due to high-volume demand. Cosmetics and healthcare are emerging as high-growth sectors owing to the functional and biocompatible nature of soy lecithin.

Segmentation:

By Form

By Grade

- Pharmaceutical Grade

- Industrial Grade

- Food Grade

- Others

By Modification

- Genetically Modified

- Non-Genetically Modified

By Application

- Paints & Coatings

- Rubber

- Plastics

- Detergents

- Adhesives

- Pharmaceuticals

- Fabric Treatment

- Others

By End-Use Industry

- Building & Construction

- Transportation

- Medical & Healthcare

- Cosmetics & Personal Care

- Food & Beverage

- Textiles

- Agriculture

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Regional Analysis:

North America

The North America Soy Lecithin Market size was valued at USD 116.74 million in 2018 to USD 153.64 million in 2024 and is anticipated to reach USD 307.43 million by 2032, at a CAGR of 9.1% during the forecast period. The Global Soy Lecithin Market holds a significant share in North America, accounting for approximately 24% of the global revenue. It benefits from a mature food processing industry, strong demand for clean-label products, and high R&D investment. The United States leads the region, with widespread usage in dietary supplements, health foods, and pharmaceutical formulations. Non-GMO and organic lecithin variants see growing demand, driven by regulatory alignment and consumer preferences. Companies operating in this region focus on innovation and value-added product development to meet evolving industry needs.

Europe

The Europe Soy Lecithin Market size was valued at USD 95.04 million in 2018 to USD 120.82 million in 2024 and is anticipated to reach USD 224.15 million by 2032, at a CAGR of 8.1% during the forecast period. Europe contributes around 19% of the Global Soy Lecithin Market revenue. It is driven by strict food safety regulations, growing preference for natural emulsifiers, and the expanding use of lecithin in pharmaceuticals and cosmetics. Key markets include Germany, France, and the UK, where non-GMO labeling and organic sourcing play crucial roles. The regional industry emphasizes sustainability and traceability, prompting increased adoption of clean-label ingredients. Food manufacturers and supplement producers continue to integrate soy lecithin to enhance product functionality and market appeal.

Asia Pacific

The Asia Pacific Soy Lecithin Market size was valued at USD 185.86 million in 2018 to USD 256.11 million in 2024 and is anticipated to reach USD 547.64 million by 2032, at a CAGR of 10.0% during the forecast period. Asia Pacific holds the largest share in the Global Soy Lecithin Market, accounting for approximately 42%. It benefits from rapid industrialization, rising disposable incomes, and growing demand for functional food and cosmetics. China and India are the largest consumers due to their expanding food and pharmaceutical sectors. Local production of soybeans and government support for food processing further enhance market growth. Regional companies are also responding to demand for organic and non-GMO lecithin in premium health products.

Latin America

The Latin America Soy Lecithin Market size was valued at USD 40.56 million in 2018 to USD 53.98 million in 2024 and is anticipated to reach USD 102.39 million by 2032, at a CAGR of 8.4% during the forecast period. Latin America represents around 8% of the Global Soy Lecithin Market. Brazil and Argentina lead consumption, supported by strong agricultural bases and soybean processing industries. Demand is growing across food, feed, and pharmaceutical segments, especially in functional beverages and bakery products. Cost advantages in raw material sourcing offer regional players export opportunities. The market is expanding steadily as local manufacturers adapt to international quality and labeling standards.

Middle East

The Middle East Soy Lecithin Market size was valued at USD 18.82 million in 2018 to USD 23.67 million in 2024 and is anticipated to reach USD 42.97 million by 2032, at a CAGR of 7.8% during the forecast period. The region accounts for about 4% of the Global Soy Lecithin Market revenue. Growth is supported by increasing applications in confectionery, pharmaceuticals, and personal care sectors. Gulf Cooperation Council (GCC) countries are investing in food manufacturing, creating new demand for lecithin. Import dependence remains high, but local sourcing and private-label product growth are improving regional supply chains. Demand for clean-label and plant-based emulsifiers is rising among health-conscious consumers.

Africa

The Africa Soy Lecithin Market size was valued at USD 22.99 million in 2018 to USD 35.20 million in 2024 and is anticipated to reach USD 65.50 million by 2032, at a CAGR of 7.9% during the forecast period. Africa contributes roughly 5% of the Global Soy Lecithin Market. South Africa dominates usage, followed by Nigeria and Egypt, driven by expanding processed food consumption and pharmaceutical manufacturing. Limited domestic soybean processing affects price stability, leading to higher import reliance. Growing urbanization and dietary shifts toward packaged foods are boosting lecithin demand. Multinational companies are entering local markets with affordable emulsifier solutions tailored to regional cost dynamics and quality expectations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- American Lecithin Company

- Lipoid GmbH

- DuPont de Nemours Inc.

- Sonic Biochem Extractions

- Cargill Inc.

- NOW Foods

- Wilmar International

- LECICO GmbH

- Praan Naturals

- Lasenor Emul S.L

Competitive Analysis:

The Global Soy Lecithin Market features a moderately consolidated competitive landscape, with key players focusing on product innovation, clean-label offerings, and regional expansion. Major companies such as Cargill Inc., DuPont de Nemours Inc., Wilmar International, and Lipoid GmbH maintain a strong presence through integrated supply chains and diversified portfolios. It is marked by strategic investments in non-GMO and organic product lines to meet growing consumer demand. Companies are also strengthening distribution networks and entering joint ventures to enhance market reach. Smaller regional players compete on cost and customization, especially in Asia-Pacific and Latin America. The market exhibits high competition in the food and nutraceutical segments, where players differentiate based on purity, sourcing standards, and functional performance. Innovation in powdered and de-oiled lecithin formats is driving product segmentation. The Global Soy Lecithin Market remains dynamic, with continuous focus on sustainability, regulatory compliance, and tailored solutions for high-growth industries.

Recent Developments:

- In April 2025, Lipoid Kosmetik AG, a division of Lipoid GmbH, was recognized as a triple award winner at the BSB Innovation Awards 2025. The company received accolades for its MorinGuard® upcycled ingredient, the PhytoSolve range of phospholipid-based delivery systems, and the Peeling Complex for gentle exfoliation. These innovations highlight Lipoid’s commitment to sustainable sourcing and advanced delivery technologies in cosmetic and personal care applications.

Market Concentration & Characteristics:

The Global Soy Lecithin Market exhibits moderate concentration, with a mix of multinational corporations and regional suppliers influencing pricing, distribution, and innovation. It is characterized by vertically integrated operations, where leading players manage sourcing, processing, and product development. The market operates on long-term supply contracts, especially in food, pharmaceutical, and cosmetic applications. It shows high sensitivity to soybean price fluctuations, regulatory shifts, and consumer trends favoring clean-label and non-GMO ingredients. Demand patterns vary across regions, with mature markets emphasizing product quality and emerging markets prioritizing affordability. The Global Soy Lecithin Market also displays strong adaptability, with manufacturers customizing formulations for diverse industrial needs while complying with evolving safety and labeling standards.

Report Coverage:

The research report offers an in-depth analysis based on form, grade, modification, application, and end-use industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising consumer demand for clean-label, non-GMO ingredients will accelerate product innovation and organic lecithin adoption.

- Functional food and beverage growth will drive increased usage of soy lecithin in emulsification and texture enhancement.

- Pharmaceutical applications will expand due to lecithin’s role in liposomal drug delivery and controlled-release formulations.

- Asia-Pacific will continue to lead global volume growth, supported by industrialization and growing health awareness.

- Strategic investments in de-oiled and powdered lecithin will diversify product portfolios and improve margin performance.

- Increasing regulatory scrutiny on food additives will require continuous quality, traceability, and compliance improvements.

- Cosmetic and personal care manufacturers will integrate soy lecithin into natural and sustainable product lines.

- Competition from sunflower lecithin and synthetic emulsifiers will pressure pricing and demand differentiation.

- Technological advances in processing will improve lecithin purity, stability, and shelf life across applications.

- Strategic partnerships and capacity expansions will define market leadership over the next decade.