Market Overview:

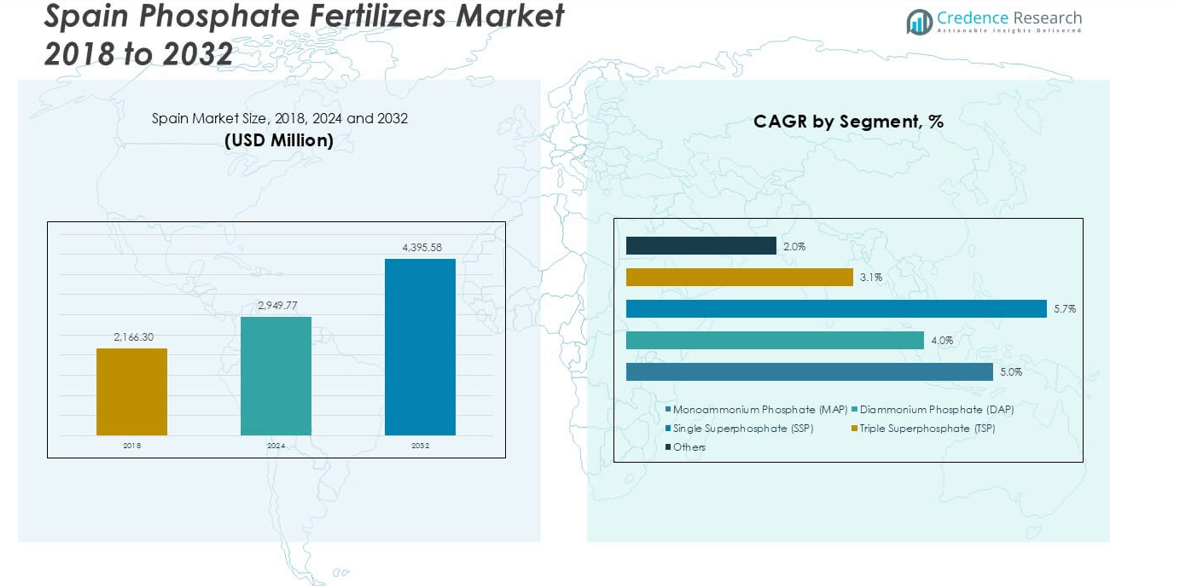

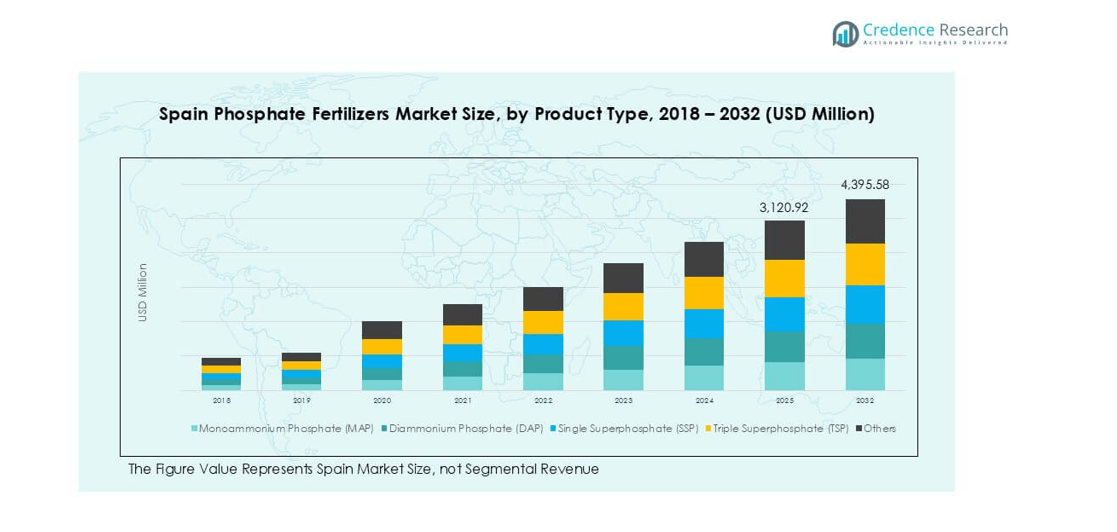

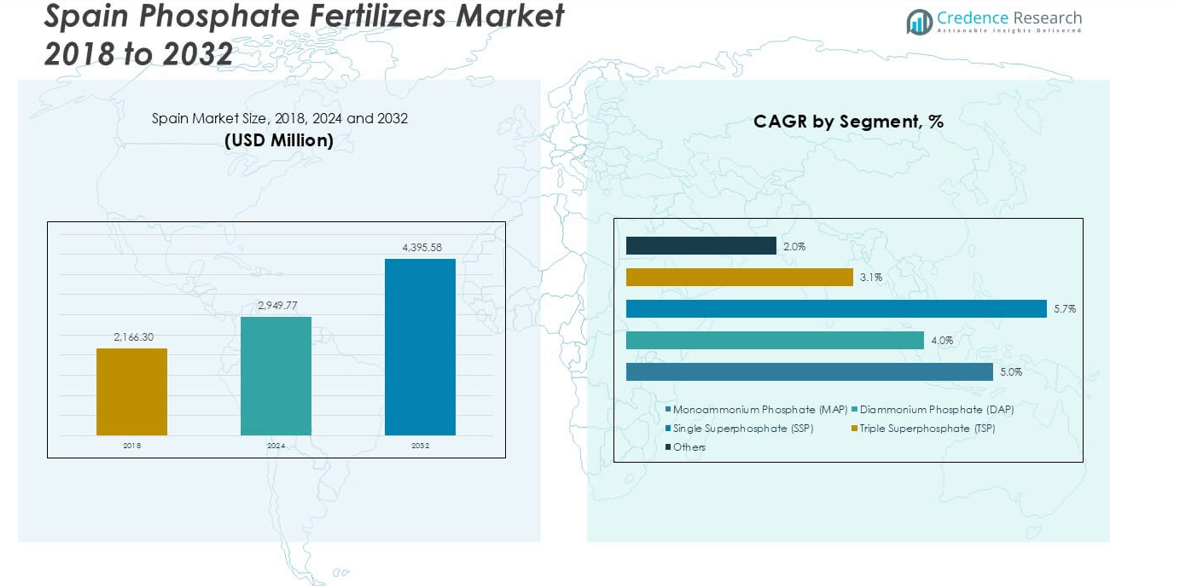

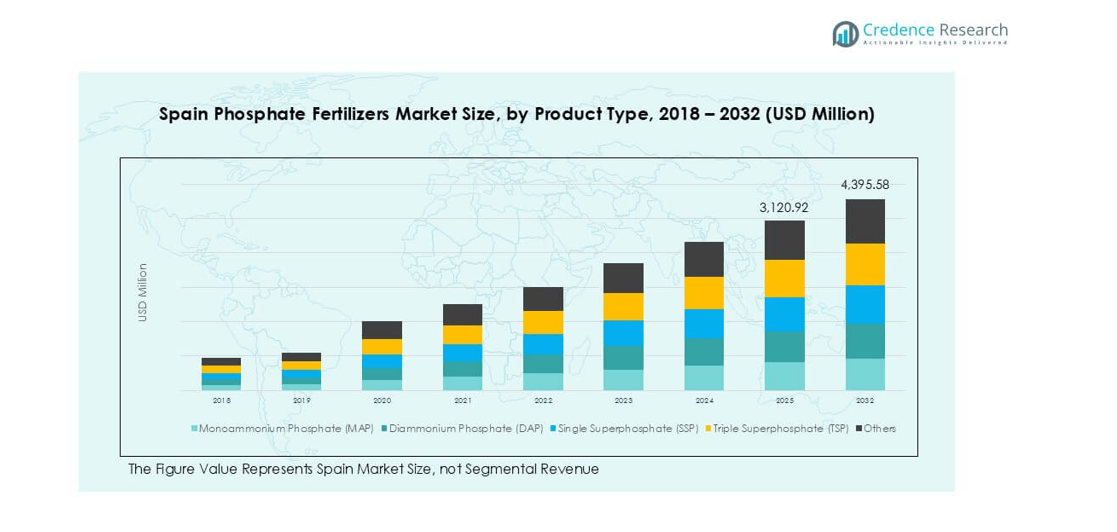

Spain Phosphate Fertilizers market size was valued at USD 2,166.30 million in 2018 and grew to USD 2,949.77 million in 2024. It is anticipated to reach USD 4,395.58 million by 2032, at a CAGR of 5.01% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Phosphate Fertilizers Market Size 2024 |

USD 2,949.77 million |

| Spain Phosphate Fertilizers Market, CAGR |

5.01% |

| Spain Phosphate Fertilizers Market Size 2032 |

USD 4,395.58 million |

Spain’s phosphate fertilizers market is driven by major players such as Yara International, EuroChem Group, ICL Group Ltd, BASF SE, OCI Nitrogen, Nutrien Ltd., CF Industries Holdings, K+S AG, Helm AG, and COMPO Expert GmbH. These companies dominate supply through high-quality MAP, DAP, and specialty phosphate products, supported by robust distribution networks and agronomic services. The South region leads with 32% market share, driven by extensive olive, citrus, and greenhouse cultivation requiring consistent phosphorus inputs. The East region follows with 24% share, supported by fruit, vegetable, and viticulture production. These regions form the core demand hubs, enabling steady market growth and encouraging suppliers to expand water-soluble and precision farming fertilizer offerings.

Market Insights

- The Spain phosphate fertilizers market was valued at USD 2,949.77 million in 2024 and is projected to reach USD 4,395.58 million by 2032, registering a CAGR of 5.01% during the forecast period.

- Rising demand for cereals, grains, and horticulture crops drives phosphate consumption, with MAP and DAP holding over 60% combined share due to high nutrient efficiency and suitability for varied soils.

- Trends include growing adoption of water-soluble fertilizers for drip irrigation, precision farming practices, and bio-based phosphorus products aligning with EU sustainability policies.

- The market is moderately consolidated with major players like Yara International, EuroChem, BASF SE, Nutrien, and ICL Group expanding specialty phosphate portfolios and strengthening cooperative distribution networks.

- Regionally, the South leads with 32% share, followed by the East with 24%, Central with 18%, North with 16%, and Islands contributing 10%, forming the main demand clusters.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Monoammonium Phosphate (MAP) leads the Spain phosphate fertilizers market, holding over 35% share in 2024. Its dominance comes from high nutrient concentration and suitability for a variety of soils and crops. Diammonium Phosphate (DAP) follows closely, favored for its high phosphorus and nitrogen content supporting early root development. Single Superphosphate (SSP) and Triple Superphosphate (TSP) maintain steady demand due to affordability and wide use in traditional farming. Growing adoption of precision farming and nutrient-specific fertilization drives demand for MAP and DAP as farmers seek higher yield efficiency.

- For example, Fertiberia’s “Impact Zero” fertilizer, made with green hydrogen, was used in a pilot project on maize fields for PepsiCo, paving the way for a major expansion in 2024.

By Application

Cereals & Grains dominate the market, accounting for over 40% share in 2024. Rising production of wheat, barley, and maize in Spain drives strong phosphate demand for improved root strength and yield. Oilseeds form the second-largest segment, benefiting from growing sunflower cultivation and higher demand for edible oils. Fruits & Vegetables show rapid growth, supported by Spain’s large horticulture industry and export potential. Government programs promoting balanced fertilizer use and soil health improvement further boost phosphate use across all segments, ensuring sustained demand growth.

- For instance, in 2023, Spain’s wheat harvest was drastically reduced by severe drought, resulting in a production of less than half of the 5.8 million metric tons stated.

Market Overview

Rising Demand for High-Yield Crops

Spain’s growing need for cereals, grains, and horticultural produce fuels phosphate fertilizer use. Farmers adopt high-analysis fertilizers like MAP and DAP to boost soil fertility and achieve higher yields. Government initiatives supporting food security and productivity further accelerate adoption. Rising exports of fruits and vegetables add pressure for consistent, quality harvests. These factors collectively strengthen phosphate demand and ensure sustained market expansion through the forecast period.

- For instance, in 2023, Fertiberia was active in the Castilla y León and Aragón regions through its regional subsidiary and logistics centers. That year, it also partnered with PepsiCo on a pilot program in Spain to provide low-carbon fertilizers for potato and corn crops.

Precision Farming and Soil Health Focus

Adoption of precision agriculture technologies drives targeted phosphate fertilizer application. Spanish farmers increasingly use soil testing, GPS-guided equipment, and smart nutrient management systems to optimize phosphorus usage. This trend minimizes wastage, reduces environmental impact, and enhances yield efficiency. Government programs promoting balanced fertilization practices support this shift, resulting in higher adoption of premium and customized phosphate blends.

- For instance, in 2024, John Deere focused on hardware and software updates for its precision technology. This included the introduction of the new G5Plus CommandCenter displays, which have built-in variable-rate application capabilities.

Supportive Government Policies and Subsidies

Spain benefits from EU Common Agricultural Policy (CAP) incentives promoting sustainable farming and nutrient management. Subsidies for fertilizer purchases and programs encouraging balanced NPK application boost phosphate usage. Policymakers also support initiatives for soil quality improvement and crop diversification, which create demand for phosphorus-rich fertilizers. These measures ensure steady growth in fertilizer consumption, particularly for high-value crops and cereals.

Key Trends & Opportunities

Shift Toward Water-Soluble Fertilizers

Farmers in Spain increasingly adopt water-soluble phosphate fertilizers to meet drip irrigation needs. This trend supports precision dosing and improves nutrient uptake efficiency for high-value crops. Horticultural producers, particularly in greenhouse farming, prefer these products for enhanced solubility and quick absorption. Rising adoption of fertigation practices provides opportunities for fertilizer manufacturers to expand water-soluble product portfolios.

- For instance, in 2023, ICL Specialty Fertilizers likely provided a smaller but significant portion of the total water-soluble fertilizer used in Spanish greenhouses, which covered approximately 49,316 hectares in the main growing regions like Almería.

Grwing Demand for Specialty and Bio-Based Fertilizers

Demand for environmentally friendly phosphate fertilizers is rising as Spain focuses on sustainable agriculture. Specialty products with slow-release formulations or bio-enhanced phosphorus are gaining traction. These solutions improve soil microbial activity and reduce runoff losses, aligning with EU sustainability goals. Market players investing in R&D and launching innovative bio-based phosphate products can capture growing demand among eco-conscious farmers.

- For instance, EuroChem offers various advanced fertilizers, including “enhanced-efficiency fertilizers” (EEFs) like their ENTEC and UTEC products, which are designed to reduce nutrient loss, increase efficiency, and lower the environmental impact of farming.

Key Challenges

Environmental Regulations and Runoff Concerns

Strict EU regulations on nutrient runoff and phosphate pollution create compliance challenges for farmers. Over-application risks penalties and environmental damage, prompting cautious fertilizer use. This limits market growth potential unless solutions offer better nutrient efficiency and low leaching risk. Manufacturers must innovate to provide eco-friendly formulations that meet these regulatory standards.

Volatility in Raw Material Prices

Fluctuating global prices of phosphate rock and related inputs increase production costs for fertilizer suppliers. Import dependence exposes Spain to supply chain risks and price volatility. Rising costs can reduce farmers’ purchasing power and shift demand toward cheaper alternatives, impacting market growth. Long-term supply contracts and local sourcing initiatives are essential to mitigate these risks.

Regional Analysis

South (Andalusia, Murcia, Extremadura)

The South leads phosphate consumption with 32% market share. Large acreage of olives, citrus, and horticulture drives phosphorus demand. Drip irrigation supports soluble MAP and fertigation blends. Greenhouse clusters in Almería intensify application frequency and dosing control. Export-focused fruit growers prioritize consistent nutrient programs. Water-scarce zones favor efficient, water-soluble grades to cut losses. Regional cooperatives negotiate seasonal bulk purchases and logistics.

East (Catalonia, Valencia, Aragon, Balearic)

The East holds 24% market share. High-value fruits, vegetables, and wine grapes require reliable phosphorus supply. Precision farming adoption boosts targeted MAP and DAP usage. Vineyards emphasize root development and early vigor responses. Processing industries prefer predictable quality and certified inputs. Ports enable steady import flow and competitive pricing. Retail networks support small and medium farms with tailored blends.

Central (Castilla-La Mancha, Madrid, Castilla y León)

The Central region accounts for 18% market share. Cereals, sunflower, and legumes create steady baseline demand. Broadacre farms prioritize cost-effective SSP and balanced NPK formulations. Variable soils increase reliance on soil testing and calibrated doses. Larger farm sizes enable planned seasonal procurement. Coop storage smooths supply during peak application windows. Growing oilseed rotations support phosphorus replenishment strategies.

North (Galicia, Asturias, Cantabria, Basque Country, Navarra, La Rioja)

The North represents 16% market share. Mixed farming and dairy systems maintain consistent phosphorus needs. Forage and maize silage programs favor dependable TSP and DAP inputs. Rainfall patterns raise runoff concerns and stewardship practices. Farmers adopt split applications and buffer management. Viticulture in Rioja demands precise early-season phosphorus. Regional guidance encourages balanced nutrient plans. Retailers stock low-leaching, efficiency-focused products.

Market Segmentations:

By Product Type:

- Monoammonium Phosphate (MAP)

- Diammonium Phosphate (DAP)

- Single Superphosphate (SSP)

- Triple Superphosphate (TSP)

- Others

By Application:

- Cereals & Grains

- Oilseeds

- Fruits & Vegetables

- Others

By Geography:

- South (Andalusia, Murcia, Extremadura)

- East (Catalonia, Valencia, Aragon, Balearic)

- Central (Castilla-La Mancha, Madrid, Castilla y León)

- North (Galicia, Asturias, Cantabria, Basque Country, Navarra, La Rioja)

Competitive Landscape

The Spain phosphate fertilizers market is moderately consolidated, with global and regional players competing through product innovation, distribution strength, and pricing strategies. Leading companies such as Yara International, EuroChem Group, ICL Group Ltd, BASF SE, OCI Nitrogen, Nutrien Ltd., CF Industries Holdings, K+S AG, Helm AG, and COMPO Expert GmbH collectively hold a significant market share. These players focus on high-analysis phosphate products like MAP and DAP, supported by efficient logistics and agronomic advisory services. Many companies are expanding their water-soluble and specialty phosphate offerings to serve precision farming and fertigation needs in Spain’s horticulture sector. Strategic partnerships with local cooperatives and distributors help improve market penetration and ensure timely supply during peak application seasons. Continuous R&D investment in eco-friendly and slow-release formulations allows these players to meet strict EU environmental regulations and capture demand from sustainability-focused farmers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2023, Yara announced that it is acquiring the organic-based fertilizer business of Agribios, a company in Italy. The acquisition includes a production facility in Ronco all’Adige, focused on sustainable farming solutions through organic-based and organo-mineral fertilizers. This deal aligns with Yara’s strategy to expand its offerings in regenerative agriculture, complementing its current mineral fertilizer portfolio.

- In May 2022, Coromandel International, a fertilizer manufacturer, plans to buy a 45% stake in Baobab Mining and Chemicals Corporation (BMCC), a rock phosphate mining firm based in Senegal Africa, for $19.6 million (approximately $150 crore).

- In May 2022, Indian Potash Ltd signed a five-year agreement with Israel Chemical Ltd to import 0.6-0.65 million tonnes of potash muriate annually.

- In February 2022, EuroChem Group (hereafter referred to as “EuroChem” or “the Group”), a leading global producer of fertilizer, recently announced that it had completed the acquisition of the Serra do Salitre phosphate project in Brazil.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for phosphate fertilizers will grow steadily with rising production of cereals and horticultural crops.

- Adoption of precision farming will increase targeted application of MAP, DAP, and water-soluble products.

- Fertigation and drip irrigation systems will drive higher use of soluble phosphate grades in greenhouse farming.

- Specialty and bio-based phosphate fertilizers will gain popularity to meet EU sustainability targets.

- Companies will invest in R&D for slow-release and eco-friendly formulations to reduce nutrient losses.

- Strategic partnerships with cooperatives will expand reach and improve seasonal supply consistency.

- Digital advisory tools will support farmers in optimizing phosphorus application rates.

- Regional demand will stay strongest in the South and East, supported by export-oriented crops.

- Volatility in raw material prices may lead to more localized sourcing and strategic imports.

- Market players will enhance farmer training programs to promote balanced nutrient management practices.