Market Overview

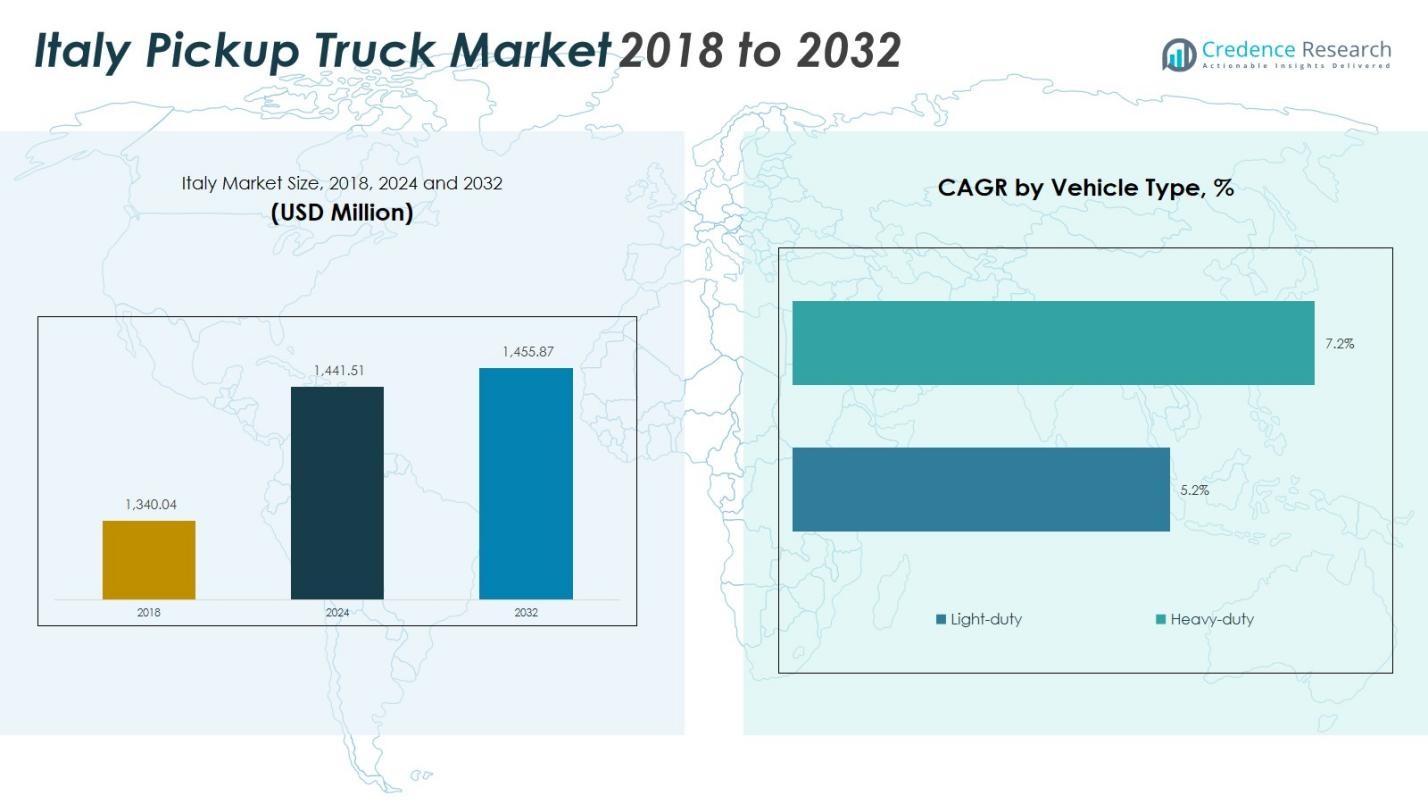

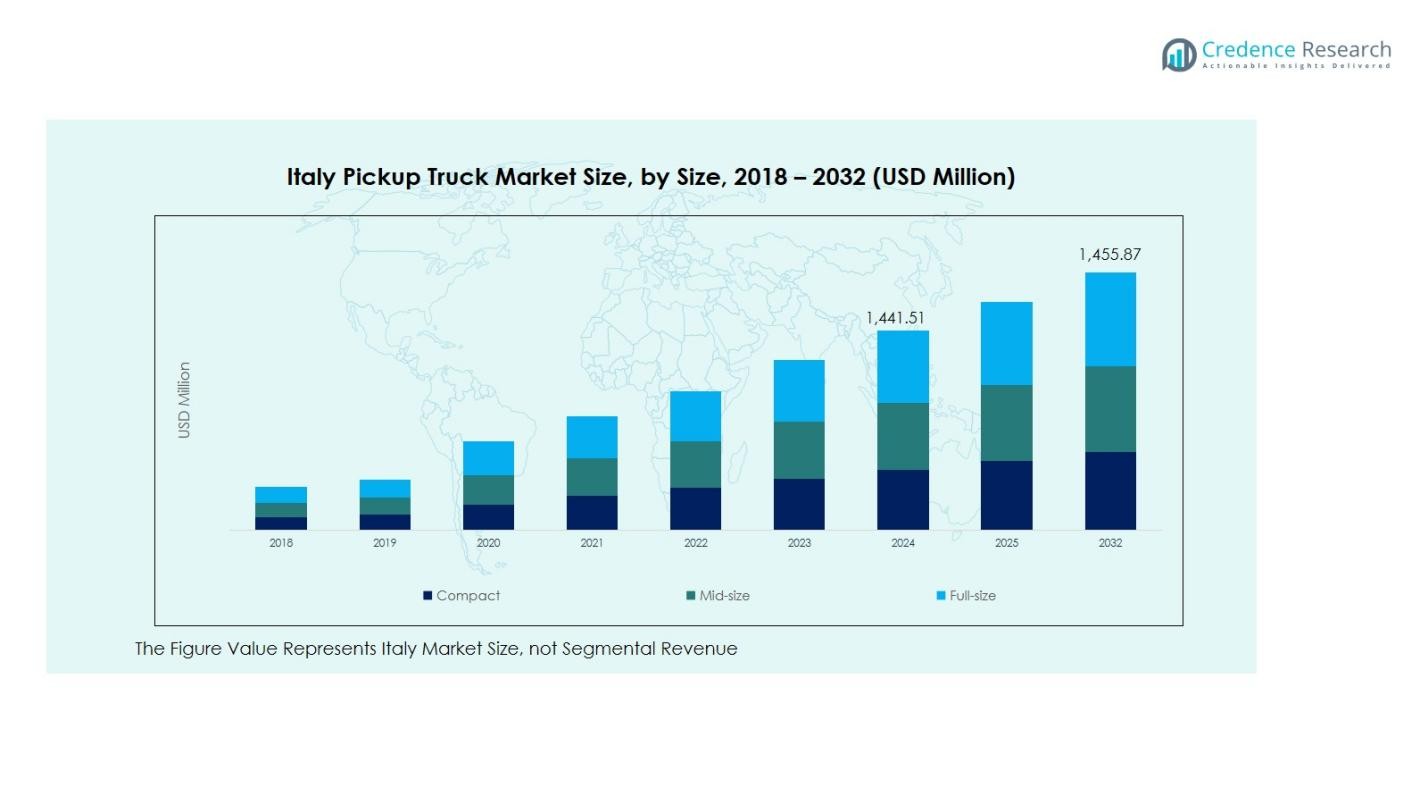

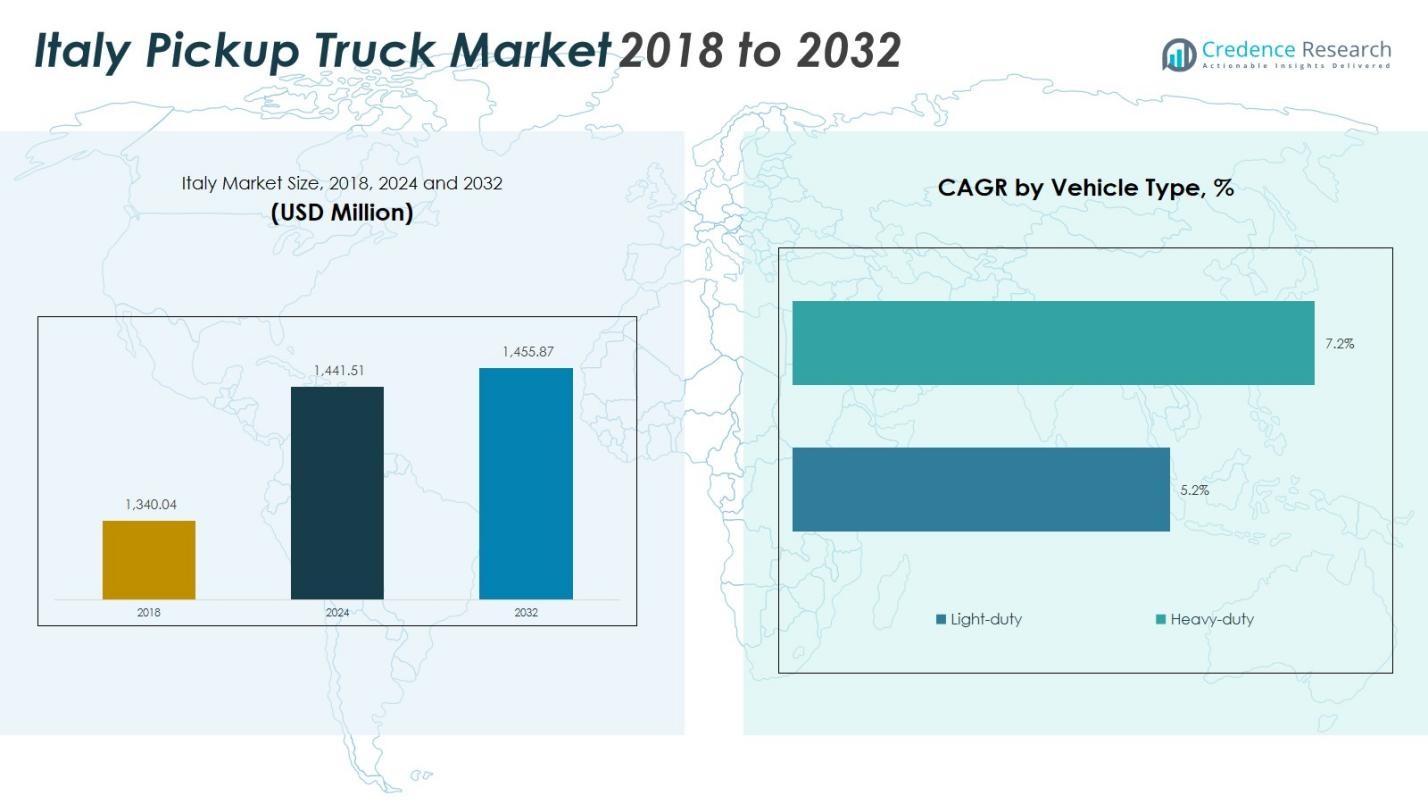

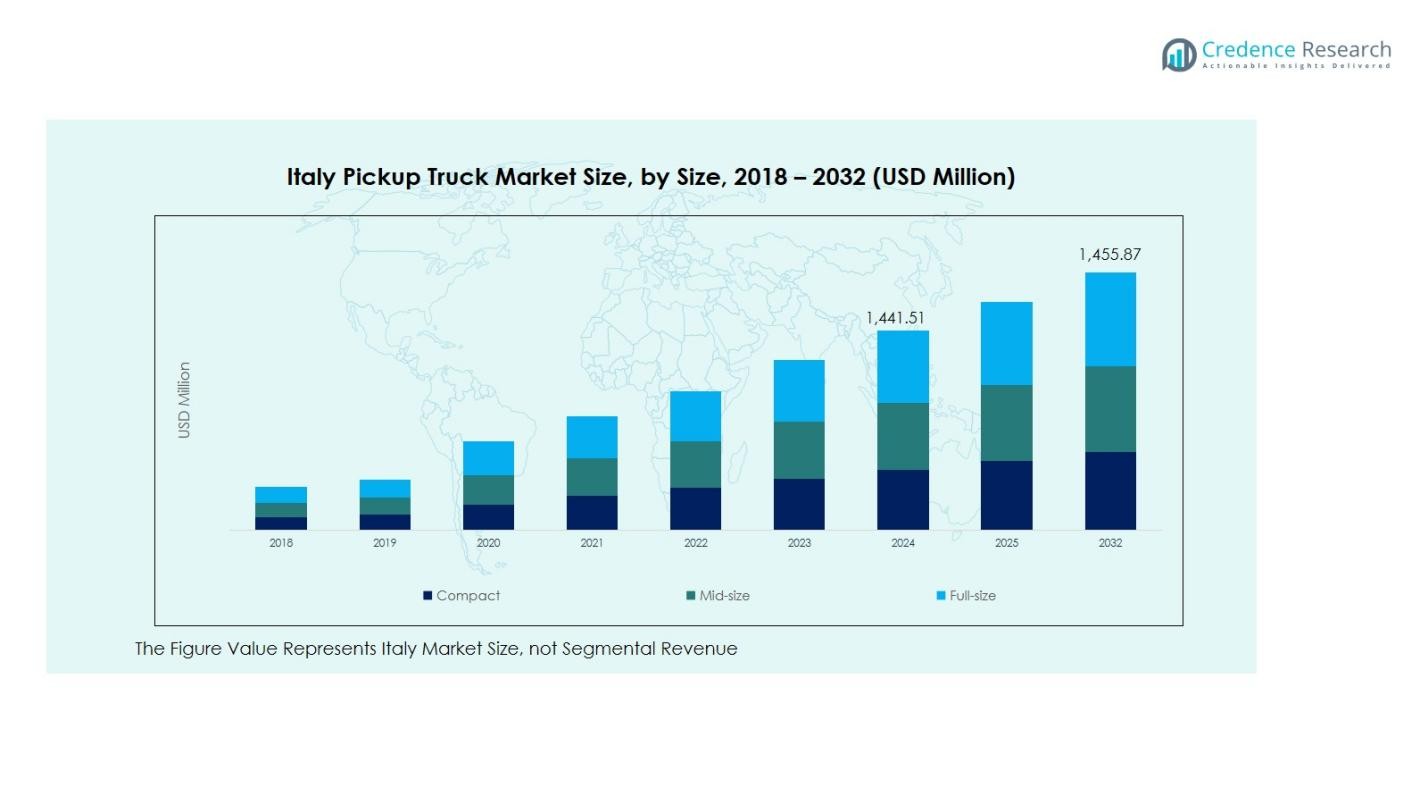

Italy Pickup Truck Market size was valued at USD 1,340.04 million in 2018, reaching USD 1,441.51 million in 2024, and is anticipated to reach USD 1,455.87 million by 2032, at a CAGR of 0.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Pickup Truck Market Size 2024 |

USD 1,441.51 Million |

| Italy Pickup Truck Market, CAGR |

0.12% |

| Italy Pickup Truck Market Size 2032 |

USD 1,455.87 Million |

Italy Pickup Truck Market is shaped by the presence of top global manufacturers such as Toyota, Ford, Volkswagen, Isuzu, Mitsubishi, Nissan, and Foton, all of which offer versatile models to meet local demands across commercial, industrial, and personal use. Toyota Hilux and Ford Ranger lead with strong reliability and performance across fleet and utility applications. Northern Italy emerges as the leading region with a 42% market share in 2024, supported by high commercial activity, urban logistics, and industrial operations. Central Italy and Southern Italy & Islands follow with shares of 29% each, driven by agriculture, construction, and tourism-based demand, with growing interest in eco-friendly pickup models.

Market Insights

Market Insights

- The Italy Pickup Truck Market is valued at USD 1,441.51 million in 2024 and is projected to grow at a CAGR of 0.12% through 2032.

- The market is driven by growth in urban logistics, last-mile delivery, and infrastructure-led demand, especially in light-duty and commercial vehicle segments.

- Trends include rising adoption of electric pickups and connected vehicle technologies, supported by regulatory incentives and expanding charging infrastructure.

- Key players like Toyota, Ford, and Volkswagen maintain leadership through product reliability and aftersales support, with strategic focus on sustainability and digital features.

- Northern Italy leads the market with 42% share, followed by Central and Southern regions at 29% each, while light-duty pickups represent 65% of total segment share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

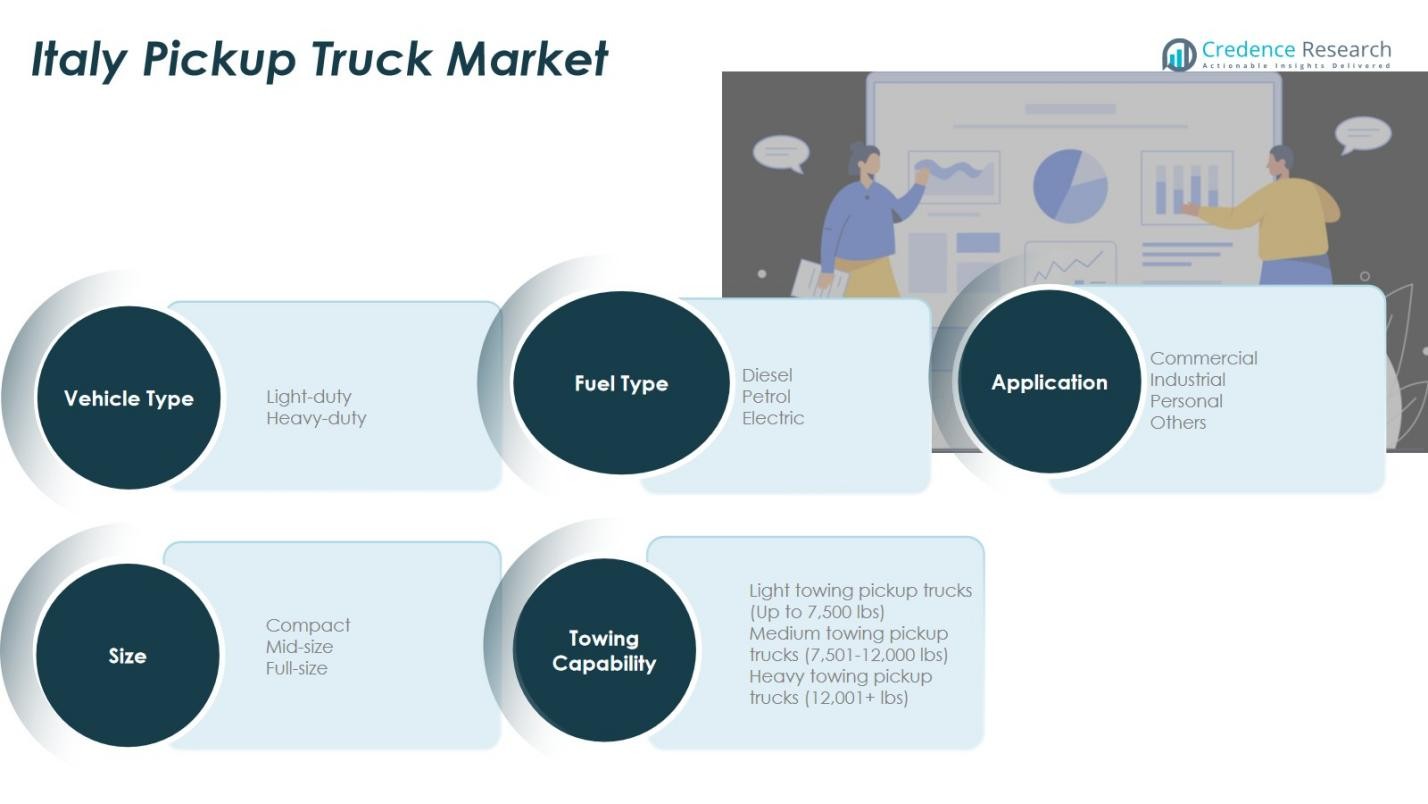

By Vehicle Type:

The light-duty segment holds a dominant share of 65% in the Italy Pickup Truck Market in 2024, driven by growing demand from urban logistics and last-mile delivery services. These trucks offer better fuel efficiency and maneuverability, making them ideal for small businesses and personal use. Heavy-duty trucks, accounting for the remaining 35%, remain crucial for construction and industrial operations requiring higher payload capacity. Regulatory incentives for cleaner transportation and fleet modernization further support adoption across both segments.

- For instance, government initiatives such as Italy’s National Recovery and Resilience Plan provide substantial incentives for fleet modernization, including up to €20,000 subsidies for new electric light commercial vehicles, promoting cleaner transport solutions across both segments.

By Application:

The commercial segment leads the Italy Pickup Truck Market with a 48% share in 2024, supported by high utilization in logistics, construction, and agricultural operations. Industrial applications account for 26%, driven by demand from manufacturing and mining sectors. The personal segment captures 18%, reflecting lifestyle preferences and the trend of recreational vehicle usage. Other uses, including emergency and utility services, occupy the remaining share. The growing e-commerce sector and SME activities further amplify demand across commercial and industrial buyers.

- For instance, Lidl Italia partnered with Daimler Truck Italia and LC3 Trasporti to introduce the fully electric Mercedes-Benz eActros 600, with the collaboration being announced in May 2025 and the first unit delivered to Lidl for operations at that time.

By Fuel Type:

Diesel pickups dominate the Italy Pickup Truck Market with a 72% share in 2024 due to their superior torque and cost-effective performance for heavy-duty applications. Petrol variants hold a 20% share, catering to light-duty and personal users seeking lower emission levels and smoother performance. Electric pickups, with an 8% share, are rapidly gaining traction in line with Italy’s national decarbonization goals and urban emission regulations. Government incentives and advancements in EV infrastructure are expected to boost the adoption of electric pickups in the forecast period.

Key Growth Drivers

Key Growth Drivers

Urban Logistics Expansion

The expansion of urban logistics and last-mile delivery services is a key driver in the Italy Pickup Truck Market, as businesses increasingly rely on compact mobility solutions to navigate congested metropolitan areas. Light-duty pickups are particularly favored for their fuel efficiency, maneuverability, and versatility, allowing logistics operators to fulfill deliveries in narrow streets and pedestrian zones. The growth of e-commerce and the need for rapid transportation solutions have further accelerated this trend. Additionally, supportive government initiatives for sustainable commercial vehicle use and fleet modernization are boosting market penetration.

- For instance, FOTON Motors secured 400 cumulative orders for its Tunland G7 pickups in Italy, a model that meets strict EU emissions standards and offers robust features ideal for urban delivery conditions.

Infrastructure Investments and Industrial Activity

Increasing investments in infrastructure, construction, and industrial developments are major contributors to the rising demand for pickup trucks in Italy. Companies in these sectors depend on heavy-duty trucks for efficient transport of equipment and materials across job sites. The market benefits from ongoing modernization projects, growth in regional construction, and expansion in manufacturing activities. Pickup trucks offer cost-effective load-carrying capacity, durability, and adaptability, making them indispensable in these industries. Demand for robust vehicles that withstand rugged conditions is also driving product innovation and sales in the heavy-duty segment.

- For instance, Astra Veicoli Industriali, specialized in heavy trucks for mining and construction sectors, supplying durable vehicles capable of handling rugged terrains and heavy loads for roadworks and urban redevelopment projects.

Shift Toward Sustainable Fleet Operations

The growing emphasis on sustainability and emissions reduction is shaping fleet purchasing decisions across Italy. This shift is driving demand for cleaner alternatives, including electric and hybrid pickup trucks. Companies are increasingly investing in low-emission vehicles to comply with EU regulations and corporate sustainability goals. Incentives and tax credits offered by the Italian government for eco-friendly commercial vehicles are accelerating the adoption of green technologies. As electric charging infrastructure improves, more fleet operators are transitioning from conventional diesel-powered pickups to electric models, unlocking long-term cost savings and environmental benefits.

Key Trends & Opportunities

Electrification of Pickup Trucks

Electrification presents a major trend and opportunity in the Italy Pickup Truck Market, supported by growing environmental awareness and regulatory pressure to reduce CO₂ emissions. Several OEMs are introducing electric pickup models targeting both commercial and personal users. The segment’s growth is supported by improvements in battery range, faster charging technologies, and government incentives. These developments position electric pickups as a viable alternative for businesses looking to reduce fuel costs and meet sustainability targets. Aligned with Italy’s decarbonization goals, electrification represents a high-growth opportunity for manufacturers and fleet operators alike.

- For instance, Isuzu is set to launch its all-electric D-Max pickup in Europe in 2025, featuring a 9 kWh battery and robust towing capacity, targeting commercial users seeking sustainability without sacrificing performance.

Technological Advancements and Connectivity

Enhanced vehicle technologies such as telematics, ADAS, and seamless connectivity are transforming the Italy Pickup Truck Market. Advanced features support fleet management with real-time tracking, route optimization, and predictive maintenance. These technologies improve operational efficiency and safety, helping businesses reduce downtime and operating costs. Moreover, the integration of digital dashboards, infotainment systems, and driver-assist features enhances user experience. The adoption of smart technologies not only boosts product appeal but also differentiates offerings in a competitive market. This trend presents an opportunity for OEMs to integrate value-added services and data-driven solutions.

- For instance, Italy’s ADAS market growth is supported by advancements in radar, LiDAR, and camera-based systems, improving hazard detection and helping comply with EU safety regulations that mandate features such as automatic emergency braking and lane departure warnings

Key Challenges

Key Challenges

Slow Economic Growth and Weak Consumer Spending

Italy’s moderate economic recovery and consumer spending limitations pose a challenge for sustained pickup truck sales. High vehicle acquisition costs, particularly in the case of heavy-duty or electric pickups, deter small businesses and individual buyers. Financing constraints and rising ownership expenses add to the burden. In such an environment, businesses often delay fleet upgrades or opt for used vehicles instead of new purchases. Economic uncertainty also impacts corporate investments and infrastructure projects, further influencing market demand. Overcoming these macroeconomic barriers is essential for achieving consistent market expansion.

Regulatory Compliance and Emission Restrictions

Stringent emission standards and regulatory compliance requirements significantly impact the Italy Pickup Truck Market, particularly for diesel-powered vehicles. The transition toward low-emission and electric models requires high upfront investments in R&D and infrastructure development. Manufacturers also face challenges in complying with evolving EU standards, including Euro 7 norms, which demand cleaner engine technologies. Additionally, restrictions on vehicles in urban low-emission zones and potential increases in diesel taxes create operational uncertainties for fleet operators. These regulatory pressures may slow the adoption of traditional pickups while increasing costs for market participants.

Regional Analysis

Northern Italy

Northern Italy leads the pickup truck market with a share of 42%, driven by industrial concentration, high commercial activity, and advanced infrastructure. Regions like Lombardy, Veneto, and Emilia-Romagna act as critical hubs for manufacturing, logistics, and construction, fueling increased adoption of both light- and heavy-duty pickups. The presence of SMEs and a strong export-oriented economy further support demand for fleet and utility vehicles. Additionally, high purchasing power and better road networks enhance the region’s uptake of modern and fuel-efficient models. Growing investments in green logistics and electric vehicle infrastructure also favor emerging electric pickup adoption.

Central Italy

Central Italy holds a 29% share of the pickup truck market, supported by steady growth in construction, agriculture, and light industrial activities across regions such as Tuscany, Lazio, and Umbria. The segment benefits from increased demand in rural and semi-urban areas where pickup trucks are used for both commercial and personal utility. Cultural preferences for versatile vehicles among small business owners contribute to market stability. Moreover, the growing tourism and hospitality sectors drive demand for specialized fleet pickups. Ongoing infrastructure improvements and greater focus on sustainable mobility are expected to strengthen the region’s adoption of electric and hybrid pickups.

Southern Italy & Islands

Southern Italy and the islands account for 29% of the pickup truck market, driven by agricultural operations, construction activity, and public infrastructure projects across regions including Sicily, Campania, and Puglia. Pickup trucks are widely used for transporting goods in rugged terrains and coastal areas, supporting demand for durable and high-ground-clearance models. The region also sees rising adoption among small businesses and municipality services. However, lower purchasing power and a slower economic recovery compared to northern regions pose challenges. Government incentives for green vehicles and rural development projects offer opportunities for market expansion, particularly in the electric and compact pickup category.

Market Segmentations:

By Vehicle Type

By Application

- Commercial

- Industrial

- Personal

- Others

By Fuel Type

By Size

- Compact

- Mid-size

- Full-size

By Towing Capability

- Light towing pickup trucks (Up to 7,500 lbs)

- Medium towing pickup trucks (7,501–12,000 lbs)

- Heavy towing pickup trucks (12,001+ lbs)

By Region

- Northern Italy

- Southern Italy & Island

- Central Italy

Competitive Landscape

Competitive landscape in the Italy Pickup Truck Market is defined by the presence of key players such as Toyota, Ford, Volkswagen, Isuzu, Mitsubishi, Nissan, and Foton. These brands collectively shape market dynamics through strategic product positioning, brand loyalty, and performance-driven offerings. Toyota Hilux and Ford Ranger remain top-performing models due to their durability, fuel efficiency, and strong aftersales support. Volkswagen and Nissan continue to innovate around driver comfort and safety features, targeting both commercial and personal buyers. The competitive environment is further intensified by the rising focus on electric pickups and sustainable fleet solutions. OEMs are increasingly investing in electric powertrains, lightweight materials, and smart connectivity to differentiate their products. Strategic partnerships, dealership expansions, product updates, and promotional financing schemes are common strategies to gain and retain market share. Additionally, customization options and localized marketing campaigns play a pivotal role in appealing to regional customer preferences in Italy’s diversified pickup truck market.

Key Player Analysis

- Toyota (Hilux)

- Ford (Ranger)

- Volkswagen (Amarok)

- Isuzu (D-Max)

- Mitsubishi (L200)

- Nissan (Navara)

- Foton (Tunland G7)

Recent Developments

- In November 2025, RAM unveiled its compact lifestyle pickup, the RAM Rampage, in Italy at the Fieracavalli 2025 exhibition, marking a new product entry into the Italian pickup-truck market.

- On July 30, 2025, Tata Motors announced an agreement to acquire the non-defence commercial vehicle business of the Italian Iveco Group for approximately €3.8 billion through an all-cash voluntary tender offer.

- In March 2024, FOTON delivered 200 units of its TUNLAND G7 pickup trucks in Italy, bringing the cumulative orders in the country to 400 units.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Application, Fuel Type, Size, Towing Capability and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Italy Pickup Truck Market will witness steady demand growth driven by urban logistics and regional delivery services.

- Electric pickup trucks will gain market share as emissions regulations tighten and charging infrastructure improves.

- OEMs will increasingly focus on fuel-efficient and sustainable models to comply with EU environmental targets.

- Light-duty pickups will continue to dominate due to their suitability for urban and small business use.

- Technological advancements in telematics and connectivity will enhance fleet management and driver safety.

- Expansion of e-commerce and last-mile delivery networks will further boost commercial vehicle adoption.

- Customization options and aftermarket upgrades will become a key differentiator for manufacturers.

- Domestic regulatory incentives will encourage fleet modernization and transition to clean energy vehicles.

- Competitive price offerings and flexible financing options will influence customer purchasing behavior.

- Regional infrastructure development and construction projects will support long-term demand for heavy-duty pickup trucks.

Market Insights

Market Insights Key Growth Drivers

Key Growth Drivers Key Challenges

Key Challenges