Market Overview

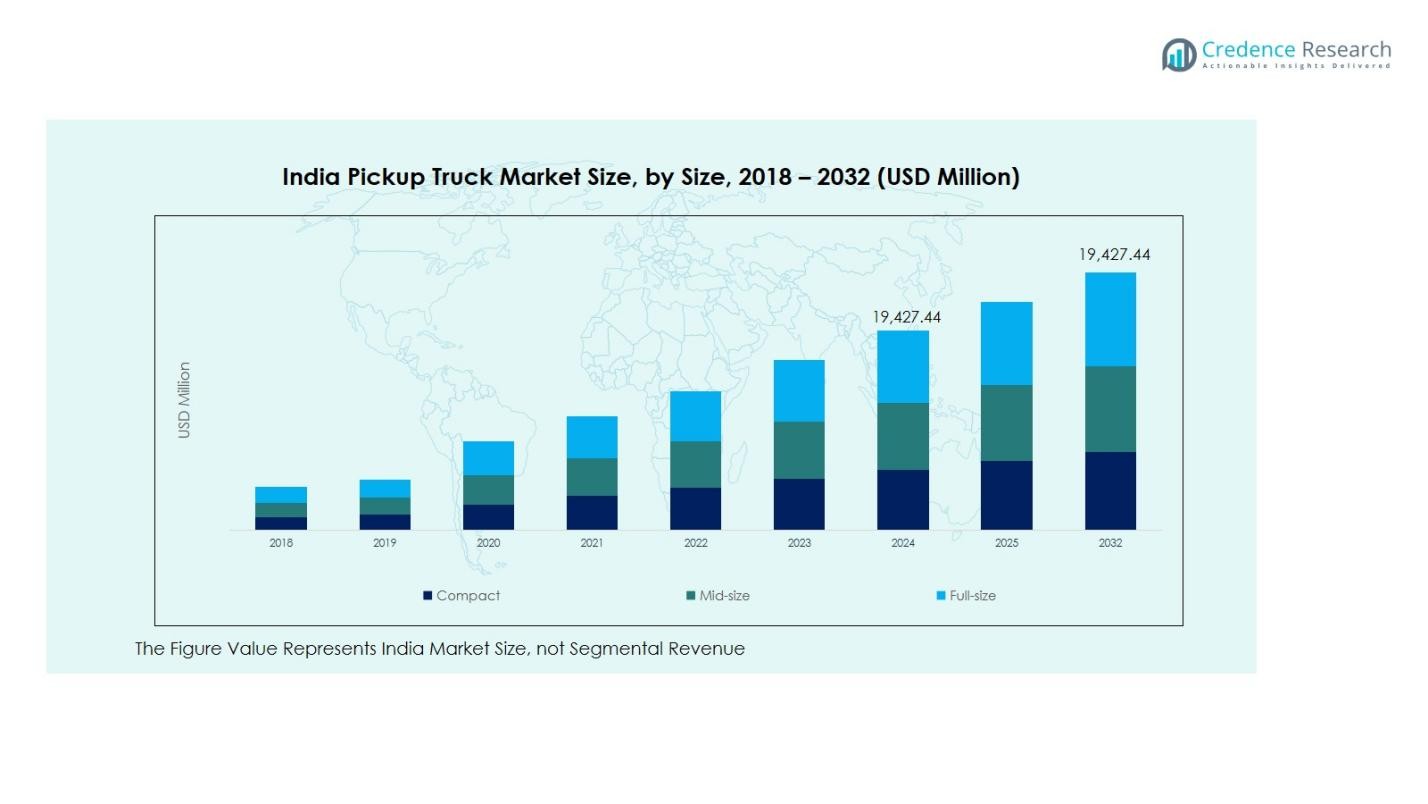

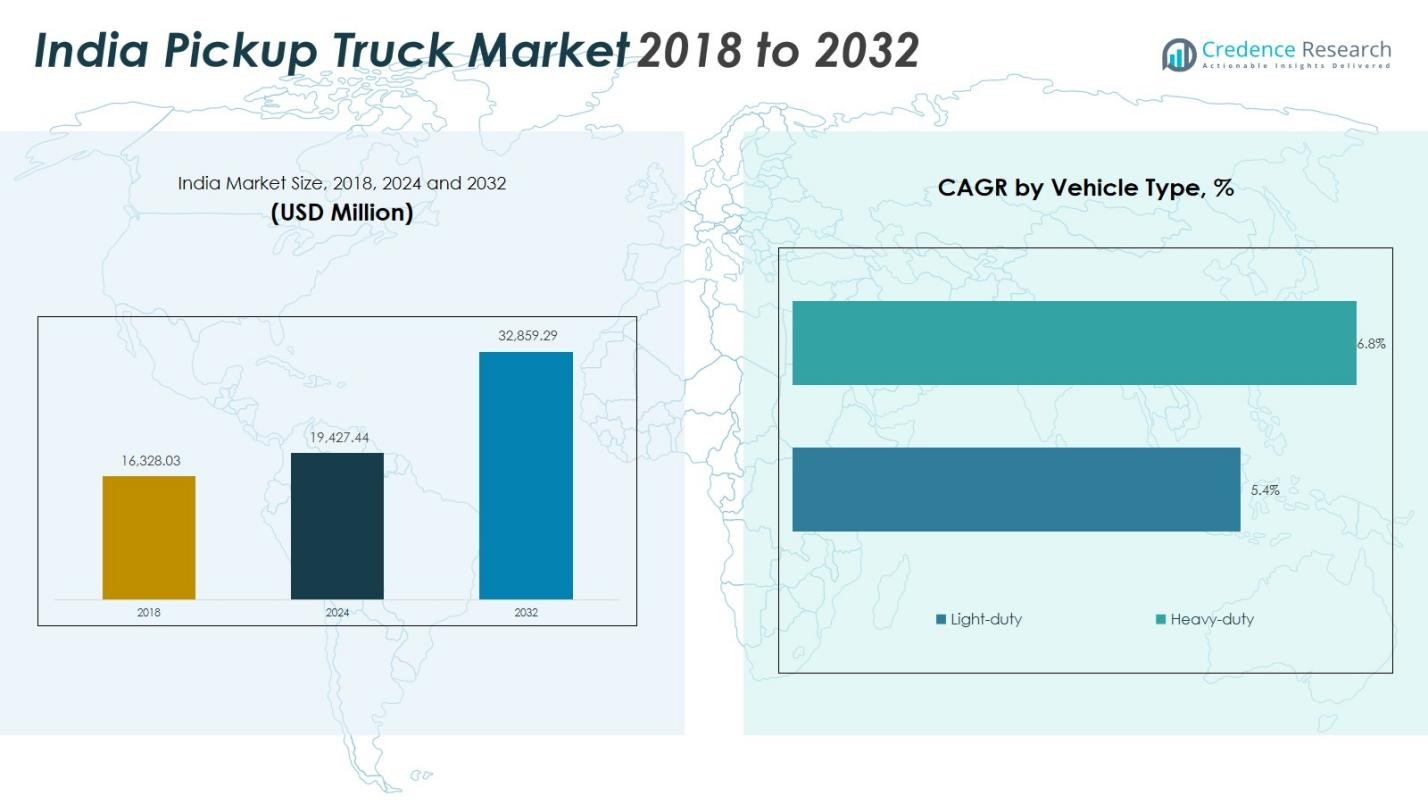

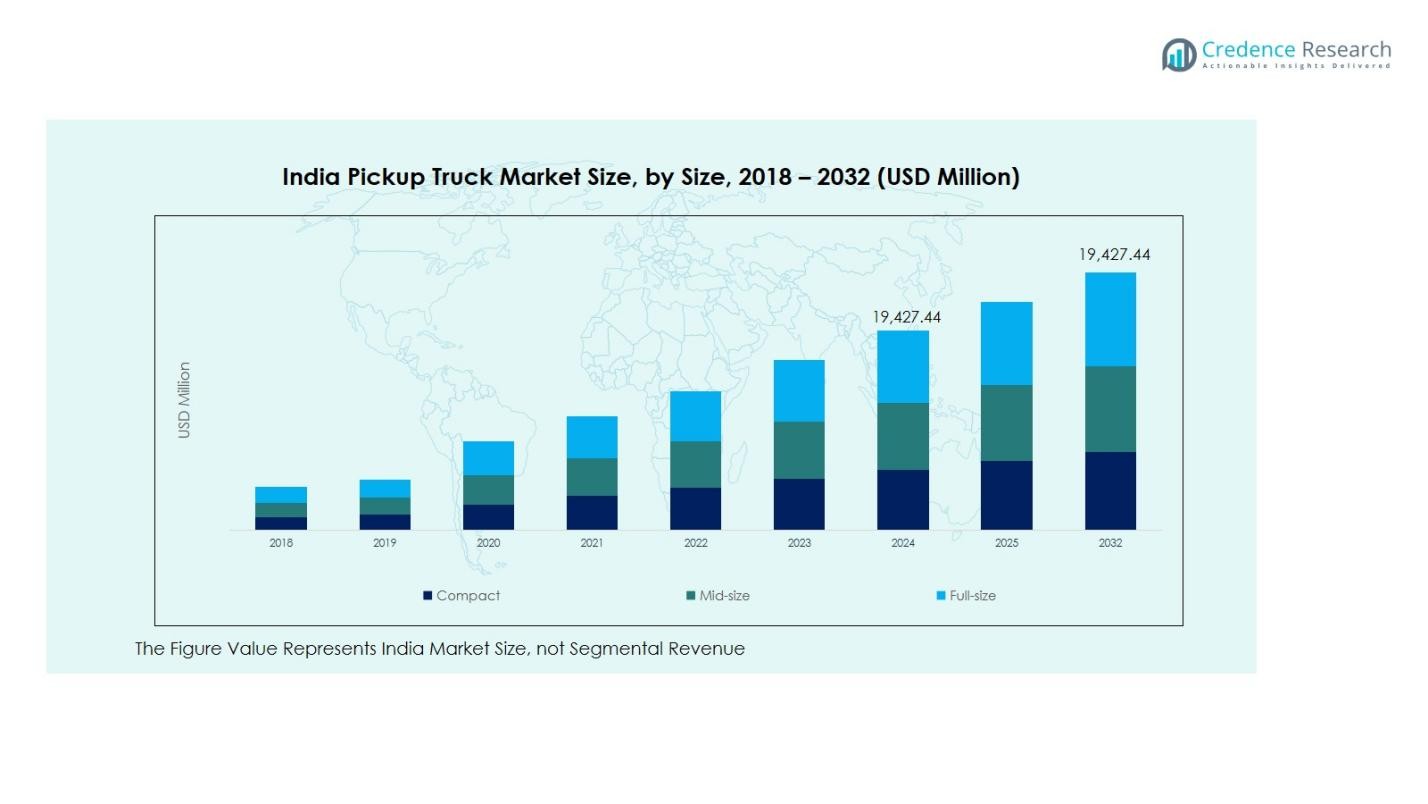

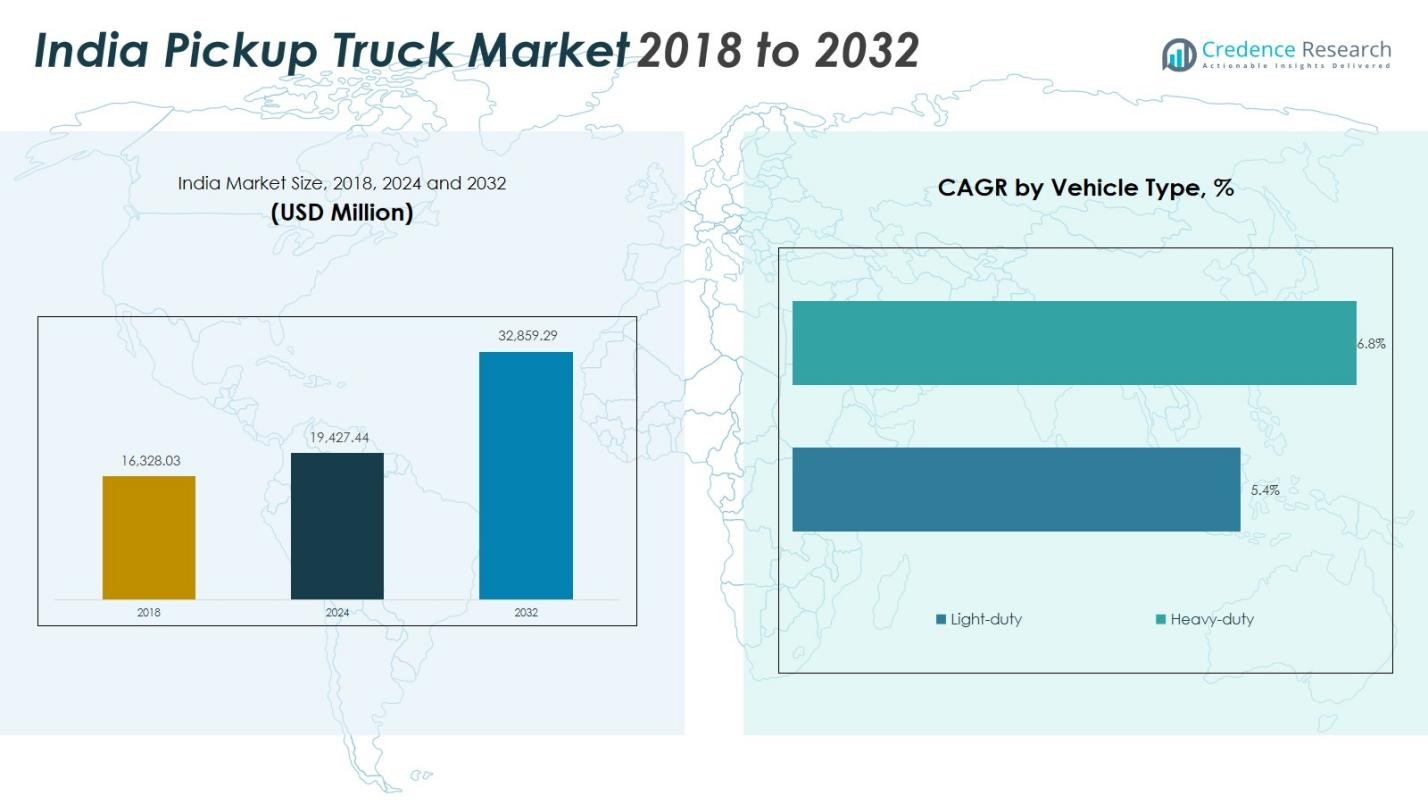

India Pickup Truck Market size was valued at USD 16,328.03 Million in 2018, reached USD 19,427.44 Million in 2024, and is anticipated to reach USD 32,859.29 Million by 2032, at a CAGR of 6.79% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Pickup Truck Market Size 2024 |

USD 19,427.44 Million |

| India Pickup Truck Market, CAGR |

6.79% |

| India Pickup Truck Market Size 2032 |

USD 32,859.29 Million |

The India Pickup Truck Market is driven by prominent manufacturers such as Mahindra & Mahindra, Tata Motors, Ashok Leyland, Isuzu Motors, and Force Motors, each offering a diverse range of pickup models tailored for both commercial and lifestyle applications. These companies focus on enhancing product durability, fuel efficiency, and connectivity features to meet evolving customer needs. North India leads the market with a 33% share in 2024, fueled by extensive infrastructure development and high demand from logistics and construction sectors. The region’s strategic location and rapid urban expansion further strengthen its dominance in the national pickup truck landscape.

Market Insights

Market Insights

- The India Pickup Truck Market was valued at USD 19,427.44 Million in 2024 and is projected to reach USD 32,859.29 Million by 2032, growing at a CAGR of 6.79% during the forecast period.

- Rising infrastructure development, urban expansion, and logistics demand are key drivers fueling market growth, with light-duty pickups holding 62% share due to their efficiency and versatility.

- Electrification and connected fleet management are emerging trends, with increasing interest in EV pickups and telematics-enabled fleet monitoring systems across industries.

- Major players such as Mahindra & Mahindra, Tata Motors, and Isuzu Motors are enhancing product offerings, expanding dealerships, and adopting BS6-compliant engines to strengthen their market presence.

- Regionally, North India leads with 33% market share, followed by South at 28% and West at 24%, while high initial costs, regulatory compliance challenges, and limited EV charging infrastructure present key restraints to market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

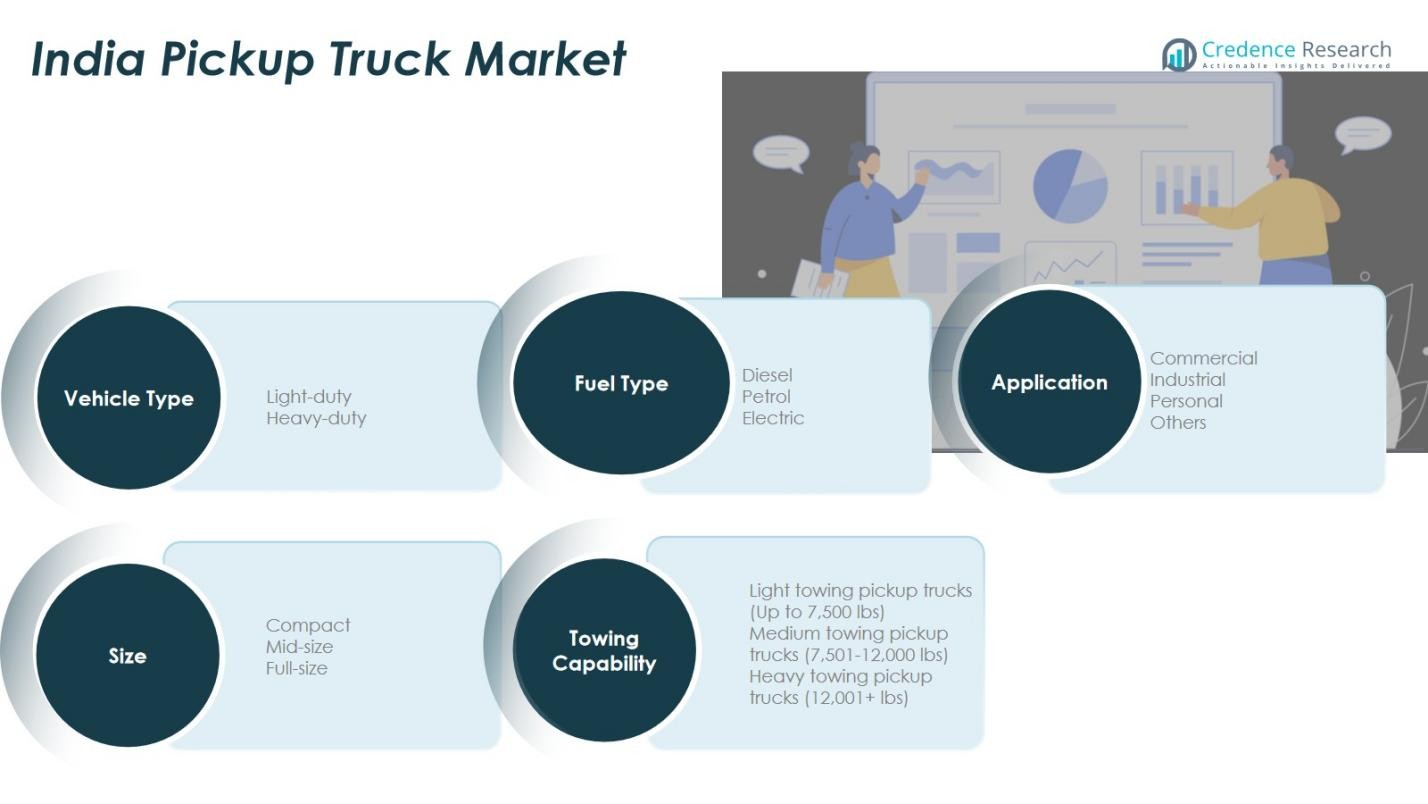

By Vehicle Type

Light-duty pickup trucks hold the dominant share of 62% in 2024, driven by their versatility, fuel efficiency, and affordability. These vehicles are widely used across urban and semi-urban areas for logistics, e-commerce deliveries, and personal mobility. Light-duty pickups also meet Bharat Stage VI (BS6) emission standards, appealing to environmentally conscious buyers. Meanwhile, heavy-duty trucks, accounting for about 38%, cater primarily to construction and mining industries. However, rising infrastructure projects and government investments in logistics corridors are expected to boost heavy-duty pickup adoption through 2032.

- For instance, Chevrolet expanded its electric van lineup with the roll-out of the Chevrolet BrightDrop 400 in U.S. cities like Dallas and Denver, designed for last-mile logistics and meeting emission standards.

By Application

The commercial segment dominates the India Pickup Truck Market with 48% share in 2024, owing to high demand from logistics, utility services, and last-mile delivery businesses. Increased adoption of pickups for agricultural produce transport and FMCG distribution further boosts this segment. The industrial segment follows with around 27% share, driven by construction and mining applications. Personal use accounts for 18%, supported by lifestyle usage and leisure trends. The others category, with about 7%, includes government and defense utilization, influenced by fleet modernization initiatives.

- For instance Tata Motors’ Ace and Mahindra’s Jayo are widely used by courier and e-commerce companies like Flipkart and Amazon India for their agility and payload capacity.

By Fuel Type

Diesel-powered pickups dominate the market with 78% share in 2024, due to higher torque, better fuel economy, and suitability for towing and heavy payloads. Diesel remains the preferred choice in rural and industrial zones. The petrol segment, accounting for around 14%, is growing steadily, particularly in urban regions where commuters prioritize lower emissions and smoother engine performance. The electric segment, presently holding 8% share, is emerging as OEMs introduce electrified models in response to sustainability mandates and incentives under India’s FAME-II scheme, positioning EV pickups for long-term growth.

Key Growth Drivers

Key Growth Drivers

Rising Infrastructure and Urban Development

The India Pickup Truck Market is significantly driven by the rapid development of urban infrastructure, smart cities, and industrial corridors. Increased investments in roads, logistics parks, and rural connectivity are boosting demand for versatile pickup trucks capable of handling diversified freight needs. Government initiatives such as Bharatmala and PM Gati Shakti further enhance logistics efficiency, promoting higher adoption of light- and heavy-duty pickups. Moreover, real estate and construction firms are increasingly incorporating these vehicles into their fleets, contributing to sustained market expansion.

- For instance, government initiatives like Bharatmala and PM Gati Shakti are facilitating improved road networks and logistics parks, which in turn boost the demand for versatile pickup trucks suited to diversified freight needs.

Growing E-Commerce and Last-Mile Delivery

The explosion of India’s e-commerce and logistics sector is a key catalyst for the pickup truck market. With rising online retail penetration in Tier II and Tier III cities, companies need efficient, compact transport solutions to support last-mile deliveries. Pickup trucks provide a balance of payload capacity, fuel efficiency, and maneuverability that suits dense urban and rural areas. Small businesses and MSMEs also prefer pickups for intra-city distribution. This demand surge is further supported by leasing and flexible financing options, which enable startups and growing enterprises to expand quickly.

- For instance, Mahindra’s Bolero Maxx Pik-Up HD is another key player, favored in urban and rural last-mile logistics for its robust 60-liter fuel tank and iMaXX telematics technology to improve delivery efficiency and reduce operational costs.

Shifting Consumer Preferences and Lifestyle Utility

A rising number of individual buyers are viewing pickup trucks as lifestyle vehicles, leading to increased demand for dual-purpose models suitable for both personal and commercial use. Features such as advanced infotainment systems, enhanced safety, and SUV-like comfort are making pickups more appealing for family use and adventure travel. OEMs are responding with new models that blend rugged utility with modern convenience. The combination of rugged aesthetics, customization options, and multi-use functionality positions pickups as desirable alternatives to traditional SUVs among younger consumers.

Key Trends & Opportunities

Electrification and Alternative Fuel Adoption

Although still in its nascent stage, electrification presents a major growth opportunity in the India Pickup Truck Market . OEMs are beginning to explore electric pickups and alternative fuel models in response to India’s push for clean mobility and lower carbon emissions. Government incentives under schemes like FAME II and rising investment in EV infrastructure are building the foundation for future adoption. As battery technology becomes more affordable and range improves, manufacturers who invest early in electric pickup development stand to gain a competitive edge.

- For instance, Blue Energy Motors launched India’s first electric heavy-duty truck featuring battery swapping technology that enables battery changes in about seven minutes, drastically reducing downtime and enhancing logistics efficiency on the Mumbai-Pune highway, declared India’s first electric corridor for sustainable freight transport.

Advanced Telematics and Connectivity Integration

The integration of advanced telematics, fleet management software, and real-time monitoring systems is emerging as a key trend. Pickup trucks equipped with IoT capabilities enable operators to track vehicle location, performance, and fuel usage, leading to more efficient operations. The rise of connected vehicles also benefits logistics companies seeking to optimize route planning and reduce downtime. This trend is supported by India’s growing digital infrastructure and increasing adoption of 4G/5G connectivity. Enhanced connectivity not only increases productivity but also boosts safety and compliance.

- For instance, Eicher Motors launched its Eicher LIVE telematics solution, equipping all new commercial vehicles with connected technology that enables real-time tracking of location, engine diagnostics, and fuel usage, helping operators reduce downtime and optimize maintenance schedules.

Key Challenges

High Initial Purchase and Operating Costs

Pickup trucks, particularly larger and feature-rich models, entail higher upfront costs compared to conventional light commercial vehicles. Additionally, operating expenses such as fuel, maintenance, and insurance add to the total cost of ownership. For small businesses and independent operators, these costs can be prohibitive. Although financing options have improved, inflationary pressures and fluctuating input costs exacerbate economic barriers. Market leaders must address this challenge through localized production, efficient supply chains, and value-focused product offerings to maintain growth in price-sensitive segments.

Regulatory Compliance and Emissions Transition

The transition to stringent emission standards such as BS6 has placed pressure on manufacturers to adopt cleaner technologies, increasing production and R&D costs. While necessary for environmental sustainability, compliance demands significant upgrades in engine systems, after-treatment technologies, and monitoring mechanisms. Rural users, in particular, face challenges in servicing and maintaining these advanced vehicles due to limited access to BS6-compatible infrastructure. Balancing regulatory compliance with accessibility and affordability remains a challenge for OEMs targeting both urban and rural customers in India’s diverse market.

Regional Analysis

North India

North India holds a significant share of the India Pickup Truck Market , capturing 33% of the total revenue in 2024. The region’s robust growth is driven by large-scale construction, mining, and infrastructure projects across states like Uttar Pradesh, Haryana, and Rajasthan. Pickup trucks are extensively used for transporting raw materials and equipment to remote and semi-urban locations. Rising e-commerce activity in major cities like Delhi and NCR further boosts demand for light-duty pickups for last-mile delivery services. Increasing agricultural mechanization in Punjab and Haryana also supports sustained usage in rural markets.

South India

South India accounts for 28% market share and is one of the leading regions in terms of pickup truck adoption. The market is propelled by the region’s strong automotive manufacturing base in Tamil Nadu, Karnataka, and Andhra Pradesh, ensuring easy availability of vehicles and after-sales services. The booming IT and e-commerce sectors in Bengaluru and Hyderabad generate demand for efficient intra-city logistics. Additionally, the region has a well-developed network of national highways and industrial corridors, facilitating seamless movement of goods and driving the need for versatile pickup trucks across commercial and industrial applications.

West India

West India contributes 24% to the India Pickup Truck Market and demonstrates consistent growth due to a strong industrial presence in Maharashtra and Gujarat. Pickup trucks are widely used in the logistics and manufacturing sectors, especially in automotive, textiles, and FMCG supply chains. The region also benefits from a high concentration of export-oriented industries and port-based trade, creating substantial demand for heavy-duty and diesel-powered pickups. Growth in urban centers like Mumbai, Pune, and Ahmedabad, paired with expanding smart city initiatives, further drives the adoption of technologically advanced and fuel-efficient pickup models.

East India

East India holds 15% market share, presenting significant growth potential despite its smaller base compared to other regions. Rising infrastructure development in states like West Bengal, Odisha, and Jharkhand is driving the demand for pickup trucks to support mining, steel, and cement industries. Increasing investments in road connectivity and urban development are also enabling greater mobility and trade across regional markets. Although the region faces logistical challenges in remote areas, government initiatives for infrastructure modernization are expected to create new opportunities for OEMs to expand distribution networks and introduce rugged, affordable pickup variants tailored to local needs.

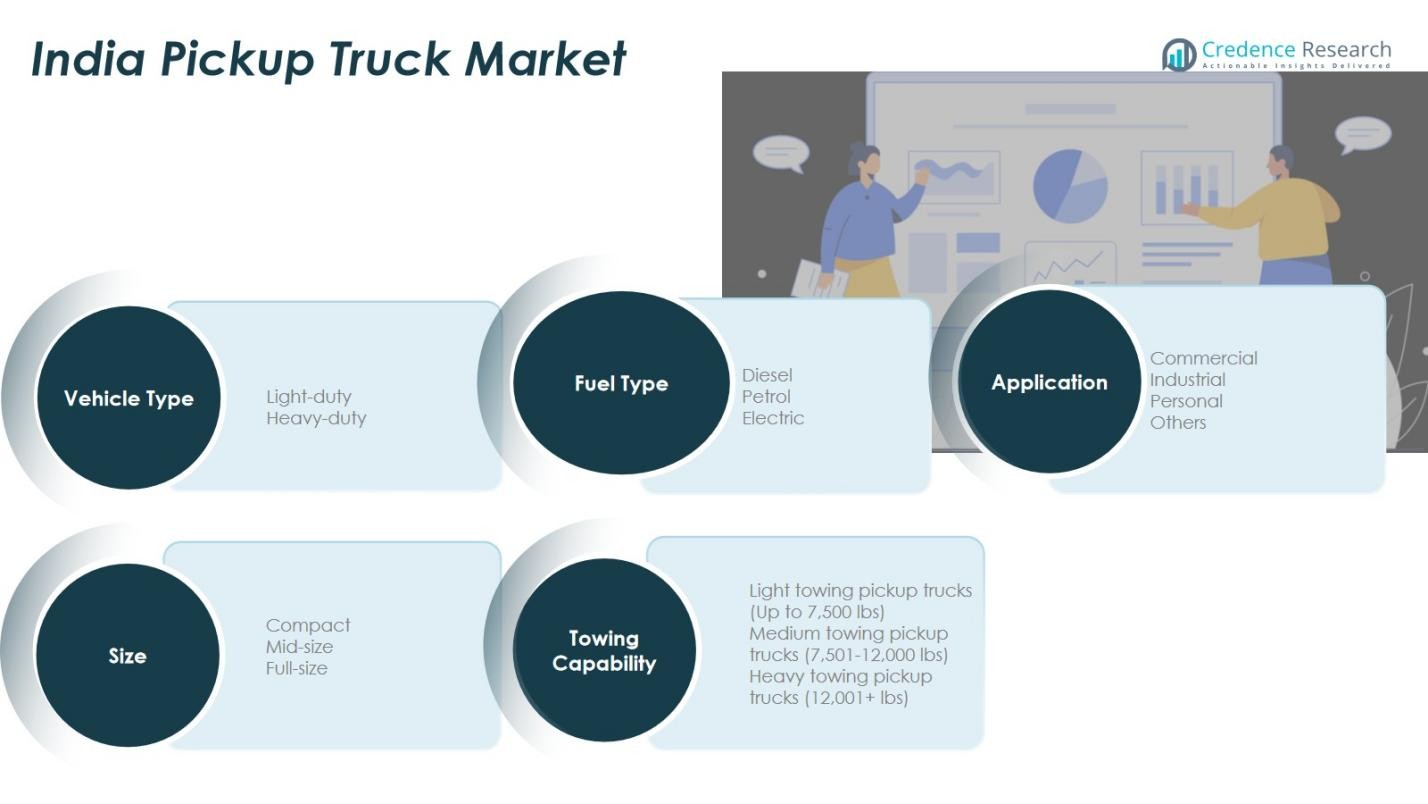

Market Segmentations:

By Vehicle Type

By Application

- Commercial

- Industrial

- Personal

- Others

By Fuel Type

By Size

- Compact

- Mid-size

- Full-size

By Towing Capability

- Light towing pickup trucks (Up to 7,500 lbs)

- Medium towing pickup trucks (7,501–12,000 lbs)

- Heavy towing pickup trucks (12,001+ lbs)

By Region

- North India

- South India

- West India

- East India

Competitive Landscape

The competitive landscape of the India Pickup Truck Market is shaped by major players including Mahindra & Mahindra, Tata Motors, Ashok Leyland, Isuzu Motors, and Force Motors. These manufacturers dominate the market with a strong product portfolio, wide distribution networks, and substantial brand equity. Mahindra and Tata lead the segment with popular models designed for both commercial and personal use, emphasizing durability and fuel efficiency. Companies are increasingly focusing on BS6-compliant engines, safety enhancements, and connected features to align with evolving customer expectations. Strategic collaborations, dealership expansions, and localization of components also play a pivotal role in maintaining competitive advantage. Additionally, international brands are exploring Indian opportunities through assembly partnerships or direct imports, targeting premium lifestyle and performance-oriented truck buyers. Efforts to introduce electric and alternative fuel pickup variants signal a shift toward sustainable mobility, creating opportunities for innovation. However, competitive pricing and after-sales service will remain crucial differentiators in sustaining market leadership.

Key Player Analysis

- Ford Motor Company (Ranger)

- Toyota Motor Corporation (Hilux)

- Mitsubishi Motors Corporation (Triton / L200)

- Isuzu Motors Ltd. (D-Max)

- Nissan Motor Co., Ltd. (Navara)

- Volkswagen AG (Amarok)

- Mazda Motor Corporation (BT-50)

- Great Wall Motors (P Series / Cannon)

- LDV (Maxus T60)

- Haval (Pickup Variants)

Recent Developments

- In October 2025, Mahindra launched a facelift of its “Bolero” pickup-based model (the Bolero Pickup / Camper line) in India.

- In October 2025, Toyota Kirloskar Motor (via its parent Toyota Motor Corporation) announced plans to introduce an “affordable pickup truck” as part of a roll-out of 15 new or refreshed models in India by 2030.

- In April 2025, Mahindra & Mahindra announced the acquisition of a 58.96 % stake in SML Isuzu Limited (for ~₹555 crore), as part of its strategy to strengthen its presence in India’s truck and bus segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Application, Fuel Type, Size, Towing Capability and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The India Pickup Truck Market is expected to witness steady demand from infrastructure and rural development projects across the country.

- OEMs will increasingly introduce multi-utility pickup models that cater to both commercial and personal use requirements.

- Adoption of electric and hybrid pickup trucks is likely to accelerate as India strengthens its EV ecosystem and incentives.

- Digitization and telematics integration will become standard features, enhancing fleet and route management efficiency.

- Light-duty pickups will continue to dominate the market due to their versatility and lower operating costs.

- After-sales service, financing solutions, and dealership expansion will remain key focus areas for market leaders.

- Partnerships with logistics and e-commerce companies will drive market penetration and enhance fleet utilization rates.

- Manufacturers will increasingly localize components and adopt lean production strategies to reduce costs and improve price competitiveness.

- Pickup truck demand from Tier II and Tier III cities will rise as regional logistics and MSME sectors expand.

- Increased consumer interest in lifestyle-oriented and off-road capable pickup models will create new segments of demand.

Market Insights

Market Insights Key Growth Drivers

Key Growth Drivers