Market Overview

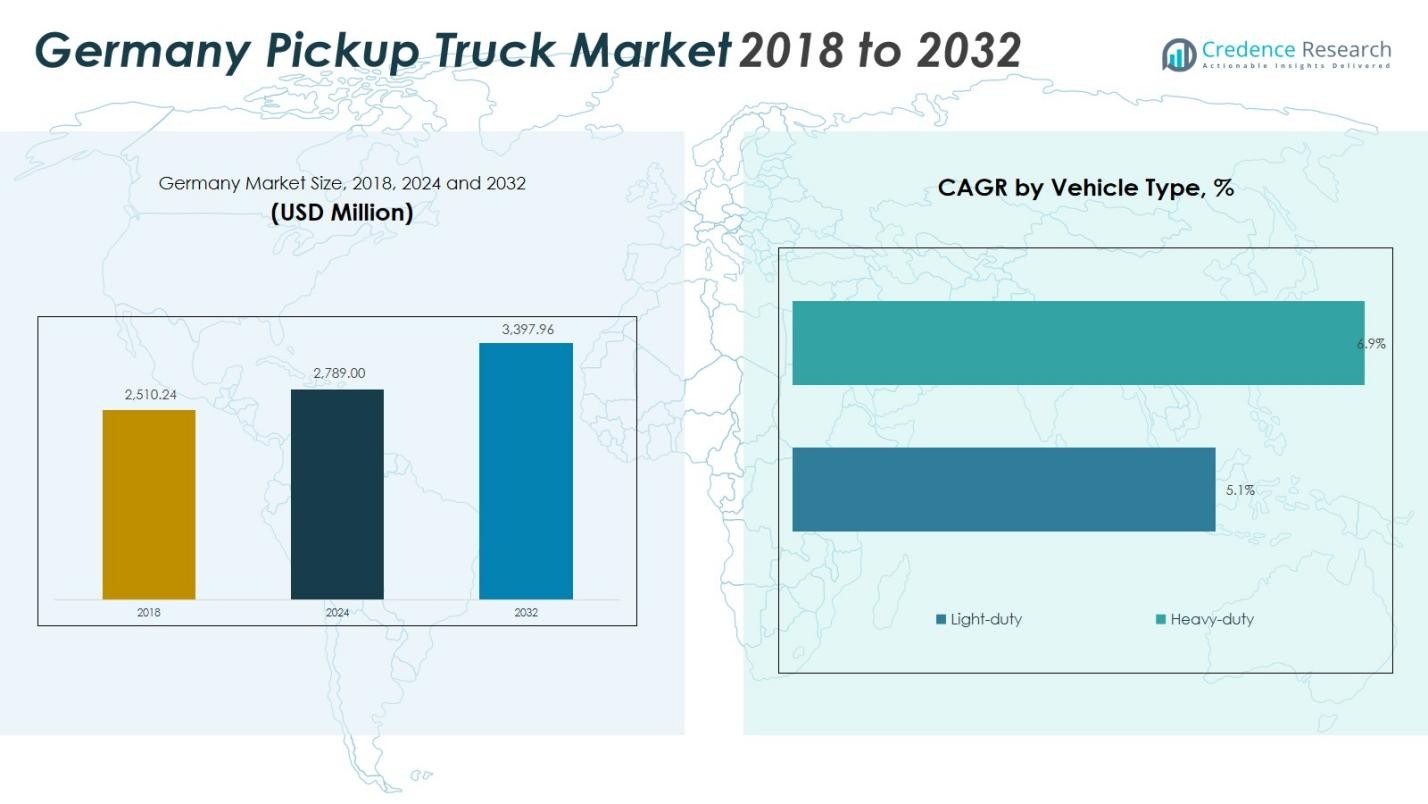

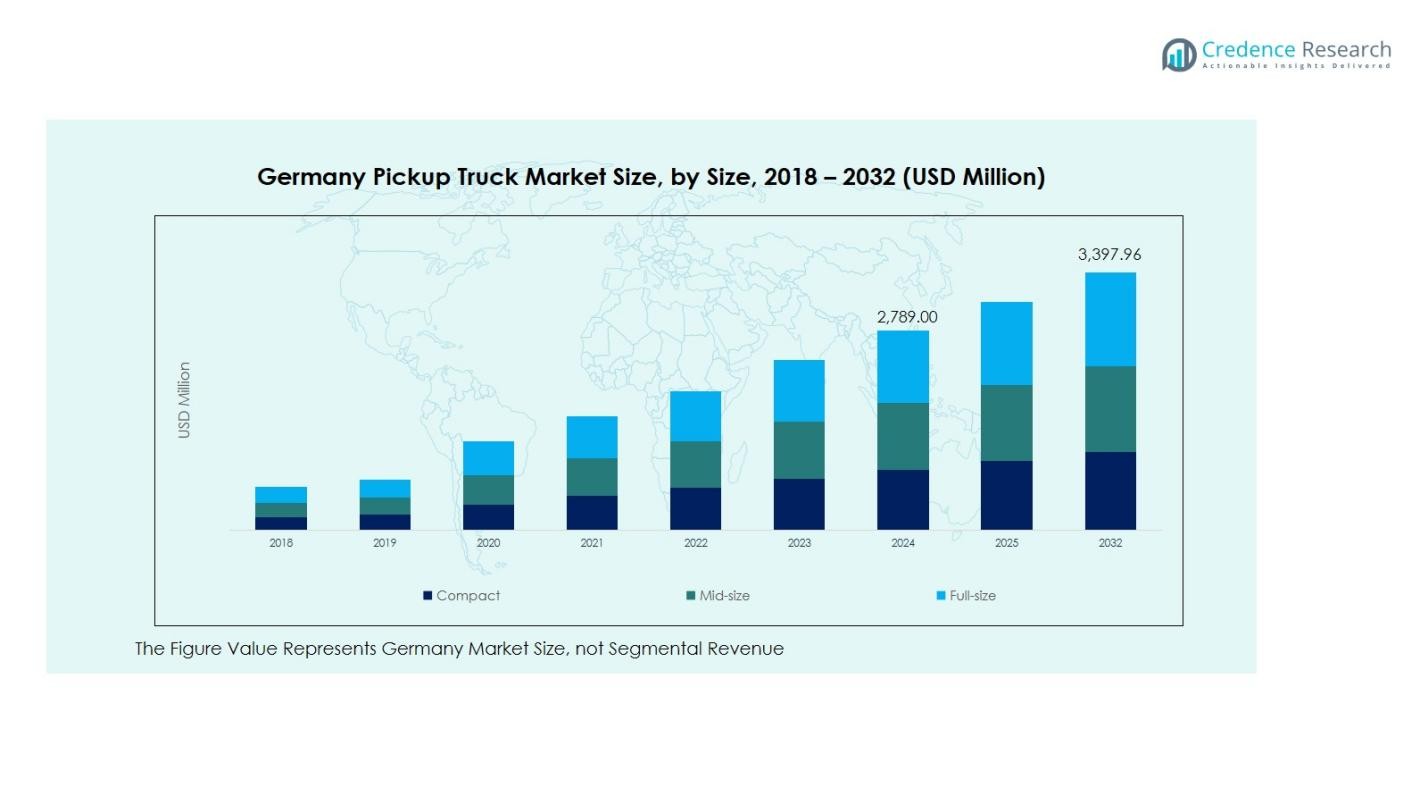

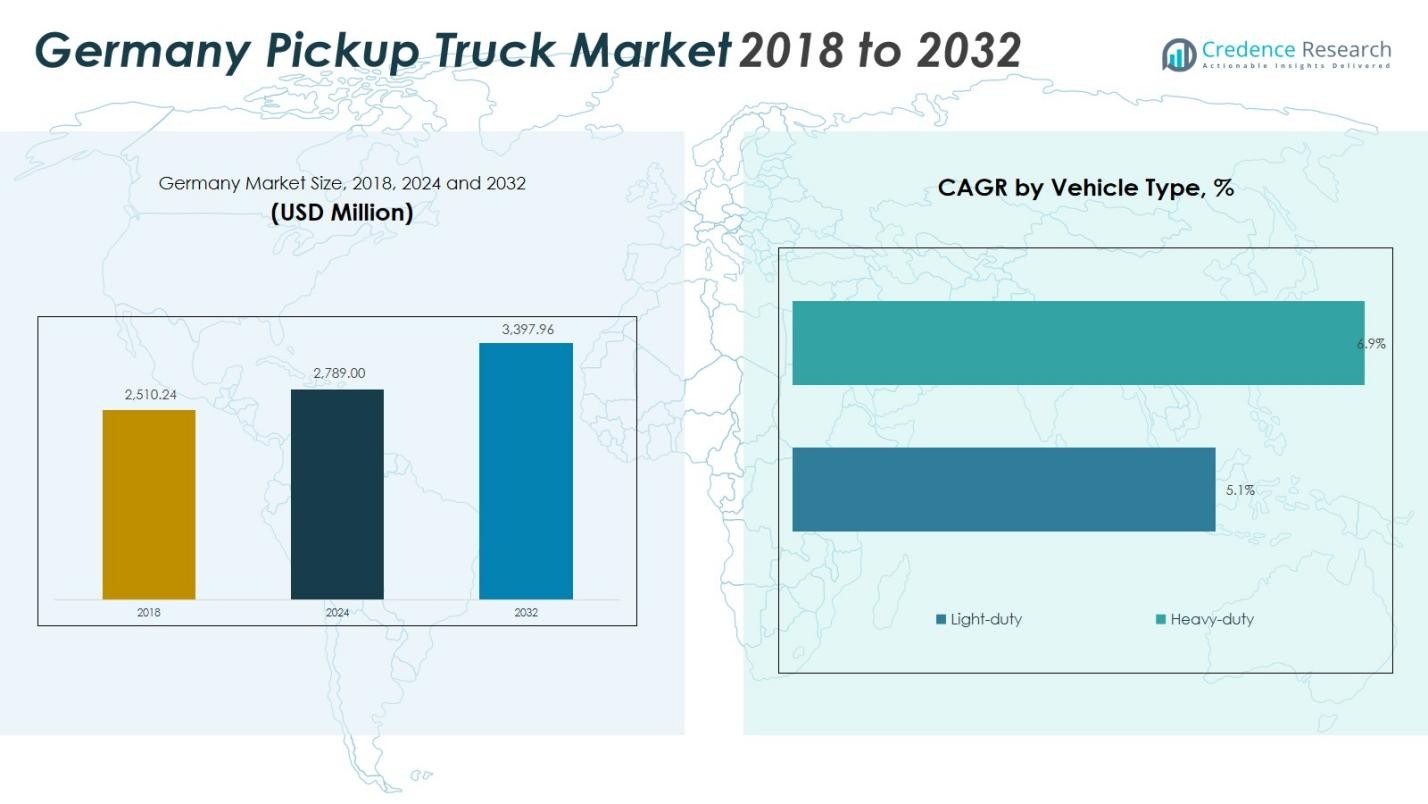

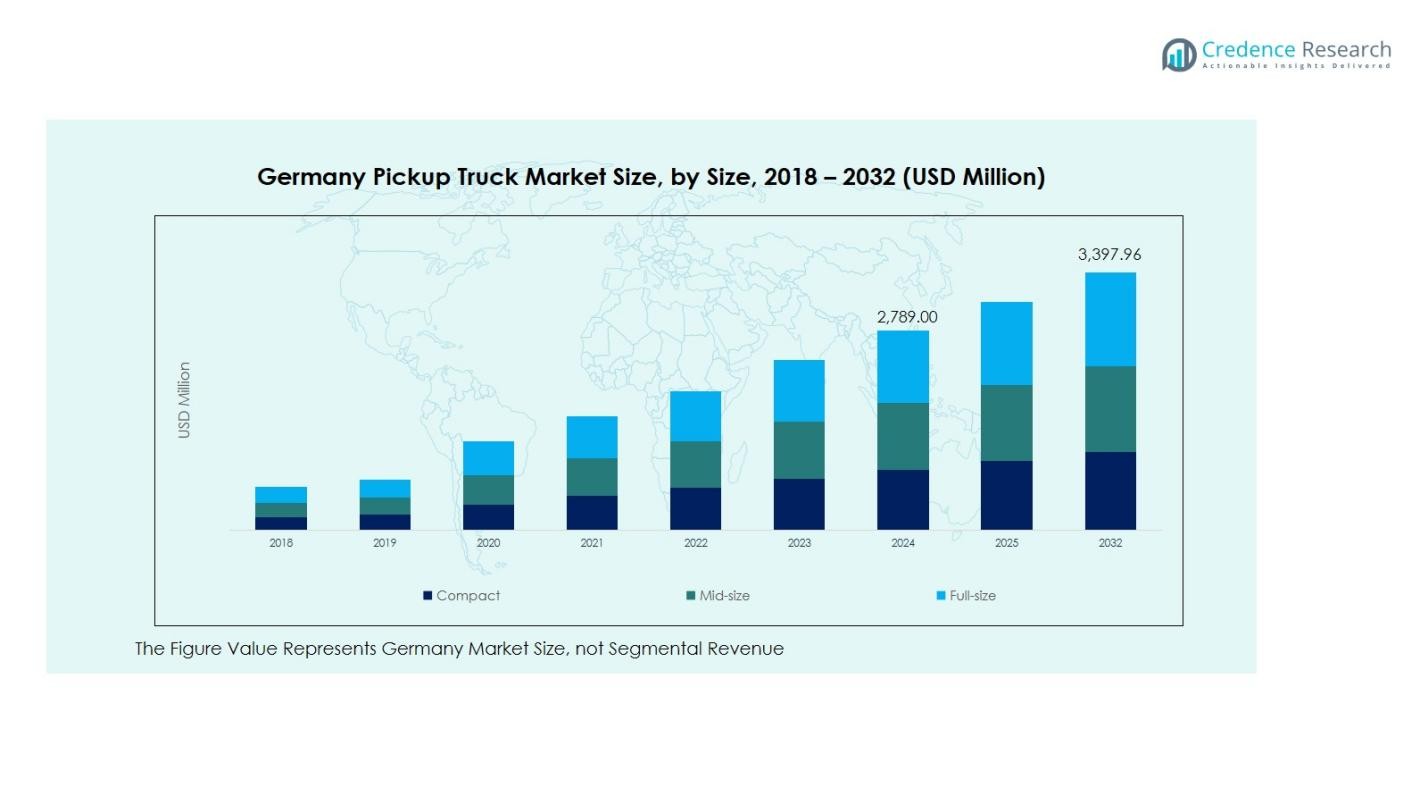

Germany Pickup Truck Market size was valued at USD 2,510.24 million in 2018, increased to USD 2,789.00 million in 2024, and is anticipated to reach USD 3,397.96 million by 2032, at a CAGR of 2.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Pickup Truck Market Size 2024 |

USD 2,789.00 Million |

| Germany Pickup Truck Market, CAGR |

2.50% |

| Germany Pickup Truck Market Size 2032 |

USD 3,397.96 Million |

Germany Pickup Truck Market is shaped by the presence of leading manufacturers such as Ford Motor Company, Toyota Motor Corporation, Volkswagen AG, Nissan Motor Co., Ltd., Isuzu Motors Ltd., and Mitsubishi Motors Corporation. These players strengthen their footholds through product innovation, expanding dealership networks, and regional manufacturing to cater to diverse vehicle applications. Bavaria leads the regional market with 28% share in 2024, driven by strong demand from construction, agriculture, and SMEs. North Rhine-Westphalia follows with 24% market share, supported by industrial hubs, logistics infrastructure, and growing adoption of light-duty and electric pickup models.

Market Insights

- Germany Pickup Truck Market size is USD 2,789.00 million in 2024 and will grow at a CAGR of 2.50% through 2032.

- The market is driven by strong demand from commercial sectors, including logistics, construction, and agriculture, with the light-duty segment accounting for 65% share in 2024.

- A key trend is the rising adoption of electric pickups, supported by regulatory incentives and infrastructure development, with diesel engines still dominating at 70% share but gradually losing momentum.

- Major players like Ford, Volkswagen, Toyota, and Nissan enhance their presence through product innovations, regional manufacturing, and expanded dealer networks.

- Bavaria leads the market with 28% share due to industrial and agricultural needs, followed by North Rhine-Westphalia at 24%, highlighting regional demand concentrations and growth potential in infrastructure-heavy areas.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vehicle Type:

In the Germany Pickup Truck Market, the light-duty segment holds the dominant position with a market share of 65% in 2024. This segment’s popularity is driven by growing demand in urban and suburban areas for personal transportation and business logistics. Light-duty pickups are favored for their flexibility, fuel efficiency, and lower ownership costs compared to heavy-duty models. The heavy-duty segment, although smaller, is seeing steady adoption, particularly in construction and agricultural applications requiring higher towing capacity and durability. Ongoing upgrades in payload capacity and engine performance also support market growth.

- For instance, Volkswagen has introduced electric light-duty models tailored for city deliveries, combining flexibility with compliance to strict emission standards.

By Application:

The commercial segment dominates the Germany Pickup Truck Market, accounting for 55% of the market share in 2024. The segment benefits from increased adoption among small and medium-sized enterprises, delivery services, and municipal services requiring versatile and efficient vehicle solutions. Industrial applications also contribute significantly, especially in sectors like construction, mining, and utilities. The personal segment, while smaller, is expanding as pickups gain traction for lifestyle use and off-road utility. The “Others” category, including governmental and specialized uses, adds to demand diversification.

- For instance, the Mercedes-Benz Unimog stands out as a multipurpose off-road vehicle popular among lifestyle users and small contractors for its all-wheel drive and terrain adaptability.

By Fuel Type:

The diesel segment leads the Germany Pickup Truck Market with 70% market share in 2024, owing to diesel engines’ superior torque, fuel efficiency, and longer lifespan in commercial applications. Diesel pickups remain preferred for heavy hauling and long-distance driving. However, the electric segment is showing rapid growth potential, driven by Germany’s strong EV infrastructure, emission regulations, and incentives encouraging fleet modernization. Petrol-based pickups, though less dominant, retain a niche user base due to lower initial costs and suitability for light-duty or personal use in urban environments.

Key Growth Drivers

Rising Demand from Commercial and Industrial Sectors

The increasing use of pickup trucks across construction, logistics, and utility sectors is a major driver in the Germany Pickup Truck Market. Medium and small enterprises are adopting pickups for their dual utility in transportation and equipment hauling. The surge in infrastructure development and distribution networks fuels demand for powerful and reliable vehicles. Companies are increasingly opting for light-duty and diesel-powered pickups to ensure fuel efficiency and cost-effectiveness, further boosting market growth.

- For instance, GHH Fahrzeuge, based in Germany, manufactures robust diesel and electric load-haul dump trucks and articulated dump trucks widely used in mining and construction sectors. Their products, like the MK-A30 with payloads up to 50 tons, offer reliability and high operational availability in tough environments.

Expansion of Electric Mobility and Sustainability Initiatives

The German government’s strong push toward reducing carbon emissions and promoting electrification is spurring growth in electric pickup truck adoption. Incentives for EV purchases, developing charging infrastructure, and clean mobility policies are encouraging manufacturers to introduce electric models. Companies like Volkswagen and Ford are investing heavily in EV technology to meet sustainability targets. This shift supports long-term market expansion as environmentally conscious consumers and fleet operators adopt electric pickups as cost-effective and compliant alternatives.

- For instance, Germany relaunched a €3 billion incentive program in 2025 offering up to €4,000 for new EV purchases priced under €45,000 to make EV ownership accessible to low- and middle-income households.

Advancements in Vehicle Technology and Safety Features

Technological advancements in pickup truck design, including improved safety systems, telematics, and enhanced towing capacities, are driving market appeal. Manufacturers are integrating features like advanced driver-assistance systems (ADAS), connectivity, and fuel-efficient engines to cater to evolving customer needs. These innovations enhance operational efficiency and driver safety, making pickups more suitable for both urban and industrial applications. The adoption of hybrid powertrains and lighter materials further supports vehicle performance and efficiency, contributing to increased market penetration.

Key Trends and Opportunities

Growing Popularity of Lifestyle and Personal-Use Pickups

Pickup trucks are increasingly gaining popularity among private users in Germany, driven by demand for multifunctional vehicles that offer both lifestyle and utility benefits. Modern designs, higher comfort, and feature-rich interiors are attracting non-commercial users, especially in suburban and rural areas. This trend opens new opportunities for manufacturers to diversify their portfolio and improve marketing strategies. With rising disposable incomes and interest in outdoor activities, lifestyle pickup models are becoming integral to market expansion.

- For instance, Volkswagen’s 2025 Amarok combines rugged utility with premium comfort, offering features like “Savona” leather seats, dual-zone climate control, and adaptive cruise control to appeal to both work and leisure users.

Rise of Modular and Customizable Pickup Variants

A key trend is the growing demand for customizable pickups with modular design options. Businesses and private users seek tailored features such as enhanced bed configurations, towing equipment, auxiliary power solutions, and off-road capabilities. Manufacturers are responding by offering customizable packages and accessories suited to different applications. This trend not only enhances customer satisfaction but also increases aftermarket revenue streams. The flexibility of design customization aligns with Germany’s evolving automotive culture, supporting premium segment growth.

- For instance, the startup Slate offers a compact electric pickup truck with over 100 accessories available, including a flat-pack SUV conversion kit, storage solutions, and roof racks, allowing buyers to tailor the vehicle for work or recreation.

Key Challenges

High Vehicle Cost and Price Sensitivity

One of the major challenges in the German pickup truck market is the high upfront cost of ownership, particularly for advanced models equipped with modern technologies. Price sensitivity among SMEs and individual buyers limits the adoption of premium and electric pickup variants. Moreover, additional costs related to insurance, maintenance, and fuel contribute to cautious spending. The lack of affordable financing options or subsidies for certain segments creates barriers for market penetration, especially in cost-sensitive regions.

Stringent Emission Regulations and Compliance Constraints

Germany’s strict emission standards challenge manufacturers to invest heavily in green technology and compliance frameworks, increasing R&D costs and creating regulatory hurdles. Diesel-powered pickups, which still dominate the market, face heightened scrutiny and restrictions in low-emission zones. The transition to electric and hybrid systems requires substantial infrastructure and long development cycles. Compliance pressures can slow market entry and increase vehicle prices, posing challenges for both OEMs and fleet operators seeking to balance performance and regulatory demands.

Regional Analysis

Bavaria

Bavaria holds the largest share in the Germany Pickup Truck Market with around 28% of total revenue in 2024, driven by strong demand from construction, agriculture, and industrial sectors. The region’s economic strength and substantial rural and semi-urban areas contribute to high pickup utilization for both commercial and personal mobility. Key players like Volkswagen and MAN have a significant presence in the region, further stimulating adoption. The rising popularity of multipurpose light-duty pickups and expansion of small businesses are reinforcing growth. Additionally, Bavaria’s infrastructure investments are increasing fleet renewal cycles and driving demand for durable vehicles.

North Rhine-Westphalia

North Rhine-Westphalia accounts for 24% of the market share in 2024, supported by its highly industrialized landscape and concentration of logistics networks. The region’s dense urban centers and strong economic base drive demand for pickup trucks across commercial and industrial applications. The presence of numerous distribution hubs and the growing e-commerce sector increase the need for fleet upgrades and versatile vehicles with optimized payload capacity. Public and private infrastructure projects also fuel demand for heavy-duty models. The ongoing shift toward electric vehicles incentivizes fleet operators to consider electric pickup options for urban low-emission zones.

Lower Saxony

Lower Saxony holds 18% of the market share in 2024, benefiting from its deep-rooted automotive ecosystem, including manufacturing and R&D centers for brands like Volkswagen. The region’s mix of rural and industrial areas boosts pickup truck use for agricultural and supply-chain activities. The demand is concentrated in light-duty and diesel-backed variants due to versatility and fuel efficiency. Government-supported innovation initiatives in electric mobility and sustainable transportation further support future growth. Increasing infrastructure development, complemented by rural connectivity needs, continues to push the market forward, especially among SMEs and utility-focused buyers.

Baden-Württemberg

Baden-Württemberg represents 15% of the market share in 2024, with robust demand driven by advanced engineering industries and high-income demographics. Pickup trucks are increasingly used in medium-scale manufacturing, construction, and personal utility applications. Strong export-oriented industries and wide adoption of high-performance vehicles provide growth opportunities. Consumer awareness of electrification and sustainability trends drives interest in hybrid and electric pickup models. The region’s established technology landscape encourages innovation in vehicle design and connectivity. Government initiatives promoting clean transportation are expected to increase the shift toward electric pickup options over the forecast period.

Other Regions

Other regions collectively account for 15% of the Germany Pickup Truck Market share in 2024, driven by a mix of urban and rural demand patterns. Growing adoption in logistics, passenger transportation, and government services supports moderate but consistent sales. Regions like Saxony are benefiting from EV manufacturing advancements, which positively impact electric pickup adoption. Urban centers like Berlin encourage the use of compact and eco-friendly models, while rural areas lean toward diesel-powered light-duty pickups for agricultural use. Market growth is further influenced by increasing infrastructure investments and the rise of SMEs across the country.

Market Segmentations:

By Vehicle Type

By Application

- Commercial

- Industrial

- Personal

- Others

By Fuel Type

By Size

- Compact

- Mid-size

- Full-size

By Towing Capability

- Light towing pickup trucks (Up to 7,500 lbs)

- Medium towing pickup trucks (7,501 – 12,000 lbs)

- Heavy towing pickup trucks (12,001+ lbs)

By Region

- Bavaria

- North Rhine-Westphalia

- Lower Saxony

- Baden-Württemberg

- Other Regions

Competitive Landscape

The competitive landscape of the Germany Pickup Truck Market is characterized by the presence of both global and domestic manufacturers, with key players including Ford Motor Company, Toyota Motor Corporation, Isuzu Motors Ltd., Volkswagen AG, Nissan Motor Co., Ltd., and Mitsubishi Motors Corporation. These companies drive market growth by introducing new models with enhanced towing capacity, fuel efficiency, and advanced safety features. Ford and Volkswagen lead in light-duty and commercial pickup categories, while Toyota and Nissan maintain a strong foothold in personal and utility-driven segments. Strategic alliances, regional manufacturing, and dealership expansion further strengthen their market presence. Additionally, growing emphasis on electric and hybrid pickup models signals a shift toward sustainable mobility, with several players investing in EV technology and local assembly to meet emissions regulations. Competitive pricing, product customization, and aftersales support are key strategies used by manufacturers to retain customer loyalty and capture emerging demand in both urban and rural markets.

Key Player Analysis

Recent Developments

- In April 2025, Isuzu started mass production of its all-electric pickup truck variant of the D-Max, which is expected to launch in left-hand-drive European markets (including Germany) in the third quarter of 2025.

- In November 2025, Schaeffler AG announced it had won a major order to supply its dual-inverter powertrain solution (targeted at electrified pickup truck platforms) to an OEM for the North American market.

- In November 2025, Daimler Truck AG entered the second phase of real-world trials for its GenH2 fuel-cell heavy-duty trucks in Germany, in partnership with five additional companies.

- In September 2025, Jakob Mining Vehicles announced a partnership with EDAG to develop an electric pickup truck (the TerraCharge) aimed at the mining sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Application, Fuel Type, Size, Towing Capability and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Germany Pickup Truck Market is expected to grow steadily, driven by sustained demand from commercial and industrial users.

- Electric pickup adoption will accelerate as charging infrastructure improves and emissions regulations tighten.

- Light-duty pickup trucks will continue to dominate due to versatility and increasing preference for dual-purpose vehicles.

- OEMs will expand electric and hybrid pickup offerings, fueled by both policy incentives and consumer demand for low-emission models.

- Technological advancements in safety, telematics, and connectivity will enhance vehicle performance and user experience.

- Customization and modular design options will gain traction, appealing to diverse user segments including lifestyle buyers.

- Fleet modernization initiatives among SMEs and logistics operators will increase demand for efficient and durable pickup models.

- The aftermarket segment will grow as vehicle owners seek accessory upgrades and performance enhancements.

- Regional manufacturing and strategic partnerships will expand as companies align with local sustainability and production goals.

- Increased focus on sustainable materials and lightweight design will support fuel efficiency and reduce lifecycle environmental impact.