Market Overview

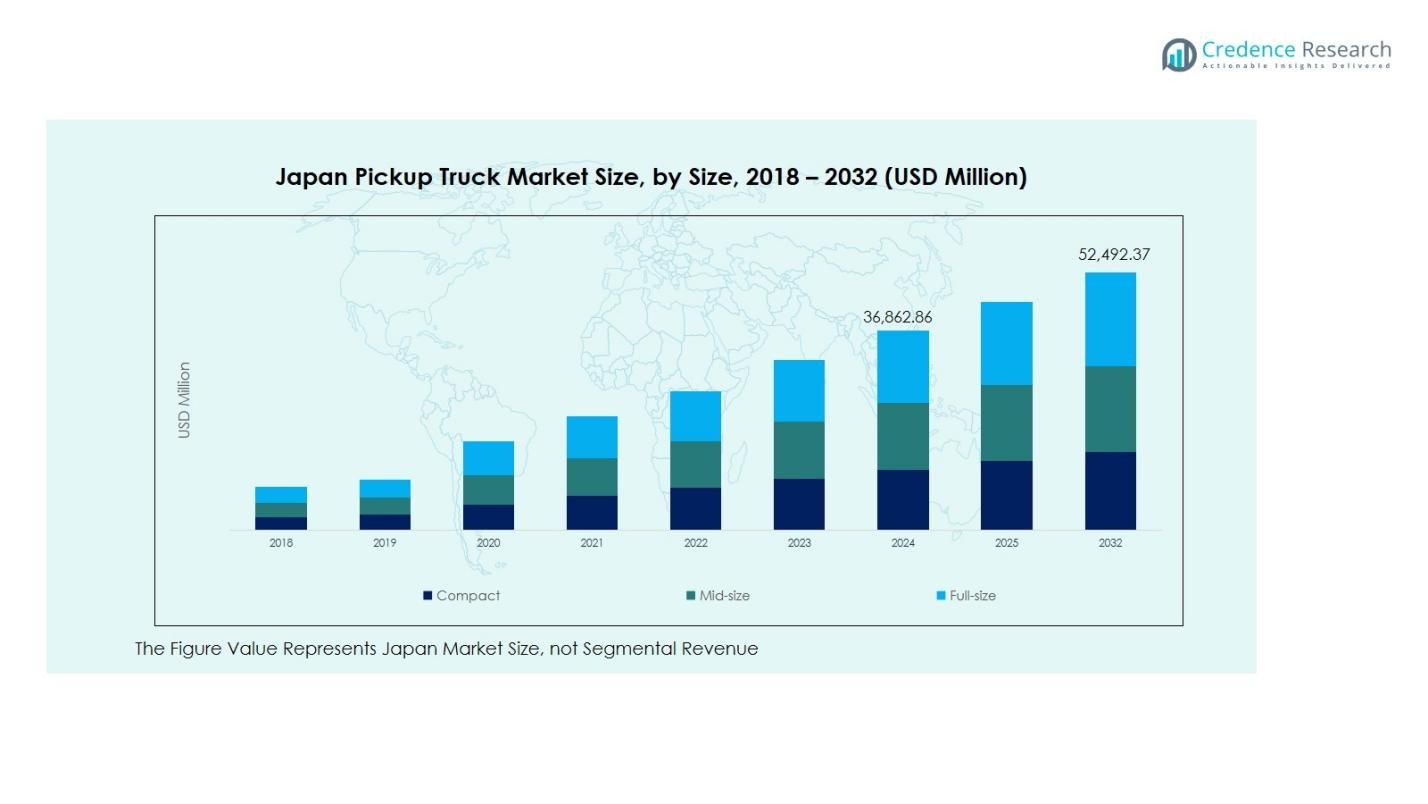

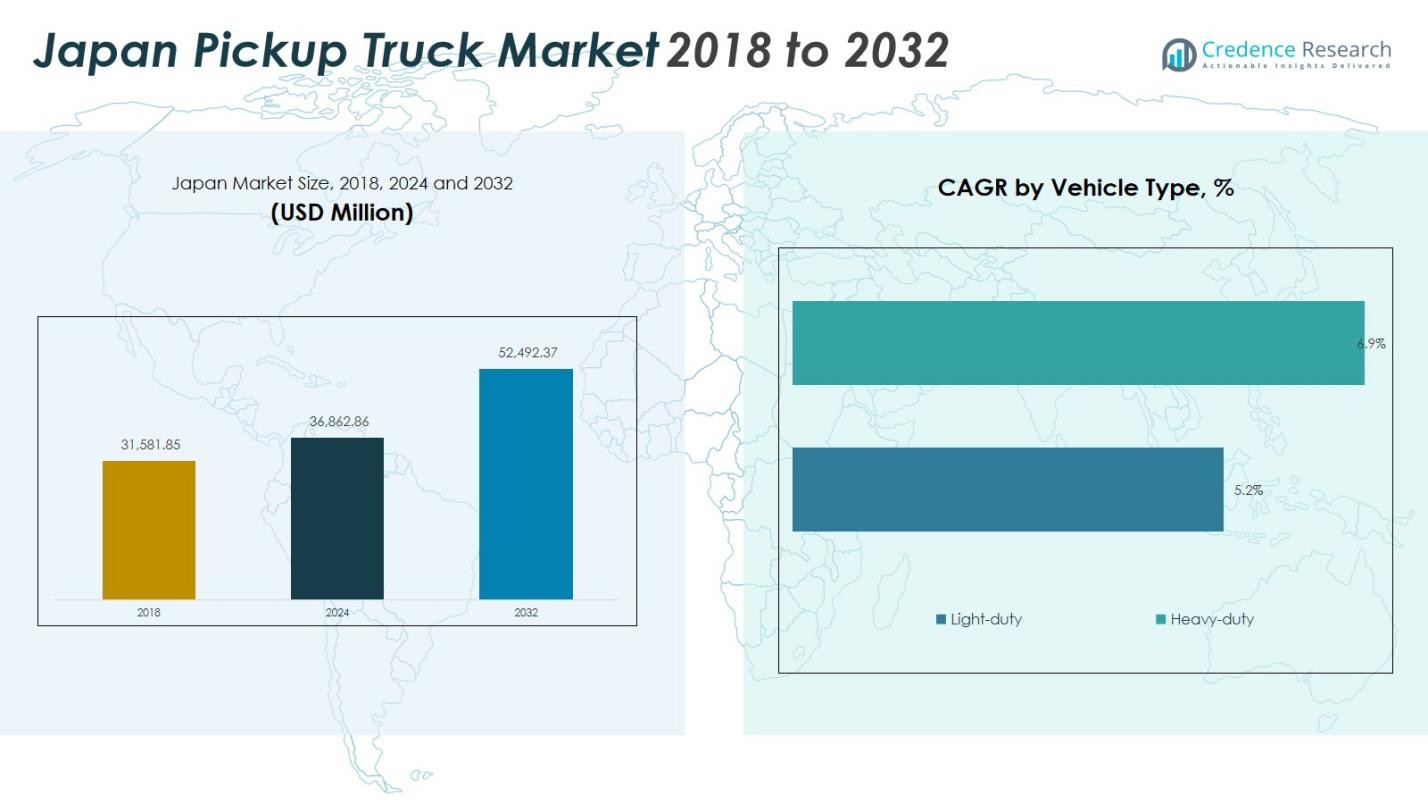

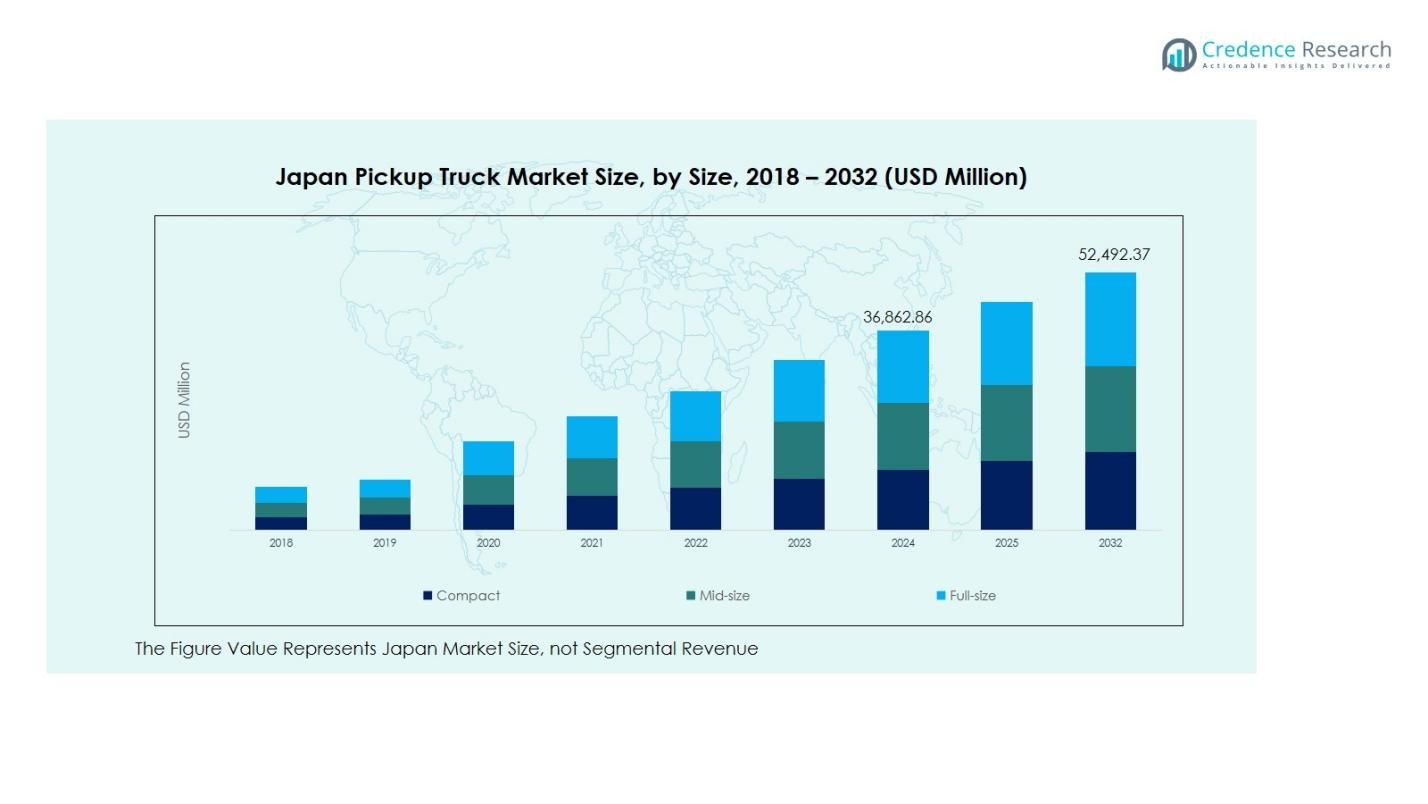

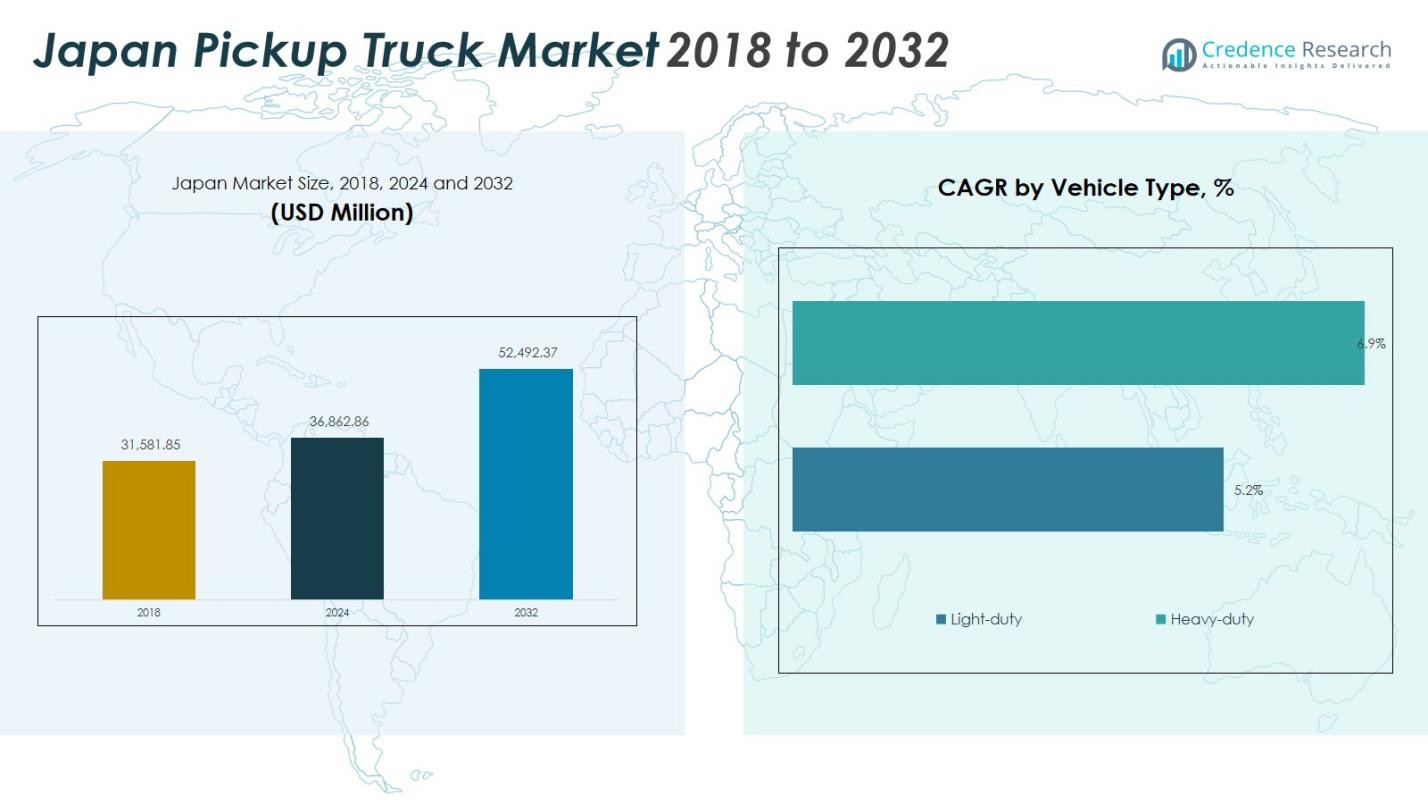

Japan Pickup Truck Market size was valued at USD 31,581.85 Million in 2018 and increased to USD 36,862.86 Million in 2024. The market is expected to reach USD 52,492.37 Million by 2032, growing at a CAGR of 4.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Pickup Truck Market Size 2024 |

USD 36,862.86 Million |

| Japan Pickup Truck Market, CAGR |

4.52% |

| Japan Pickup Truck Market Size 2032 |

USD 52,492.37 Million |

Japan Pickup Truck Market is led by major automotive manufacturers including Toyota Motor Corporation, Nissan Motor Co., Ltd., Isuzu Motors Ltd., Mitsubishi Motors Corporation, Mazda Motor Corporation, Honda Motor Co., Ltd., and Suzuki Motor Corporation. These players strengthen their market position through diversified product portfolios, technological innovation, and strong dealership networks. Toyota holds a significant presence with popular models catering to both commercial and personal use. Regionally, Kanto dominates the market with 38% share, driven by high industrial activity and urban demand. Other key regions like Chubu and Kansai also contribute significantly due to their manufacturing and logistics infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Japan Pickup Truck Market size was USD 36,862.86 Million in 2024 and is projected to reach USD 52,492.37 Million by 2032, expanding at a CAGR of 4.52%.

- Market growth is driven by rising demand from industrial and logistics sectors, coupled with surging adoption of light-duty pickups that account for 62% of total segment share. Increased e-commerce penetration and fleet upgrades also support market expansion.

- Key trends include a shift toward electrification and hybrid models, with manufacturers enhancing efficiency and safety through advanced driver-assistance systems and telematics.

- Leading players such as Toyota, Nissan, and Isuzu dominate through strong brand loyalty and localized offerings, while emerging electric models intensify competition and encourage product diversification.

- Regionally, Kanto leads with 38% market share due to high urban demand and commercial activity, followed by Chubu at 20% and Kansai at 16%, while emerging adoption in rural regions is driven by agriculture and infrastructure projects.

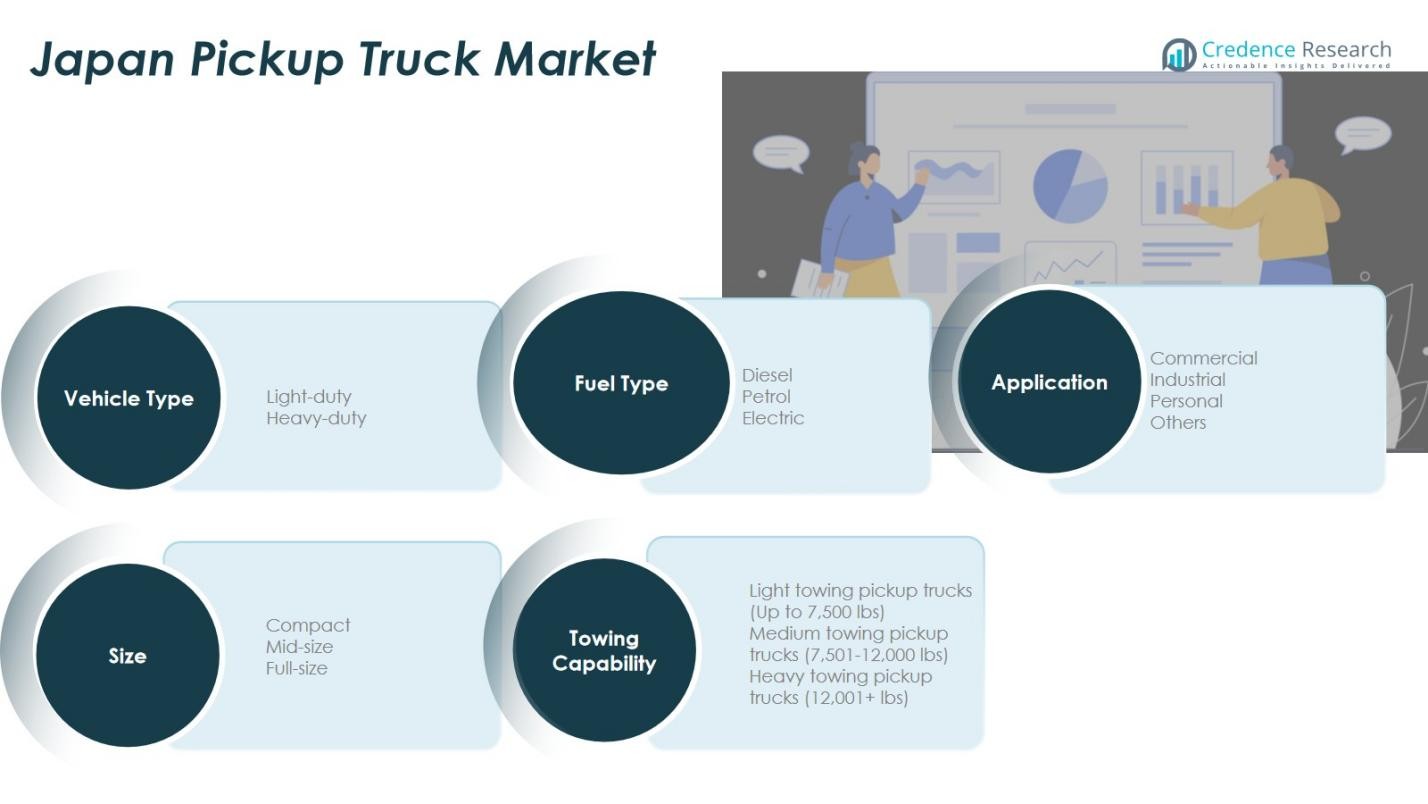

Market Segmentation Analysis:

By Vehicle Type:

In the Japan Pickup Truck Market, light-duty pickup trucks dominate with 62% market share owing to their versatility, lower operating costs, and suitability for urban and suburban usage. These vehicles are preferred for their compact size and efficiency in logistics, last-mile delivery, and small business operations. Heavy-duty models account for the remaining share, driven by demand in construction and industrial sectors. The popularity of light-duty trucks is also supported by increasing consumer preference for personal-use pickups that balance performance with fuel efficiency and comfort.

- For instance, the Toyota Hilux, a light-duty pickup, features a 2.8-liter turbo diesel engine delivering 200 HP, with a payload capacity of 470 kg and a fuel tank capacity of 80 liters, making it suitable for both urban logistics and personal use with balanced fuel efficiency and power.

By Application:

The commercial segment leads the Japan Pickup Truck Market with 45% market share, driven by strong demand from logistics, delivery services, and infrastructure development projects. Pickup trucks are widely used for transporting goods, tools, and equipment in sectors such as construction and agriculture. The industrial segment holds a significant share due to the role of pickups in manufacturing and mining operations. Personal use is growing steadily in urban centers where pickups are increasingly viewed as lifestyle vehicles, while the “Others” category includes government and utility sectors.

- For instance, Mitsubishi’s pickup models cater to the growing personal-use market by combining rugged off-road capability with comfort, appealing to urban customers and recreational users.

By Fuel Type:

The diesel segment dominates the Japan Pickup Truck Market with 58% share, reflecting its superior torque, fuel efficiency, and towing capacity, which are vital for both commercial and industrial use. Diesel pickups remain the preferred choice in fleet operations and for heavy-load transportation. However, the petrol segment remains relevant for light-duty and personal-use trucks due to lower upfront costs and lower emissions. The electric pickup truck segment is emerging, supported by Japan’s infrastructure for EVs and government incentives, and will likely gain traction as automakers introduce new models focused on sustainability and performance.

Key Growth Drivers

Rising Demand for Commercial and Logistics Applications

The growing penetration of e-commerce and the expansion of logistics and delivery services are major growth drivers in the Japan Pickup Truck Market. Pickup trucks are increasingly preferred for last-mile delivery, construction materials transport, and utility services due to their versatility, payload capacity, and operational efficiency. With urbanization and infrastructure development accelerating, demand for reliable, compact, and fuel-efficient pickups is rising. Companies are investing in fleet upgrades, achieving reduced operational costs and enhanced flexibility. This trend is especially dominant in urban and suburban centers, driving sustained market expansion.

- For instance, Isuzu is trialing its fully-electric D-Max pickup truck with National Grid Electricity Distribution to electrify fleets and reduce operational costs, with features like a 1-tonne payload and off-road capabilities tailored for utility services.

Technological Advancements and Model Upgrades

Technological innovation is transforming the pickup truck landscape in Japan, with manufacturers integrating advanced safety, connectivity, and powertrain technologies into new models. Features such as hybrid and electric drivetrains, advanced driver-assistance systems (ADAS), and telematics are becoming standard. These upgrades enhance the vehicle’s appeal for both personal and commercial buyers seeking environmental compliance and operational performance. Automakers are strategically investing in R&D to introduce models that align with emission norms and customer expectations, enabling product differentiation and boosting demand across multiple applications.

- For instance, Nissan introduced the Frontier Pro, its first-ever plug-in hybrid electrified pickup, showcasing its commitment to advanced powertrains that enhance fuel efficiency and reduce emissions.

Government Support for Clean Mobility Solutions

Government policies promoting emission reduction and cleaner transportation are accelerating the adoption of low-emission pickups, especially electric models. Incentives such as tax reductions, subsidies for EVs, and stricter fuel economy standards are encouraging manufacturers and fleet operators to transition away from traditional diesel-powered vehicles. This drive aligns with Japan’s commitment to carbon neutrality by 2050, pushing automakers to accelerate production of hybrid and electric pickup trucks. The shift presents a significant opportunity for innovative manufacturers to capture new customer segments and future-proof their fleet offerings.

Key Trends & Opportunities

Key Trends & Opportunities

Shift Toward Electrification and Hybrid Models

The transition to electric and hybrid pickup trucks is a major trend shaping the Japan Pickup Truck Market. Manufacturers are scaling production of electrified models to meet growing consumer and regulatory demand. This shift creates opportunities in charging infrastructure development, battery innovations, and renewable energy integration. Fleet owners and consumers are increasingly favoring EVs for their lower maintenance costs and operational efficiency. As EV infrastructure expands across Japan, the market is poised to see rapid adoption, supported by government incentives and advancements in battery technology and vehicle range.

- For instance, Mitsubishi Motors showcased the Elevance Concept at the 2025 Japan Mobility Show, featuring a plug-in hybrid electric vehicle (PHEV) system with a high-efficiency gasoline engine compatible with carbon-neutral fuels and a large-capacity battery, enhancing eco-friendly performance and adventure utility.

Personal Lifestyle Adoption of Pickup Trucks

Pickup trucks are emerging as lifestyle vehicles in Japan, appealing to urban customers seeking rugged aesthetics, spacious cabins, and utility for outdoor activities. Automakers are customizing designs and offering premium models with advanced infotainment, connectivity, and comfort features. This shift is creating a niche segment that blends utility with personal use, spurring demand for compact and mid-sized pickups. The trend offers opportunities for developers to introduce more versatile, consumer-oriented vehicles. Stylish design, fuel efficiency, and customizable options are key differentiators in this increasingly competitive segment.

- For instance, Mitsubishi Triton returned to the Japanese market in February 2024 with a renewed “Power for Adventure” concept and double-cab configuration aimed at active-lifestyle buyers.

Key Challenges

High Initial and Maintenance Costs

Despite technological advancements, pickup trucks often carry higher upfront and maintenance costs compared to smaller utility vehicles, posing a challenge in price-sensitive markets. Costs associated with advanced drivetrain technology, safety features, emissions control systems, and compliance with environmental regulations add to overall expenses. Fleet operators and small businesses may hesitate to invest, especially without long-term incentives or financing options. Additionally, electric pickups face challenges related to battery replacement and charging infrastructure, which can further elevate ownership costs and slow the adoption rate in cost-conscious customer segments.

Competition from Alternative Vehicle Types

The increasing availability of compact vans, mini-trucks, and advanced SUVs is creating competitive pressure on the pickup truck segment. Many of these vehicles offer similar cargo capacity with better fuel efficiency, maneuverability, or lower pricing, making them appealing alternatives for urban logistics and transport needs. Moreover, the high density of urban areas in Japan limits the practicality of larger pickup models. This competitive dynamic requires manufacturers to enhance product differentiation through features, durability, and total cost of ownership to maintain their presence in key commercial and personal-use categories.

Regional Analysis

Hokkaido and Tohoku

In the Japan Pickup Truck Market, Hokkaido and Tohoku hold 12% market share, driven by the region’s strong agricultural, forestry, and construction activities. Pickup trucks are widely used for transporting equipment, agricultural produce, and supplies across rural and semi-rural areas where heavy-duty performance and durability are essential. The region’s colder climate and challenging terrain also favor 4×4 pickup models with high towing capacity. Increasing investments in rural infrastructure and renewable energy projects are expected to sustain demand. Additionally, government-led incentives for improving logistics networks further support growth in these regions.

Kanto

Kanto commands the largest share in the Japan Pickup Truck Market with 38% of total revenue, owing to its dense population, advanced industrial infrastructure, and dominant e-commerce activity centered around Tokyo. Pickup trucks are widely used for urban delivery, service operations, and commercial transport. The market benefits from high fleet adoption in logistics, retail, and construction industries. Additionally, demand for light-duty and electric pickups is rising due to regulatory pressure and corporate sustainability initiatives. The region’s strong automotive presence also drives continuous innovation, making Kanto a major hub for new product launches and mobility solutions.

Chubu

The Chubu region holds about 20% market share in the Japan Pickup Truck Market, supported by its strong manufacturing base and automotive cluster centered around Aichi Prefecture. Pickup trucks are essential for transporting parts, tools, and equipment between factories and plants, particularly in sectors like automotive, machinery, and electronics. Growth is also driven by mineral and chemical processing industries that require robust vehicles for operations and logistics. Industrial expansion, smart factory trends, and increasing adoption of hybrid pickups are influencing market development. The region’s proximity to key automotive OEMs further accelerates innovation and localized model production.

Kansai

Kansai accounts for 16% of the Japan Pickup Truck Market, driven by robust commercial activities in Osaka, Kyoto, and Kobe. The region’s diversified economy includes retail, food processing, textiles, and construction, all of which rely on pickup trucks for daily operations. Pickup adoption is also rising among SMEs and urban customers for business and personal use. Continuous urban redevelopment and warehousing projects are increasing demand for fuel-efficient, light-duty models. Additionally, sustainability policies and EV infrastructure in Osaka are enticing fleet operators to consider electric and hybrid pickup models, enhancing long-term growth prospects in Kansai.

Chugoku and Shikoku

Chugoku and Shikoku jointly represent 9% of the market share, with demand largely originating from ports, fishing, and small-scale manufacturing businesses. Pickup trucks are utilized for coastal infrastructure maintenance, raw material transport, and rural mobility, particularly in areas with limited access to commercial trucks. The region’s topography and extensive coastline make pickups a practical option for rugged terrain and multi-purpose utility. Growing investment in tourism and renewable energy is boosting vehicle demand. However, market expansion is somewhat constrained by lower urbanization and limited charging infrastructure for electric pickups, though hybrid adoption is gradually increasing.

Kyushu and Okinawa

Kyushu and Okinawa account for 5% of the Japan Pickup Truck Market, supported by strong agricultural and seafood exports, tourism, and emerging industrial projects. Pickup trucks are essential in remote areas for transportation, farm operations, and goods movement. The tourism industry also utilizes pickups for service fleets and off-road activities. Increasing suburban development and infrastructure upgrades provide growth opportunities. However, high vehicle taxes and limited model availability challenge widespread adoption. Emerging EV mobility initiatives and local incentives in cities like Fukuoka are creating demand for sustainable pickup truck solutions, particularly in hybrid and compact forms.

Market Segmentations:

By Vehicle Type

By Application

- Commercial

- Industrial

- Personal

- Others

By Fuel Type

By Size

- Compact

- Mid-size

- Full-size

By Towing Capability

- Light towing pickup trucks (Up to 7,500 lbs)

- Medium towing pickup trucks (7,501–12,000 lbs)

- Heavy towing pickup trucks (12,001+ lbs)

By Region

- Hokkaido and Tohoku

- Kanto

- Chubbu

- Kansai

- Chugoku and Shikoku

- Kyushu and Okinawa

Competitive Landscape

The Japan Pickup Truck Market features key players such as Toyota Motor Corporation, Nissan Motor Co., Ltd., Isuzu Motors Ltd., Mitsubishi Motors Corporation, Mazda Motor Corporation, Honda Motor Co., Ltd., and Suzuki Motor Corporation. These companies dominate through robust product portfolios, extensive dealer networks, and strong brand loyalty. Toyota leads the segment with popular models tailored to both commercial and personal uses, emphasizing fuel efficiency and high resale value. Nissan and Isuzu are prominent in diesel-powered and heavy-duty segments, while Mazda and Mitsubishi continue to innovate in compact and mid-size platforms. In recent years, manufacturers have focused on electrification, safety enhancements, and integrating advanced telematics to meet evolving customer expectations and regulatory standards. Strategic partnerships, localized production, and diversification into hybrid and electric models are shaping competitive dynamics. Meanwhile, foreign entrants face challenges due to Japan’s strong domestic preferences and established OEM dominance, ensuring market competition remains intense yet innovation-driven.

Key Player Analysis

Recent Developments

- In April 2025, Nissan Motor Co., Ltd. announced the all-new Frontier Pro, its first-ever plug-in-hybrid pickup.

- In February 2025, Toyoda Gosei acquired a stake in the Japanese startup EV Motors Japan (EVM-J), targeting commercial electric trucks and buses.

- In March 2024, Isuzu Motors unveiled its first battery-electric pickup truck (the D-MAX BEV).

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Application, Fuel type, Size, Towing Capability and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Japan Pickup Truck Market will see rising adoption of electric and hybrid models driven by emission targets and government incentives.

- Demand for compact and mid-size pickups will increase as urban users seek versatile and fuel-efficient options.

- Commercial fleet expansion in logistics and e-commerce sectors will continue to drive market growth.

- Advanced connectivity, telematics, and driver-assistance systems will become standard across new pickup models.

- Automakers will invest in localized production and technological upgrades to maintain competitive advantage.

- Lifestyle-oriented pickups will gain popularity, particularly among younger and outdoor-oriented consumers.

- Regulatory pressures will accelerate the phase-out of older diesel models and support cleaner alternatives.

- Strategic partnerships between domestic OEMs and global battery or tech firms will shape future innovation.

- Fleet electrification and charging infrastructure development will support long-term adoption of EV pickups.

- Market competition will intensify as foreign manufacturers explore new entry strategies into the Japanese market.

Key Trends & Opportunities

Key Trends & Opportunities